Fedspeak Monitor: June 3rd

This weeks’ Fedspeak comes against the backdrop of a surprisingly neutral Jobs Day report. This week saw communication from Goolsbee, Barkin, Jefferson, Collins, Bowman, Harker, Master and Bullard.

This weeks’ Fedspeak comes against the backdrop of a surprisingly neutral Jobs Day report. This week saw communication from Goolsbee, Barkin, Jefferson, Collins, Bowman, Harker, Master and Bullard.

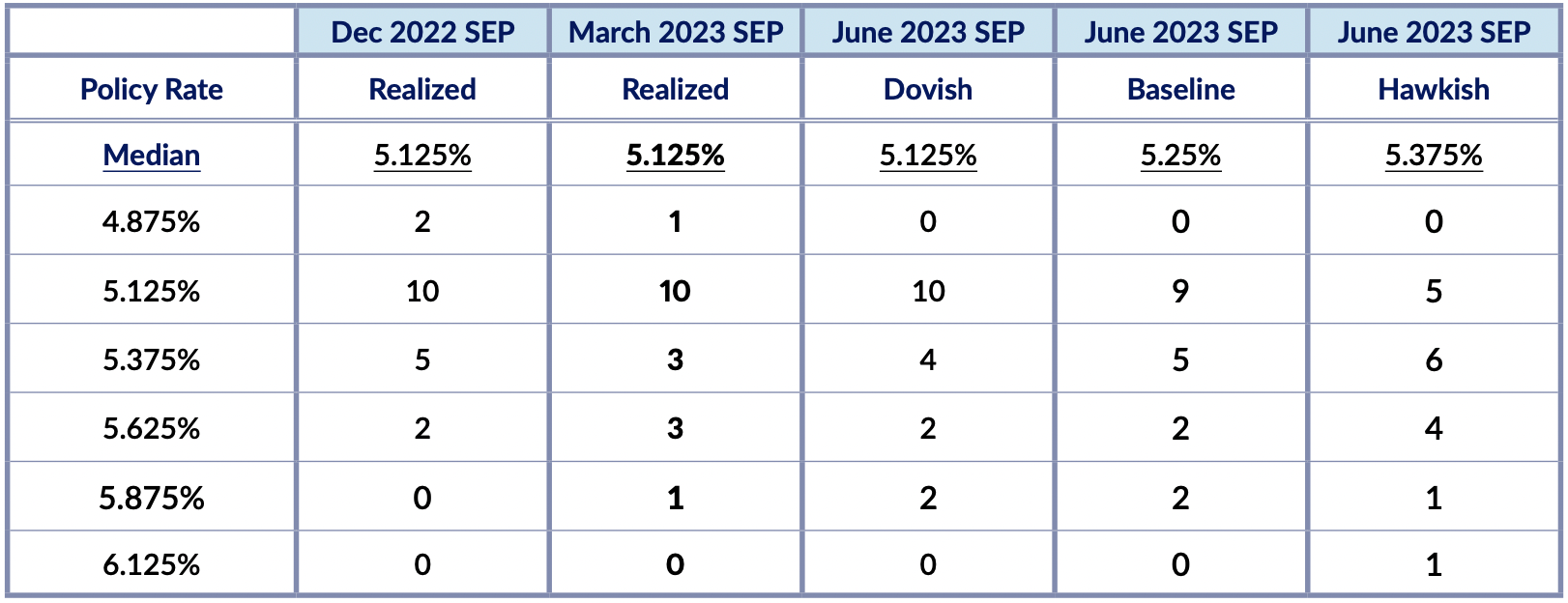

This weeks’ Fedspeak comes against the backdrop of a surprisingly neutral Jobs Day report. This week saw communication from Goolsbee, Barkin, Jefferson, Collins, Bowman, Harker, Master and Bullard. There seems to be a growing consensus around a skip at the June meeting at the same time as the terminal rate seems to be coalescing around 5.375%. This week Harker firmed up his policy stance, favoring a skip at this coming meeting together with optionality for a further hike later in the summer.

Vice Chair Nominee Phillip Jefferson offered the clearest statement of the logic behind these two choices, stating “a decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle.” The pandemic has seen some real acrobatics in terms of Fed communications, which may be coming to a close with this week’s increased clarity about the 2023 terminal rate. We have moved our base-case median dot from 5.25% to 5.375% and eliminated the dovish scenario put forward last week.

The full version of this Fedspeak Monitor is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.