On the eve of the blackout period last week, Federal Reserve Governor Christopher Waller delivered a speech outlining why he believes the Fed should reduce interest rates by 25bps at the July 2025 FOMC meeting. Governor Waller’s arguments were rooted in data and solid macroeconomic analysis, and many of his points align with the analysis we have put forth over the last year. In particular: (1) the labor market is weaker than the headline numbers imply and the risk is skewed towards the downside, (2) monetary policy should “look through” tariffs, like any other supply shock, and (3) there is a clear deceleration in economic activity with the risk skewed further towards the downside.

The Labor Market

Governor Waller:

“Now let's talk about the labor market… looking a little deeper, I see reasons to be concerned. Half of the payroll gain came from state and local government, a sector of employment that is notoriously difficult to seasonally adjust this time of year. In contrast, private payroll employment grew just 74,000, a much smaller gain than in the previous two months.”;

“With hiring already low, at a certain point, declining demand would overcome any instinct to hold on to workers, and if that attitude does shift, it implies that a larger and more sudden reduction in payrolls and an increase in the unemployment rate are a risk.”

We share similar views to Governor Waller. On the surface, the labor market looks quite healthy, with nonfarm payroll gains averaging ~130k per month for 2025H1, the unemployment rate still in the low 4s, and the prime-age (25-54) employment rate still slightly above pre-pandemic peak.

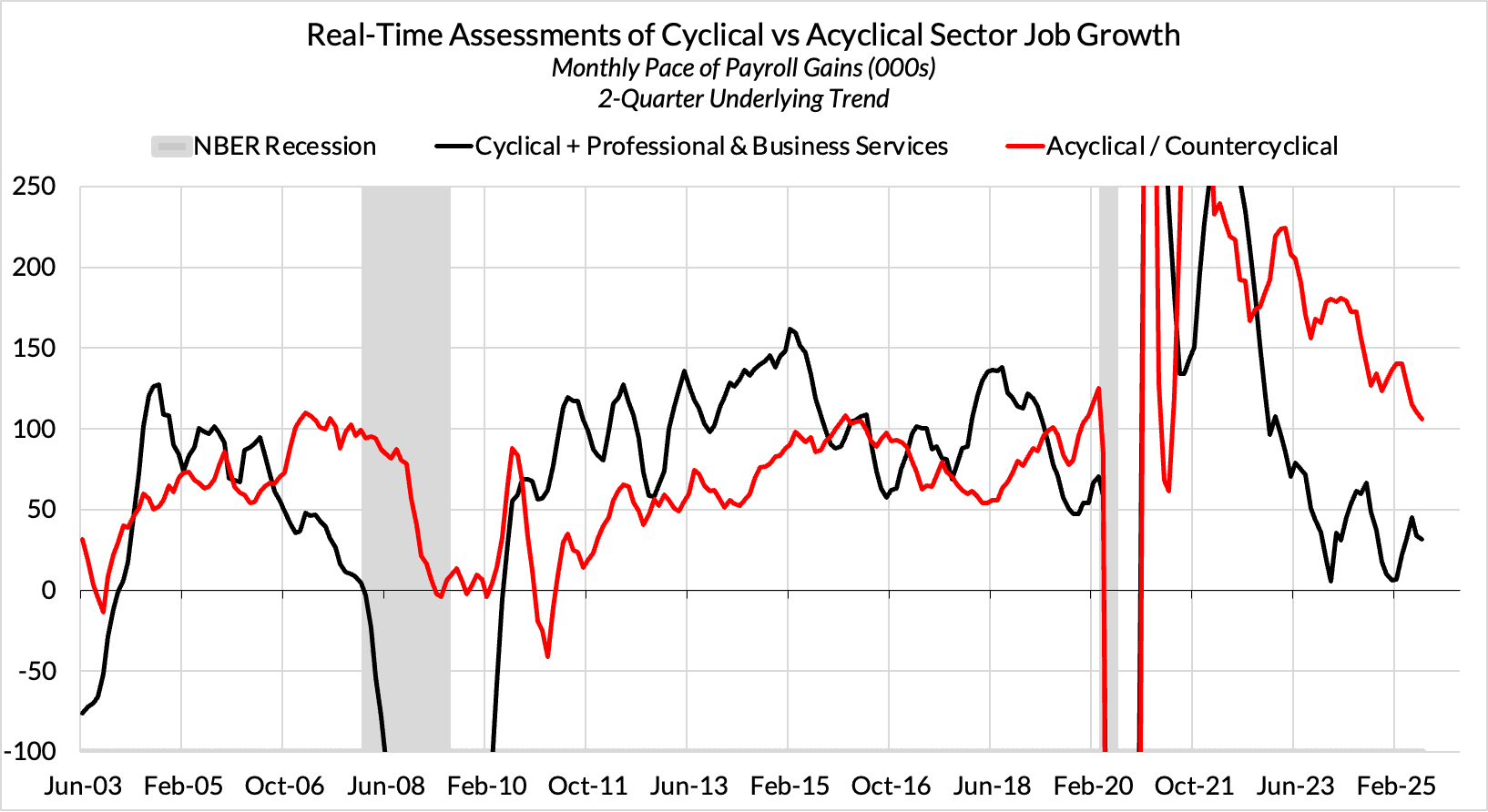

Looking under the hood of the data, the labor market is softer than what the headline numbers imply. We have noted over the past year that job growth over the last two years has been dominated by acyclical sectors (e.g. healthcare, state and local government, private education), with construction being the lone cyclical sector showing strength (though fading). Acylical sectors now face headwinds as post-pandemic catch up dynamics are dissipating. Quits and hires rates–two of the best indicators for assessing labor market tightness–signal more sluggish labor market momentum and potential for widening slack. As Senior Economist Preston Mui laid out in April, this slowdown in hiring can pose a threat to the labor market even without layoffs.

Tariffs

Governor Waller has been consistent on his views on tariff inflation for months now and cited the same rationale in his latest speech:

“First, tariffs are one-off increases in the price level and do not cause inflation beyond a temporary surge. Standard central banking practice is to "look through" such price-level effects as long as inflation expectations are anchored, which they are.”

As Executive Director Skanda Amarnath noted in “The Supply Problem In The Fed's Framework - Part 1: What Should the Fed Do About Tariff Inflation?,” tariffs are a negative supply shock and lead to a one-time (though not time-limited) increase in the price level, rather than persistent inflation. The appropriate response would be for monetary policymakers to “look through” the tariff effects. The Fed is currently undergoing framework review and should adopt better communication techniques in their framework to help the public understand how they differentiate between supply distortions and underlying inflation.

Economic Activity

Governor Waller:

“Based on forward-looking indicators, I don't expect a rebound in the second half—in fact, most forecasts suggest that real GDP growth will remain around 1 percent at an annual rate.”;

“The slowdown in GDP is evident in consumer spending, which constitutes about two-thirds of economic activity. After hovering near 3 percent last year, real personal consumption expenditures (PCE) growth is estimated to have stepped down to 1 percent in the first half of this year.”;

“Turning to the "soft" data, this picture of declining momentum is consistent with what I am hearing from my business contacts and other sources. The Fed's July 16th Beige Book reported mixed evidence on economic activity across Federal Reserve Districts, with 5 reporting slight or modest gains and the remaining 7 having flat or declining activity.”

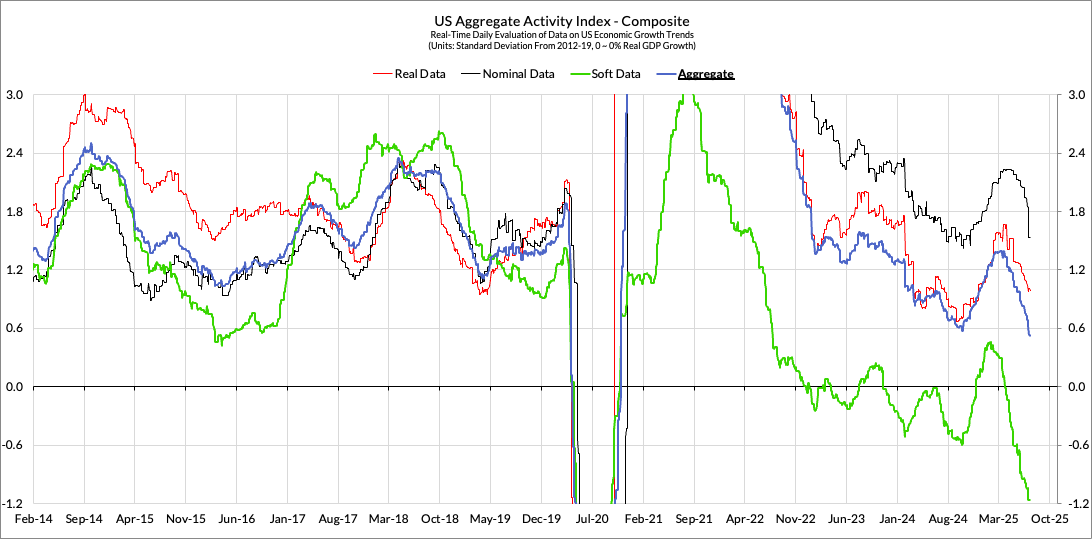

Our real-time assessment of US economic activity currently shows a clear deceleration in both soft and hard data.

Conclusion

While many commentators have accused Governor Waller of delivering a speech borne of political motivation or convenience, we believe that Governor Waller’s rationale is fundamentally sound. If there’s a marginal disagreement between our view and Governor Waller’s, it is a tactical one. We are skeptical of how other Fed officials may react if they cut in July only to see upside inflation surprises subsequently, even if those surprises are of a one-off supply-side nature. If every Fed official had the same fortitude and clarity of approach that Governor Waller has indicated, a cut in July would carry more credibility. And at least for the time being, financial conditions have reflected resilient animal spirits, buoyant risk sentiment, and robust growth expectations, that too despite no priced-in expectation for imminent cuts. That might ultimately soften the case for an urgent cut in July, but we could easily those conditions shift. If we see financial or labor markets signal a weaker outlook in the months ahead, Governor Waller’s reasoning will prove both prescient and sharply strengthen the case for imminent cuts.