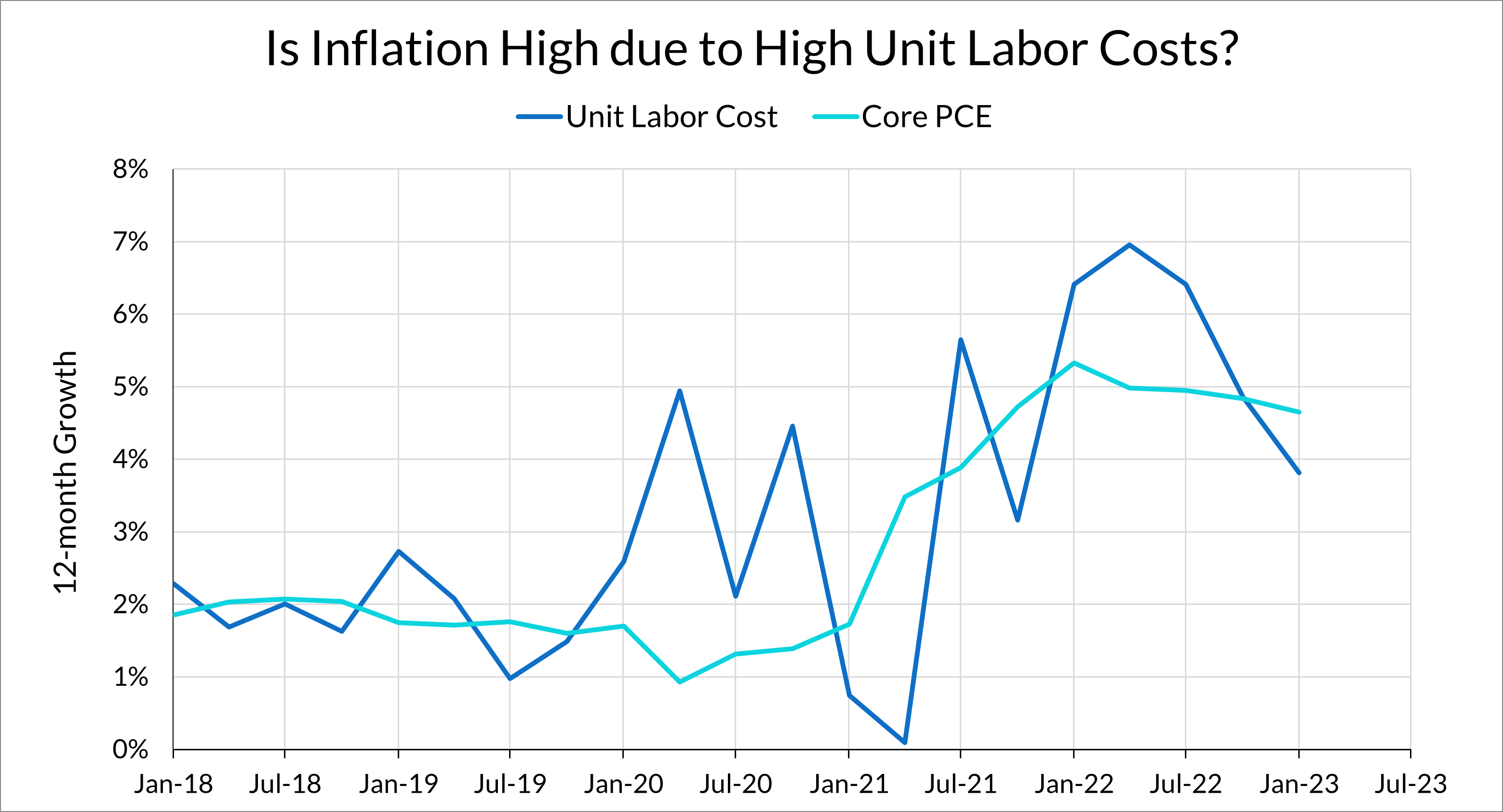

One argument that the labor market is to blame for high inflation has been the significant rise in unit labor costs during the post-pandemic recovery. The most recent example comes from the ECB:

So, there is an issue of unit labour cost—in other words, productivity—which clearly has an impact on inflation as well. We will continue to really monitor and dissect as well as we can this entire enigma of the labour market—which is, as I said, playing a critical role.

Christine Lagarde, June 15th, 2023

Some big-name economists have also unfortunately similarly cited high unit labor costs as a contributor to inflation in the US, arguing that growth in hourly compensation is too high relative to the growth in labor productivity in order to see inflation return to low levels. However, when one takes a closer look at how this statistic is constructed, one finds that “unit labor costs” are simply the product of the labor share and a price index. The notion that this “explains” inflation is therefore a near-tautology; multiplying the CPI by a relatively stable measure—my average resting heart rate, for example—would perform similarly.

The other component that makes up unit labor costs, the labor share, has an appealing theoretical relationship to the marginal labor cost of production under simplistic assumptions. However, the labor share has a tenuous empirical relationship to inflation. It’s not clear that this really measures marginal costs and, in any case, the labor share is back to pre-pandemic levels.

In short, claims about inflation rooted in unit labor cost arguments are trivial, tautological, or unsupported by the data; they are the emperor that has no clothes.

The logic that high unit labor costs are to blame for inflation is, at first glance, intuitive. Labor is used in production, high labor costs means production is costly, and costly production leads to higher prices. The term “unit cost” even seems to add a little firm-level flair, as though the measurement was of the amount of labor it takes to produce a unit of output at some specific factory or store. But if one looks closer at the derivation of the unit labor cost in the data, it turns out that the published unit labor cost is much less informative and more deceptive than widely believed.

The principal problem is that unit labor costs are, by construction and source data definition, the product of the labor share and an aggregate price index measure. I mean “product” literally here: you multiply the labor share and a price index. In other words, if you’re trying to explain inflation using unit labor cost growth, you are basically trying to explain inflation with inflation. The only non-inflation component of the ULC measure—the labor share—has a tenuous empirical relationship with inflation at best. In any case, the labor share has returned to approximately 2019 levels. Whatever change in unit labor cost growth since the pandemic is the result of higher price growth over that time period, not a change in a labor market observation.

Unit Labor Costs are Labor Shares and Inflation

To get at why this argument doesn’t work, we need to start by doing a little accounting of how the unit labor cost series is actually constructed. This accounting is key to making sure that economic intuitions don’t run ahead of the structure of actually-available data and lead to ideas like “inflation can be explained by inflation and the labor share of output.”

In the US, “unit labor costs” refer to a specific series published by the Bureau of Labor Statistics (BLS) that is calculated as the ratio of “hourly compensation” to “labor productivity” in the nonfarm business sector. In theory, the ULC is supposed to measure the average labor cost of production in the economy.

It’s important to note that hourly compensation is not derived from a composition-adjusted wage index, and productivity is not measured at the firm-level and aggregated up. Rather, these measures are coarsely created by dividing aggregates of compensation, output, and hours against each other.

Hourly compensation is simply the aggregate labor compensation (which includes wages, salaries, supplements, employer contributions, and taxes)—based primarily on the BEA’s NIPA data—divided by an index of aggregate hours based primarily on Current Employment Statistics. One can think of this as a measure of the average hourly income of employees, unadjusted for changes in composition of employed labor.

Labor Productivity is a ratio of real output to the same index of hours, where real output is nominal output from the GDP data, deflated by the value-added output price deflator for the sector.

Although both compensation and productivity are technically created using hours, in some sense the hours index is irrelevant since it appears in the denominator of both terms. In terms of the objects that actually matter and are actually measured, the ULC is created by multiplying the ratio of aggregate compensation and nominal output with the price deflator. The ratio of the first two is the nonfarm business sector labor share.

When one breaks down the composition of ULCs, it is no surprise that ULCs track inflation well: they are mechanically derived, in part, using an inflation index.

The Pandemic Explosion in Unit Labor Costs is Mostly an Artifact of Inflation

With that accounting in hand, we can show how the reality is the exact opposite of the “sensible intuition” above: mechanically, the changes in ULCs came from changes in the price deflator, which measures… inflation. We can decompose changes in unit labor costs into changes in the labor share and changes in the price deflator by taking log differences:

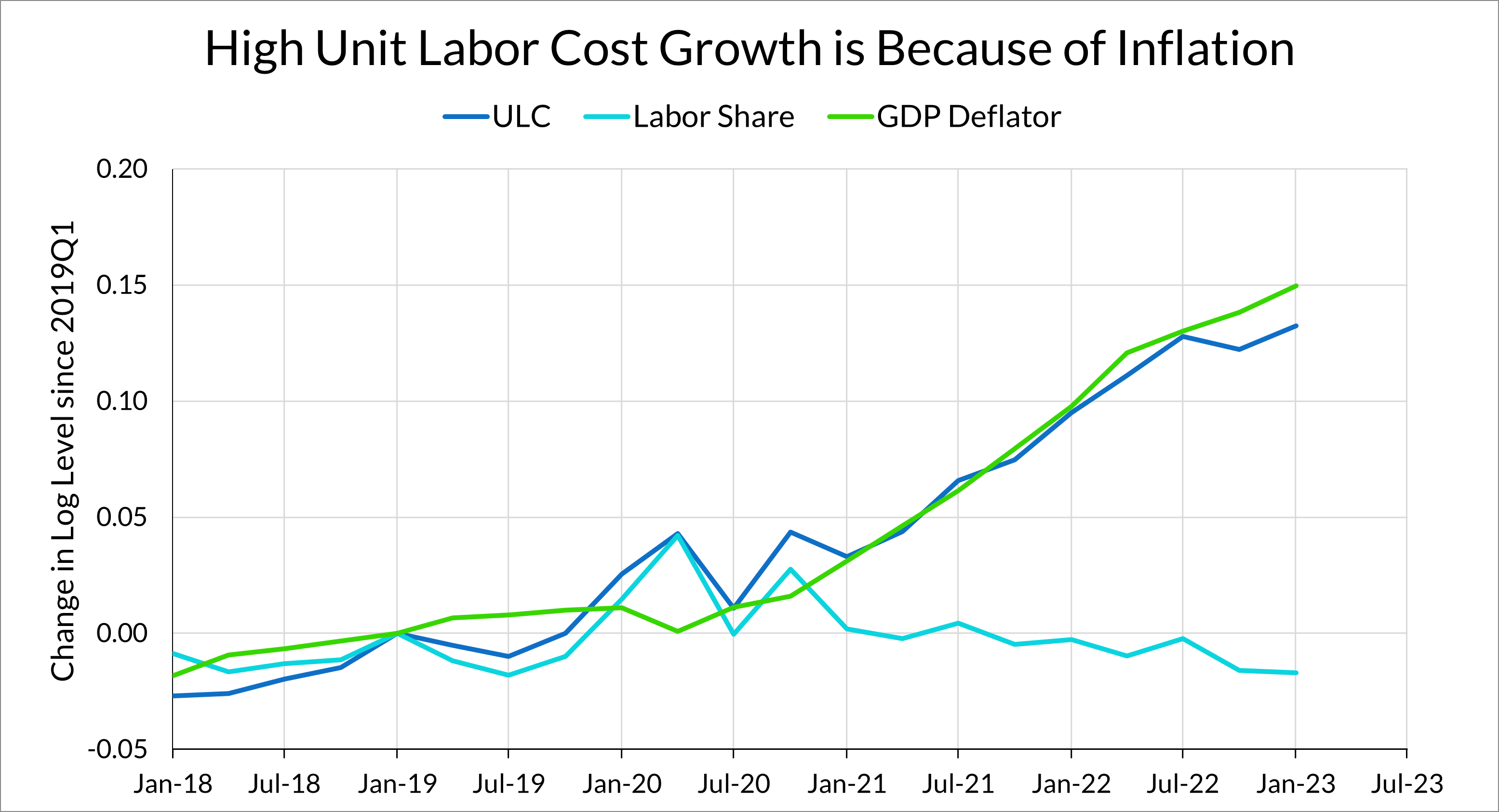

In the post-pandemic era, the increase in unit labor costs is almost entirely explained by growth in the deflator. Below, I graph the change in log unit labor costs, labor shares, and the nonfarm business sector value-added deflator since 2019Q1.

The increase in unit labor costs since 2020 is basically explained by the rapid increase in the price deflator. While there was a substantial increase in the labor share in 2020, the labor share has since fallen and is essentially back to 2019 levels.

During the post-pandemic period, the argument that inflation is high because ULCs are high necessarily implies one of two things: growth in the deflator is too high, or the labor share is too high. The first is tantamount to tautology; it is a statement that inflation is too high because inflation is too high. The second, in today’s context, is to argue that inflation is high because labor’s share of income—already at historic lows—is too high.

Sometimes that latter statement takes the form of arguing that wage growth is too high relative to productivity. It’s tempting to cast the data in that light because supposedly the unit labor cost is derived from the ratio of wages to productivity. But, as explained above, the only things that are really measured here are aggregate compensation and output. This means that statements about wage growth relative to productivity growth are exactly equivalent to statements about changes in the labor share (and changes in the price index).

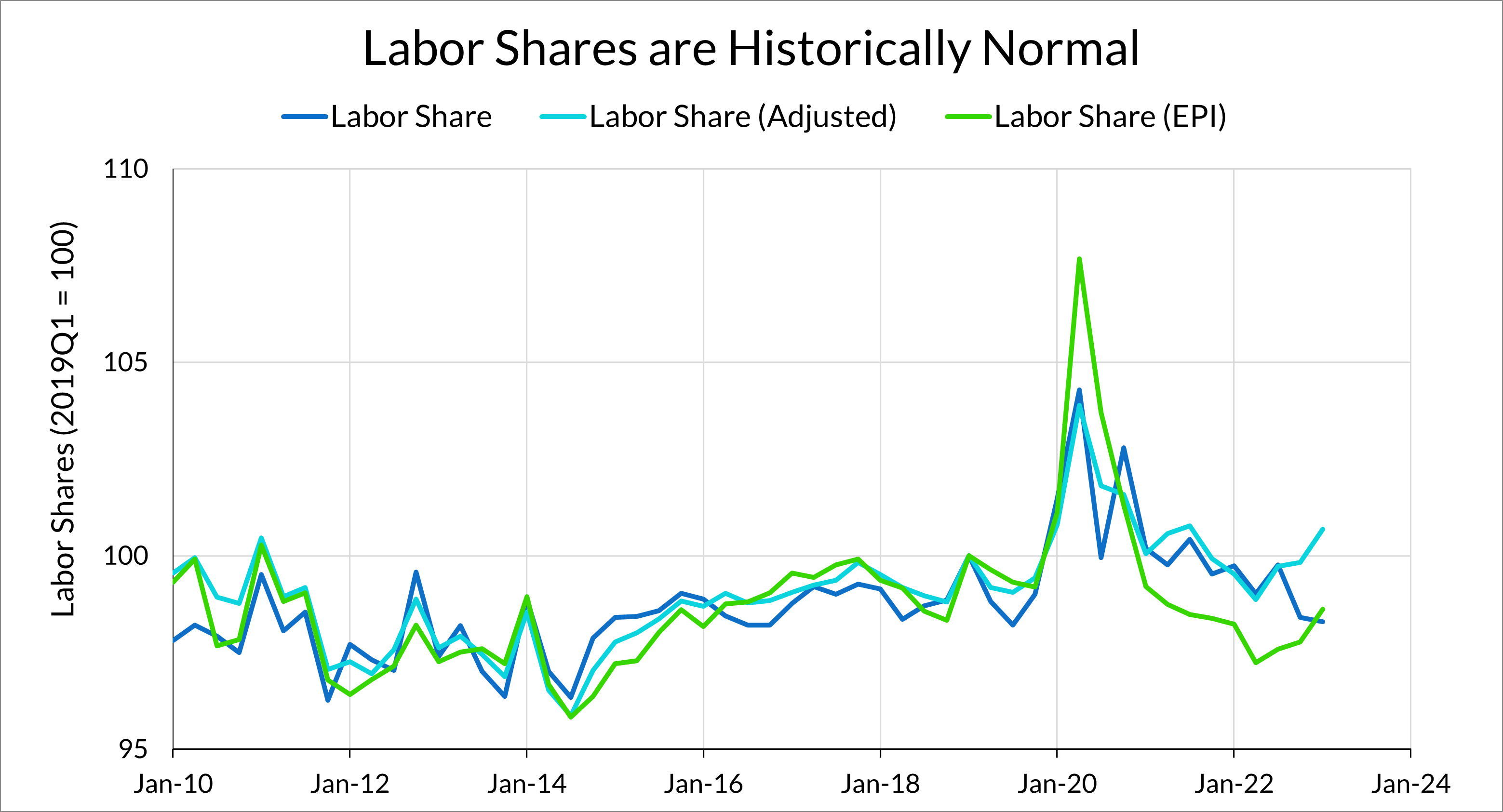

Below, I plot the labor share in the nonfarm business sector since 2010. In addition to the published nonfarm business sector ULC and labor share series, I also plot two “adjusted” series of ULC and labor shares. For the first adjustment, I scale output in the nonfarm business sector by the ratio of Gross Domestic Income and Gross Domestic Product, as in Furman and Powell (2022). I do this because there has been a significant divergence in GDI and GDP over the past two quarters, prompting Furman to question the reliability of the GDP-based estimate of unit labor costs. In the second adjustment, I use the Bivens (2019) measure of the labor share that focuses on the corporate sector (to avoid labor compensation measurement issues in the non-corporate sector) and strips out depreciation and Federal Reserve profits from output.

In historical context, it is hard to look at labor shares and conclude that compensation is too high relative to output. While labor shares did spike during the early part of the pandemic, labor shares have been decreasing ever since and are now around 2019 levels (the GDI-based measure has been increasing over the past two quarters due to divergences between GDI and GDP that may be spurious). Even if the labor share was increasing, it’s not clear that this would necessarily be inflationary; the historical norm after episodes of high price and wage growth is for nominal wage growth to outpace falling inflation, allowing real wages to catch up without triggering a wage-price spiral.

Is the Labor Share a Meaningful Metric of Marginal Costs?

The question of whether or not it’s useful to measure marginal costs and explain inflation using unit labor costs or labor shares has a long history in the academic literature. When New Keynesian models were introduced, scholars tried to find out if, as the basic sticky-price New Keynesian model predicts, inflation could be explained by expectations of future real marginal costs. One idea, put forth by Sbordone (2002) and Gali and Gertler (1999), was to use the labor share as a proxy for real marginal costs. The reasoning behind this is that under certain assumptions about the production function and the labor market, the labor share is equivalent to the economy’s average real marginal cost of production, and the unit labor cost is equivalent to the nominal marginal cost.

This belief relies on some heroic assumptions. As explained above, labor shares are created by taking the average hourly compensation and dividing it by average productivity. These objects are only equivalent to marginal wages and productivity—theoretically, the things that matter for marginal costs and therefore price-setting—under certain very specific assumptions. One requirement is that the production function of the economy exhibits a constant elasticity of output with respect to labor. The other is that the labor market behaves as if average compensation per hour is equal to the marginal cost of hiring labor in the economy.

The latter assumption can be broken in a number of ways. Over the past ten years, macro-labor economists have moved beyond thinking about wages as a singular object, especially with an eye towards the idea that measured wages are not always allocative. Composition changes in employment over the course of the business cycle, the existence of overhead labor, or the notion that labor markets are not spot markets (see Marianna Kudlyak’s brilliant work on the user cost of labor) all break this assumption.

Whether or not labor shares are a useful proxy of marginal costs has long been a source of debate in the academic literature, and still is. Rudd and Whelan (2005) found that using the labor share as a marginal cost proxy in the canonical New Keynesian model performed worse than using deviations in output. Lawless and Whelan (2011) examined sector-level Phillips curve regressions in the Euro Area and found that changes in sectoral labor shares had a negative effect on sectoral inflation, the exact opposite of what the “compensation vs. productivity” believers would predict.

Even if one thinks labor shares are a useful measure of real marginal costs, the empirical behavior of labor shares is counterintuitive. Nekarda and Ramey (2020) find that the labor share decreases in response to expansionary monetary and fiscal policy shocks. This is consistent with the results of Cantore, Ferroni and Leon-Ledesma (2020), who find similar results in the US, Euro, UK, Australia and Canada. If “wages outpacing productivity” is something to worry about, does that mean we should cut interest rates and do more Big Fiscal in an attempt to decrease the ratio of compensation to output?

Our view is that the “unit labor cost” measure is simply not a useful way of assessing the extent of labor cost pressures on inflation. One part of the ULC is just a price index, the growth of which is simply inflation itself; the other component, the labor share, does not have any clear relationship, whether in terms of its outright level or its growth rate, with inflation. In historical context, the labor share is low and has been declining over the past two years, and a non-inflationary recovery in labor shares is not out of the historical norm.