This past week saw a flurry of fedspeak with a bit of a common theme: waiting for the data. The next few weeks leading up to the June meeting will see new readings from a wide range of indicators, PCE and Jobs Day most important among them. Presumably FOMC members are looking forward to making a decision based on a fresher set of data than that available at the most recent. Most of the Fedspeak this week registered satisfaction with inflation continuing to slow, alongside an emphasis that although many are expecting a pause at this next meeting, that pause is not a foregone conclusion.

We also definitely agree with Goolsbee that you “don’t want to land the plane nose down,” by continuing to tighten into a slowing economy. That’s hard enough to do when everyone agrees on how to read the altimeter: right now, the economy does seem to be slowing, but no one's quite sure how fast. The key question though, is just how far away the ground is.

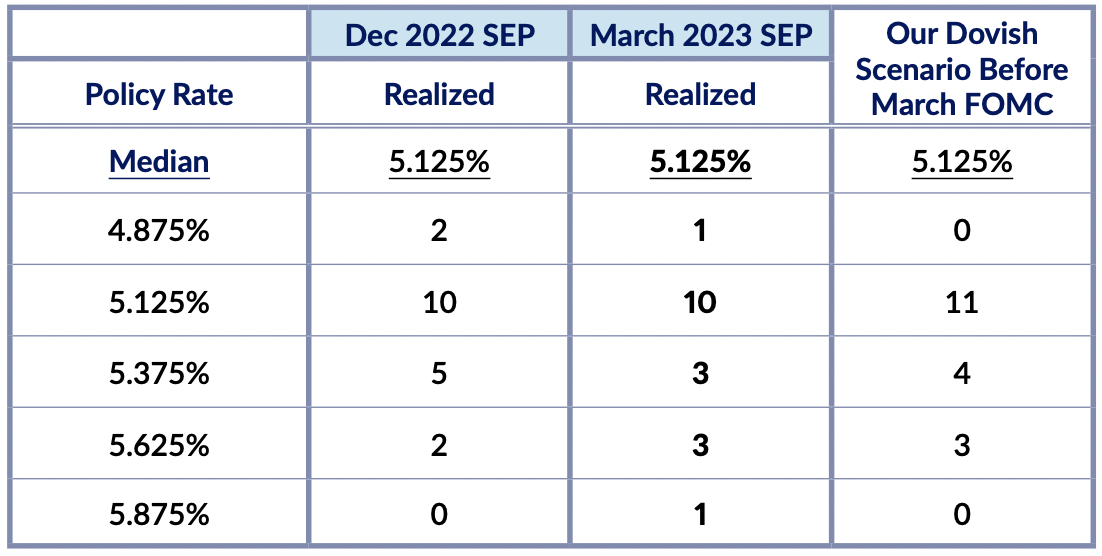

Summary Table

The full version of this Fedspeak Monitor is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.