Note: Subscribers to MacroSuite receive our FOMC preview at the beginning of the blackout period before each FOMC meeting. A public version of the preview will be released closer to the meeting. If you're interested in becoming a MacroSuite subscriber, please reach out to macrosuite@employamerica.org

Takeaway:

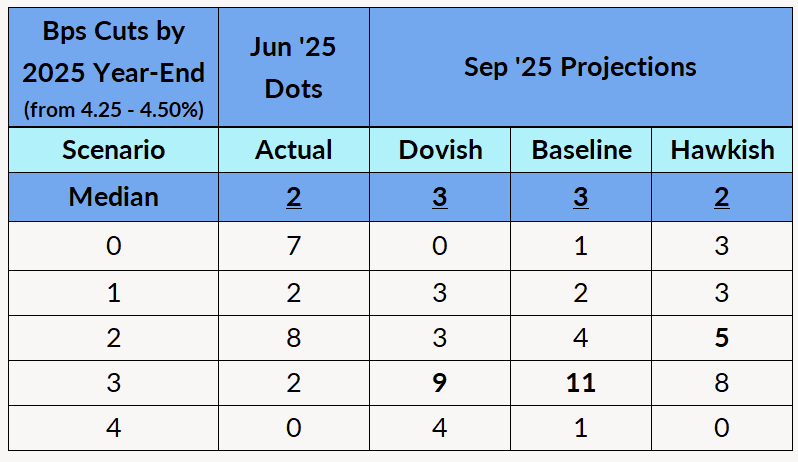

After a sufficiently worrying jobs report, a 25bp cut at next week’s meeting is a lock—with a slight possibility of a 50bp cut. We expect most members to pencil in 75bps of cuts over the next three meetings.

Even if the jobs data as a whole doesn’t look that dire, flirting with negative payrolls growth is a scary place for the Fed to be given the uncertainty around how changes to immigration are affecting the payrolls growth numbers. In our baseline scenario, we expect the bulk of the Committee to move to 75bps of cuts in 2025, with a few holdouts at 50bps of cuts and a small minority with just 0 or 25bps of cuts.

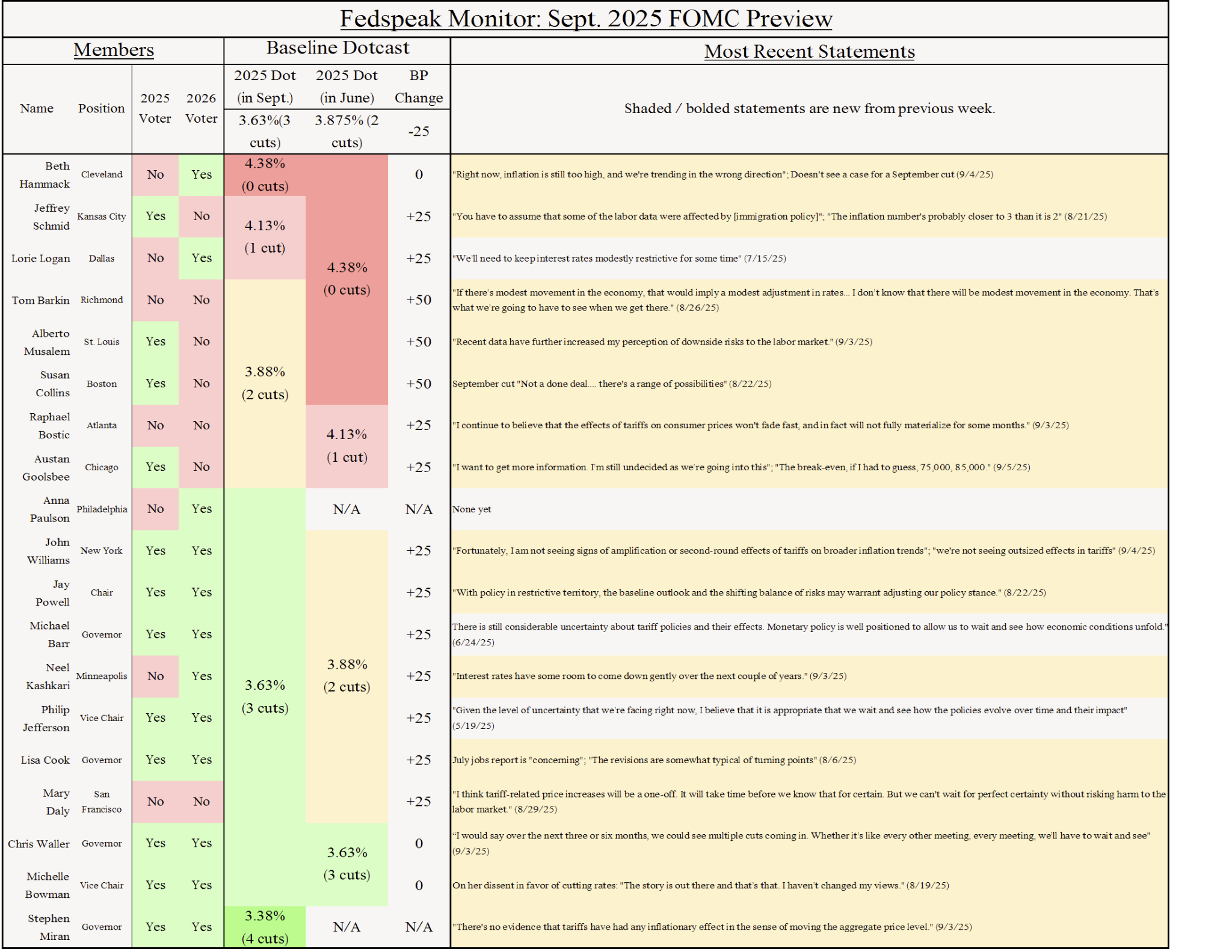

A 50bp cut is a scant possibility, but it is hard to see how it happens. The 50bp cut last September came with about a 0.5pp rise in the unemployment rate over the earlier months in the year and continued cooling of the core PCE price index. The push for a 50bp cut seemed to also come from Powell last year—it’s not obvious he’ll do so again. We wouldn’t be surprised to see Waller and Bowman (and perhaps Daly and Miran, if he’s confirmed before the meeting) advocate for 50bps, but it seems like quite a lift to get a majority of the votes there (and would likely come with multiple dissents). In a dovish scenario, they advocate for 100bps of cuts this year.

What remains to be seen is how much they will signal about the remainder of 2025. We have almost no Fedspeak since the August jobs report, just one interview with Goolsbee who even then was not committed to a September cut. There’s a lot of uncertainty about exactly how worried the Committee is, and we expect there to be a wide range of views. In our hawkish scenario, the core hawks (Hammack, Logan and Schmid) are undeterred by the labor market data; the modal member pencils in three cuts but the median remains at two.

Latest Fedspeak and Dot Projections

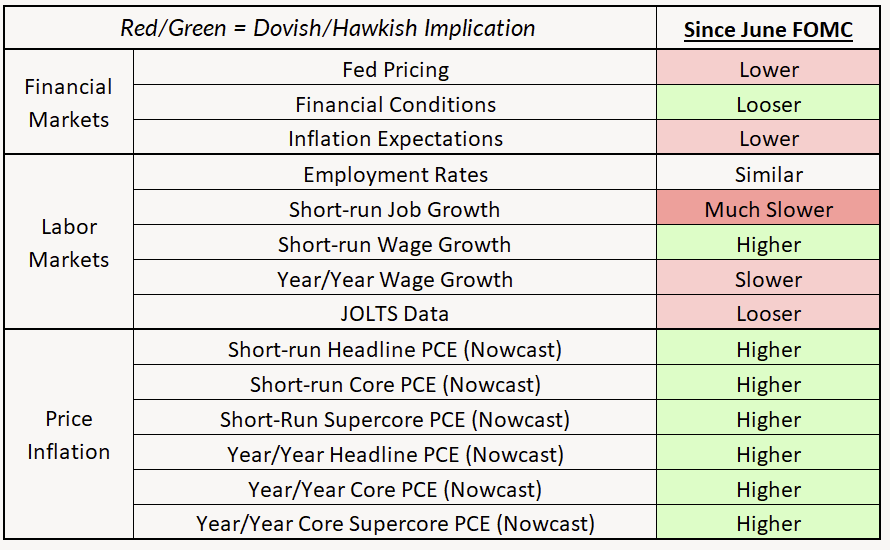

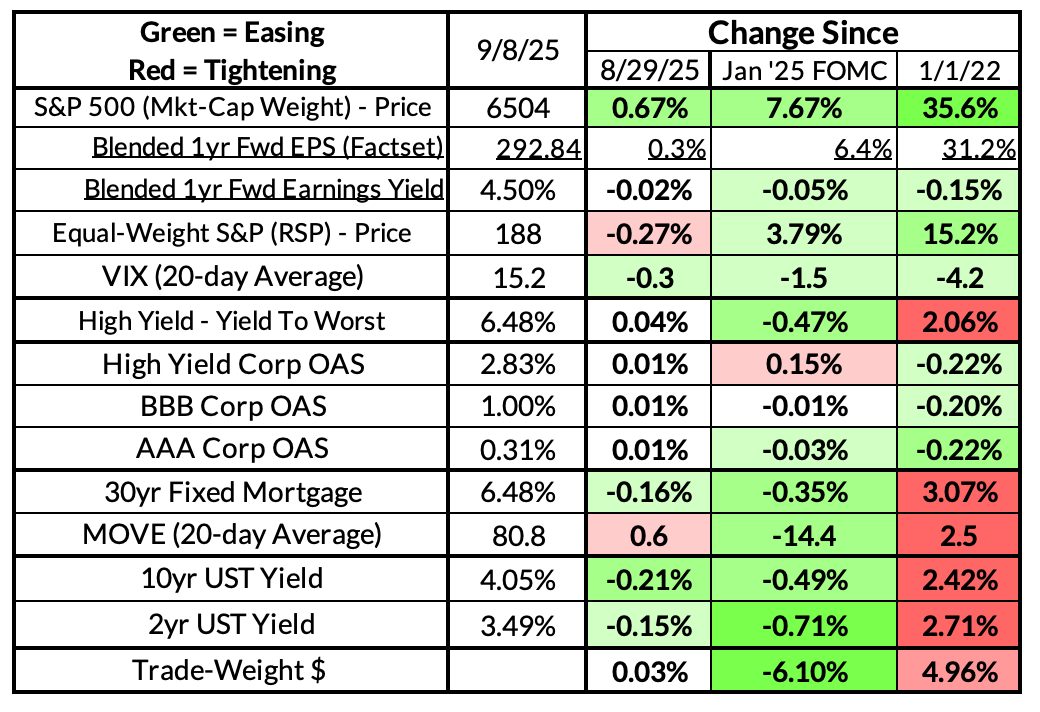

What’s Happened Since the Last Meeting

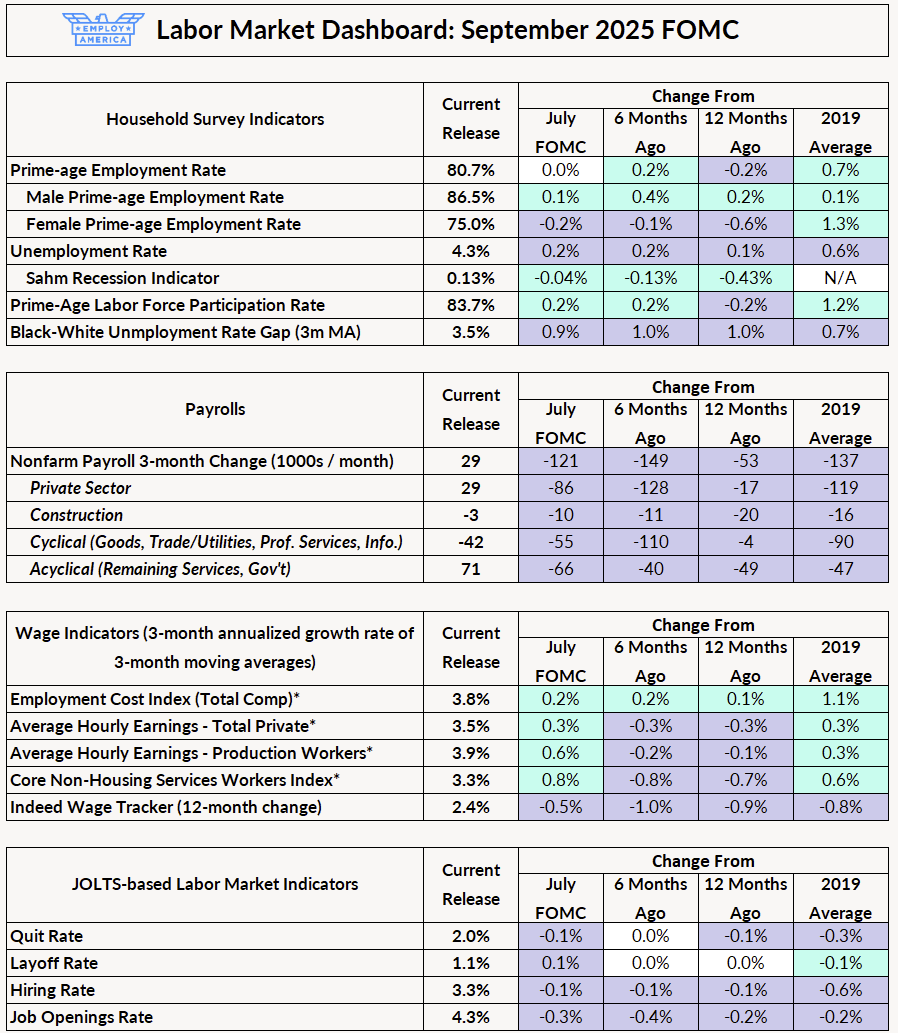

The biggest economic development since the last meeting is the soft payroll print on Friday, which showed under 30,000 jobs per month over the last three months, and revised June’s jobs growth to negative. Add to that a large downward revision from the preliminary QCEW benchmark, and payroll growth looks nearly recessionary. One topic of disagreement on the Committee has been whether or not to see slow payrolls growth as a worrying sign, given the slowdown in immigration. People are generally choosing to place more weight on other measures like the household survey, but a few members of the Committee have shared their views on where they think breakeven payrolls growth is. Bostic, Musalem, and Goolsbee—none of whom were particularly rushed about cutting—have cited breakeven rates anywhere between 30,000 and 80,000. So, the recent slowdown in payrolls should be worrying even to the hawkish side of the Committee.

That being said, the unemployment rate has only crept up slightly and employment rates, including prime-age employment rates, are holding firm. Wage growth has edged down only slightly, and still remains very healthy. JOLTS measures are generally flat as they have been for months, with job openings sliding a bit. Initial unemployment claims did come in on Thursday at 263,000, its highest since 2021, but that appears to be almost entirely due to a one-off event related to flooding in Texas.

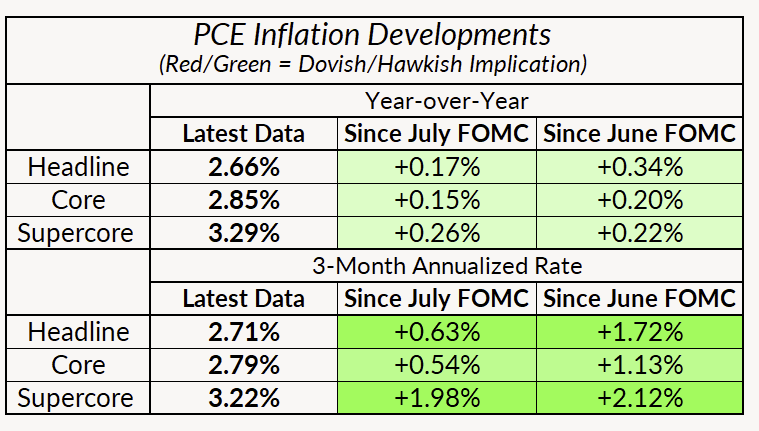

Meanwhile, PCE inflation hasn’t come in too hot. While CPI came in hot in August, the relevant components for PCE were cool; we are now tracking a 16bp reading in core PCE for August and 2.85% year-on-year (the last SEP had core PCE at 3.1% for the year). Ever since Powell’s Jackson Hole speech, the inflation data is less high-leverage now that the bulk of the Committee seems willing to adopt Waller’s stance of looking through tariff inflation.

Finally, we have new Fed personnel. Anna Paulson will replace Patrick Harker as the President of the Cleveland Fed. The Senate is trying to confirm Stephen Miran to replace Kugler, but it’s unclear if that will happen before the meeting. If so, we expect him to pencil in 100bp of cuts for 2025.

Key Fedspeak since the Last Meeting

Powell: "With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

Bowman: "I see it as appropriate to begin gradually moving our moderately restrictive policy stance toward a neutral setting"

Cook: "The revisions are somewhat typical of turning points"

Waller: "I would say over the next three or six months, we could see multiple cuts coming in. Whether it’s like every other meeting, every meeting, we’ll have to wait and see"

Bostic: "Estimates from our staff suggest that the breakeven level has declined from 125,000 to 150,000 new jobs a month to around 75,000 to 100,000 a month for 2025, and could continue to fall to a number below 50,000 per month in the next two years"

Goolsbee: Job growth in Friday’s report was “definitely” below what is needed to hold the unemployment rate stable."

Hammack: "Right now, inflation is still too high, and we're trending in the wrong direction,"

Schmid: "There's somewhat of a lean towards an agility towards rising prices in the 3rd or 4th quarter."

Musalem: "I expect the labor market to gradually cool and remain near full employment with risks tilted to the downside. Recent data have further increased my perception of downside risks to the labor market… Breakeven estimates are currently in the range of 30,000 to 80,000 jobs per month"

Daly: "I think tariff-related price increases will be a one-off. It will take time before we know that for certain. But we can't wait for perfect certainty without risking harm to the labor market."

What we’re thinking

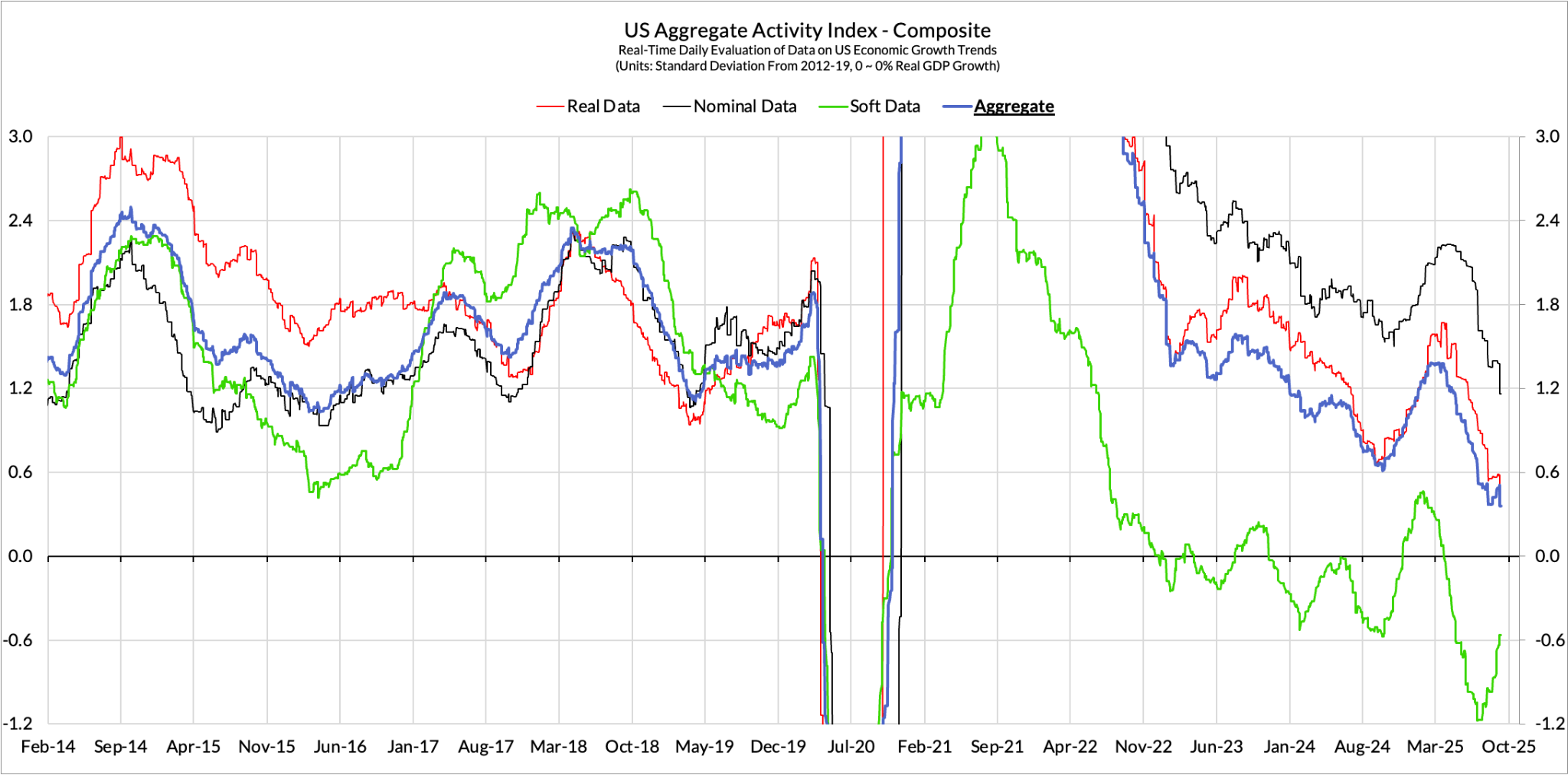

A 25bp cut at next week’s meeting would be appropriate. The labor market risks we have been warning about on the payrolls side look like they may be materializing, as cyclical sectors are now losing jobs and acyclical sectors are slowing down. Payroll growth generally does not slow down this much outside of a recession (or immediately preceding a recession). That alone signals enough risk that the Fed should start normalizing next week.

However, a broader view of the labor market suggests that the labor market risks aren’t imminent. Household survey measures—which may be more reliable right now—show health rates of participation and employment. Nominal income growth measures are still stable. Tariffs are beginning to show up in inflation, but less than anticipated; however, there do remain inflationary impulses to come from tarifs and electricity.

One final note: since the previous meeting, the Fed has released its 2025 Framework Update. While the new Framework does not contain all of the changes we would have liked to see, especially around supply dynamics and nominal income measures, we are heartened to see that the Framework kept many of the aspects of the previous Framework that emphasized the importance of Full Employment, despite those aspects receiving undue criticism for the Fed’s response (or lack thereof) to inflation in 2021.

How Has The Data Evolved Since Last FOMC?