Core-Cast is our model and publication series for nowcasting the Fed's Personal Consumption Expenditures (PCE) inflation gauges. We update our estimates from CPI, PPI, Import Price, and GDP data, along with previews and final recaps. If you'd like to become a MacroSuite subscriber to get all of our model updates before PCE is released, you can do so using this link. If you have any questions or would like to see samples of our past content, contact us here.

Summary: PCE Nowcasts

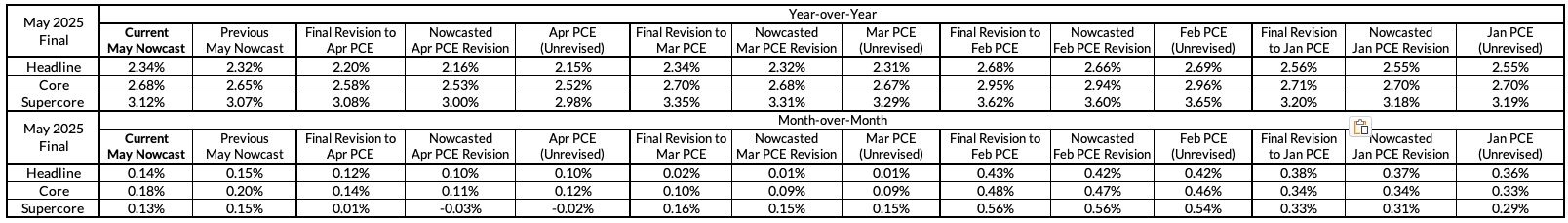

Our final nowcasts fared notably better than the consensus yet again, despite initially getting wrongfooted first by a soft CPI and then a stronger PPI release. Our year-over-year Core PCE nowcast was too cool by 3 basis points (but still substantially closer than consensus) while our month-over-month Core PCE nowcast was too hot by 2 basis points.

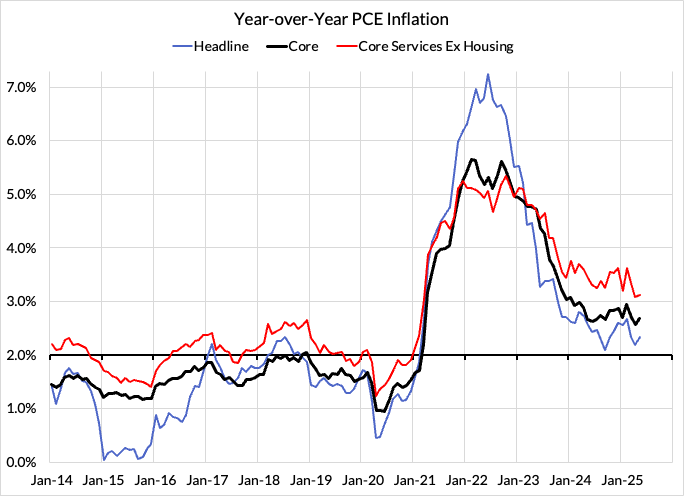

For those who have been puzzled why the Fed isn't more dovish given the string of soft CPI readings, today provides your answer. The Fed knew that the May PCE readings were not going to be as impressive as the CPI data. They are understandably reluctant to celebrate the inflation trajectory given what we learned in May. When combined with the risks of some hot prints this summer (tariff-related effects take time to materialize), it is generally not a wise move to signal excess dovishness too soon (and be vulnerable to a 180 just months later).

Waller and Bowman might have different views about the validity of an interest rate cut in July, but we see the inflation data risks tilted to the upside through the rest of the summer. We are due for a sizable used car price increase in June, along with tariff and electricity price effects that are likely to gain more steam. If labor and financial markets fail to deteriorate, the next rate cut may take more time to materialize. Financial markets are currently strong, but we do see growing cracks in the labor market, particularly in the weekly jobless claims data.

Inflation Overshoots At The Component Level

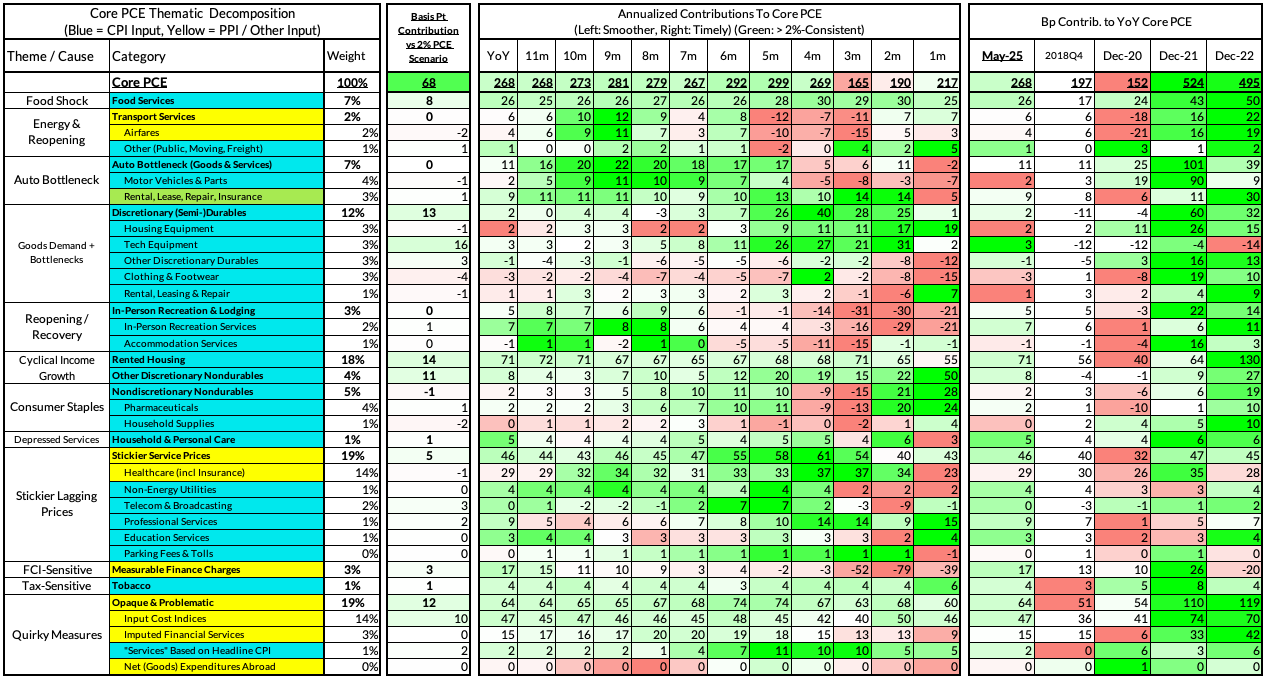

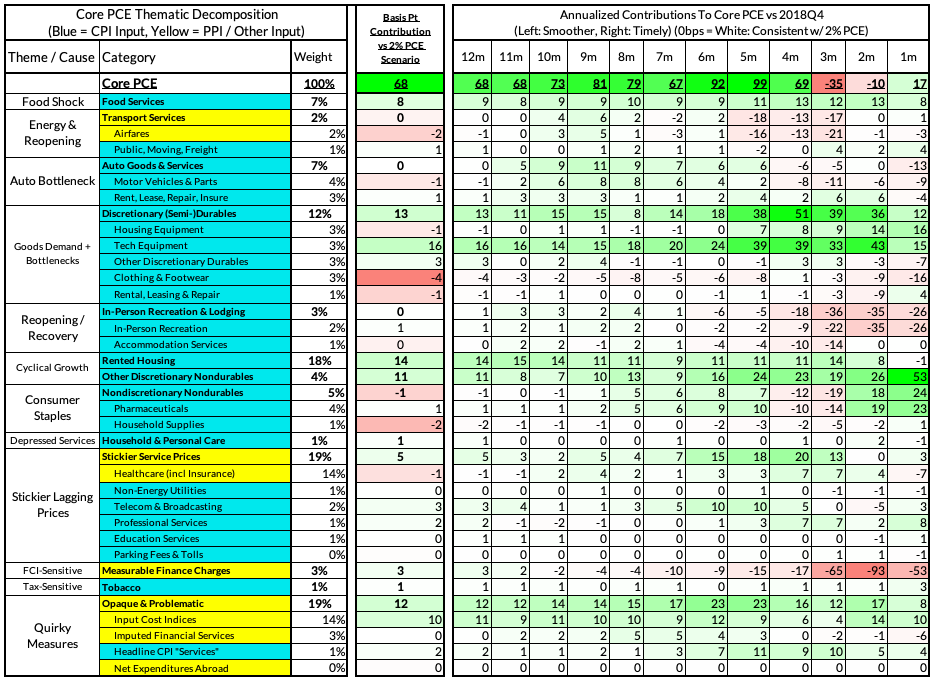

For the Detail-Oriented: Core PCE Heatmaps

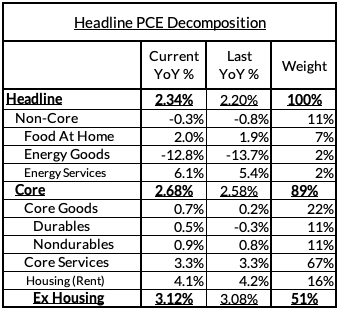

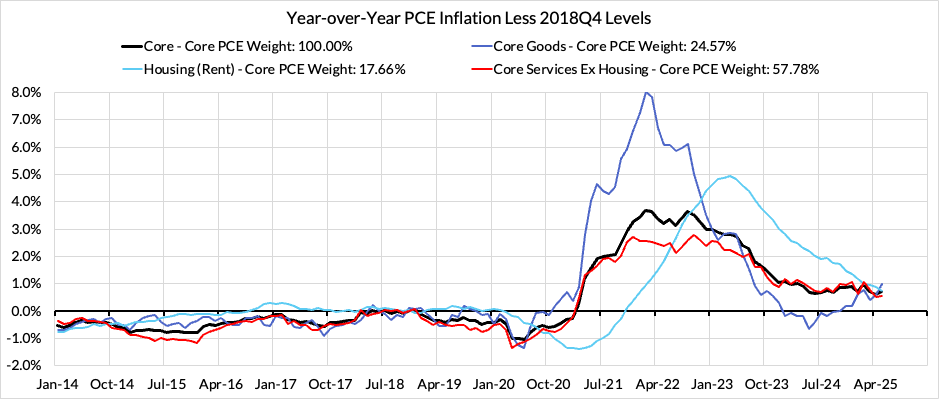

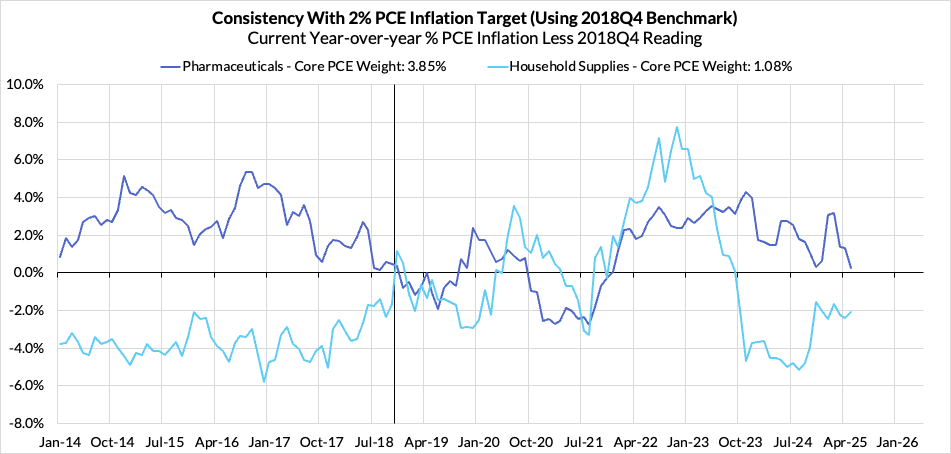

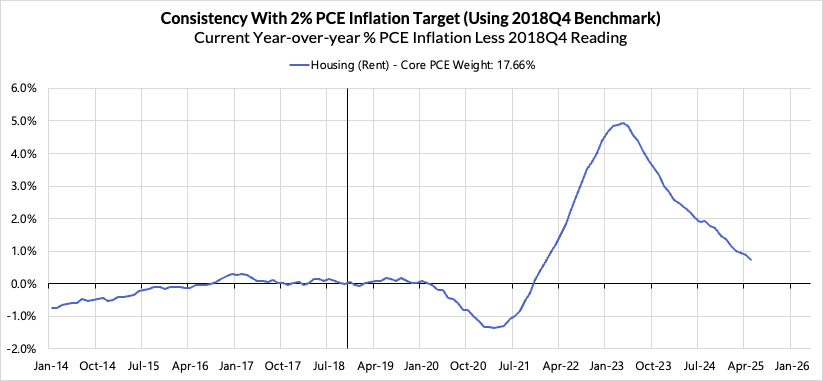

Right now Core PCE (PCE less food products and energy) is running at a 2.68% year-over-year pace as of May, 68 basis points above the Fed's 2% inflation target for PCE, 16 basis points higher than what was observed a month ago. That projected overshoot is still driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is on track to contribute 14 basis points to the 68 basis point Core PCE overshoot.

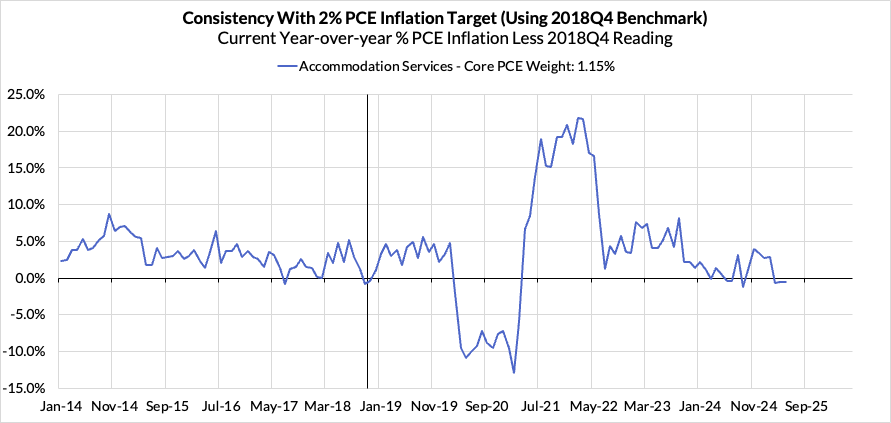

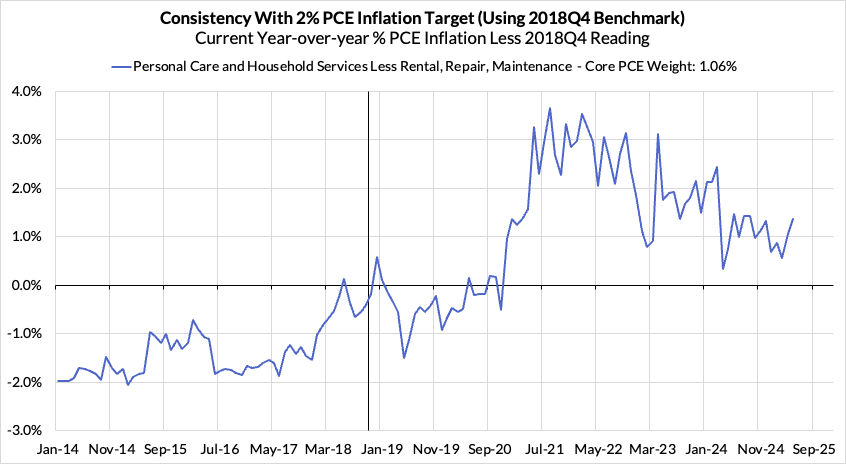

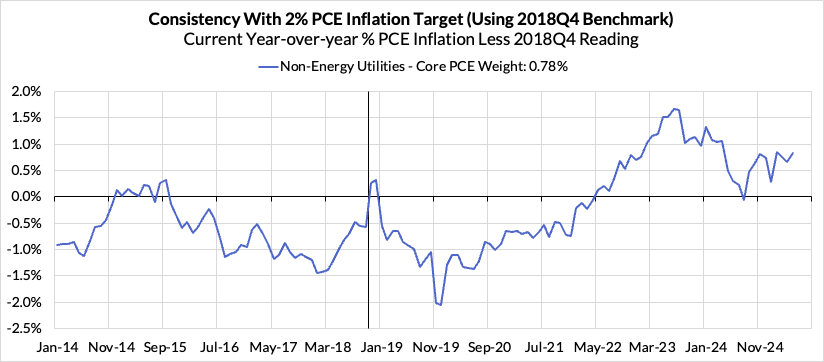

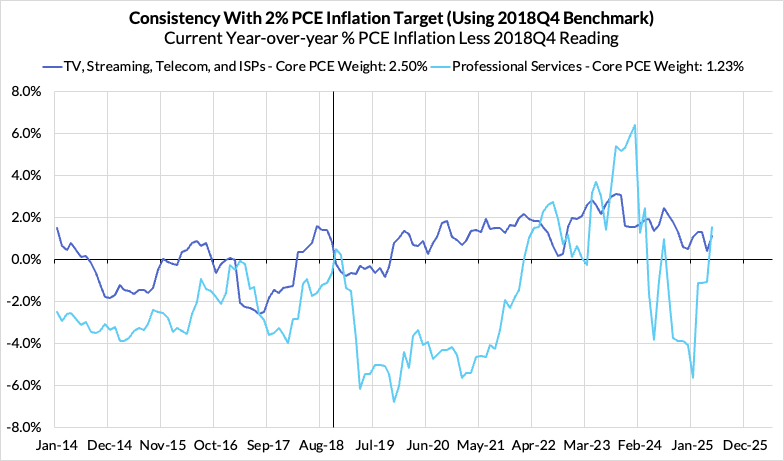

There are other contributors to the overshoot:

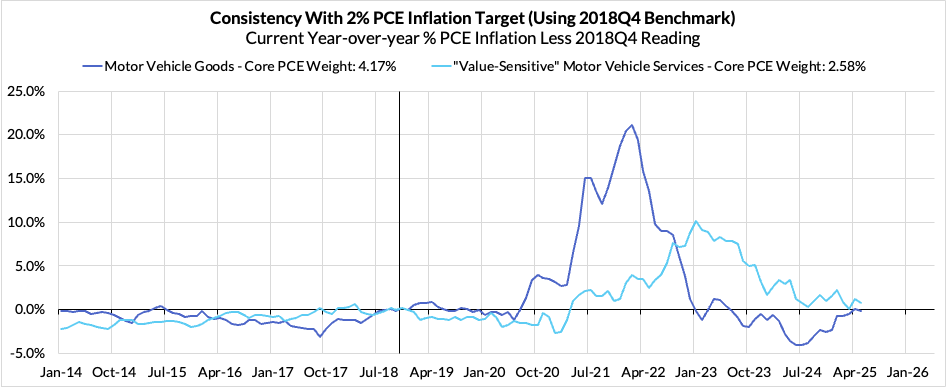

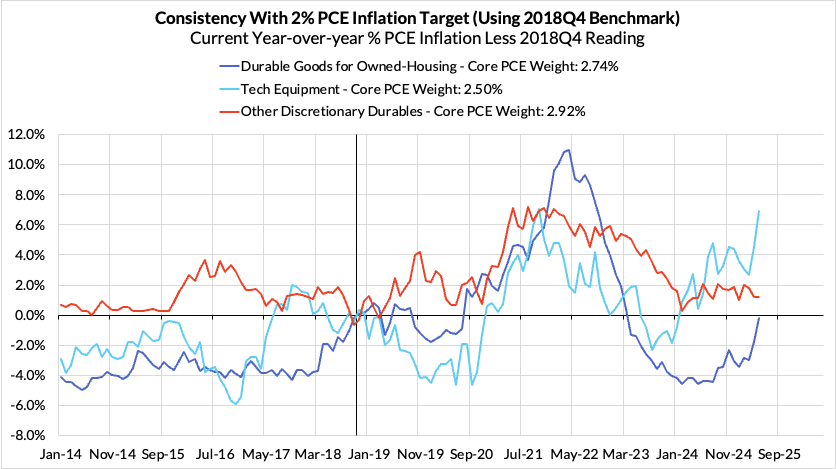

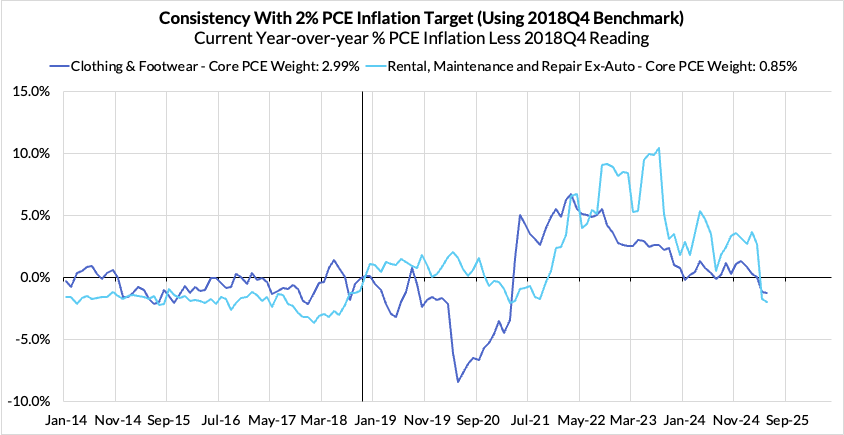

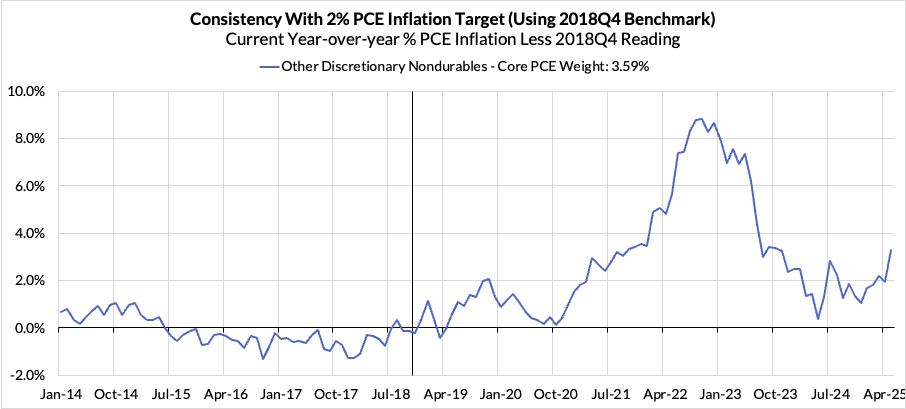

- Discretionary goods and adjacent services are adding 24 basis points now

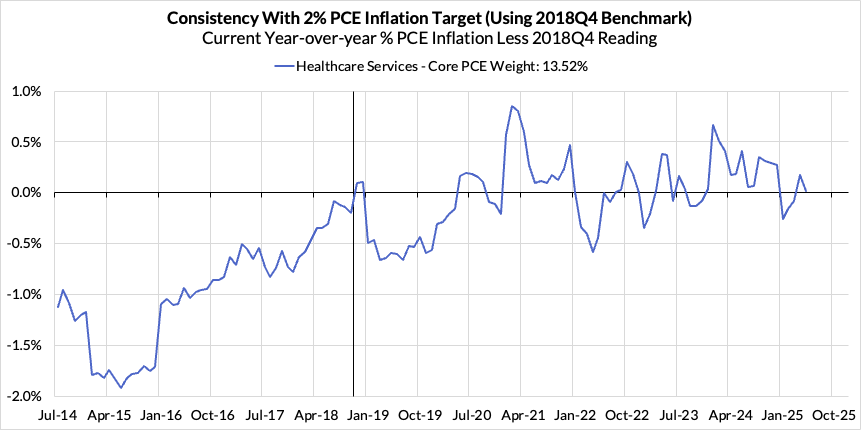

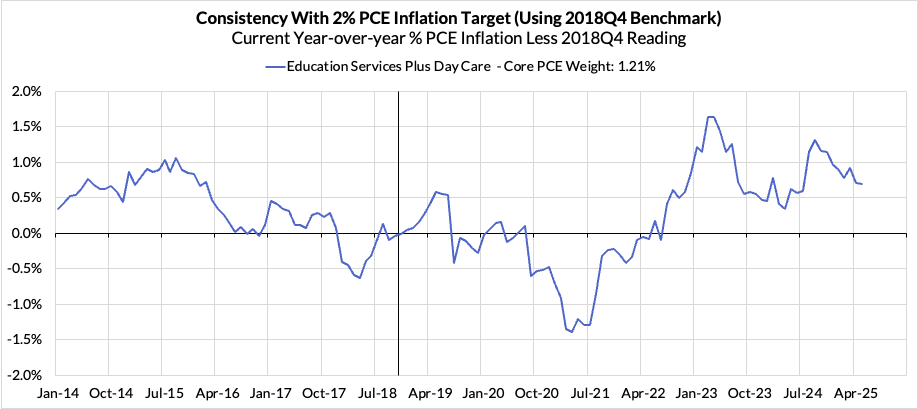

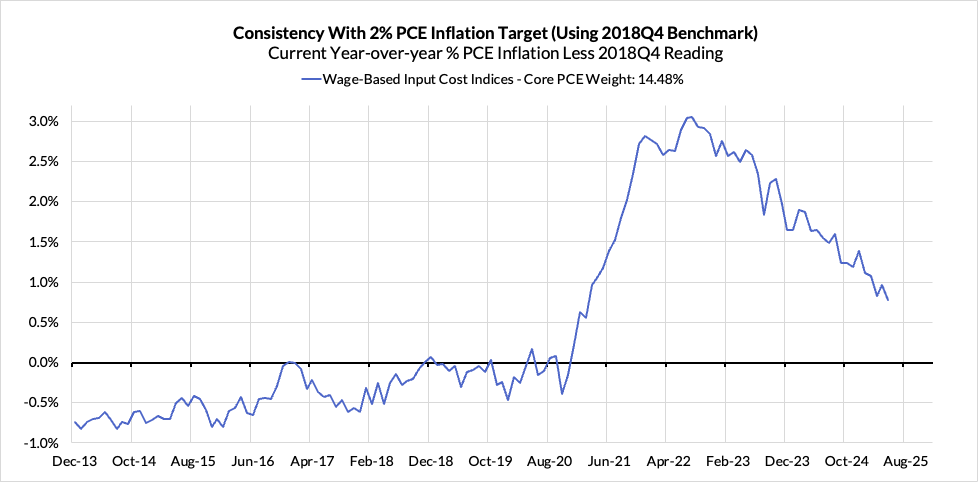

- Contributions from input cost indices (wages in specific sectors where market prices don't exist) are now adding 10 basis points to the overshoot

- Food inputs are adding 8 basis points to the overshoot

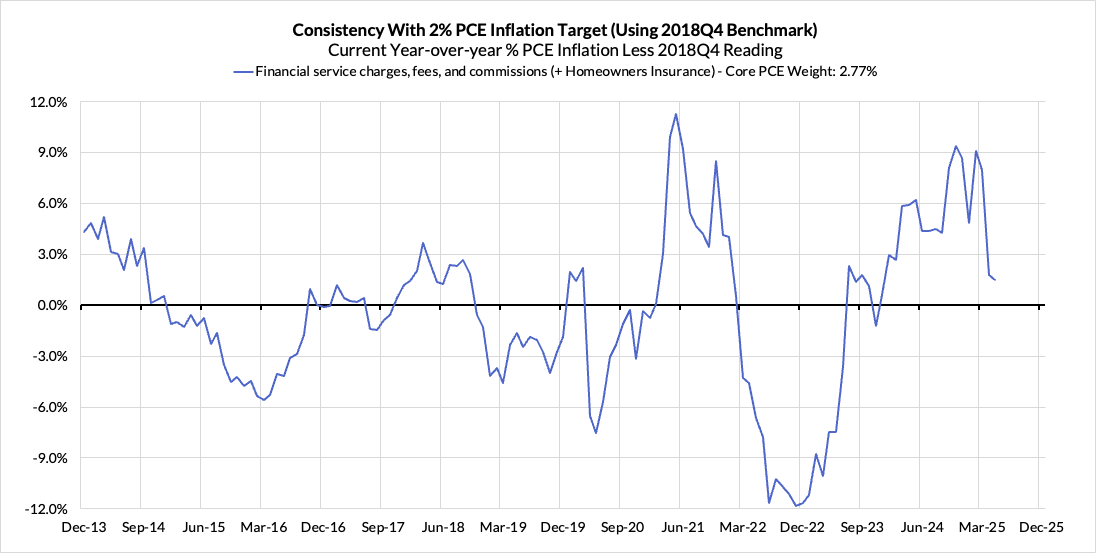

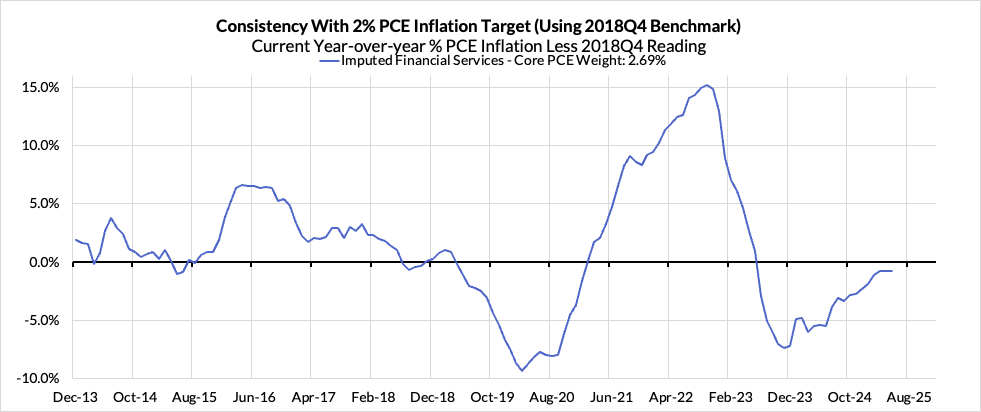

- Measured financial service charges are now adding only 3 basis points due to the equity market performance over the past 12 months

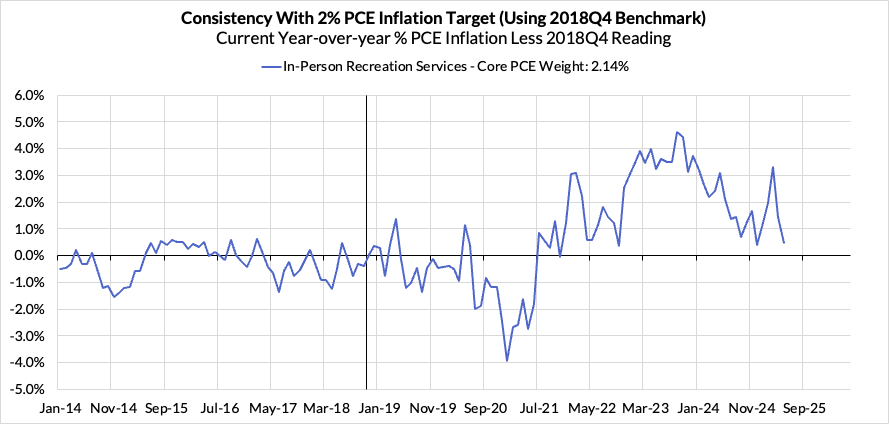

- In-person recreation services are contributing on 1 basis point now

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. May monthly annualized Core PCE ran at a 2.17% annualized pace, a 17 basis point overshoot vs 2% target inflation.

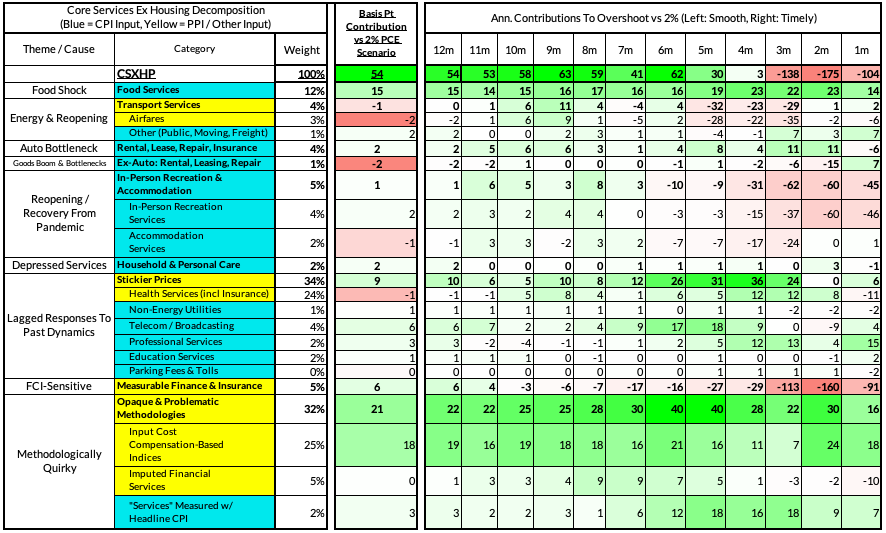

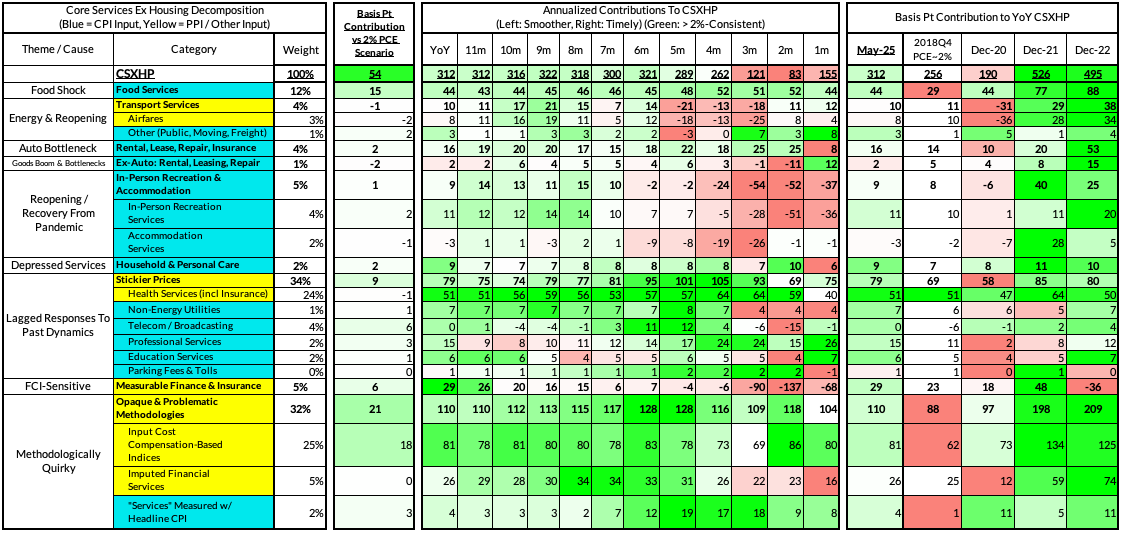

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

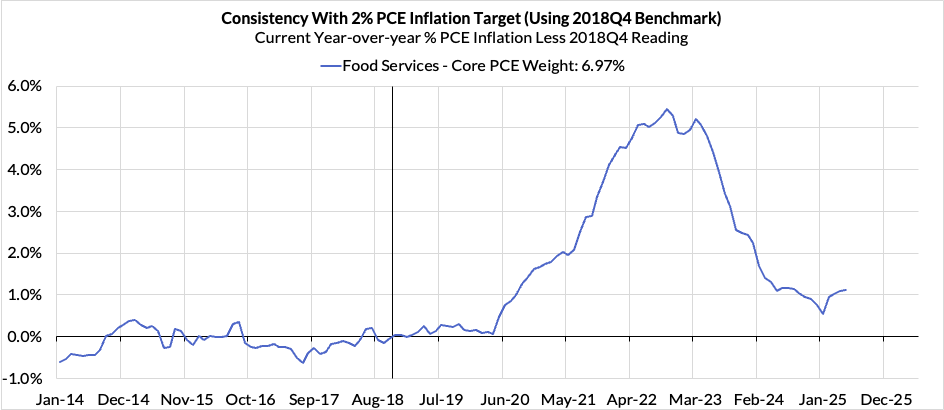

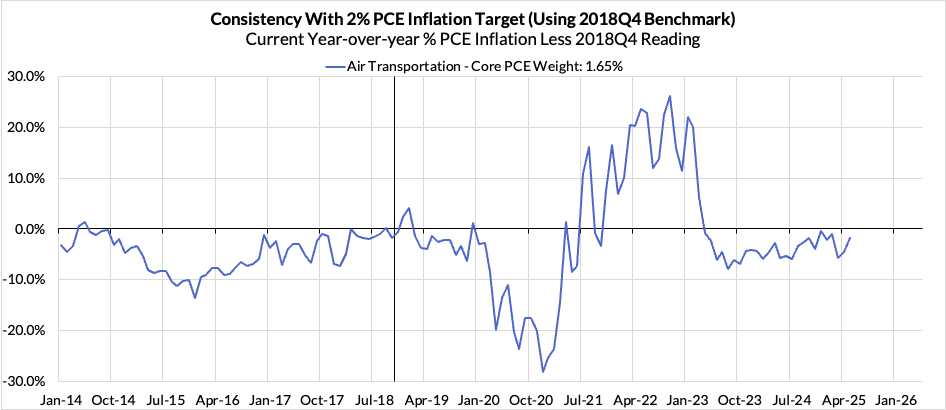

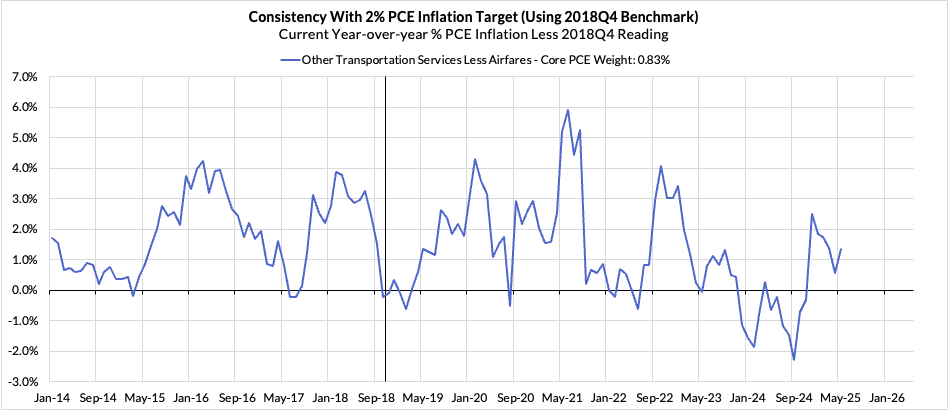

The May growth rate in "Core Services Ex Housing" ('Supercore') PCE is running at a 3.12% year-over-year pace, a 54 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

May monthly supercore ran at a 1.55% annualized rate, a 104 basis point annualized undershoot of what would be consistent with 2% Headline and Core PCE.