by Alex Williams and Skanda Amarnath

The Fed’s recent forward guidance on its zero interest rate policy (ZIRP) was a welcome sign that the Fed’s monetary policy strategy is giving appropriate emphasis to the achievement of sustainably tight labor markets. While there remains room for improvement, we highlight four welcome takeaways from the September FOMC meeting worth celebrating and building upon.

#1: Exiting ZIRP is necessarily preconditioned on achieving tight labor markets, and not just on achieving its 2% inflation target.

With the rise of monetarism and inflation targeting, inflation worries have largely trumped employment concerns in recent decades. In December 2012, the Fed committed to keep interest rates at zero until inflation projections rose above 2.5% or headline U3 unemployment fell below 6.5%, in what came to be known as the Evans Rule. If inflation had risen but incomes and employment hadn’t, the Fed reserved the right to begin raising interest rates. What’s so important about the most recent FOMC announcement is that it commits to ZIRP until unemployment is close to its pre-COVID levels and inflation has risen to its 2% target. The Fed has taken a laudable step towards erring on the side of accommodation as it pertains to both its price stability and maximum employment mandates. Given the focus on average inflation targeting in the Fed’s much-hyped framework review, it would have been all too convenient and predictable to calibrate forward guidance for ZIRP solely to an inflation target. We commend the Fed for not falling short of its commitment to both sides of the dual mandate.

We have argued elsewhere that, while the Evans Rule was a success, its original form presented many opportunities for improvement. The Fed’s mandate is to pursue maximum employment and price stability, not maximum employment or price stability. While we would prefer that a wage or income indicator be used in place of inflation, the commitment to dual conditionality helps ensure that the liftoff of interest rates will not come before the labor market has had ample opportunity to make a full recovery.

#2: Not just lower unemployment, but maximum employment.

When the Fed announced the Evans Rule in December 2012, the unemployment rate used to calibrate forward guidance was hotly contested. Those advocating for a 6.5% unemployment threshold were on the more ambitious side of the debate. Skeptics on the committee, like Philadelphia Fed President Charles Plosser and Richmond Fed President Jeffrey Lacker, were concerned that structural unemployment had risen to the point that such a threshold was so ambitious as to risk inflation.

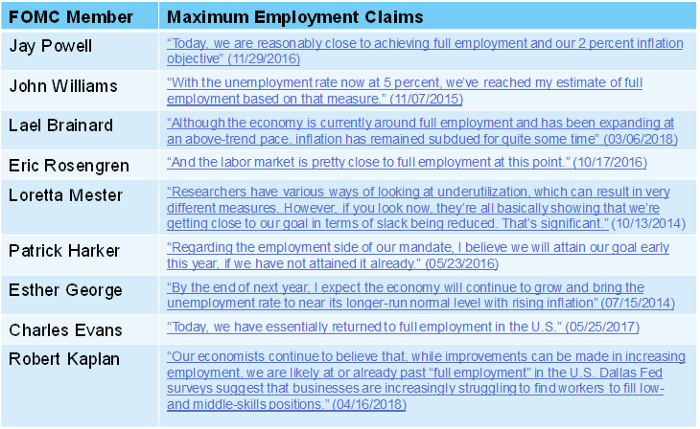

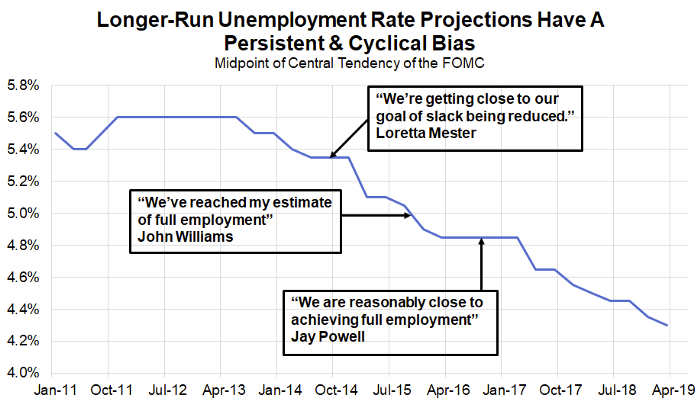

In the years since the Evans Rule — and against a backdrop of steadily falling unemployment — officials at the Fed declared again and again that the economy had gone “beyond full employment.”

In late 2019 and early 2020, we saw strong wage growth among the lowest income-earners, an increase in the quit rate, and finally a full recovery in the prime-age employment-population ratio from its pre-financial crisis peak…without ever seeing core inflation rise sustainably to its 2% target, let alone runaway inflation. The robust labor market and muted inflation of that era demonstrates that if a tradeoff between inflation and unemployment does in fact exist, then it binds at a much lower unemployment rate than previously believed.

Judging by the September meeting, FOMC members are no longer taking such an ultra-hedged approach to setting labor market thresholds for interest rate forward guidance. The Fed isn’t just aiming for a lower unemployment rate, but for an achievement of its estimate of maximum employment. While the Fed rightly evaluates maximum employment on multiple measures, the only measure outside observers can rely on is the estimate of the longer run unemployment consistent with the Fed’s dual mandate objectives. The median of FOMC members’ estimates was 4.1% both in December 2019 and 4.1% in its most recent release. While estimates of maximum employment may waiver up or down depending on how inflationary labor market progress proves to be, the Fed’s presumption that the pre-COVID labor market is achievable is not only admirable but prudent.

Since the pre-crisis labor market saw unemployment below FOMC members’ estimates of the so-called “natural rate” without inflation consistently reaching 2%, FOMC members should already be skeptical of whether such estimates really serve as a useful lower bound for how low the unemployment rate can sustainably fall. Chair Powell himself has been very critical of these unobservable estimates, most forcefully so in his 2018 Jackson Hole speech. We are glad to see the Fed take on board empirical evidence that the economy can run much hotter than it may have previously assumed.

#3: The Fed is signaling that it may begin using a fuller range of indicators for labor market strength beyond headline U3 unemployment.

As it stands, U3 unemployment has proven to be a poor guide to the state of the labor market during the COVID crisis. Right now, methodological and data collection problems make it difficult to come to an agreement on something as straightforward as the number of continuing unemployment claims in the US. Estimates vary widely as to how many temporary layoffs have already become permanent, and no one knows how many will become permanent over the duration of the crisis. At the same time, seasonal adjustments in the U3 unemployment rate had to be reformulated on the fly to account for extreme changes in the level of unemployment.

Beyond the current estimation problems, the U3 unemployment rate is a surprisingly limited indicator for the strength of the labor market. Wages, bargaining power, and labor conditions are completely left out. Using a single number to collapse all distinctions by race, gender, geography, income level and educational attainment makes it impossible to target any particular subgroup who may be experiencing much worse unemployment than the headline number. At the same time, the U3 measure sharply limits which workers count as members of the labor force. It doesn’t take very long without a job for an economically disadvantaged worker to be counted as “discouraged”, and so left out of the U3 unemployment rate. Given these problems, it is heartening to see that the Fed’s focus on labor market outcomes extends to the use of a wider range of labor market indicators.

We at Employ America look forward to the Fed employing a more robust and holistic approach to understanding labor market conditions. With Chair Powell’s comments about waiting “to see heat,” in the labor market to “call it hot” in mind, we hope to see the Fed make extensive use of wage and income-based indicators like the Employment Cost Index (ECI) and other proxies for gross labor income (GLI). When workers have the power that a tight labor market provides, these indicators will let the Fed know clearly and unambiguously.

At the same time, the Fed needs to make sure that these strong labor markets are pulling in as many workers as possible. Underemployment and persistent long-term unemployment among discouraged workers is a substantial problem carried over from the 2008 financial crisis and the ensuing jobless recovery. To ensure that history doesn’t repeat, Chair Powell has already hinted at using the labor force participation rate as a key indicator. While this would already be a substantial improvement over current practice, we at Employ America would strongly suggest that the Fed shift from the U-3 unemployment rate to a strictly superior labor utilization measure, such as an age-adjusted employment-to-population ratio or Ernie Tedeschi’s demographic-adjusted NPOP measure.

If FOMC members transparently translate their views about maximum employment to indicators other than the U-3 unemployment rate, the Fed would substantially improve the quality of their communication and dialogue with the public.

#4: While we would prefer it applied directly to wage growth, the Fed’s affirmative floor for inflation readings can function similarly in achieving wage growth.

Crucially, the new Fed framework puts a floor under inflation outcomes by demanding that inflation reach at least 2% before the Fed considers raising interest rates. The Fed has had trouble in the past with its symmetric 2% target, missing to the downside far more often than to the upside. Committing to the achievement of 2% inflation outcomes provides an affirmative “floor” for nominal outcomes that ensures that the Fed cannot easily opt for the preemptive approach to interest rate normalization that has frequently risked recession and led to systematically weaker income growth.

In light of the presence of the zero lower bound and serially below-2% inflation outcomes, the Fed may be analytically correct to address the underperformance of inflation. At the same time, continuing to cast the Fed’s goal specifically in terms of inflation does present some risks. As a purely rhetorical matter, an affirmative promise to achieve higher inflation is likely to be received by the public more negatively than an affirmative promise to achieve higher wage growth. The Fed is politically independent, but it does not operate in a political vacuum.

Inflation indices also roll together a number of economic forces with no clear relation or consistency — commodities, rents, labor costs, exchange rates, the terms of cell phone data plans — and treats them as a straightforward barometer for gauging the adequacy of income and credit creation. Depending on the source of inflationary forces, the Fed could easily find itself distracted by noise — changes in hedonic adjustment methodology, temporary supply chain strains, commodity price adjustment — over signal. Even if the Fed itself is focused on the factors that drive the underlying trend in inflation, including wages and rents, it will prove to be a communication challenge for external observers to understand whether the Fed views the achievement of its 2% target to be a sustainable achievement.

Conclusion

The Fed’s forward guidance represents a welcome step towards a more labor market-centric approach at the Fed. As discussed above, labor market tightening is now required for the Fed to exit forward guidance on rate policy. The baseline for rates liftoff is now a labor market that would have previously been dismissed as “beyond full employment.” The Fed is also taking an appropriately flexible view of the indicators that can best describe “maximum employment and price stability.” We strongly encourage the publication of maximum employment estimates across a wider range of indicators to better inform market participants as well as the workers on main street. Lastly, in order to avoid the pitfalls that come with calibrating monetary policy to inflation readings, FOMC members should clarify the forces within its assessment of inflation that will be of greatest relevance. Nevertheless, the Fed’s commitment to an affirmative floor for inflation — instead of the Evans Rule ceiling — represents a helpful development, especially if it fosters a stronger commitment to higher income growth. On all of these counts, the Fed’s framework review and policy guidance should give advocates for more equitable monetary policy reason for optimism.