Core-Cast is our model and publication series for nowcasting the Fed's Personal Consumption Expenditures (PCE) inflation gauges. We update our estimates from CPI, PPI, Import Price, and GDP data, along with previews and final recaps. If you'd like to become a MacroSuite subscriber to get all of our model updates before PCE is released, you can do so using this link. If you have any questions or would like to see samples of our past content, contact us here.

Summary: PCE Nowcasts

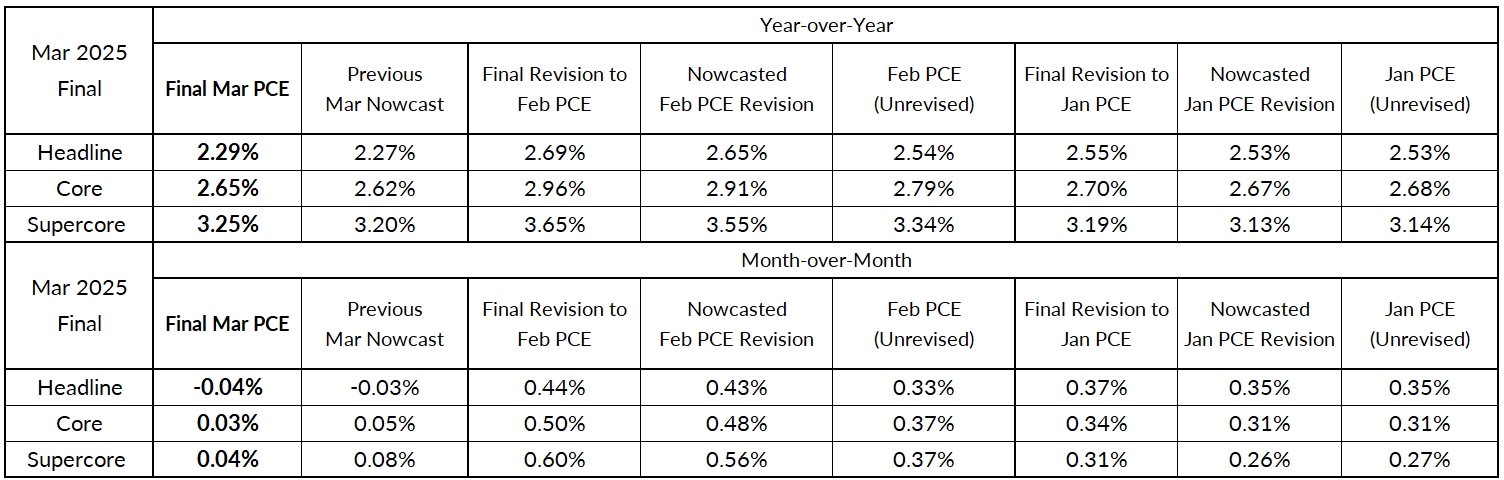

Our PCE Nowcasts caught the important contours of this release better than most of the informed forecasting consensus, and specifically recognized the downside risk to Core PCE in March alongside the sharp upside revisions to Core PCE in February. The PCE data's upside revisions were actually a bit stronger than what we modeled for January and February and leave us with a marginally higher set of year-over-year inflation readings than we were previously tracking.

While a 0.0% reading for Core PCE in March looks impressive, the revisions imply little shift to Fed policymaking in the near-term. We expect the Fed to signal high levels of uncertainty about the outlook for the economy and interest rates at the May FOMC meeting.

Discussion

Going forward, we first expect to see another month or two of softer inflation readings due to lower equity prices in March and April. The upside effects of tariffs and tariff threats are coming but will take more time to fully play out. As a result, we think the Fed can pull the trigger on an interest rate cut in June but may require see much weaker activity data to pursue additional cuts beyond June.

As for what the Fed should do, the easing of financial conditions in recent weeks alongside still-present inflation risks suggests a less pressing case for cutting interest rates. We would advise the Fed follow Governor Chris Waller's recent speech: the Fed needs to brace themselves to look through forthcoming inflationary impulses without overreacting via interest rate hikes. If there is a more precipitous decline in labor market activity, that may come with more permanent costs than a local burst of inflation. But it's easier to say these things now than what may be another storm of inflation later this year.

Inflation Overshoots At The Component Level

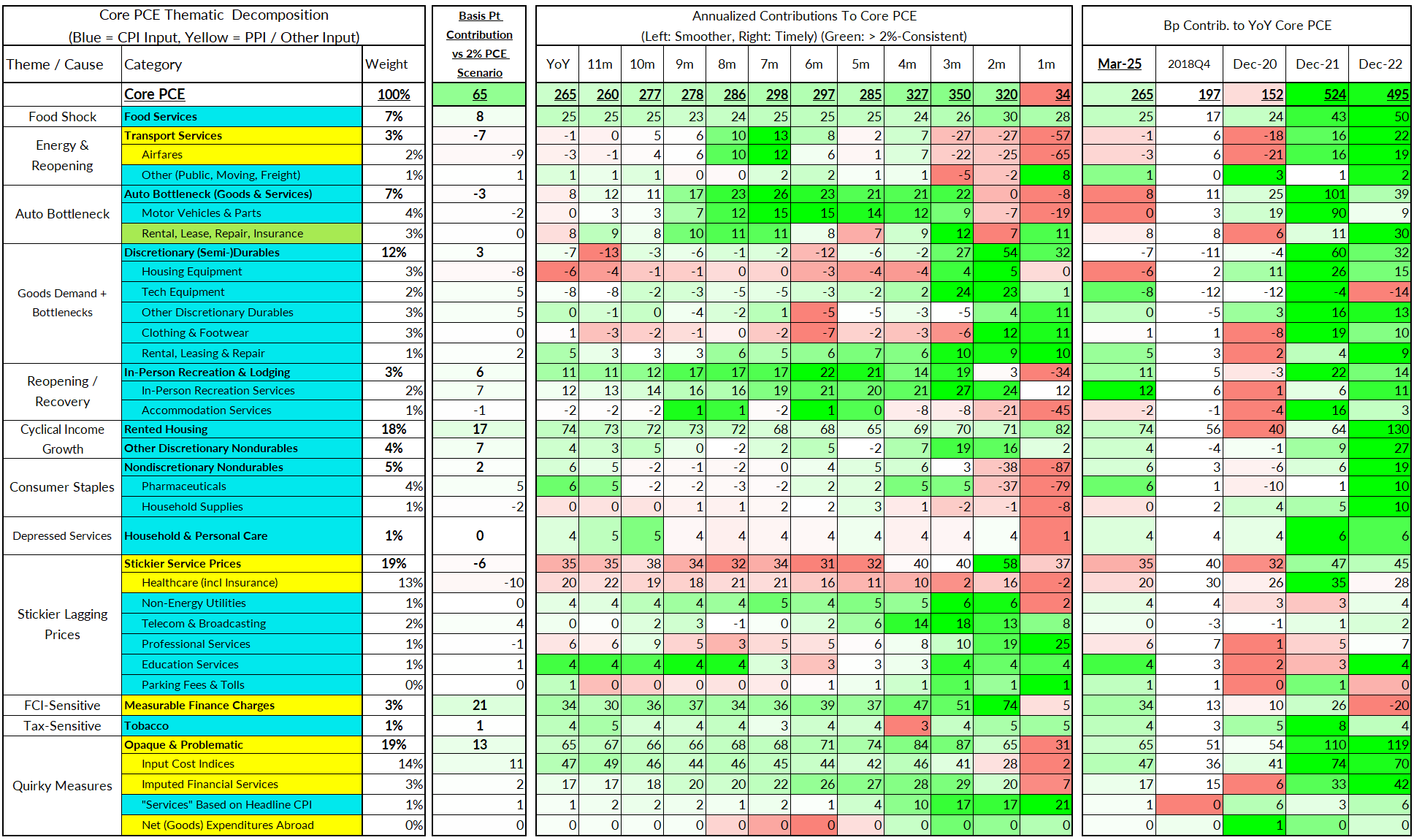

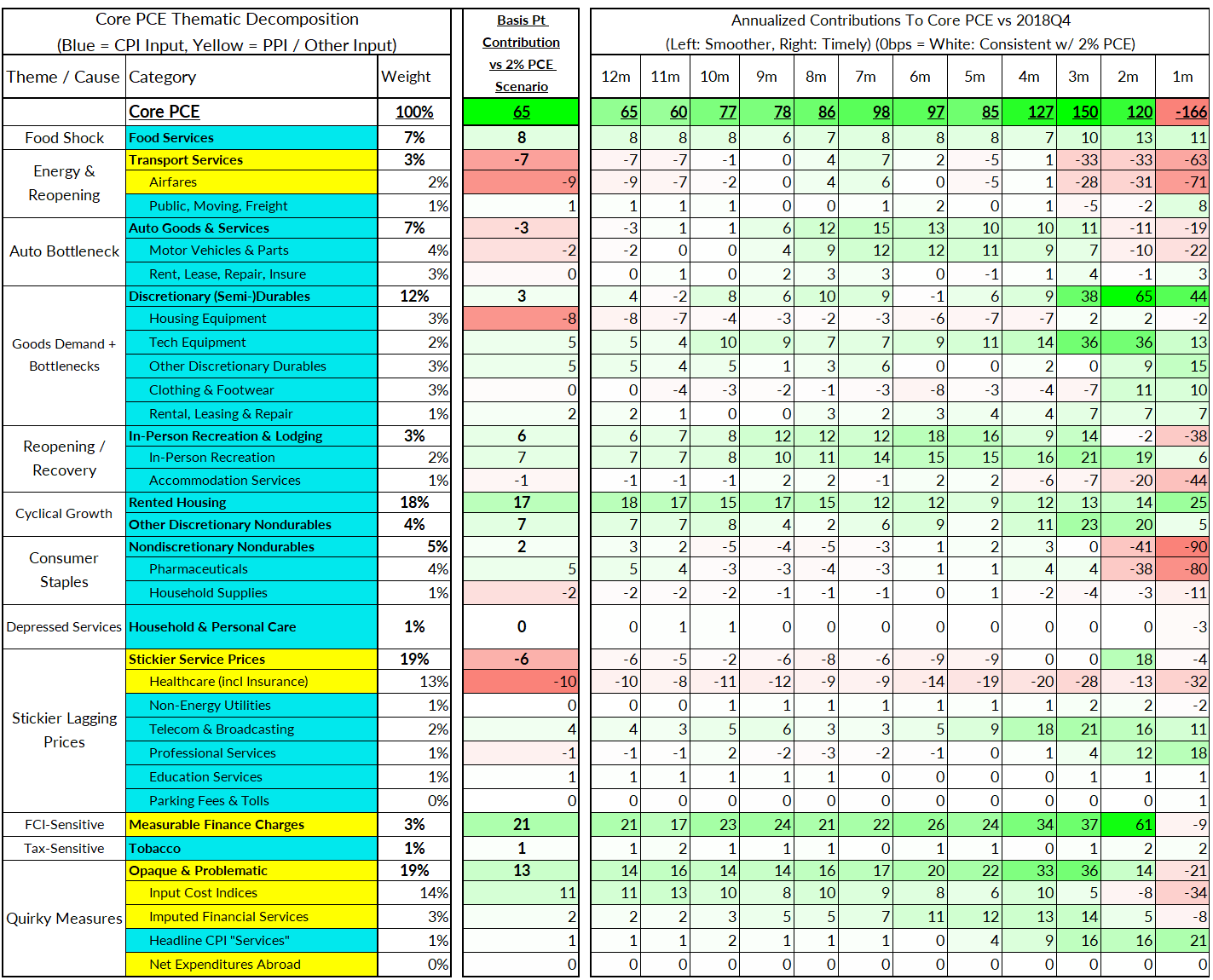

For the Detail-Oriented: Core PCE Heatmaps

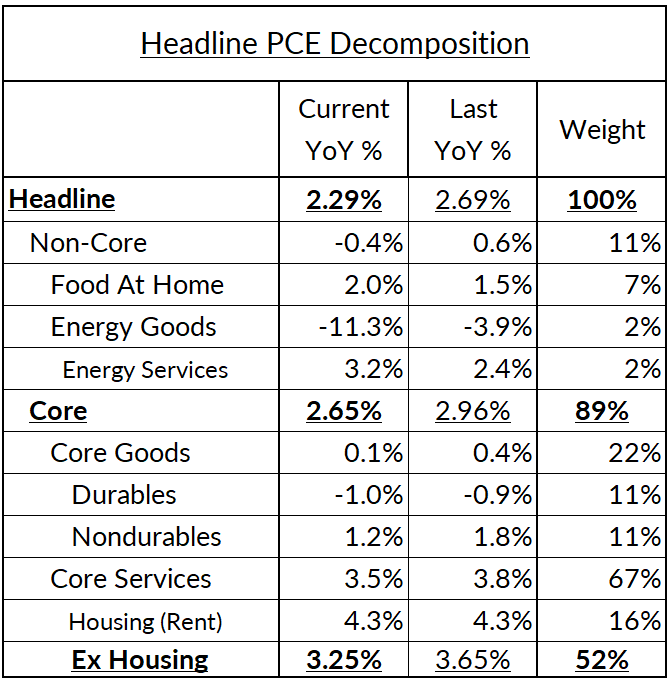

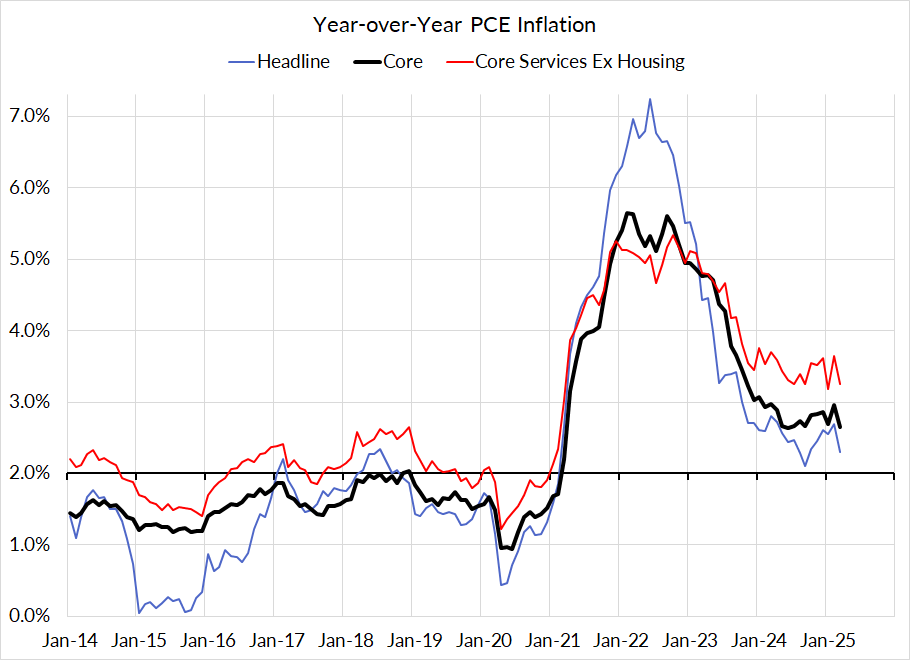

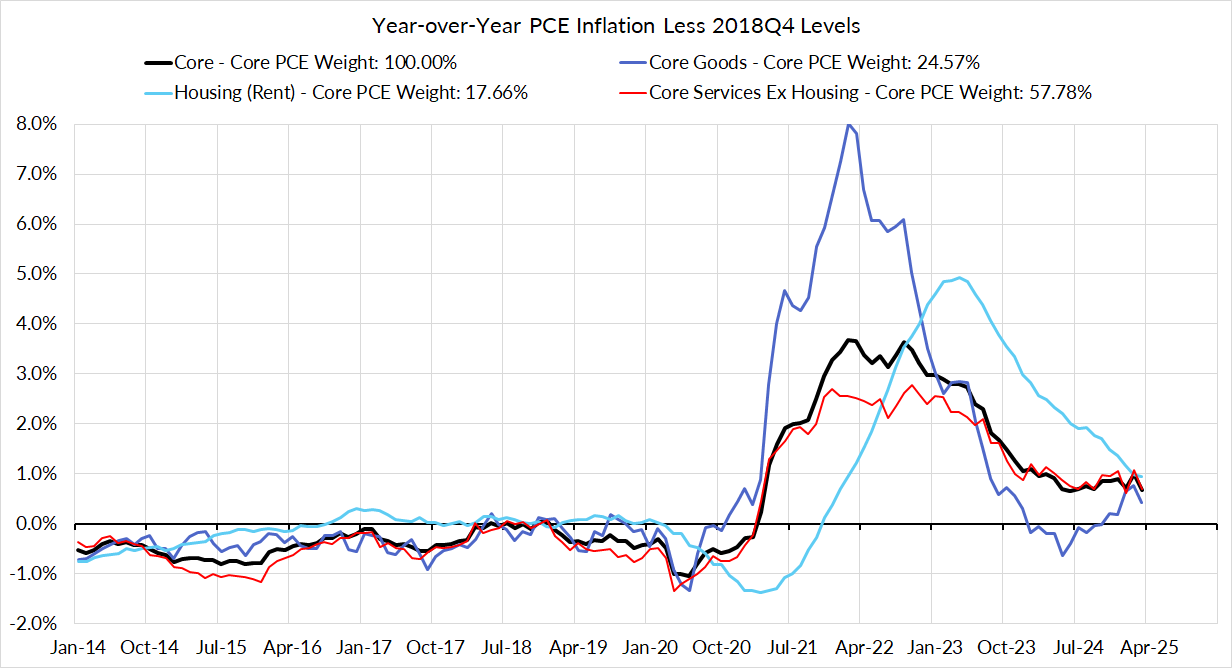

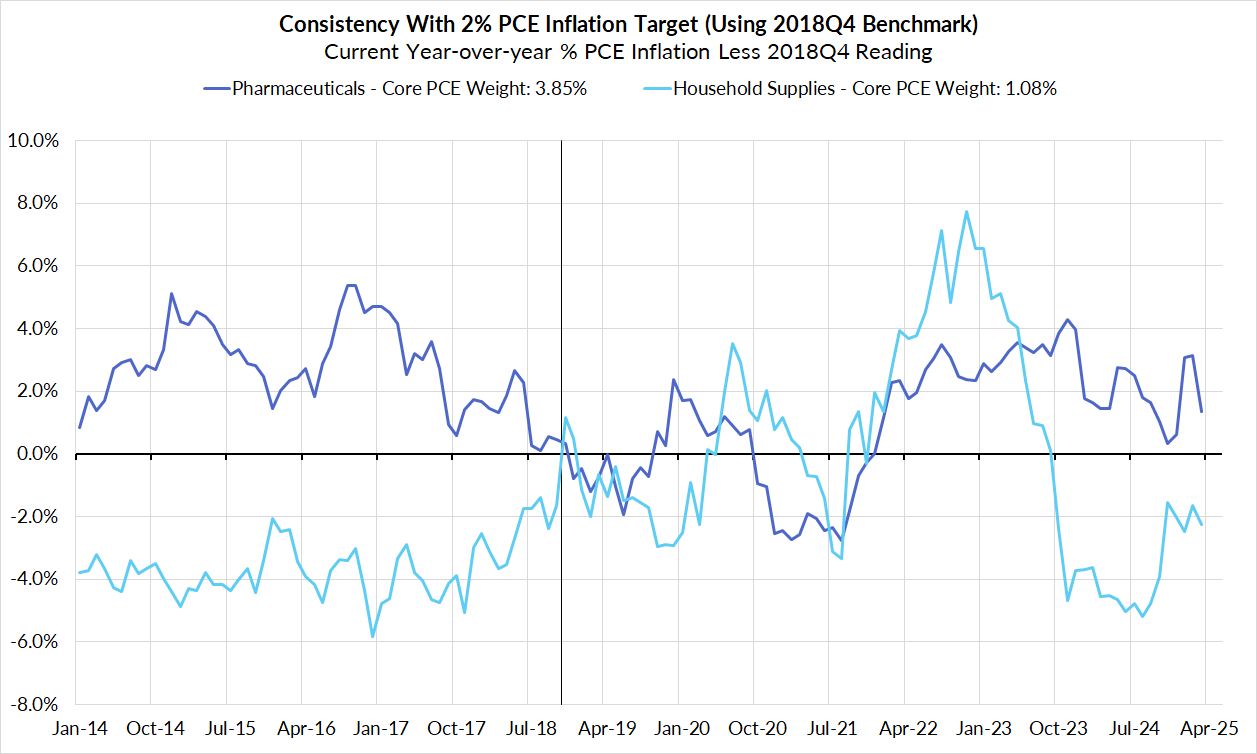

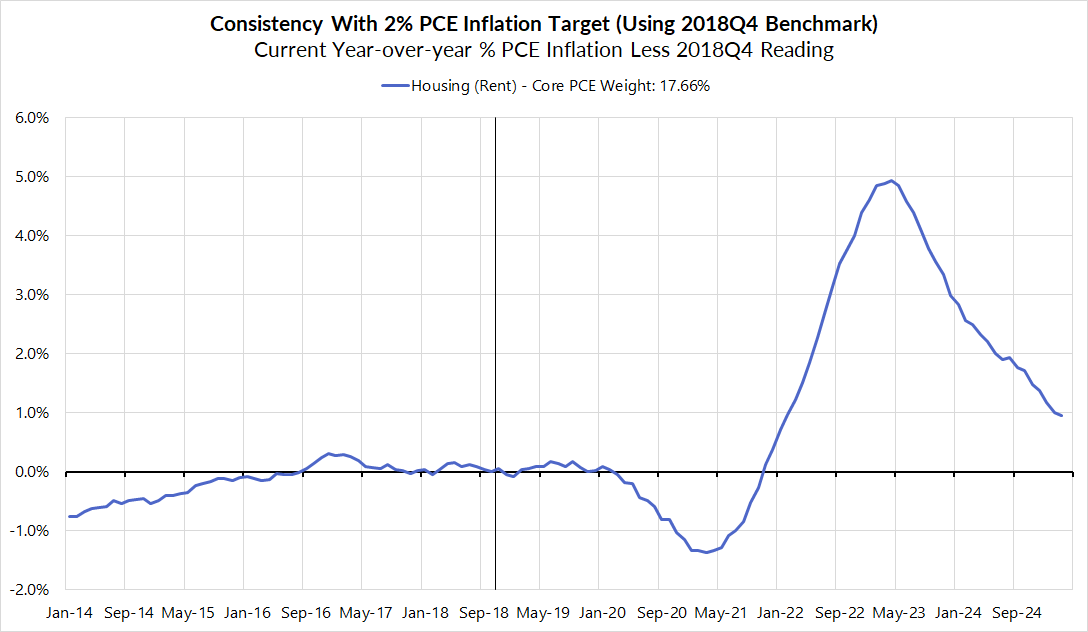

Right now Core PCE (PCE less food products and energy) is running at a 2.65% year-over-year pace as of March, 65 basis points above the Fed's 2% inflation target for PCE. That projected overshoot is still driven substantially by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is on track to contribute 17 basis points to the 65 basis point Core PCE overshoot.

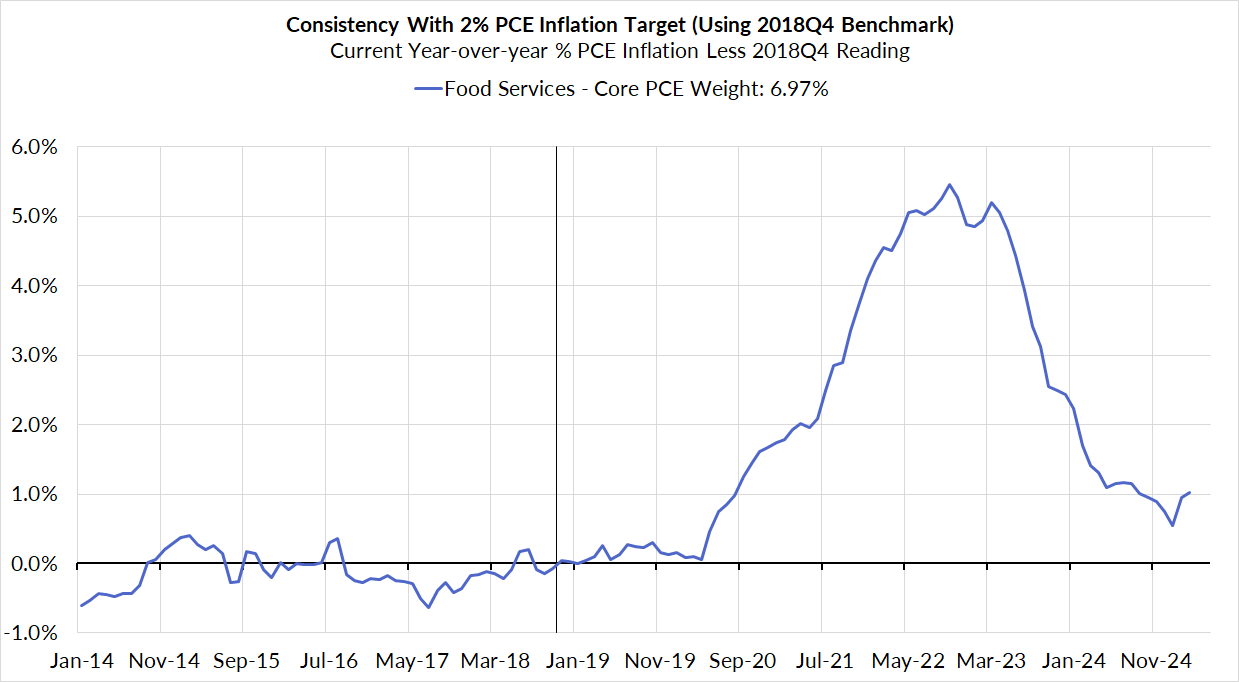

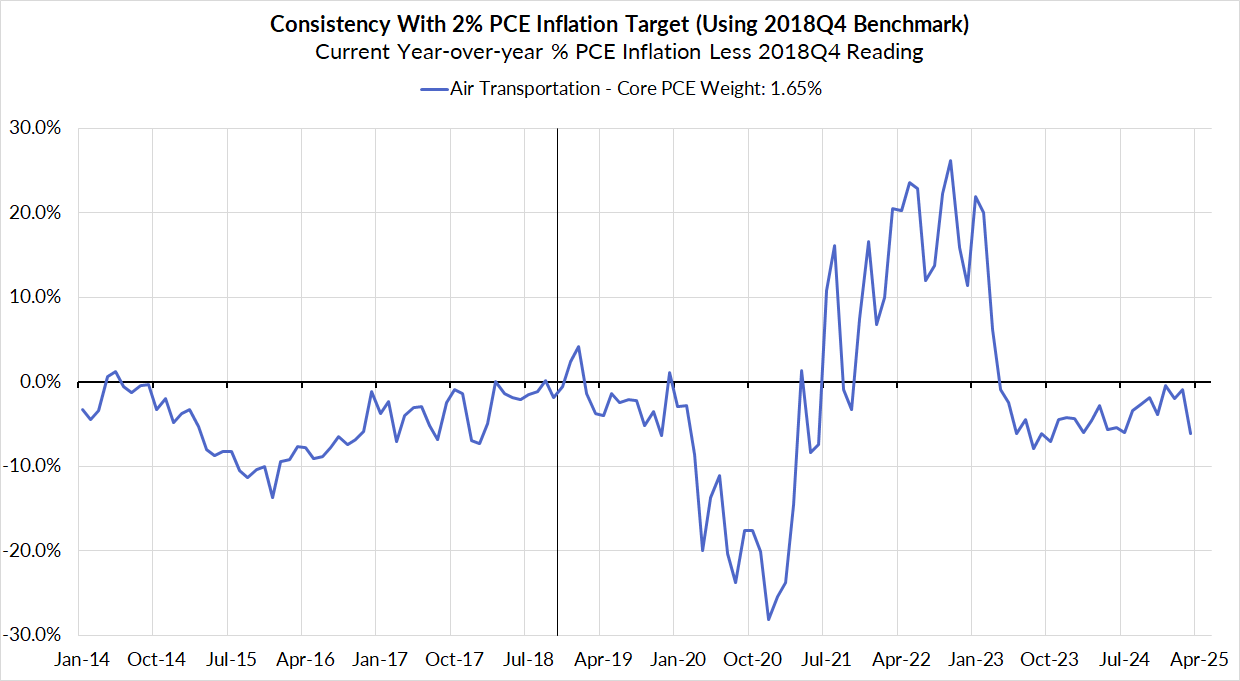

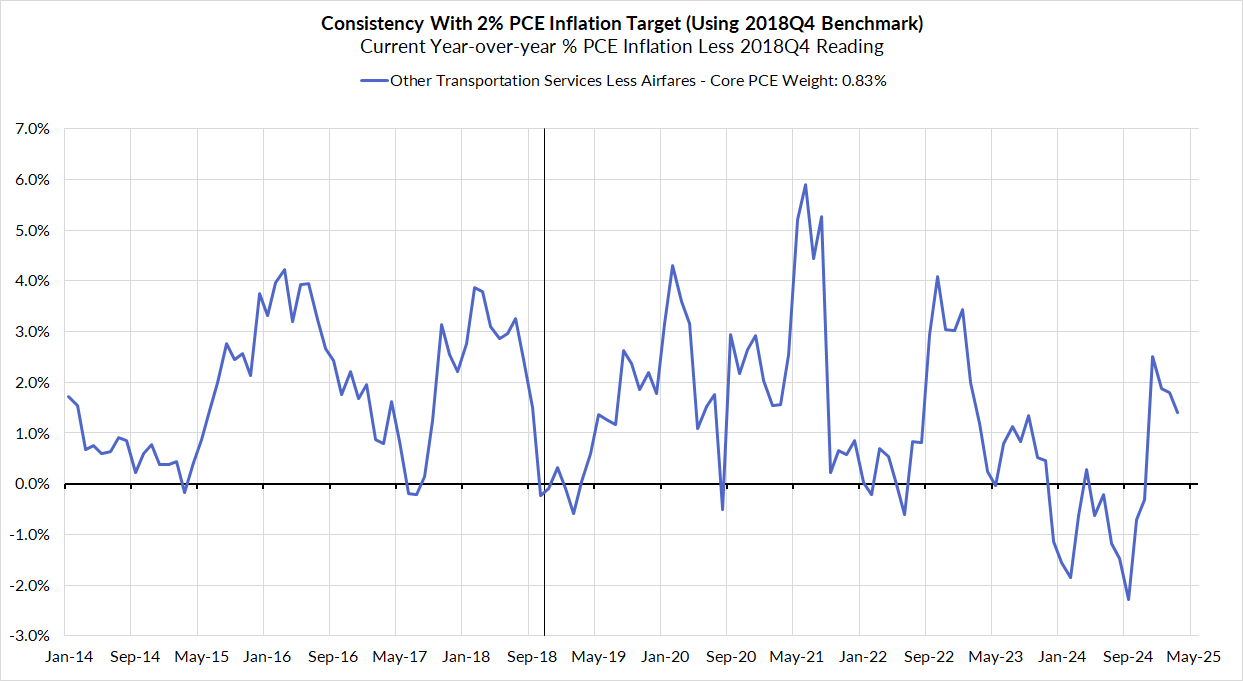

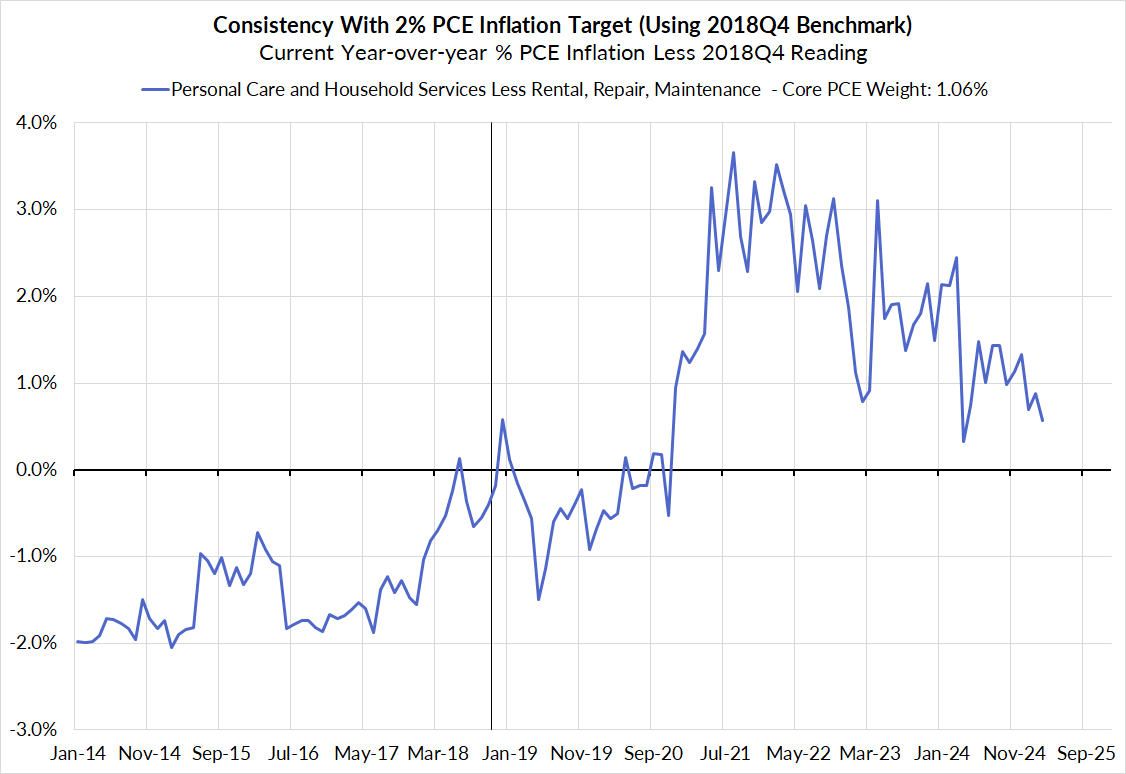

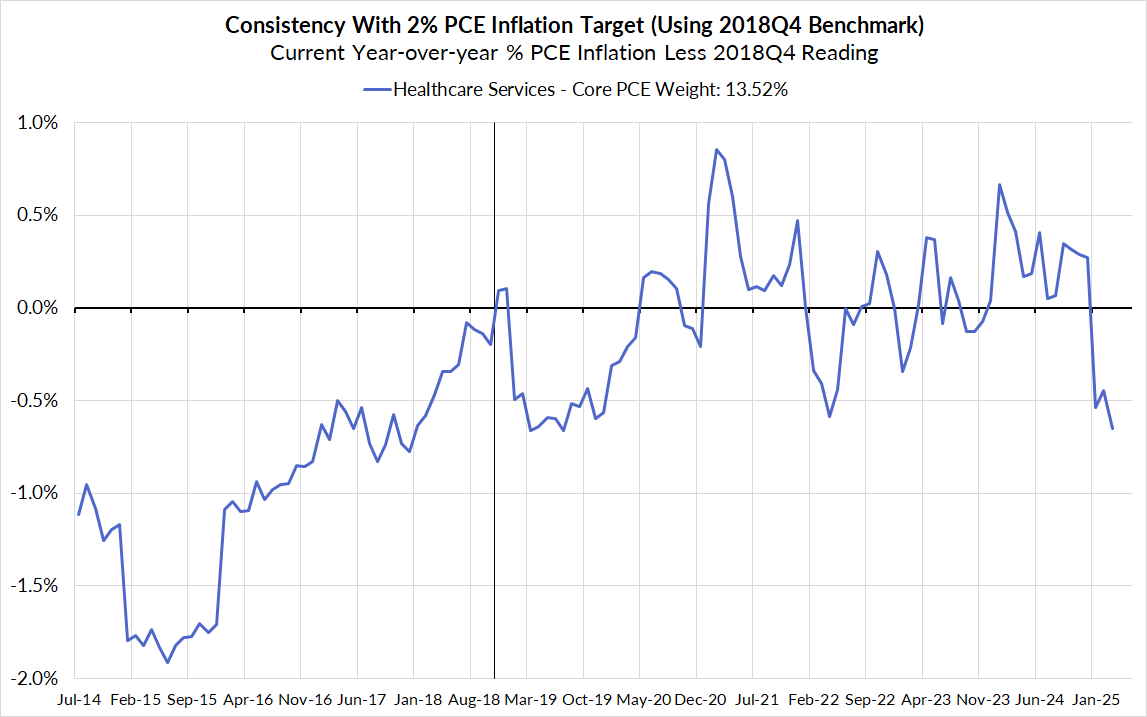

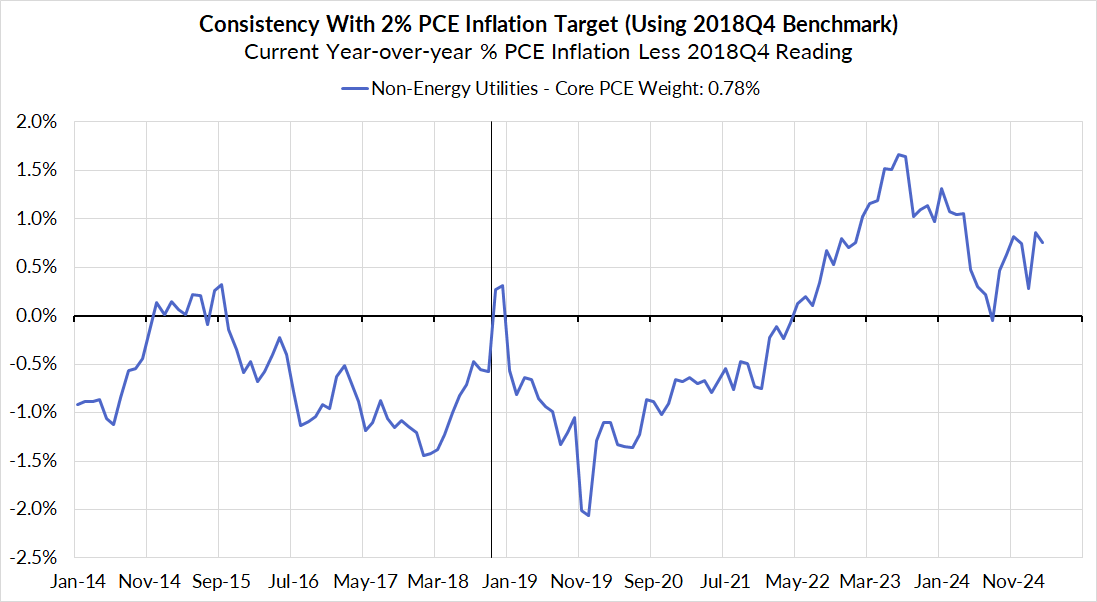

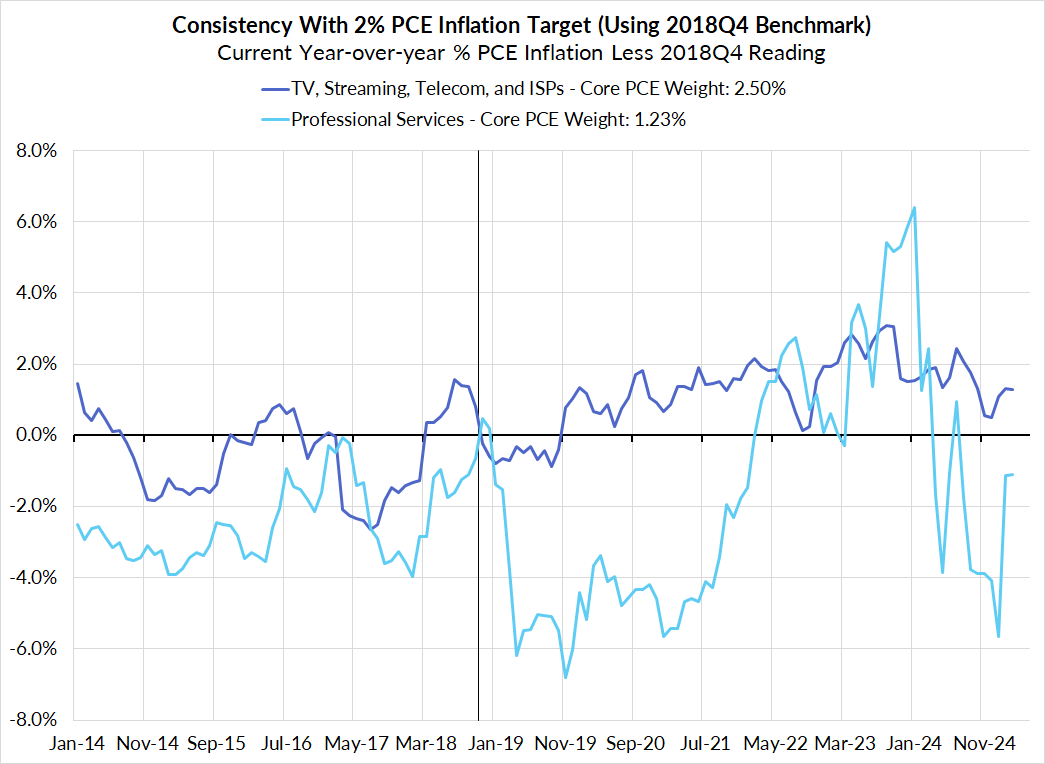

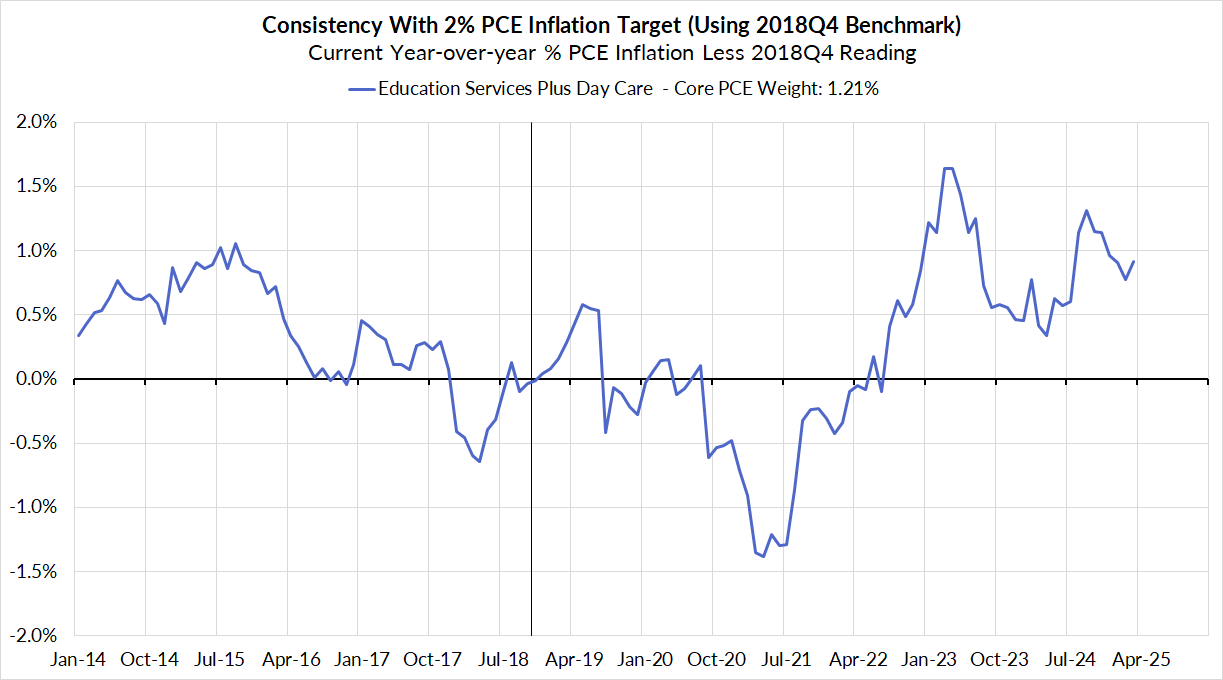

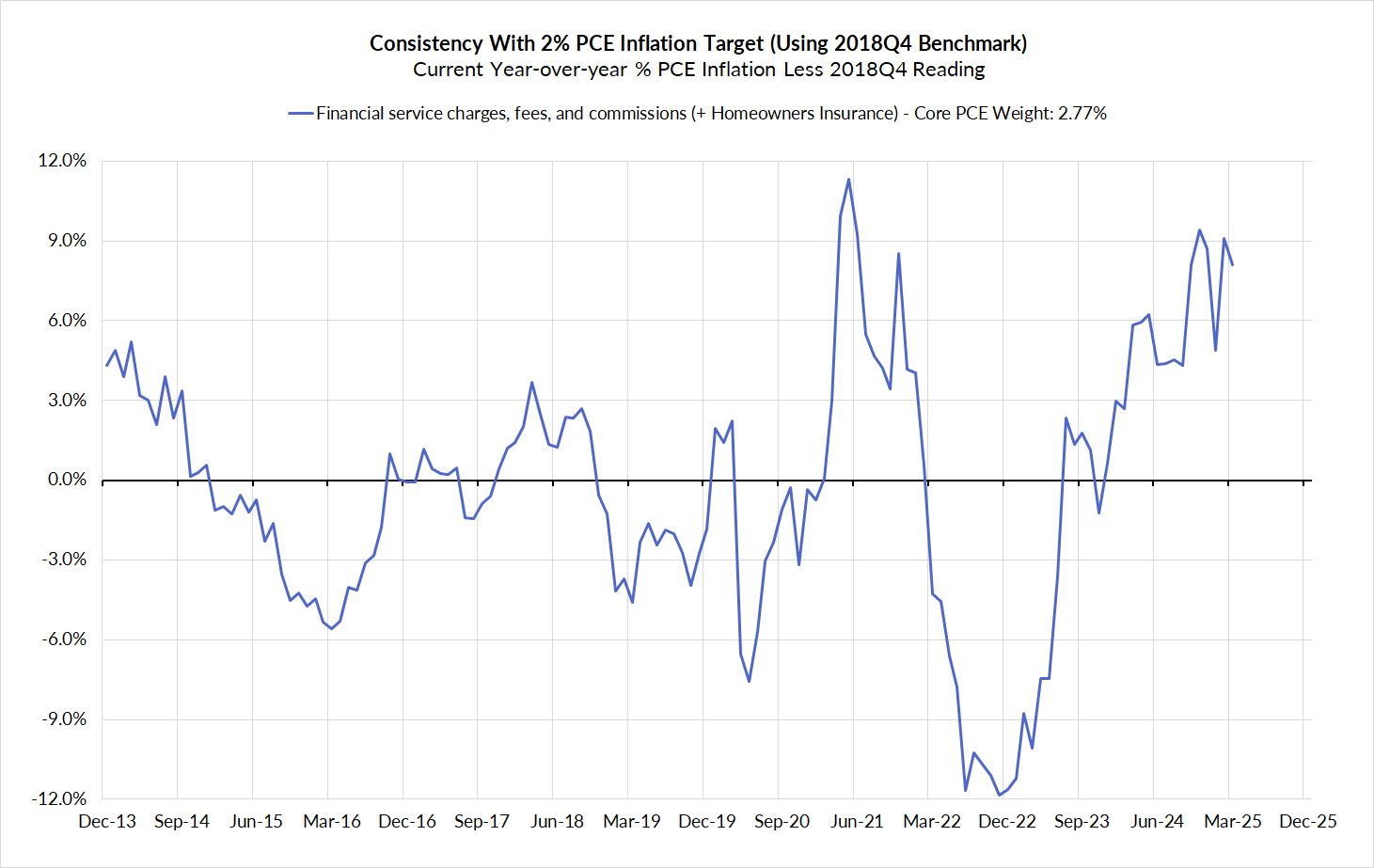

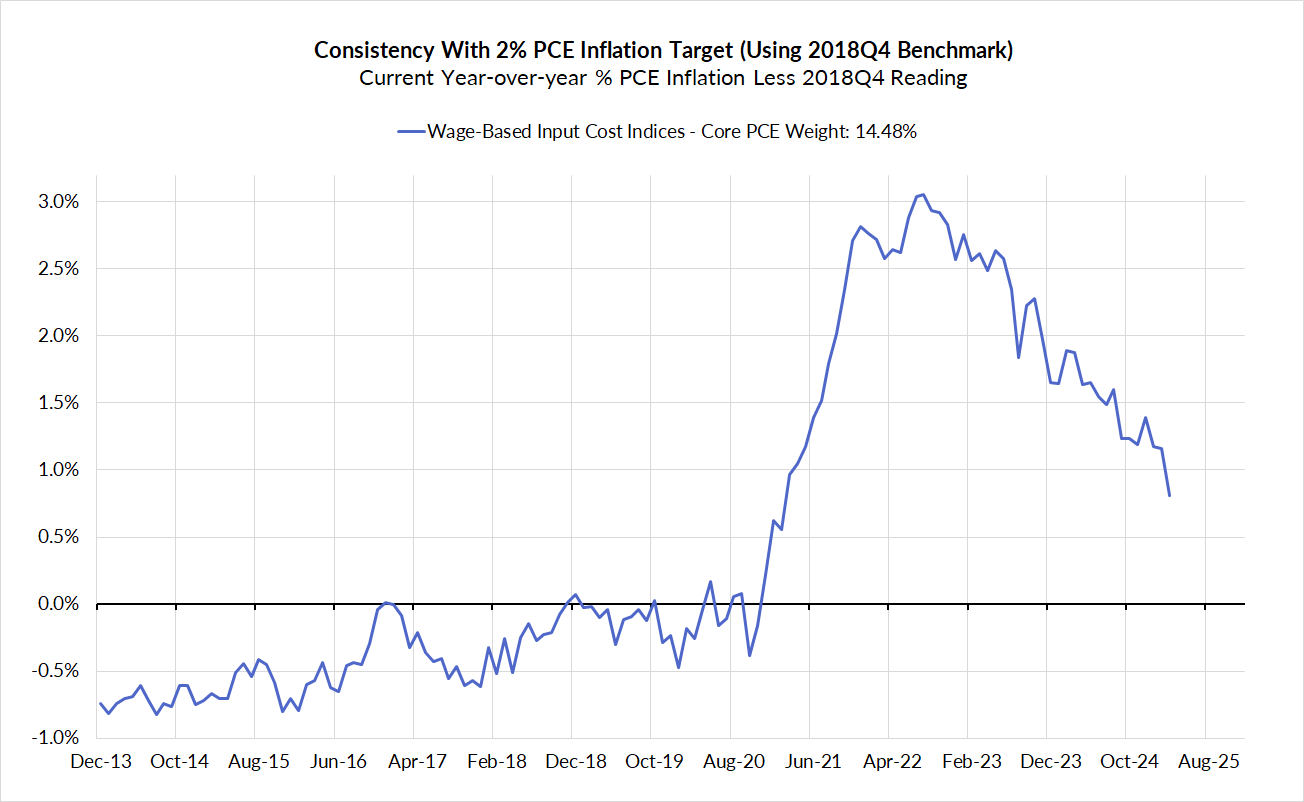

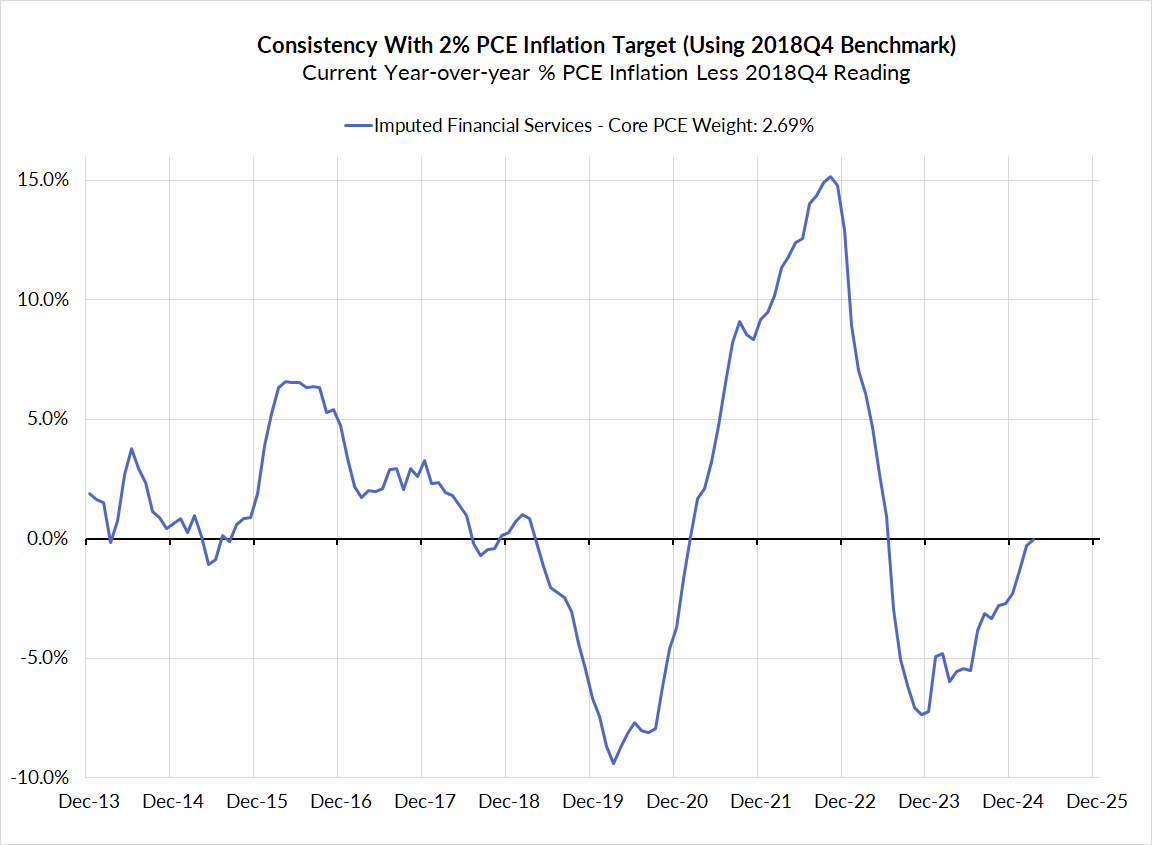

There are other contributors to the overshoot:

- Measured financial service charges are now adding 21 basis points due to the strong equity market performance over the past 12 months

- Contributions from input cost indices (wages in specific sectors where market prices don't exist) are now adding 11 basis points to the overshoot

- Food inputs are adding 8 basis points to the overshoot

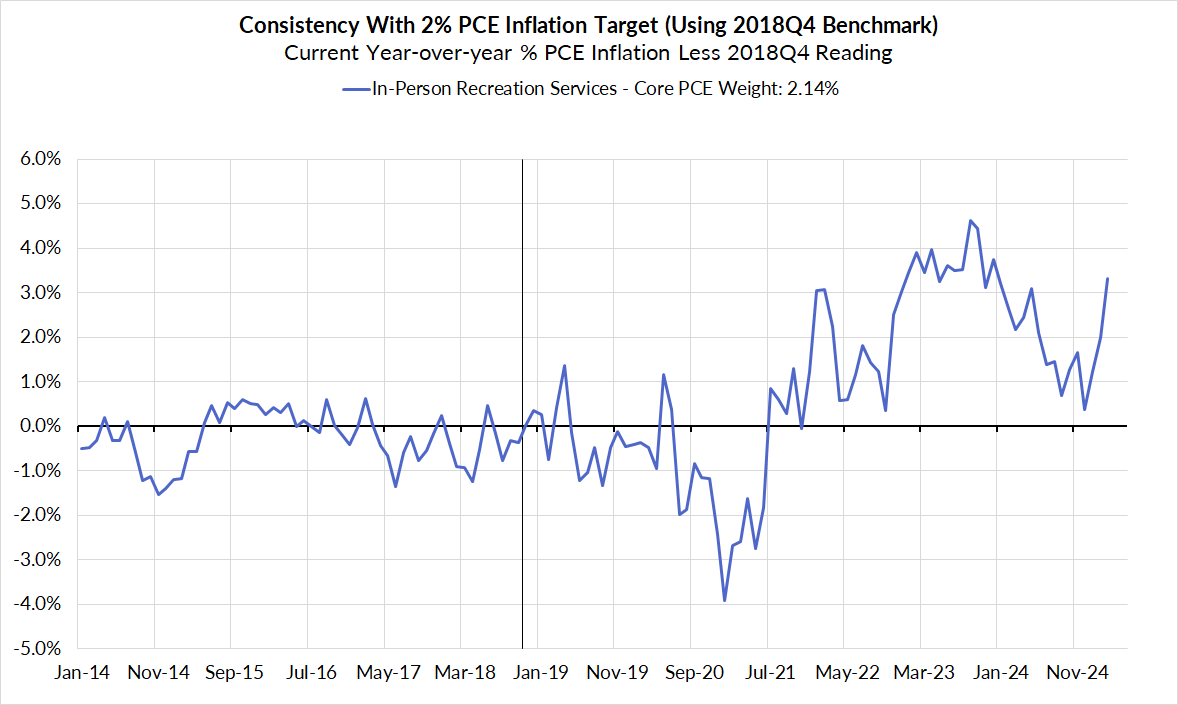

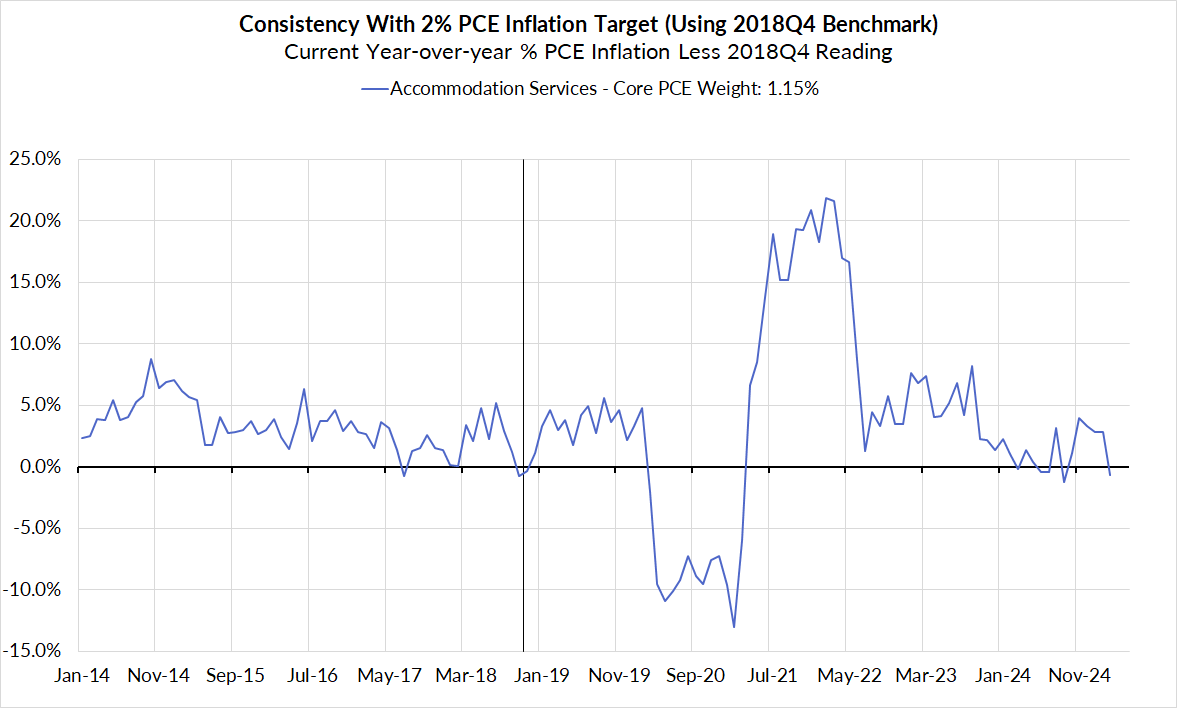

- In-person recreation and lodging services are contributing 6 basis points

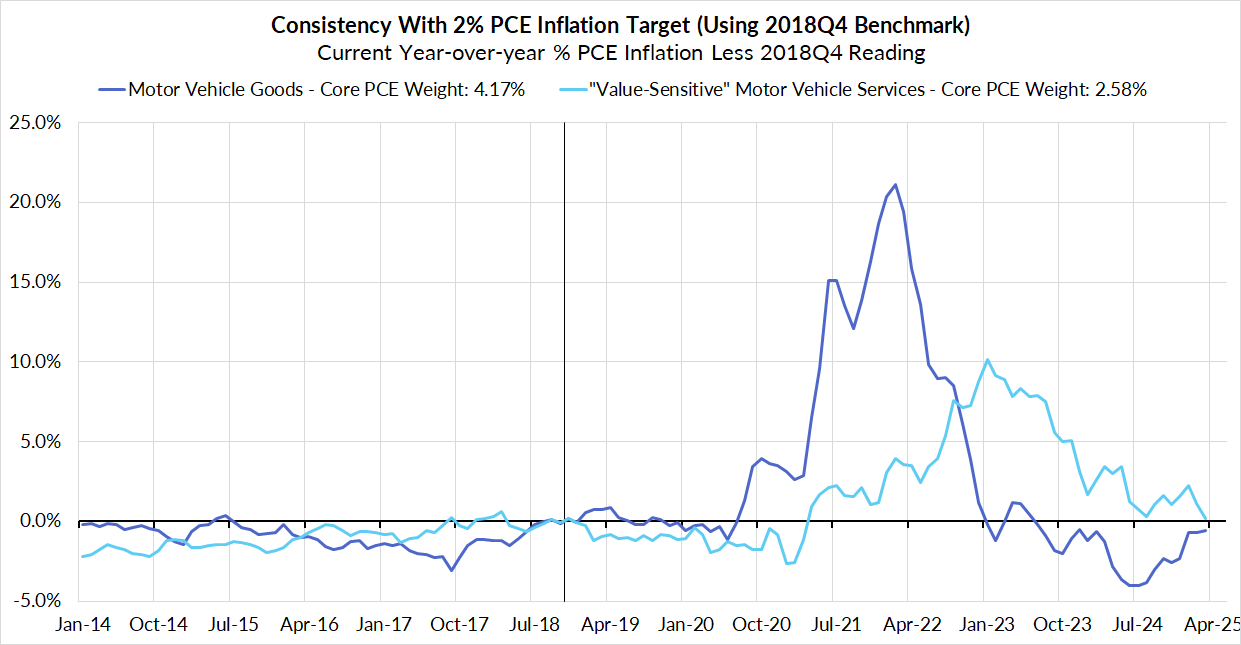

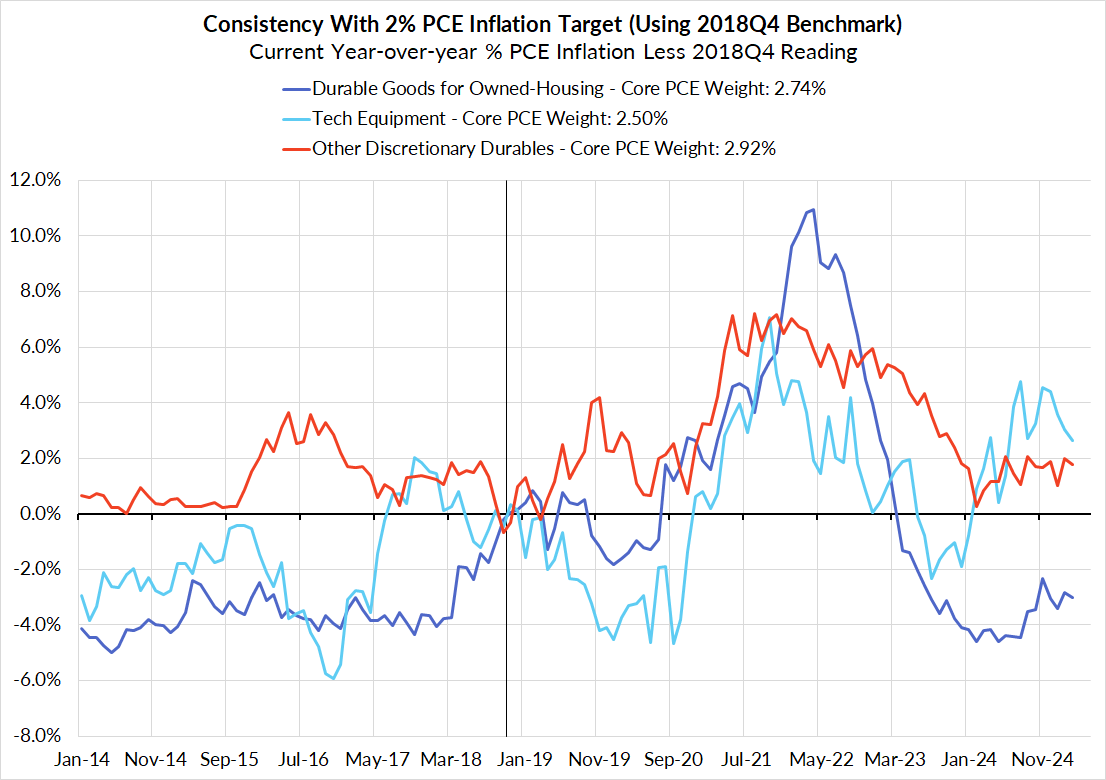

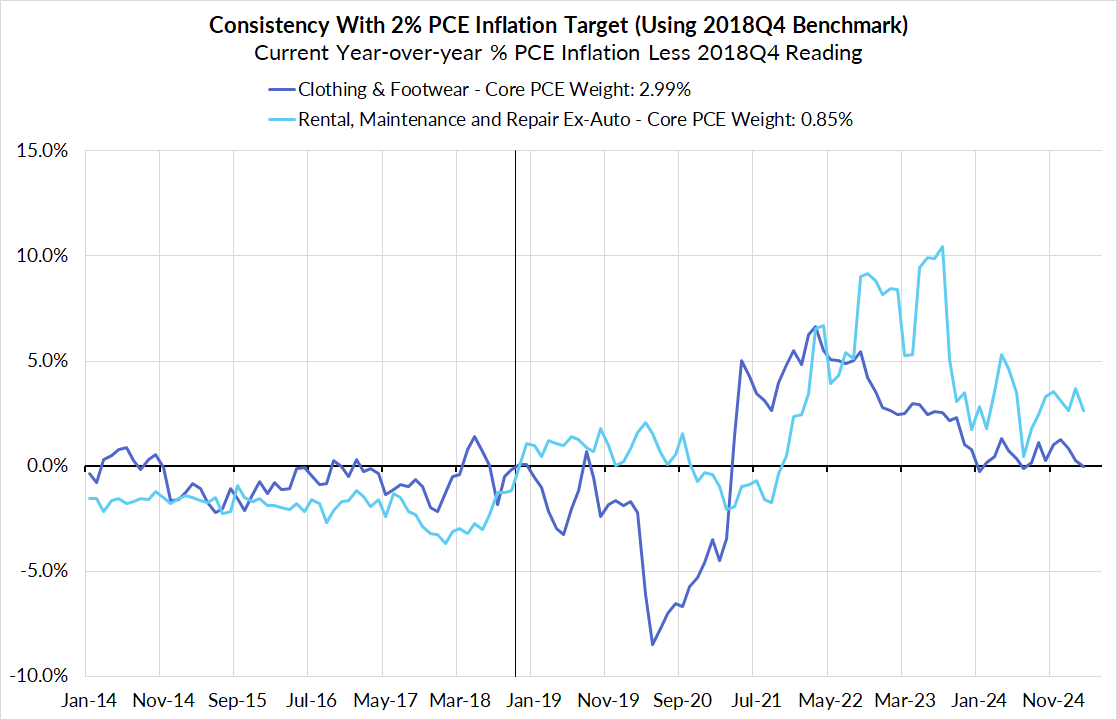

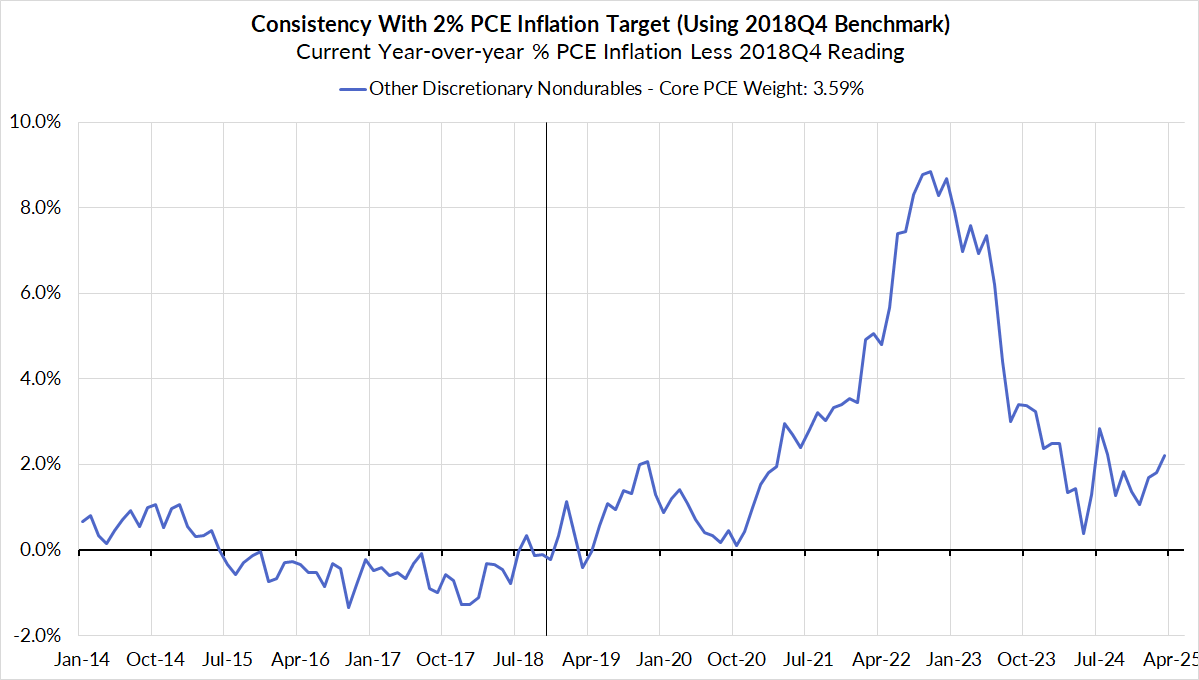

- Discretionary goods and adjacent services are adding 10 basis points

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. March monthly annualized Core PCE ran at a 0.34% annualized pace, a 166 basis point undershoot vs 2% target inflation.

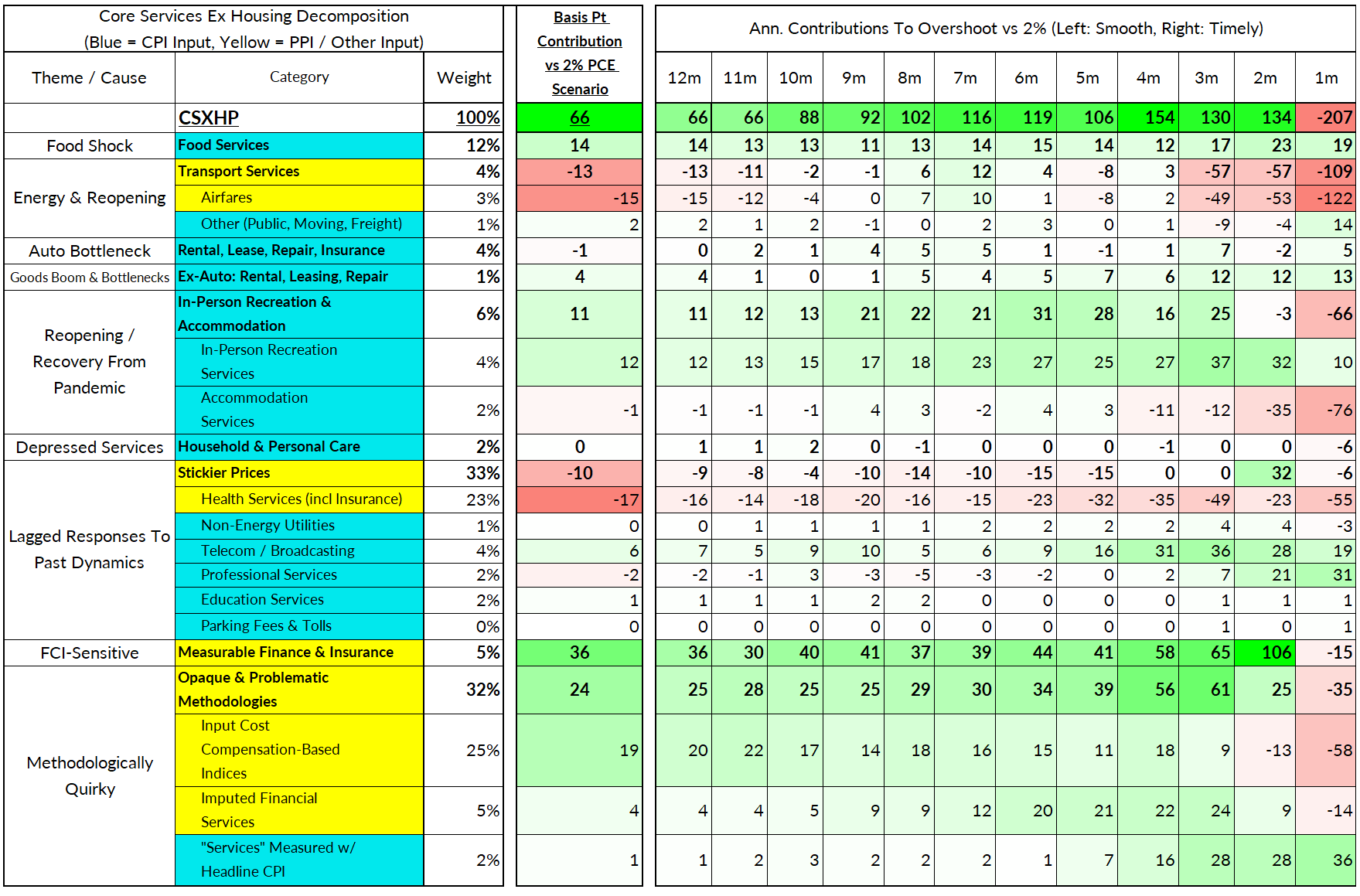

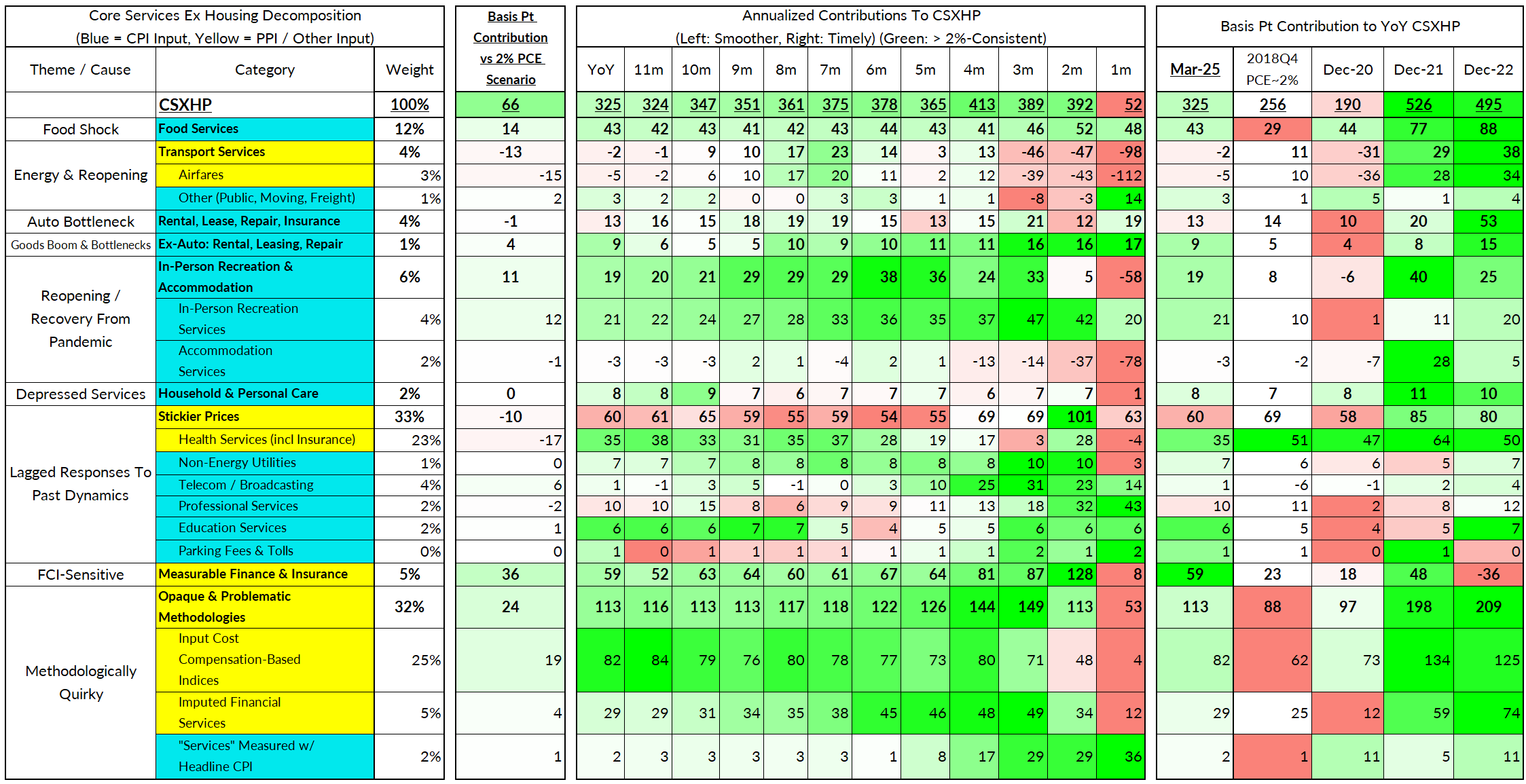

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The March growth rate in "Core Services Ex Housing" ('Supercore') PCE is running at a 3.25% year-over-year pace, a 66 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

March monthly supercore ran at a 0.52% annualized rate, a 207 basis point annualized undershoot of what would be consistent with 2% Headline and Core PCE.