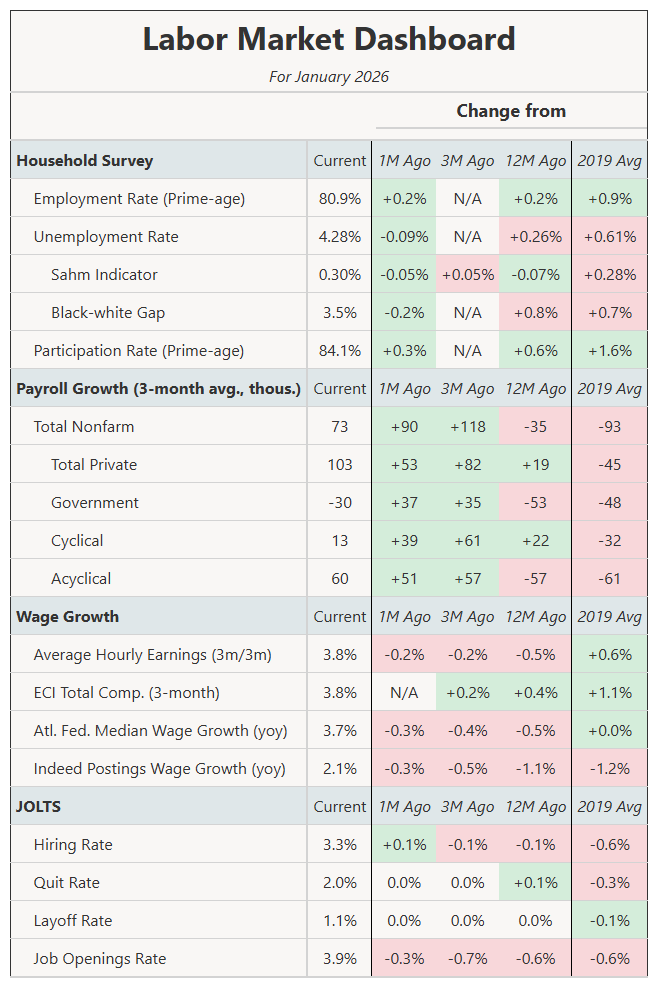

The labor market added 130,000 jobs in January 2026. The unemployment rate fell to 4.28% from 4.38% in and prime-age employment rose 0.2pp to match its cycle high at 80.9%. Quit, hire and layoff rates remained relatively stable.

While most are focusing on the benchmark revisions to the past couple of years showing lower payroll growth than normal, the interesting development to us is the continued good news in the household survey. The details of the household survey were unambiguously good, with increasing employment and participation, lower part-time underemployment, and an improving composition of employment and unemployment.

The Household Survey is All Good News

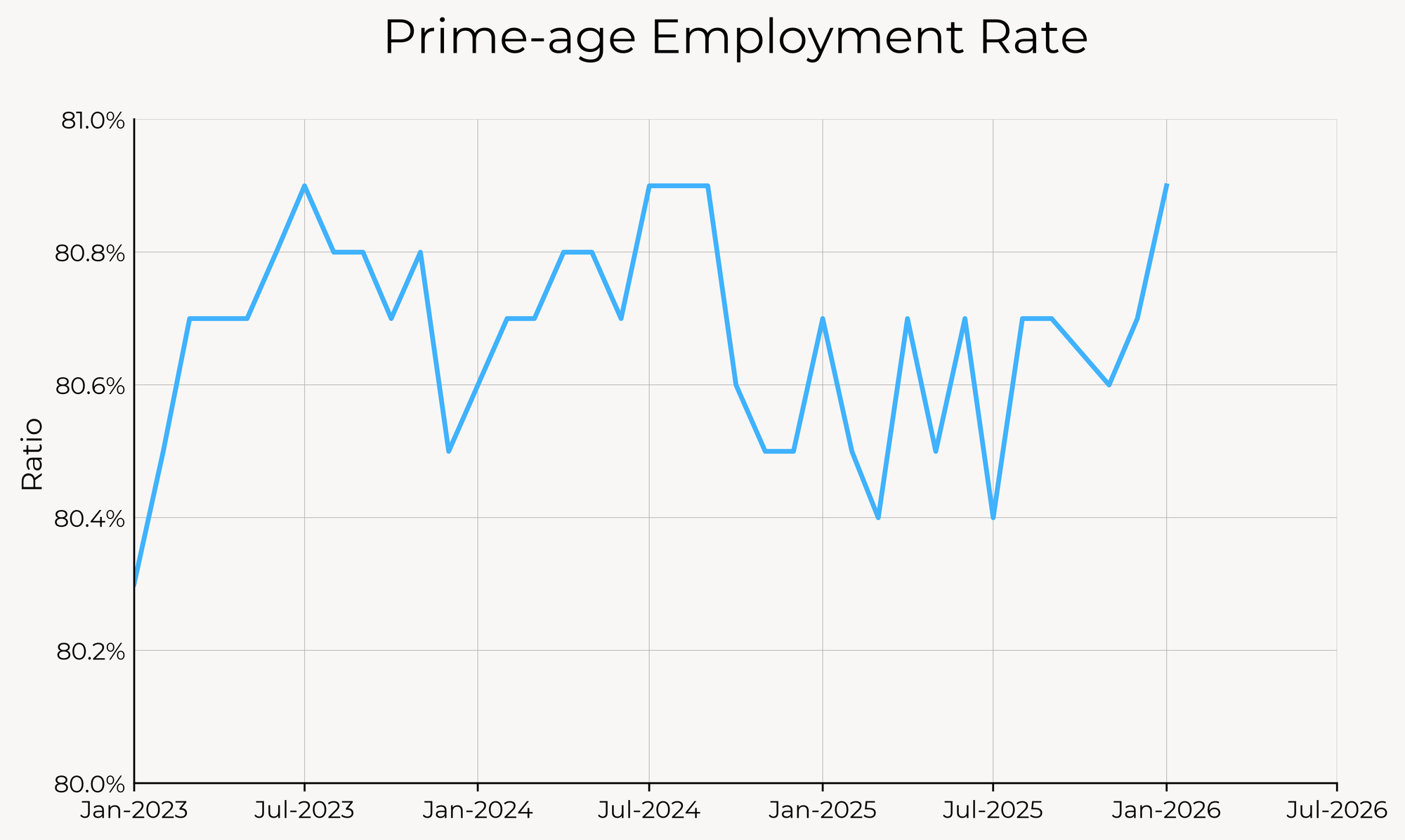

It’s hard to find anything to complain about in the January household survey. The unemployment rate continued to drop after December’s decline, and has now fallen to 4.28% from 4.54% two months ago. Prime-age employment, our favorite measure of labor market health, reached its cycle high of 80.9%:

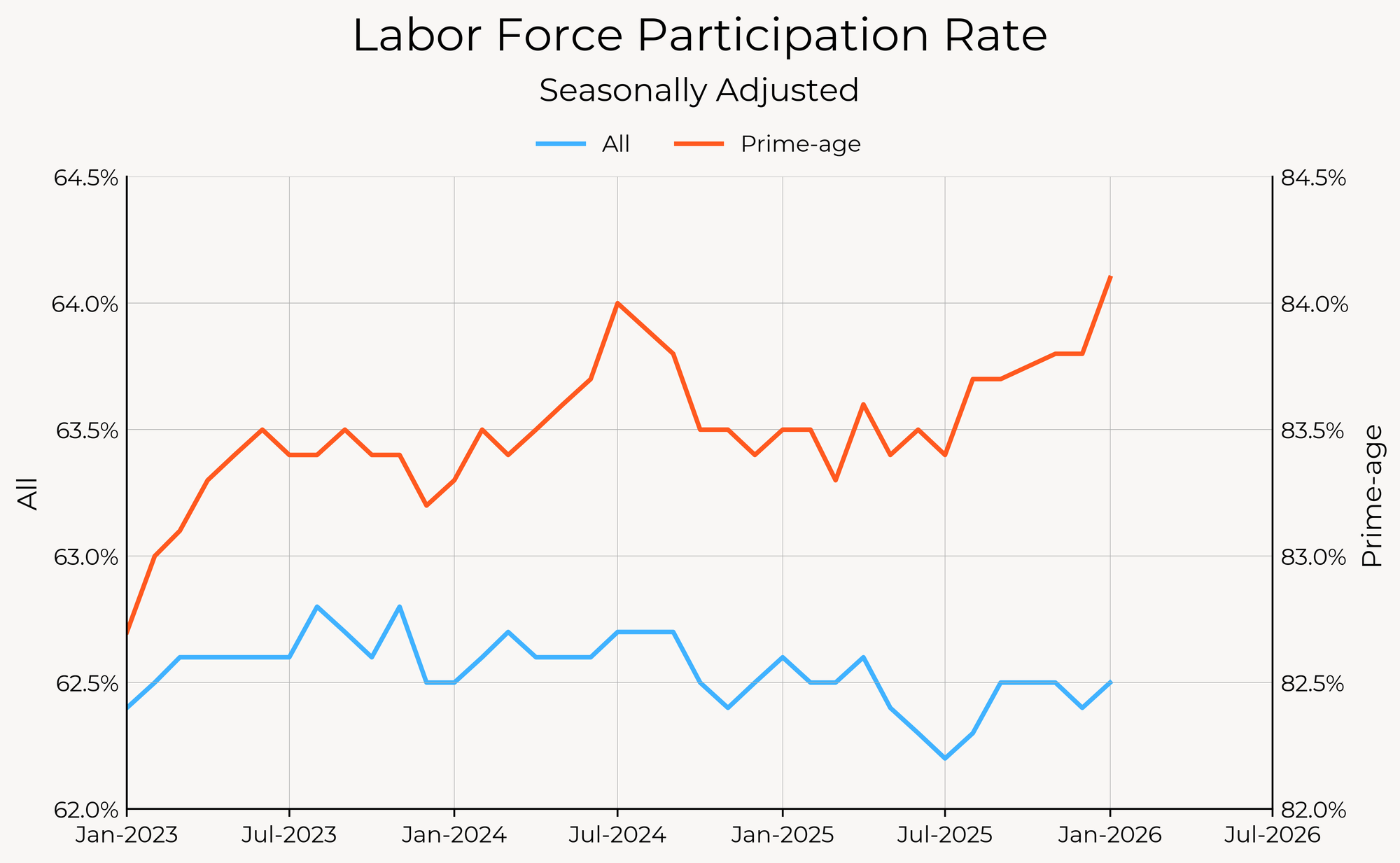

That local peak in employment is also matched by good news in labor force participation: prime-age labor force participation reached its highest level in nearly 25 years.

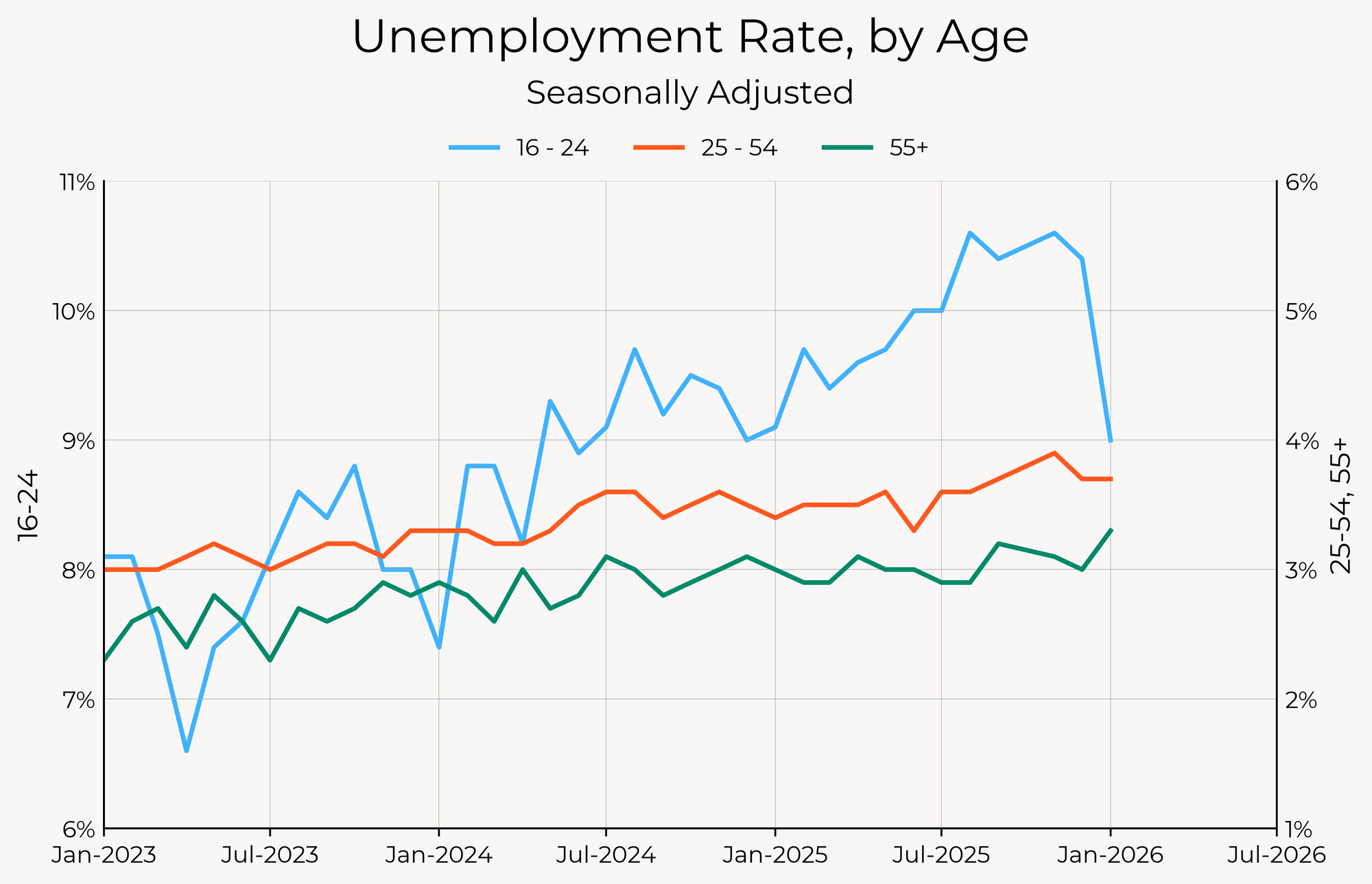

Two developments stand out in terms of accounting for the good news in the household survey. The first is a sharp decline in youth unemployment, which has been growing quickly over the past two years. The decline in youth unemployment this month basically erased the increases seen in all of 2025.

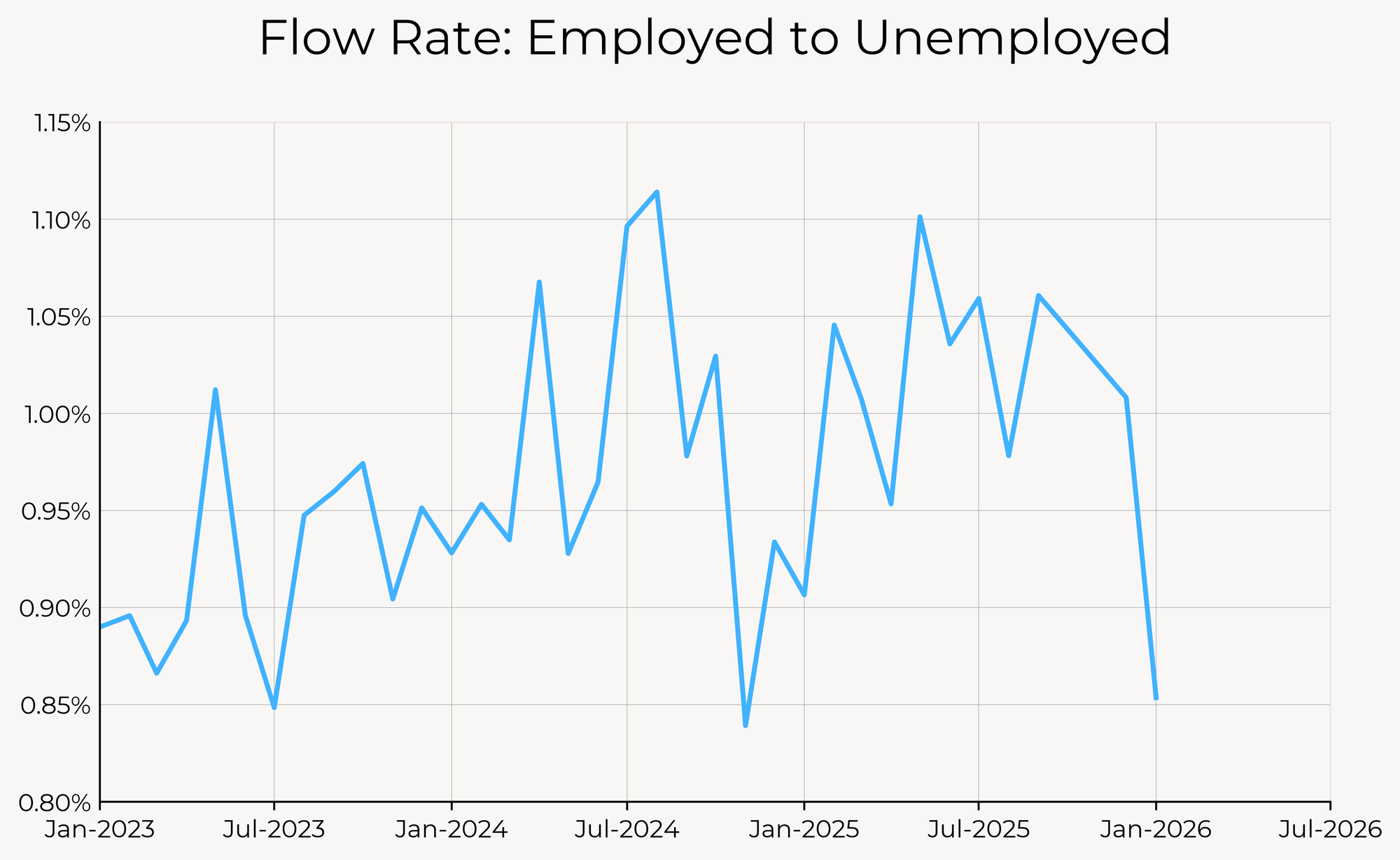

The second is a sharp decline in flows from employment to unemployment. Relatively few people lost their jobs last month (on a seasonally-adjusted basis). This month was low-hire, really low-fire.

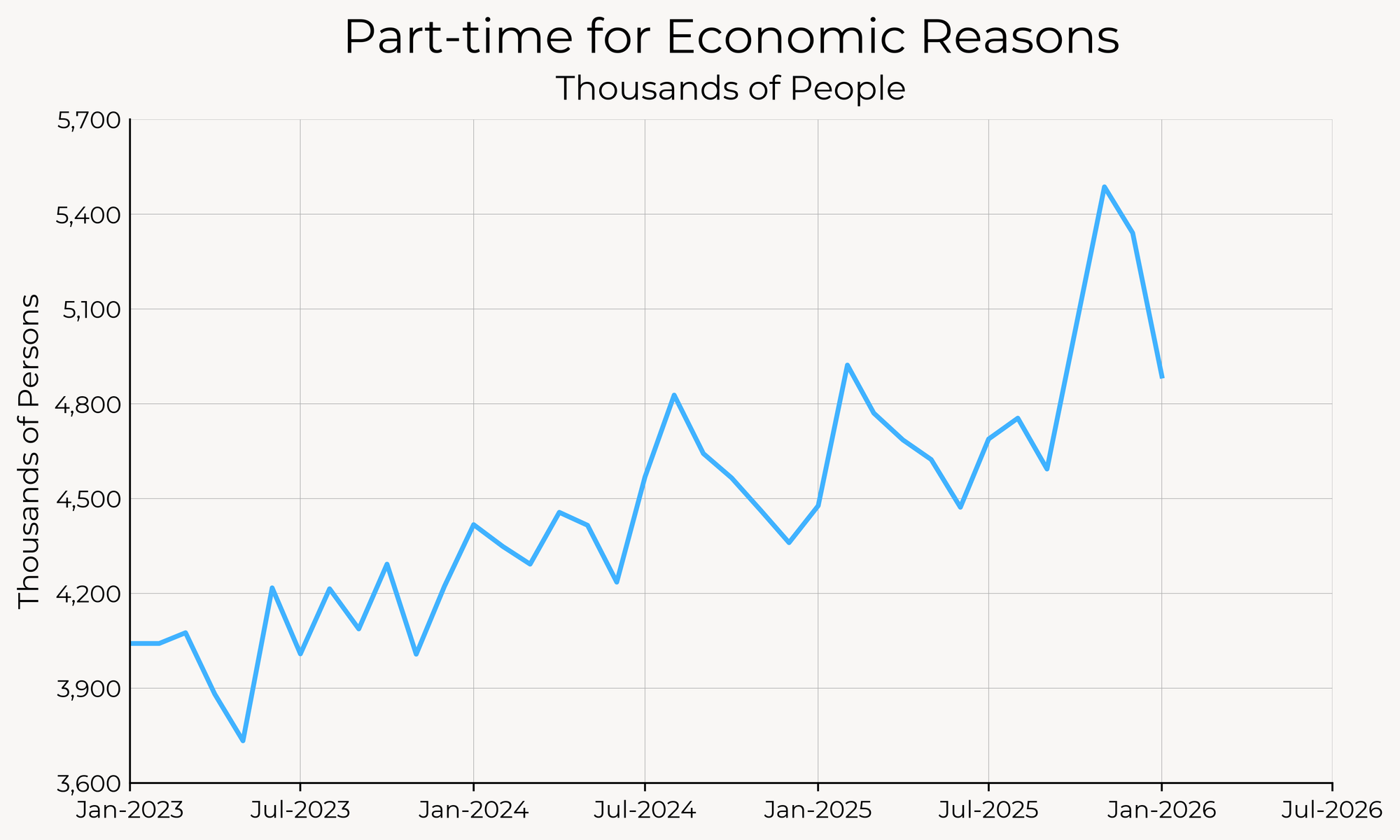

There’s also good news in the more granular details of the household survey. Involuntary part-time unemployment fell sharply after it increased late last year:

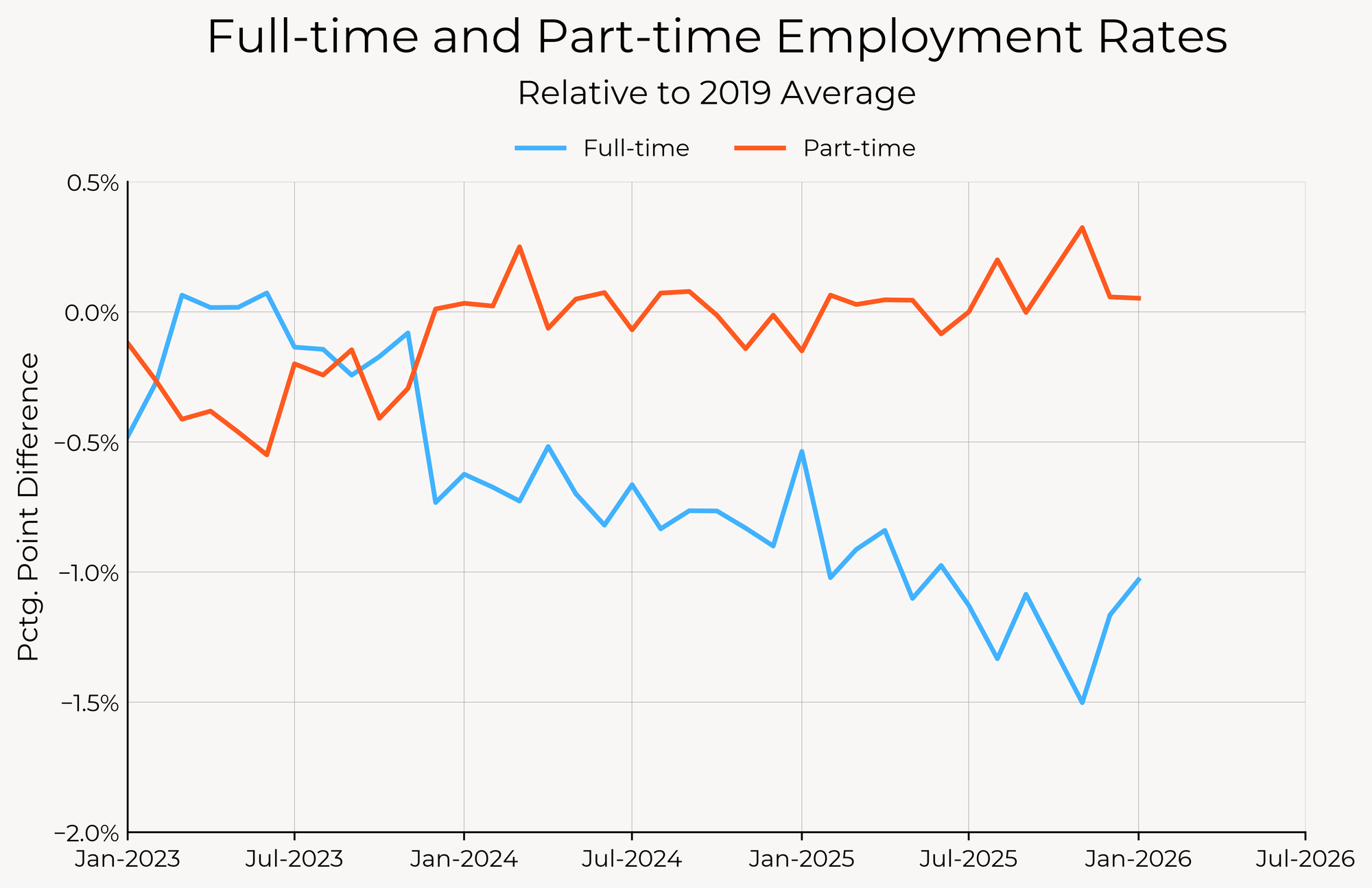

While full-time employment rates are still much weaker than pre-pandemic, the rebound in full-time employment over the past two months has undone the entire decline that occurred between February and November last year:

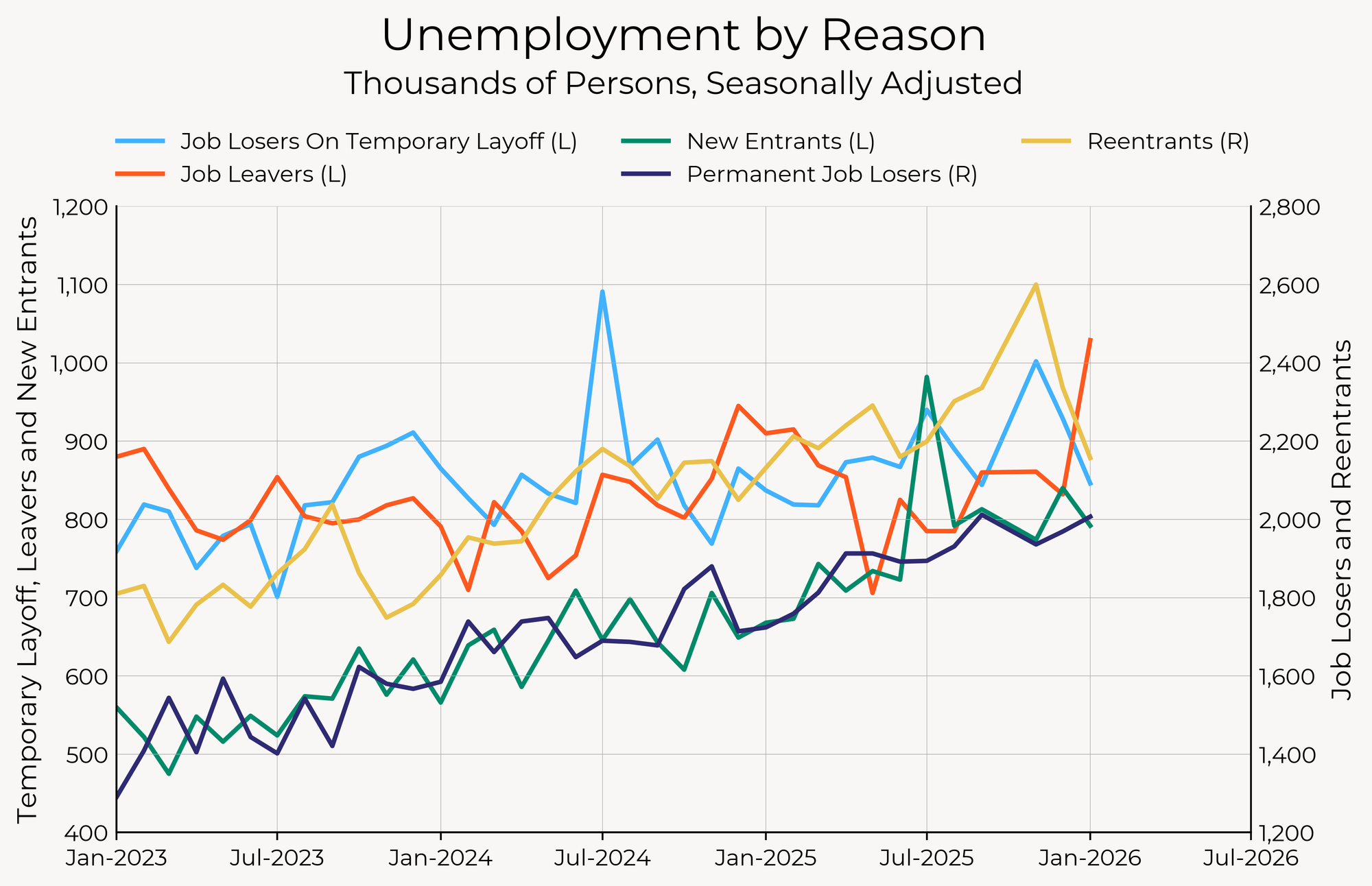

Even the composition of unemployment is encouraging. This month saw a rotation away from labor market entrants (who would be unemployed due to weak hiring) towards job leavers (probably the least bad type of unemployment).

Strong Job Growth in Unexpected Places

The “big news” in this report are the revisions to the past couple of years of payroll growth. Those revisions, which showed just 181,000 jobs added in 2025 (instead of 584,000) as previously reported) sound worrying, but don’t affect our assessment of the labor market that much. It was commonly known that large downwards revisions were coming (to anyone paying attention, anyways) and we always had the household survey, which is not subject to revisions, to refer to.

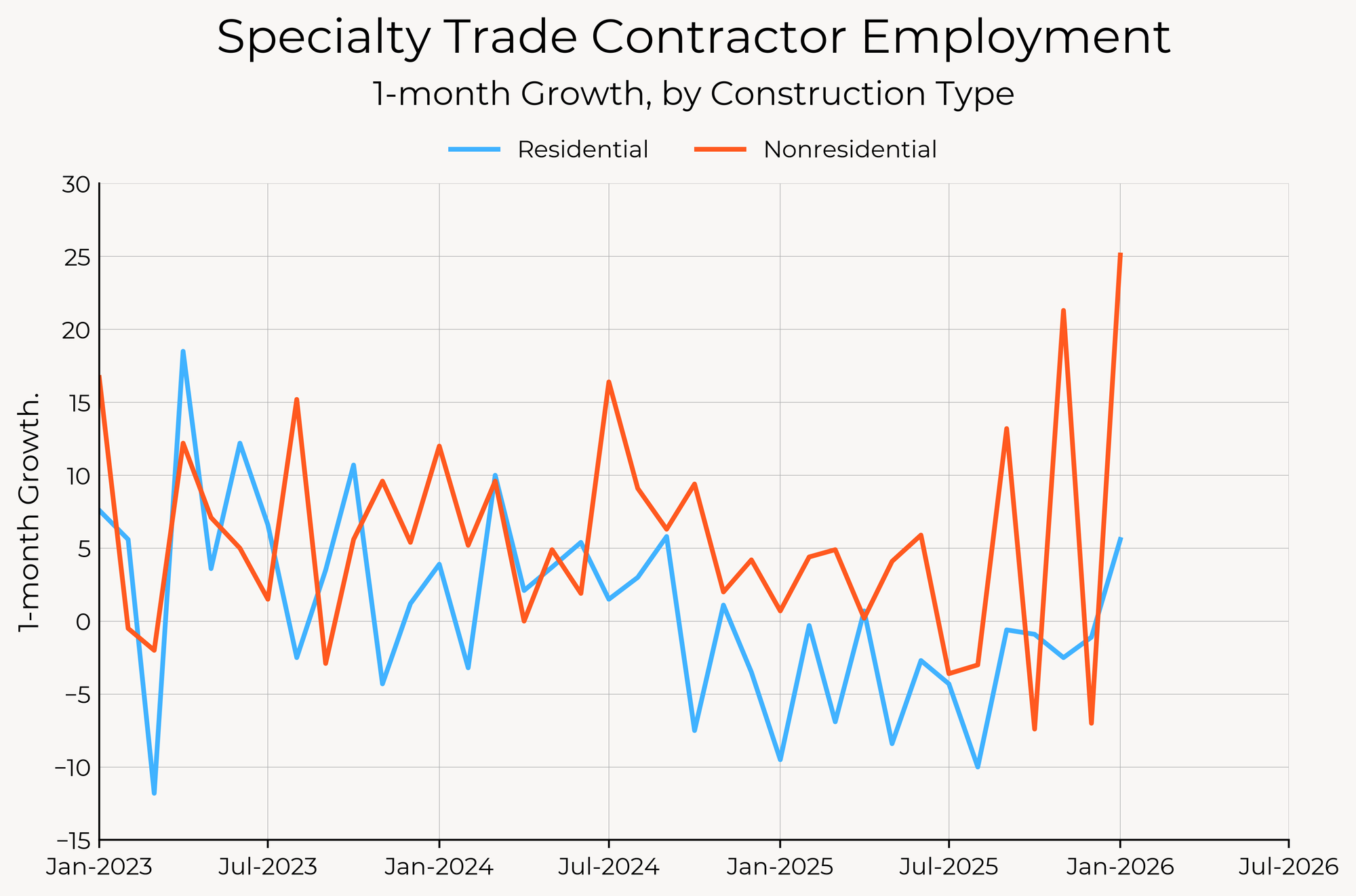

January 2026 saw strong payroll growth in construction, professional and business services, and education and health services. Construction jobs growth (which was concentrated in nonresidential specialty trade contractors) is surprising given the cold weather in January—the boom in AI investment is just too strong.

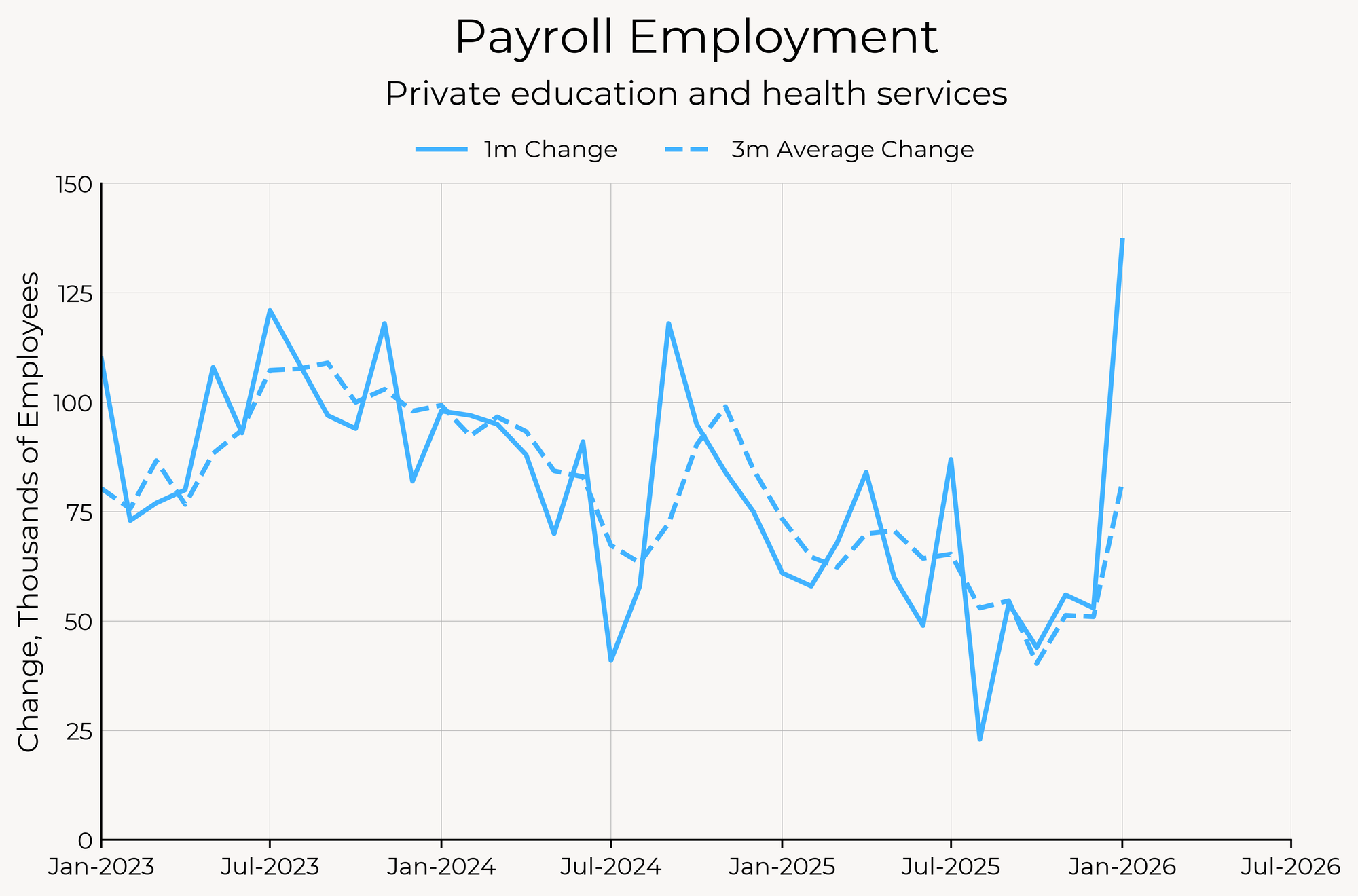

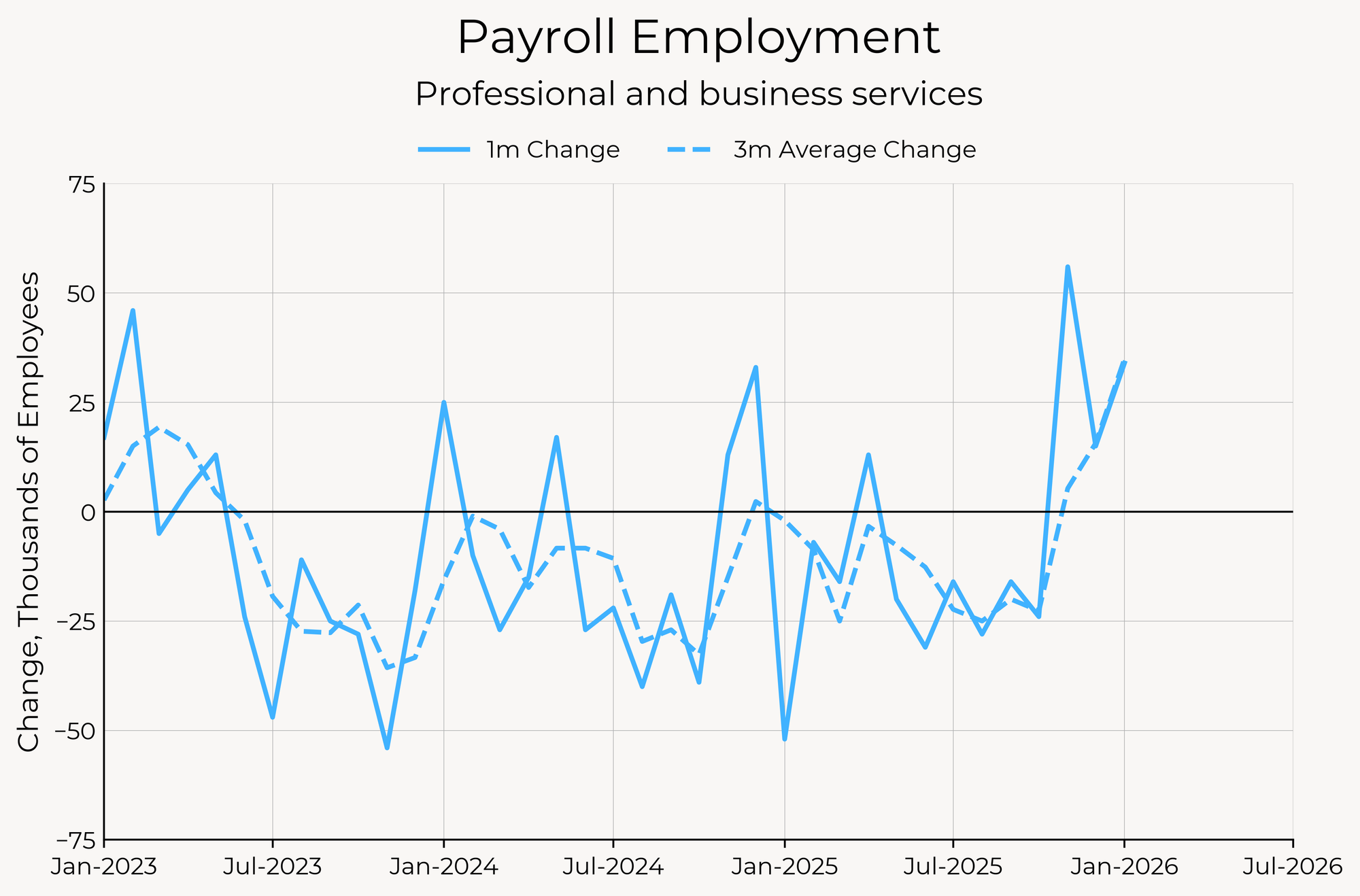

Meanwhile, we saw strong growth in employment in education and health services and professional and business services. Strong growth in these sectors belies the narrative that AI is replacing jobs—as Will Raderman’s piece on AI usage and recent graduate employment found, these are sectors with relatively high AI utilization (with the caveat that these sectoral definitions are far too coarse to say anything definitive).

What’s going on with compensation?

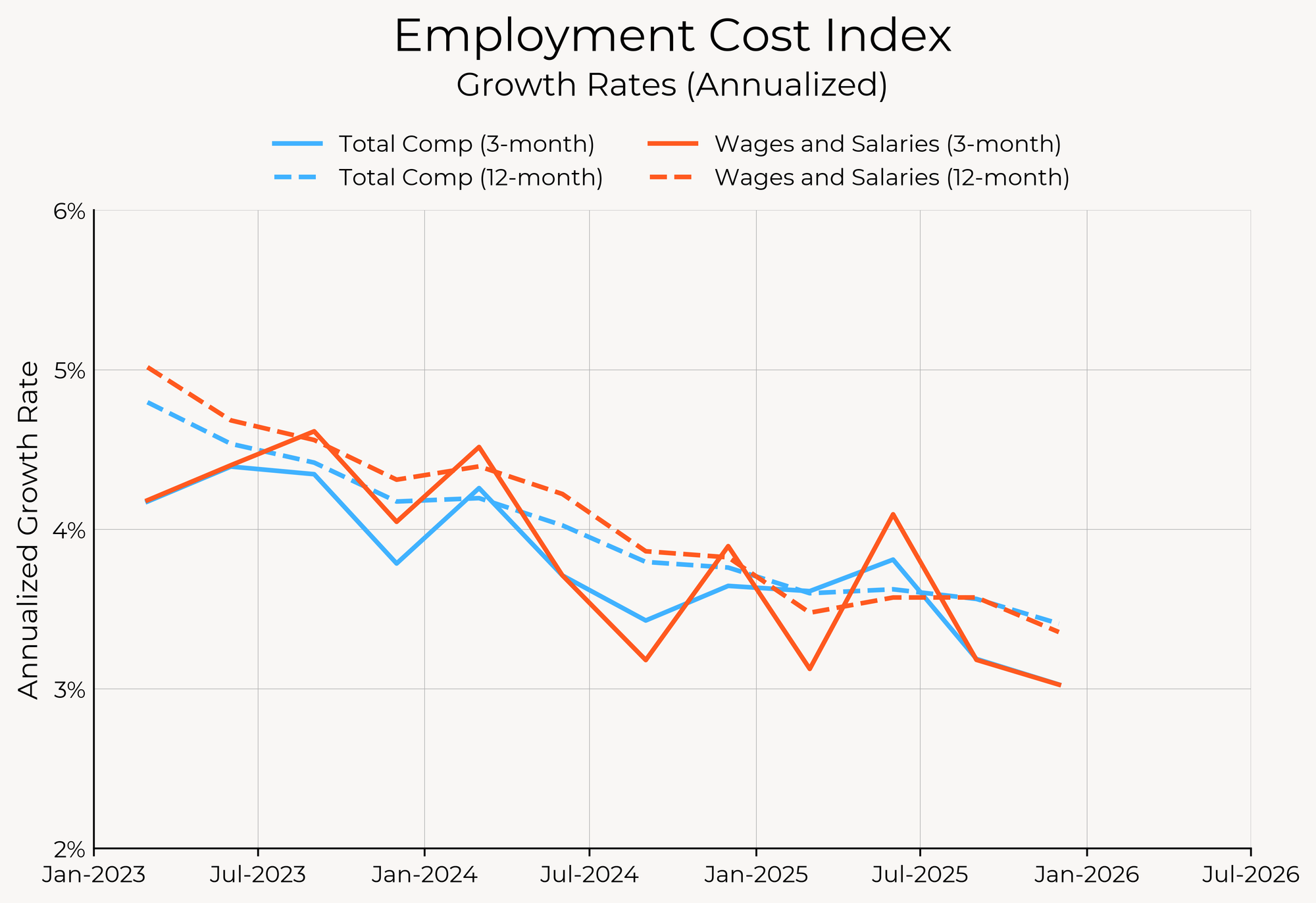

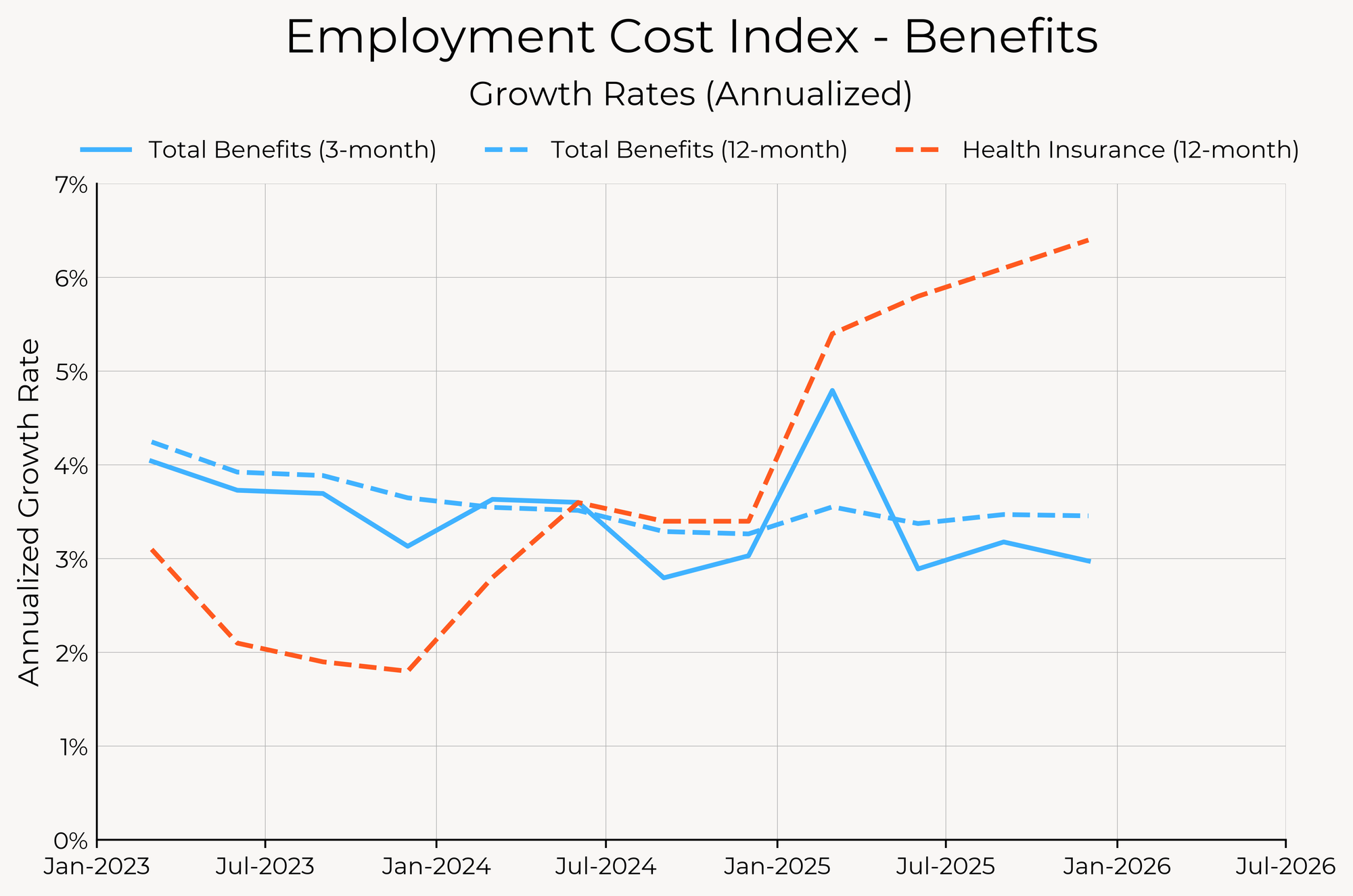

We got new data from the Employment Cost Index last month, which covers the fourth quarter of 2025. Compensation growth continued its gradual decline, with quarterly growth just barely clearing 3% last quarter.

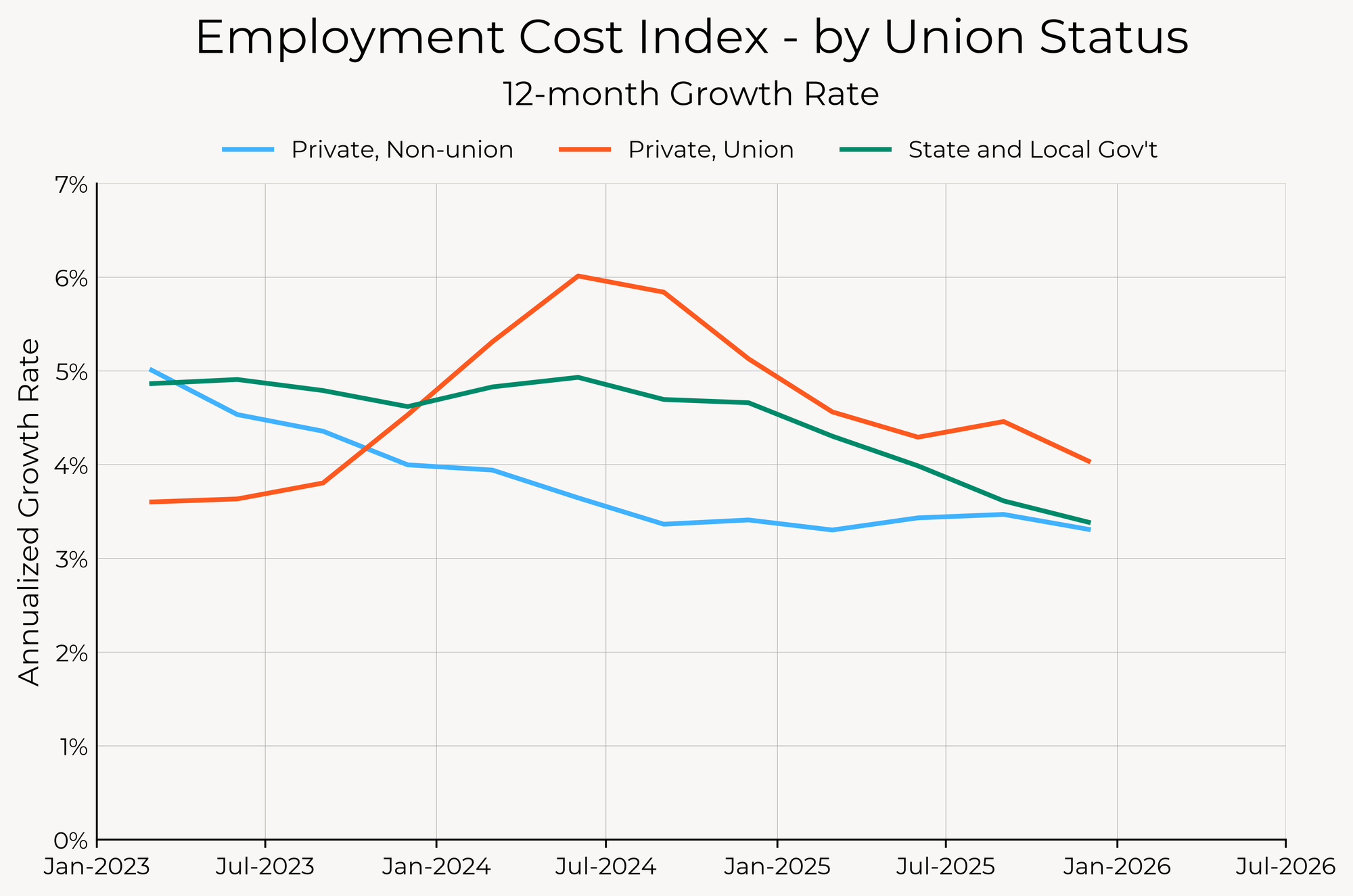

However, a look under the hood suggests that some stability is on the way—and perhaps already here. The decline in compensation growth is entirely due to a decline in the growth rate of compensation for union and government employees, whose compensation lags other workers due to the way wage contracts are set. Compensation growth for private non-union workers has been essentially flat for the last month and a half.

Somewhat worrying is the rise in health insurance costs. Health insurance benefits increased by over 6% in the past year, even while the cost growth of other wages and benefits has slowed. This doesn’t yet include any price increases in the coming year—premiums generally reset in January, and premiums for employer-sponsored insurance are expected to increase significantly in 2026.

The Labor Market Looks Stable, for Now

For now, the Fed is happy to stay put on rates as long as the labor market looks like it’s under control. The data from the last two months points towards some kind of stability in the labor market, and the timeline for rate cuts surely has been pushed back after today.

The data from January also cuts against some of the popular narratives around AI and the labor market. Youth unemployment fell, people aren’t being thrown out of work en masse, and some sectors with relatively high AI usage are still posting strong payroll gains.

That being said, this is just one month’s data. The fall in the unemployment rate could easily revert next month, given the aberrant move in the youth unemployment rate. It could also be possible that the strong employment trends we’ve seen this month are part of a new seasonal pattern that the BLS’s seasonal adjustment factors aren’t yet able to pick up on.