Core-Cast is our model and publication series for nowcasting the Fed's Personal Consumption Expenditures (PCE) inflation gauges. We update our estimates from CPI, PPI, Import Price, and GDP data, along with previews and final recaps. If you'd like to become a MacroSuite subscriber to get all of our model updates before PCE is released, you can do so using this link. If you have any questions or would like to see samples of our past content, contact us here.

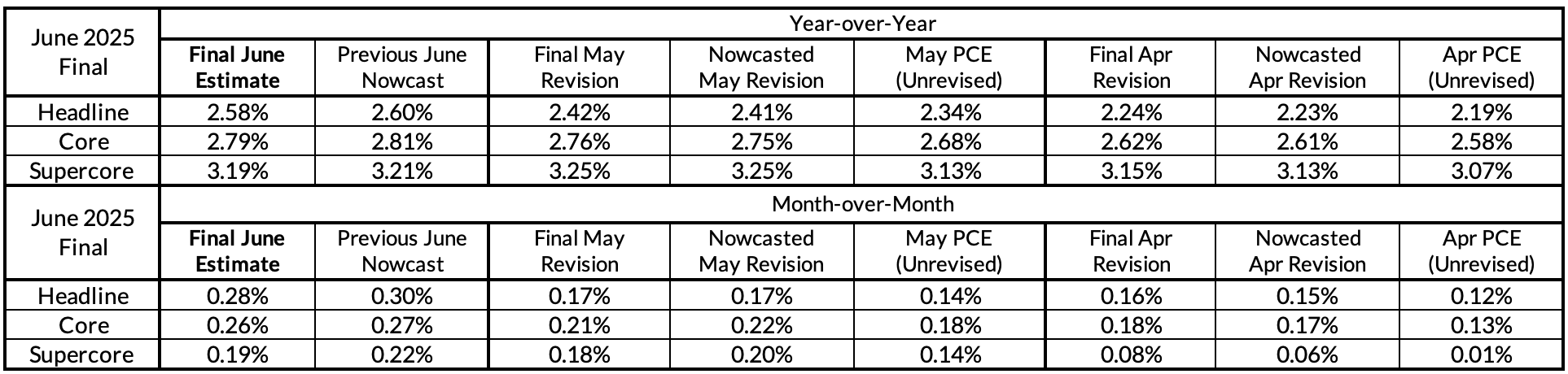

Summary: PCE Nowcasts

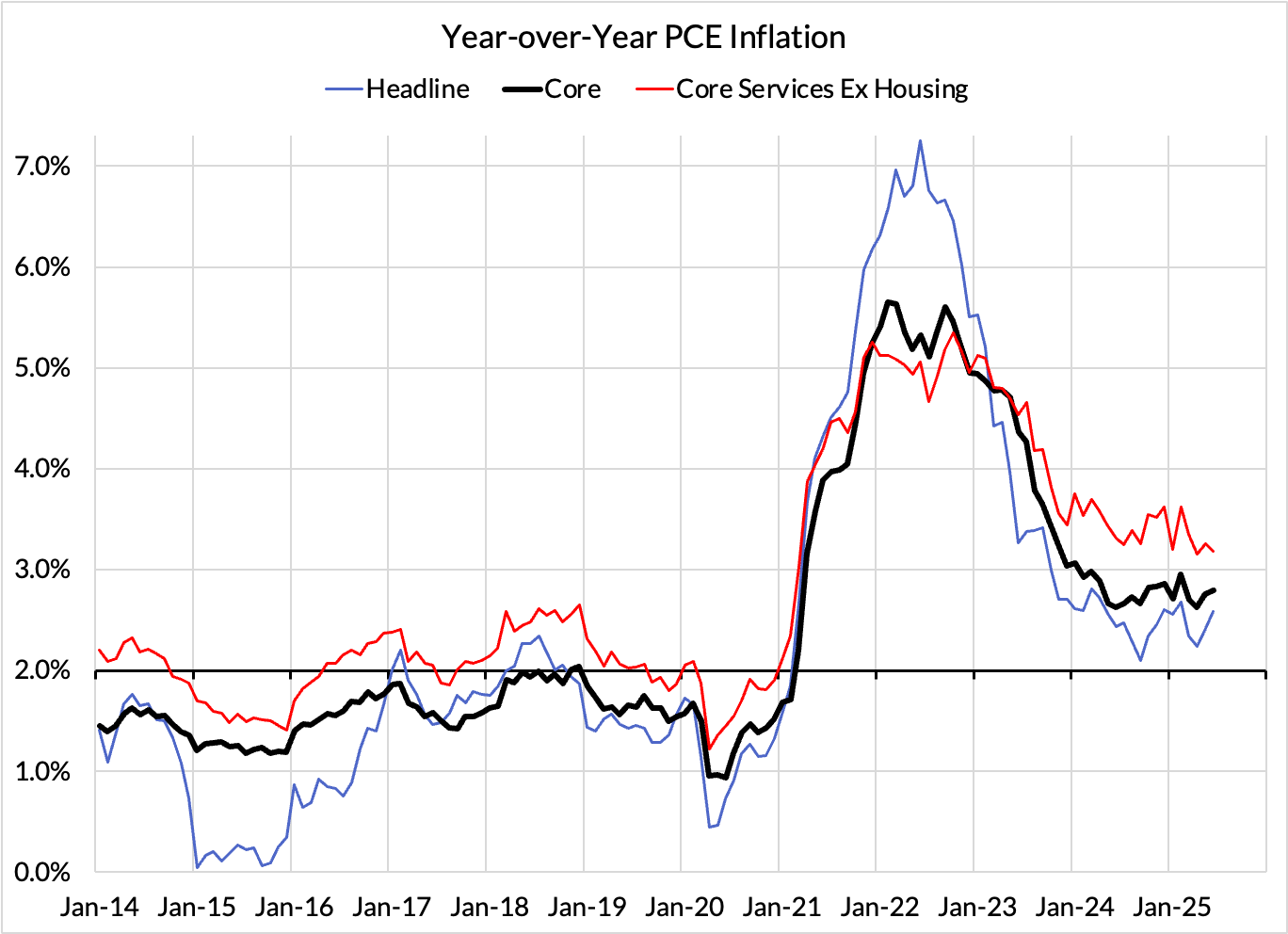

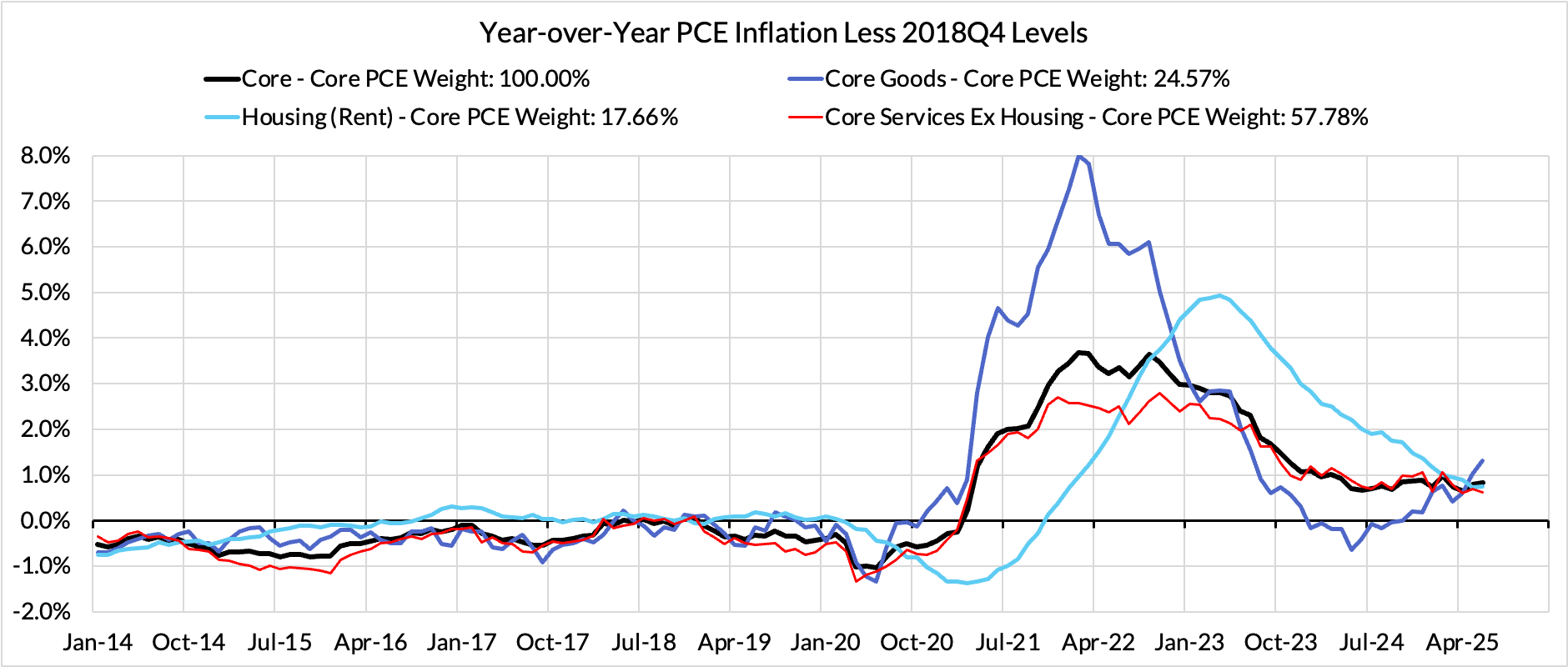

Our nowcasts following yesterday's GDP release were about as close as one could reasonably expect to the final outcome today. They tell a story of inflation coming in stronger than what the prevailing narrative around inflation suggests, and certainly so following CPI releases. Core PCE inflation is no longer showing the kind of progress in 2025 that we were seeing in previous years. Core PCE remains 79 basis points above where the Fed's inflation target on a year-over-year basis.

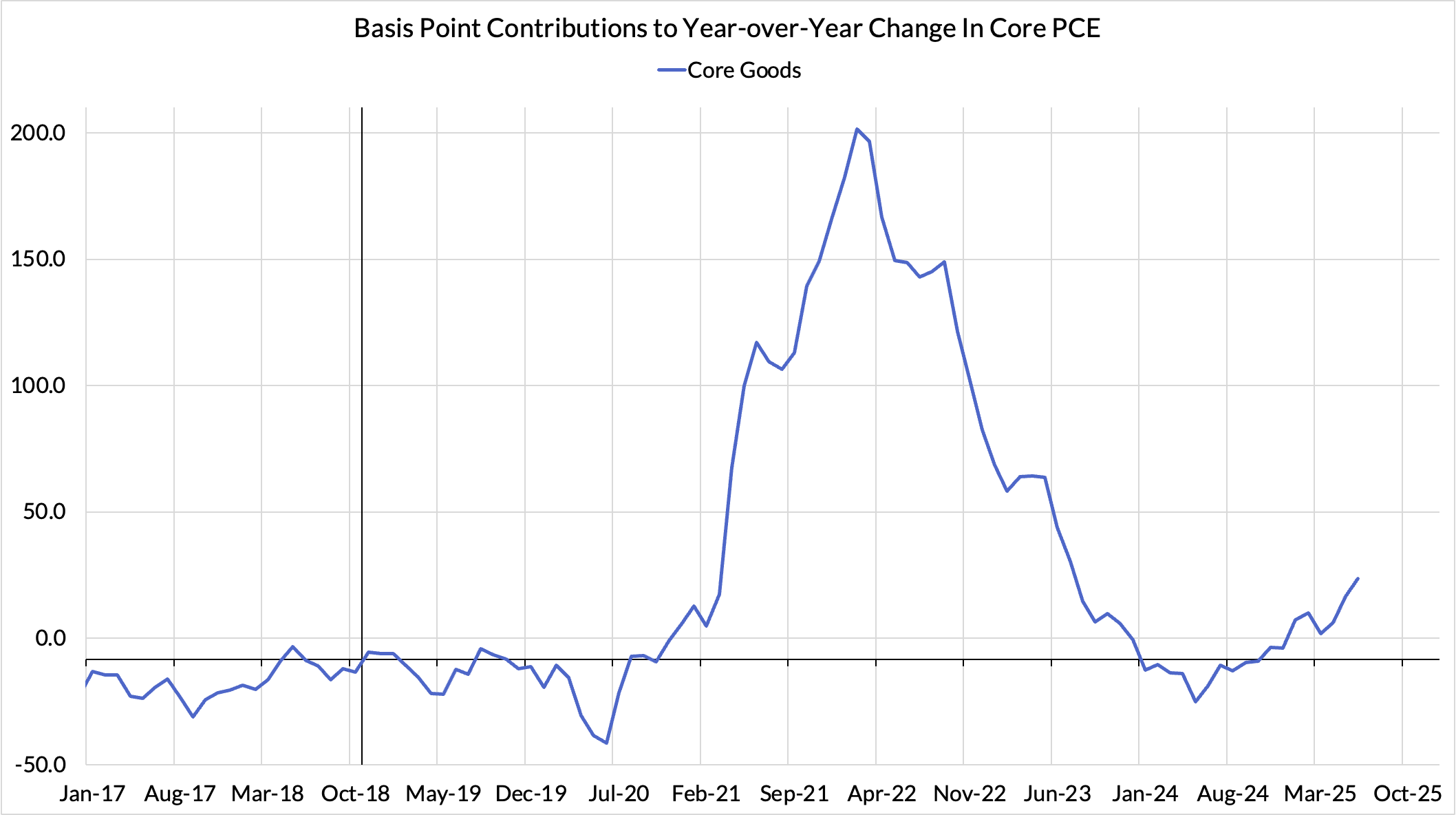

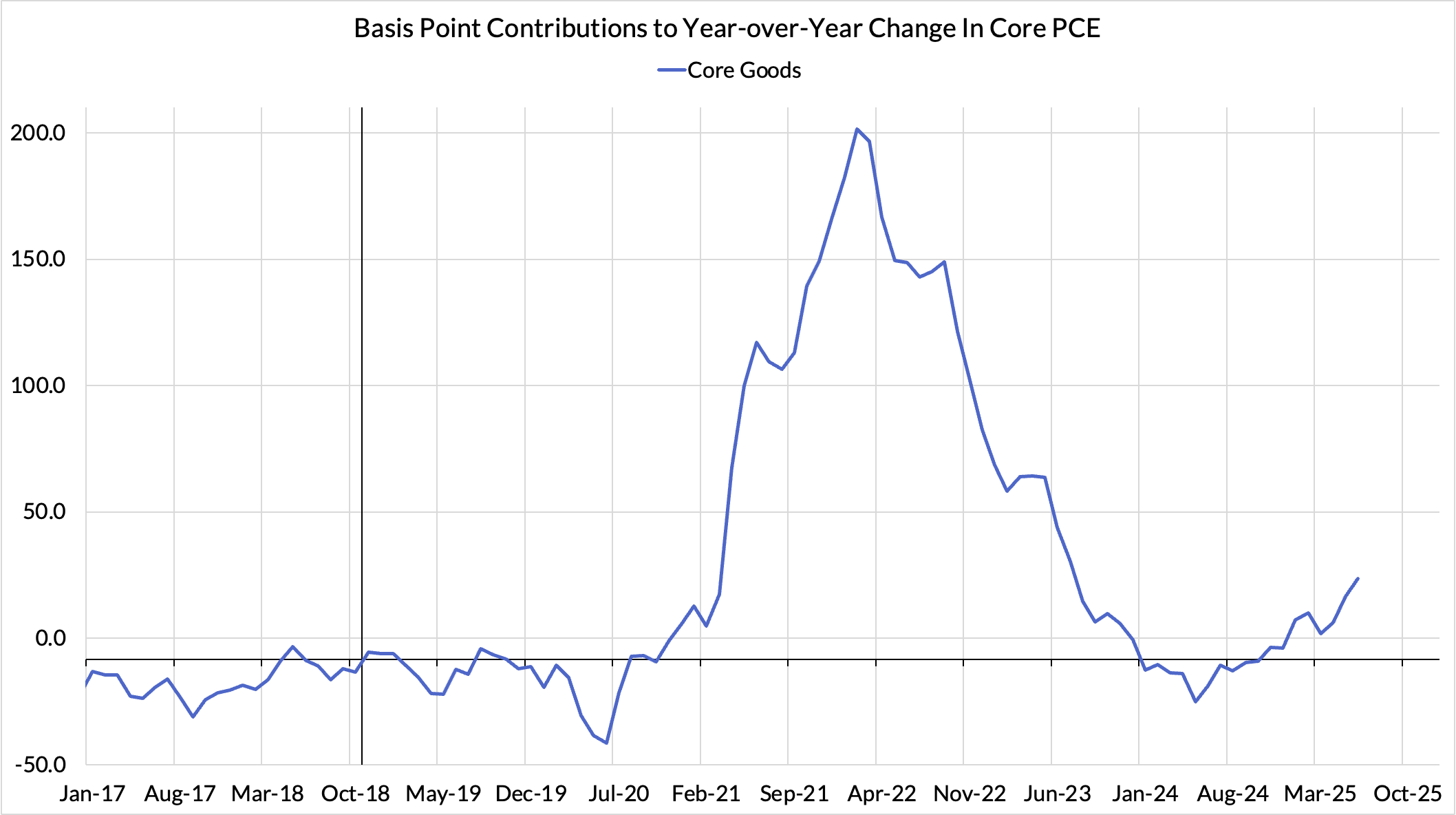

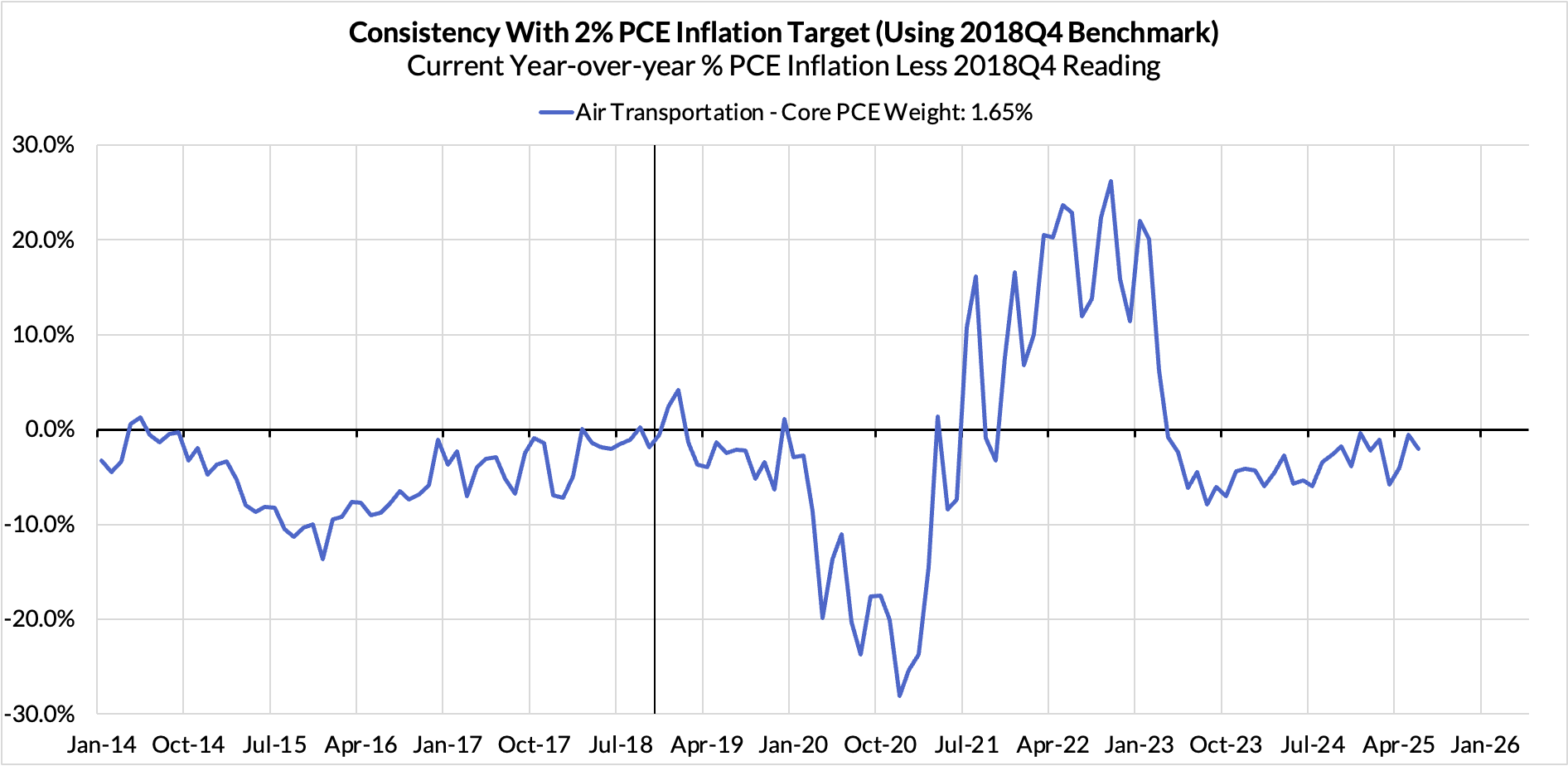

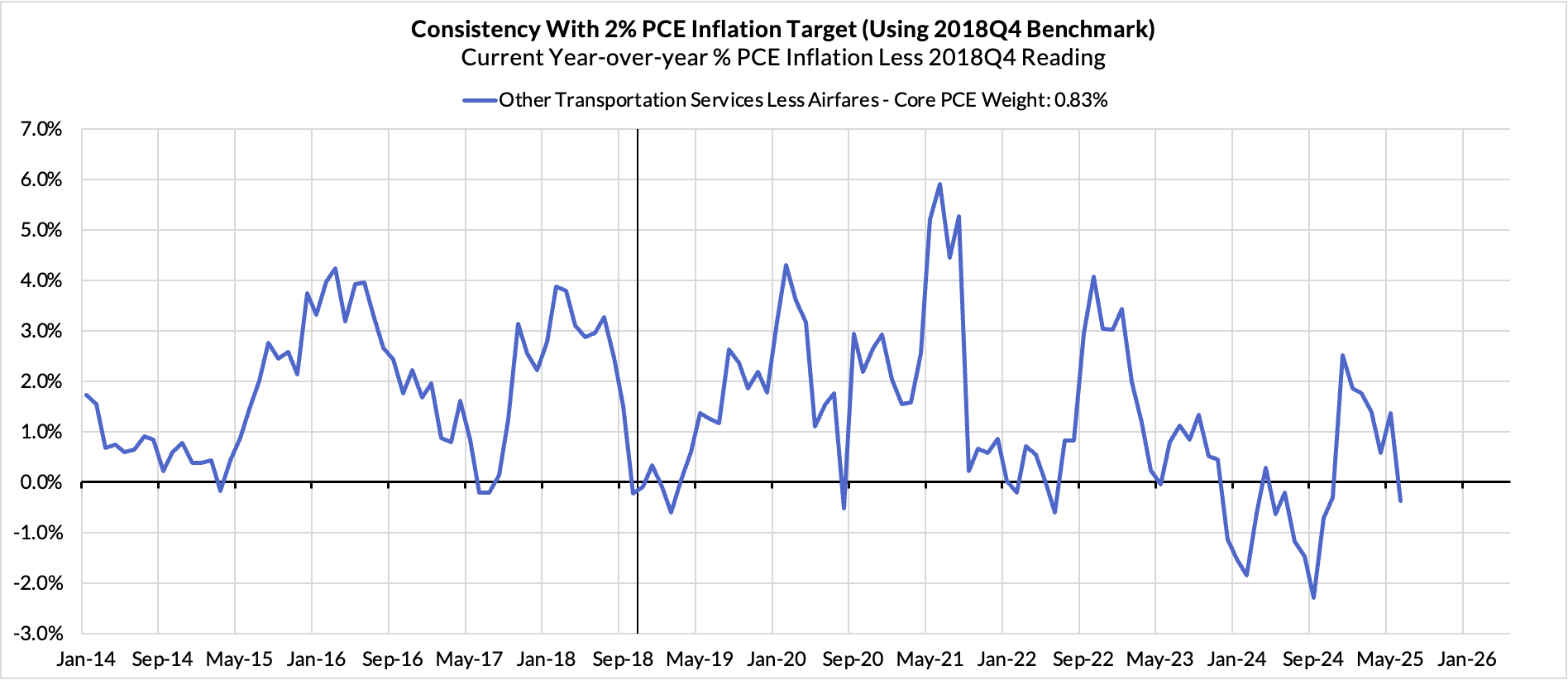

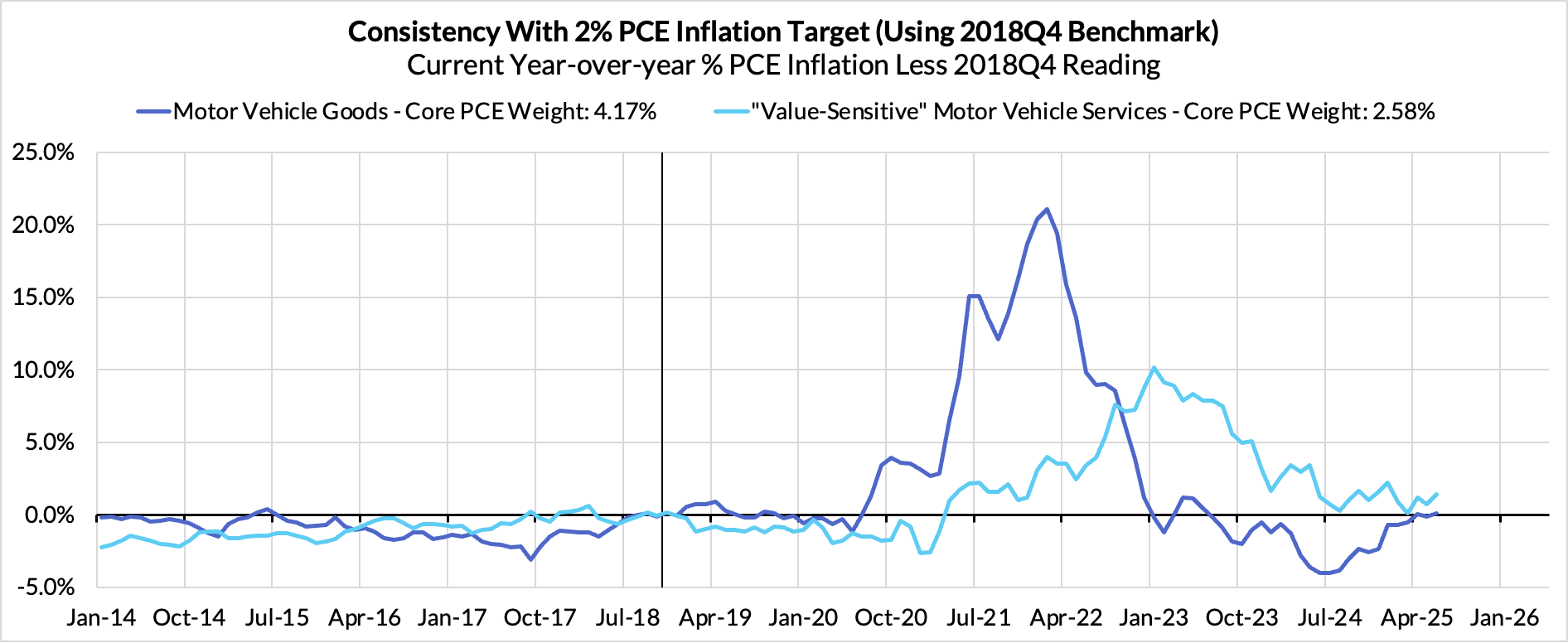

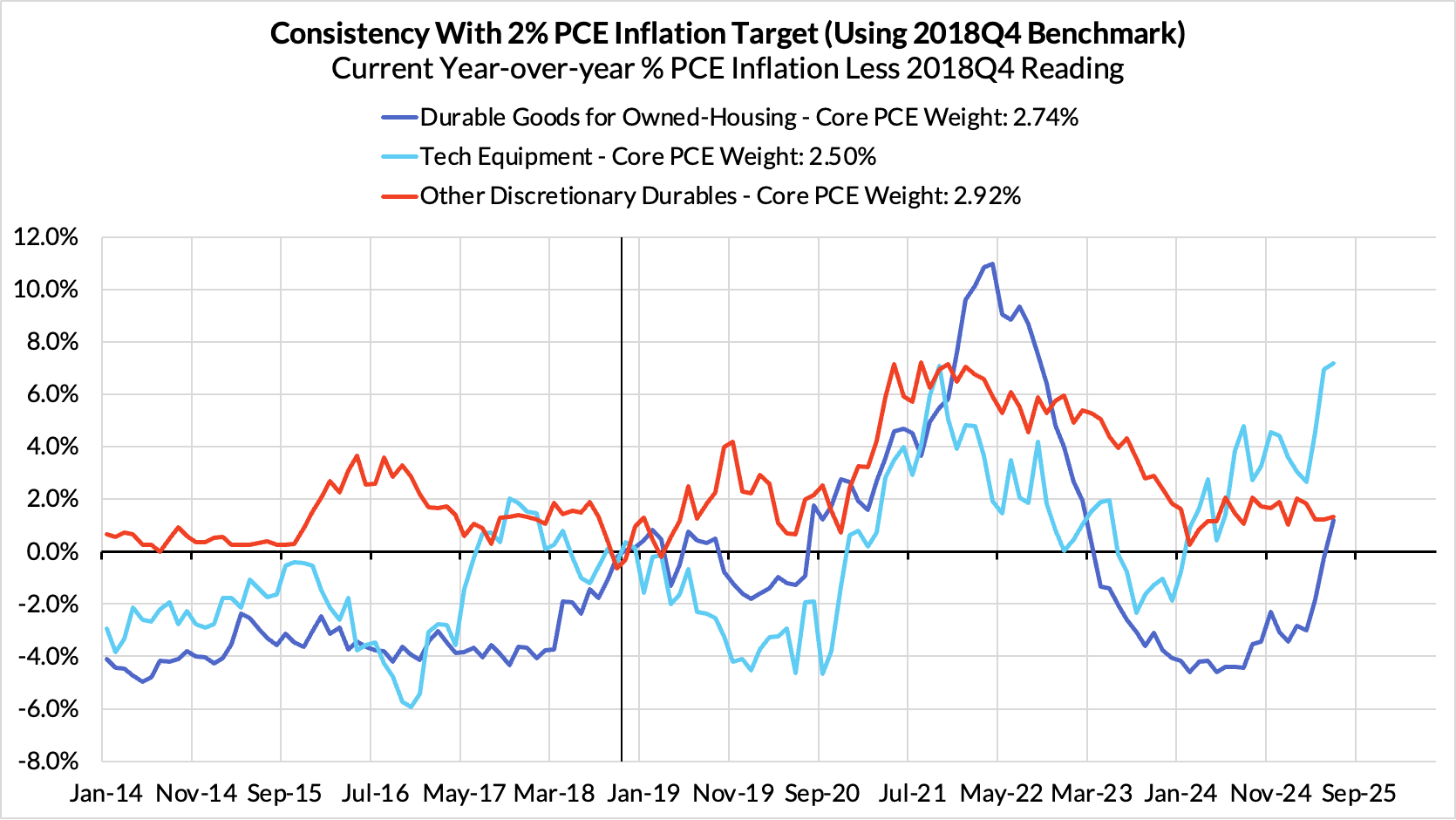

The main reason for inflation's local upside in recent months has little to do with the labor market or Fed policy in any direct sense. "Inflation is stuck above target" primarily because goods prices started accelerating materially at the end of last year. Core Goods inflation is now contributing over 30 basis points to the 79 basis point overshoot in Core PCE vs the Fed's 2% target.

We expect goods prices to continue their firm trend in the months ahead as a result of tariff-related anticipations and effects. The scale of potential acceleration remains highly uncertain and may prove to be more benign than we fear. Nevertheless, today's data will confirm the Fed's internal case for holding off on imminent rate cuts, but tomorrow's labor market data could easily change that assessment. If we see more adverse information, the Fed certainly should consider bringing forward the timeline for additional interest rate cuts.

Discussion

The plateauing of Core PCE inflation above the Fed's target is a real shame. There was a clear trajectory at the end of last year that suggested further disinflation.

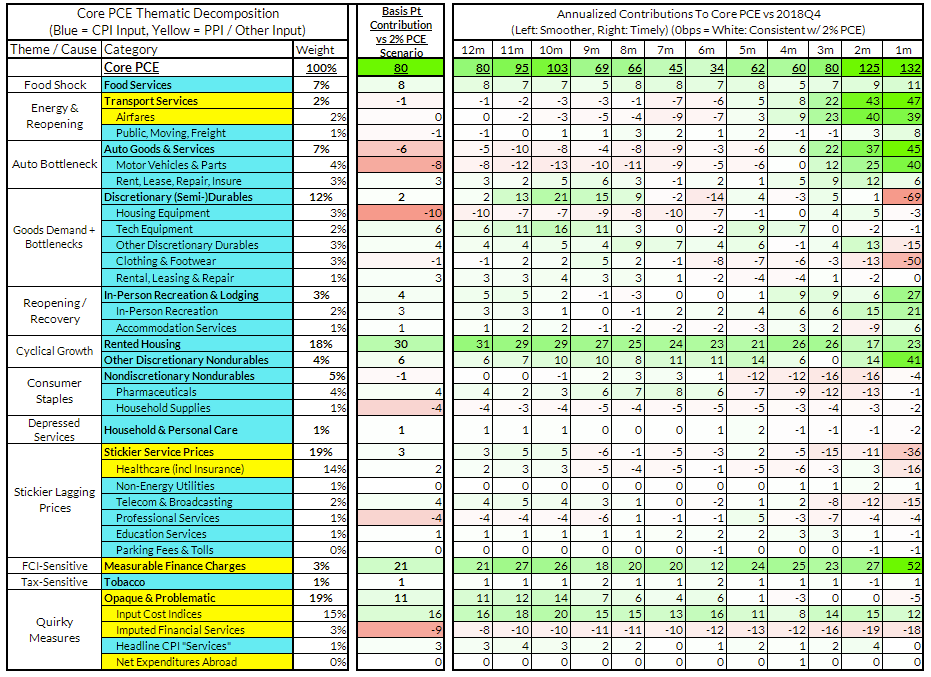

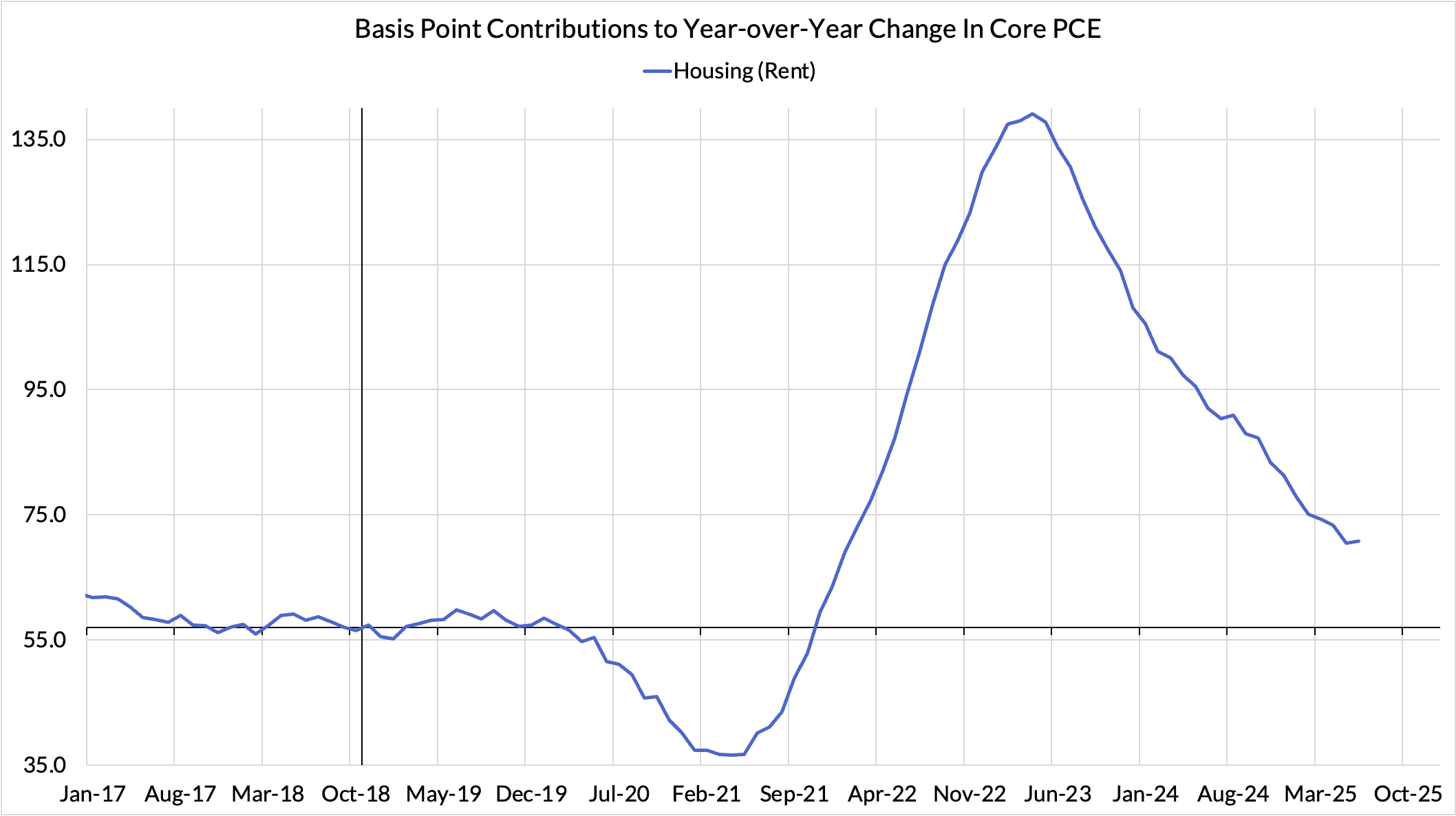

Back when the October 2024 PCE data was released (in late November), Core PCE was growing at 2.80% year-over-year, just one basis point higher than the current annual inflation rate. But of those 80 basis points of inflation, 67 basis points were likely to fall out purely due to component-relevant lags tied to housing inflation methodology, financial markets, and the labor market.

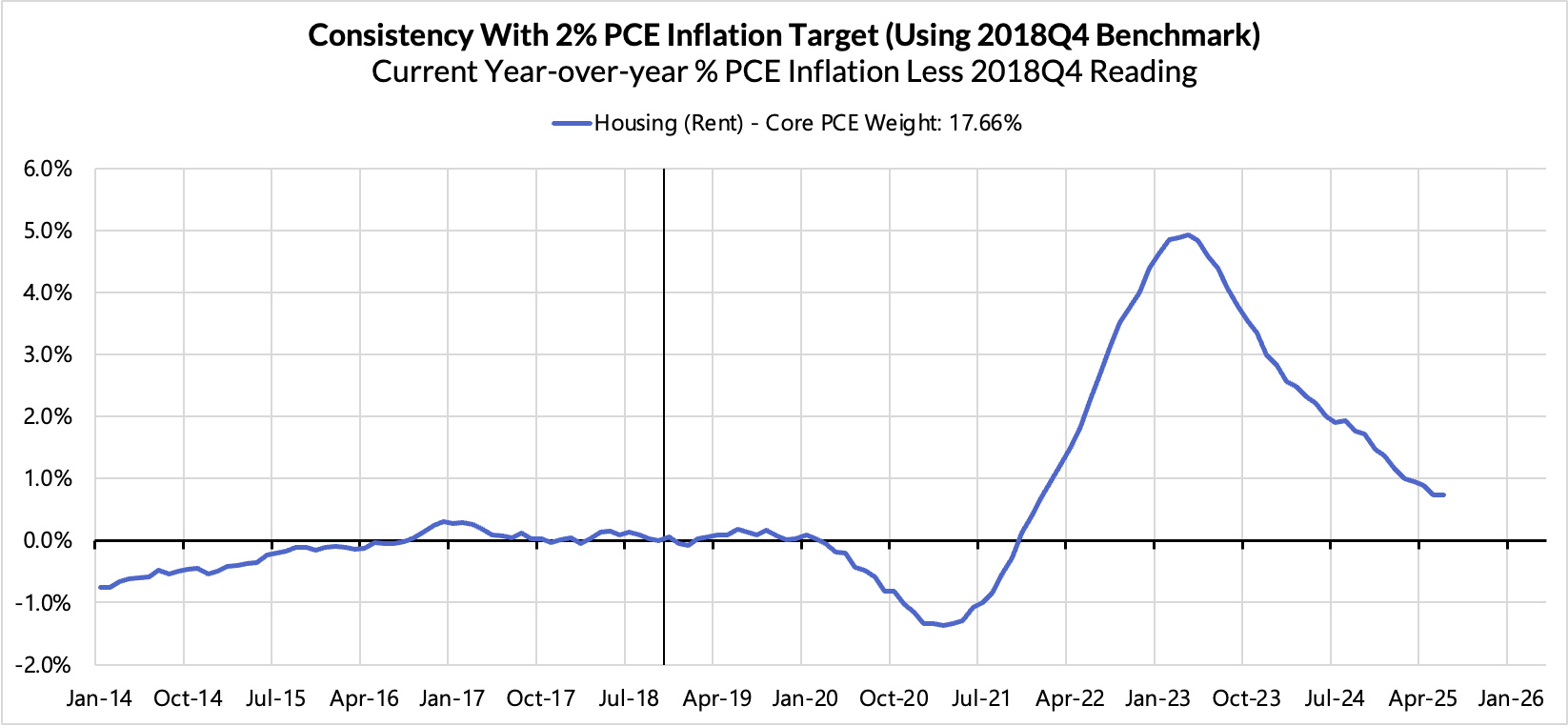

Rent PCE inflation had been drastically outperforming market rents and was adding 30 basis points to the 80 basis point overshoot. Since that time, rent PCE inflation has slowed down, now contributing only 14 basis points. Given the trends in market rents and the relevant lags, rents are poised to slow further, and eventually stop contributing to the overshoot of the 2% inflation target.

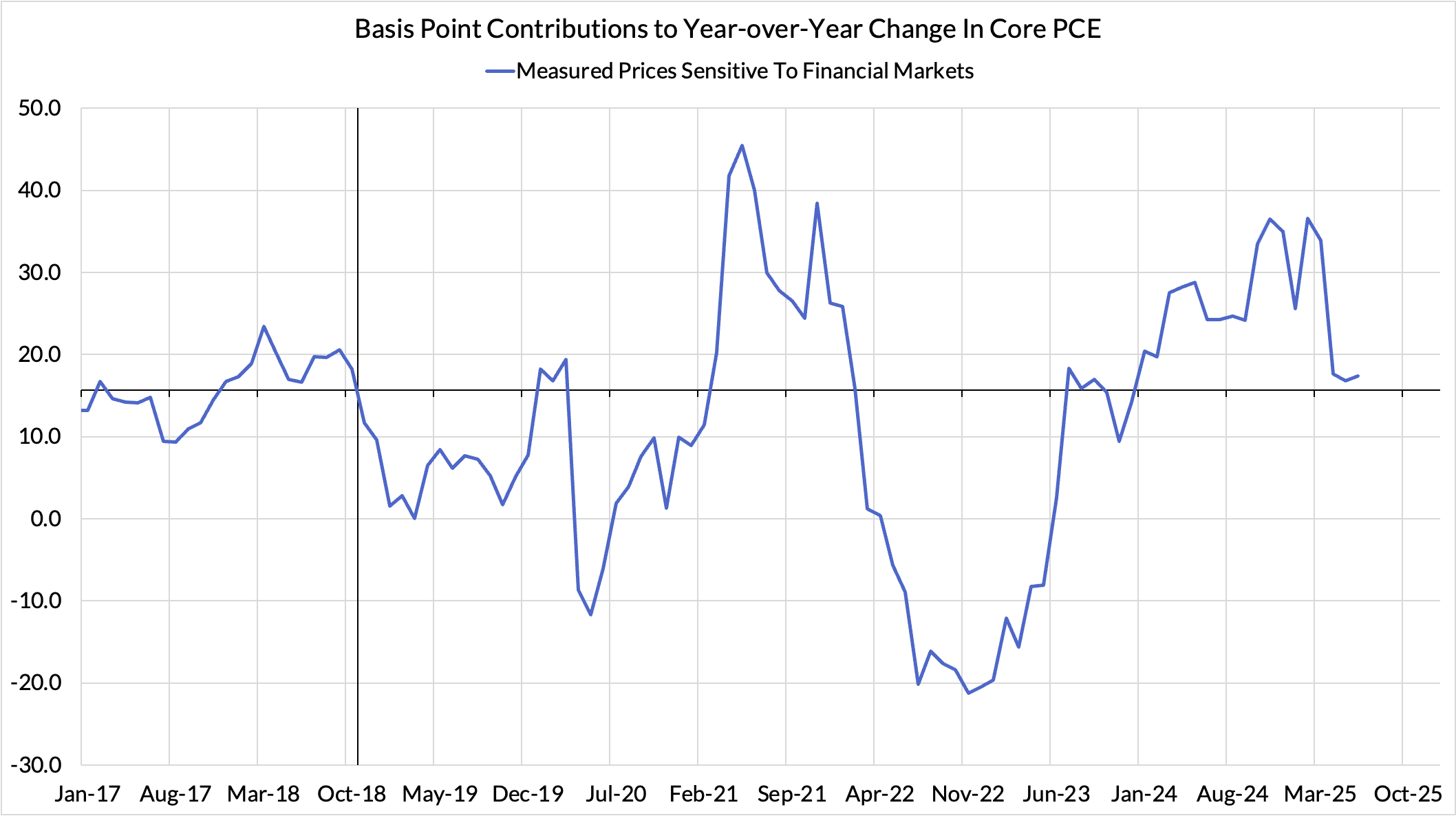

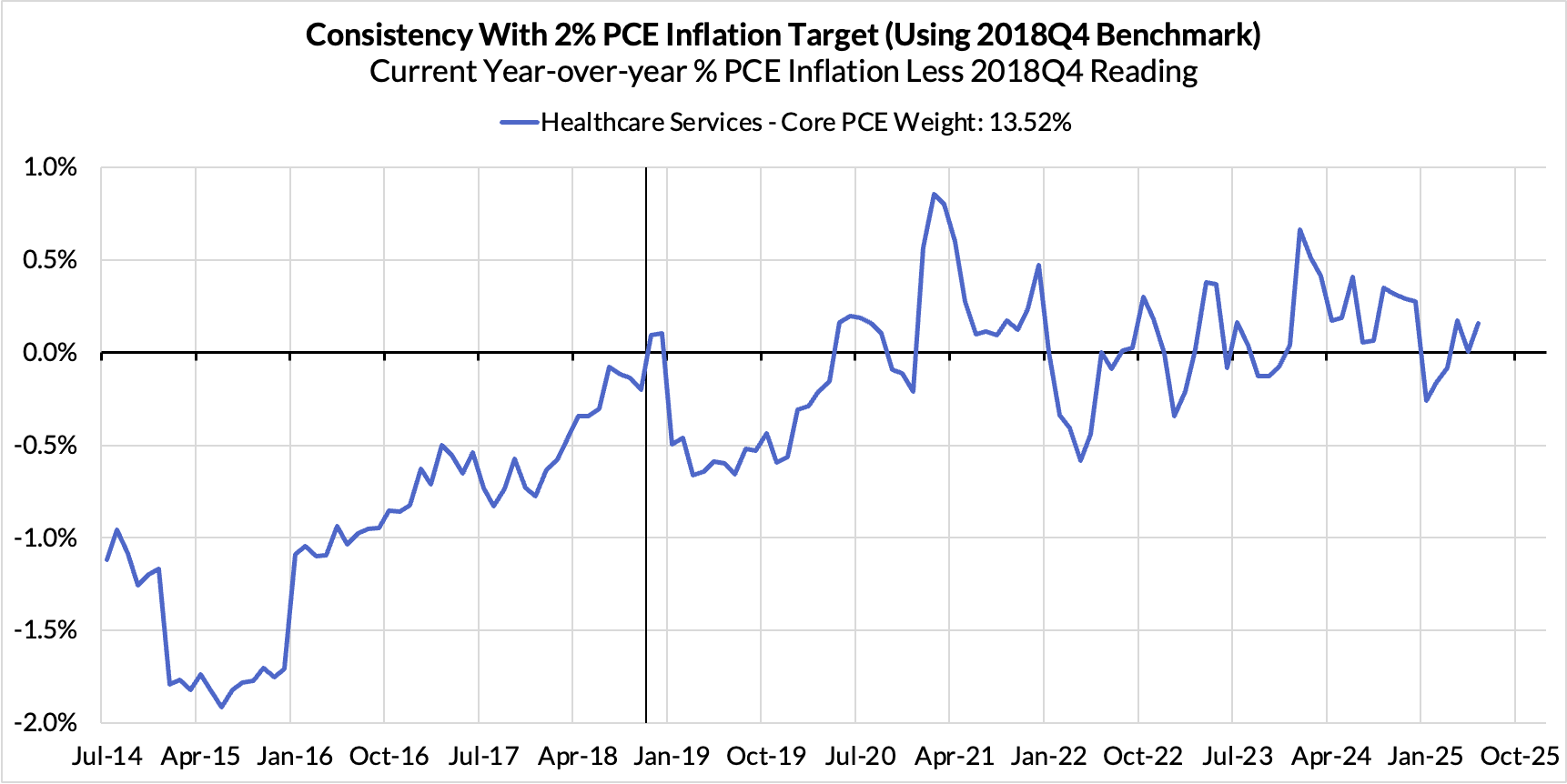

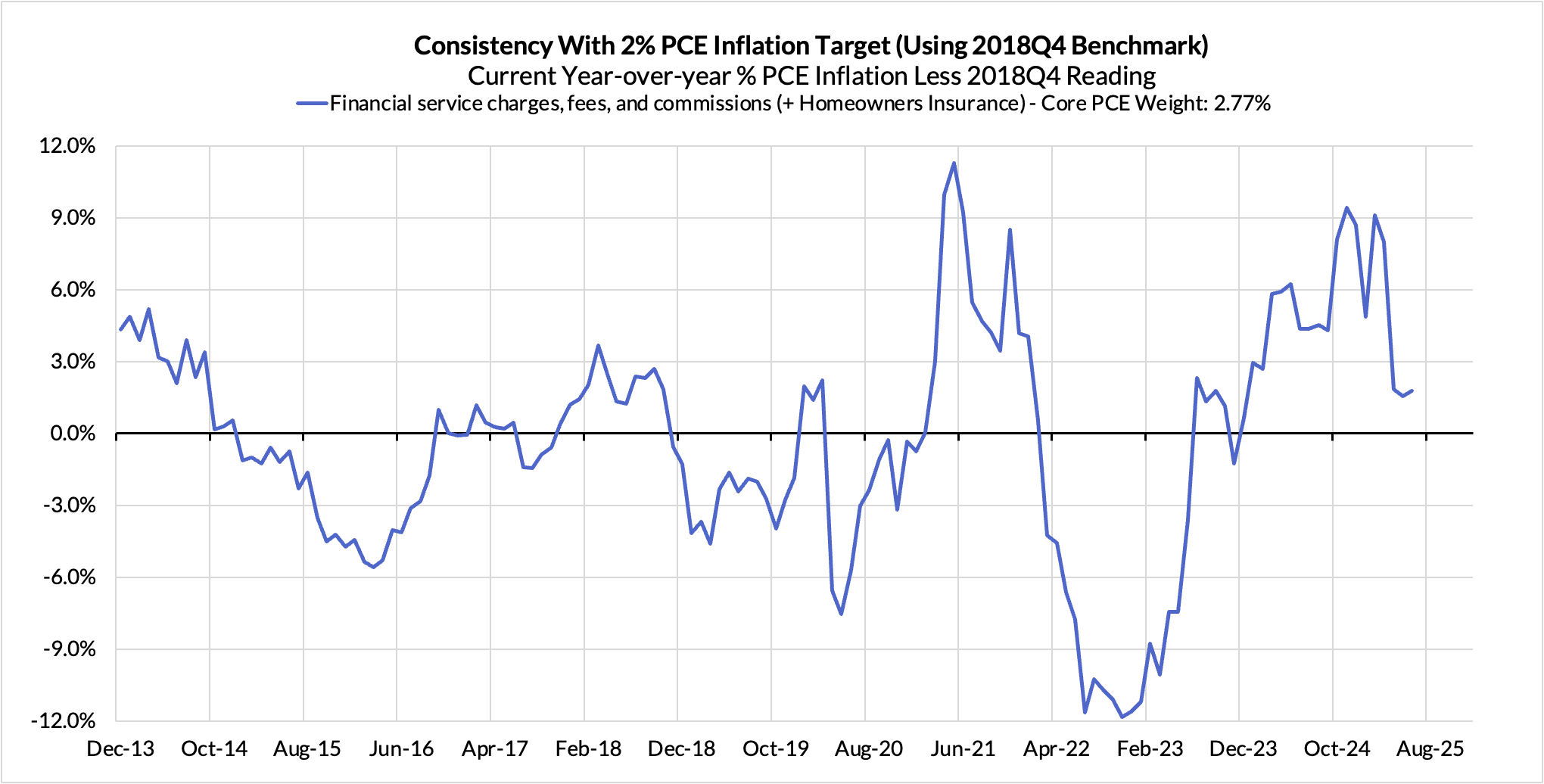

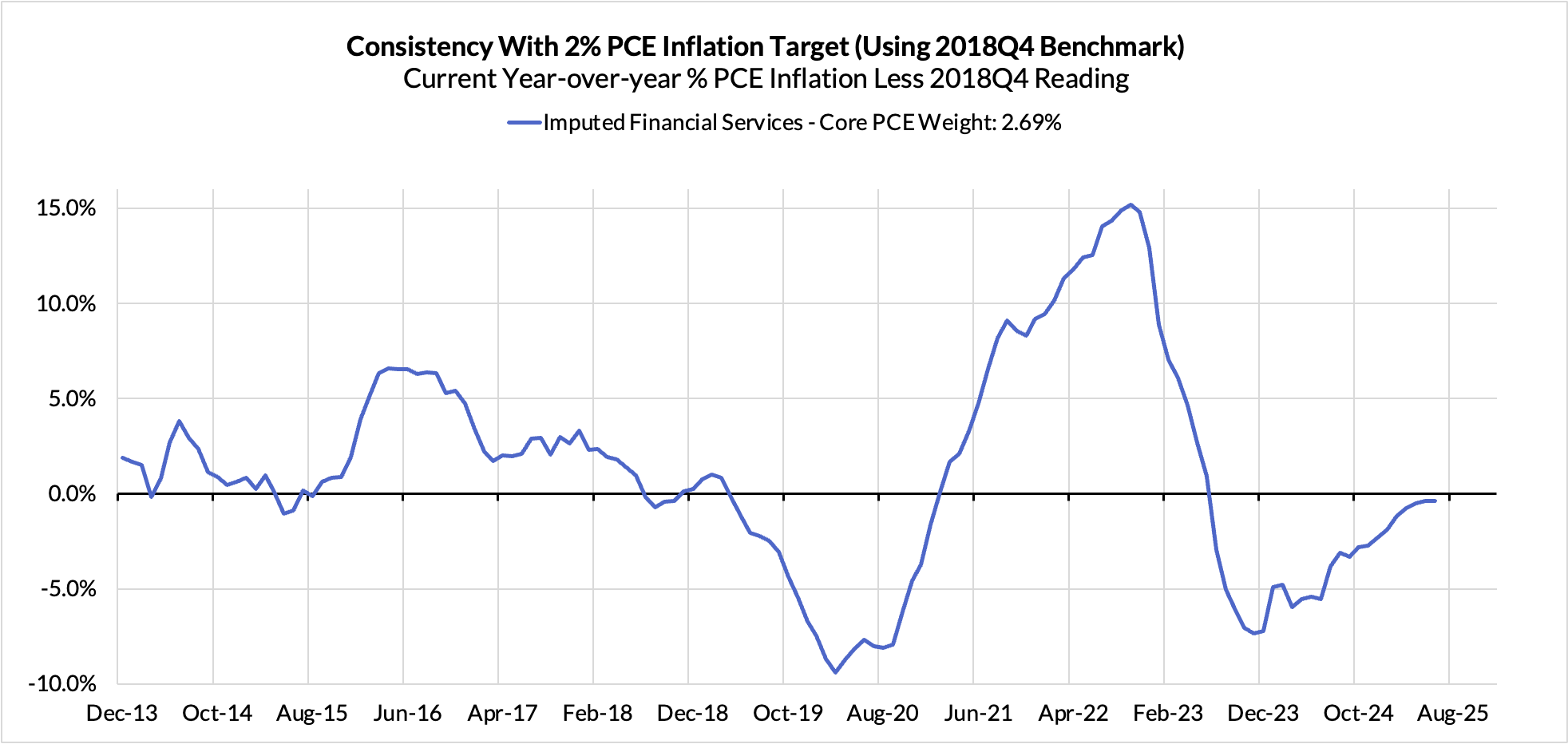

The impressive run in the stock market in 2023 and 2024 was also a major contributor to the inflation overshoot in October 2024, adding another 21 basis points. Since then, equity markets have appreciated, but at a less rapid pace. As a result, financial markets are now a more negligible contributor to the Core PCE inflation overshoot (just 4 basis points).

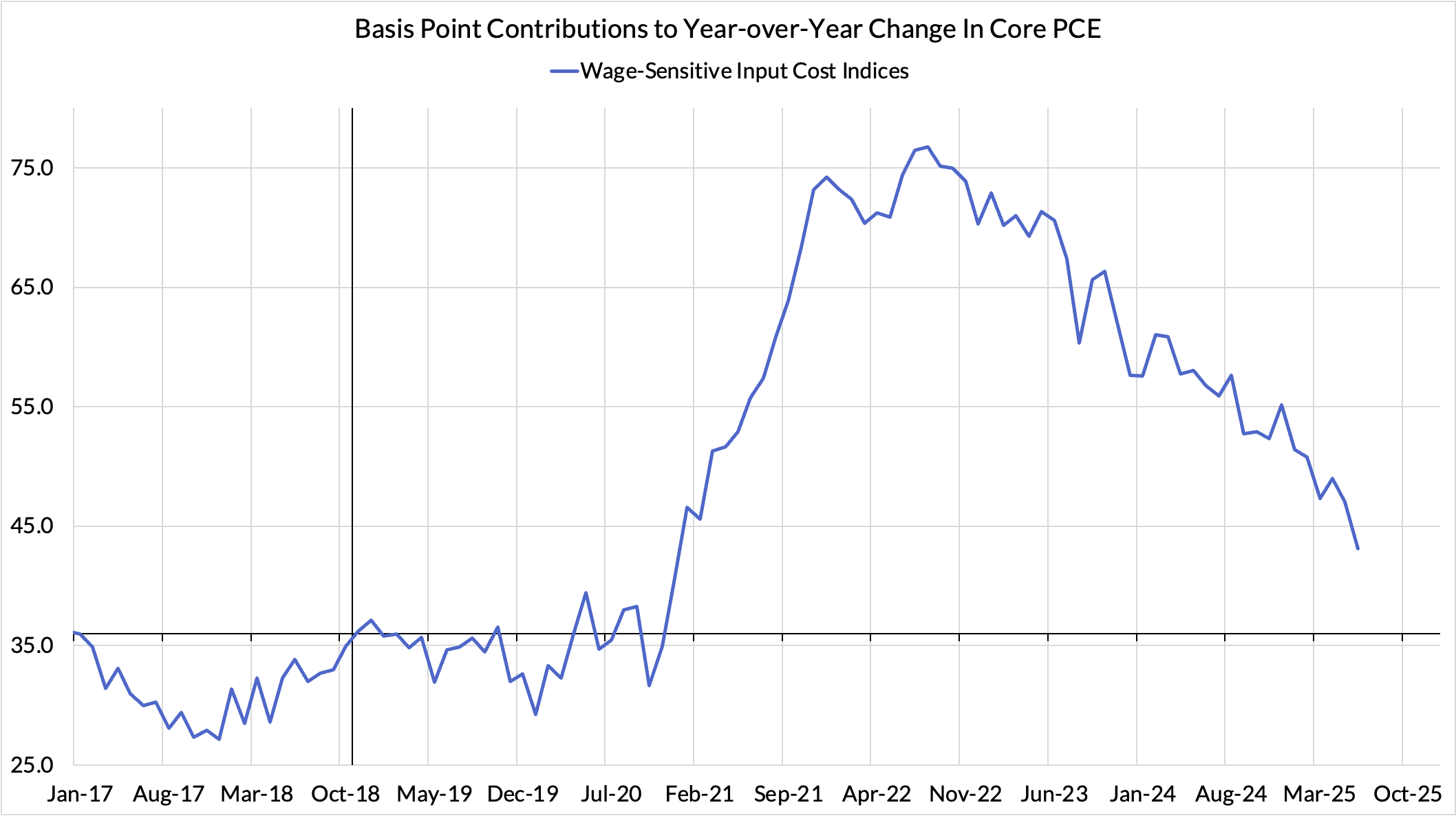

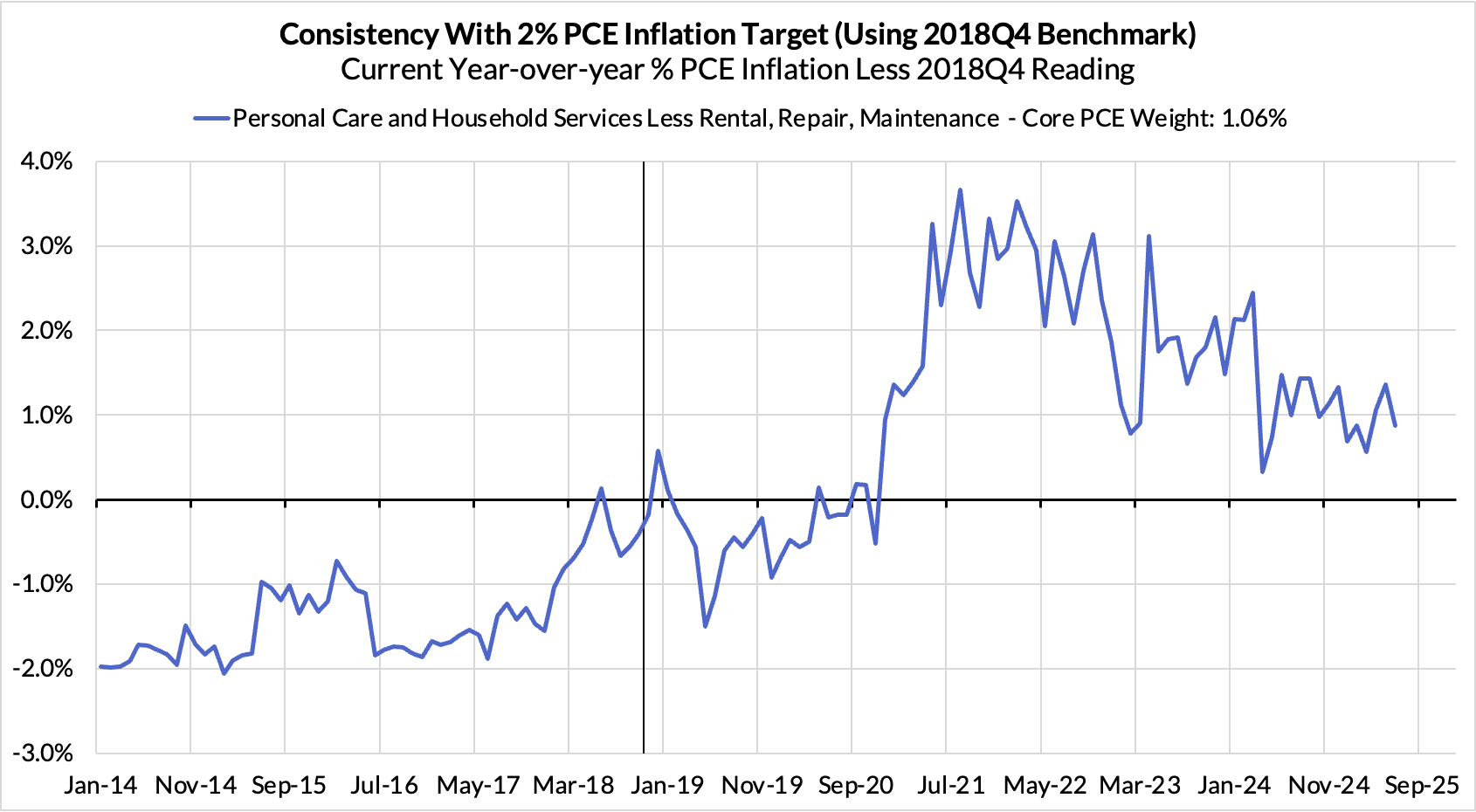

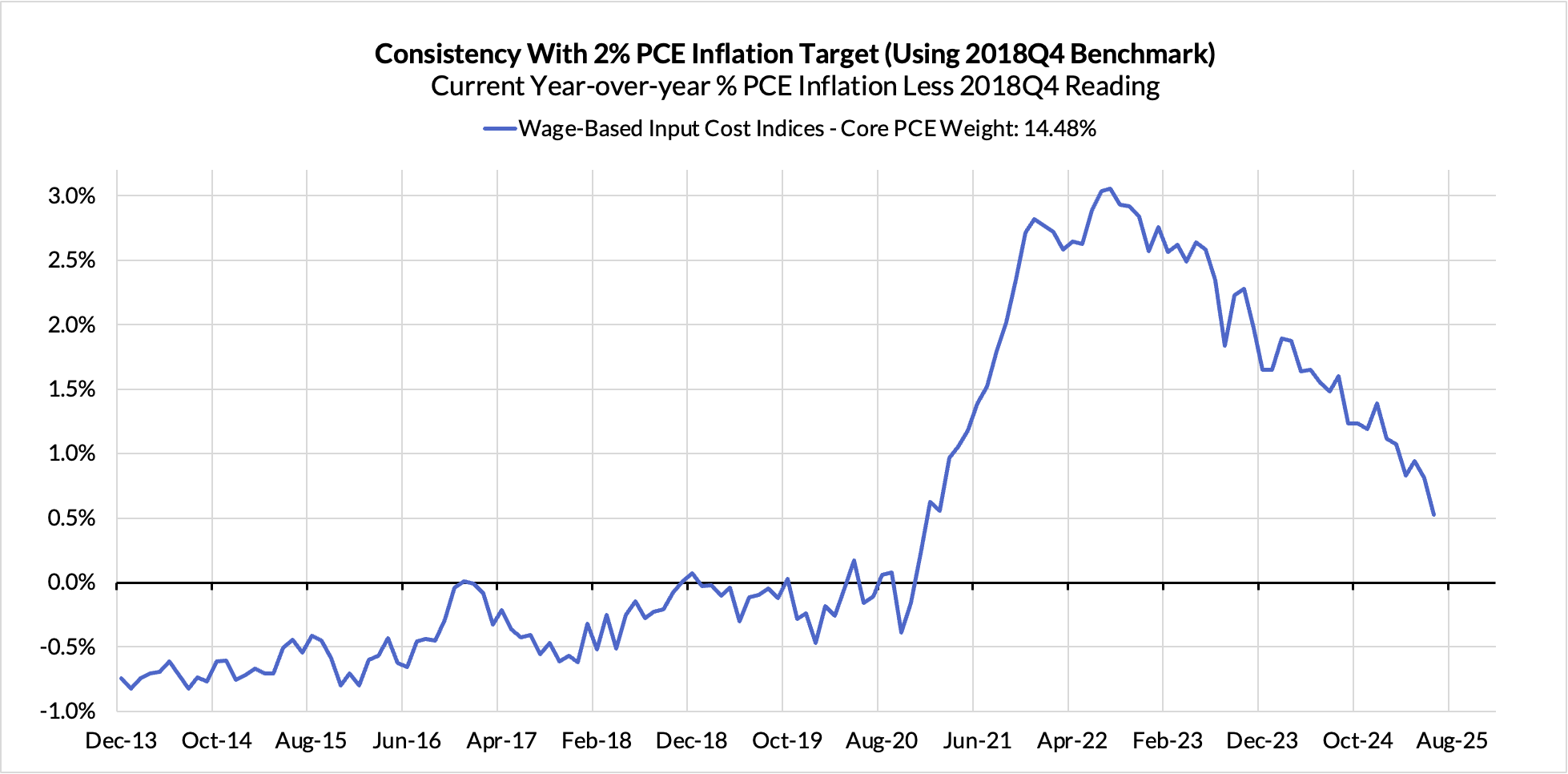

The final major contributor to the inflation overshoot in October was wage-sensitive input cost indices, adding 16 basis points to the then 80 basis point overshoot. These are components of PCE that primarily use measures of wages as an input cost proxy for final market prices, which are not directly measured. Wage growth tends to move with a lag to labor market tightness measures like the quits rate and the hiring rate. Those measures have been signaling less tightness and slower wage growth. Predictably, since October, that contribution has dwindled to just 7 basis points.

All of these lagged components to inflation have proven to lag in ways that have favored 42bps of disinflation, and yet the final result is relatively unchanged Core PCE inflation. The culprit lies primarily within goods prices, which have been a near-proportional offset.

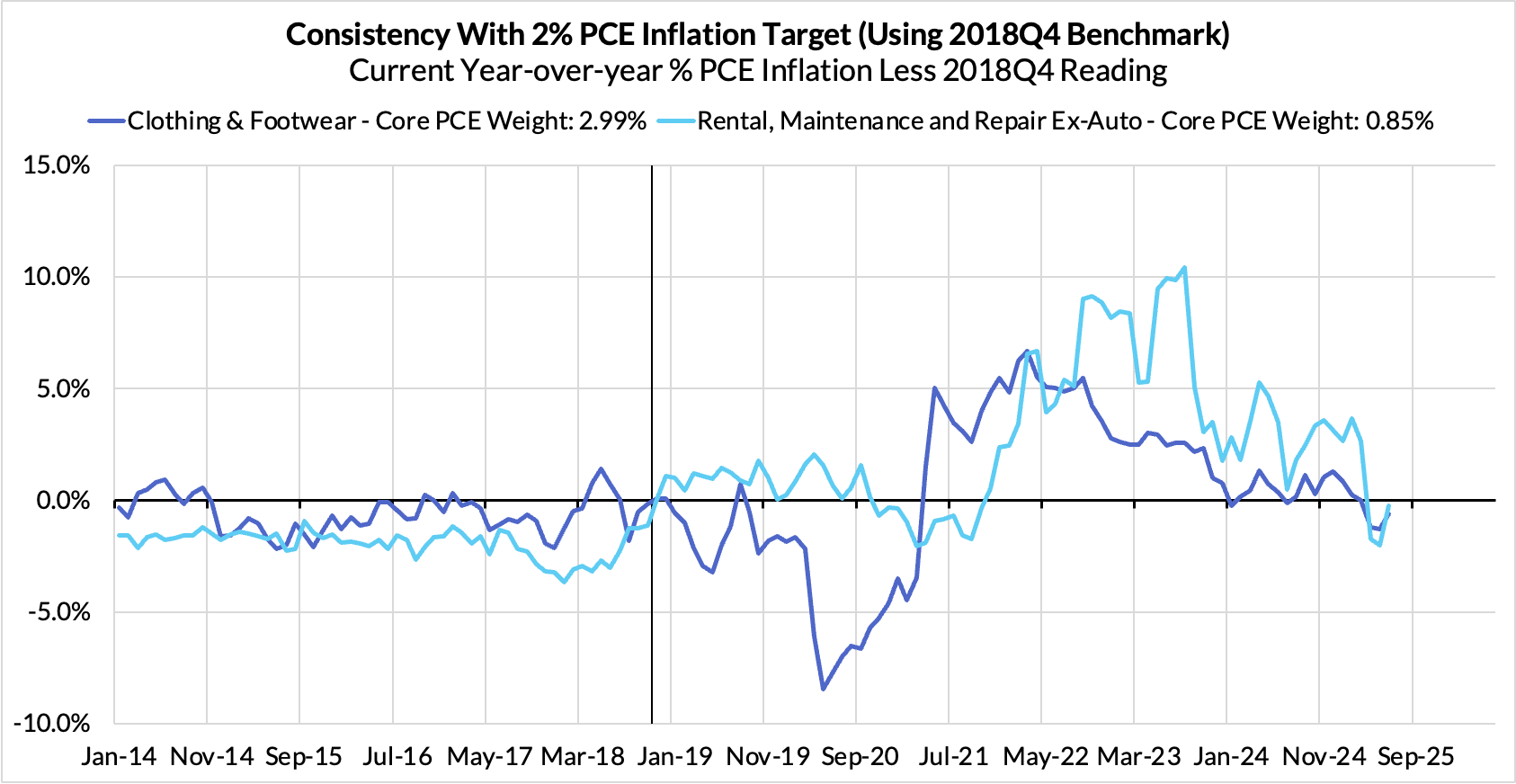

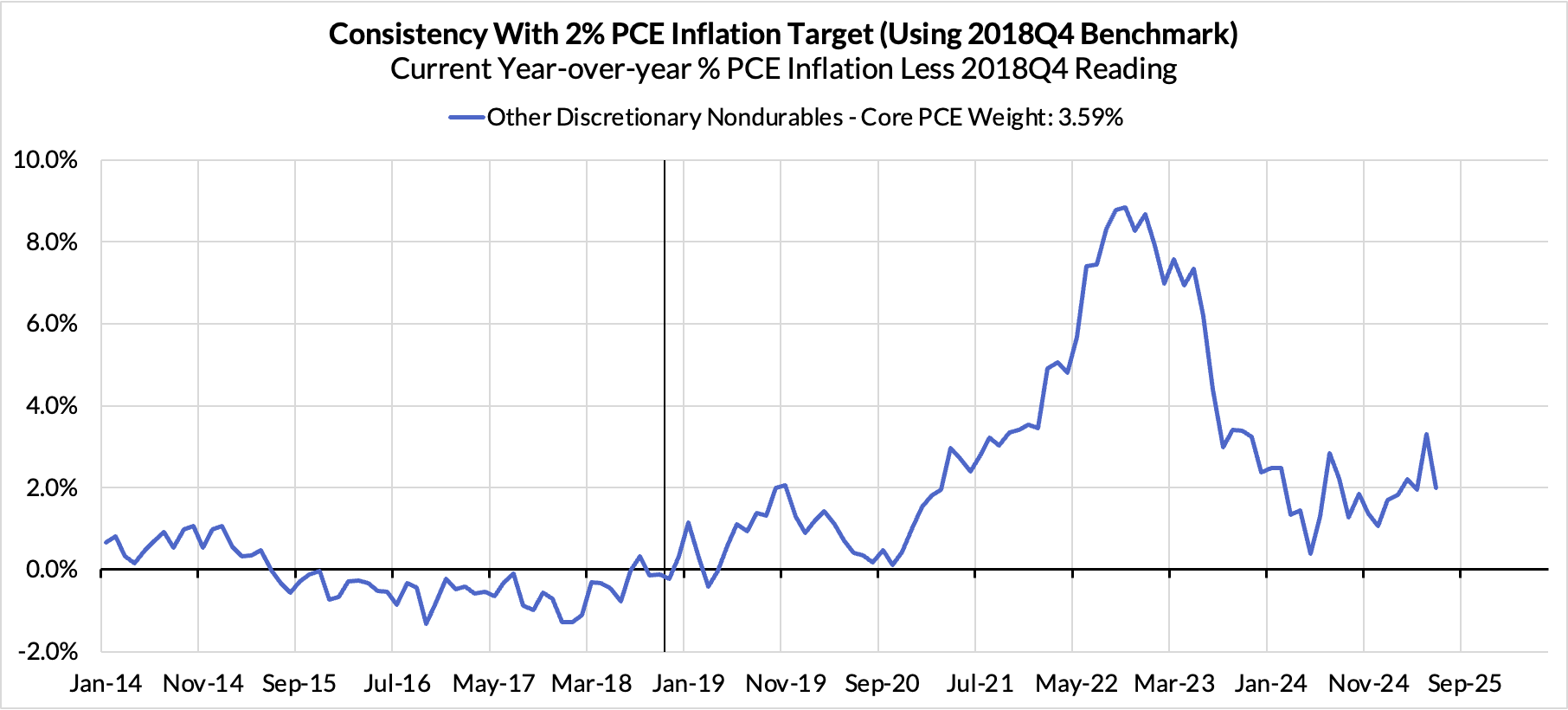

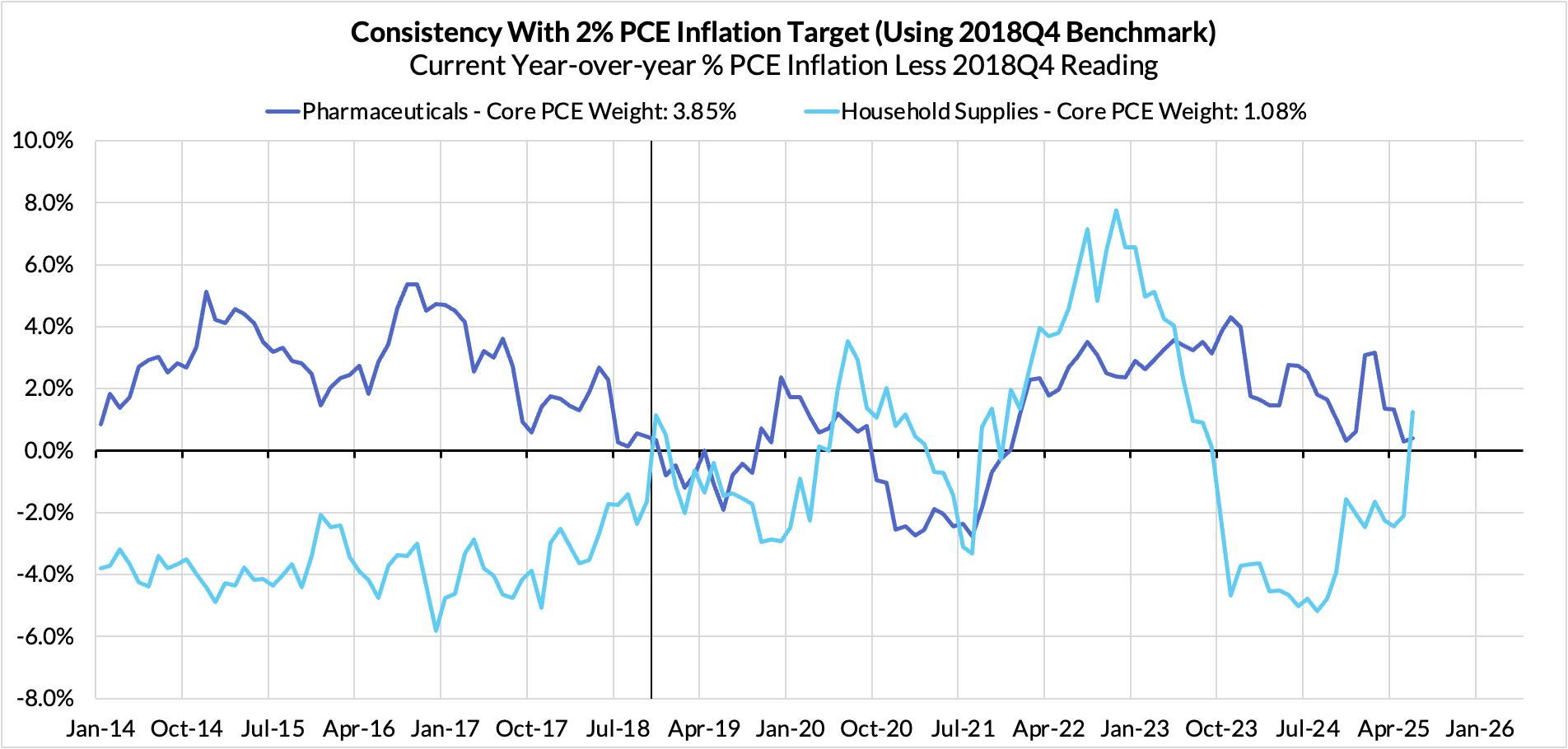

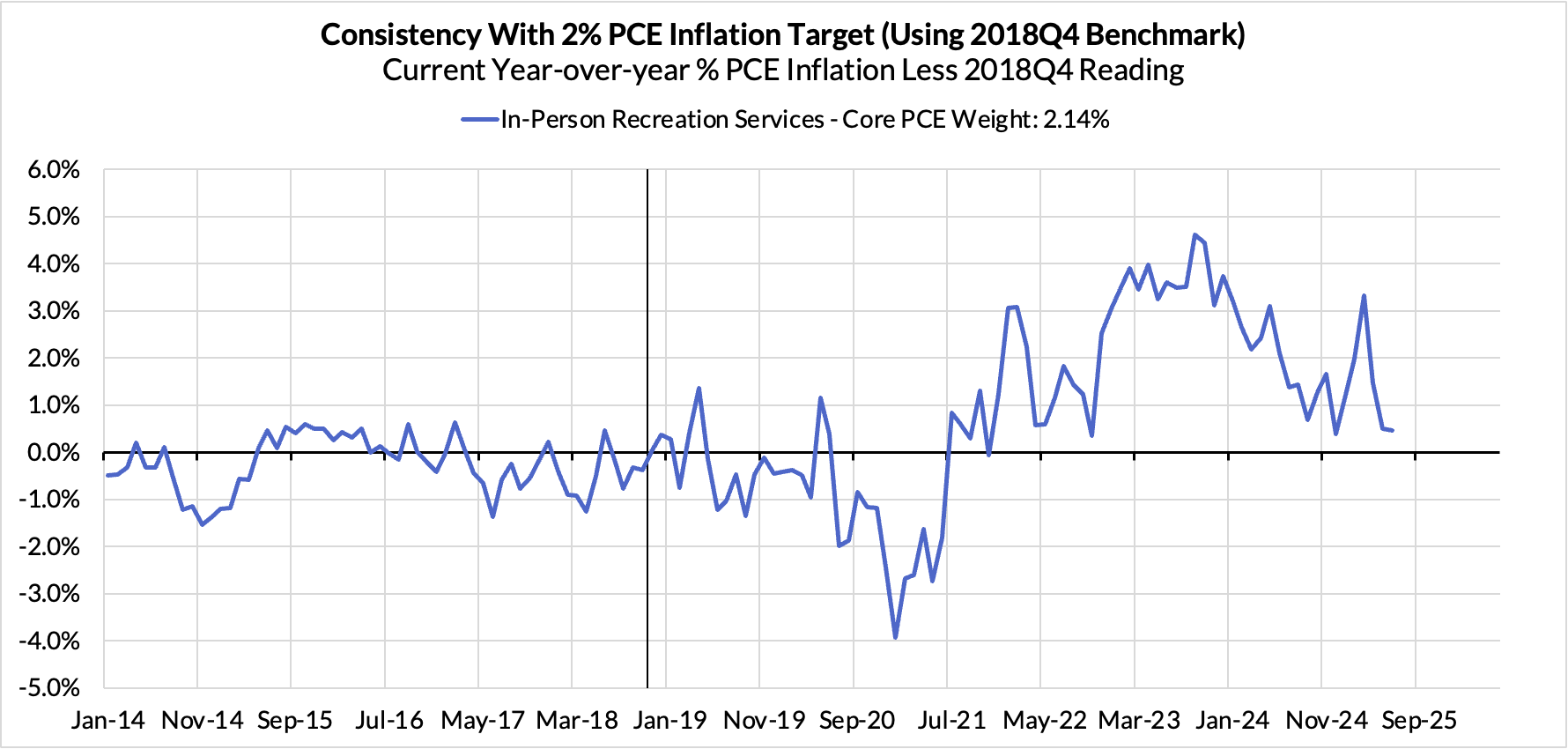

Across discretionary and nondiscretionary goods, we've already seen some acceleration, arguably faster than what would be predicted in a reasonable model for how tariffs get passed through. Were it not for the acceleration in goods prices, we might be celebrating the long-awaited return of inflation towards the 2% target. Markets would likely be more confident about the prospect for durable interest rate normalization, as would the Fed. Instead, we all have to wait and see how the price inflation data evolves. July will be the first month to substantially follow the expiry of the 90-day tariff pause, and August will be the first full month for assessing how the lapse of the pause affects pricing behavior.

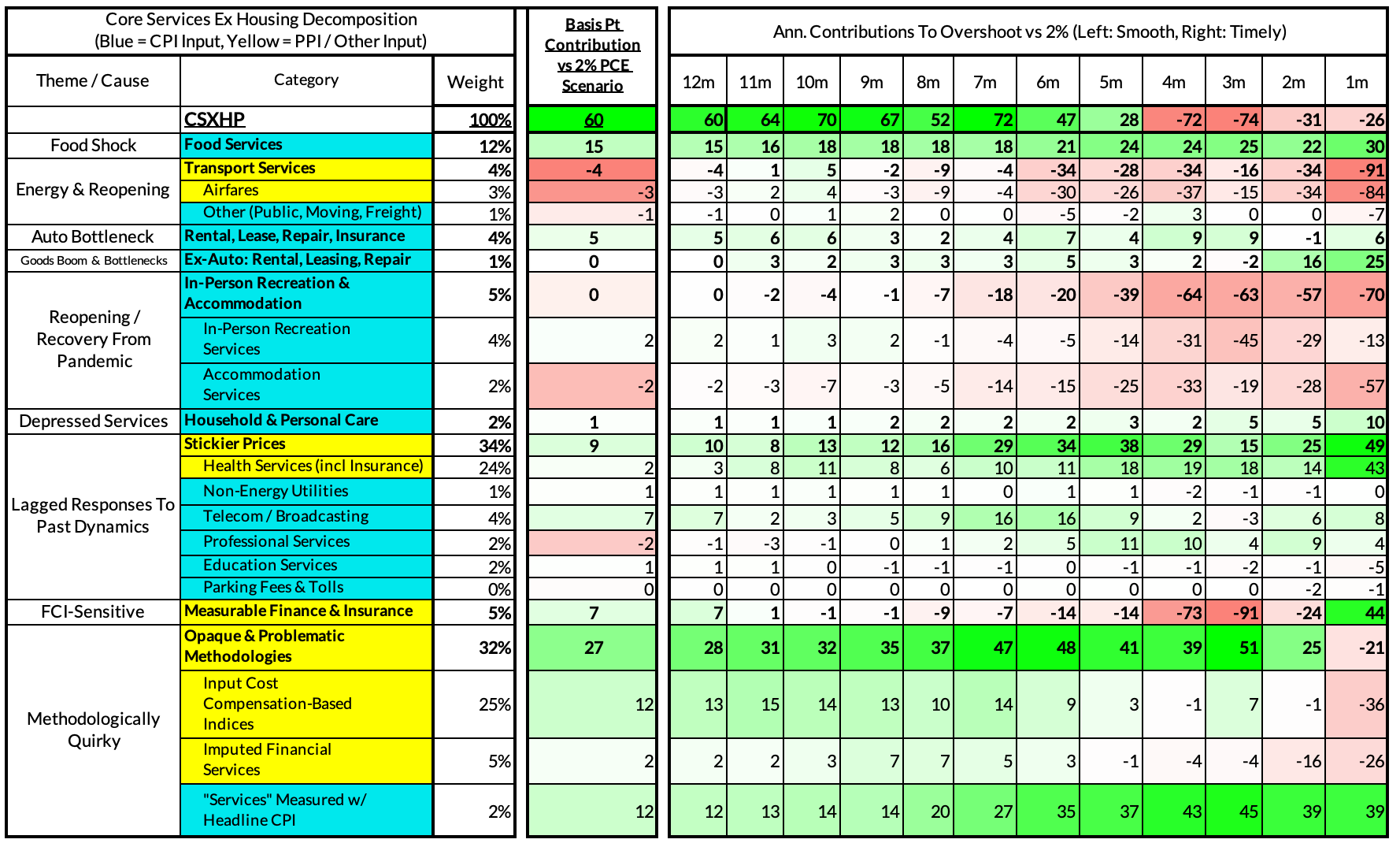

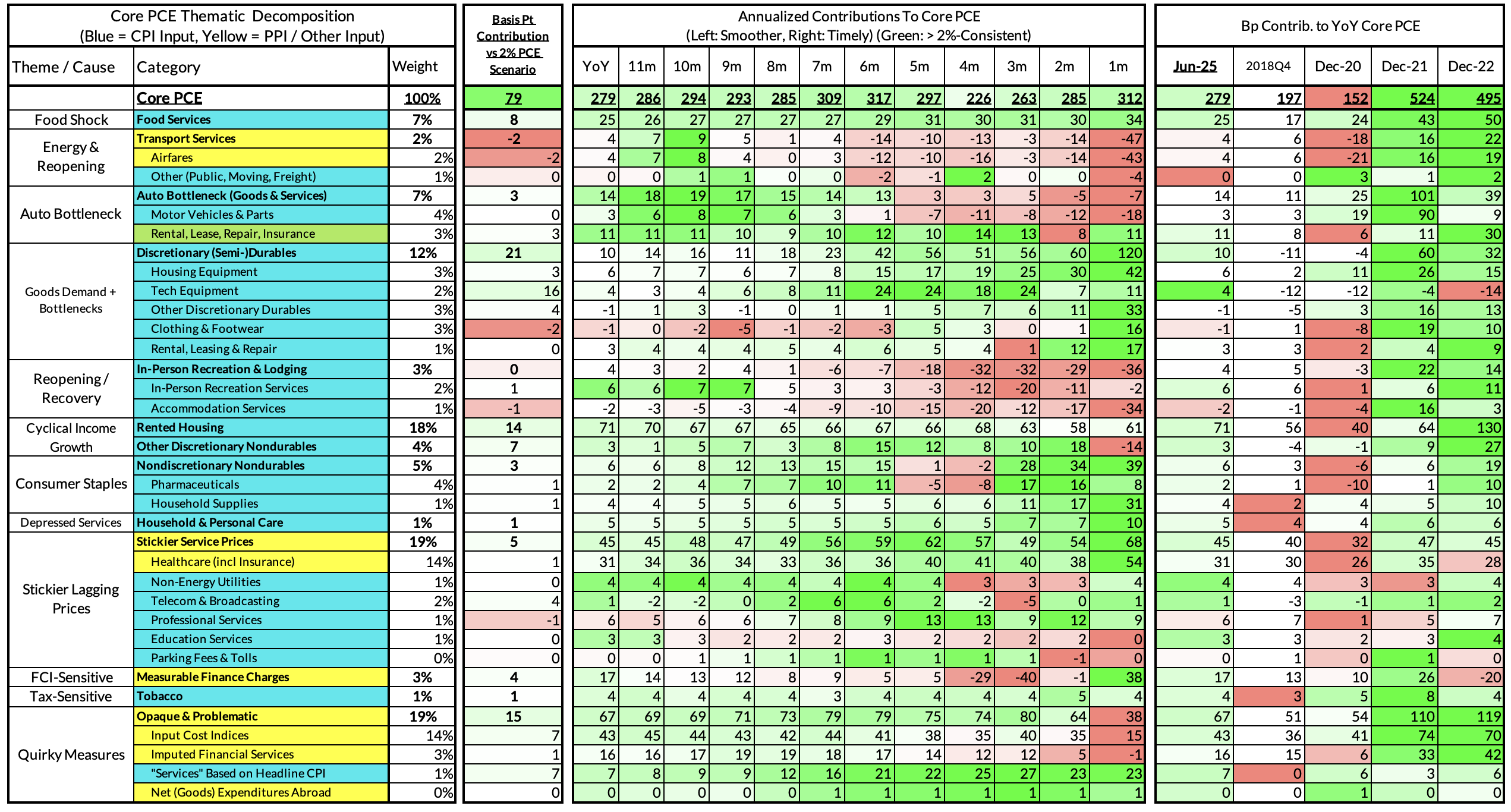

Inflation Overshoots At The Component Level

For the Detail-Oriented: Core PCE Heatmaps

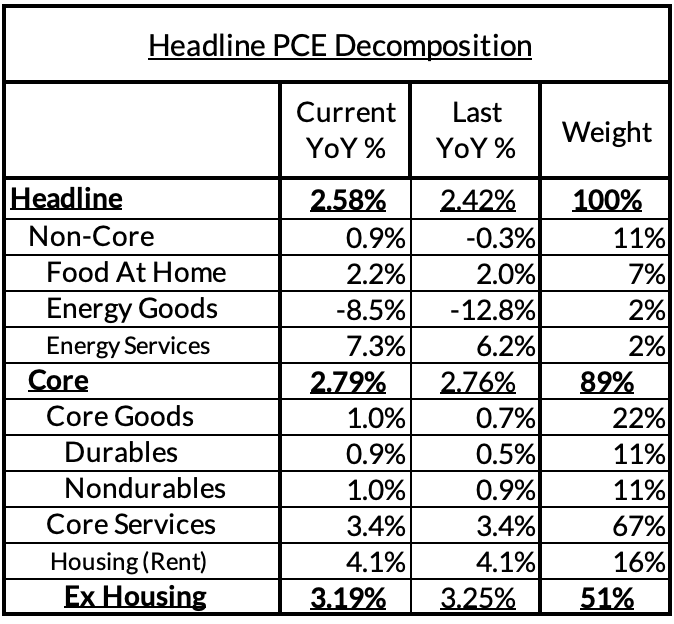

Right now Core PCE (PCE less food products and energy) is running at a 2.79% year-over-year pace as of June, 79 basis points above the Fed's 2% inflation target for PCE, 16 basis points higher than what was observed a month ago. That projected overshoot is still driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is on track to contribute 14 basis points to the 79 basis point Core PCE overshoot.

There are other contributors to the overshoot:

- Discretionary goods and adjacent services are adding 28 basis points now

- Nondiscretionary goods are adding 3 basis points

- Contributions from input cost indices (wages in specific sectors where market prices don't exist) are now adding 7 basis points to the overshoot

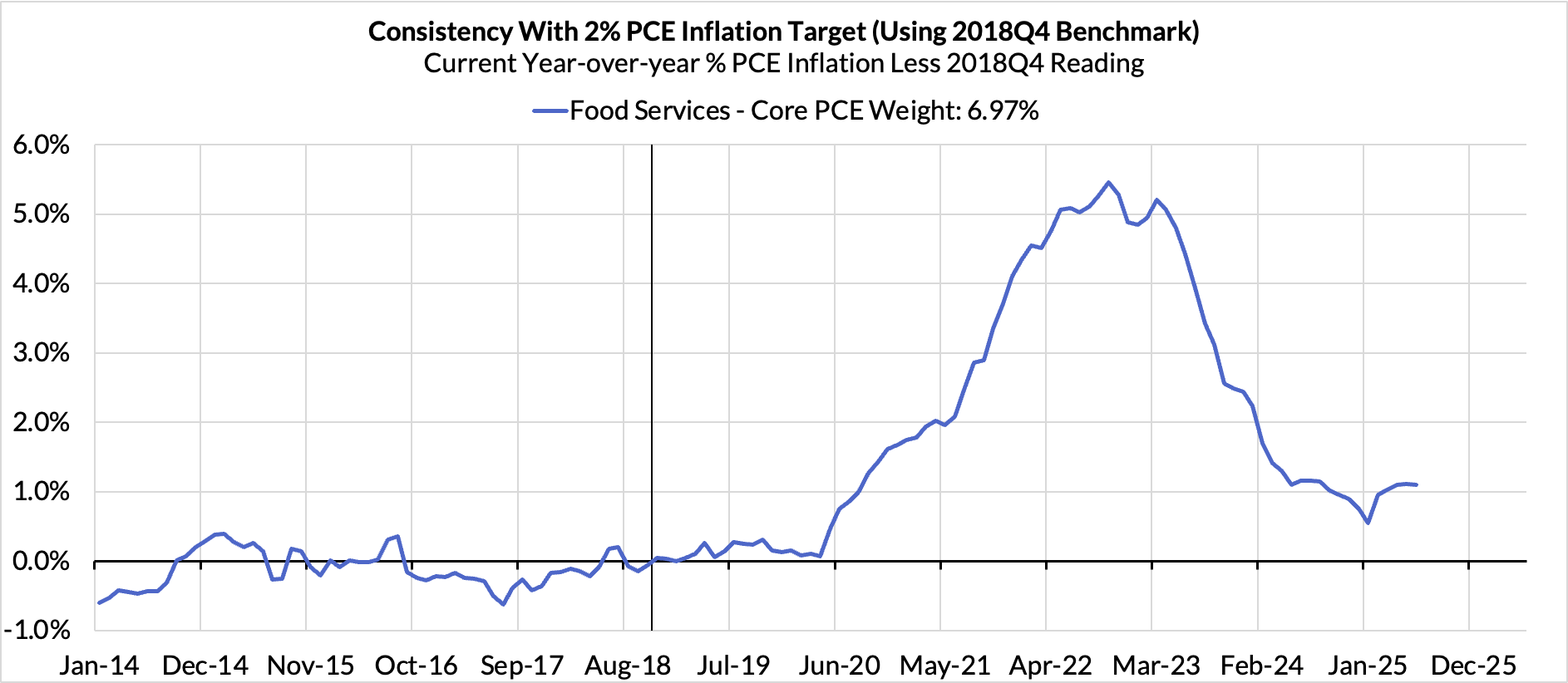

- Food inputs are adding 8 basis points to the overshoot

- Measured financial service charges are now adding only 4 basis points due to the equity market performance over the past 12 months

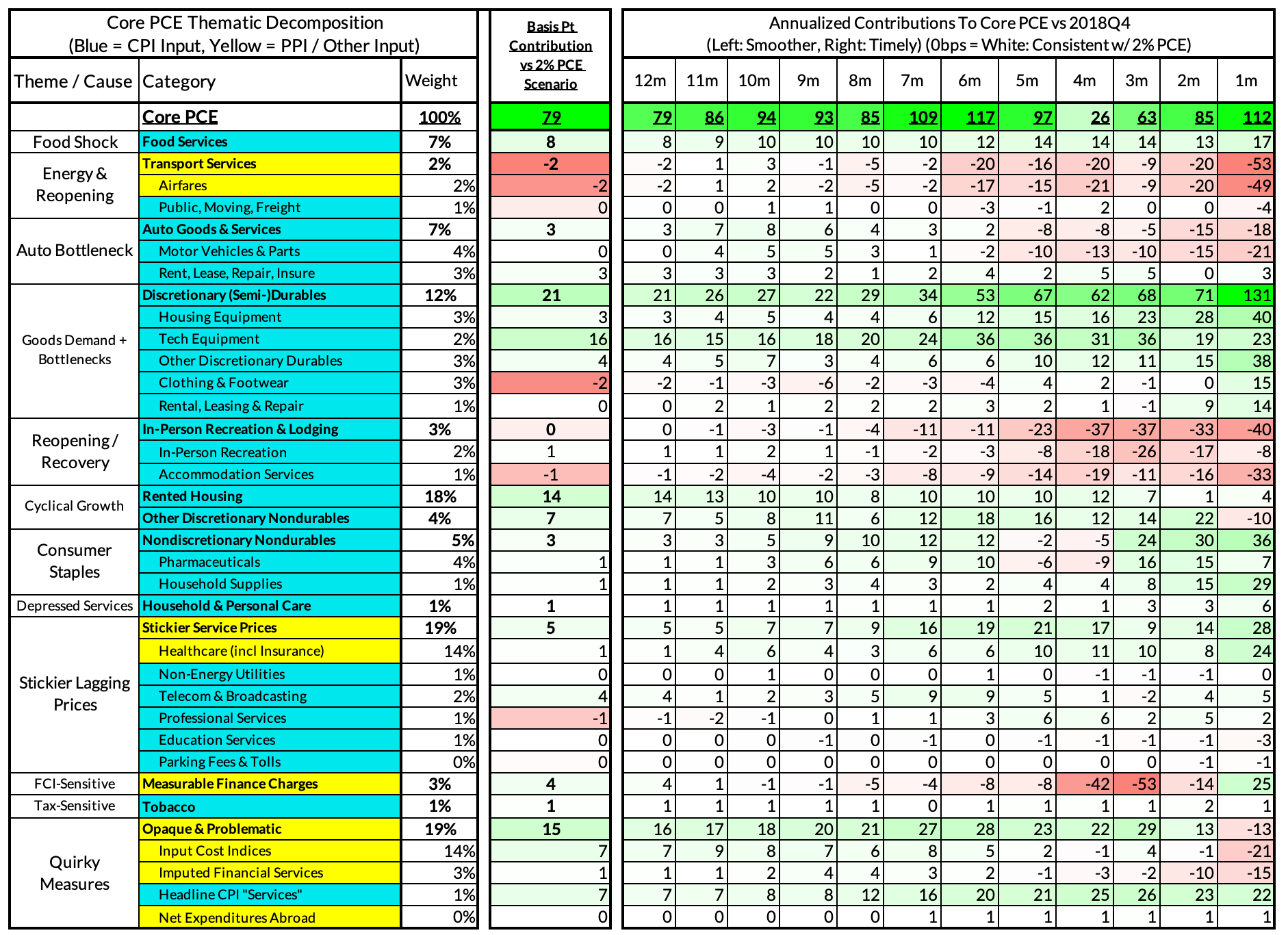

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. June monthly annualized Core PCE ran at a 3.12% annualized pace, a 112 basis point overshoot vs 2% target inflation.

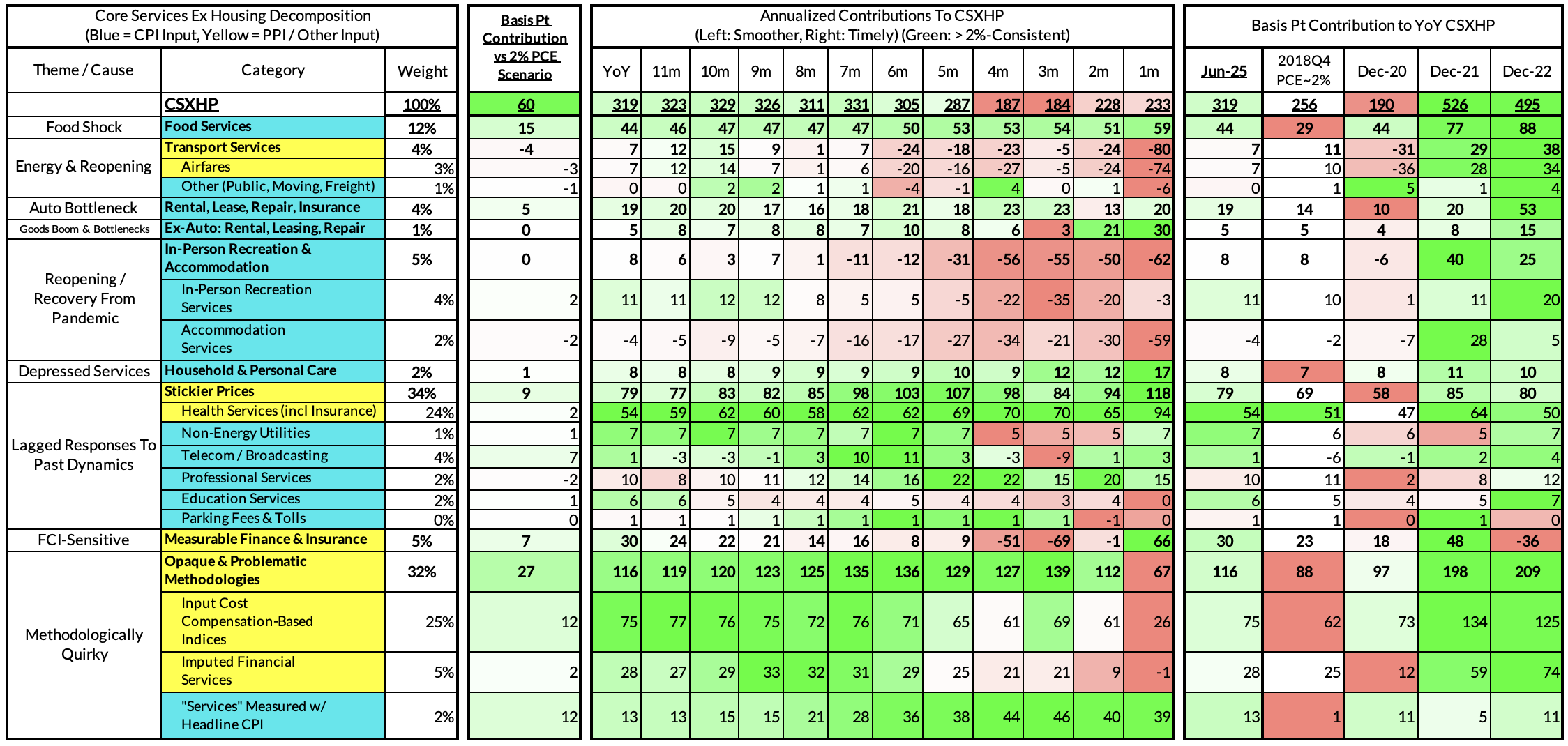

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The June growth rate in "Core Services Ex Housing" ('Supercore') PCE is running at a 3.19% year-over-year pace, a 60 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

June monthly supercore ran at a 2.33% annualized rate, a 26 basis point annualized undershoot of what would be consistent with 2% Headline and Core PCE.