This preview was originally published two days ago. It has been updated to reflect the additional information from JOLTS and the flurry of Fedspeak yesterday.

Baseline View

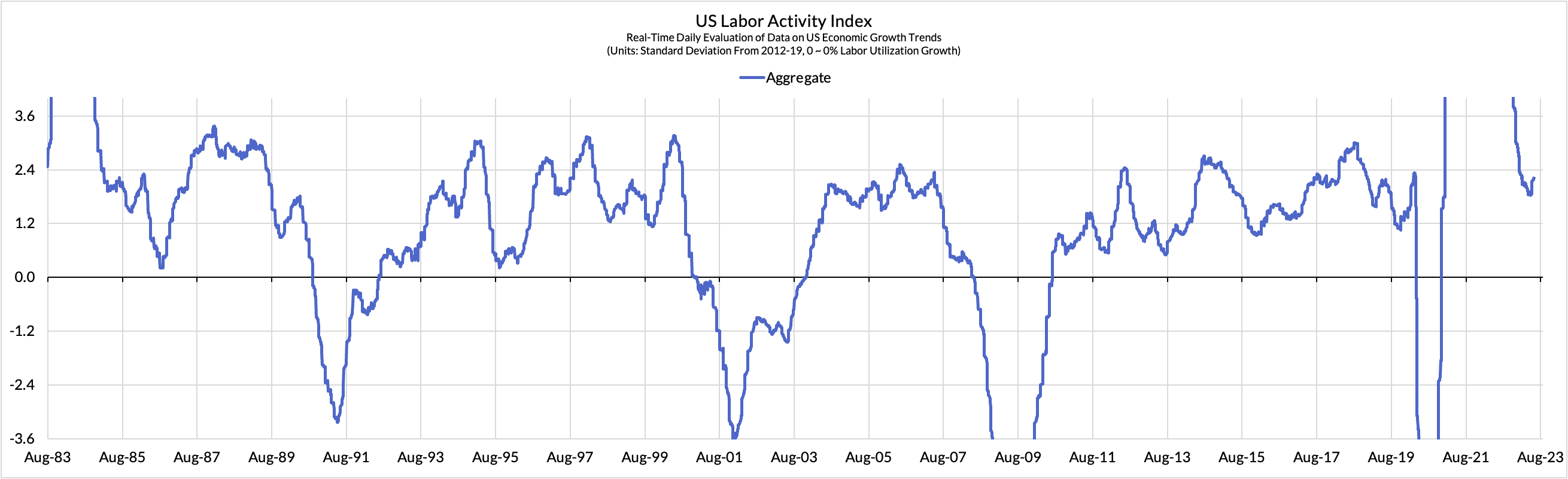

Slower job growth, slower wage growth, an unemployment rate that might fall to a new record low. In light of mixed JOLTS report and dovish Fedspeak from Governor Jefferson yesterday, there will need to be an elevated threshold for "heat" in this jobs report for us to shift our baseline for the next hike from July to June.

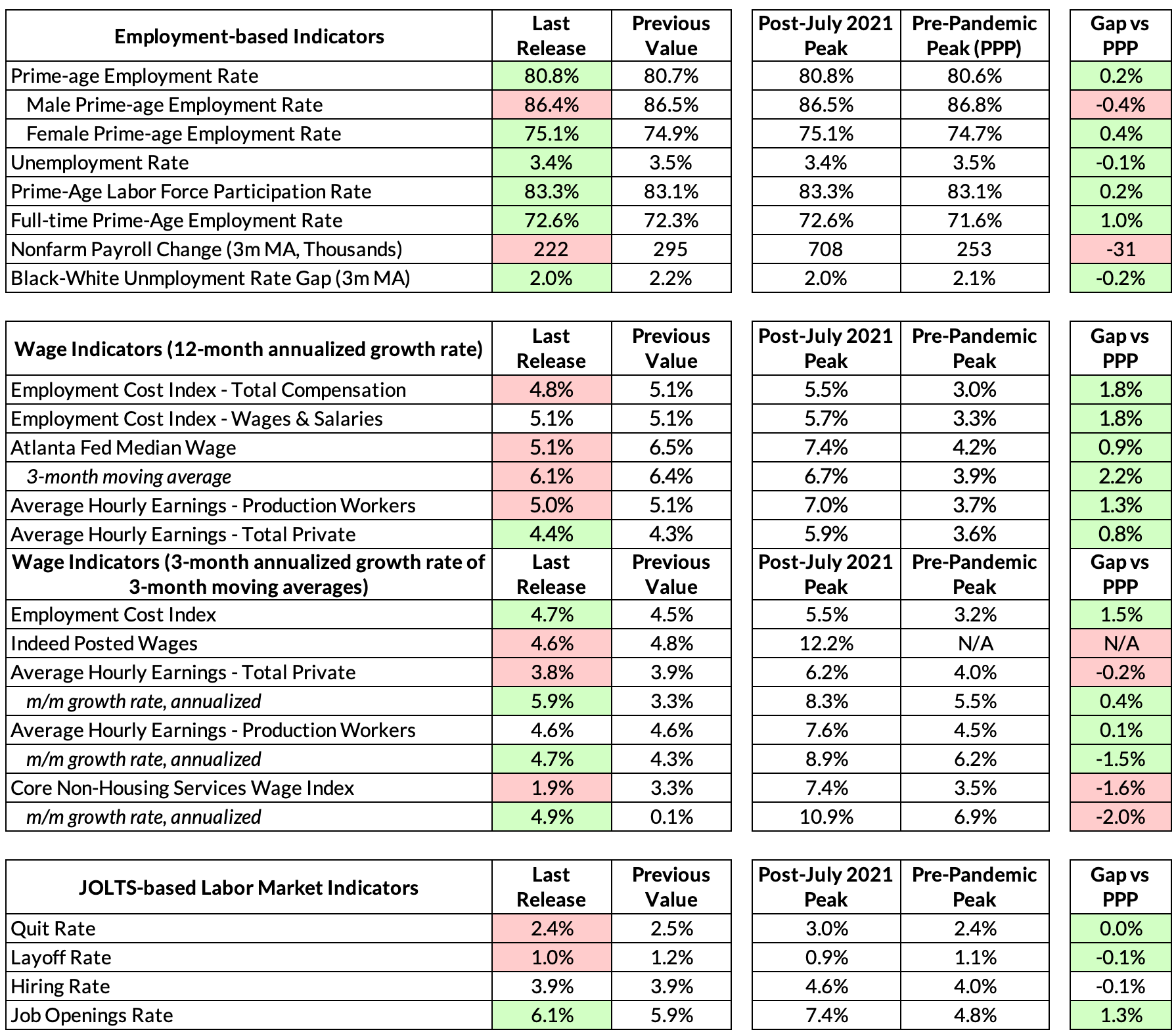

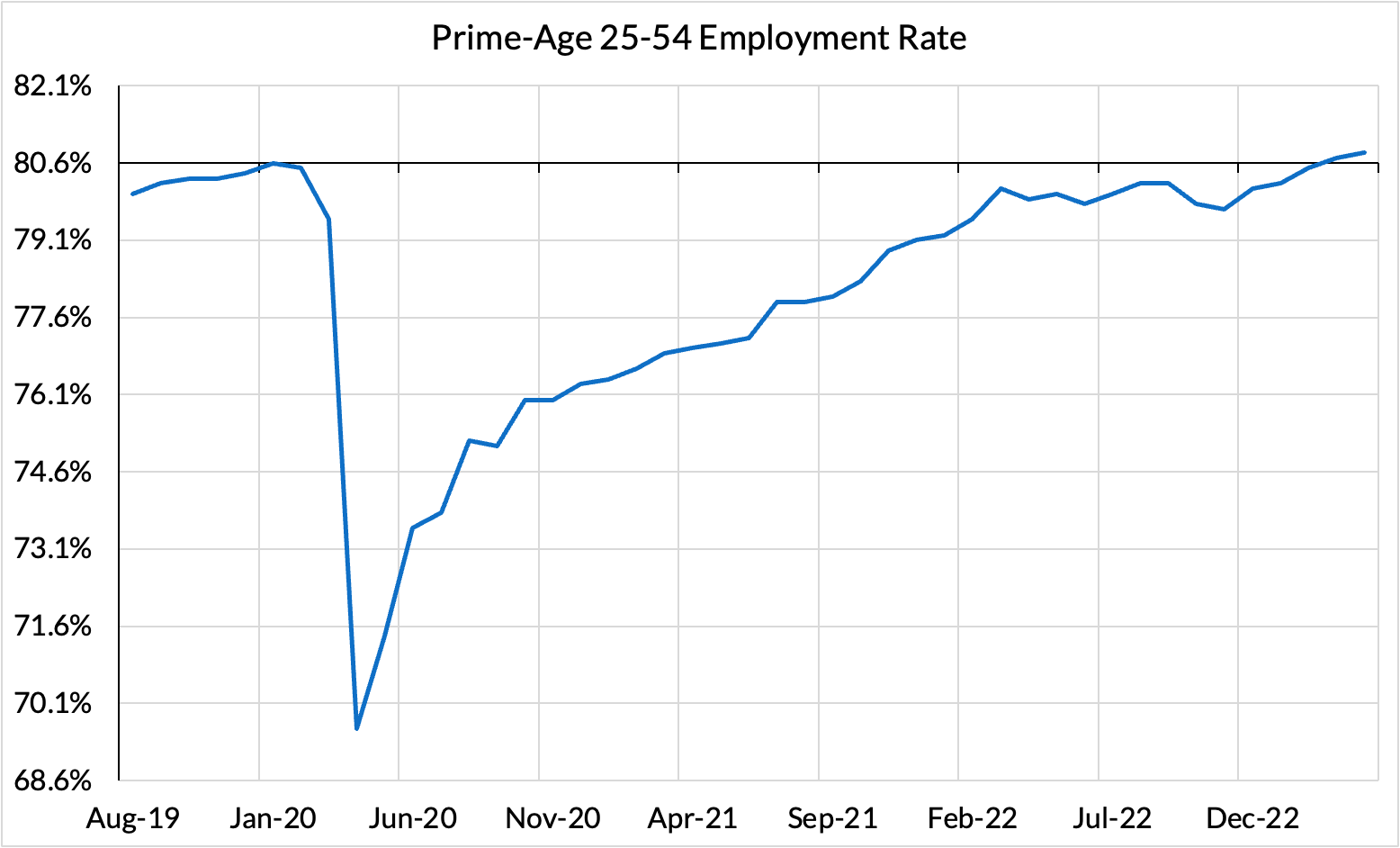

- Our biggest divergence with the forecasting consensus is on the unemployment rate (3.4% forecast vs 3.5% consensus vs 3.4% April reading). The forecasting consensus is expecting the unemployment rate to rise from 3.4% to 3.5%, while our internal models imply that the unemployment rate is more likely to fall to 3.3% than rise to 3.5%. Even a flat unemployment rate is a positive surprise vs consensus. The unrounded unemployment rate in April was 3.39%, a record low in this expansion.

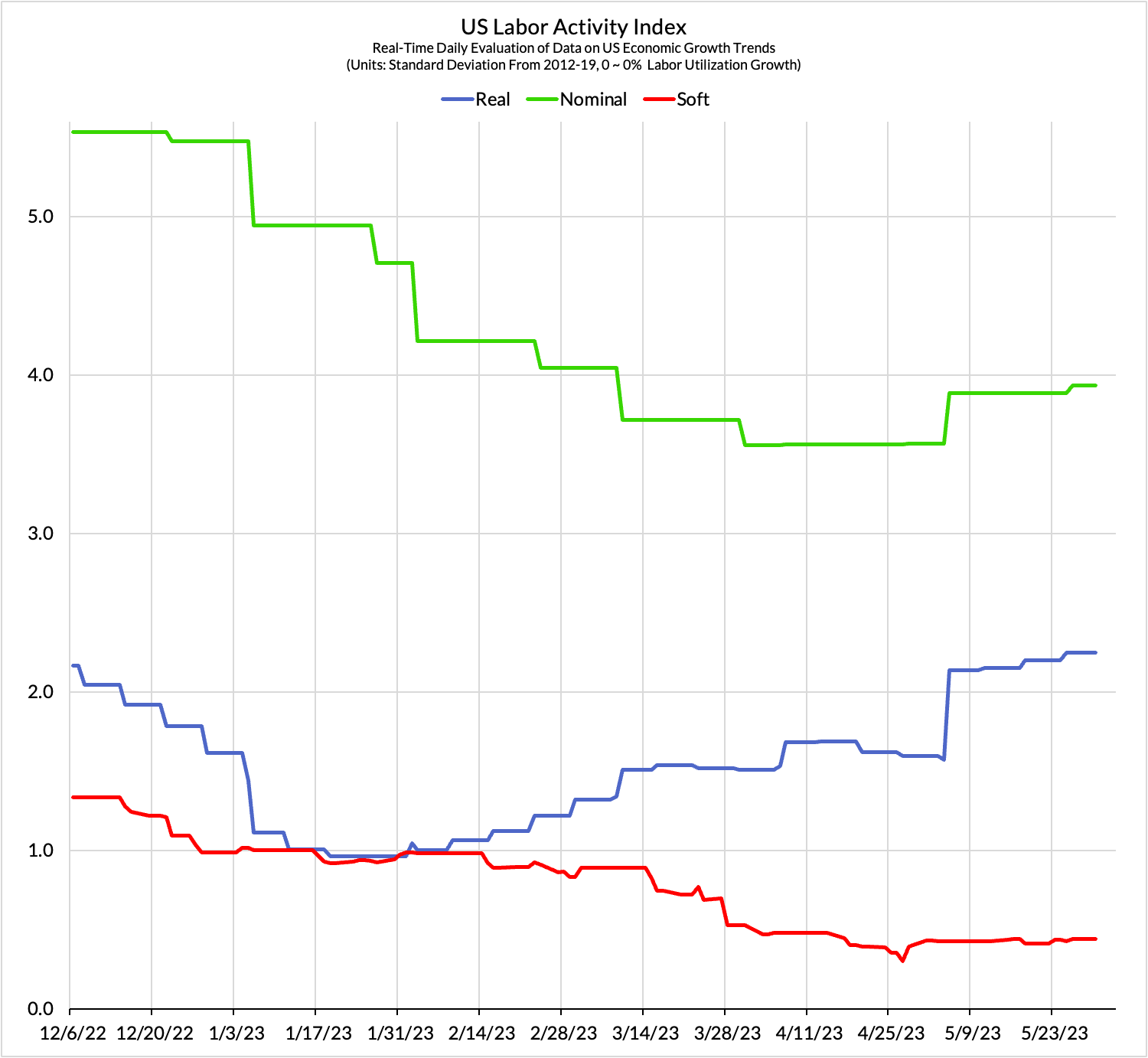

- We are expecting payroll growth to evolve in line with the forecasting consensus, ~180k vs 195k consensus vs 230k in April. The business survey data on employment was only incrementally expansionary over the course of May, and is more consistent with a slower rate of job growth than what has recently materialized in the hard data.

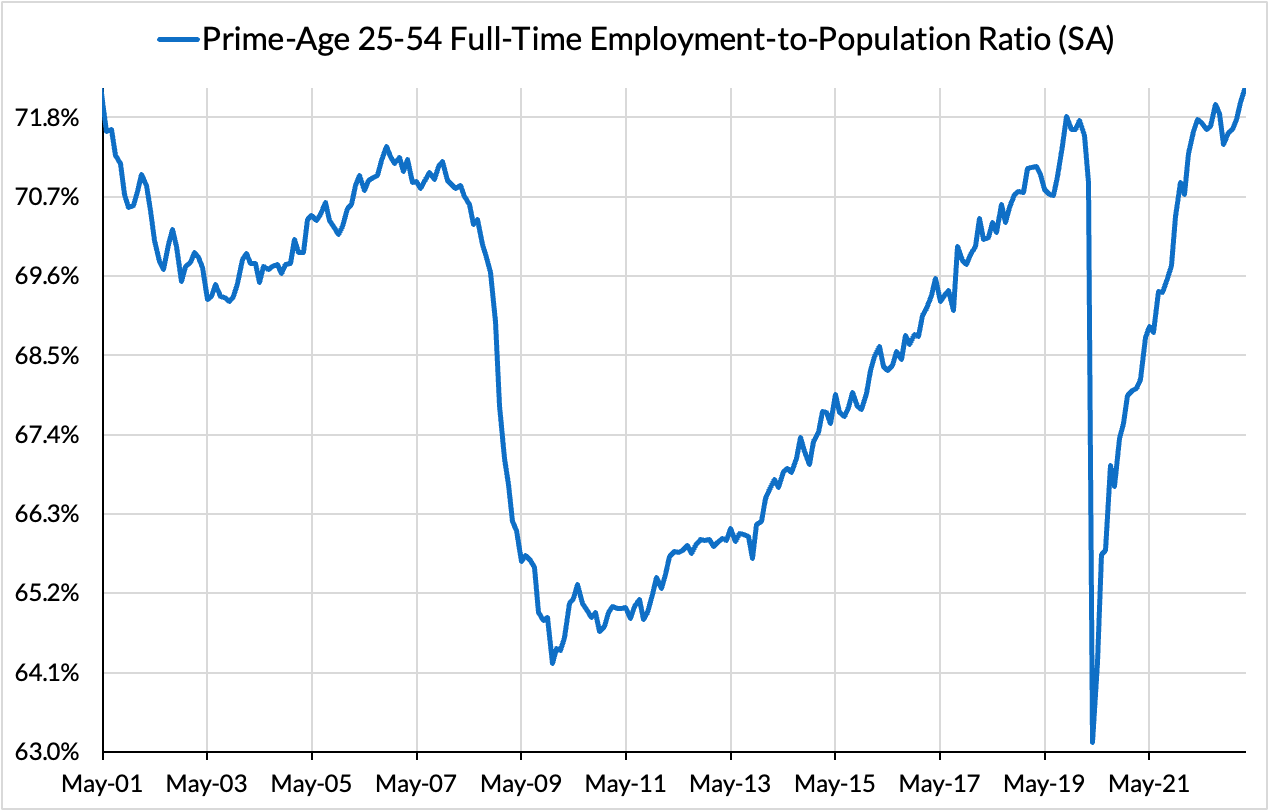

- We are expecting wage growth to slow relative to a consensus (4.3% year-over-year vs 4.4% consensus vs 4.4% in April). The quits rate is nearly back to pre-pandemic levels, the hires rate has already reverted to pre-pandemic pace, and the volatile Atlanta Fed Wage tracker is also beginning to correct. Yesterday's JOLTS data should not drastically color this broader assessment of labor market tightness, since job openings (the Fed's preferred indicator) ticked up even as the quits rate (our preferred indicator) has now fully reverted back to pre-pandemic levels. That said, AHE has too many sources of volatility (seasonal factors, revisions, etc) to take too seriously on a month-to-month basis.

Policy Risks:

Our base-case is for a June "skip" and a July hike, and both meetings are still reasonably balanced, but the our base-case was strengthened after yesterday's Fedspeak. 0, 1, or 2 hikes are all plausible over the next two meetings. A cut would require a tail risk to materialize.

- Hawkish: Contingent on a "Hot" JOLTS release on Wednesday, a wage growth upside surprise and a further decline in the unemployment rate, it could at least set the stage for June hike if May CPI comes in hot (used cars will be pushing CPI to the upside yet again). Jobs Day is the last day before the FOMC blackout period begins. So if key Fed officials are keen to change the baseline view based on upside data on Jobs Day, we should see a flurry of Fedspeak soonafter. The fact that a Fed official of Governor Jefferson's stature spoke quite clearly about the case for skipping June yesterday suggests that "skip" remains a firm base case.

- Dovish: The primary pathway way this jobs report can drive dovish Fed innovations is if we see recessionary outcomes, and even then, we suspect it would require multiple employment reports to convince the Fed to do anything more than hold rates steady in June and July. Softer wage growth is unlikely to convince the Fed on its own, but if it can be strung together over multiple months and indicators (including JOLTS indicators), it may also convince the Fed to hold both in June and July.