If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

What's Changed Since The March FOMC Meeting?

What to expect:

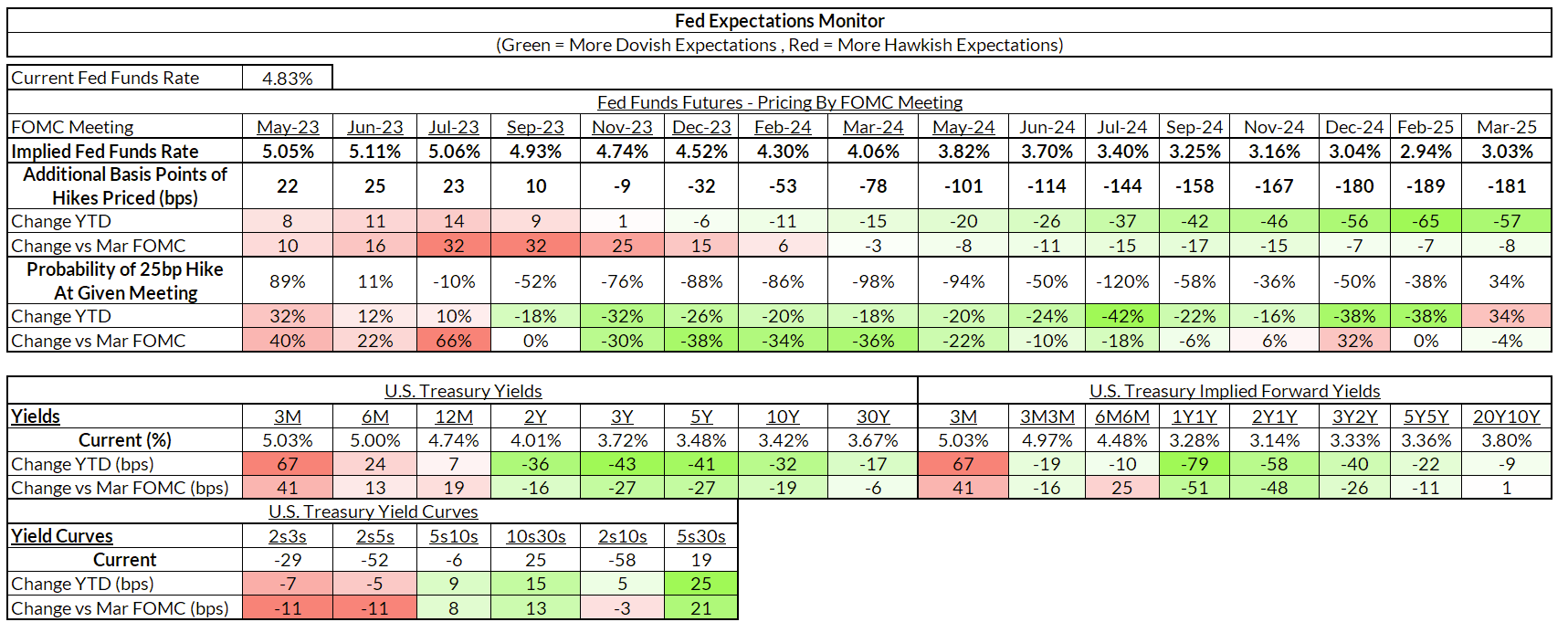

- 25 basis point hike. Market pricing currently implies an 88% chance of a 25 basis point hike at the May FOMC meeting. Barring spillover fallout from First Republic's failure prior to the FOMC meeting, the Fed will hike another 25 basis points this Wednesday.

- Holding and hiking optionality in the statement. The May FOMC statement is likely to keep optionality open for a hike at the June FOMC meeting, without a hard signal that such a hike will be warranted. Because we have seen another bank failure recently, the Fed's 25 basis point hike will coincide with no strong guidance about the FOMC's plans for the June FOMC hike. The Fed wants the option to make May the last hike, and it also wants the option to hike in June.

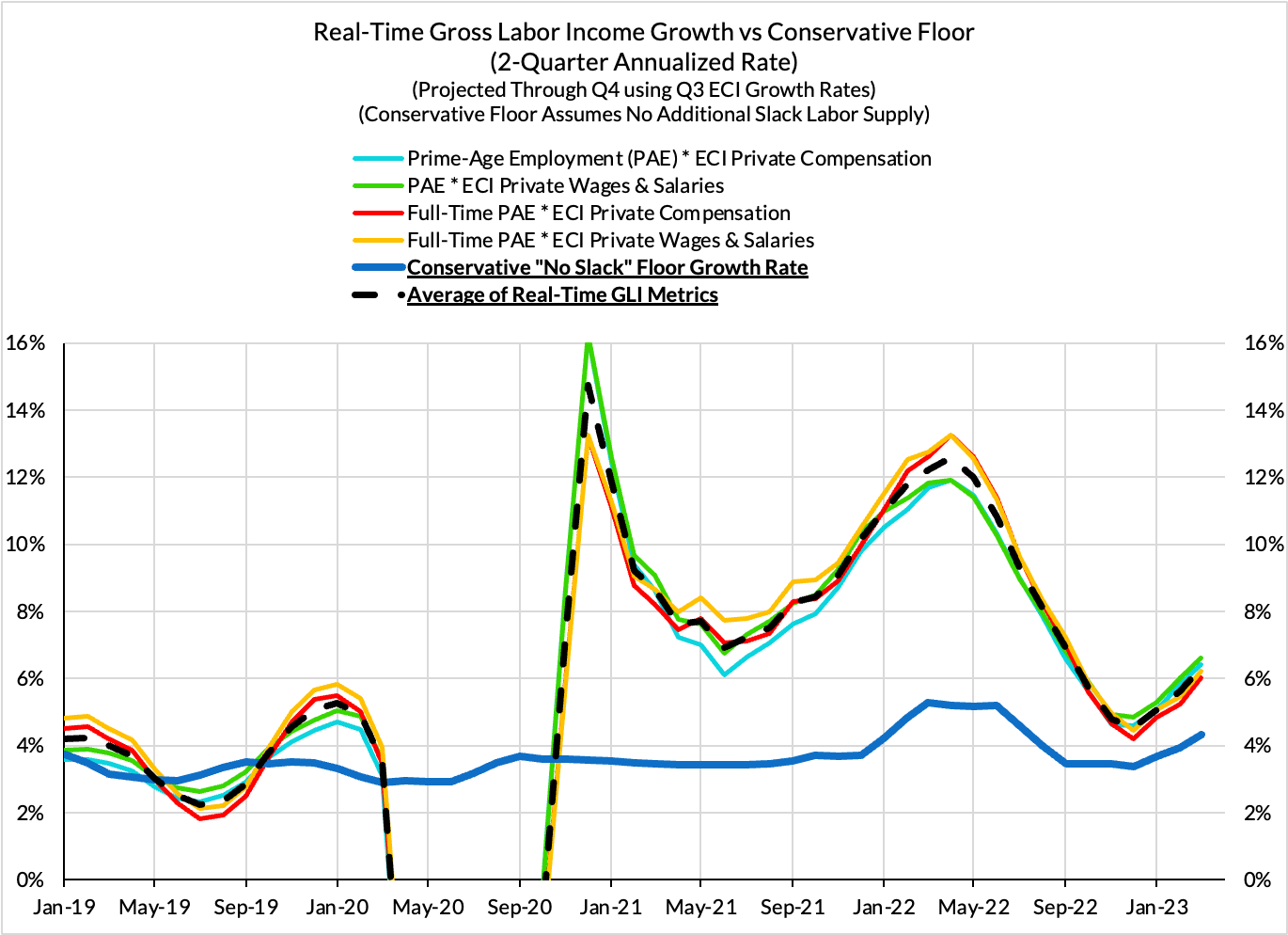

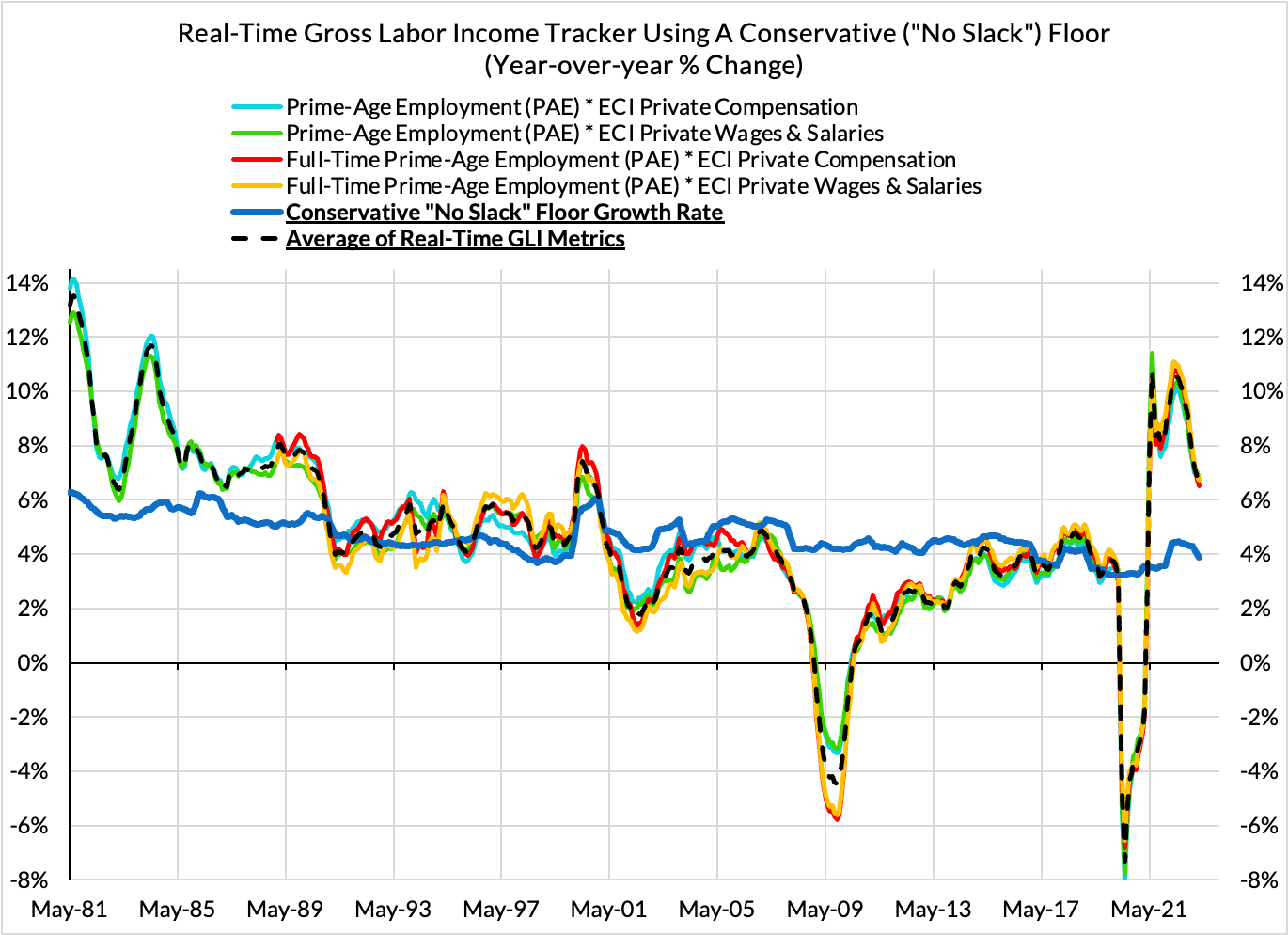

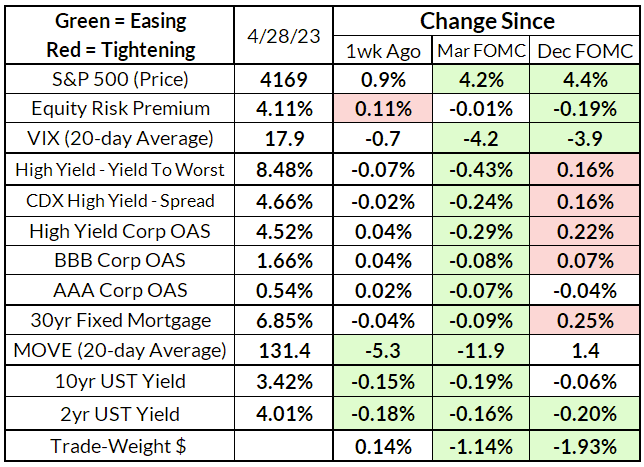

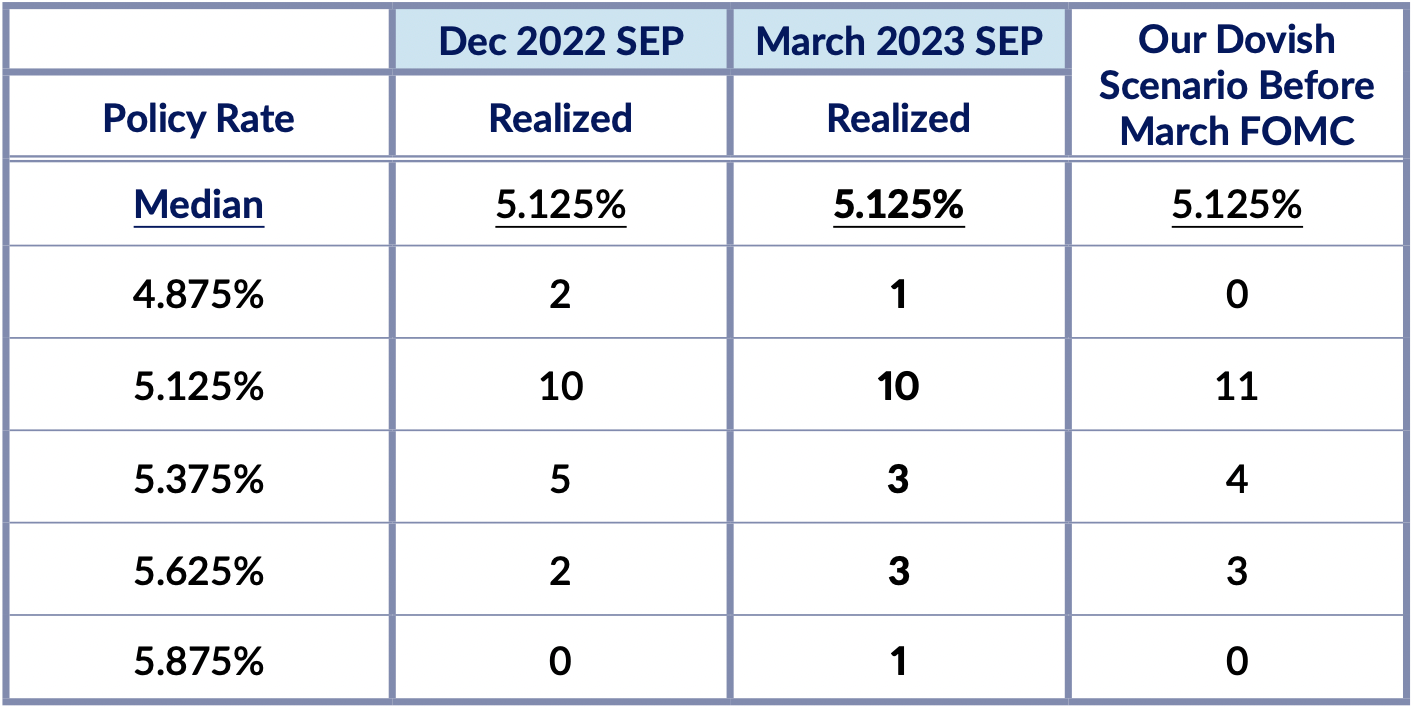

- Discomfort with inflation and labor market strength. The Fed is likely to be unsatisfied with the pace of progress on inflation thus far, and Friday's ECI release hindered the opportunity to at least walk back some of their more hyperbolic claims about an overheated labor market. Given that capital market conditions have marginally eased since the last FOMC meeting, the Fed would normally continue to posture hawkishly. And given that the Fed sees recessionary conditions as consistent with appropriate policy, the Fed staff and FOMC are likely displeased by the signs of growth resilience in the Q1 GDP and employment data.

- Uncertainties about nonlinear banking dynamics: The snafu for Fed hawks has been the developments in the banking sector. There remain ongoing challenges; Silicon Valley Bank, Signature, and Credit Suisse were certainly not the end of the story. The Fed was clearly blindsided by these dynamics and still lacks a credible story for why they were not paying attention to the close interactions between interest rate hikes and bank behavior. Given the lack of systematic public data, we are left merely with anecdotes from Beige Book to confirm the notion that bank credit conditions are tightening, even as capital market conditions look more well-behaved.

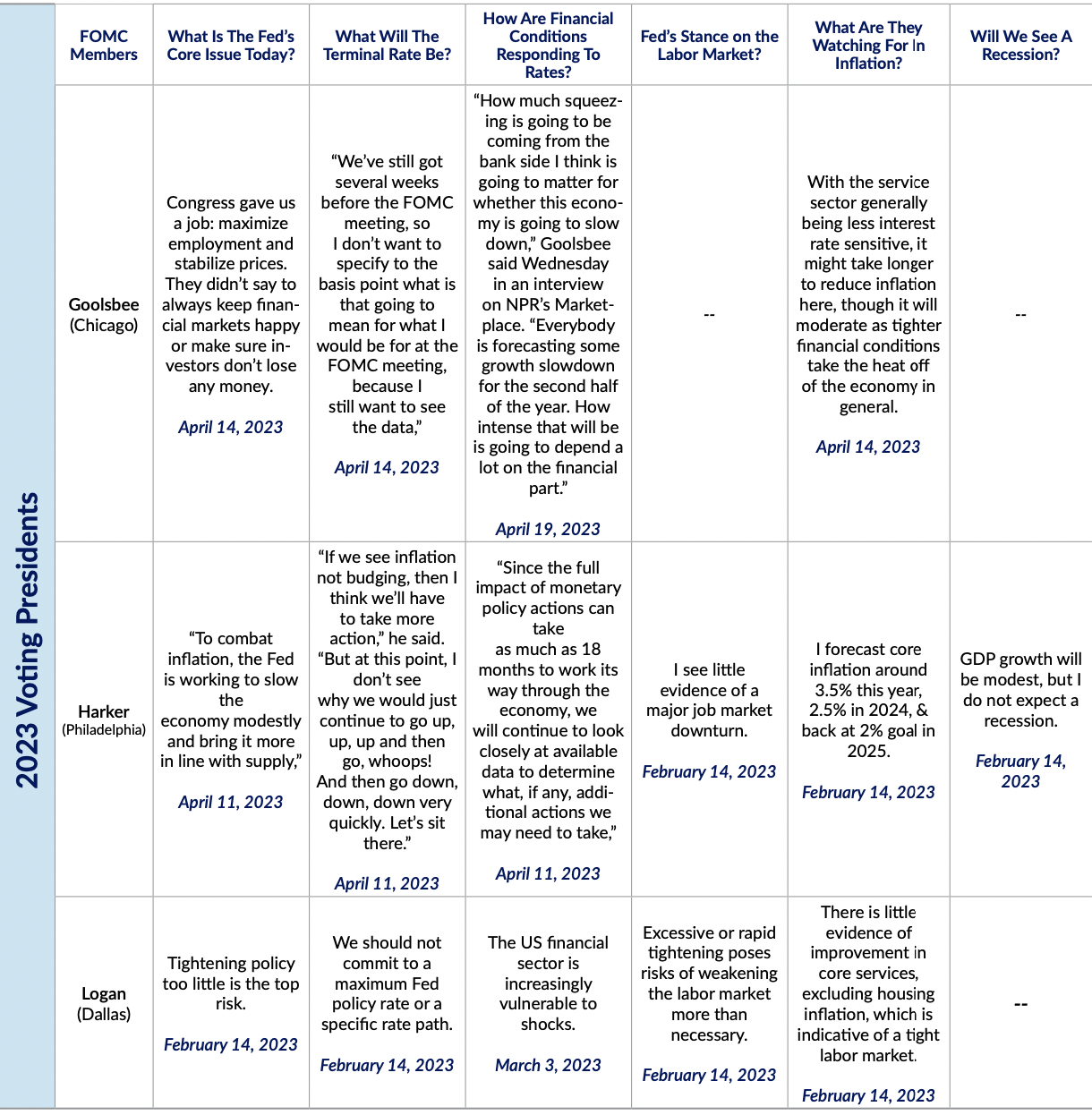

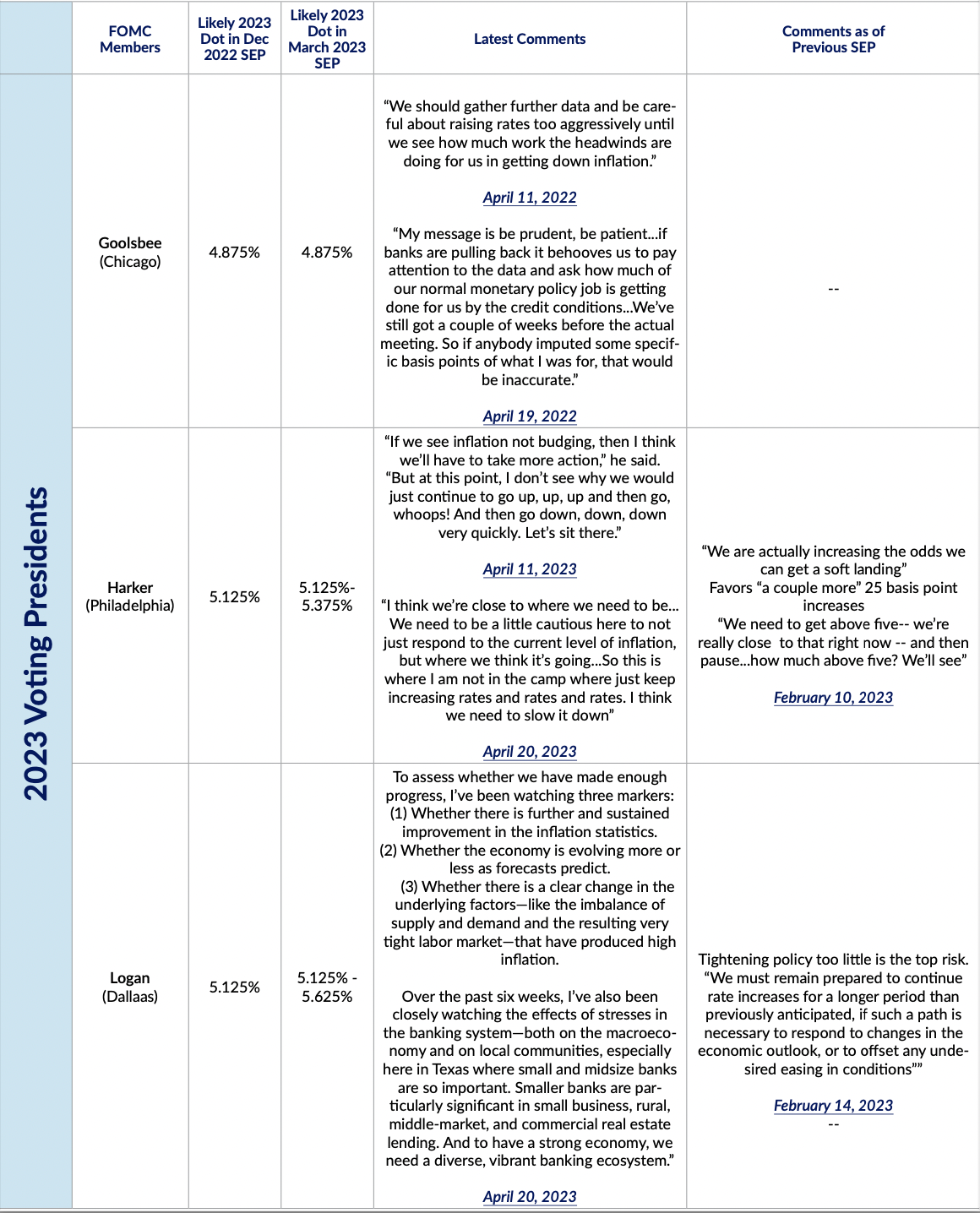

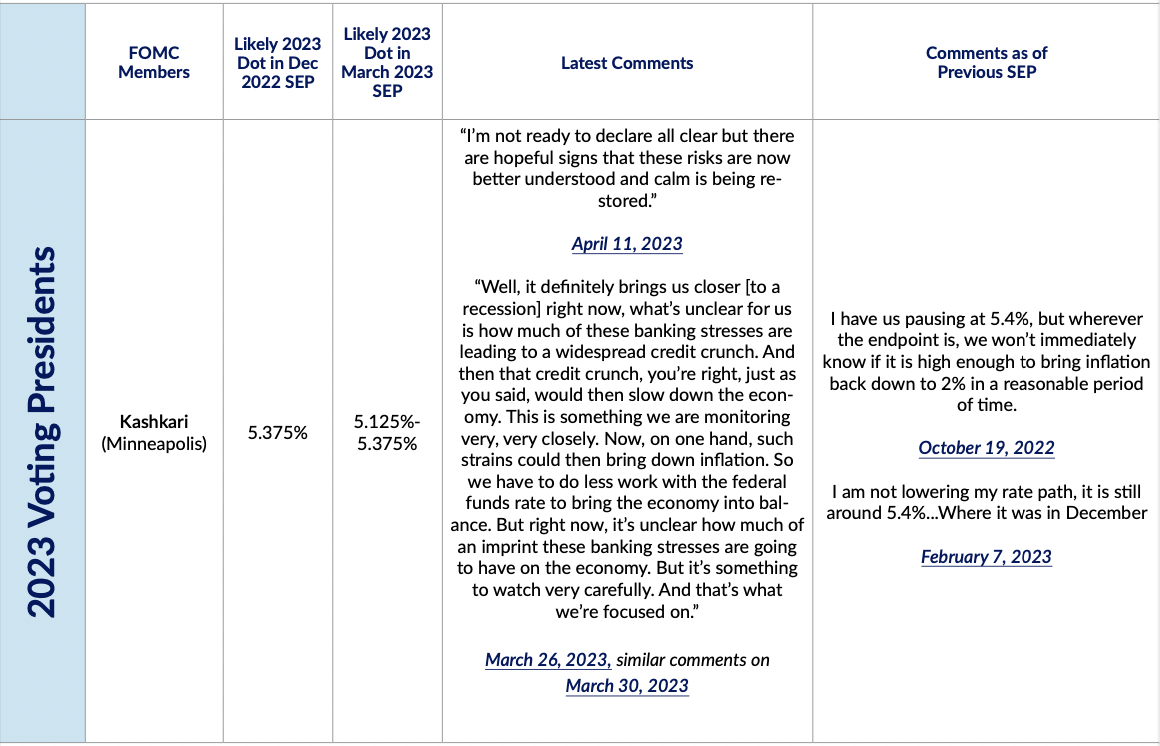

- A Goolsbee dissent? The most dovish member on the FOMC is Chicago Fed President Austan Goolsbee, who, at the March FOMC meeting, likely penciled in 4.875% as his terminal rate projection in the SEP. In the inter-meeting period, he has continued to signal a dovish posture, taking a concerned view of how bank credit conditions could evolve and amplify the effects of past Fed hikes (and diminish the need for future hikes). He did walk back the strength of his statements later, claiming he had not made up his mind at the May FOMC meeting. We will likely see more dissents at the June FOMC meeting; with a clear faction keen to stop after May and another clear faction keen to continue hiking.

The Developments That Matter:

- Not out of the woods on bank credit tightening by any stretch: The Fed staff that support monetary policy decisions are not bank analysts. They, along with FOMC members, tend to only see these dynamics from a top-down perspective...recognizing risks only after they are publicly obvious. If you keep getting blindsided by banking challenges, the rational response is to proceed with greater caution. Former regional Fed presidents Eric Rosengren and Robert Kaplan have publicly reflected that sentiment more vocally in recent weeks. Fedspeak suggests that for many non-academic-macroeconomist FOMC members, the inclination to tread lightly and stop hiking after May is strong. For these members, they are most keen to avoid getting mugged by banking dislocations. Given the attenuated nature through which financial system transmits the Fed's policies to the real economy, they probably will keep being caught offsides. Claims that the Fed can manage financial stability independent of monetary policy decisions will keep coming sporadically under pressure.

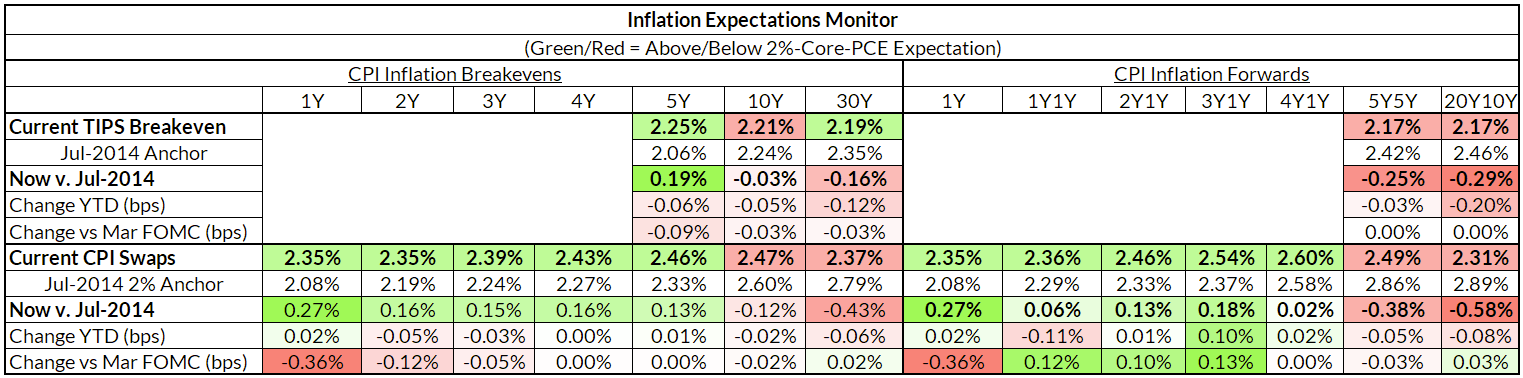

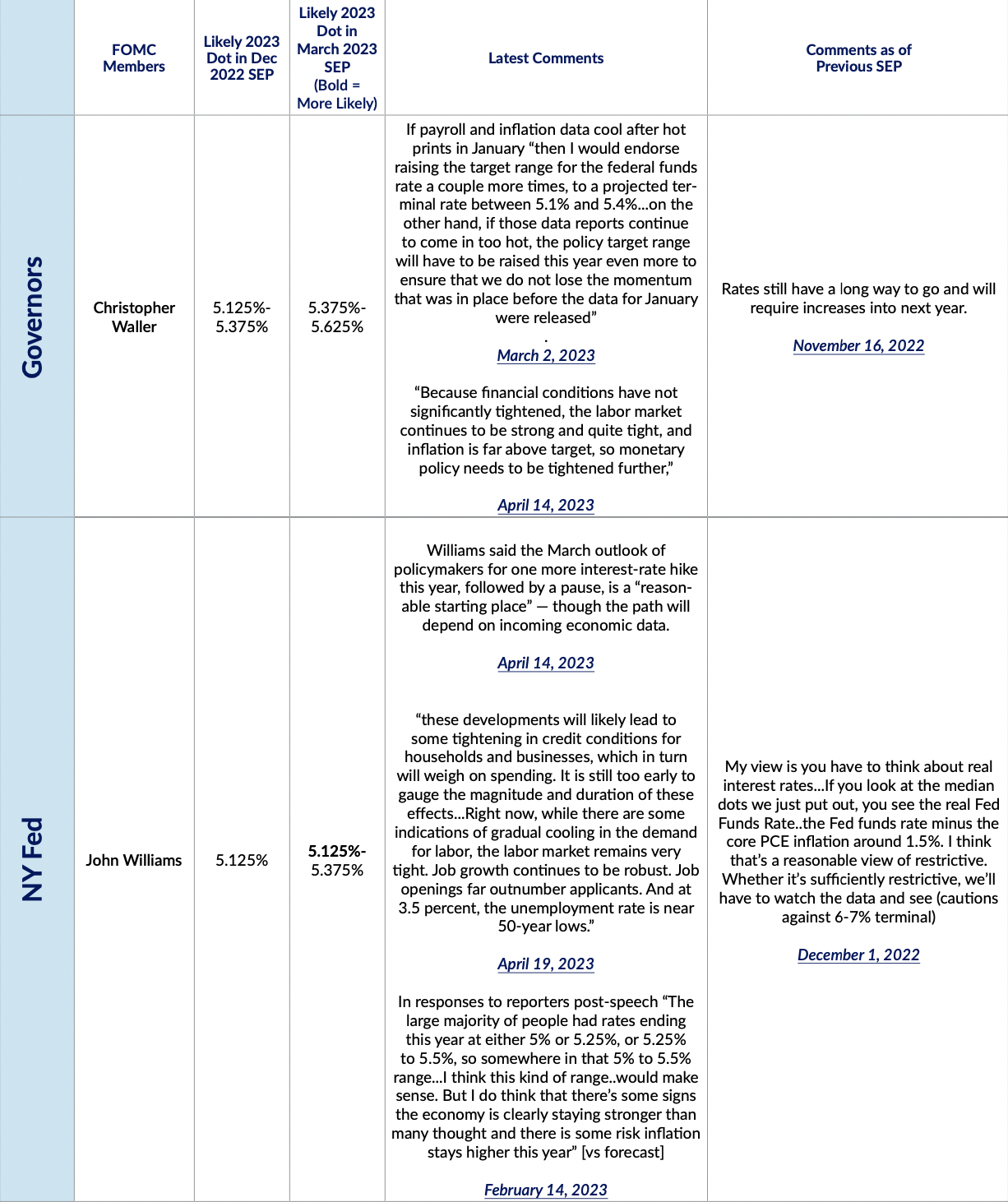

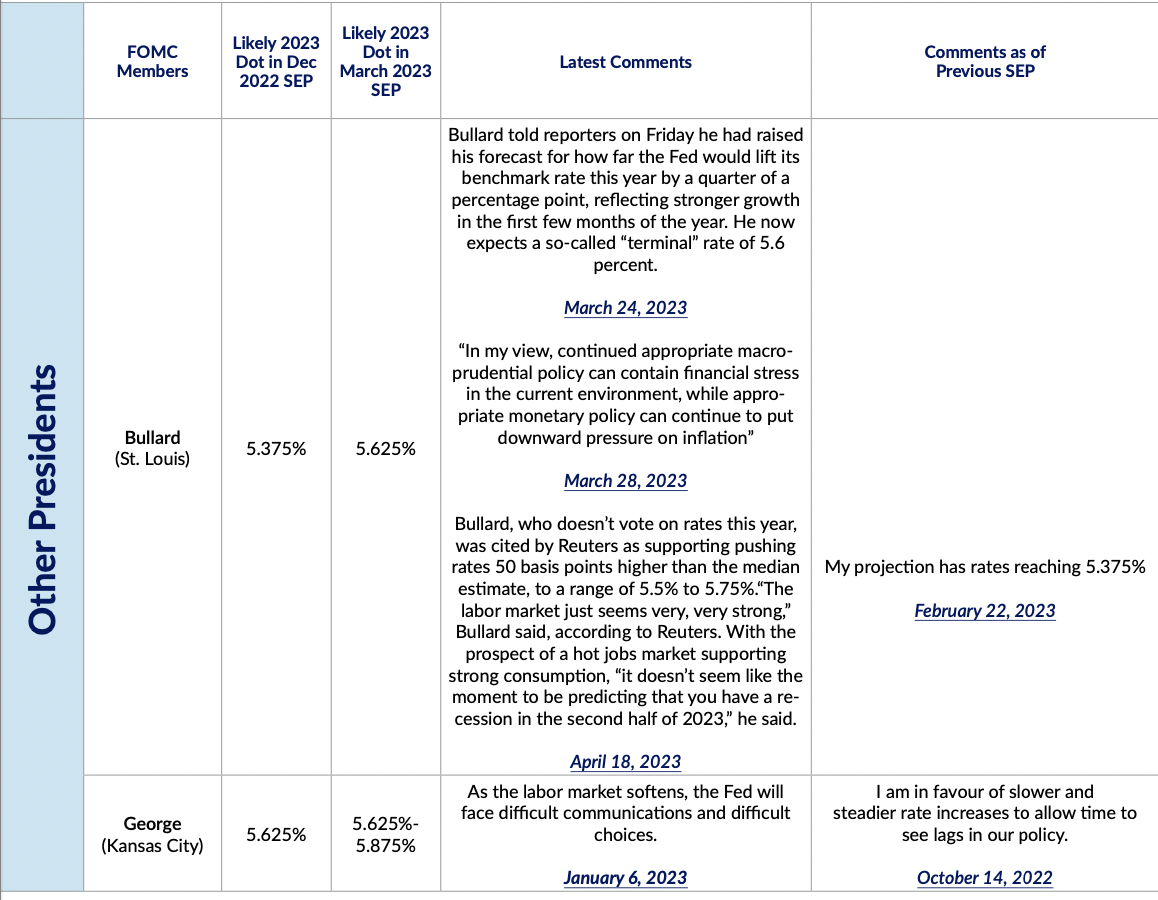

- Macroeconomist FOMC members tend to treat transmission issues as peripheral and will be more troubled by labor market and inflation data: The likes of Jim Bullard, Chris Waller, and John Williams are thinking primarily about the fundamental data they see, and it still screams hot to them. Core PCE in Q1 was hot (for reasons we flagged but the FOMC apparently missed). For these economists, the location of the inflation rate is what primarily matters for the location of the Federal Funds rate. Changes in monetary transmission (like a turn in a credit cycle) generally get short shrift from this group of FOMC members. They are more keen to only respond after weakness shows up in the macroeconomic data (often too late). For these members, they mostly fear inflation continuing to surprise to the upside after systematically underappreciating the scale of the inflation surge. Given that used car price dynamics are coiling into the April and May CPI releases, and given the lagged nature of rent inflation dynamics, FOMC members are liable to keep getting caught offsides here as well.

- A split FOMC will punt on key questions: As the previous two points make clear, there are starker differences emerging about near-term FOMC decisions. The Fed will need to come to a decision, but at least for now, that probably means no hard signals in the May FOMC statement about a June FOMC meeting policy bias/preference between hike or hold.

What We Think the Fed Should Do: Move Into Serious Risk Management Mode

- Keep financial conditions for the real economy stable from here: A hike at the May FOMC meeting is priced in and reconcilable with our general framework, which hinges on two individually necessary conditions: 1) labor income growth remains resilient and respectable on a forward-looking basis, 2) the inflation outlook remains elevated for the time being. Nevertheless, the combination of bank credit conditions tightening and hard evidence of rising layoffs should raise the probabilities associated with downside risks, even if not enough to fold into the baseline modal outlook.

- In our framework, the Fed would be forward looking and not merely setting policy according to the baseline modal outlook. An unruly tightening of bank lending conditions and a snowballing of layoffs are both dynamics that are difficult to immediately reverse ('putting toothpaste back into the tube'). Even while upside risks to inflation have been identifiable throughout the past 18-24 months, the downside risks are only now growing more identifiable. Especially given the opacity of tracking how much bank lending conditions are tightening in real-time, capital market conditions cannot be the sole basis for gauging financial conditions in totality.

- Stable financial conditions would be most consistent with stopping hikes after the May FOMC meeting. While a May FOMC hike is baked into the cake and seems not as pivotal, a June FOMC hike is not baked in and could prove more disruptive.

- The Fed should still be taking each decision meeting by meeting, but the downside risks warrant avoiding strong guidance for a June hike at this stage. We suspect that outside of used cars and rent, there are areas of both consumer prices and wage growth that can show more material deceleration. Core Services Ex Housing PCE in March was consistent with nearly 2% Headline and Core PCE. There are non-wage reasons to believe in further convergence here. Still, the path to achieving 2% PCE inflation, absent recession, will likely require another 12-15 months. It remains to be seen whether the FOMC has that patience.

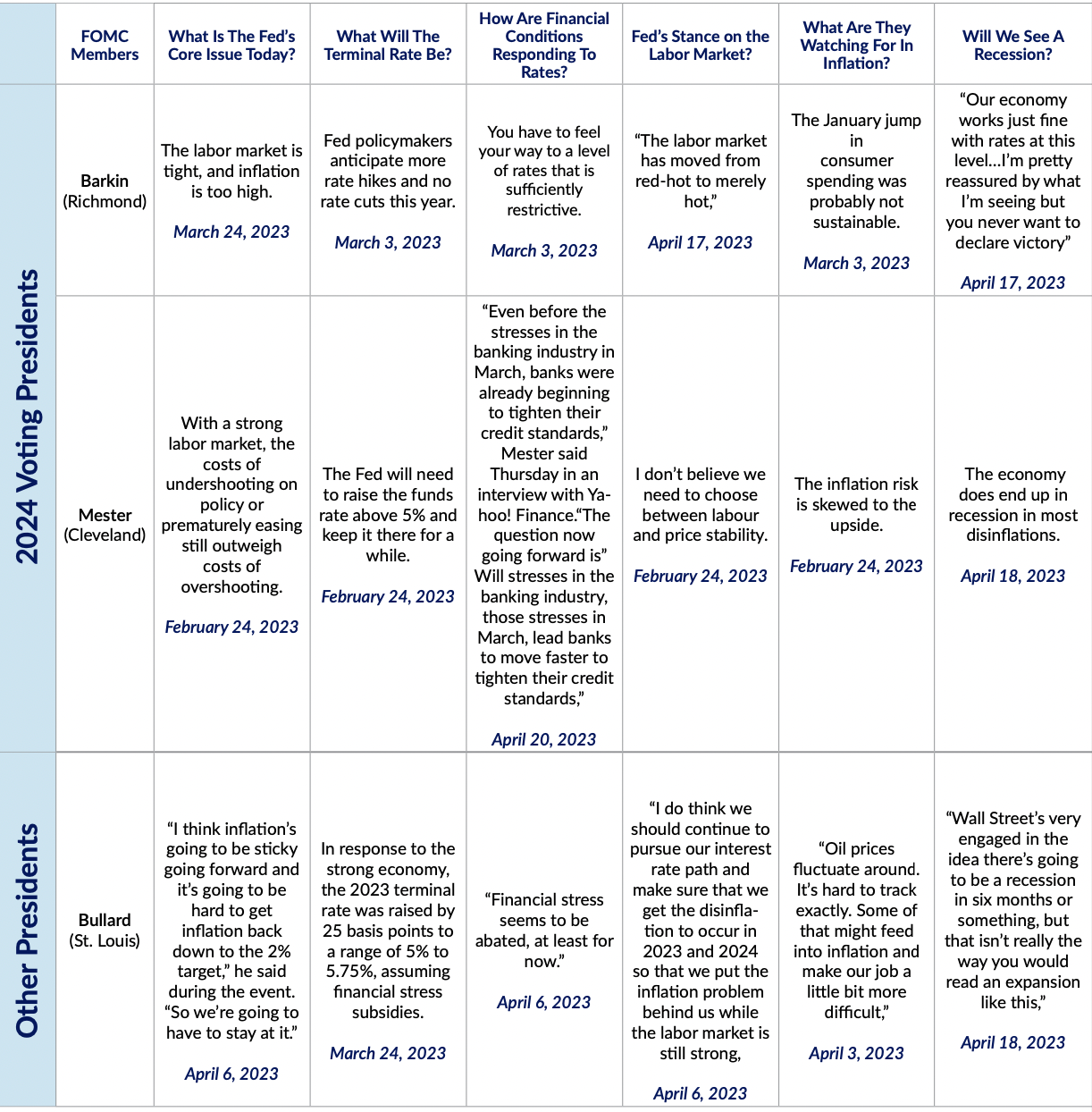

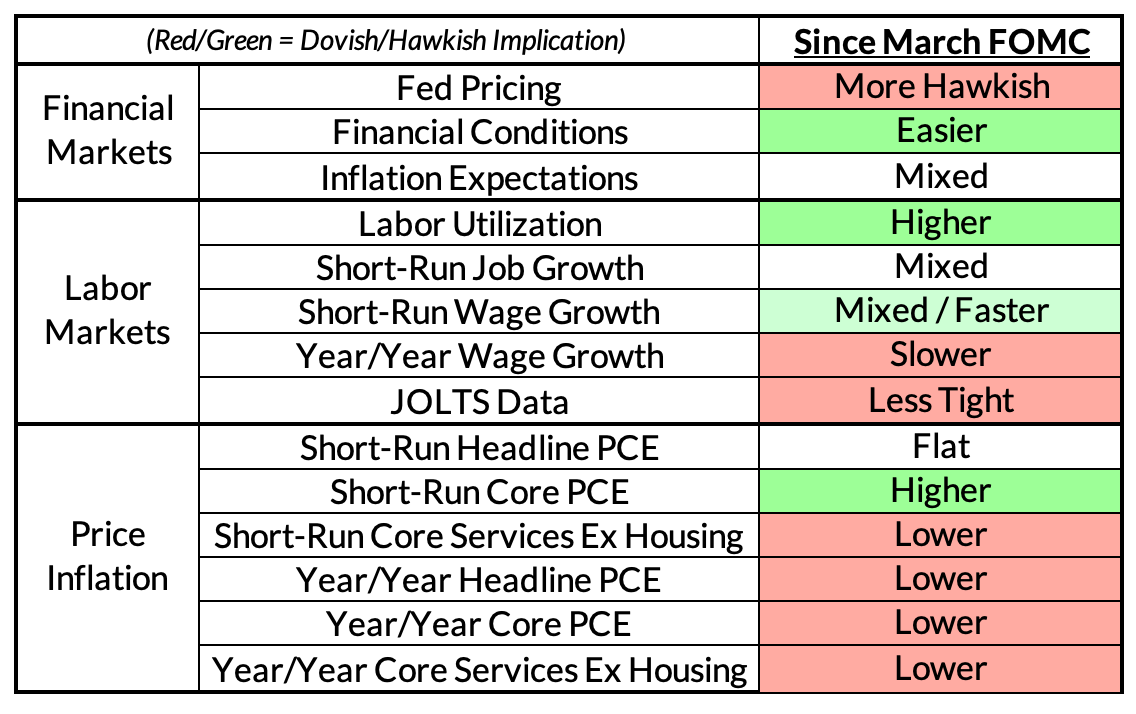

Intermeeting Financial Conditions Dashboard

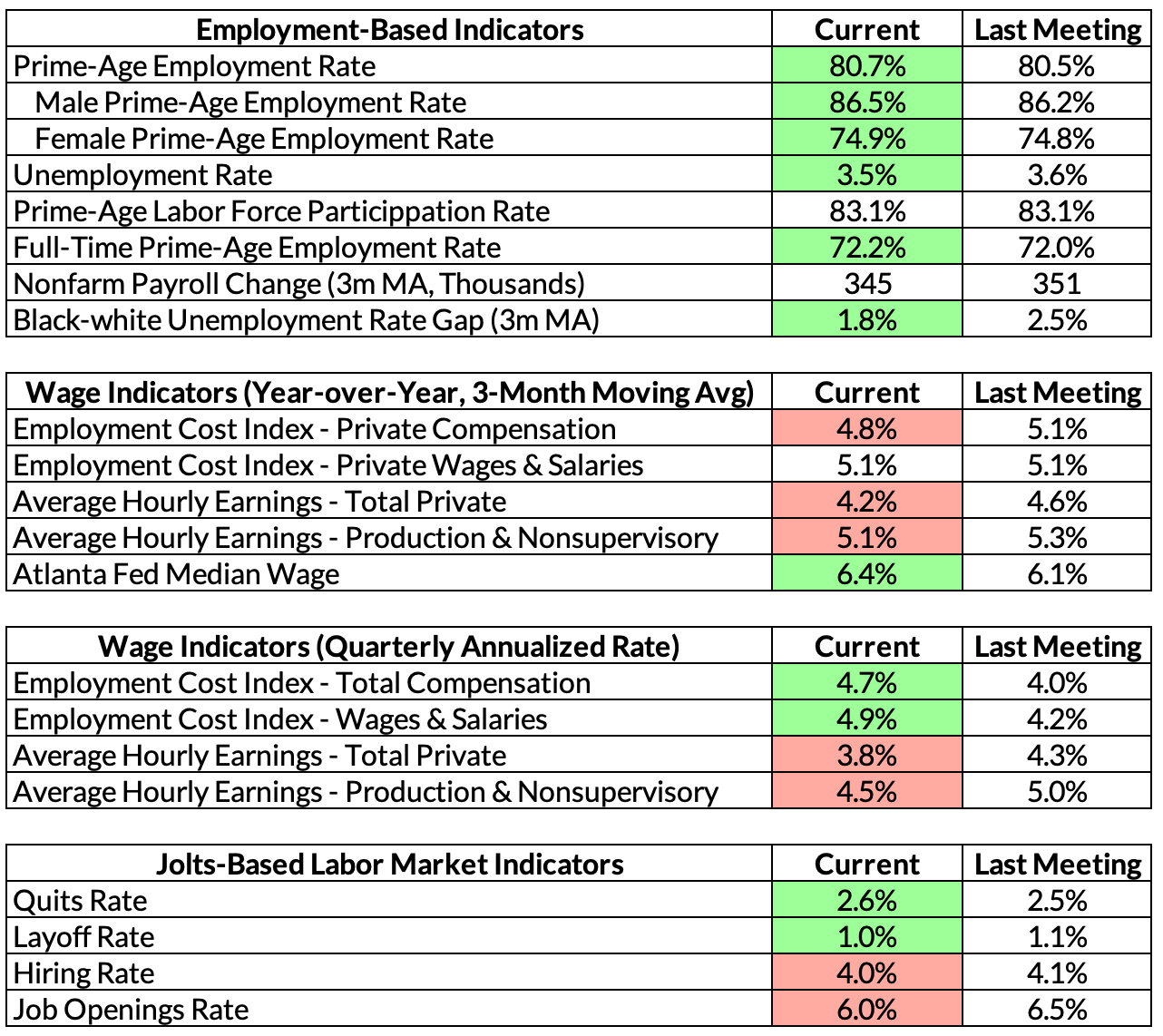

Intermeeting Labor Market Dashboard

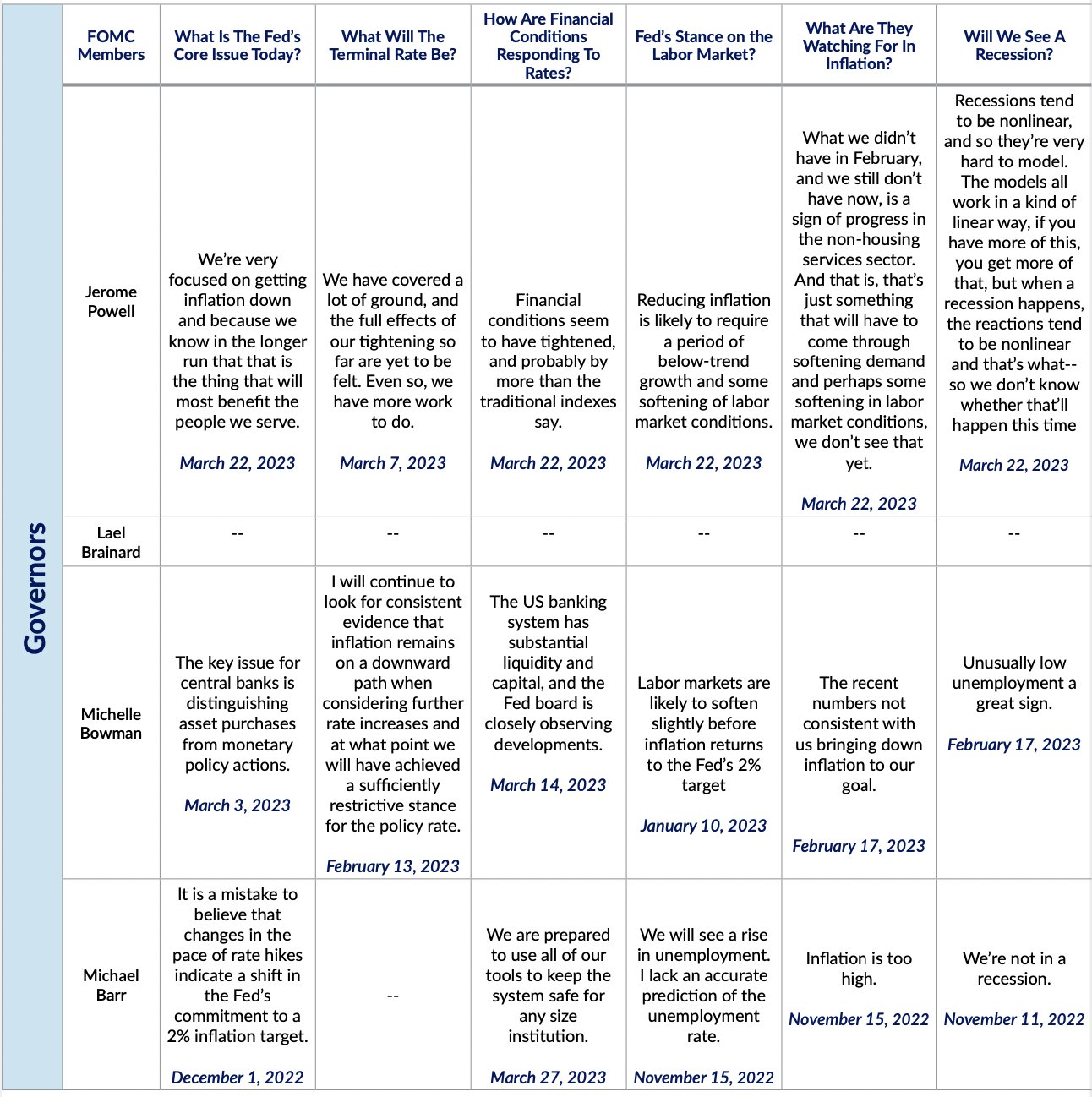

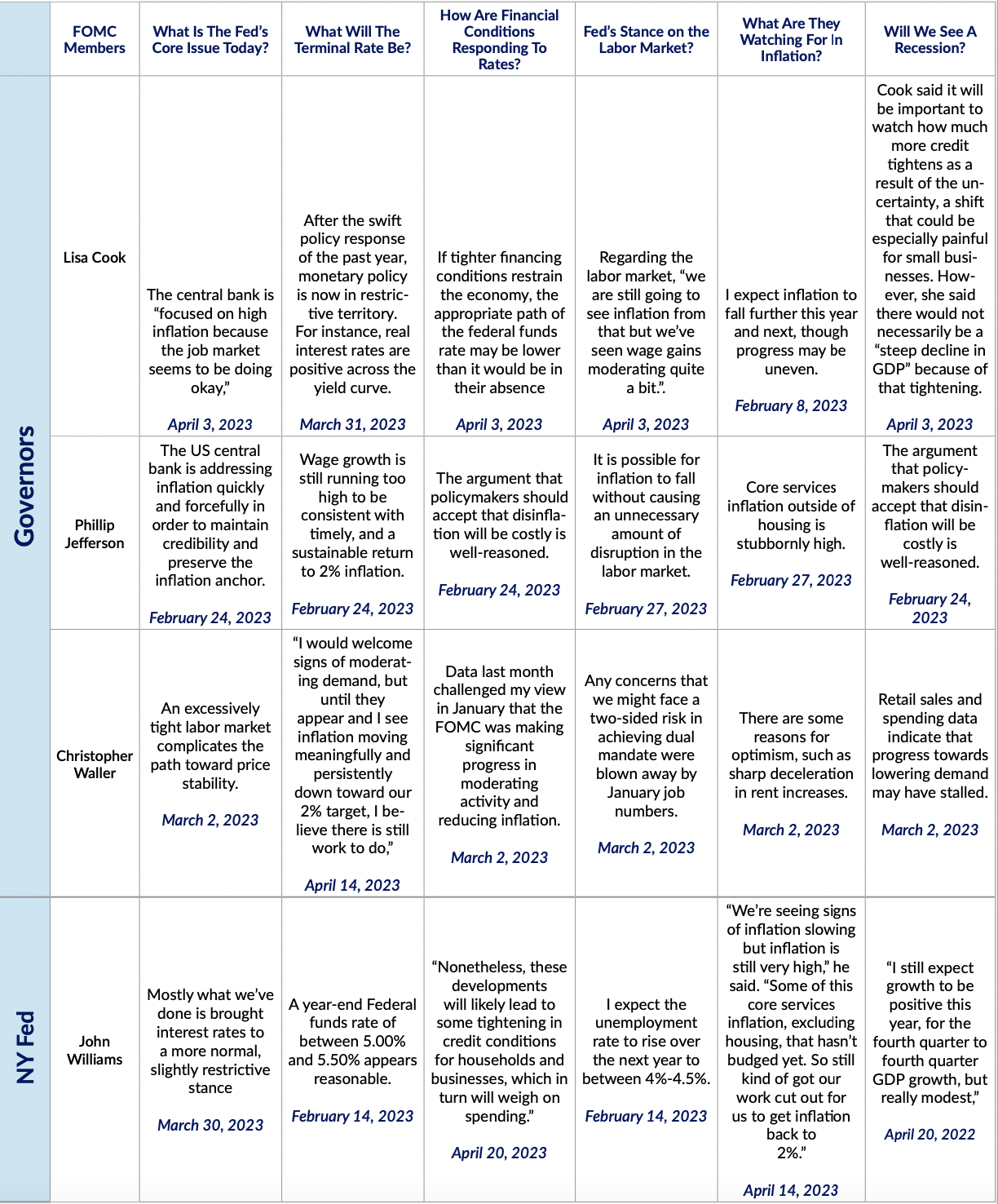

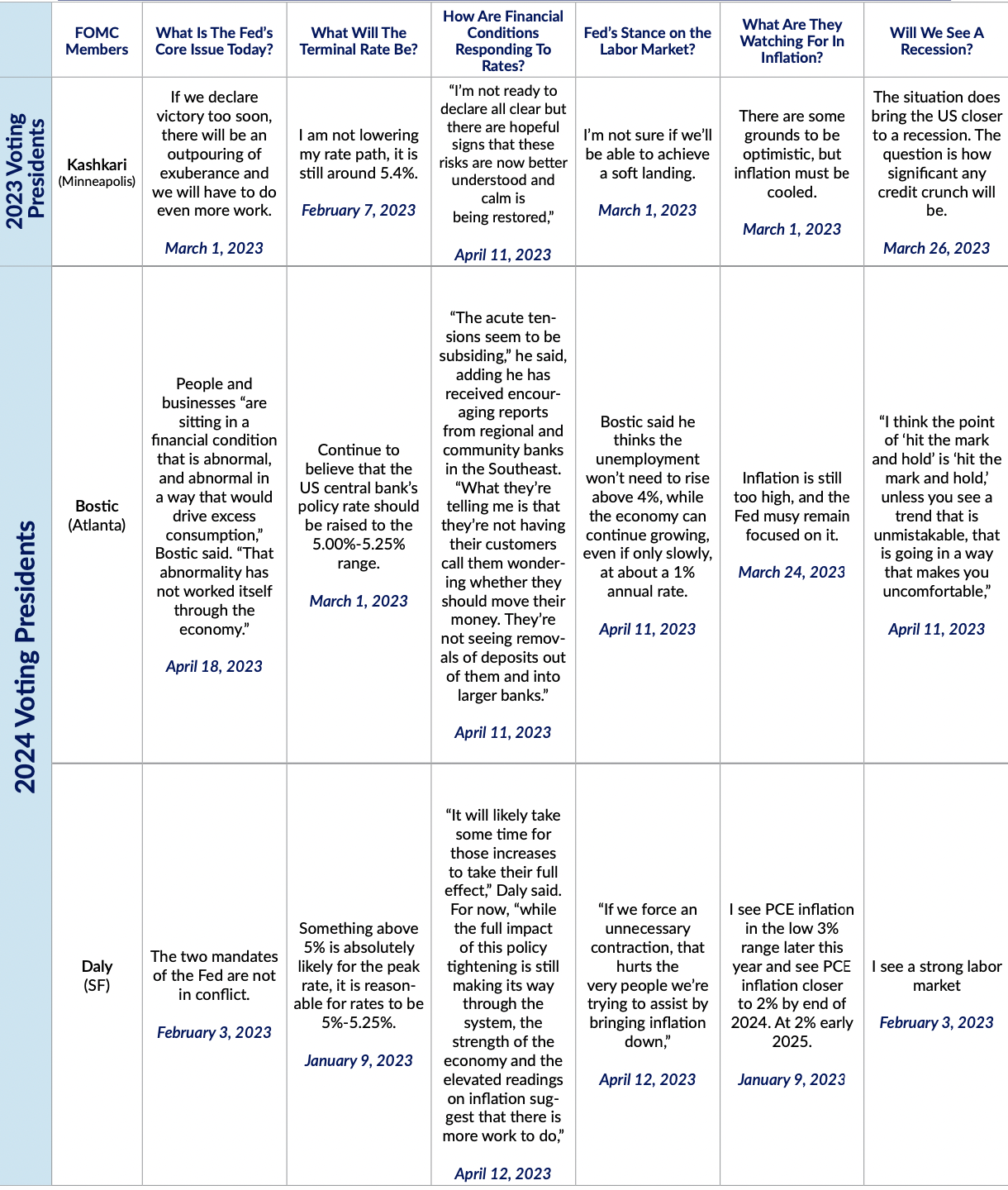

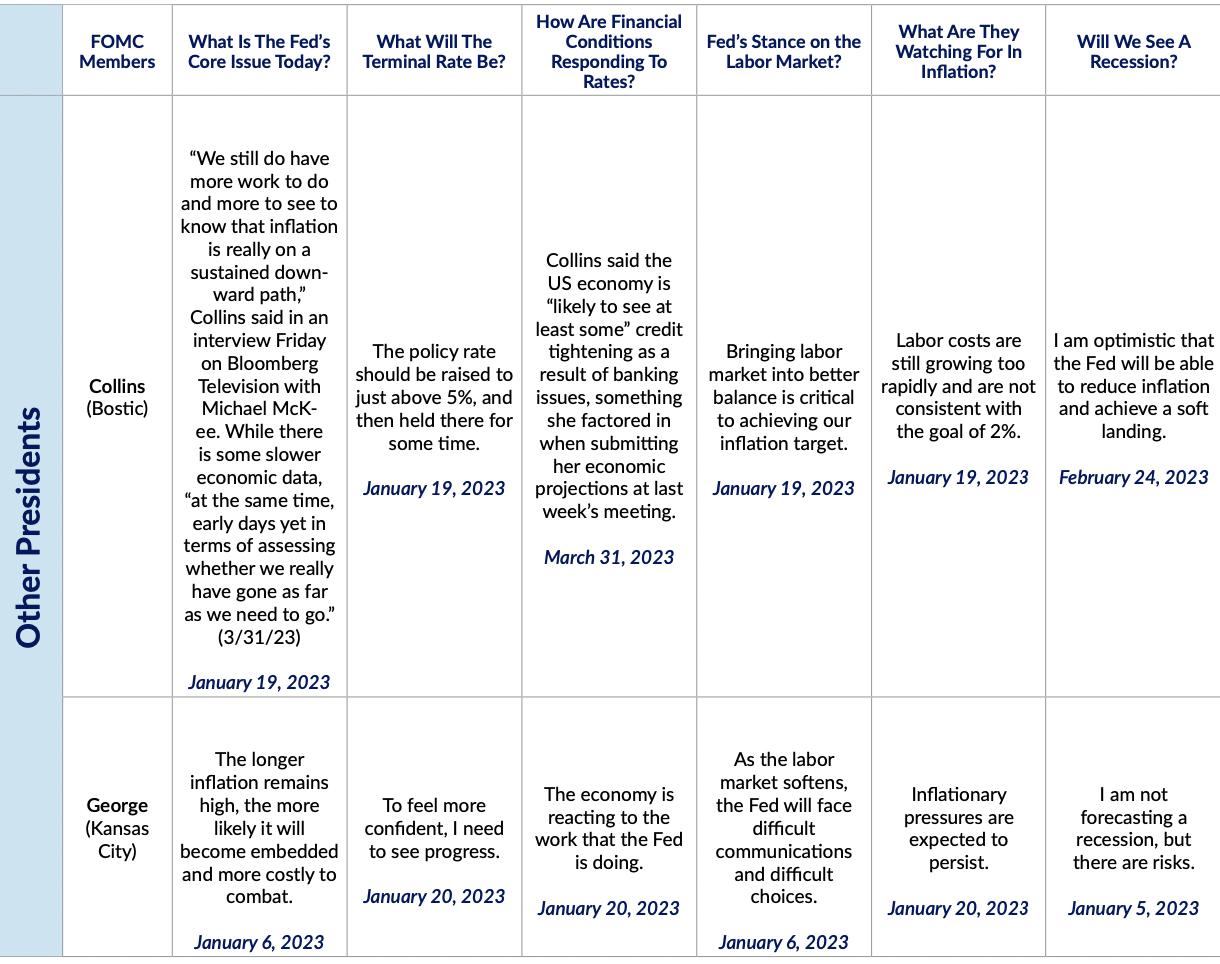

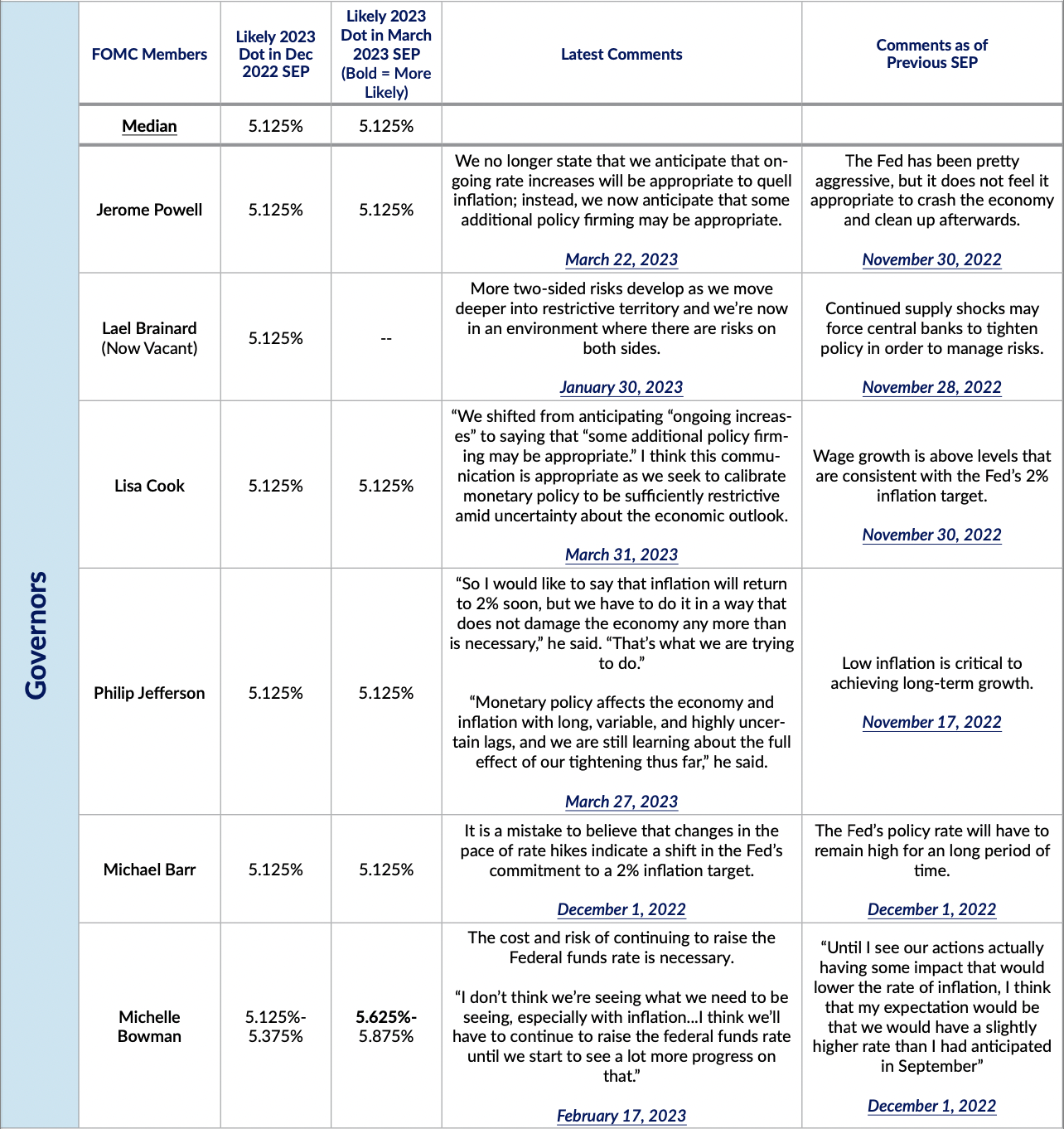

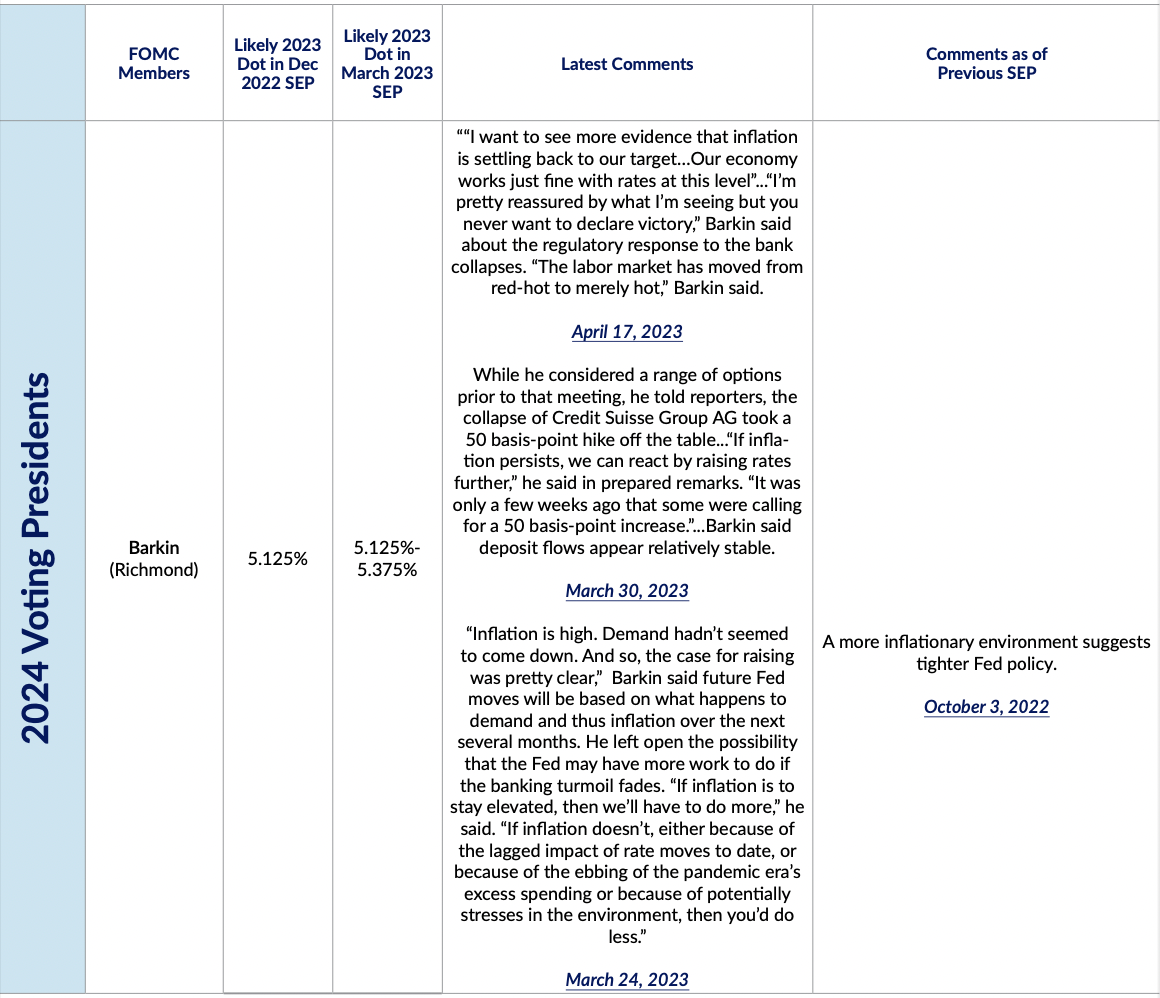

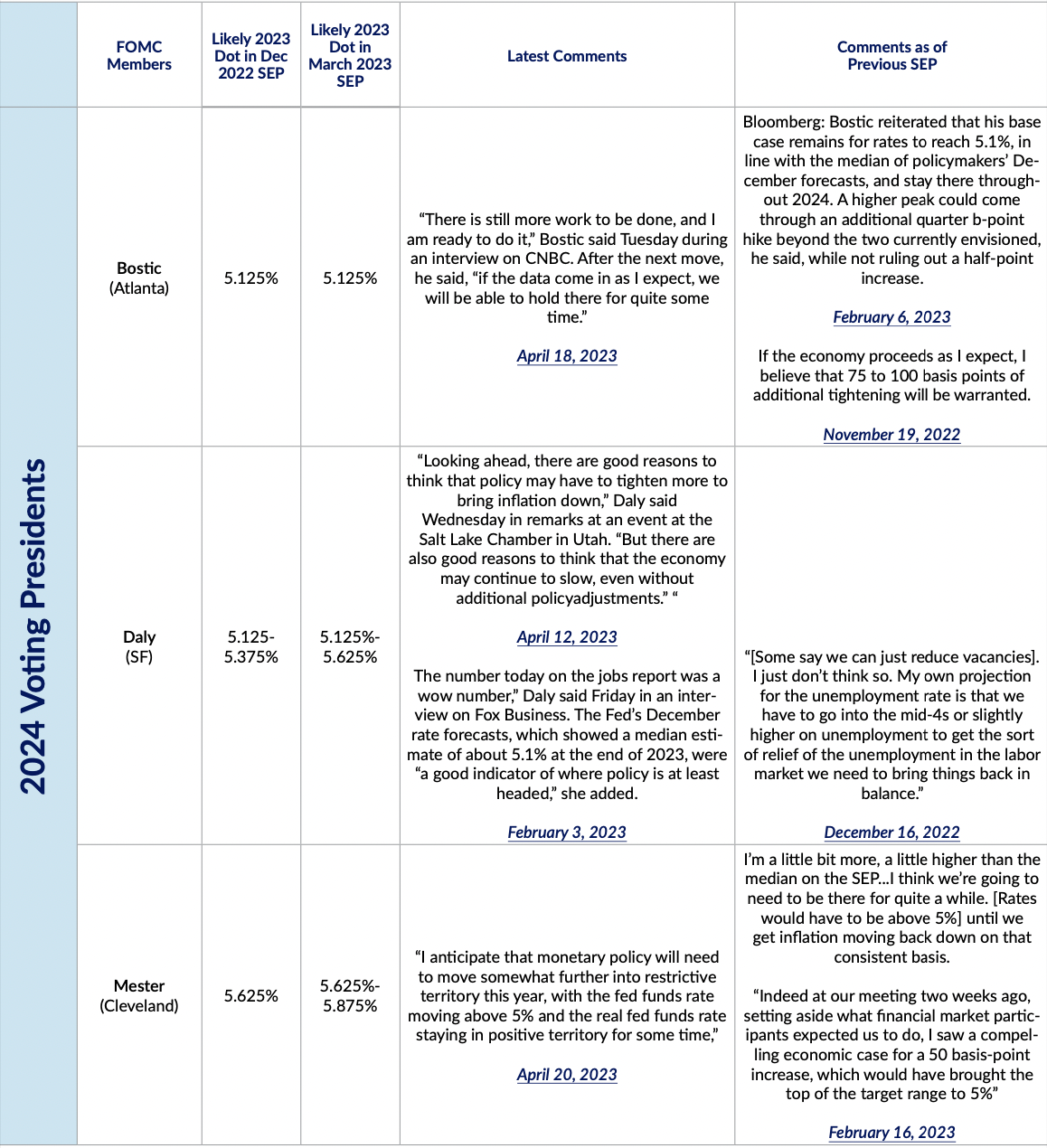

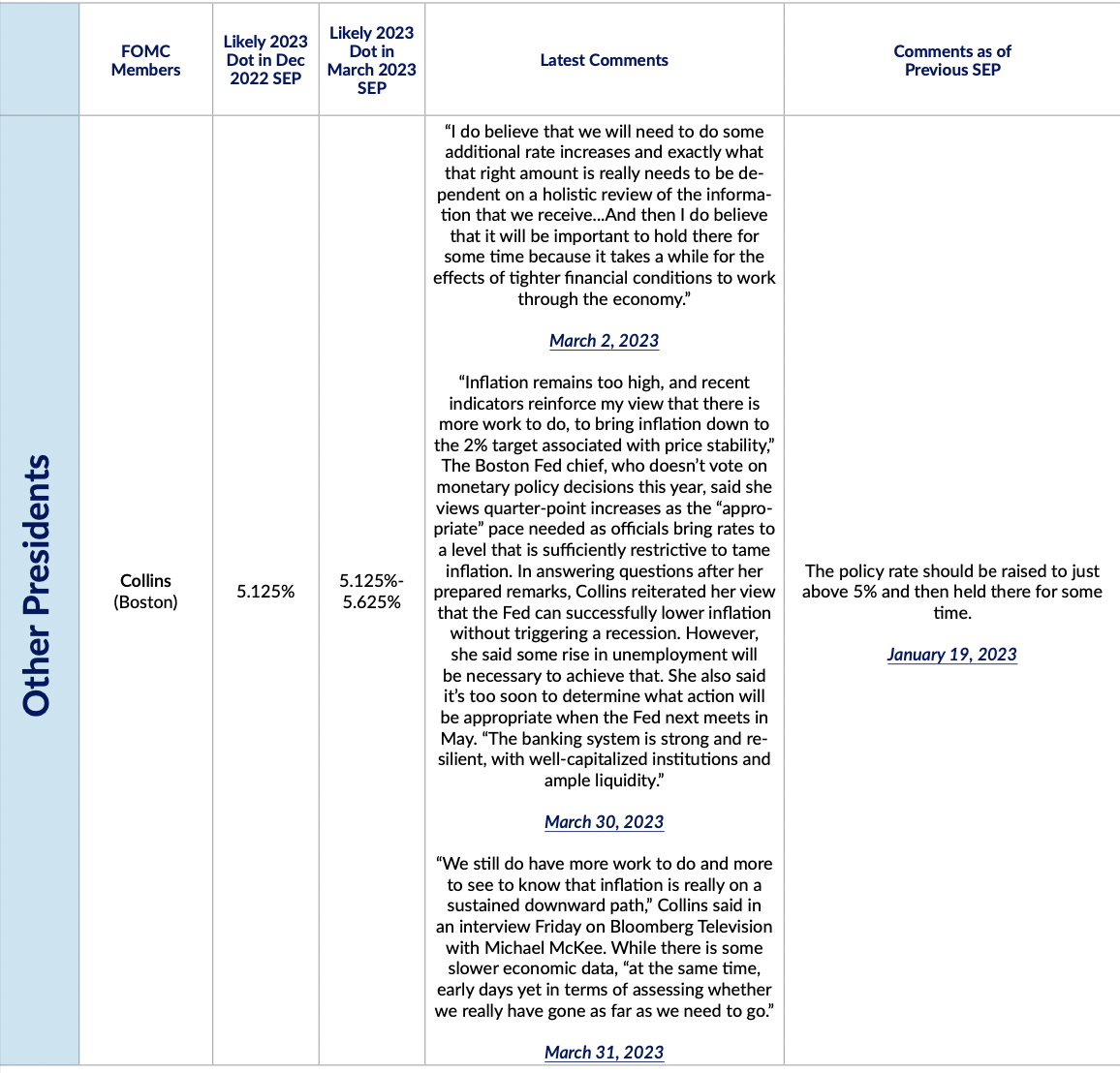

Latest Fedspeak

We will begin releasing our estimates of June interest rate projections for each FOMC member following the May FOMC meeting.

Summary Table

Monetary Policy

Multi-Dimensional