January 2026 FOMC Preview

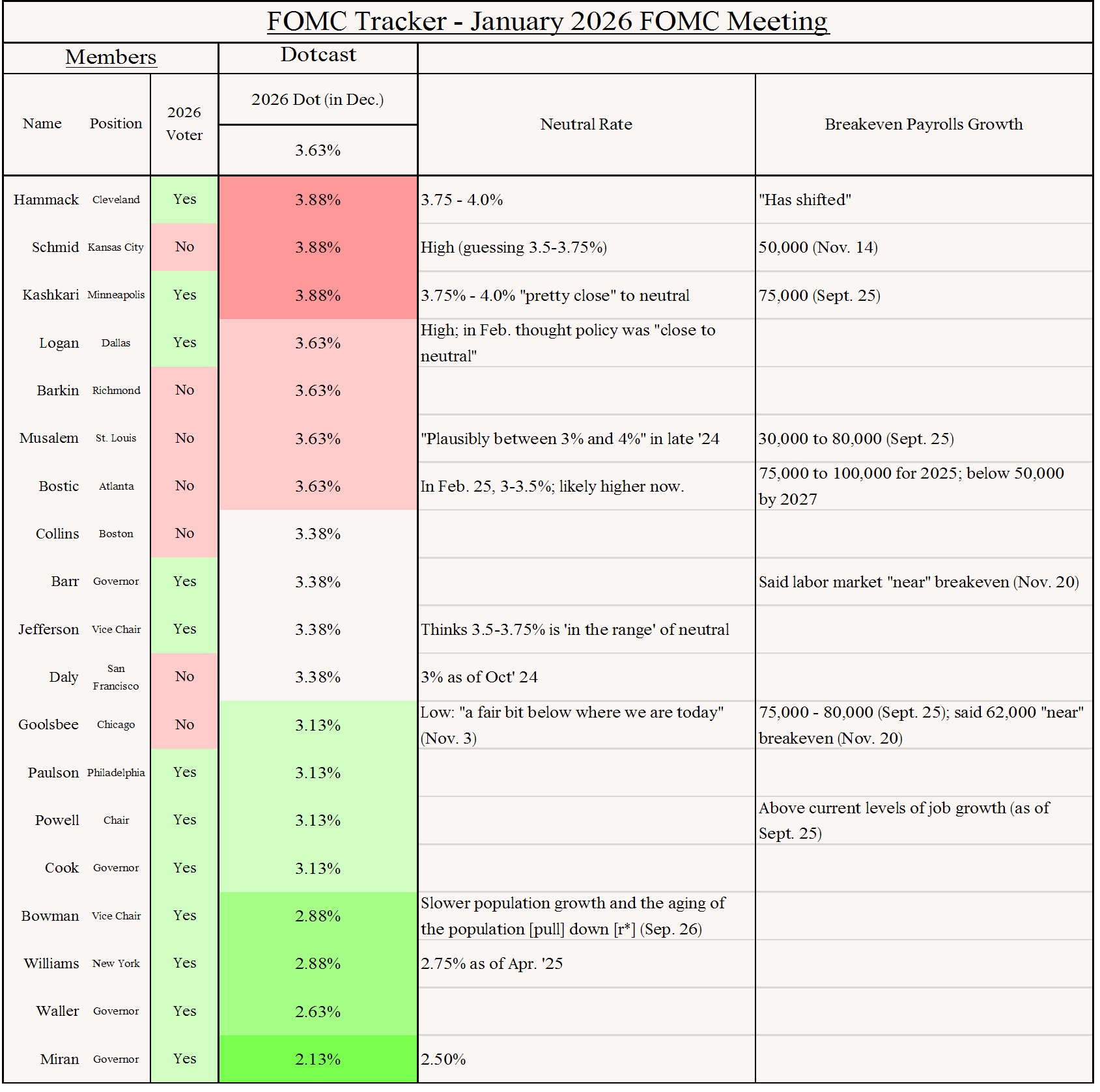

This has been one of the most telegraphed meetings in a while, as pretty much every FOMC member, from hawk to dove, has signaled their intent to hold rates for the near future, barring visible labor market stress.

This has been one of the most telegraphed meetings in a while, as pretty much every FOMC member, from hawk to dove, has signaled their intent to hold rates for the near future, barring visible labor market stress.

Note: Subscribers to MacroSuite receive our FOMC preview during the blackout period before each FOMC meeting. A public version of the preview will be released closer to the meeting. If you're interested in becoming a MacroSuite subscriber, please reach out to macrosuite@employamerica.org

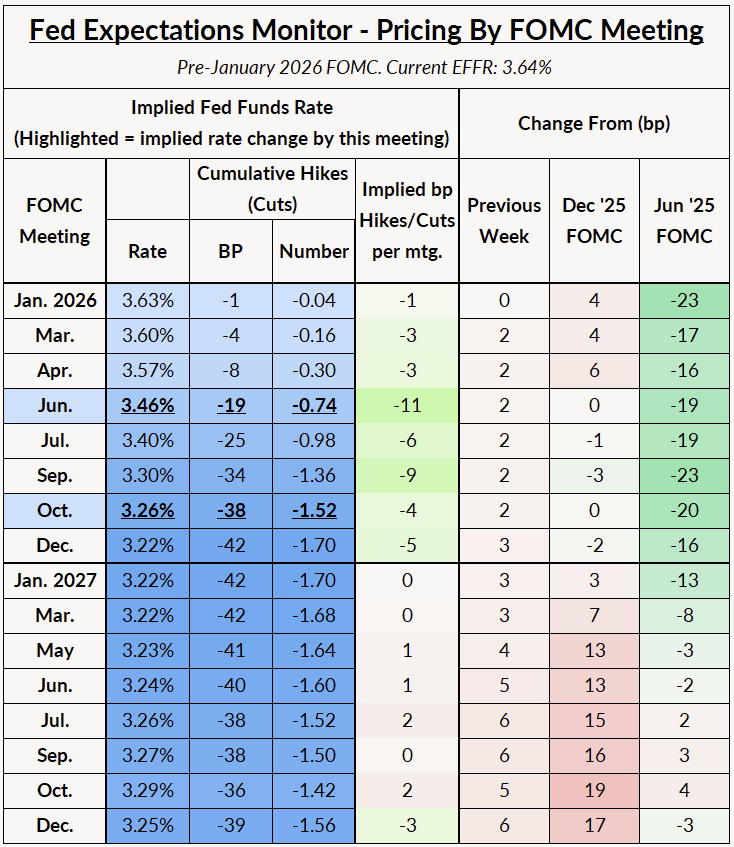

The Fed won't cut next week, and probably not at the following meeting in March. Frankly, we don't expect anything interesting in terms of communicating future policy. This has been one of the most telegraphed meetings in a while, as pretty much every FOMC member, from hawk to dove, has signaled their intent to hold rates for the near future, barring visible labor market stress (barring Stephen Miran).

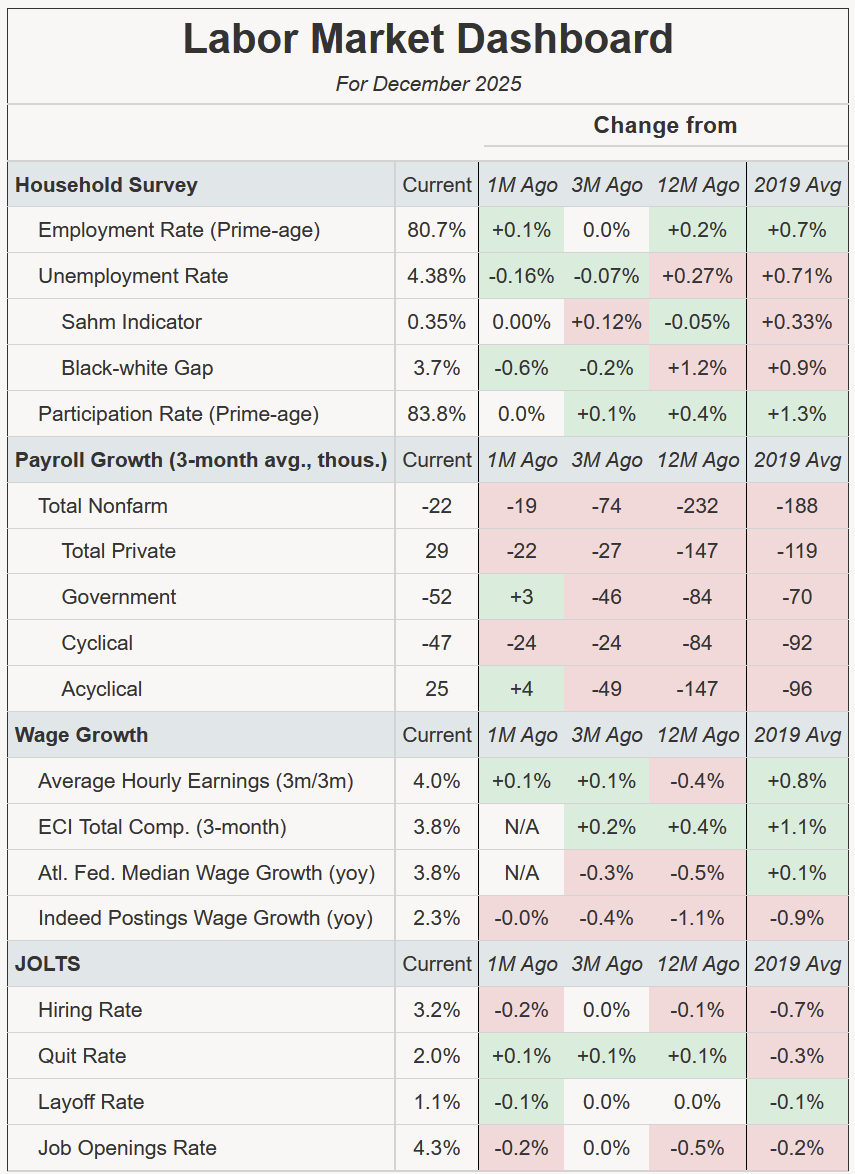

That labor market stress simply hasn't shown up. The labor market looks like it reaching some kind of stabilization, with the unemployment falling below 4.4% in the December 2025 jobs report. Despite the increase in the unemployment rate this year, the labor force participation and employment rates have been steady (or even rising) over the past year, especially among prime-aged workers. Employment for most groups has improved for most groups since the unemployment rate was 3.5%, except for workers under the age of 30. While we do still see a very sluggish labor market in terms of growth, hiring, and dynamism, we don't see any signs of imminent deterioration.

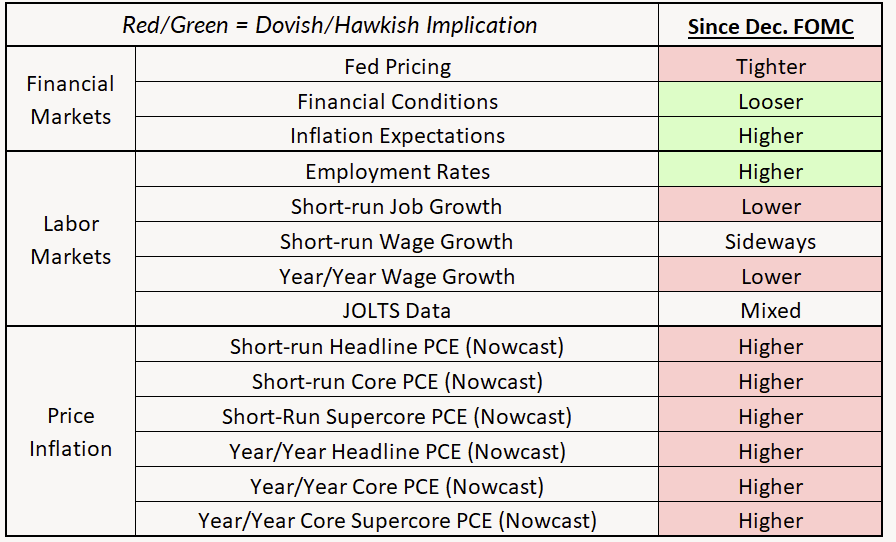

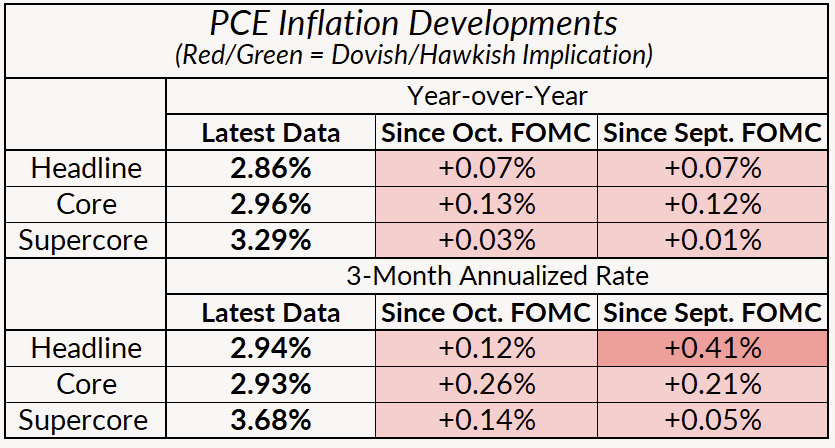

Meanwhile, inflation remains elevated and the Fed still has no data on Q1, when many businesses reset prices. We do not expect any dovish signals next week, with the Fed fully in wait-and-see mode for the next couple meetings.

In that light, the ensuing press conference is sure to focus on the battle over Fed independence given the Department of Justice's criminal investigation into Powell and Lisa Cook's case at the Supreme Court. Powell's statement on Sunday is the strongest pushback we've seen from him on Fed independence, and potentially points towards him staying on the Board beyond his term as Chair.

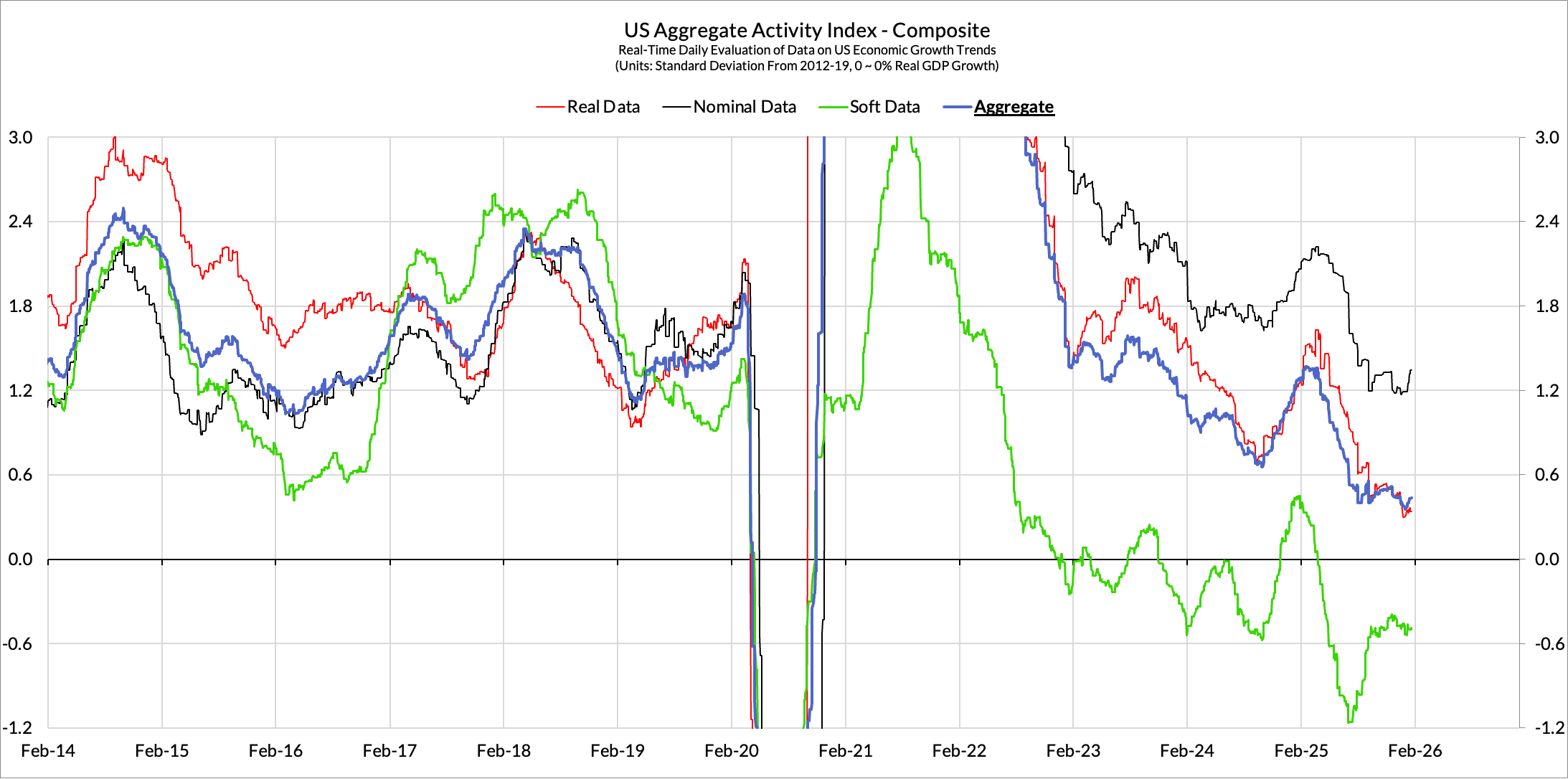

On one hand, the labor market is not as dire as the increase in the unemployment rate would suggest. Strong employment levels and participation suggest some underlying strength int he labor market, at least for now. The impulse of the recovery over the last four years is still being felt.

However, we think the downside risks to the labor market are higher than both the market and the FOMC think. FOMC members' predictions, both in their dots and their Fedspeak, are relatively sanguine. While markets and most of the Committee see no more than 2 rate cuts this year, we think there's an underappreciated possibility that further labor market slowdown or a tech asset collapse necessitate more cuts.