Macro and Markets

Summary: Today's FOMC Statement and press conference shows high continuity with the thinking reflected in the December FOMC meeting. The Fed does not appear to be impressed by the deceleration in wage growth in 2022H2 enough to explicitly rethink the inflation, unemployment, or interest rate outlook right now.

Energy price volatility, which may be with us for quite some time as we pursue decarbonization, is one of our nation’s greatest macroeconomic threats.

What to Expect: 1. The Fed will step down from their breakneck pace of 75 basis point hikes to a still very brisk 50 basis point pace of hikes. 2. FOMC members are likely to signal that the peak Fed Funds Rate will be above 5%, likely in the target

Summary 1. Friday's Q3 ECI release showed a modest slowdown in the pace of wage growth. Coupled with what we already knew about Q3 employment growth, we are continuing to see a slower—though still highly respectable and resilient—pace of gross labor income growth (~6.1% annualized

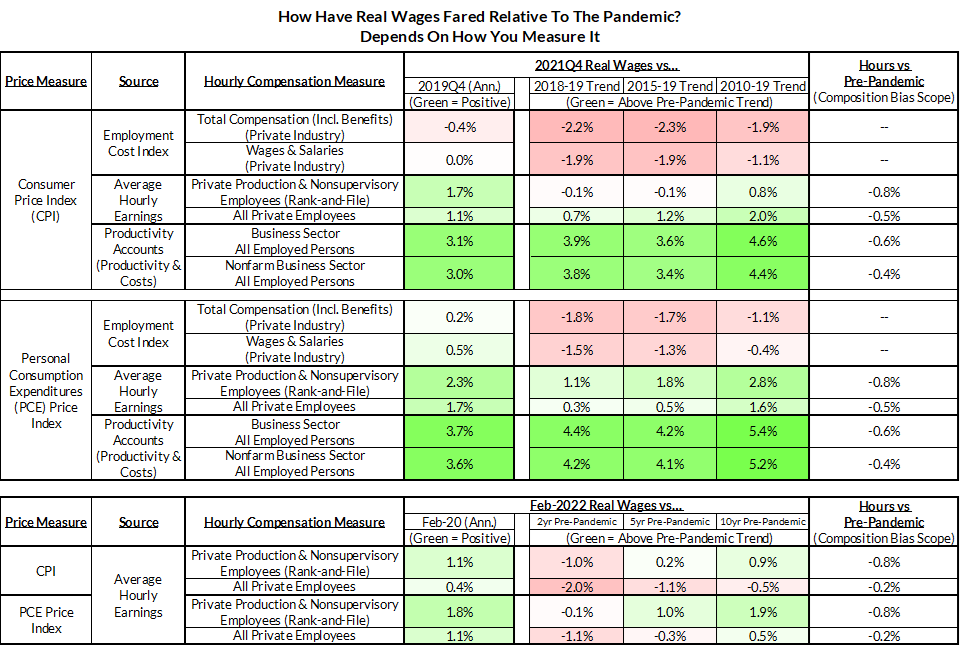

As of the first quarter of 2022, we have effectively recovered the jobs and wages lost to the pandemic-induced recession.

If we are trying to describe the nature of the real constraints that the economy has been facing over the past 6-12 months, we need a richer economic vocabulary than one that reduces every inflationary constraint to a domestic labor constraint.

This is meant to be a quick "micropost" and may be light on linking & original charts I was recently quoted saying that oil prices surging past $150 was "not implausible" in 2022. The reasons for my concern remains, but through delivering greater demand certainty and

Energy security has taken on new importance in wake of Russia’s invasion of Ukraine. We can use existing tools to confront these challenges without sacrificing our climate goals.