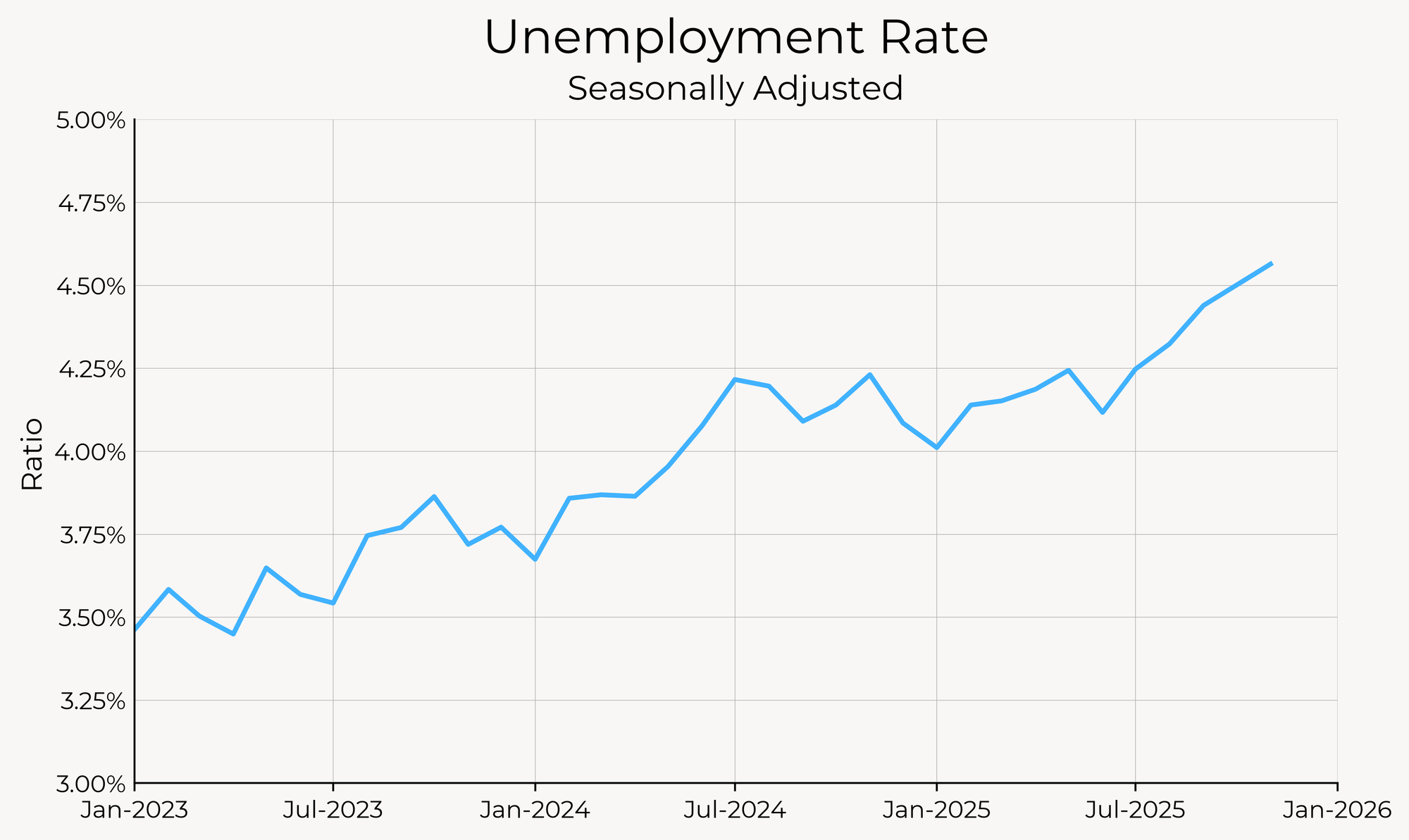

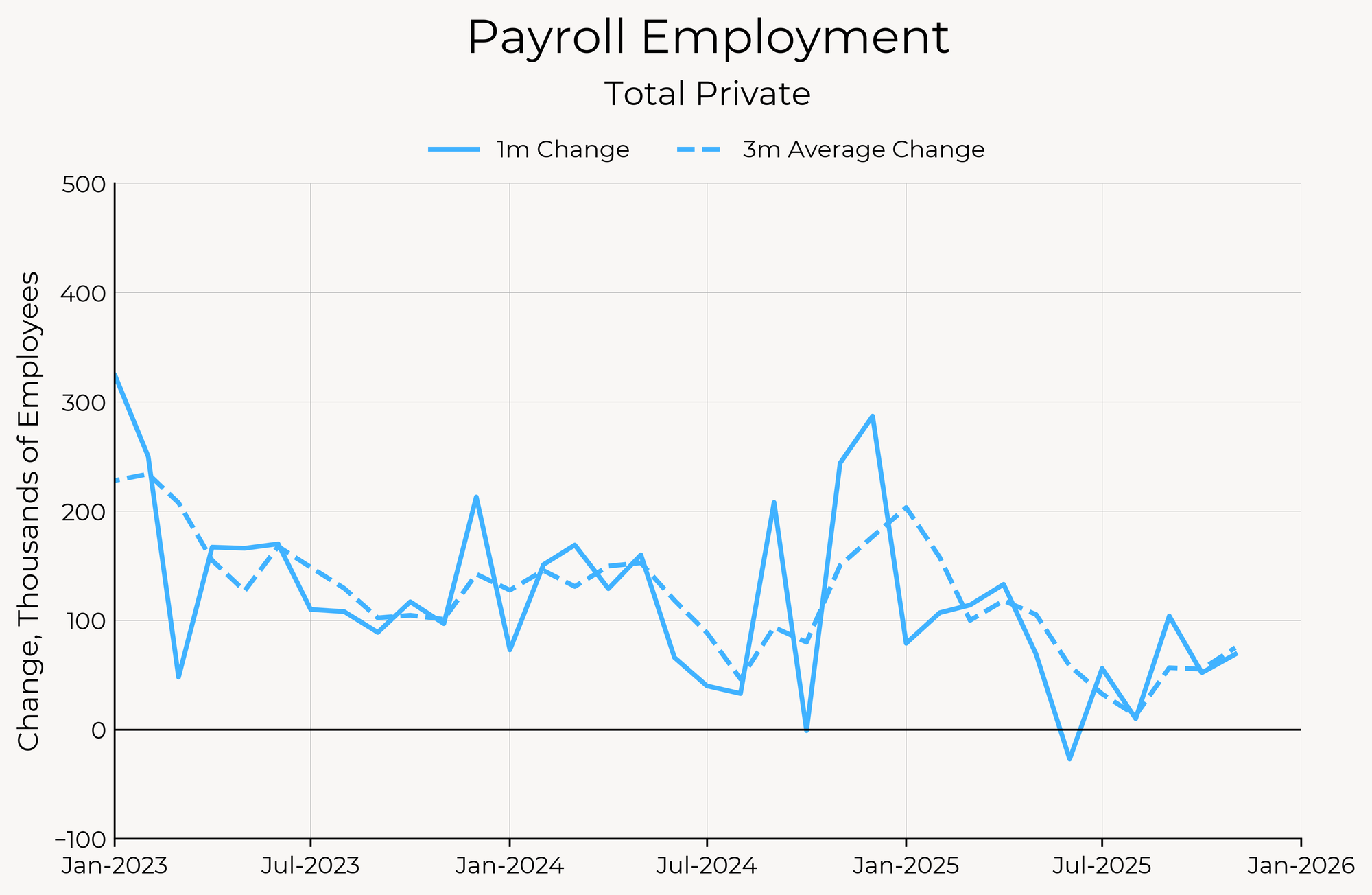

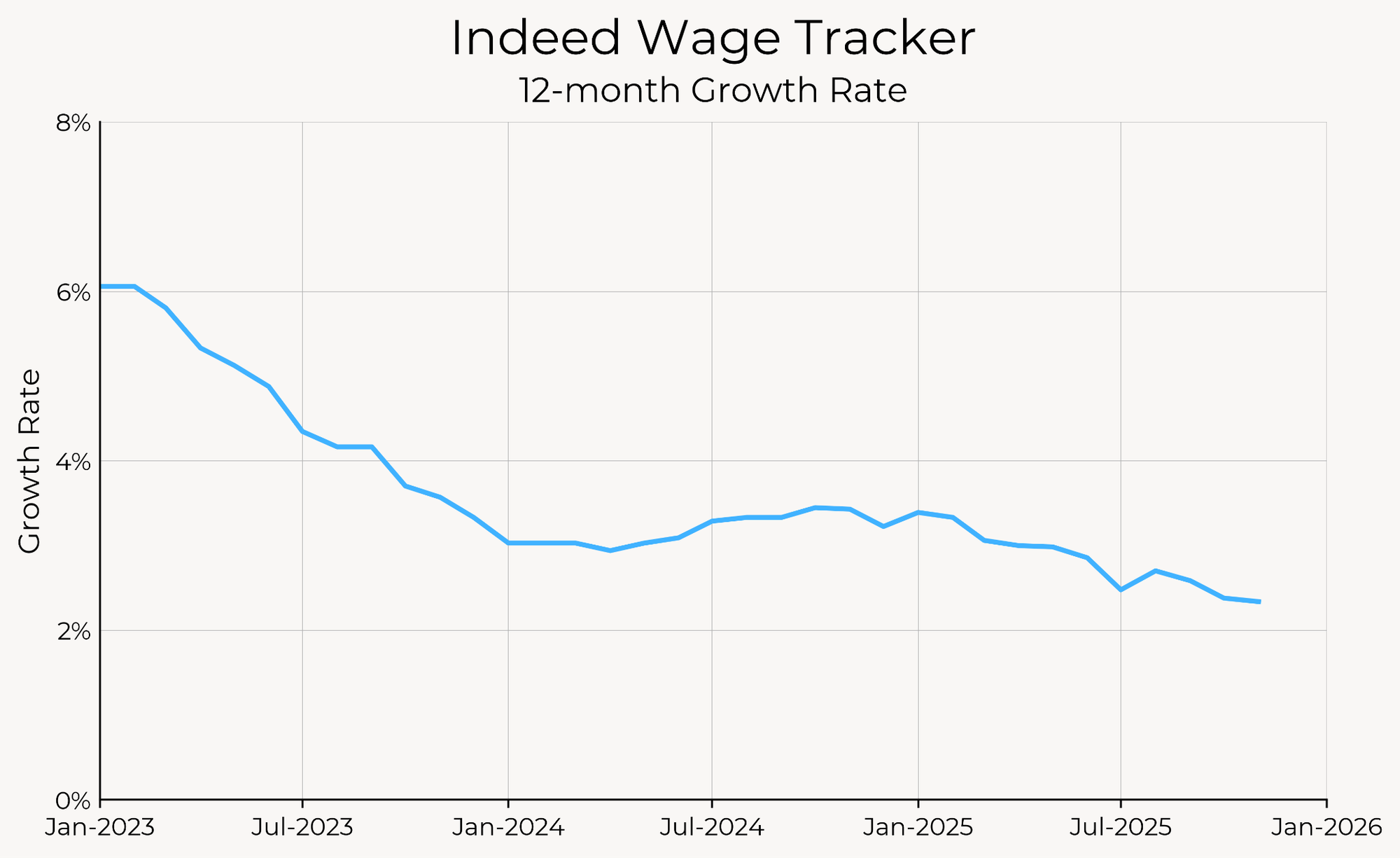

The labor market added 64,000 jobs in November after losing 105,000 jobs in October, largely due to the federal government shutdown. Private-sector jobs grew by 52,000 and 69,000 over the last two months, respectively, and have been growing since the summer. The unemployment rate rose from 4.44% in September to 4.56% in November, but measures of participation and employment rates, especially for the prime-aged, are not so dire. Average hourly earnings growth fell to 3.51%; Indeed wage posting growth fell again from 2.38% to 2.34%, another low.

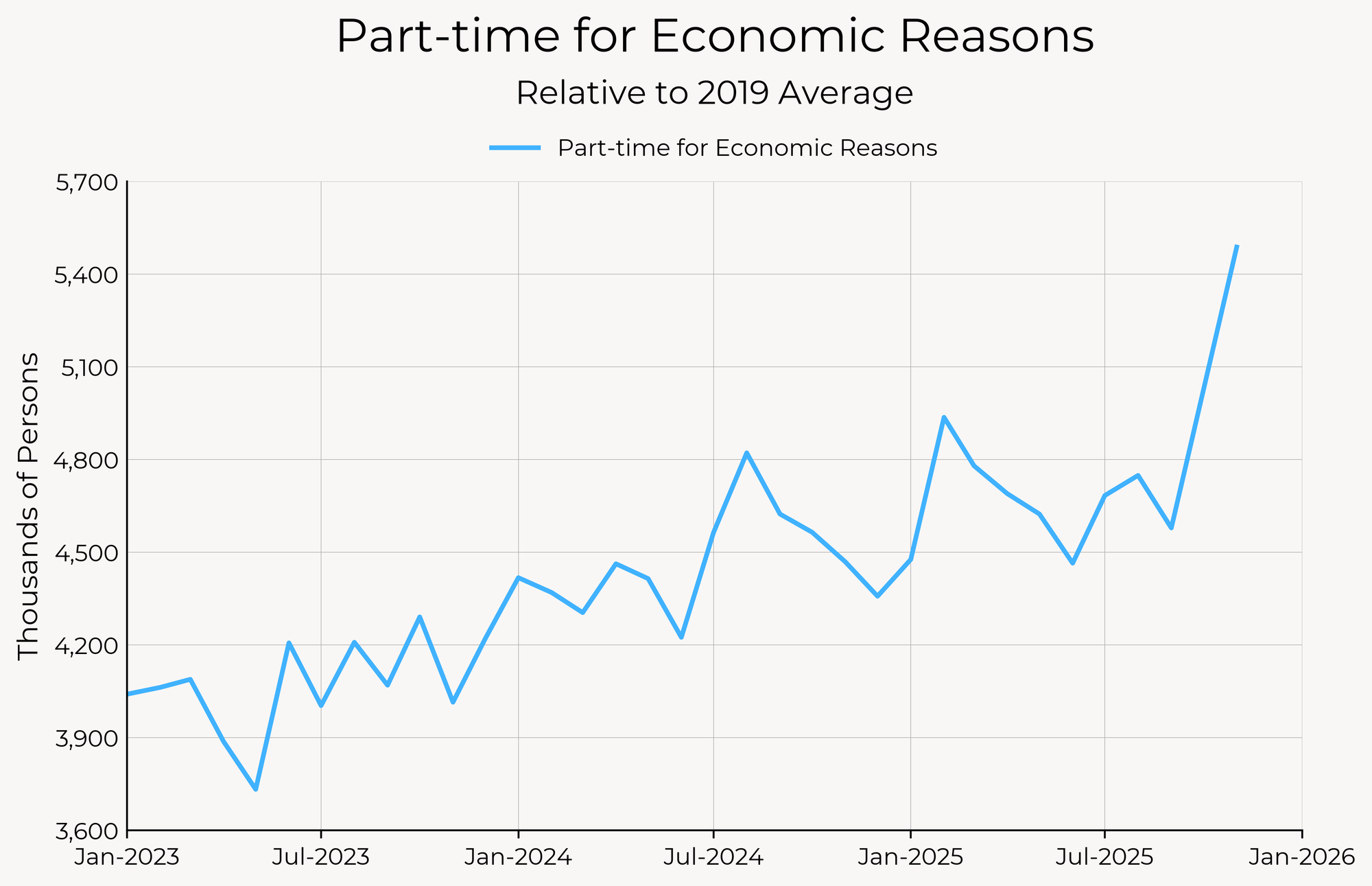

The data overall definitely do show a weakening of the labor market, but that weakening so far is limited to the more vulnerable sections of the labor market—youth unemployment, black unemployment, and part-time employment for economic reasons are all up. For all the talk about declining labor supply, it seems like labor demand is falling by even more.

| Labor Market Dashboard | |||||

| For November 2025 | |||||

| Change from | |||||

|---|---|---|---|---|---|

| Household Survey | Current | 1M Ago | 3M Ago | 12M Ago | 2019 Avg |

| Employment Rate (Prime-age) | 80.6% | N/A | -0.1% | +0.2% | +0.6% |

| Unemployment Rate | 4.56% | N/A | +0.24% | +0.33% | +0.90% |

| Sahm Indicator | N/A | N/A | N/A | N/A | N/A |

| Black-white Gap | 4.4% | N/A | +0.6% | +1.8% | +1.6% |

| Participation Rate (Prime-age) | 83.8% | N/A | +0.1% | +0.3% | +1.3% |

| Payroll Growth (3-month avg., thous.) | Current | 1M Ago | 3M Ago | 12M Ago | 2019 Avg |

| Total Nonfarm | 22 | +30 | +11 | -159 | -144 |

| Total Private | 75 | +20 | +62 | -75 | -73 |

| Government | -53 | +10 | -51 | -84 | -70 |

| Cyclical | 3 | +21 | +48 | -9 | -42 |

| Acyclical | 19 | +9 | -37 | -150 | -102 |

| Wage Growth | Current | 1M Ago | 3M Ago | 12M Ago | 2019 Avg |

| Average Hourly Earnings (3m/3m) | 3.7% | -0.3% | +0.0% | -0.6% | +0.5% |

| ECI Total Comp. (3-month) | 3.8% | N/A | +0.2% | +0.4% | +1.1% |

| Atl. Fed. Median Wage Growth (yoy) | 4.1% | 0.0% | -0.1% | -0.6% | +0.4% |

| Indeed Postings Wage Growth (yoy) | 2.3% | -0.0% | -0.4% | -1.1% | -0.9% |

| JOLTS | Current | 1M Ago | 3M Ago | 12M Ago | 2019 Avg |

| Hiring Rate | 3.2% | -0.1% | -0.2% | -0.1% | -0.7% |

| Quit Rate | 1.9% | -0.1% | -0.1% | -0.1% | -0.4% |

| Layoff Rate | 1.1% | 0.0% | +0.1% | 0.0% | -0.1% |

| Job Openings Rate | 4.3% | 0.0% | -0.3% | -0.3% | -0.2% |

Source: Bureau of Labor Statistics, Author’s Calculations. Red indicates weaker labor market development; green indicates stronger.

That increase in unemployment isn’t as ugly as it looks

The most dire sign from this month’s release is the increase in the unemployment rate, from 4.44% to 4.56%. The unemployment rate is now on track to meet or exceed the Fed’s projection of 4.5% from earlier this year. The unemployment rate has increased by 45 bp since June alone.

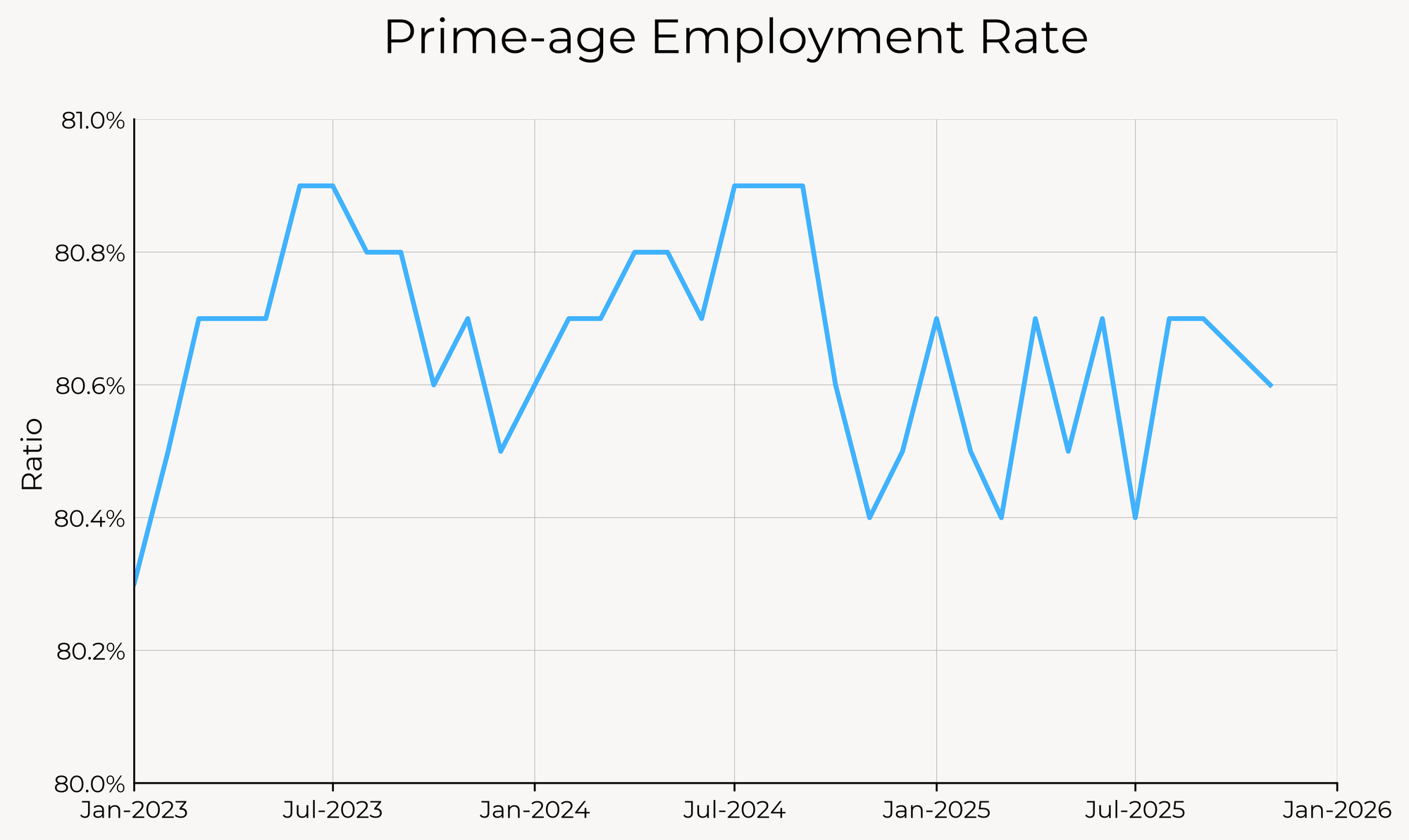

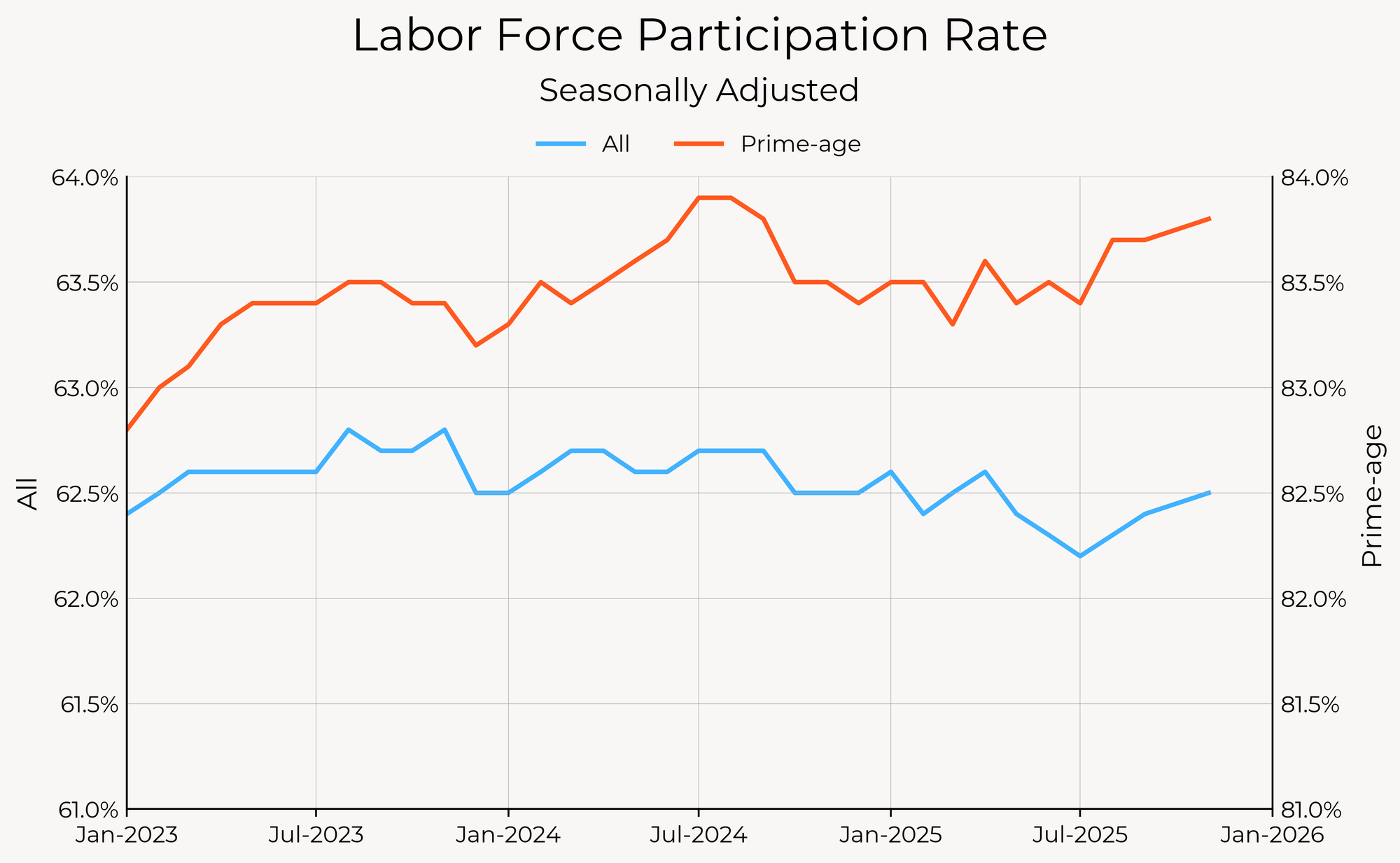

But if one looks at employment rates and participation, among prime-age rates, things don’t look so bad. Prime-age employment hasn’t noticeably deteriorated since mid-2024.

The rise in the unemployment rate is best described as an inability of employment to keep pace with labor force participation growth. While unemployment rates have been down since mid-2025, participation rates have actually risen—not the sort of thing we see during the beginning of sharp labor market downturns.

The payroll numbers showed significant job losses in October, due to the government shutdown. Private sector payroll growth looks much healthier, and in fact has been rising since the summer. As Chair Powell noted at his press conference last week, it’s likely that payroll growth is currently being estimated. We have enough evidence from the household survey that overall job growth is running under breakeven at this point, regardless of what the monthly payroll releases are telling us.

Where labor market weakness is showing up

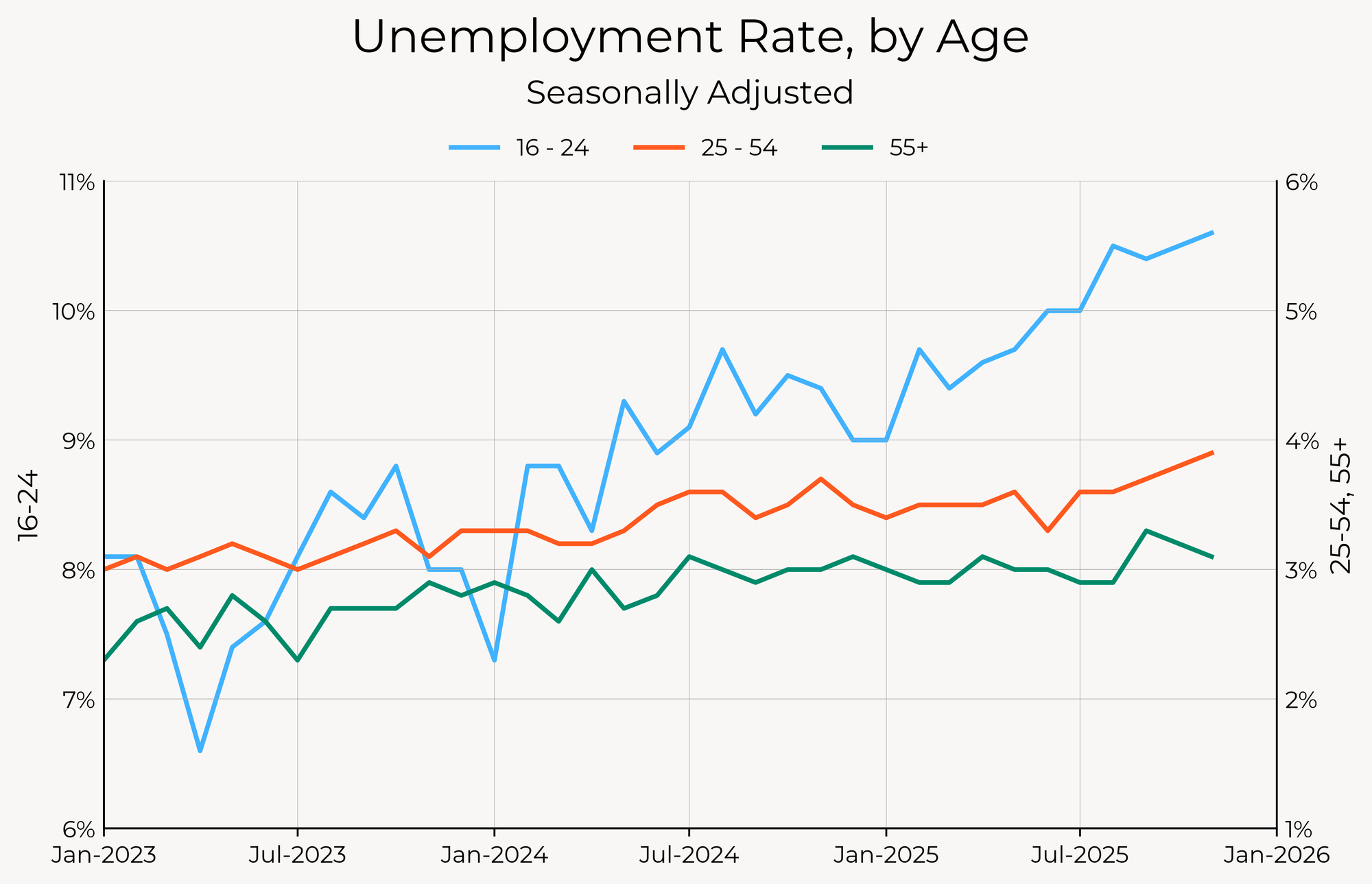

While overall prime-age employment rates are holding up, we’re seeing weakness on the fringes of the labor market. In particular, the unemployment rate for people aged 16 to 24 has increased rapidly, from 9% to 10.6%, since the beginning of this year. Unemployment rates for prime-age and older workers are up only slightly.

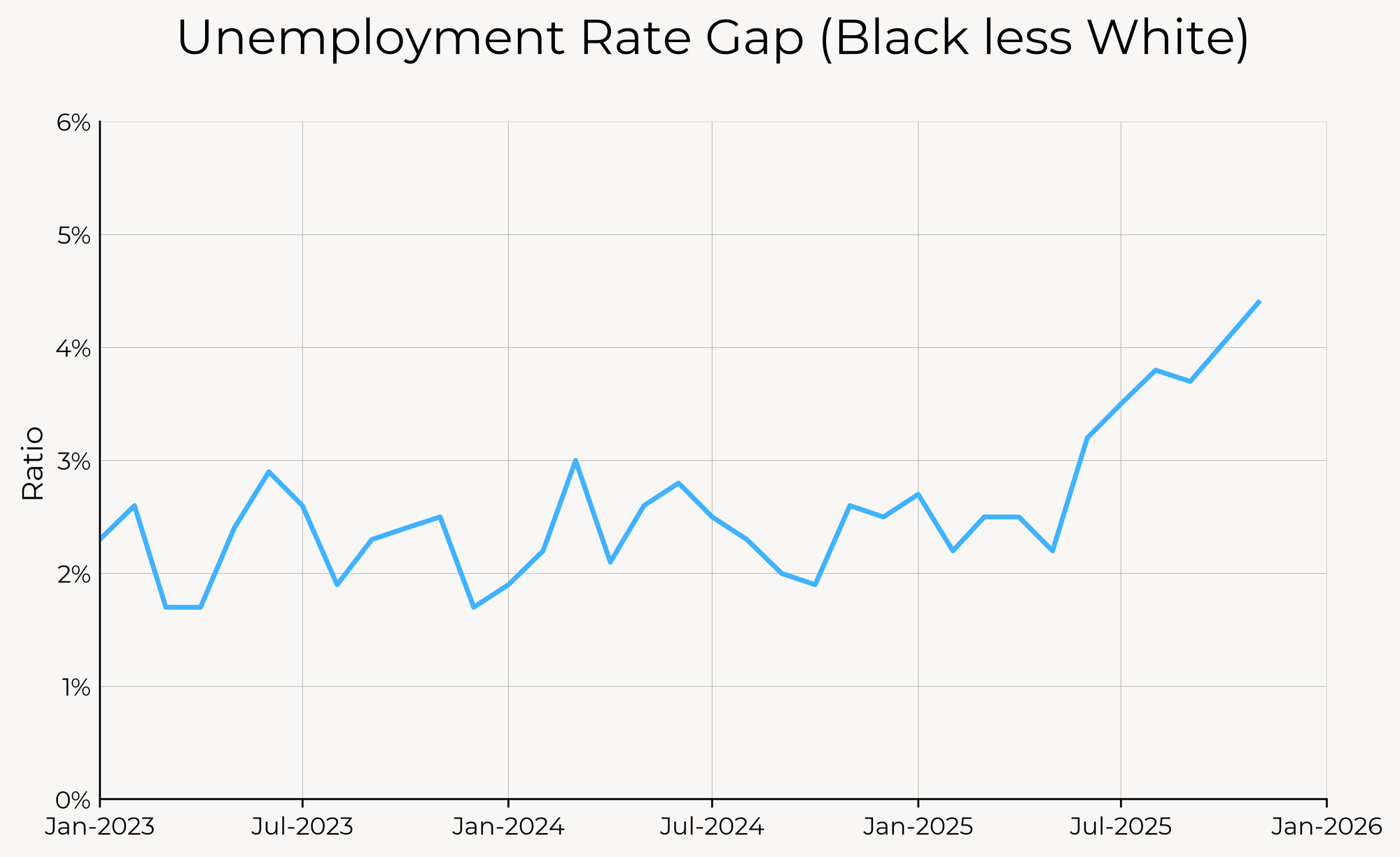

The gap between black and white unemployment was steady up until mid-2025, when the black unemployment rate began to rise. The black unemployment rate has jumped 2.3pp since May; during the same time period, white unemployment only rose by 0.1pp. The black unemployment rate increased sharply between September and November, by 0.8pp, possibly due to the federal government shutdown.

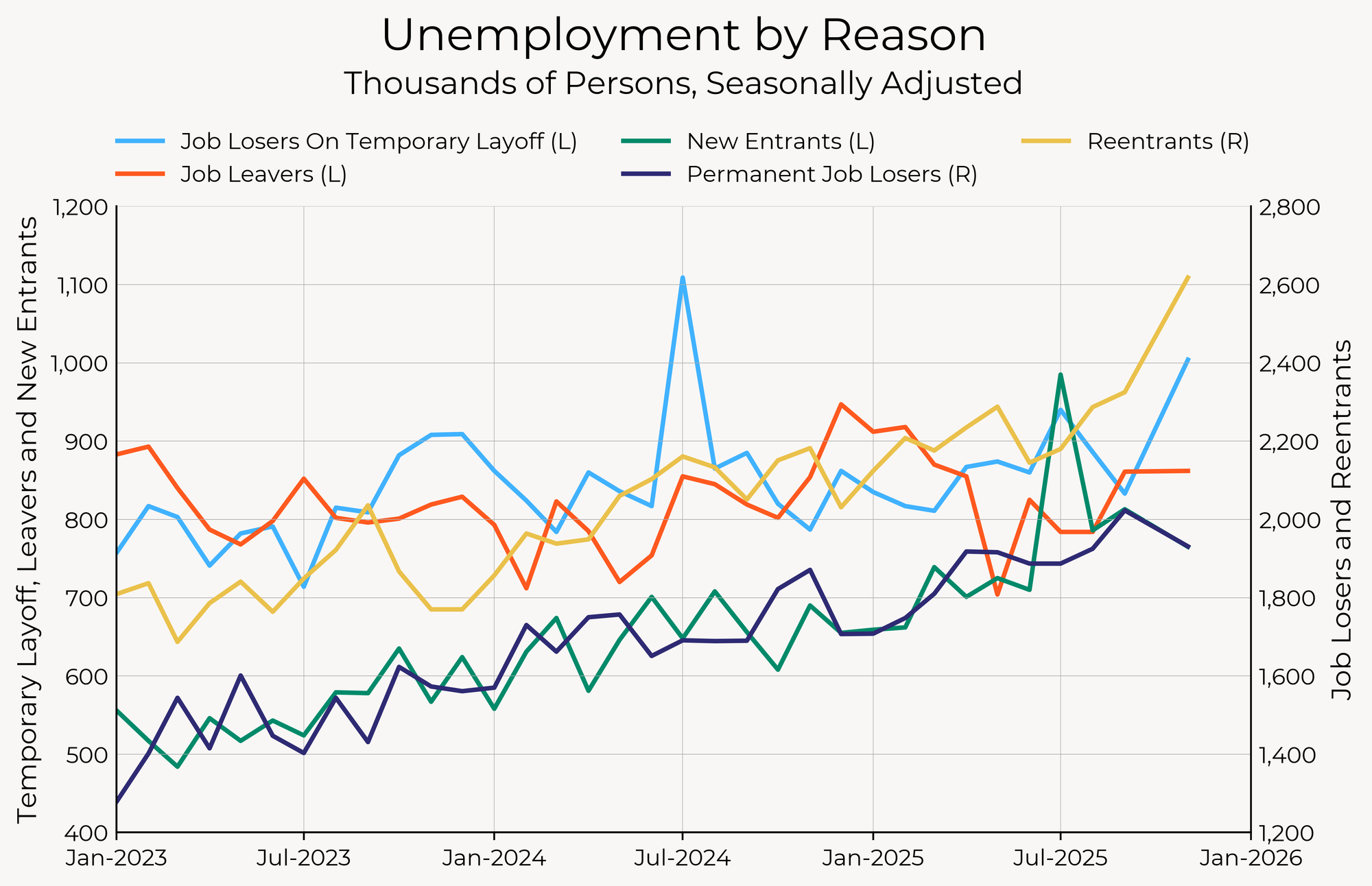

The increase in the unemployment rate this month came mostly from those on temporary layoff and reentrants. The number of permanent job losers actually fell this month. Aside from those on temporary layoff, this is still a story of depressed labor demand falling on the shoulders of marginal workers trying to enter the workforce, rather than mass layoffs.

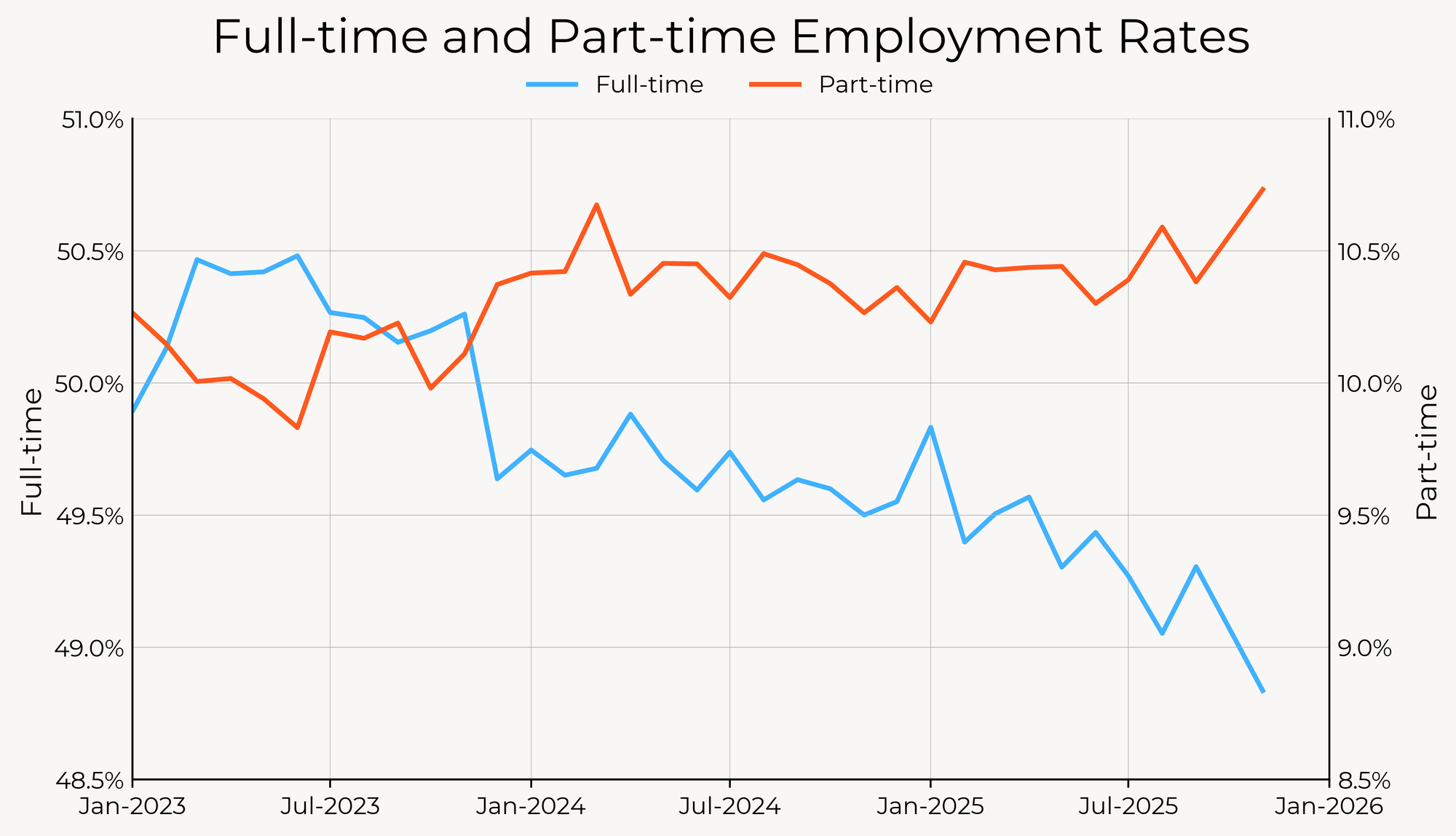

Within the margin of those employed, we’re also seeing weakness. The full-time employment rate fell below 49% this month as part-time employment continues to make up the slack. The rise in part-time employment came about by a sharp increase in the number of those part-time unemployed for economic reasons. About 5/6ths of part-time employees are part-time for noneconomic reasons—school, taking care of family, etc.—but over the last twelve months, the growth in part-time for economic reasons accounts for more than half of the growth in part-time employment.

Finally, we also got a new release of the Indeed Wage Tracker today. 12-month growth in posted wages continued to slow to 2.34%, its lowest growth rate in its history (since 2019).

Slowing Wage and Employment Growth Pose a Headwind to Consumption

While the increase in the unemployment rate isn't dire, there are definitely signs of weakness in the labor market. Labor demand is simply not keeping up with labor supply, resulting in a slow slippage in the unemployment rate and slowing wage growth. Wage growth is likely to be challenged by the rising cost of health insurance benefits, which are growing faster than wage growth, even before premium increases next year.

With today's jump in the unemployment rate, the Fed's decision to cut in December looks prescient. It also means that the bar from here to future cuts is lower—the Fed's forecast is for unemployment to fall to 4.4% by the end of 2026. With the current path of policy, both fiscal and monetary, it's not clear how that happens.