Core-Cast is our model and publication series for nowcasting the Fed's Personal Consumption Expenditures (PCE) inflation gauges. We update our estimates from CPI, PPI, Import Price, and GDP data, along with previews and final recaps. If you'd like to become a MacroSuite subscriber to get all of our model updates before PCE is released, you can do so using this link. If you have any questions or would like to see samples of our past content, contact us here.

We apologize for the delay in the release of our public recap of the PCE release.

Summary: PCE Nowcasts

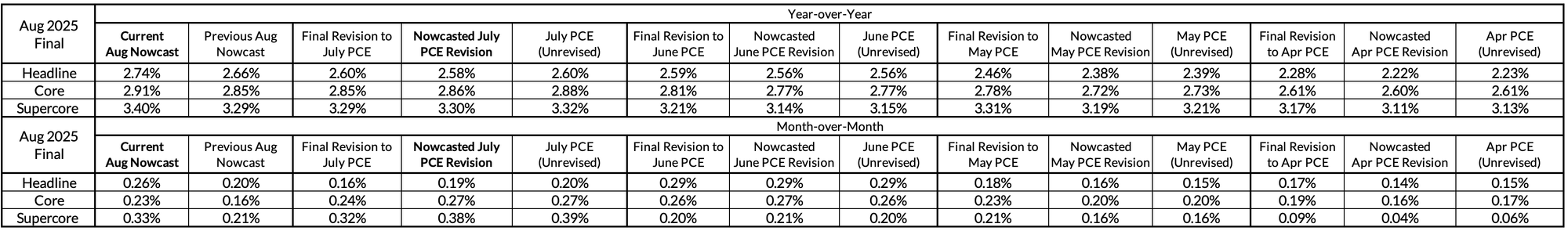

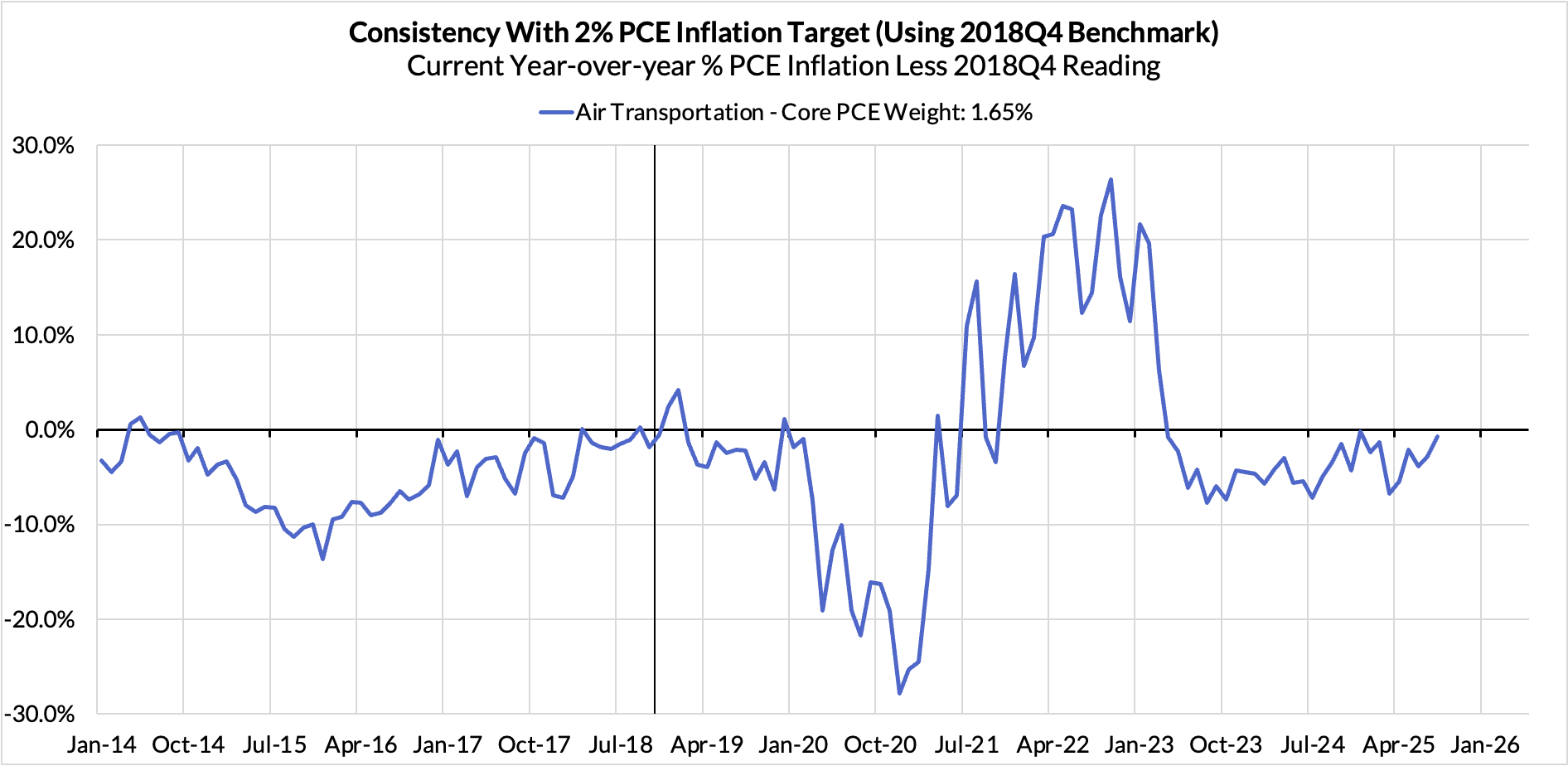

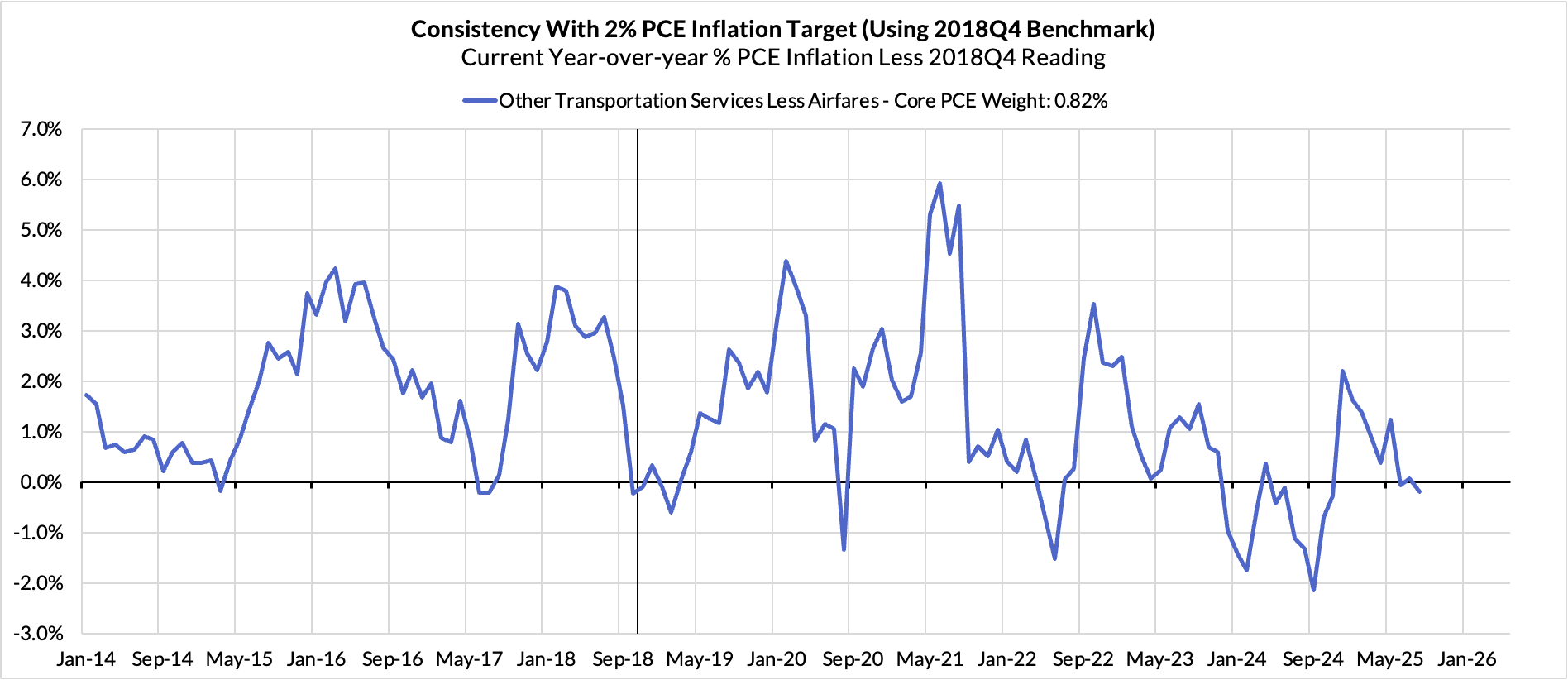

The August PCE release delivered us an outlier nowcasting error of +7bps on the m/m Core PCE reading and +6bps on the y/y reading. The explanation for the error is fundamentally straightforward: the annual benchmark revisions adjusted some of the seasonal factors for some of the hardest-to-nowcast components of PCE, specifically the PPI inputs and the BEA indices. We will refine our models to better account for this idiosyncrasy, which only affects the August PCE release.

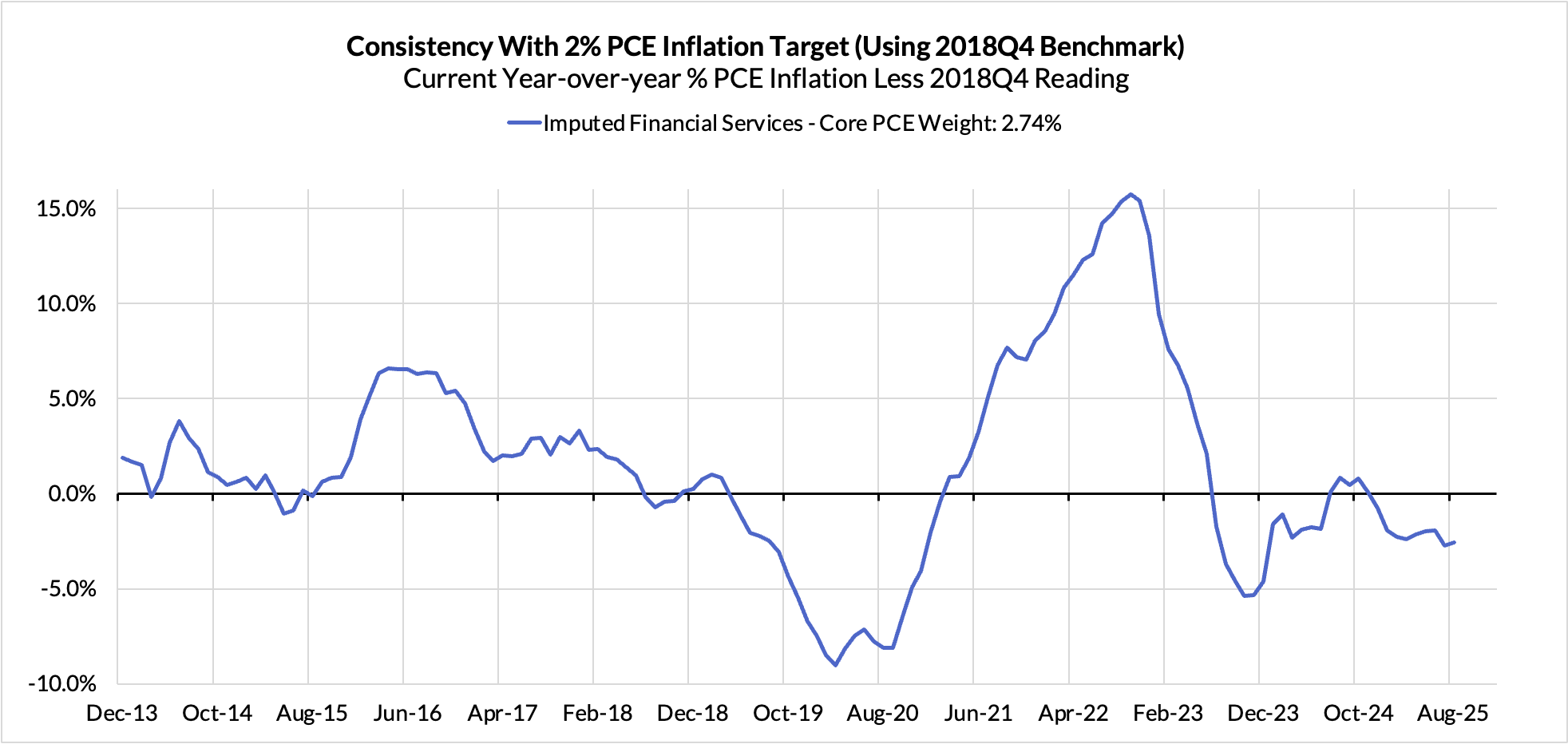

The sources of error on the m/m nowcast overlap but are nevertheless distinct from the y/y nowcast. Half of the m/m nowcast error came from airfares (PPI input), with the remainder coming from imputed financial services (BEA index) and healthcare services (PPI input). The y/y nowcast error was more predominantly about healthcare services, with residual tracking errors in airfares explaining the remainder.

The upside surprise ultimately placed the reading more firmly in line with the nowcasting consensus and still fails to serve as a material surprise for the FOMC, which was likely anticipating a 2.9% y/y Core PCE reading. Nevertheless, this upside surprise for us makes us more confident that Core PCE will not materially underperform the Fed's lofty 3.1% y/y Core PCE projection for 2025Q4. On the other hand, the Fed continues to pencil a 4.5% unemployment rate for 2025Q4, well-above what the current trajectory of the labor market and activity suggests.

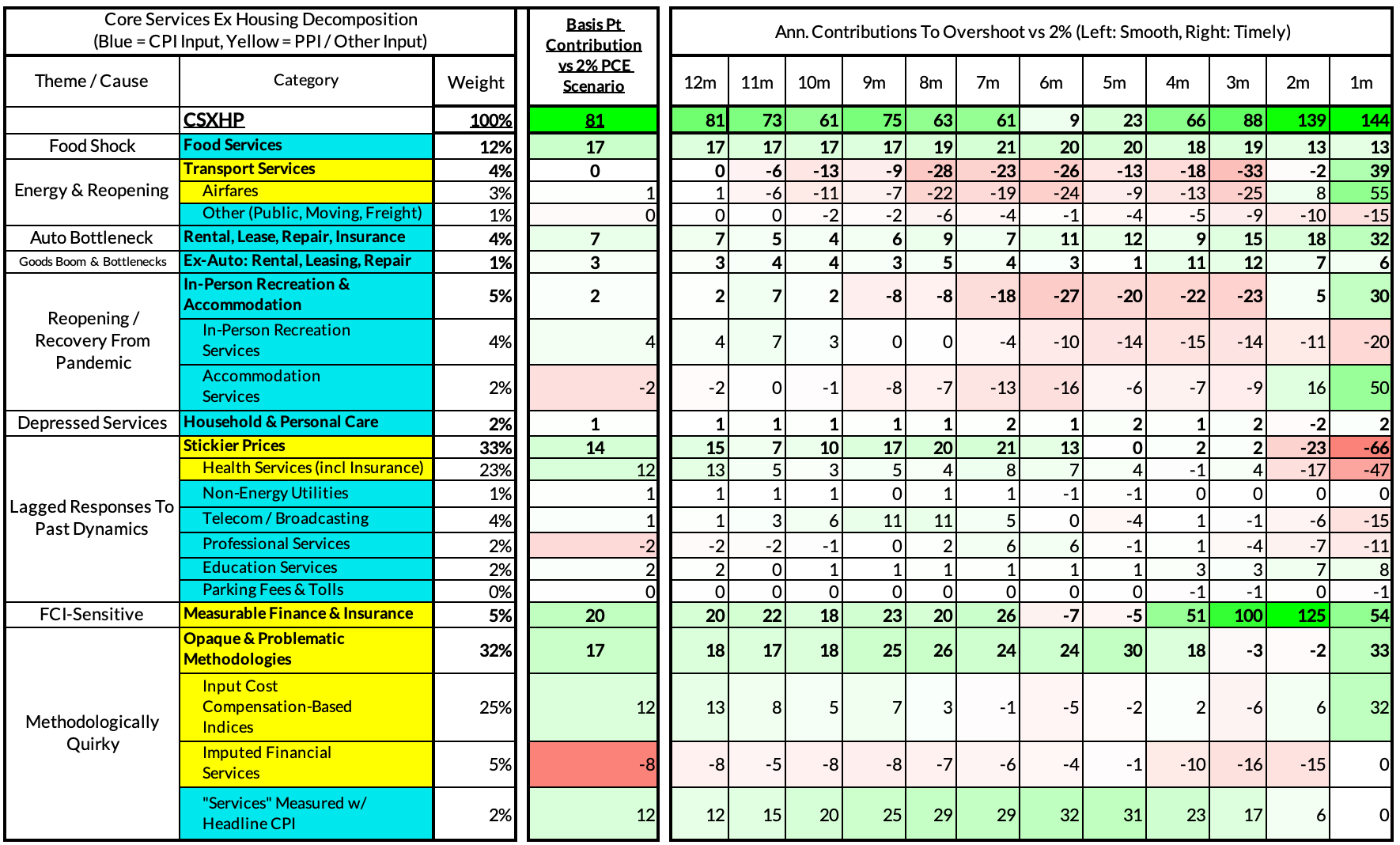

Inflation Overshoots At The Component Level

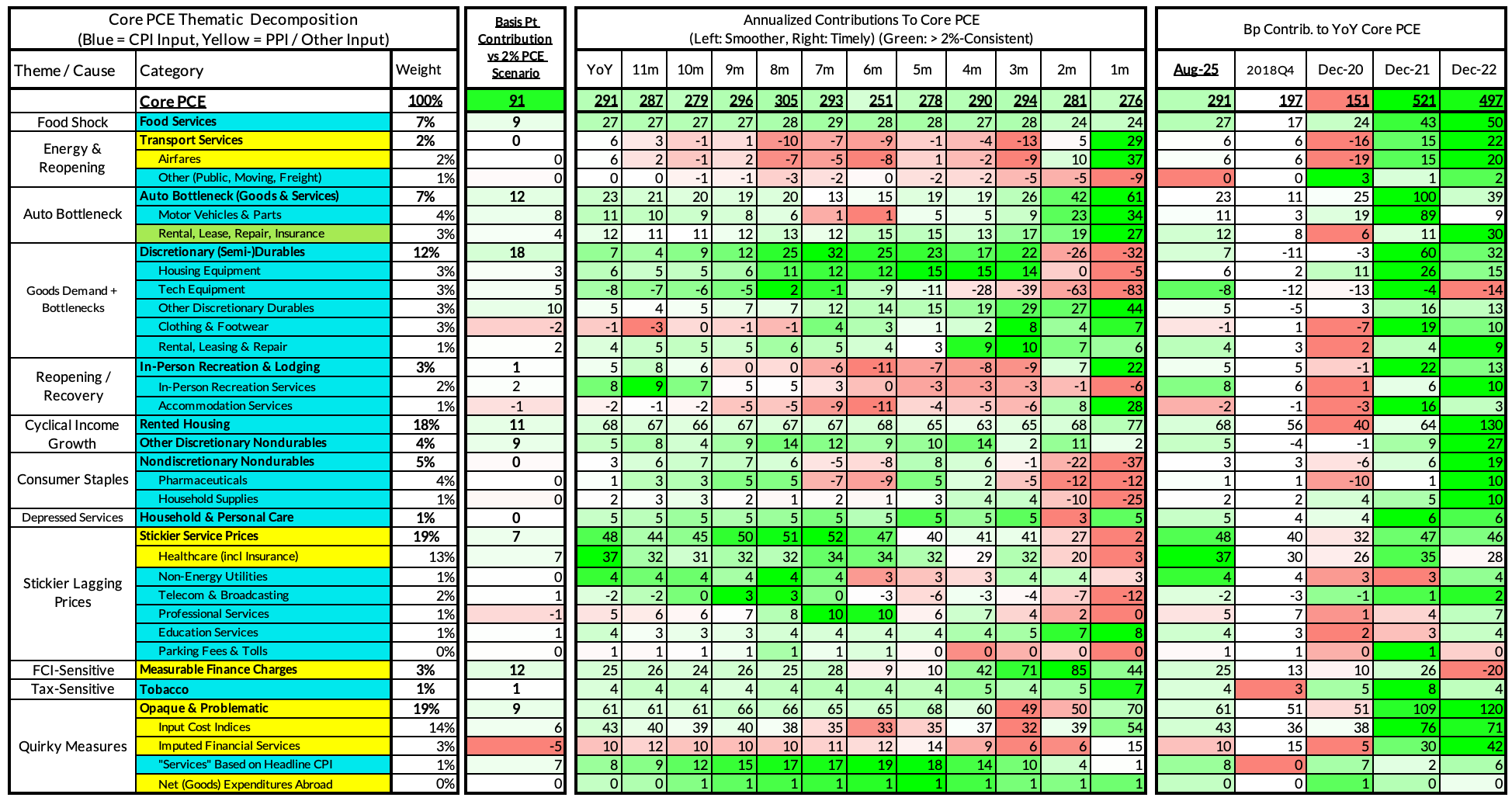

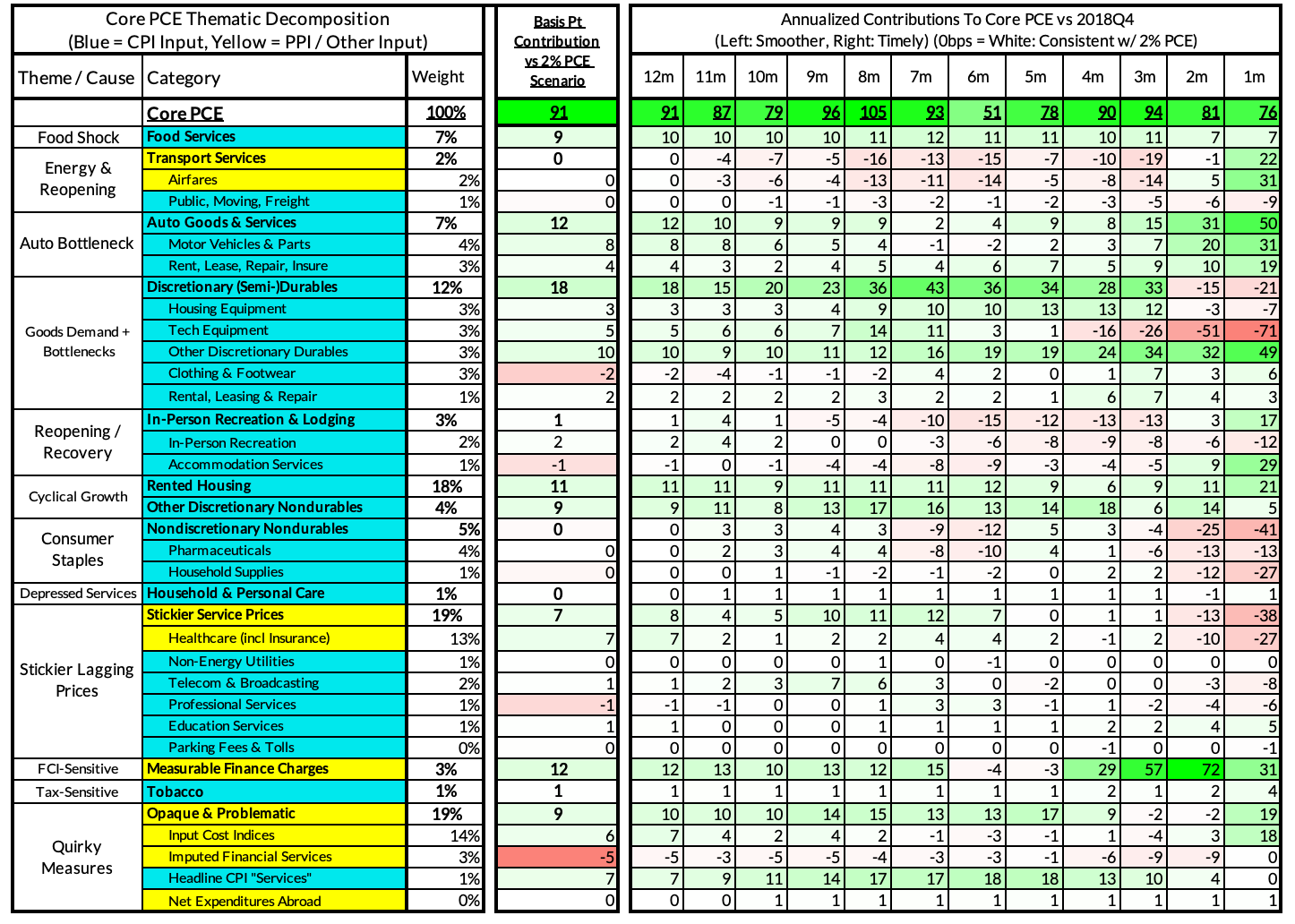

For the Detail-Oriented: Core PCE Heatmaps

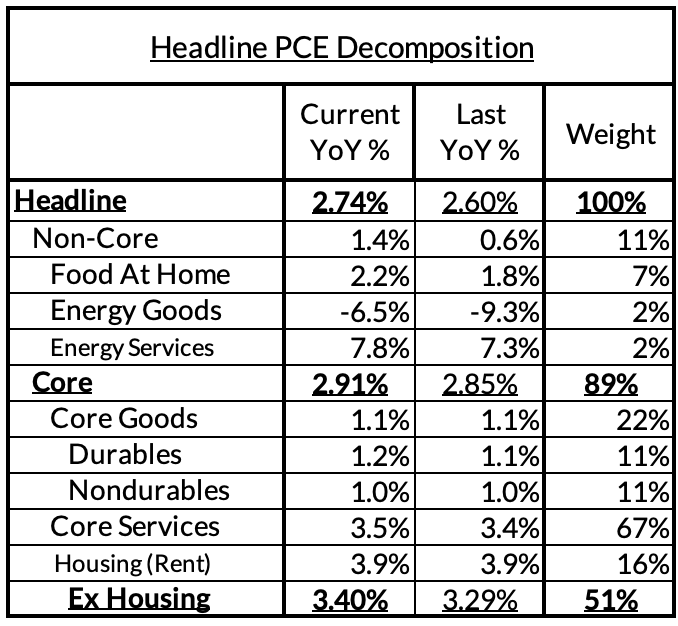

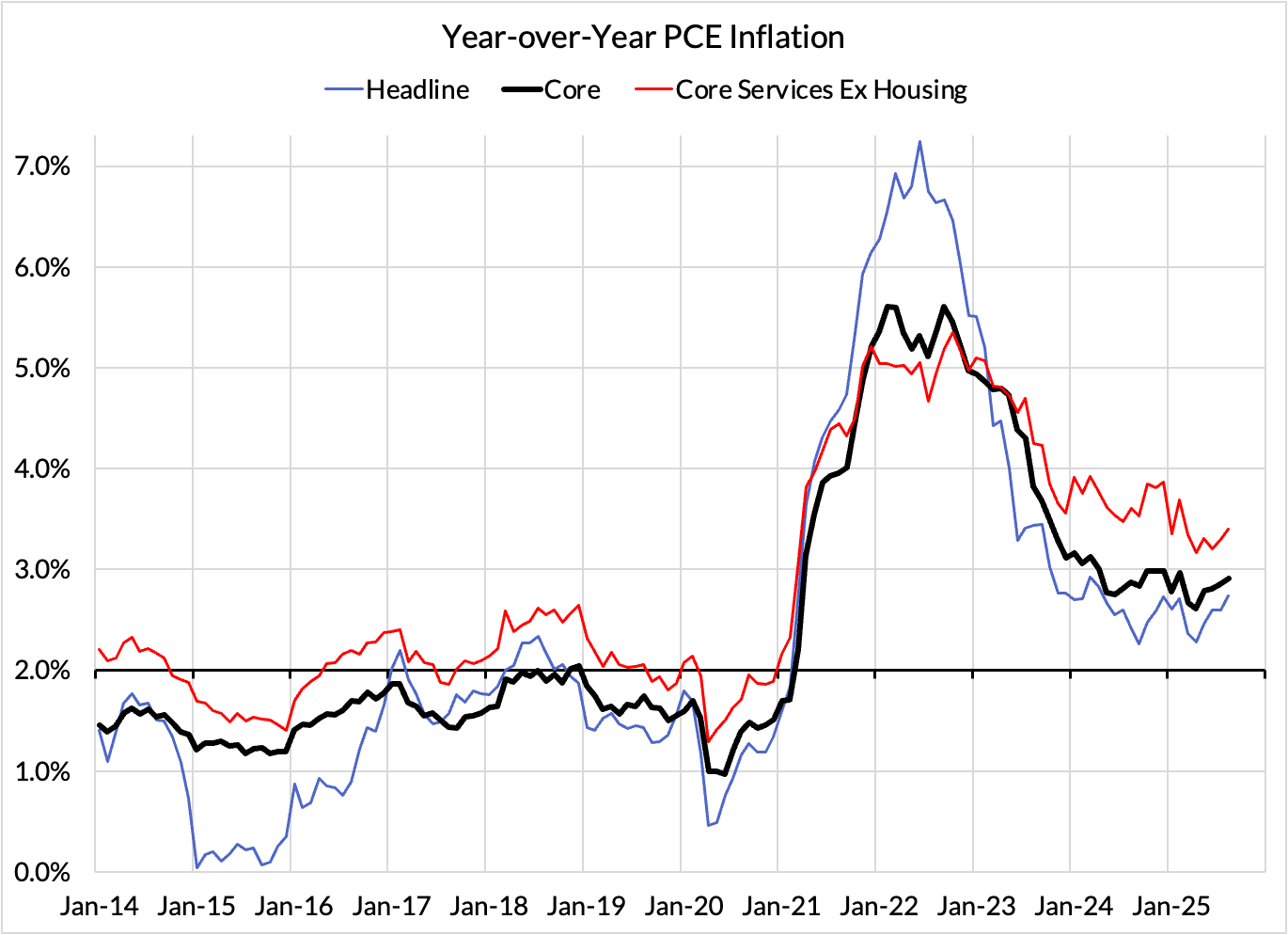

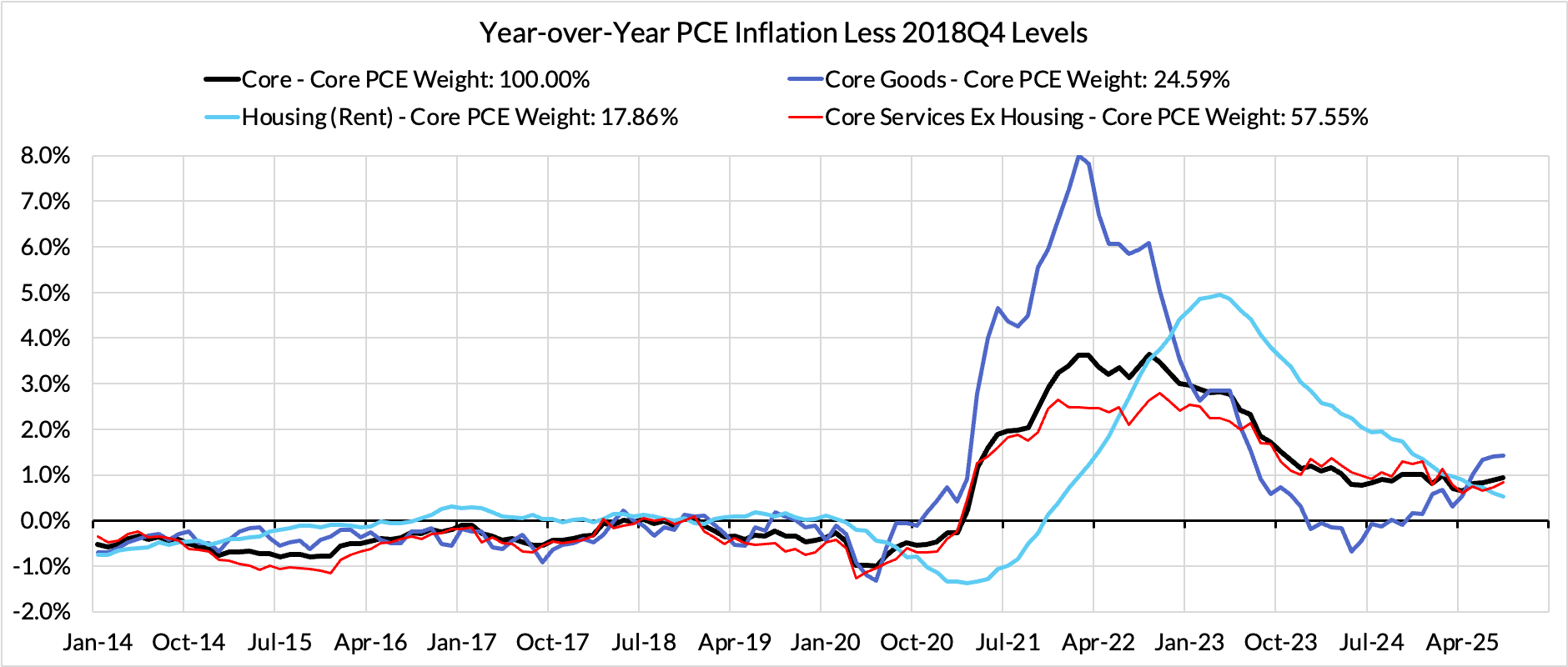

Right now Core PCE (PCE less food products and energy) ran at a 2.91% year-over-year pace as of August, 91 basis points above the Fed's 2% inflation target for PCE.

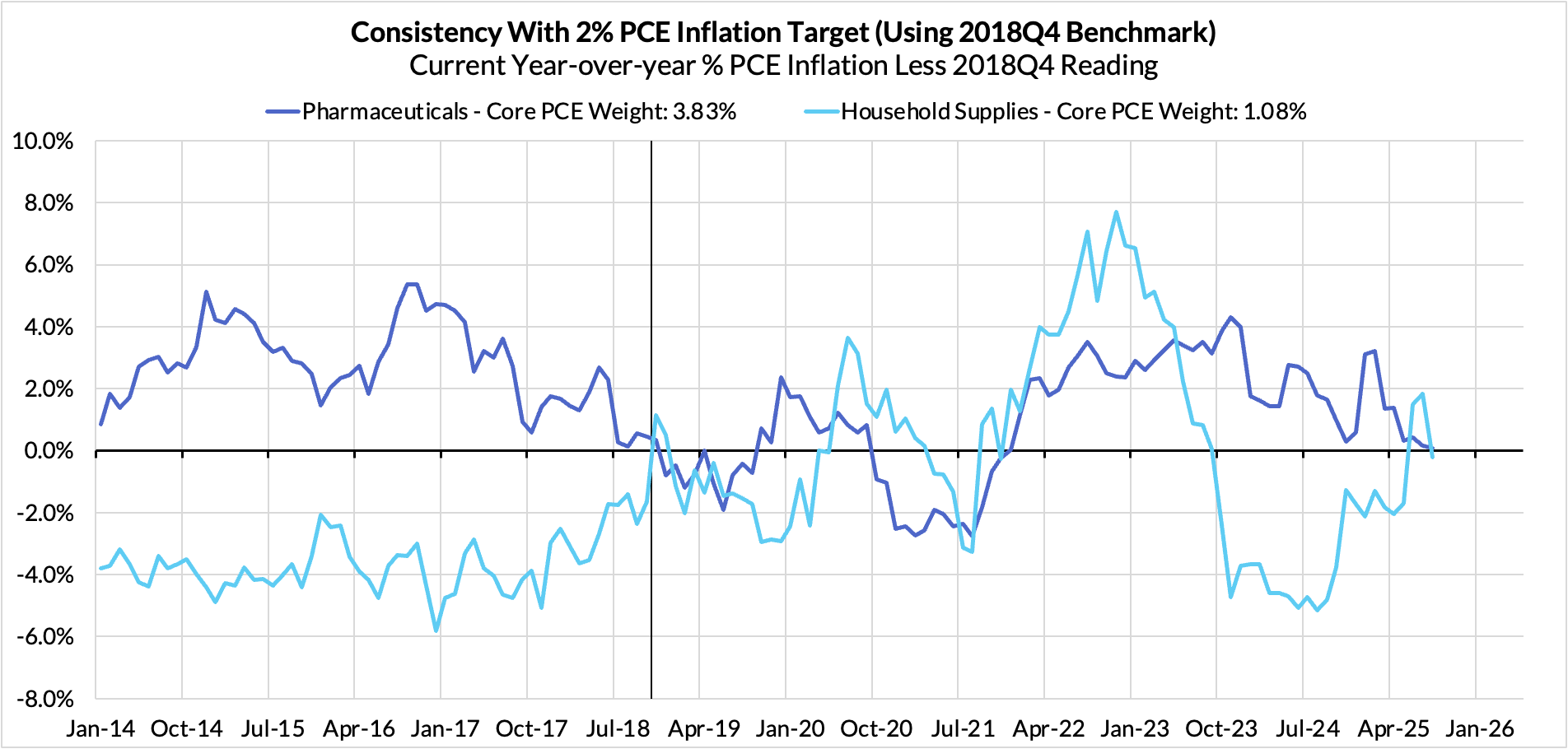

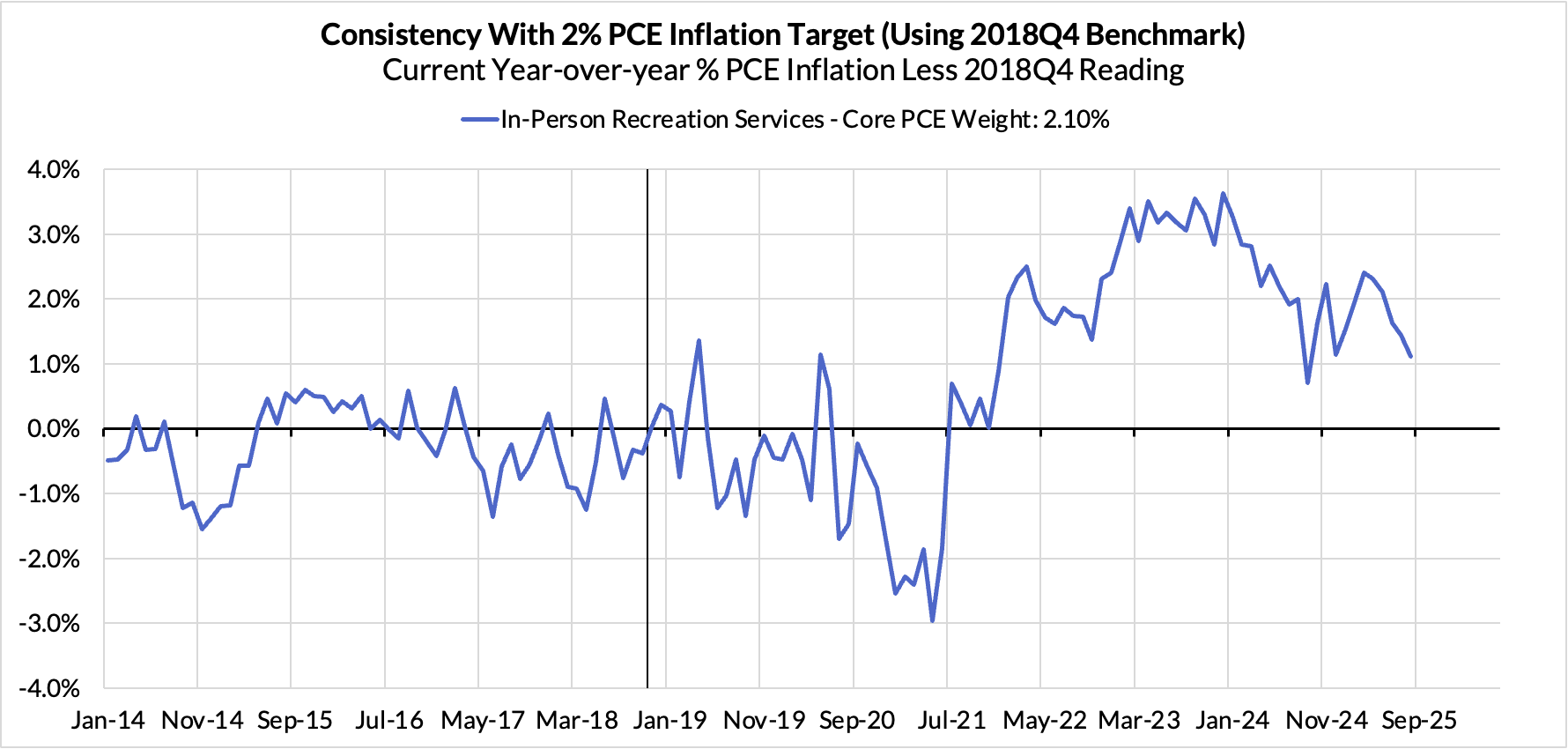

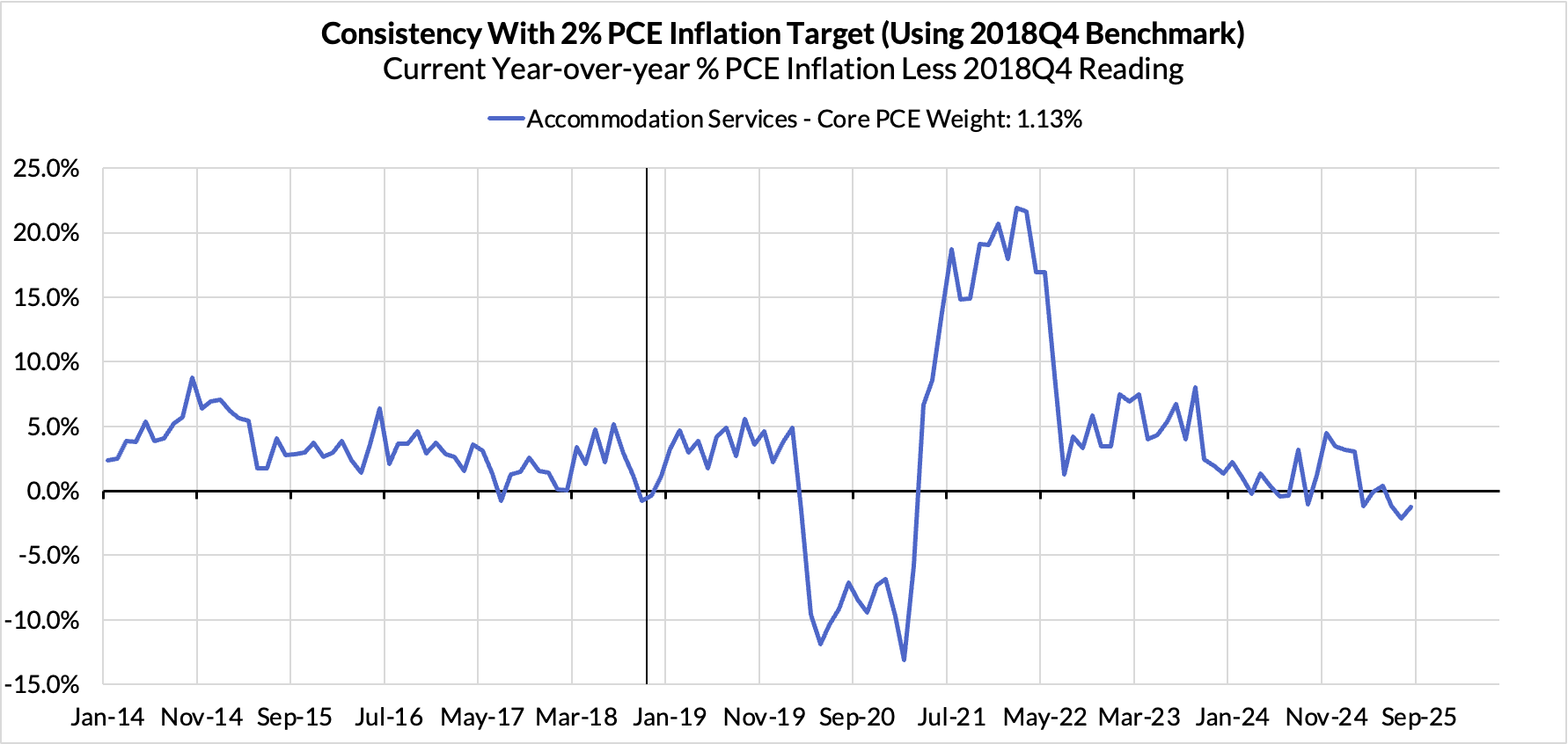

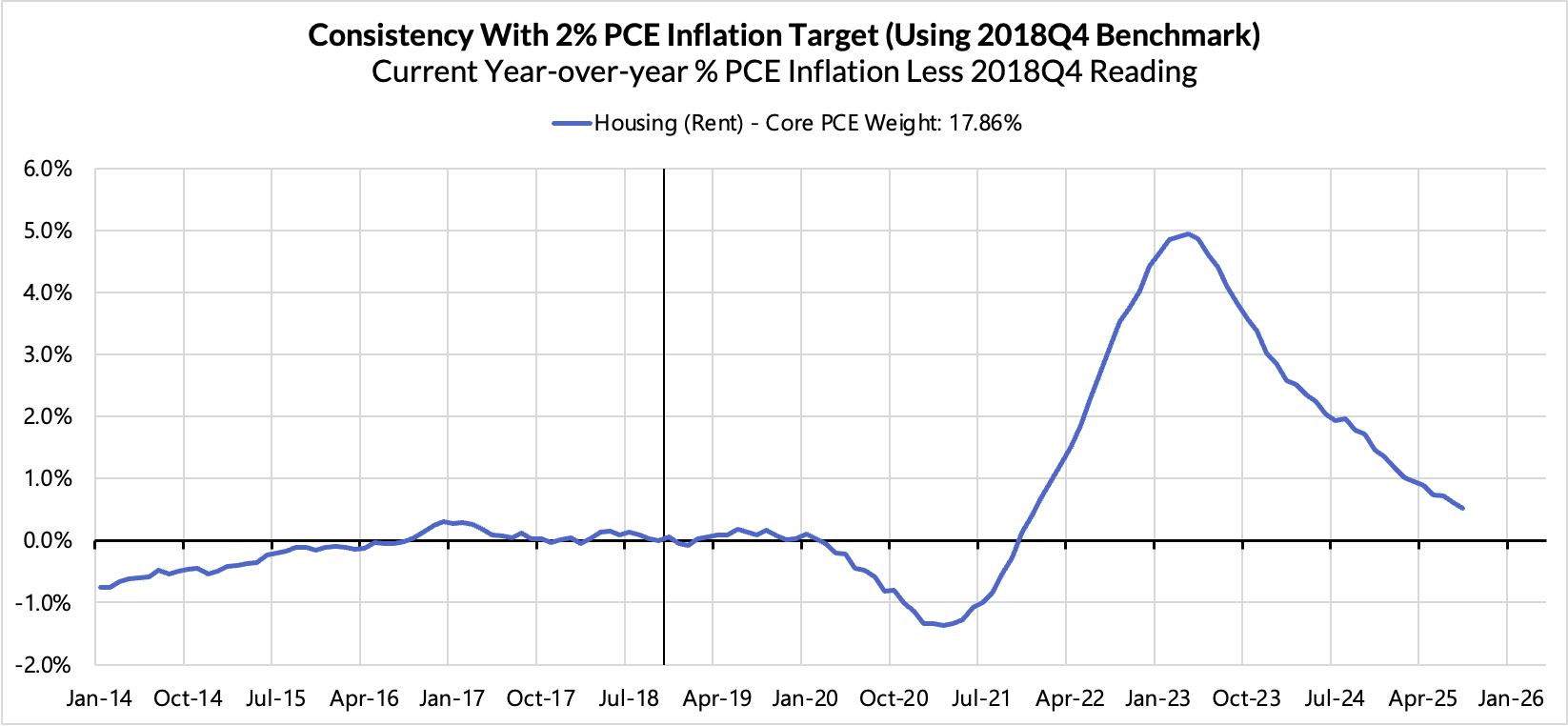

There contributors to the overshoot:

- Catch-up rent CPI inflation in response to the 2021-22 surge in household formation (a byproduct of rapidly recovering job growth) and market rents accounts for just 11 basis points to the 91 basis point Core PCE overshoot.

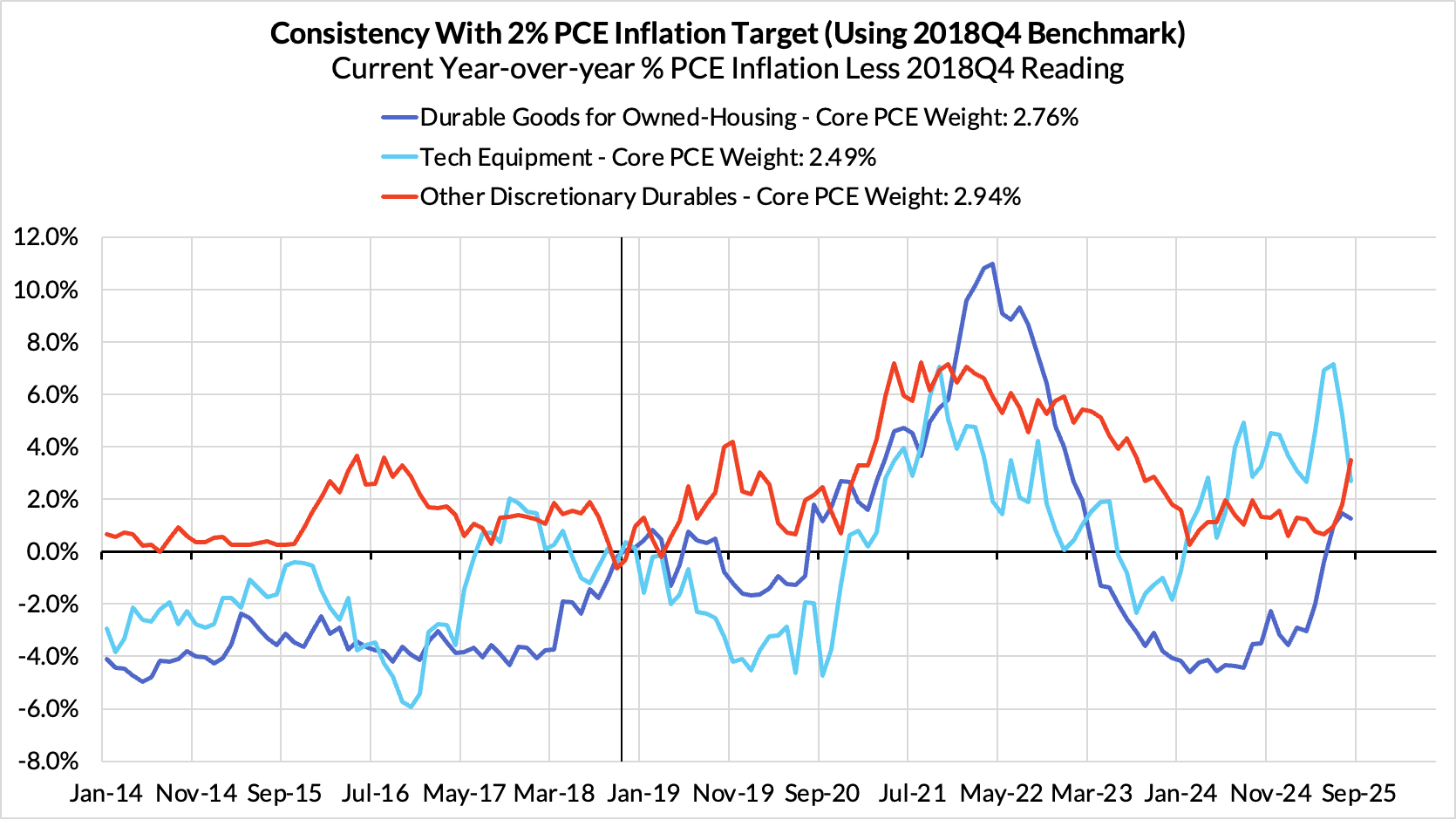

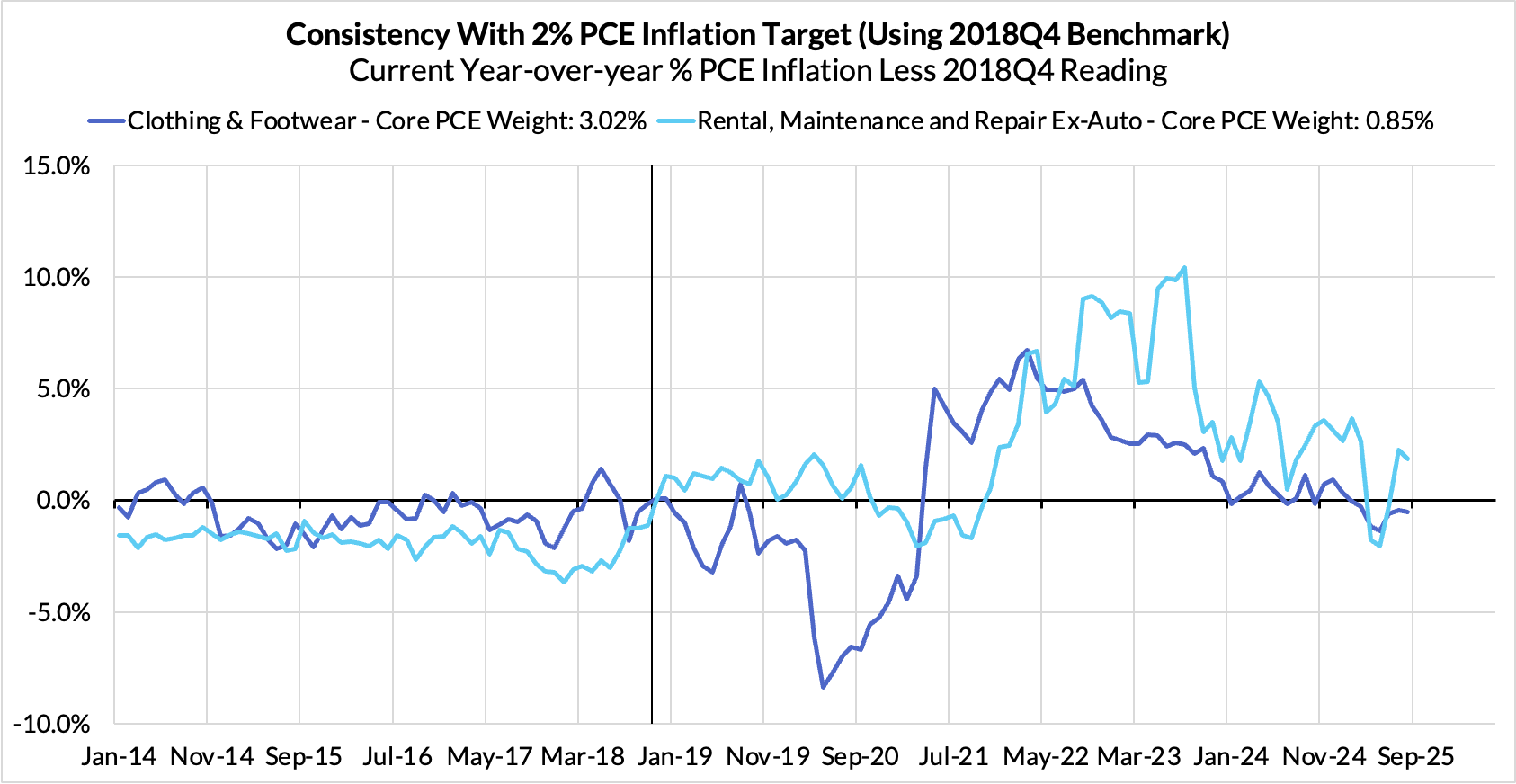

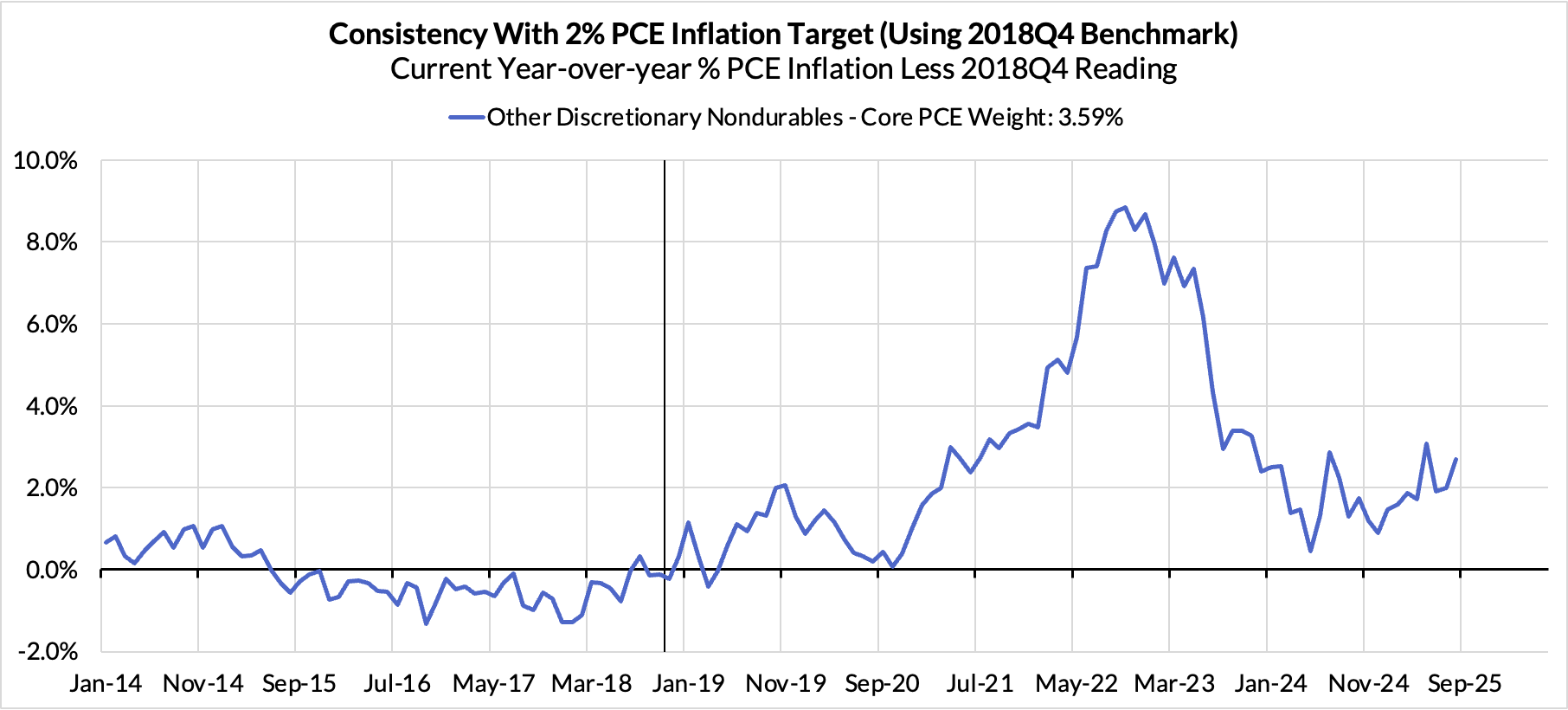

- Discretionary non-automobile goods + adjacent services are adding 27 basis points.

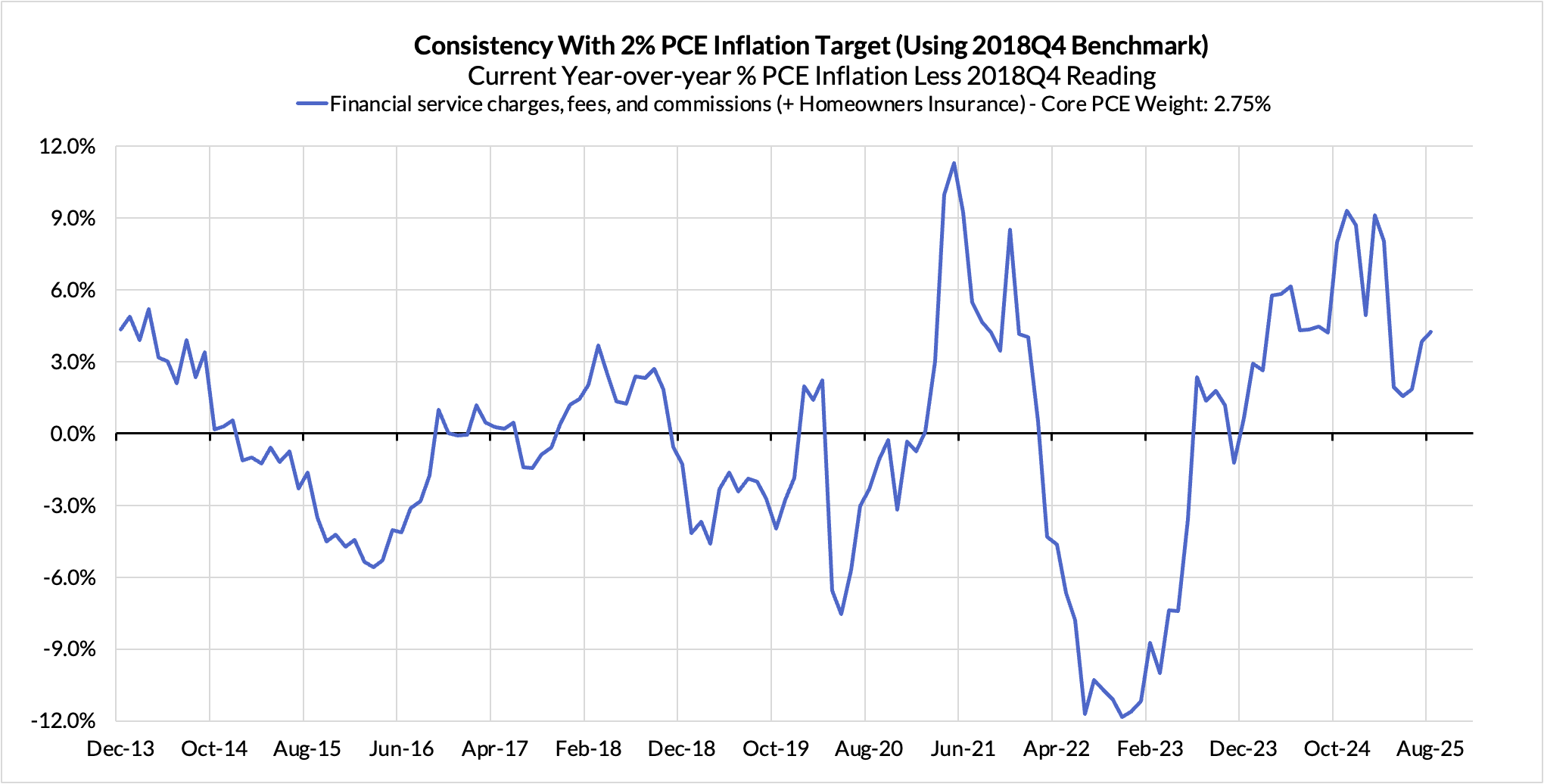

- Measurable financial service charges now account for 12 basis points of the overshoot.

- Food inputs likely adding 9 basis points to the overshoot

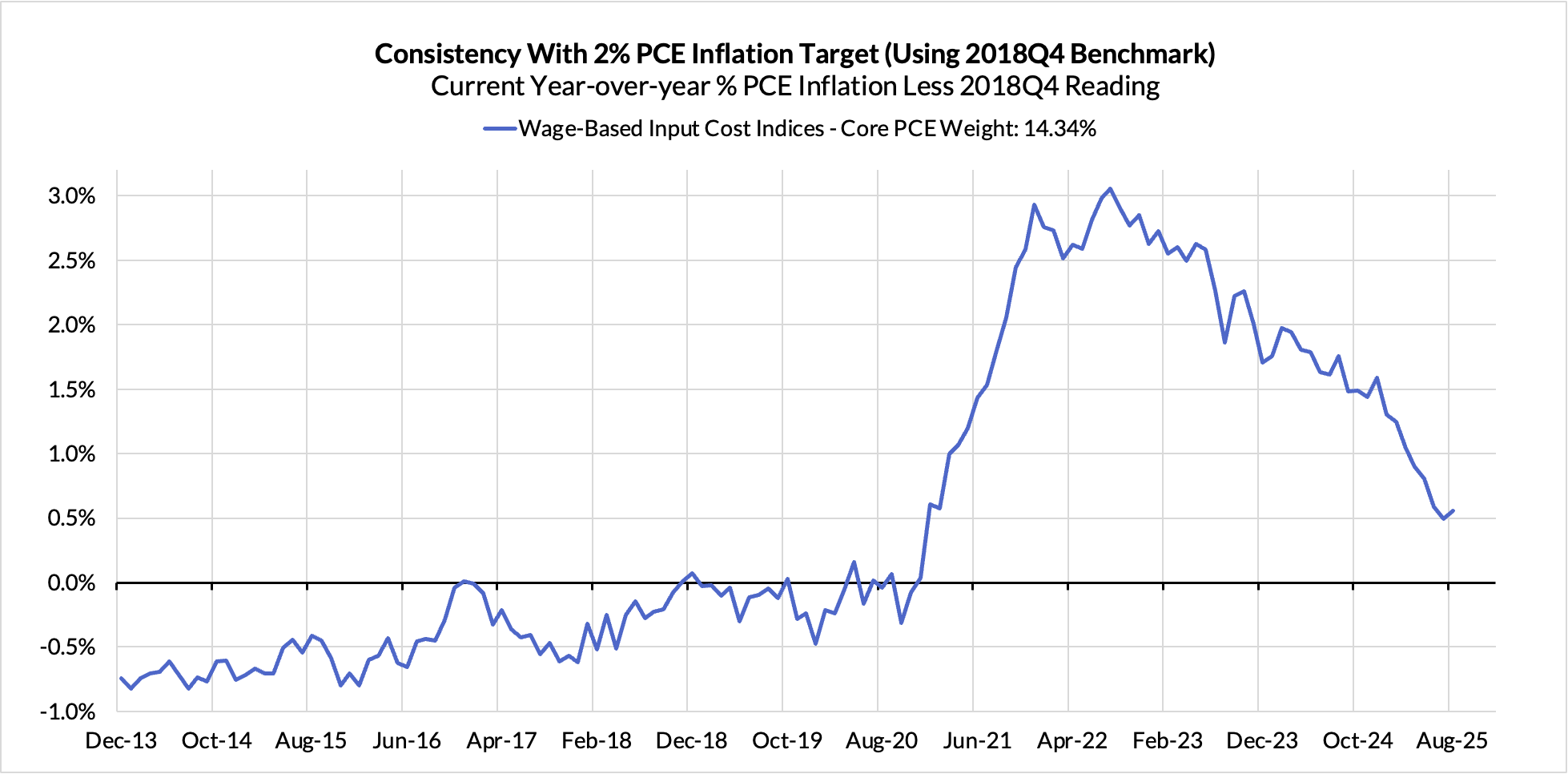

- Contributions from input cost indices (wages in specific sectors where market prices don't exist) are now likely adding 6 basis points to the overshoot

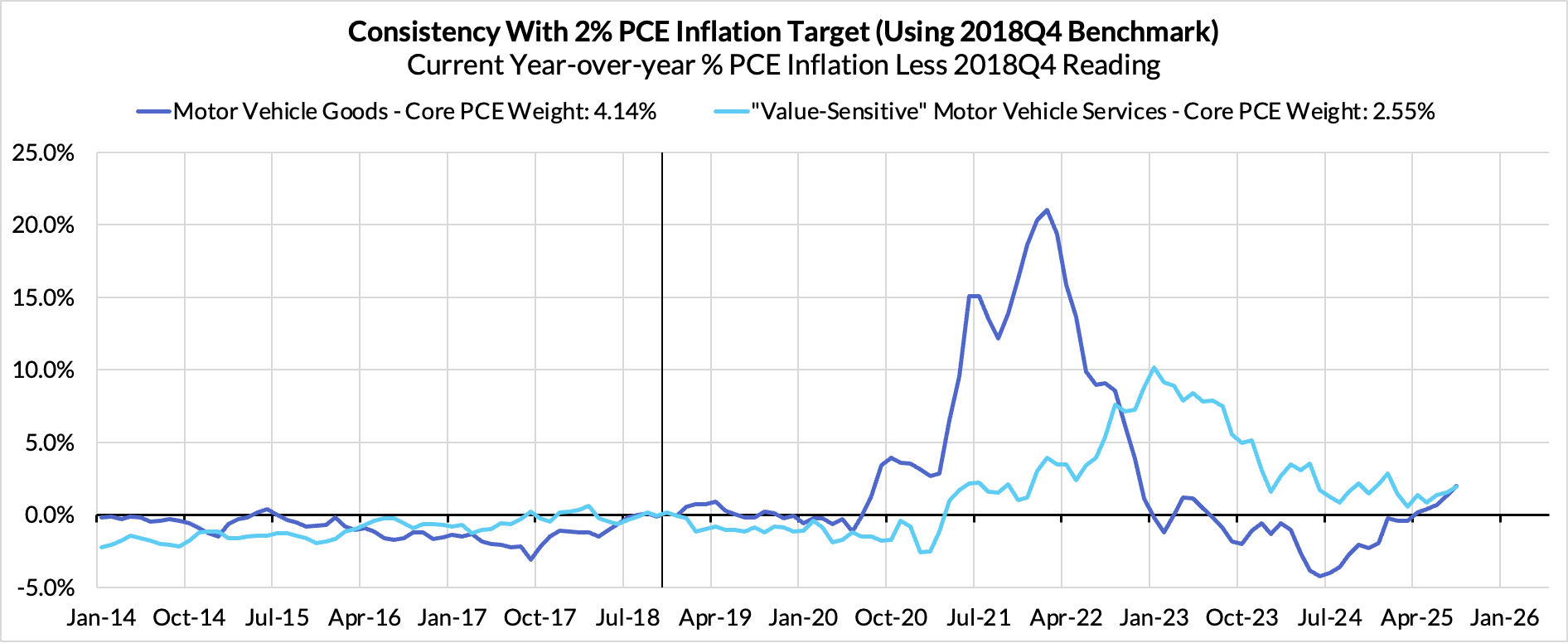

- Motor vehicle goods and services now accounts for 12 basis points of the overshoot.

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. August monthly annualized Core PCE ran at a 2.76% annualized pace, a 76 basis point overshoot vs 2% target inflation.

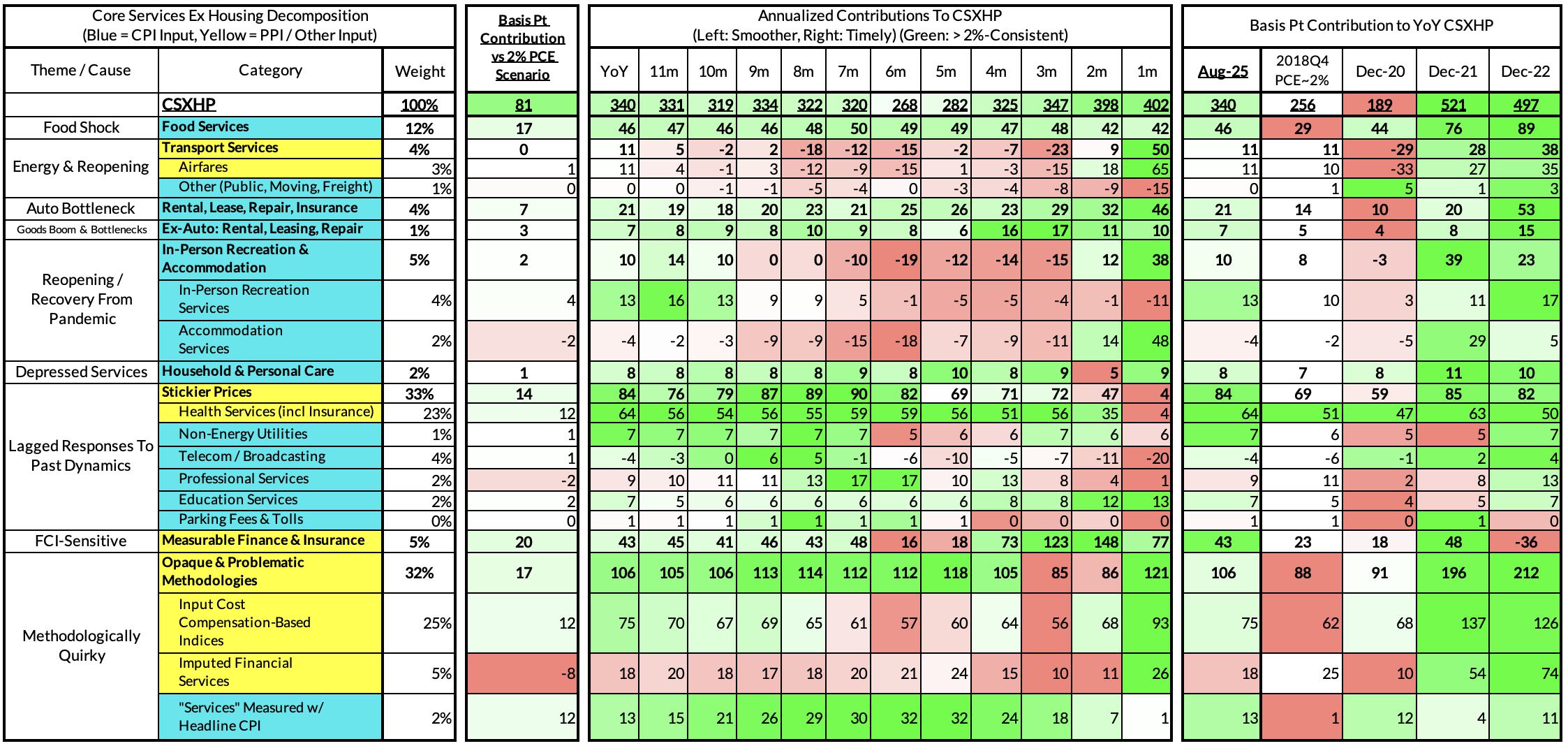

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

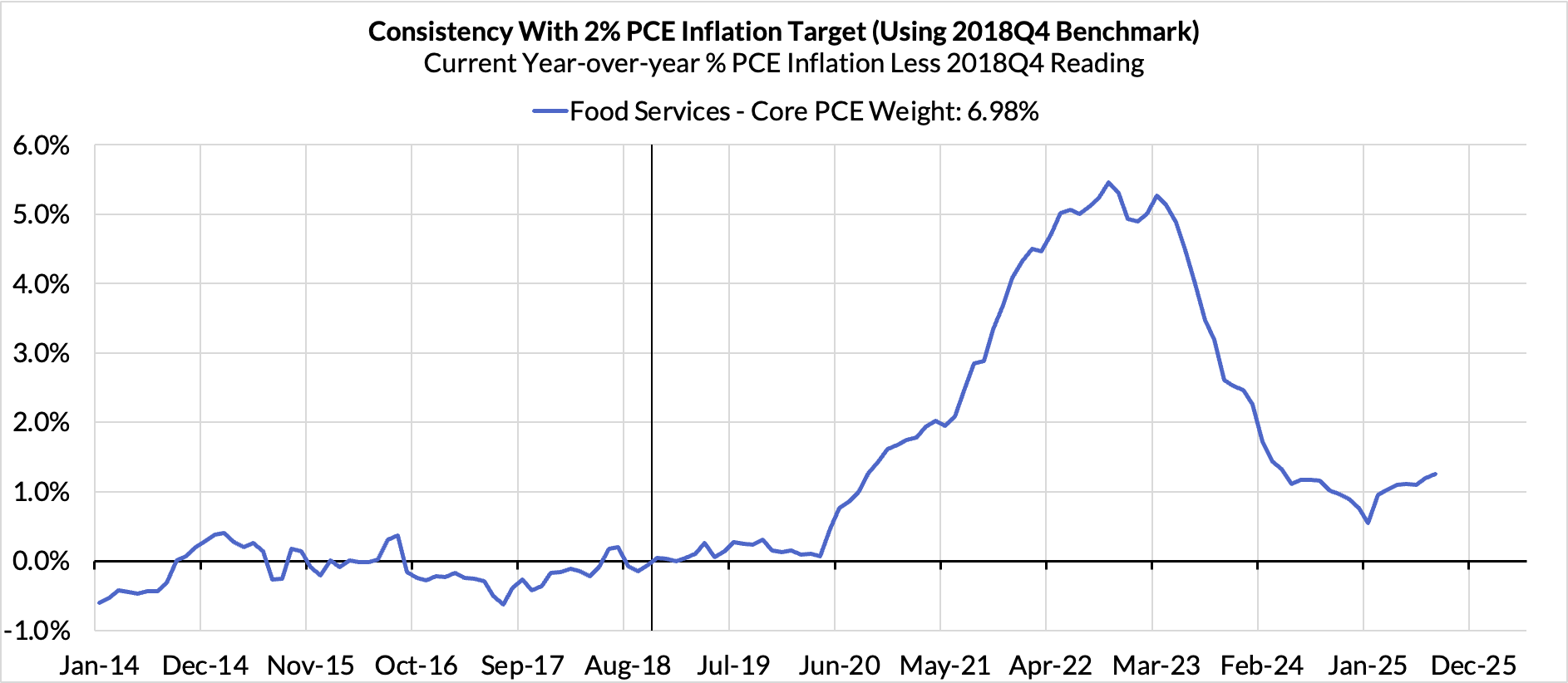

The August growth rate in "Core Services Ex Housing" ('Supercore') PCE ran at a 3.40% year-over-year pace, a 81 basis point overshoot versus the ~2.59% run rate that coincided with ~2% Headline and Core PCE inflation.

August monthly supercore ran at a 4.02% annualized rate, a 144 basis point annualized overshoot of what would be consistent with 2% Headline and Core PCE.