If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

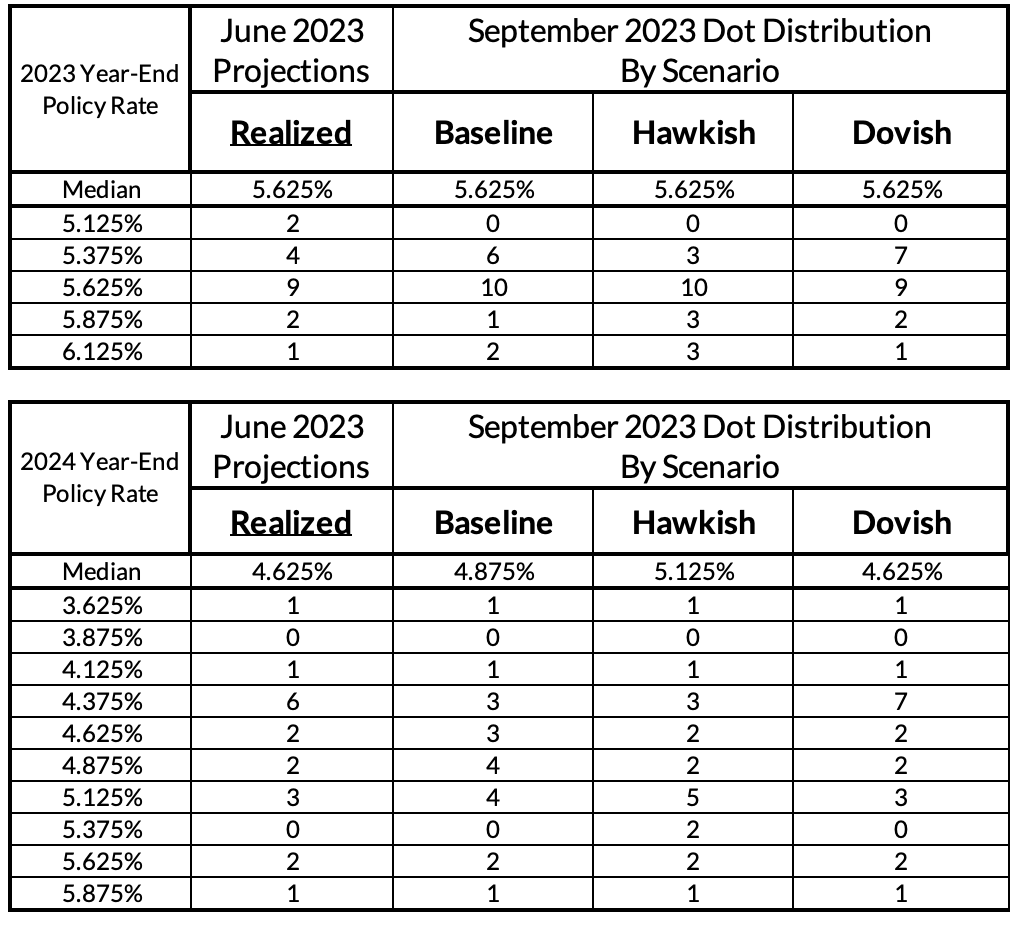

Our Scenarios For The Dot Plot

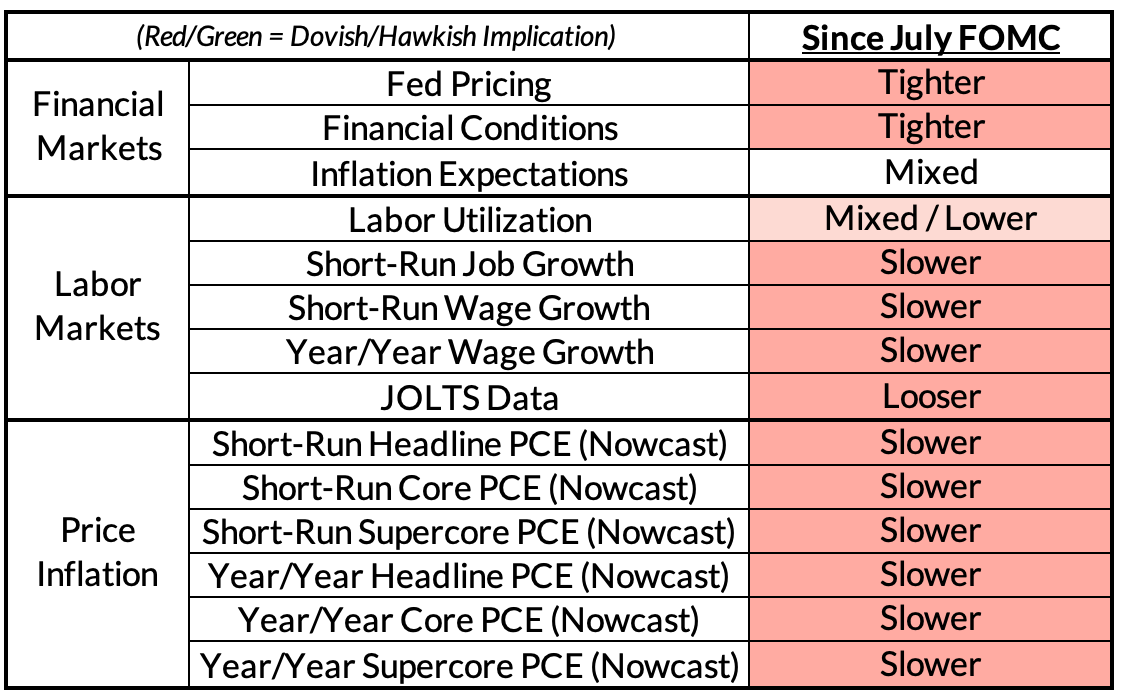

How Has The Data Evolved Since Last FOMC?

What to expect:

- A Hold: The Fed will leave its target range for the Federal Funds Rate at 5.25%-5.50%. Neither the data nor financial conditions put substantial pressure on the Fed to push for a reversion to a faster pace of hikes. The labor market is cooling on dimensions other than the unemployment rate and labor utilization; wage growth is cooling on most measures as a result. Core inflation is slowing very noticeably, even as headline inflation faces renewed pressure from oil and refined product prices. Financial conditions marginally tightened since the July FOMC meeting and are now relatively comparable to what was observed at the June FOMC meeting. It's mainly just the GDP nowcast for Q3 that is signaling the kind of "heat" that might push the Fed to hike (though this appears to be driven by supply-side forces in our view).

- A Live November Meeting. We expect policy to be based mainly on the path of Core PCE from here through to year-end. A major source of uncertainty for the Core PCE readings will be the annual revisions to national accounts data (GDP, PCE, etc). If revisions show higher inflation than previously estimated, it could be a wild-card catalyst to cement one more additional hike. The Fed will want to maintain strong optionality to deliver such a hike in their June projections (and withhold it only if the inflation data shows more decisive cooling over the coming months).

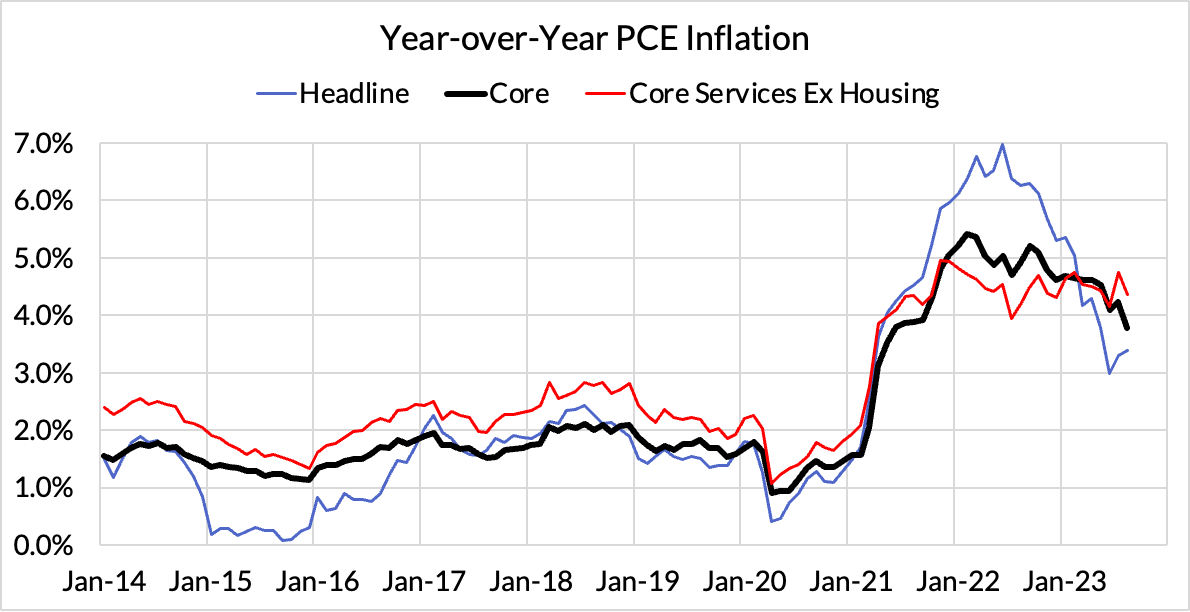

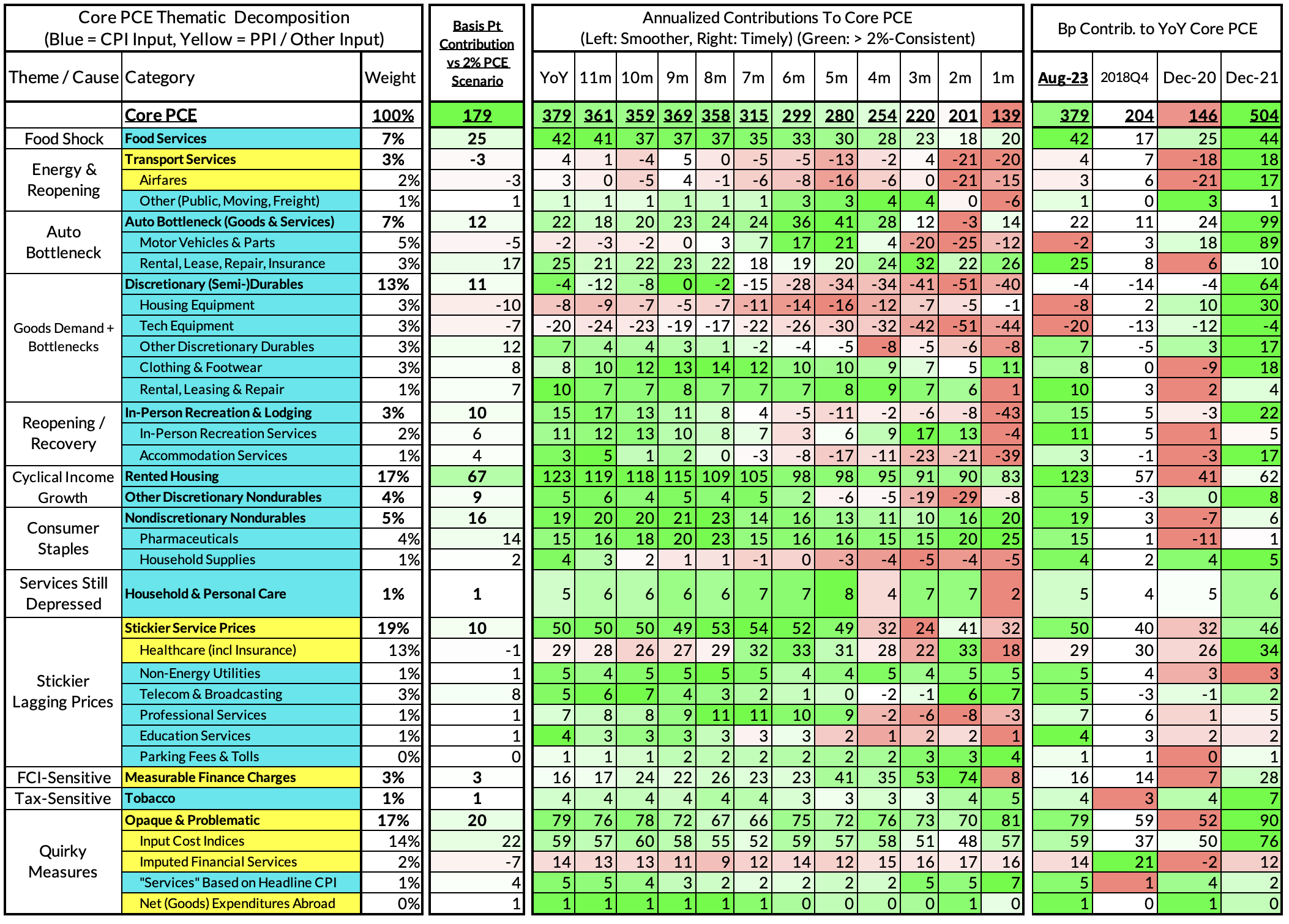

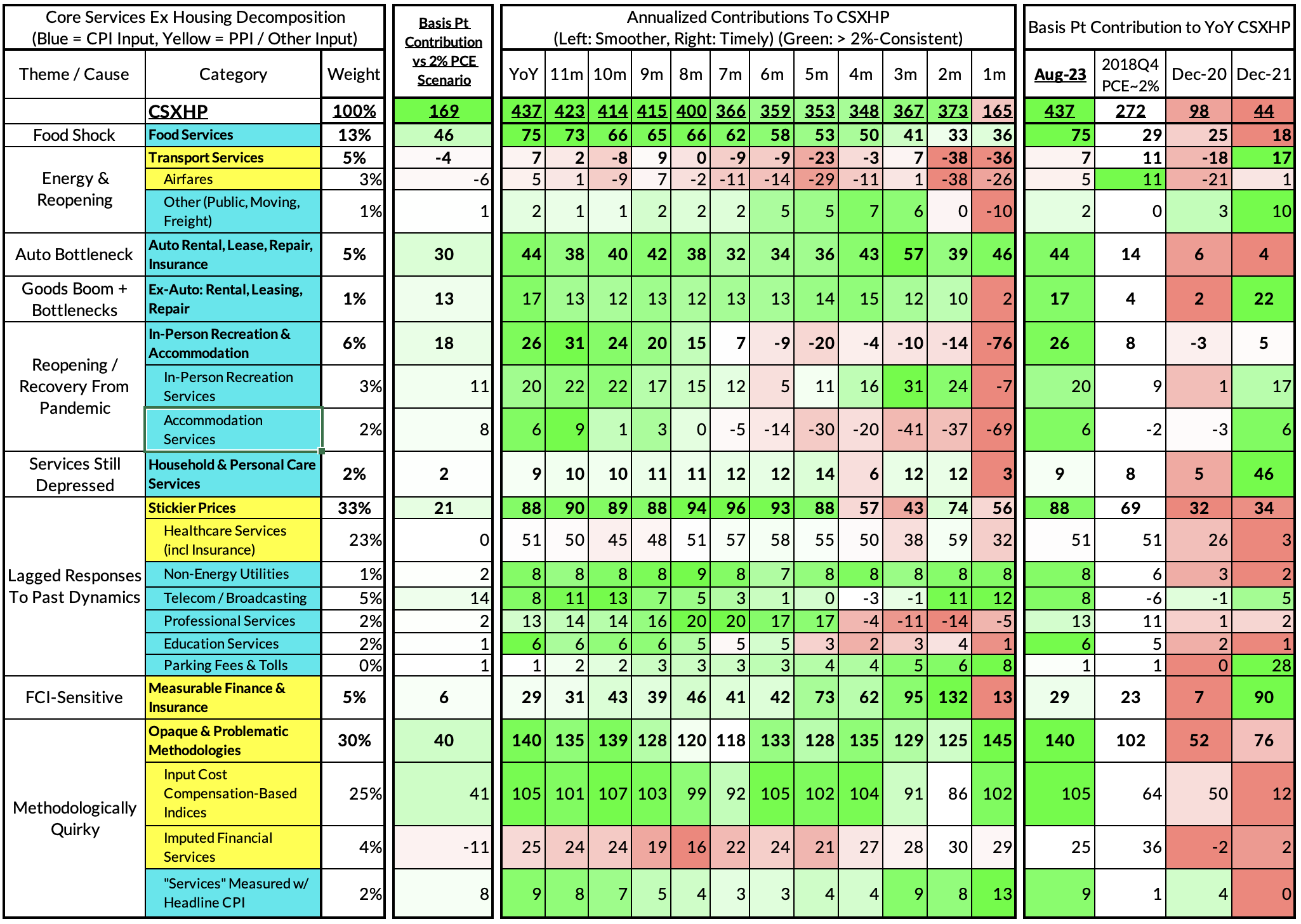

- Reluctance To Revise Down Core PCE Projections. Although the Fed used a number of other measures over the pandemic era – most notably core PCE services ex-Housing – Core PCE is still the most important. The Fed has been forced to routinely revise up their Core PCE projections over the course of this inflationary episode, but September offers the first opportunity for a downside revision. We suspect that given the history of getting burned on these projections, the Fed will remain reluctant to deliver much revision to the downside to 2023Q4 revisions (currently 3.9%, likely revised down no more than 0.1%) and leave 2024Q4 projections more unchanged (currently 2.6%).

- Consolidation around 5.625% terminal Fed Funds Rate projection: We expect the median to remain at 5.625% with a potentially solidified consensus relative to June. This solidified consensus reflects two key facts: 1) the growth data has surprised to the upside of Fed projections and some doves and hawks may be inclined to revise their projections accordingly, and 2) there is a structural bias against revising down interest rate projections, because committee members will wish to retain the optionality tied to a "hawkish bias." The progress on inflation is simply too nascent to move Fed members to reduce their interest rate projections, while the GDP upside surprises could push a few different FOMC members towards a more hawkish projection. Susan Collins of the Boston Fed was most explicit about the relevance of strong GDP growth, but even some current doves might adopt a similar response to stronger-than-expected growth.

- Resilient growth risks pushing up 2024 projections for GDP, core PCE, and the Fed Funds Rate: The fact that the Fed's projections have not played out in terms of weak growth and rising unemployment means that some FOMC members may see a higher rate path as more justified now. That is at least the risk to the 2024 dots, which currently imply 100 basis points of cuts. Some of those cuts could be taken away if the Fed shifts from an inflation-sensitive reaction function to a more growth-sensitive reaction function.

The Developments That Matter:

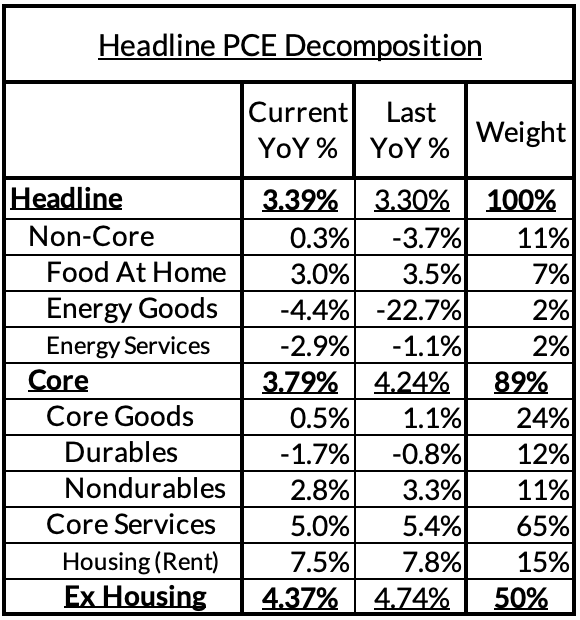

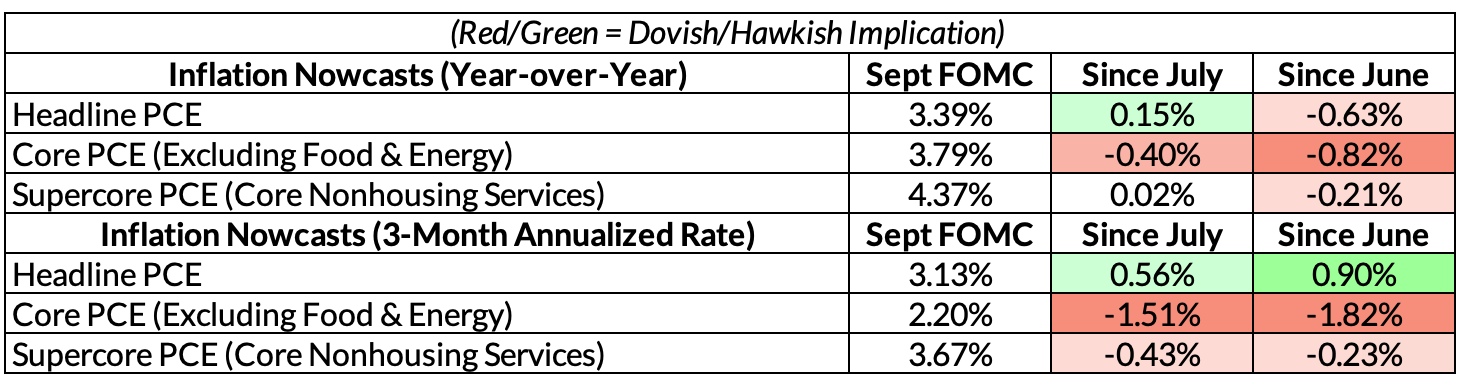

- Core PCE Is Making Progress Towards Target… Over the past three months, Core PCE inflation has slowed substantially, running potentially at a 2.2% annualized rate on a 3-month basis as of August (given what we know from CPI, PPI, and Import Prices). If Core PCE continues to cool, the policy rationale for “higher for longer” to make sure that the demand side is really slowing becomes less persuasive. However, if we see a reversal – perhaps in a worst case scenario, another spike in auto prices following a disruptive and protracted UAW strike – most on the Fed could easily be compelled to push for the final projected hike to 5.50%-5.75% on the Fed Funds Rate.

- …And Growth Is Holding Up… The Atlanta Fed GDPNow tracker has been running extremely hot recently, peaking well over 5% in recent weeks, and nearly touching 6%. Now, this estimate will likely come down as further data is added for September. However, even after accounting for that, we could still plausibly be looking at a real GDP reading indicating growth at a solid 3-4%.

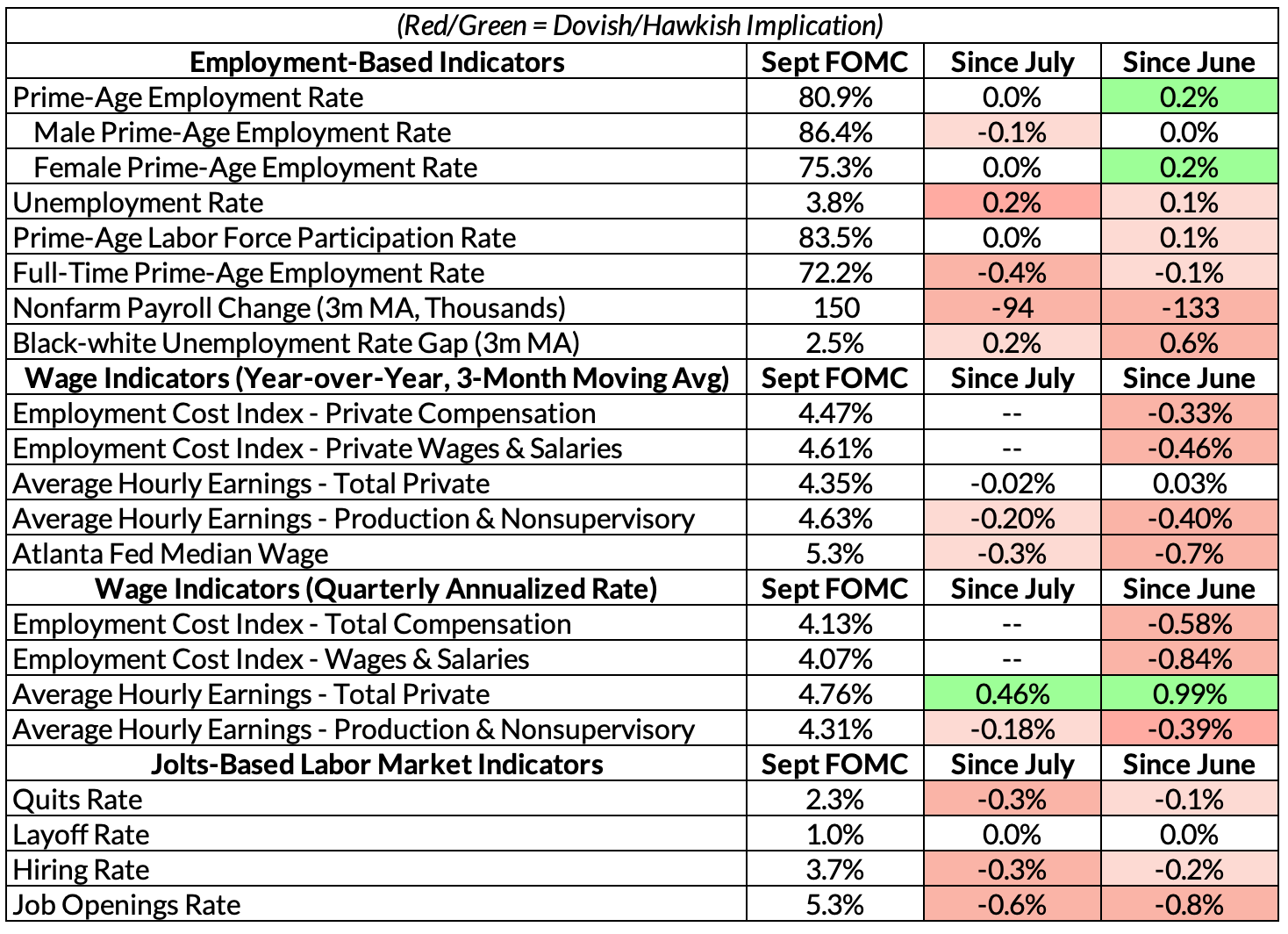

- …While Labor Markets Are Getting Looser In Terms of Growth and JOLTS…Unemployment is still low, and the recent increase in the monthly reading was due entirely to an expansion in the size of the measured labor force. Nevertheless, job-to-job transitions are slowing and labor market churn is decreasing in terms of gross and net hiring rates. Wage growth is slowing on its most robust indicators (remember that the Employment Cost Index came out at the very beginning of this past intermeeting period).

- …Which Means Productivity Will Likely Overshoot…Given the slowdown in employment growth against strong real GDP growth, we can reasonably safely expect measures of productivity to outperform relative to recent performance. Skanda Amarnath makes the full length case here. While we do not put too much stock in aggregate productivity measures, there is a strong case to be made that they will overperform in the near term, and provide an “explanation” of falling inflation under certain models.

- …And Shift Everyone’s Focus Towards Long-Term Supply-Side Impacts. Outside of a few straggler sectors, supply chains have largely healed from pandemic-era disruptions. Anecdata are beginning to roll in about suppliers or even retailers cutting prices, citing easing in their supply chains. However, this calming of the crisis in some ways raises the question of supply-side growth for monetary policy: if inflation is falling, and growth is steady, why does monetary policy need to be tight?

Our Read

- The Last Mile Might Not Be The Hardest. Hawks like Mester and Logan worry about prematurely signaling to markets that the Fed believes its job is finished, and would prefer, if not a rate hike, then that the situation be interpreted as a “skip” rather than a “pause”. Citing the difficult last mile of inflation, they clearly consider victory over inflation closer but not yet assured. But is the last mile of inflation really the hardest? Debate has broken out on this question recently, and it will be interesting to see how it concludes. But Core PCE is already running at a low-2% 3-month annualized rate and this is with still elevated rent inflation (that is poised to decelerate further). We wouldn't be spiking the football, but core PCE outcomes reflect a steady march to 2% outcomes later next calendar year.

- Shift Towards Growth Implies Different Targeted Policy Channels. As we have argued, the principal channel that runs from the monetary policy set by the Fed to instantaneous inflation rates likely requires passage through the labor market. But as the Fed’s focus shifts from inflation to growth, the relevant policy channels expand to include the goal of slowing investment in new productive capacity in order to “tame” the longer-run growth outlook. This approach, however, could in fact exacerbate certain capital-intensive supply challenges, as recent research shows more clearly.

- Relative Doves and Hawks Shift Under Growth Framework. For the past few meetings, Committee member Bostic has been a relative dove, with a long-stated preference to simply get rates above 5%. This aligned him with other doves like Goolsbee, who has been a consistent voice for ending the hiking cycle as well. The difference is, Goolsbee has paired his dovishness on terminal rates with dovishness on the longer-term path of overnight rates while Bostic has reiterated his belief in the need for a “higher for longer” strategy with an emphasis on the longer. Meanwhile hawks like Chris Waller have put inflation outcomes front and center in the setting of monetary policy. Should inflation reverse without growth noticeably slowing, we could see roles reverse, with some current hawks turning into doves in 2024, and vice versa.

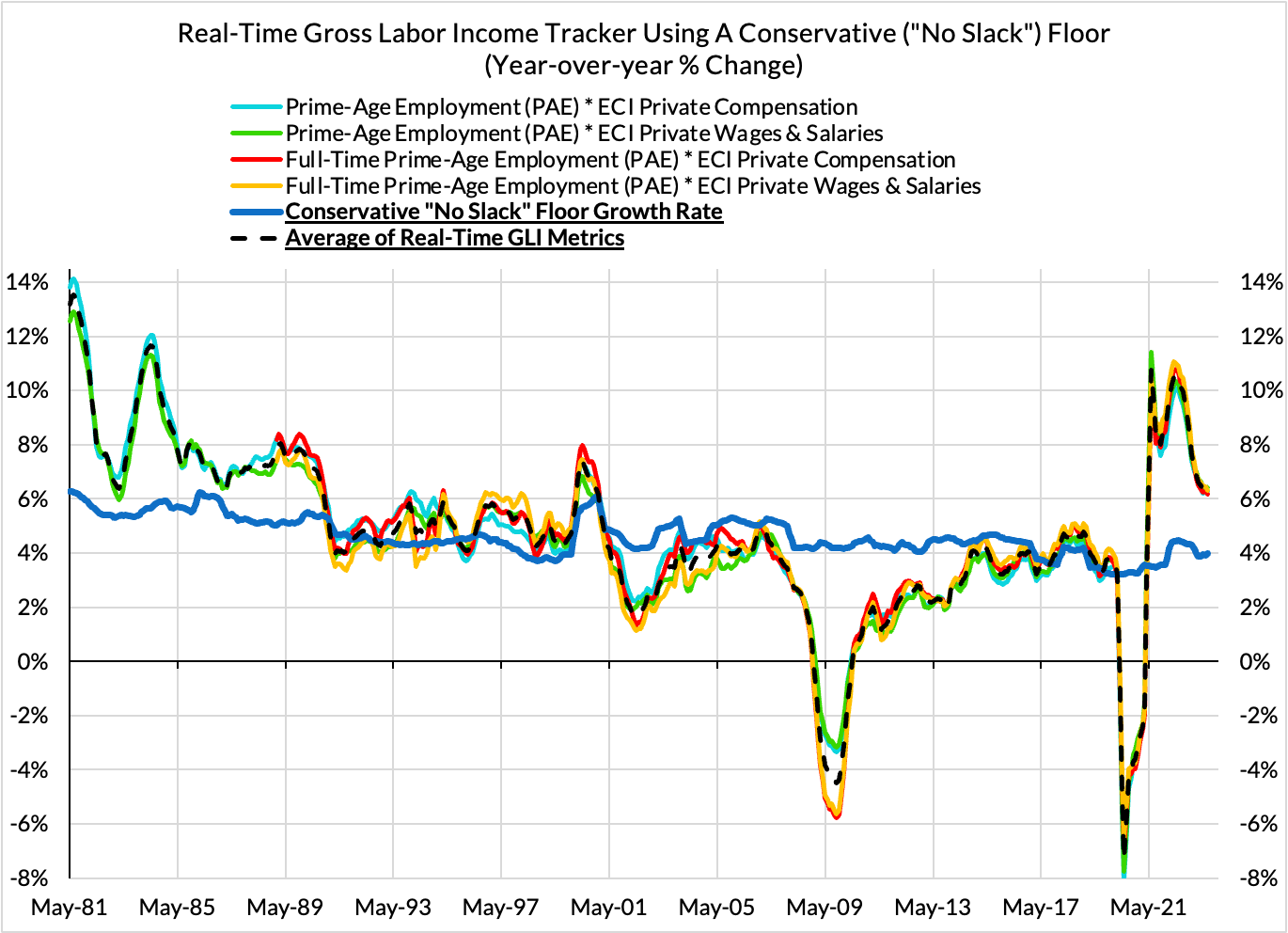

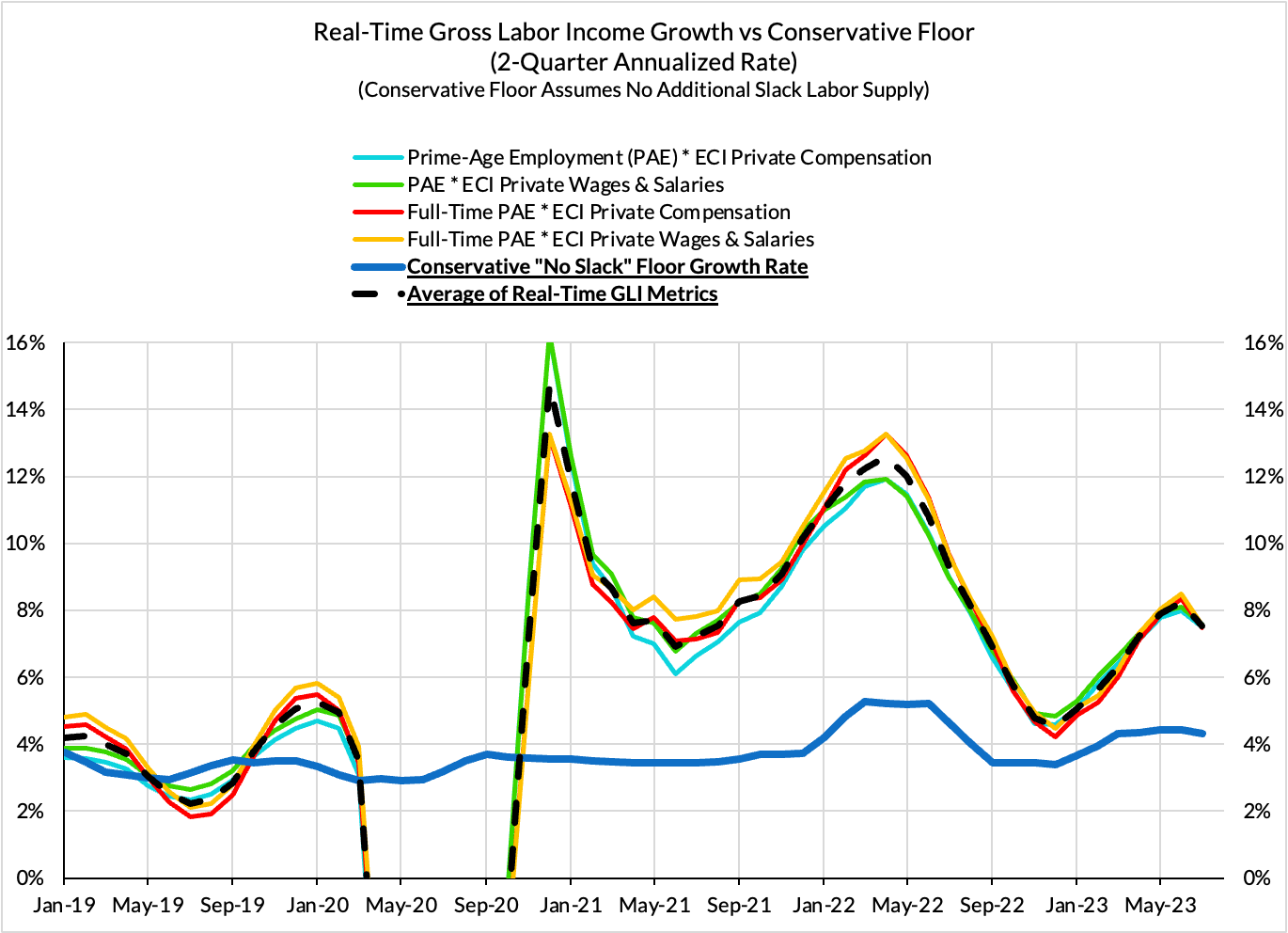

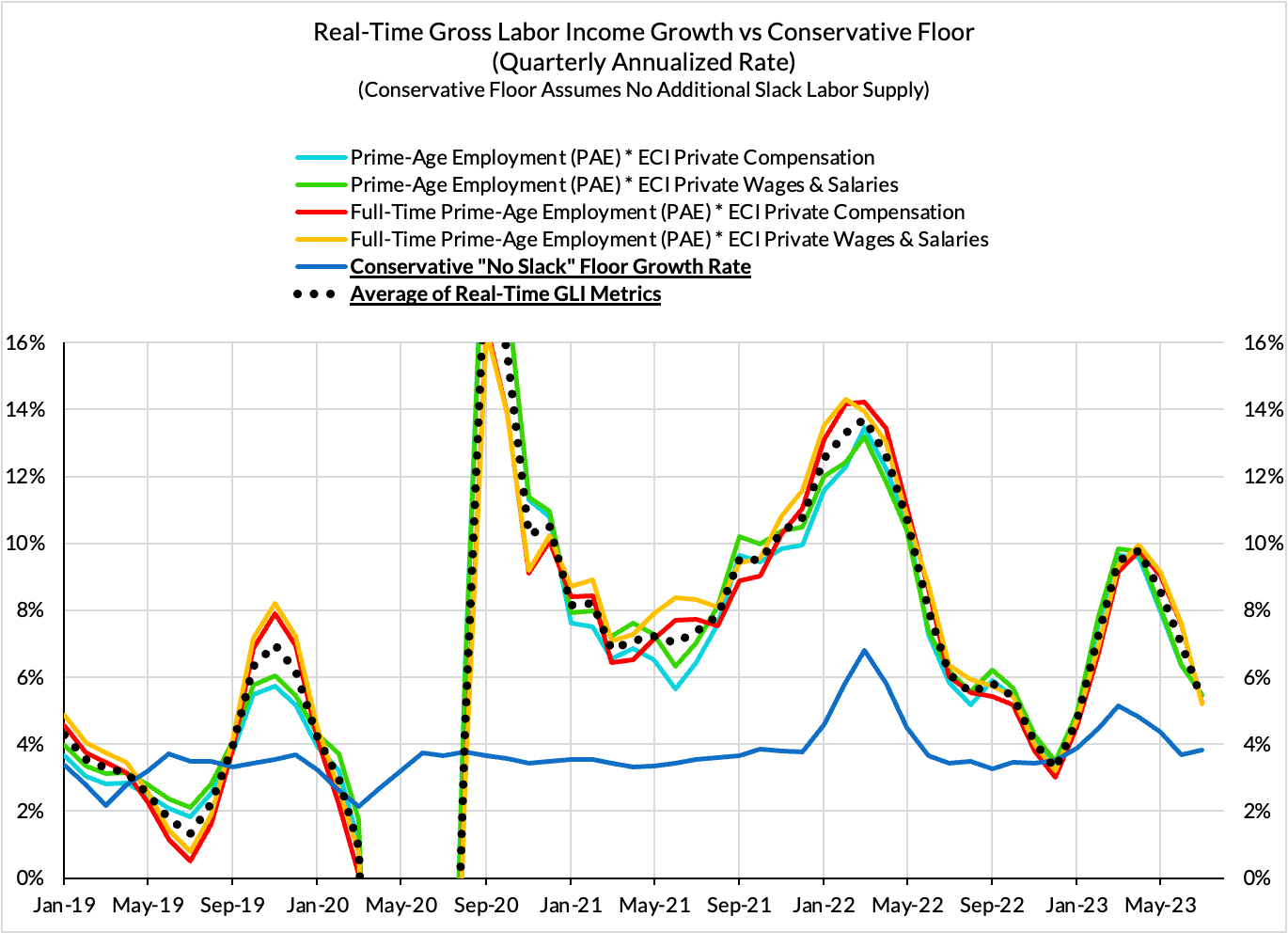

- Gross Labor Income Growth Looks Fine For Now But Slowing Job Growth Warrants Monitoring: In our own ideal framework, we would prioritize a solid growth rate for gross labor income growth. While it does appear to be structurally slowing in our view, it is also not running below the "floor threshold" that should automatically trigger policy easing. Should job growth show further signs of deceleration, especially alongside slowing wage growth, our own framework would motivate a more dovish policy posture. For the time being, the Fed has initiated a lot of tightening and inflation is starting to show more encouraging signs of reaching the Fed's goals. It would be most prudent for the Fed to wait and watch how the current dynamics fully unfold.

Our latest nowcasts for PCE as of August (updated through the Import Price data)