Core-Cast is our model and publication series for nowcasting the Fed's Personal Consumption Expenditures (PCE) inflation gauges. We update our estimates from CPI, PPI, Import Price, and GDP data, along with previews and final recaps. If you'd like to become a MacroSuite subscriber to get all of our model updates before PCE is released, you can do so using this link. If you have any questions or would like to see samples of our past content, contact us here.

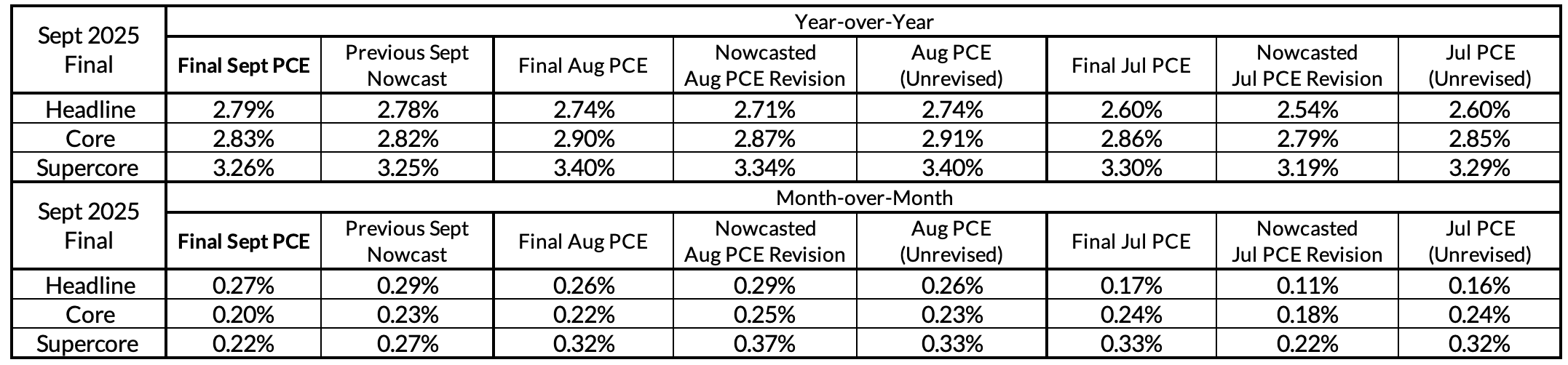

Summary: PCE Nowcasts

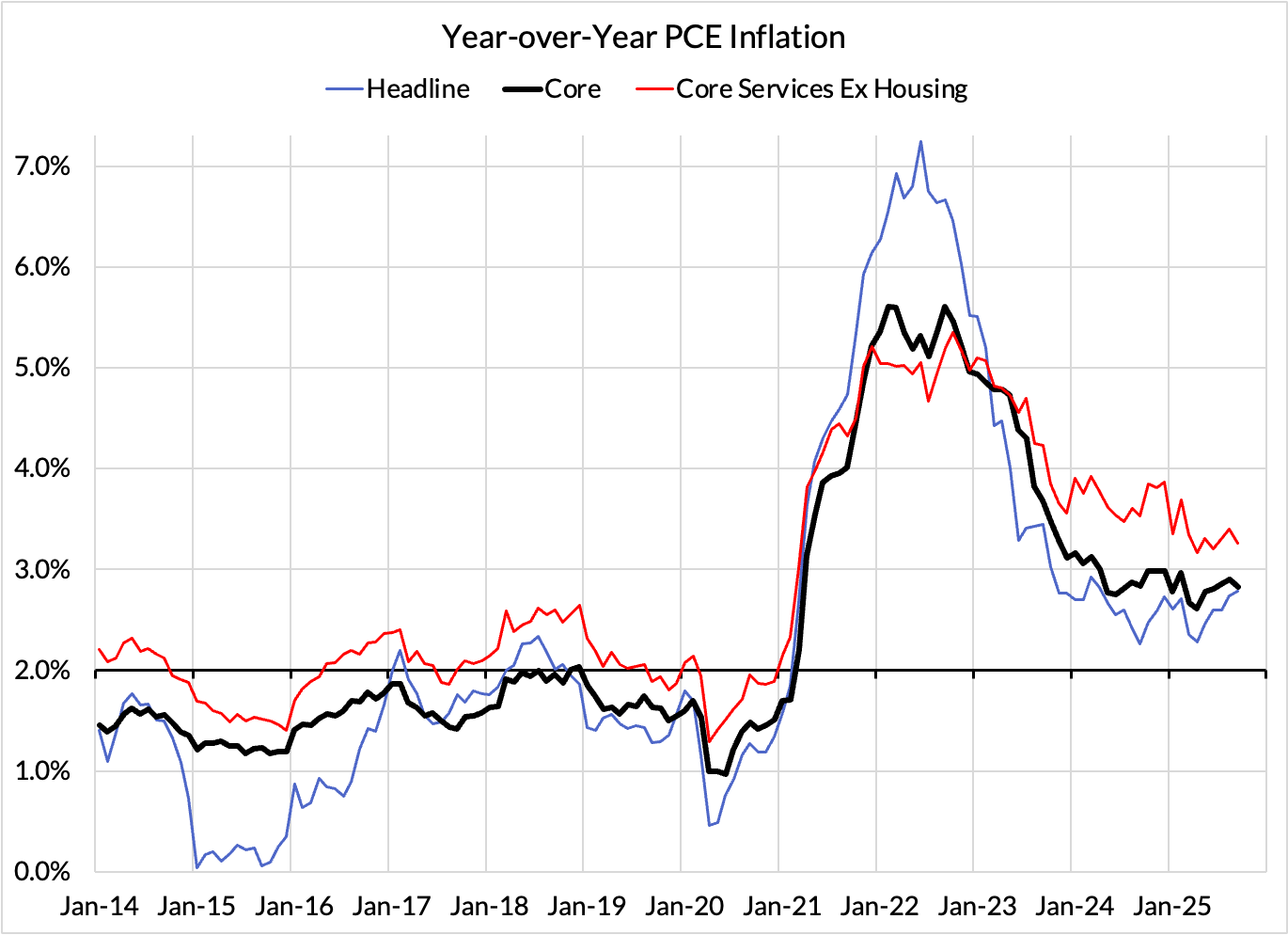

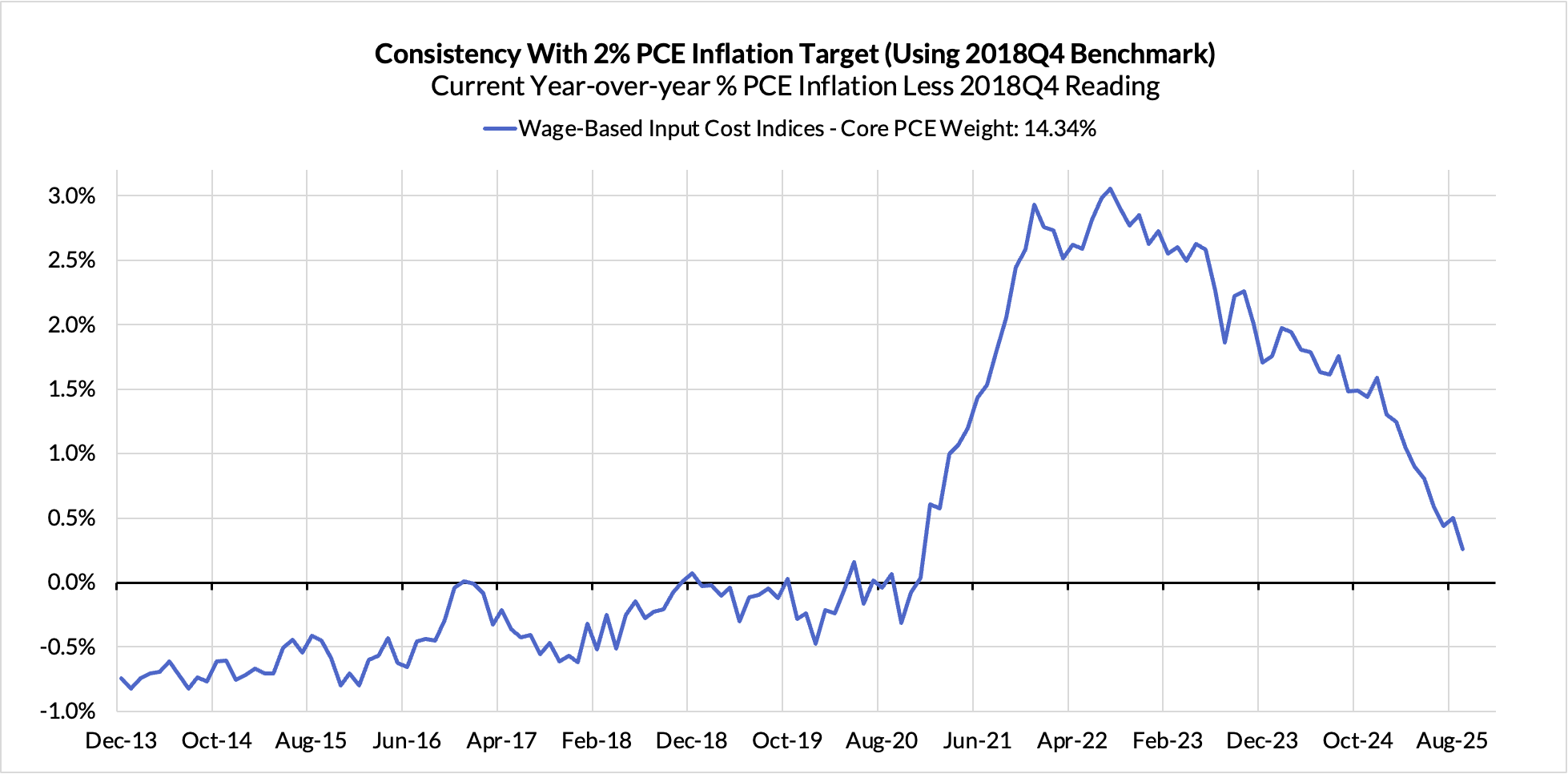

Our year-over-year nowcasts were a rounding error away from perfection for September, but the incidence of the monthly changes and revisions were slightly more disjointed. The major sources of deviation involved downside developments among wage-based input cost indices, which are non-market estimates that disinflate with a lag relative to measures of labor market tightness.

All said, inflation came in mildly below what the Fed had implicitly projected at its September FOMC meeting, but that should have been known after the CPI release several weeks earlier. With the unemployment rate also grinding higher (in line with the Fed's projections), the Fed seems primed to follow through with its final projected cut for 2025 this week.

We expect the Fed to signal heightened optionality for the next meeting. The FOMC is split among members reluctant to cut and members eager to. But with interest rates moving closer to neutral and inflation still comfortably above the target, the urgency to lower interest rates will need to be matched by downside dynamics and developments in the labor market. From where we sit, there is still substantial data fog: the labor market appears to be slowing, but how much? Some data shows deterioration (the unemployment rate) but others less so (weekly jobless claims, the prime-age employment rate). All else equal, we do not expect the Fed to cut in January after cutting December. We would urge the Fed to stay data-dependent and open-minded when evaluating the true risks to the labor market.

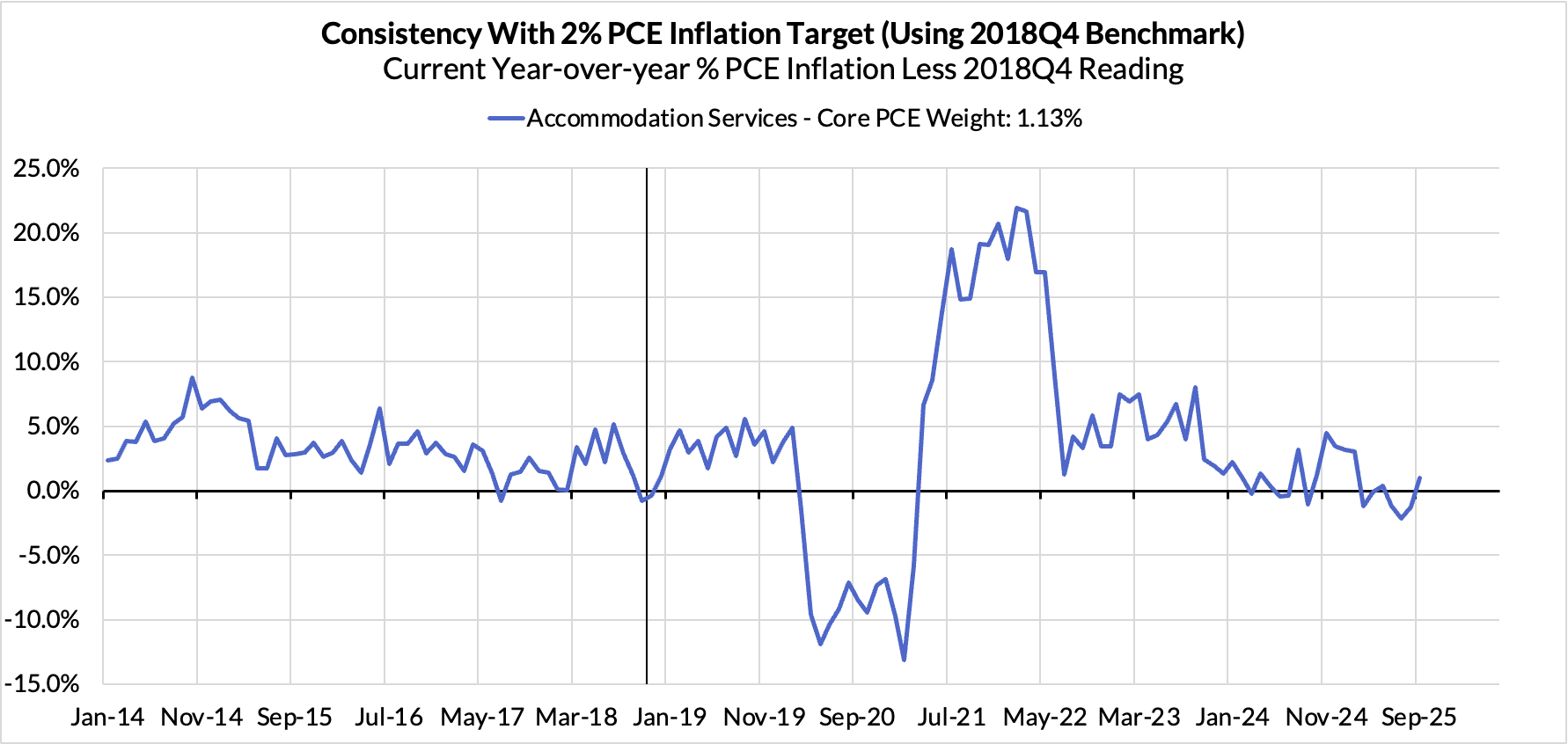

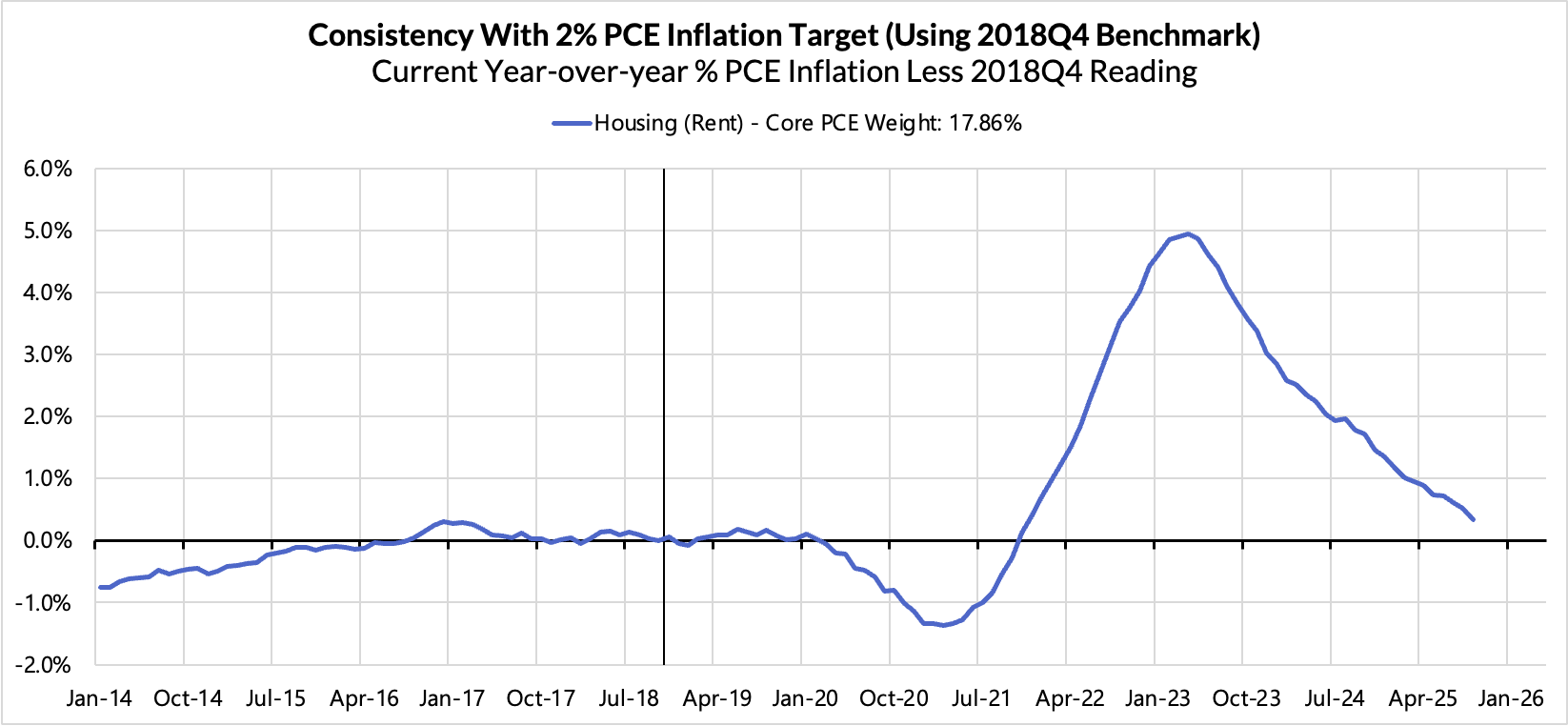

As for the inflation data, we take a more benign view of the remaining inflation readings for 2025. Tariff-induced effects are likely to operate with a lag, especially as policy measures hang in the balance of the Supreme Court in the short run and businesses hold back on restocking imports until there is greater clarity on costs and policy. Used car prices are poised to show more declines in the next two months, while rents are poised to show continued disinflation given past and ongoing softness in market rents. Tariff-related upside risks to inflation may have to wait until well into the new year.

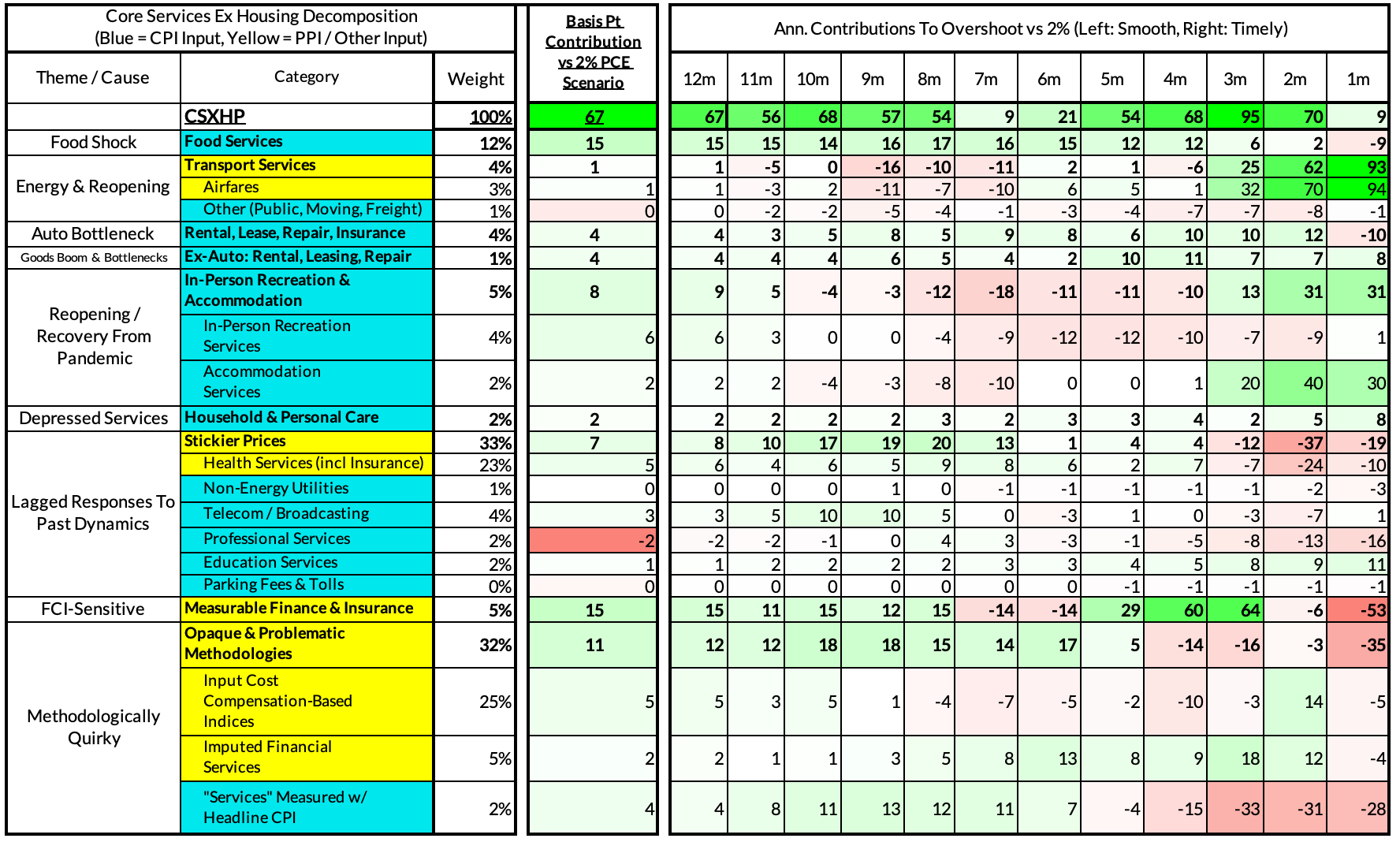

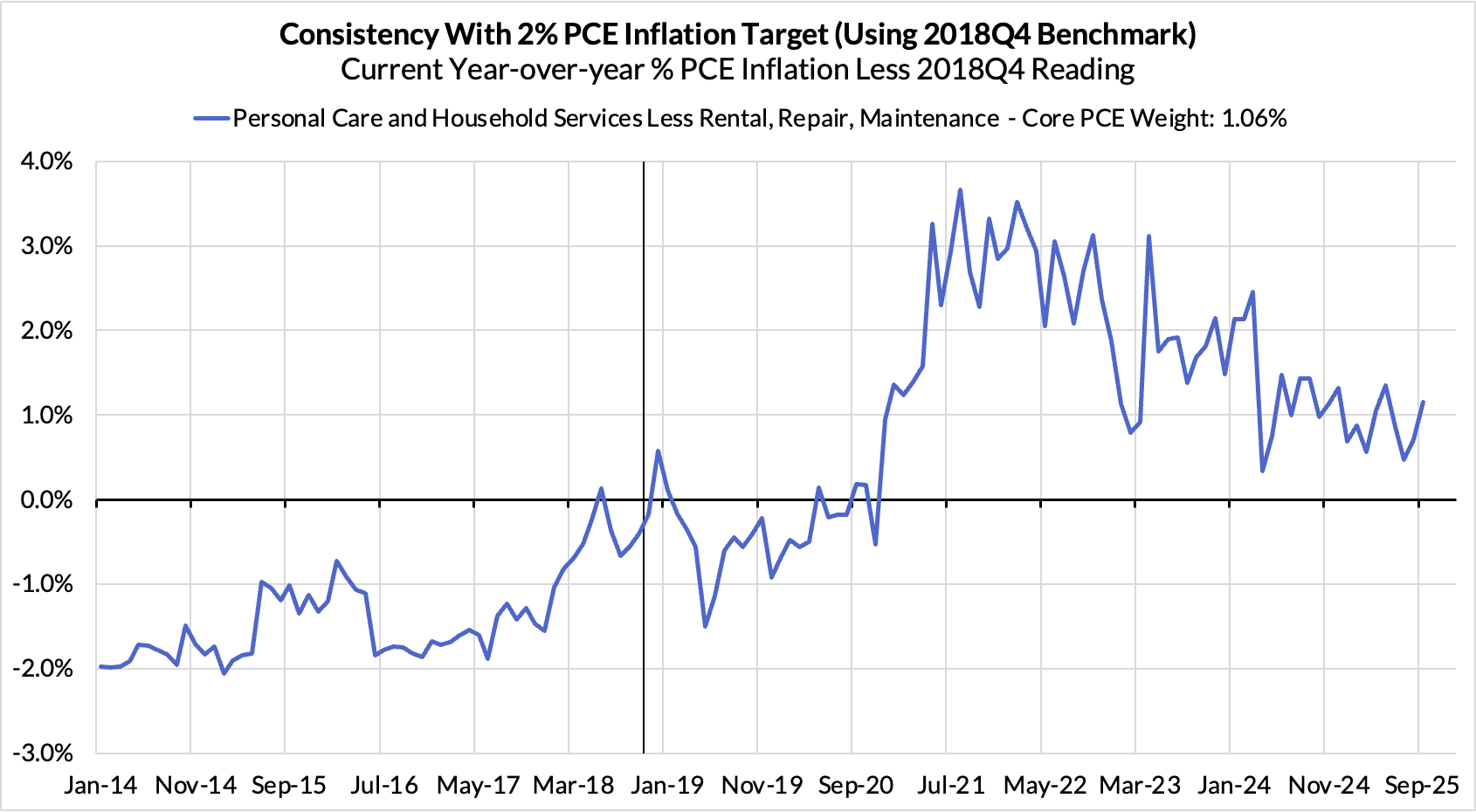

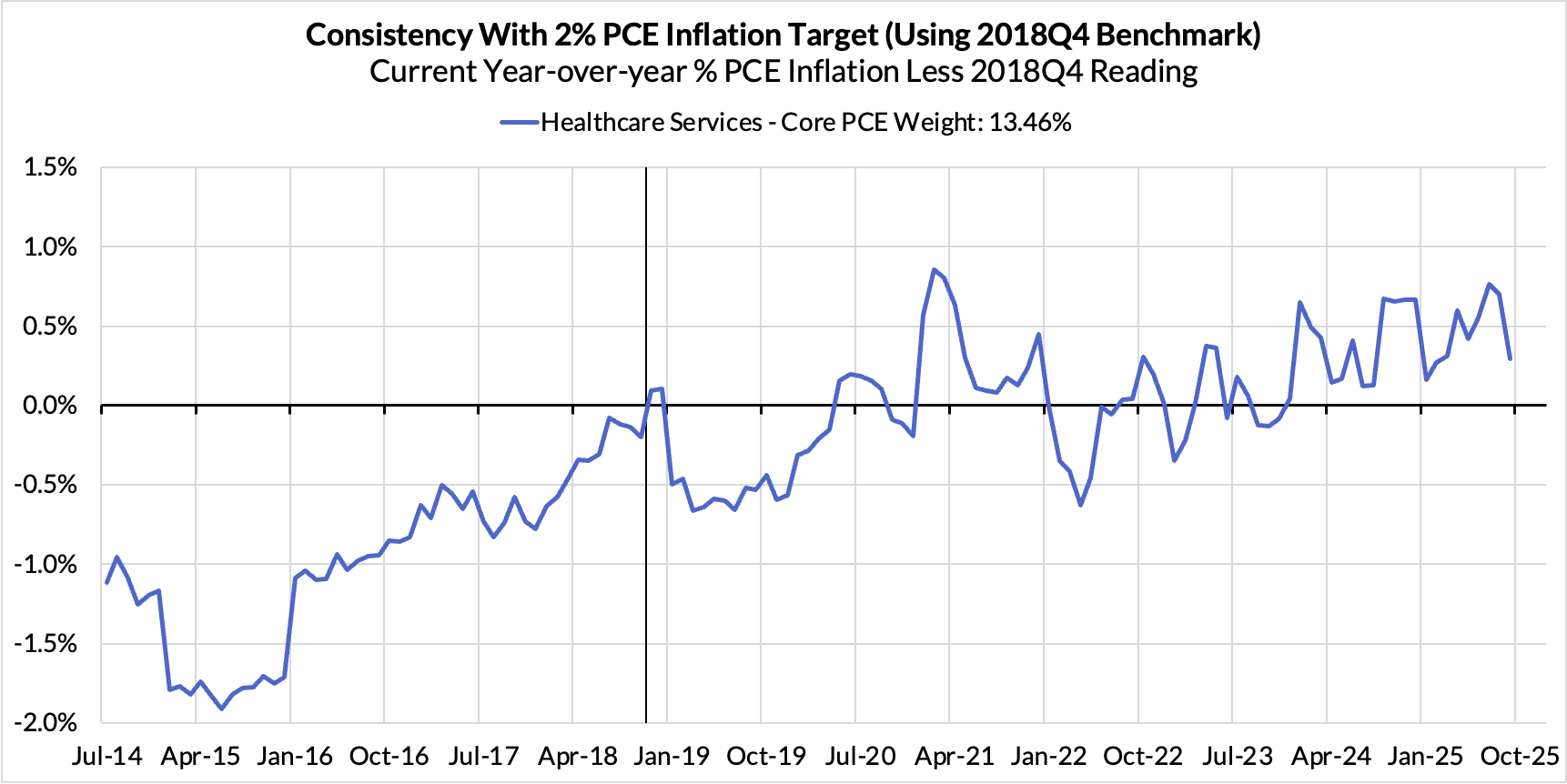

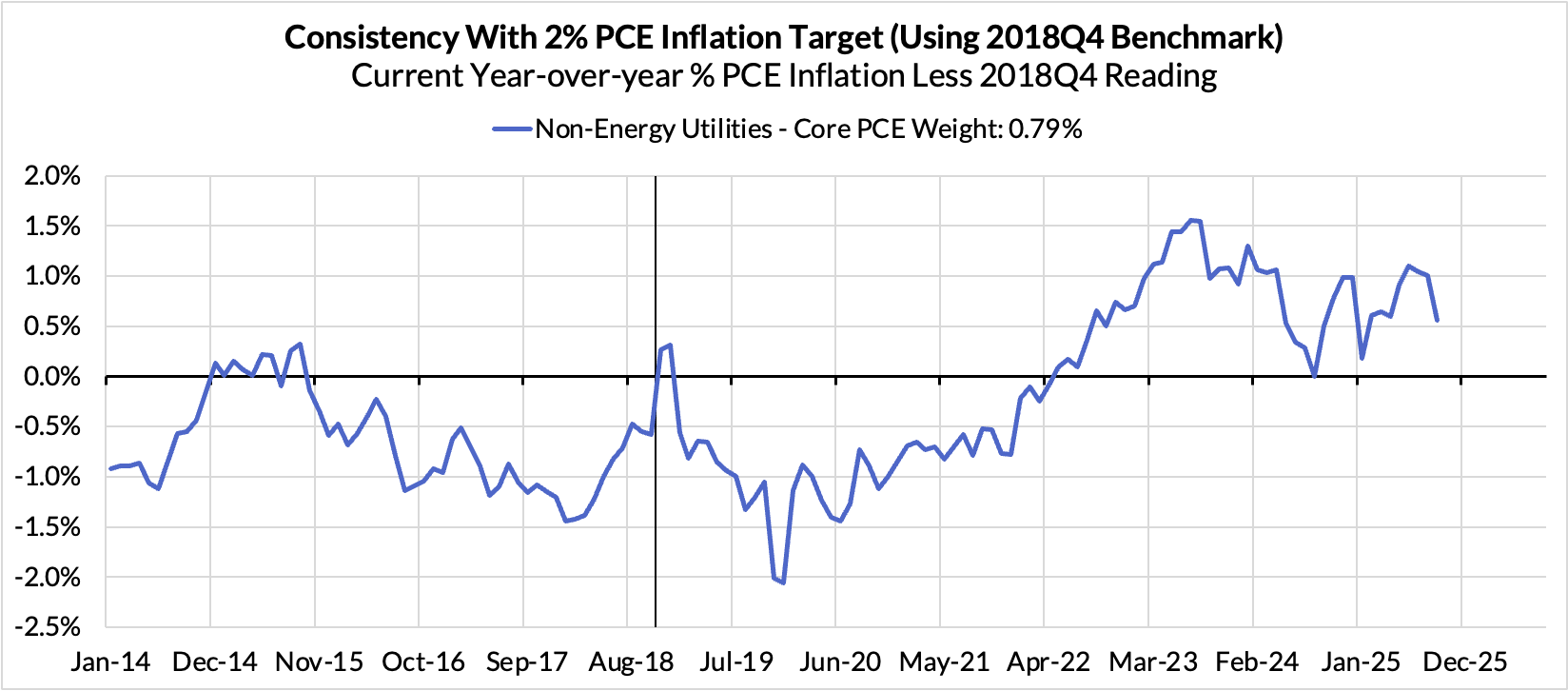

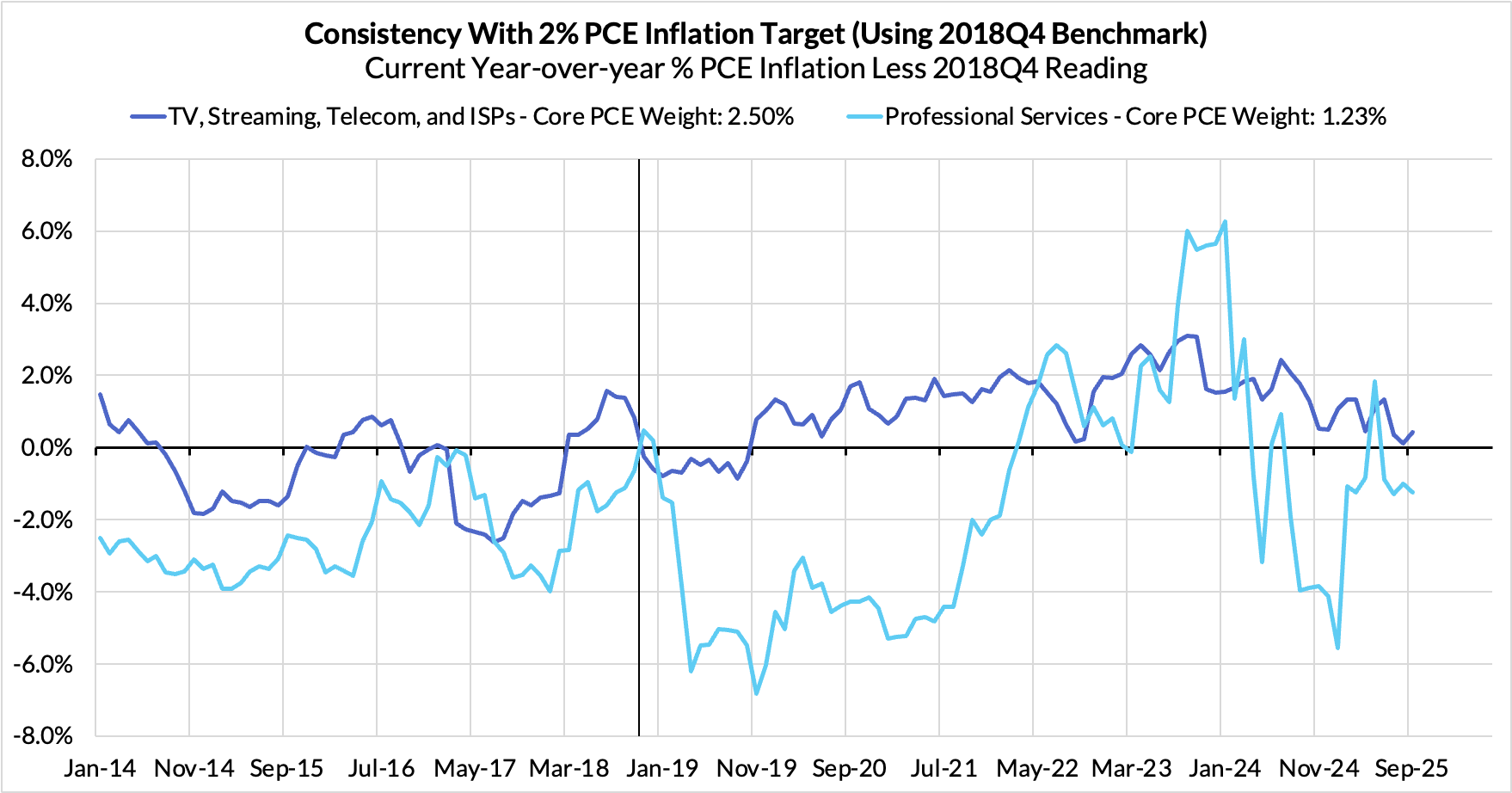

Inflation Overshoots At The Component Level

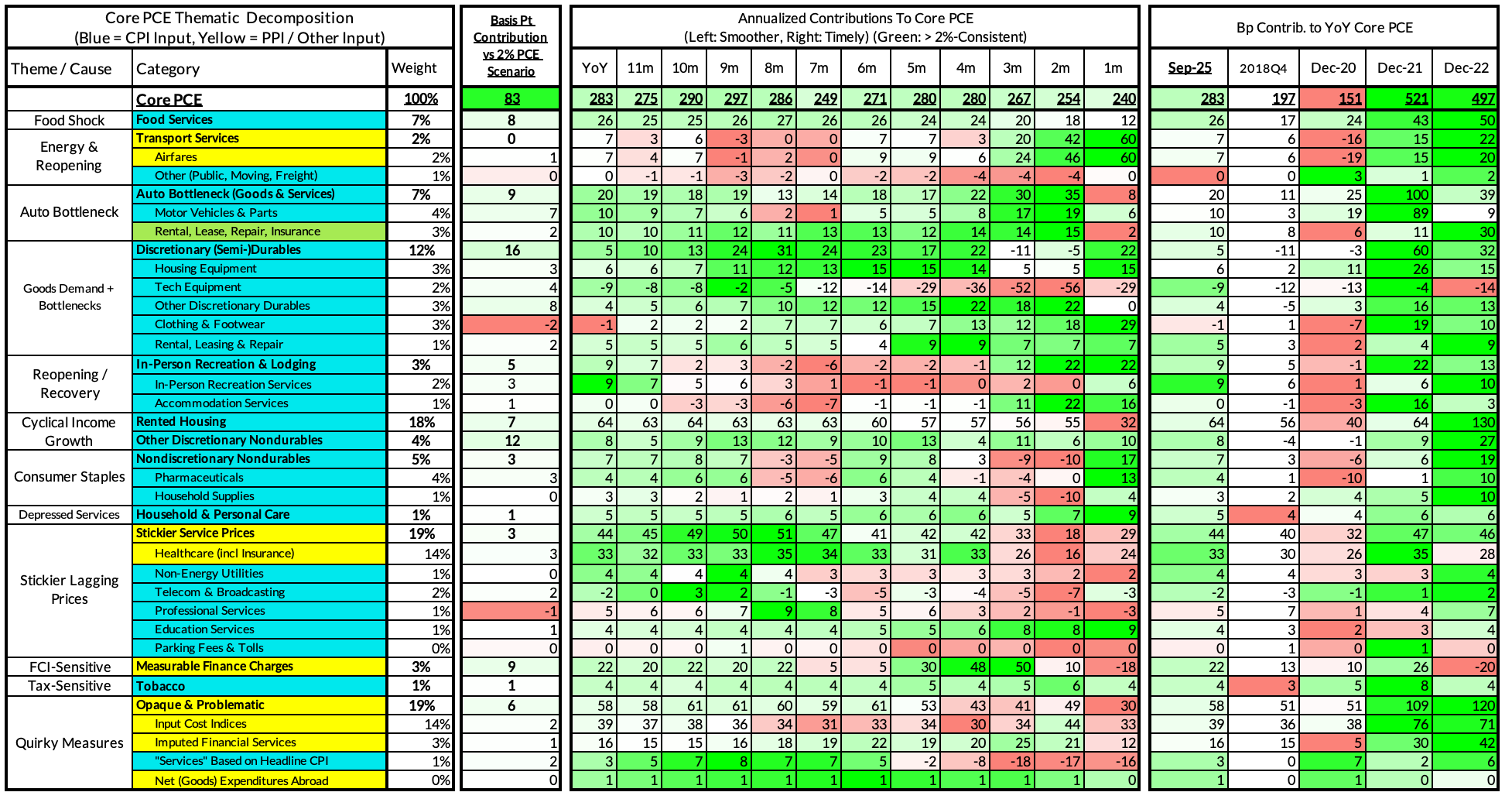

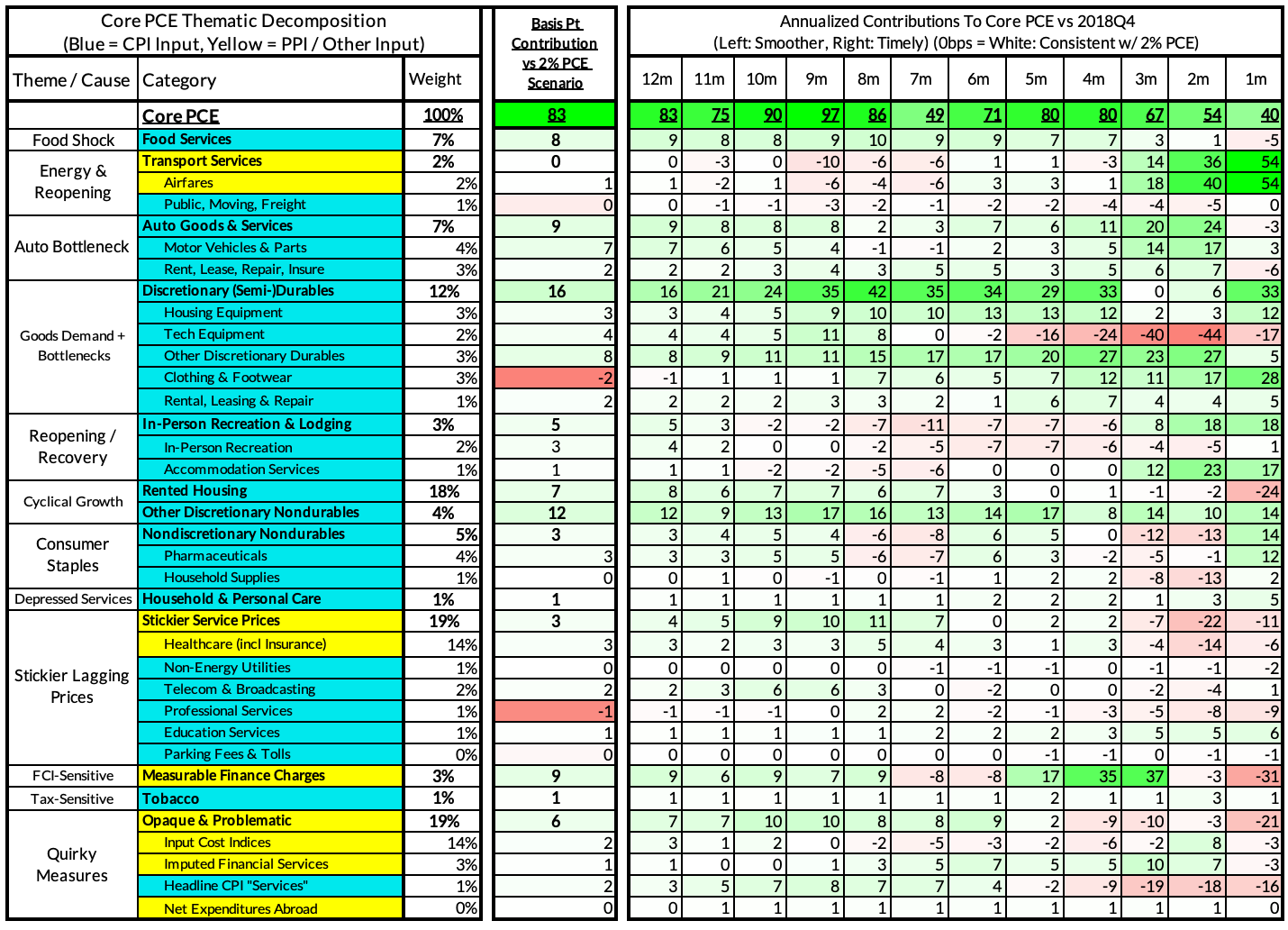

For the Detail-Oriented: Core PCE Heatmaps

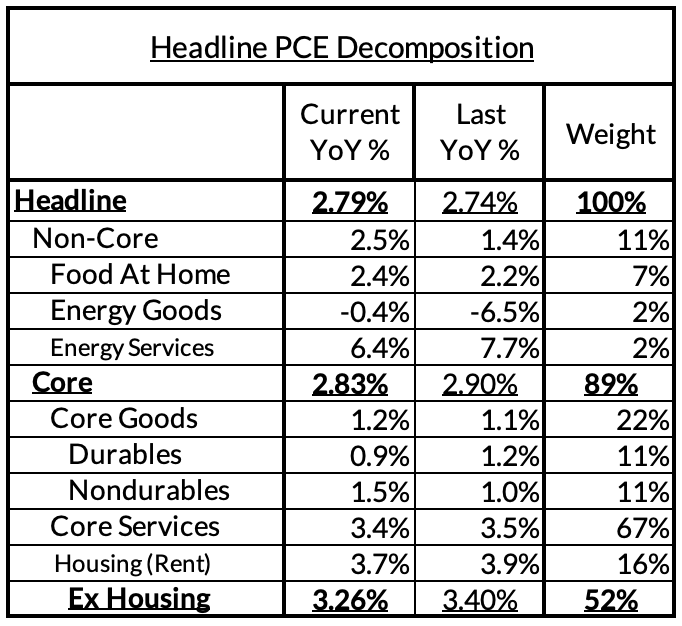

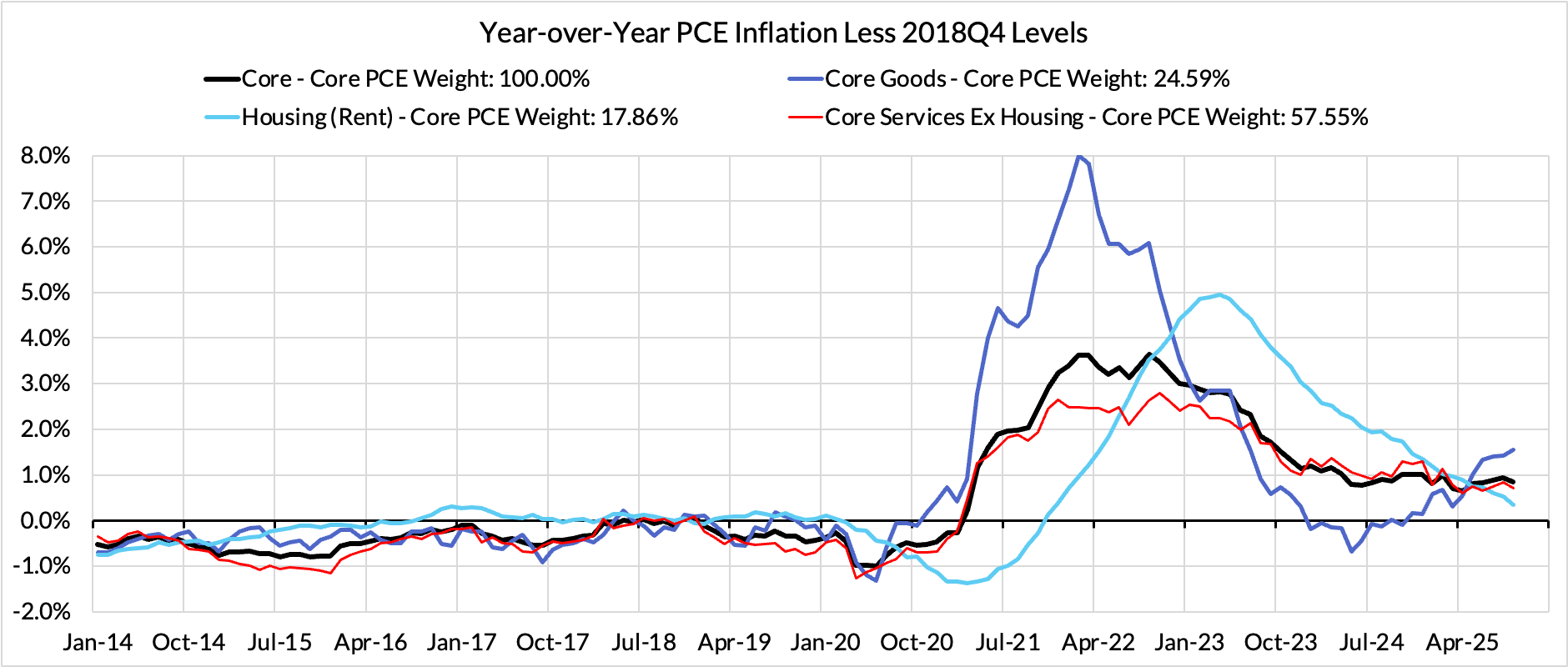

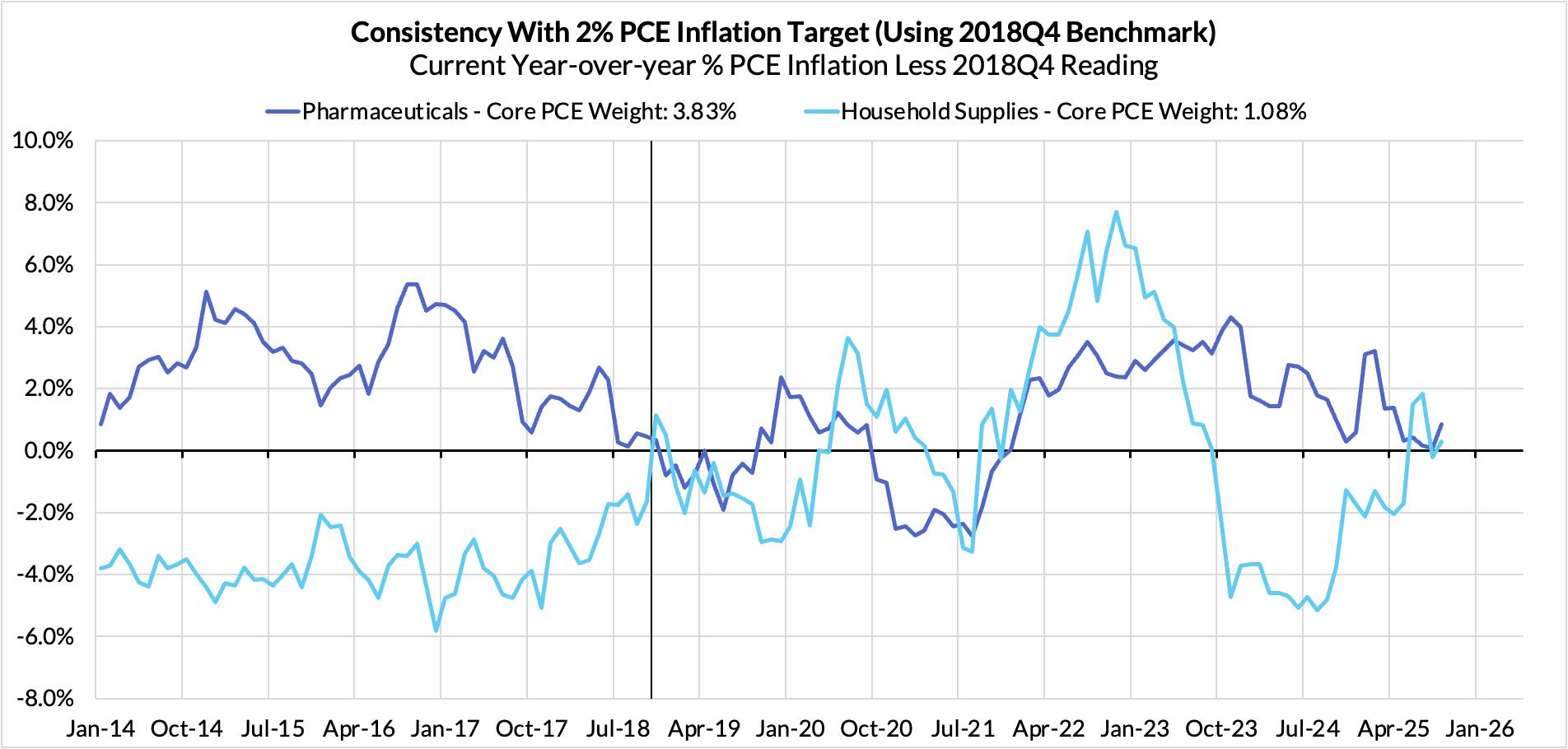

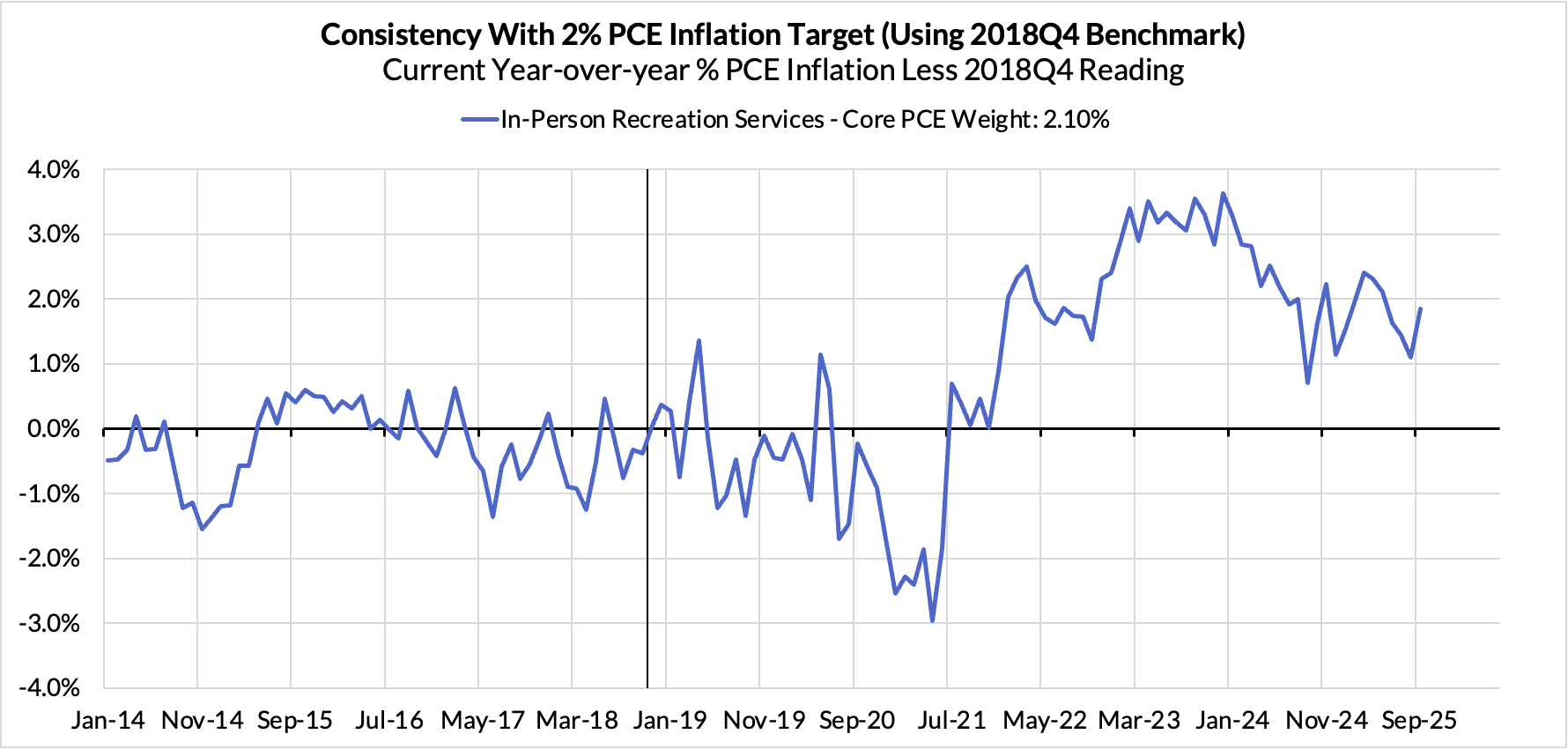

Right now Core PCE (PCE less food products and energy) is running at 2.83% year-over-year pace as of September, 83 basis points above the Fed's 2% inflation target for PCE.

The contributors to the overshoot:

- Catch-up rent CPI inflation in response to the 2021-22 surge in household formation (a byproduct of rapidly recovering job growth) and market rents are likely to account for just 7 basis points to the 84 basis point Core PCE overshoot.

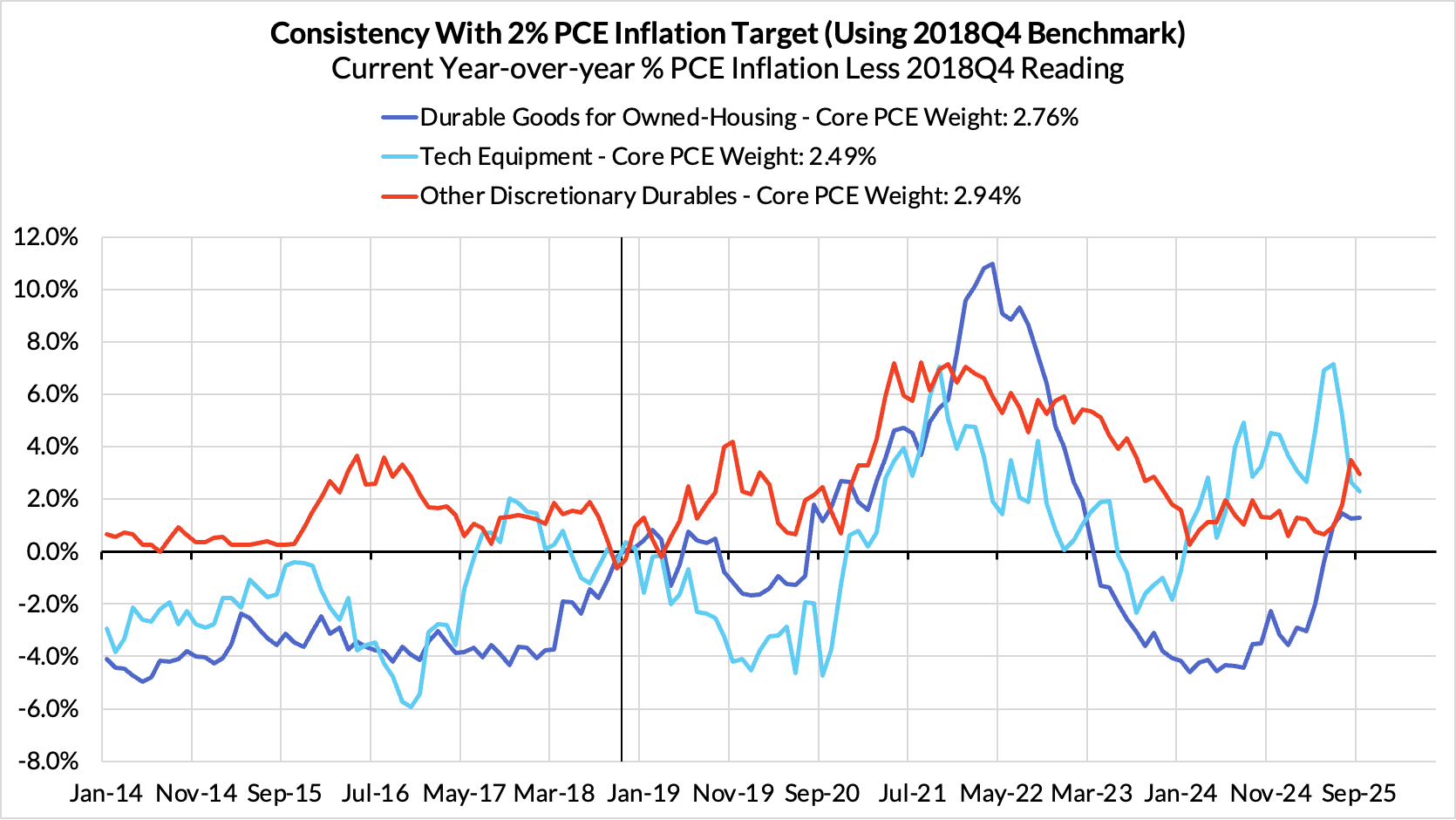

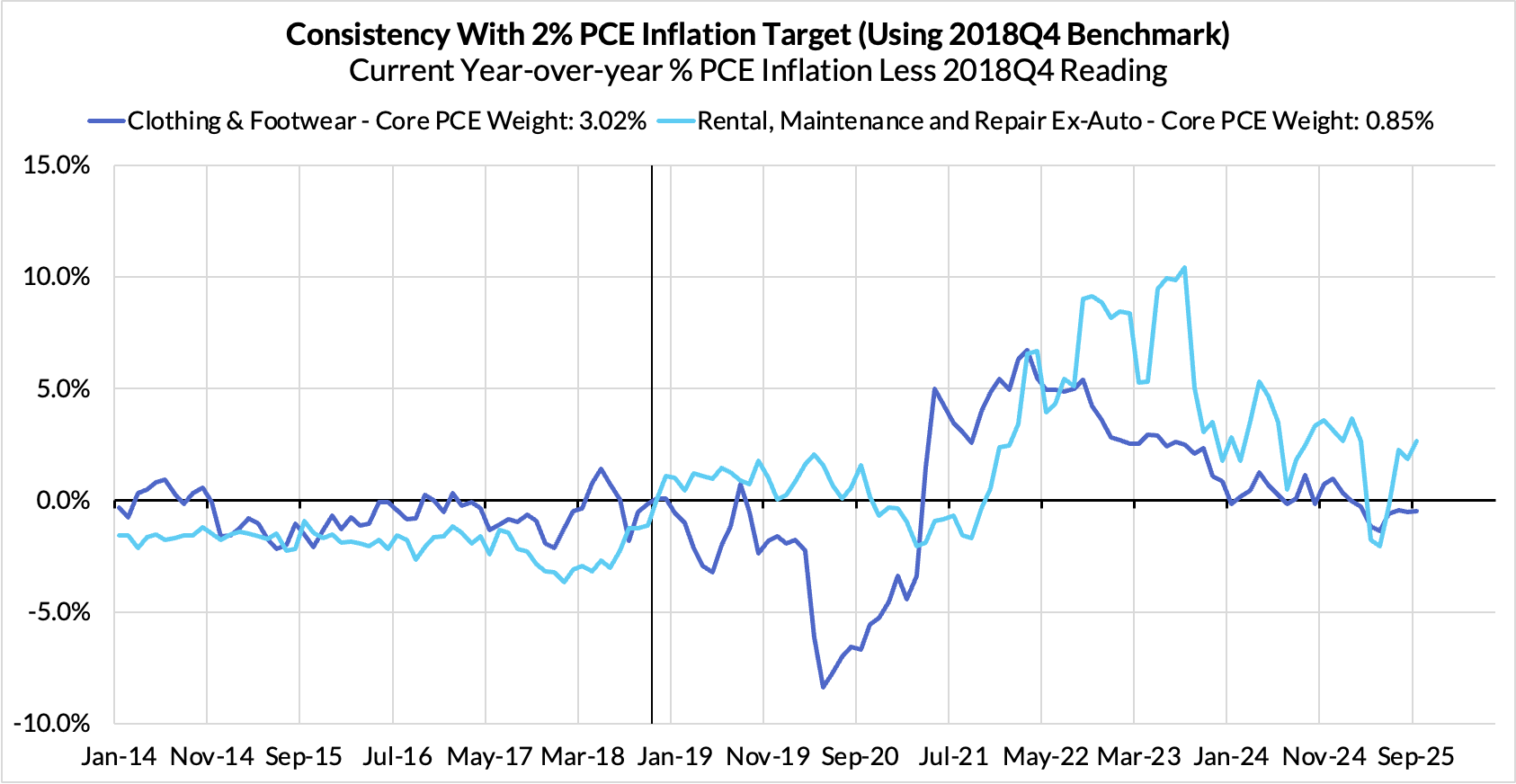

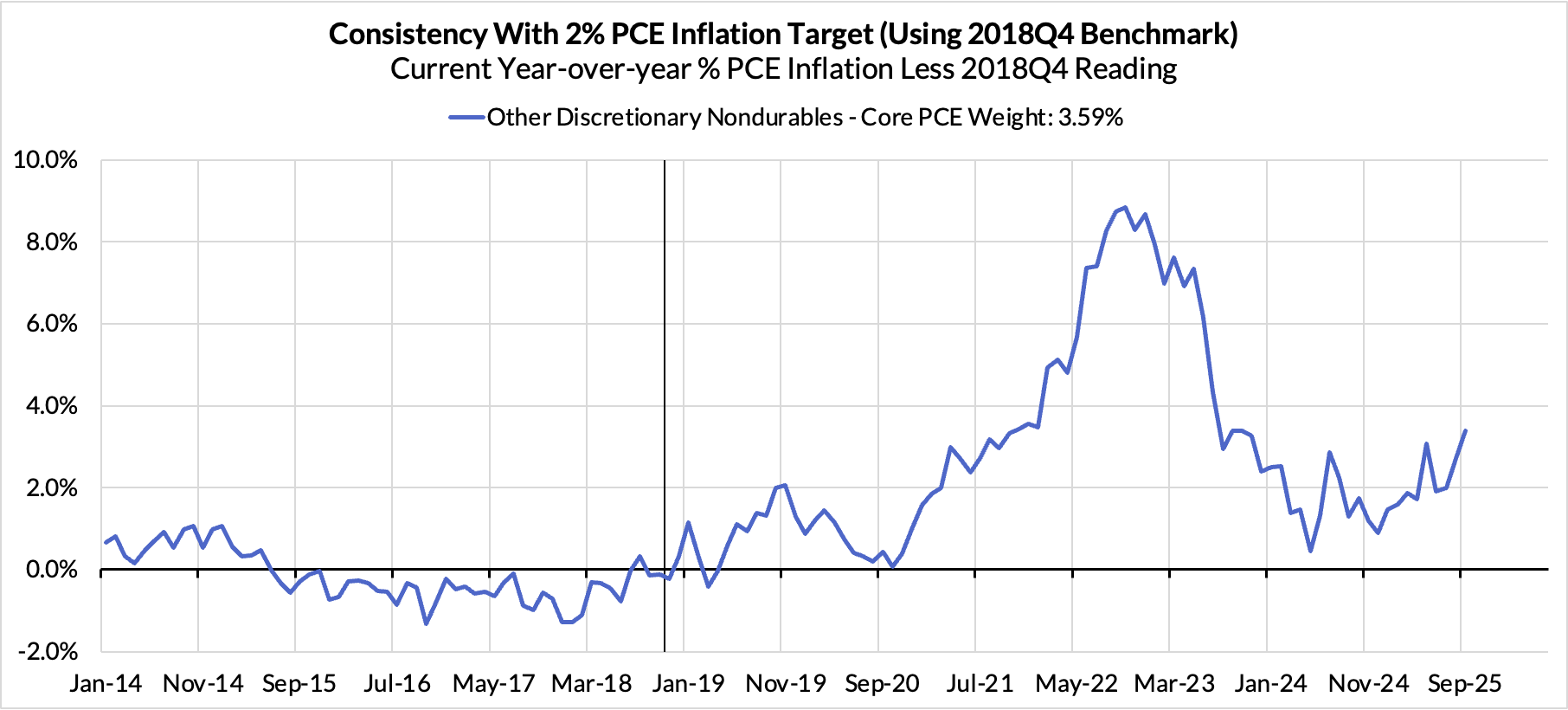

- Discretionary non-automobile goods + adjacent services are adding 28 basis points.

- Food inputs likely adding 8 basis points to the overshoot

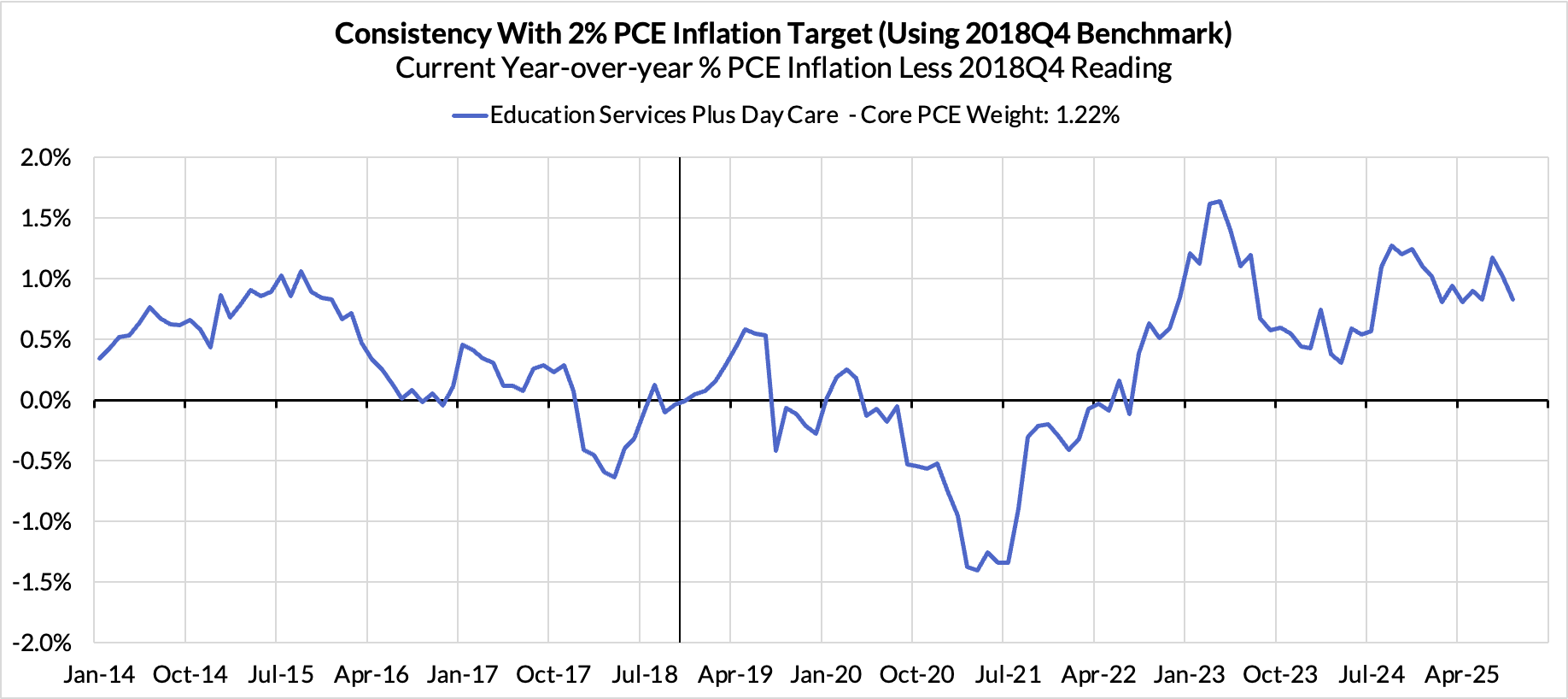

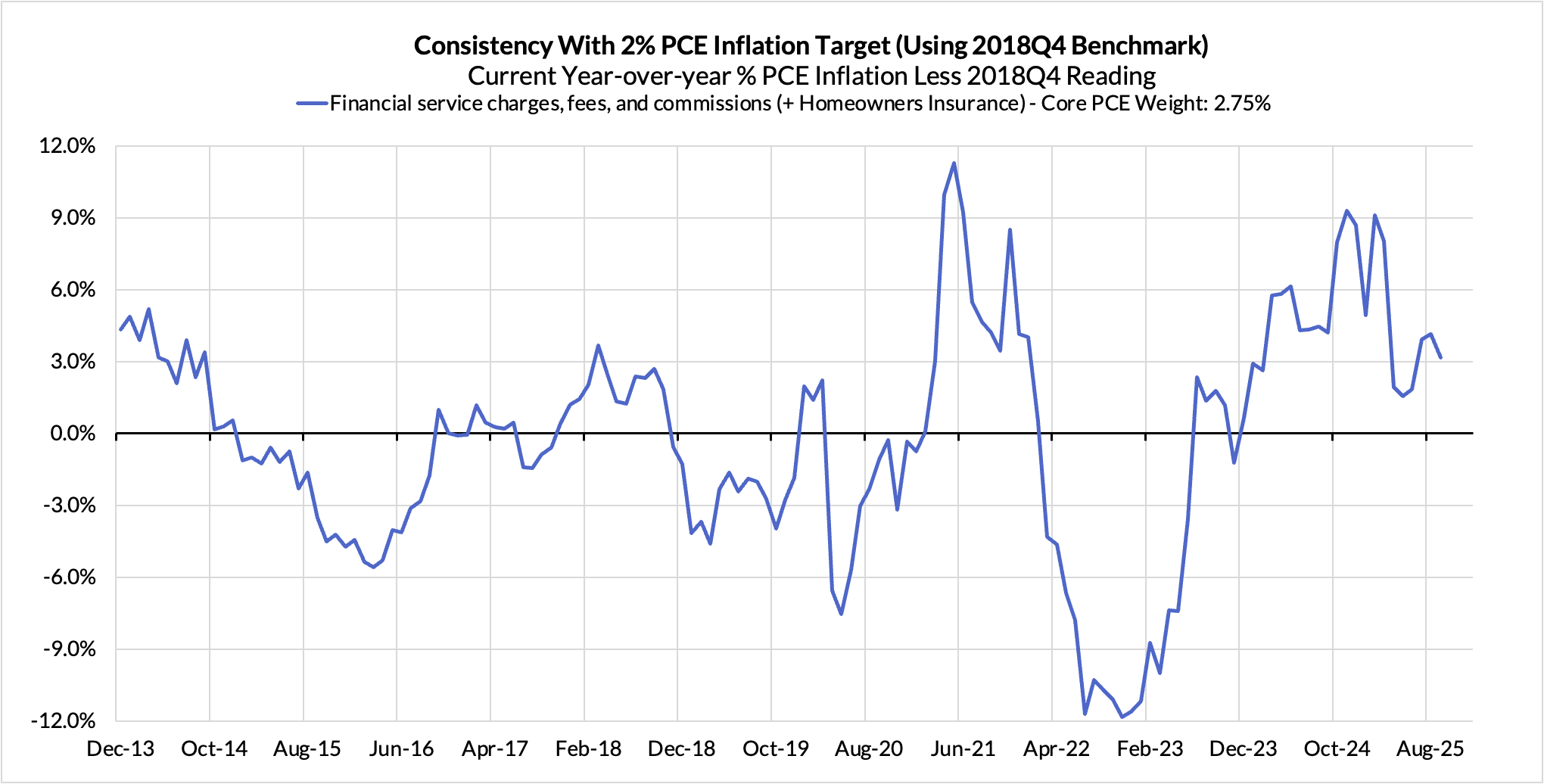

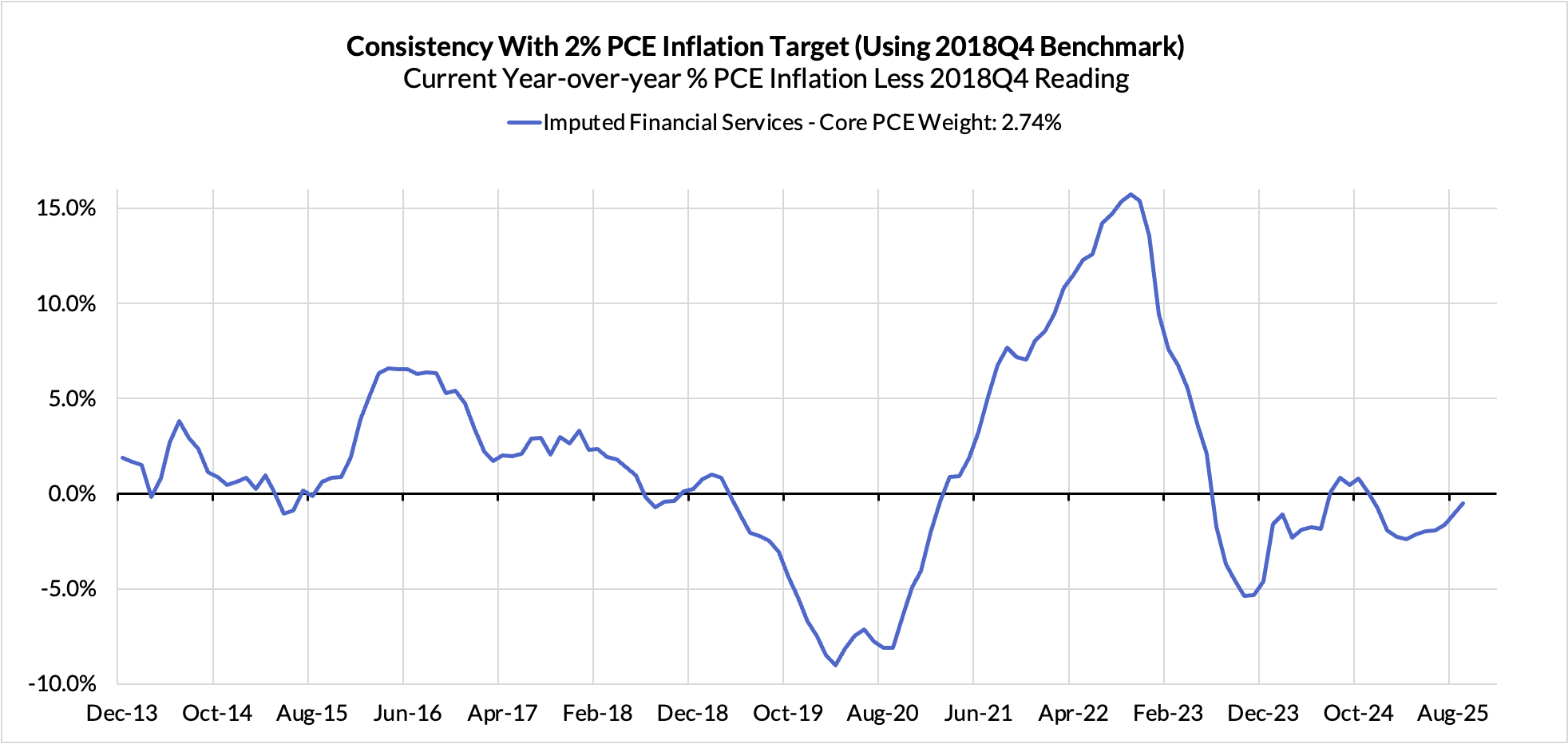

- Contributions from input cost indices (wages in specific sectors where market prices don't exist) are now likely adding just 2 basis points to the overshoot

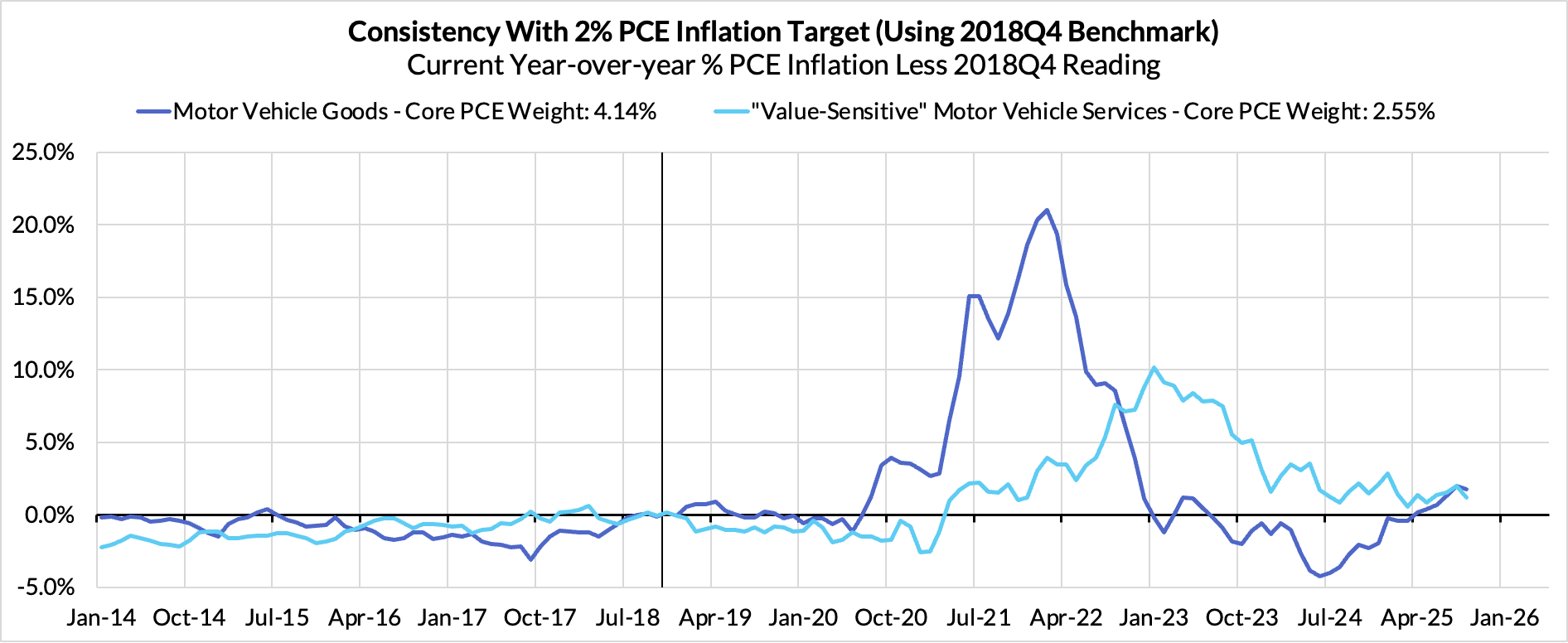

- Motor vehicle goods and services now accounts for 9 basis points of the overshoot.

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. September monthly annualized Core PCE ran at a 2.40% annualized pace, a 40 basis point overshoot vs 2% target inflation.

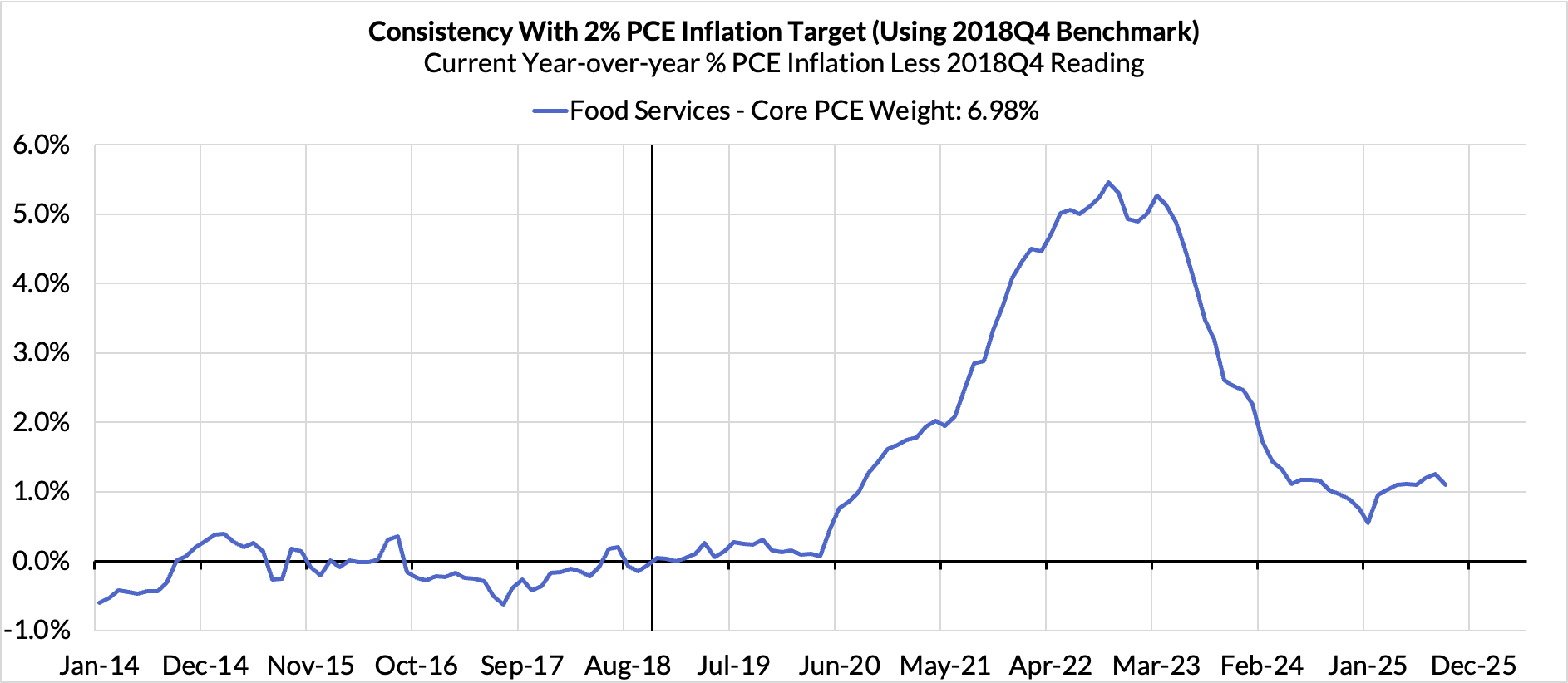

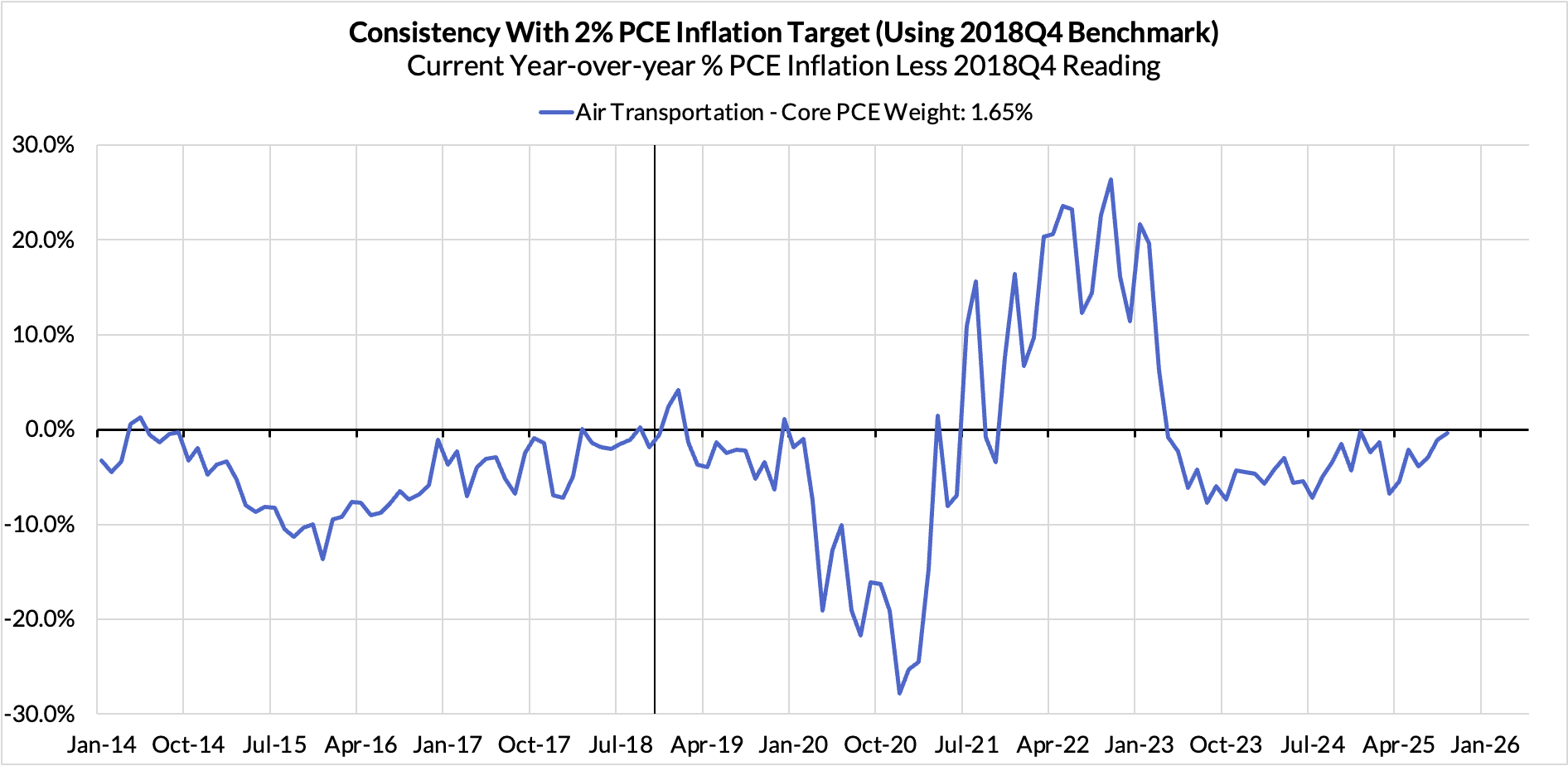

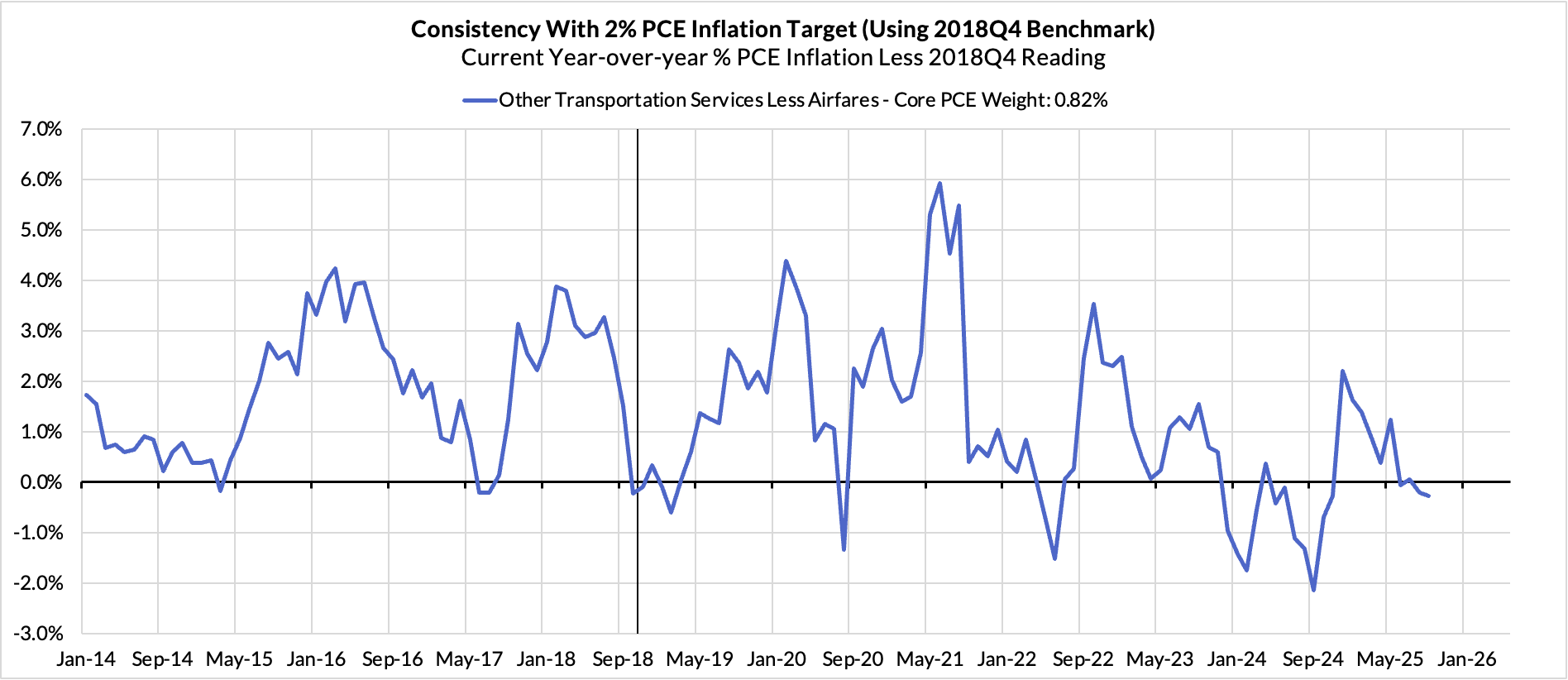

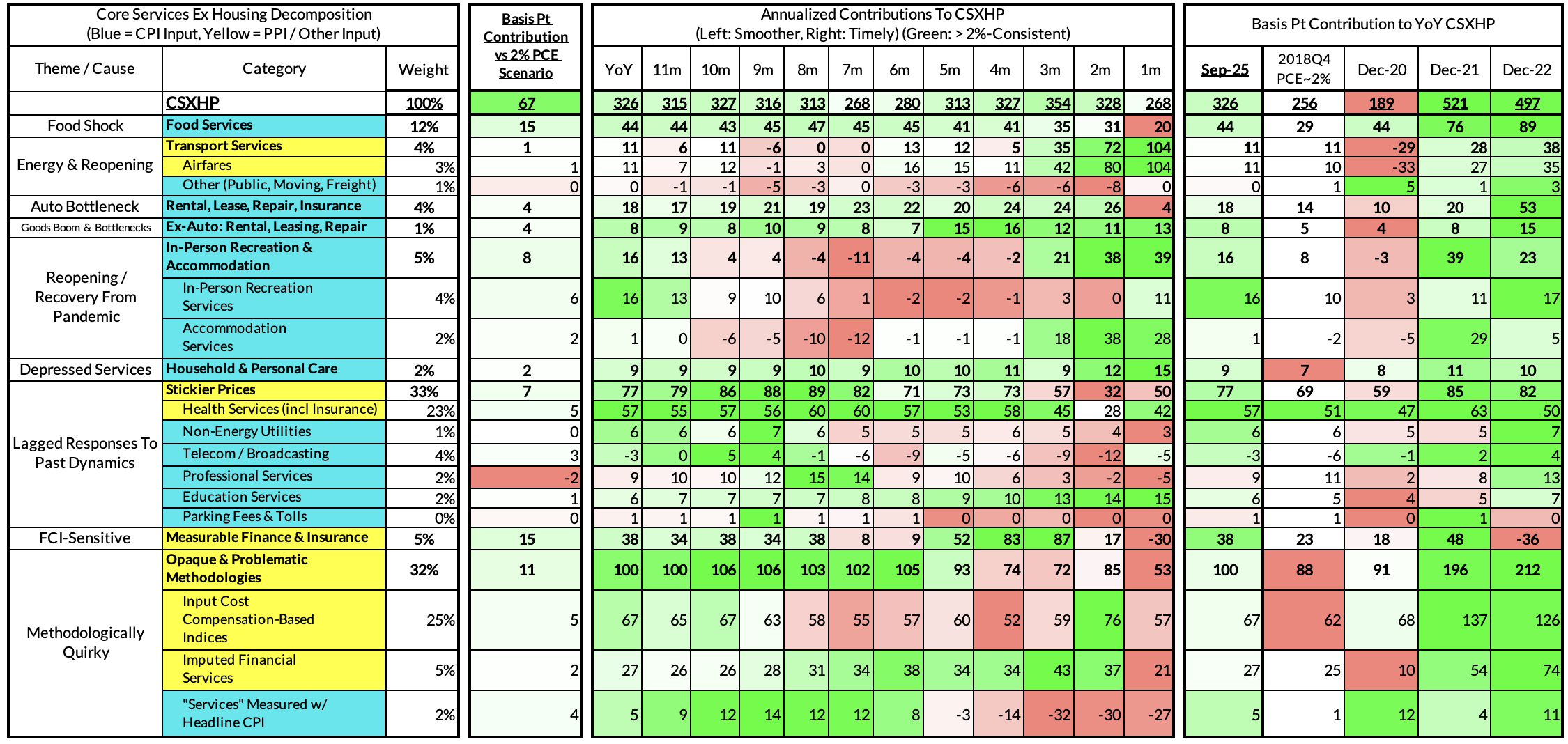

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The September growth rate in "Core Services Ex Housing" ('Supercore') PCE ran at a 3.26% year-over-year pace, a 67 basis point overshoot versus the ~2.59% run rate that coincided with ~2% Headline and Core PCE inflation.

September monthly supercore is on track to run at 2.68% annualized rate, a 9 basis point annualized undershoot of what would be consistent with 2% Headline and Core PCE.