July 2025 FOMC Preview

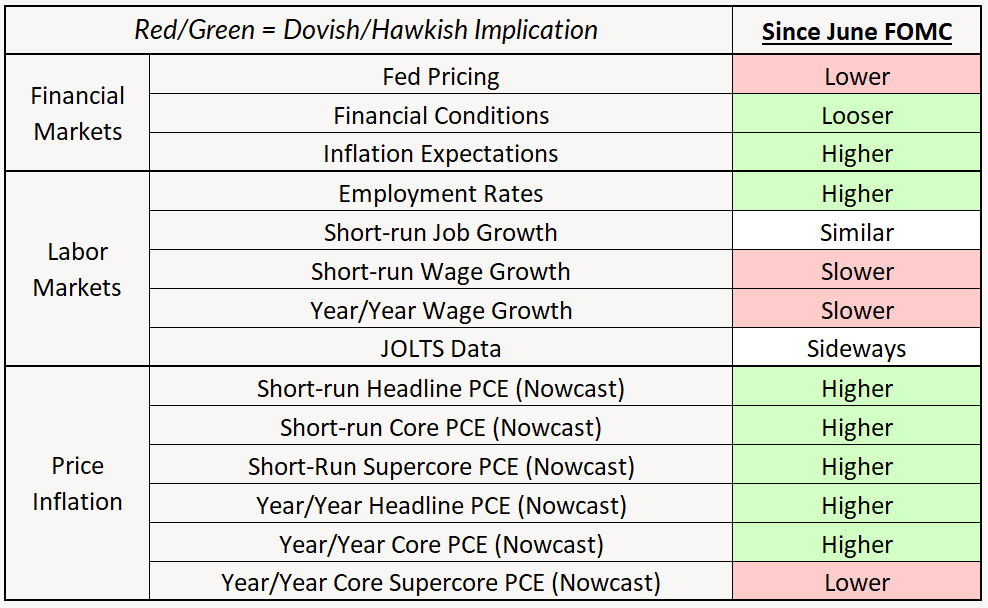

With inflation risk still unresolved and the labor market still looking similar to how it did in the previous meeting, the Committee is still mostly in wait-and-see mode.

With inflation risk still unresolved and the labor market still looking similar to how it did in the previous meeting, the Committee is still mostly in wait-and-see mode.

Note: Subscribers to MacroSuite will receive our FOMC preview a week early, at the beginning of the blackout period before each FOMC meeting.

With inflation risk still unresolved and the labor market still looking similar to how it did in the previous meeting, the Committee is still mostly in wait-and-see mode. The Committee will hold and the statement and ensuing press conference is likely to be similar to the last one, at least in terms of monetary policy. We expect the press conference will be dominated by questions about Trump’s threats to replace Powell and the accusations surrounding the Eccles renovation.

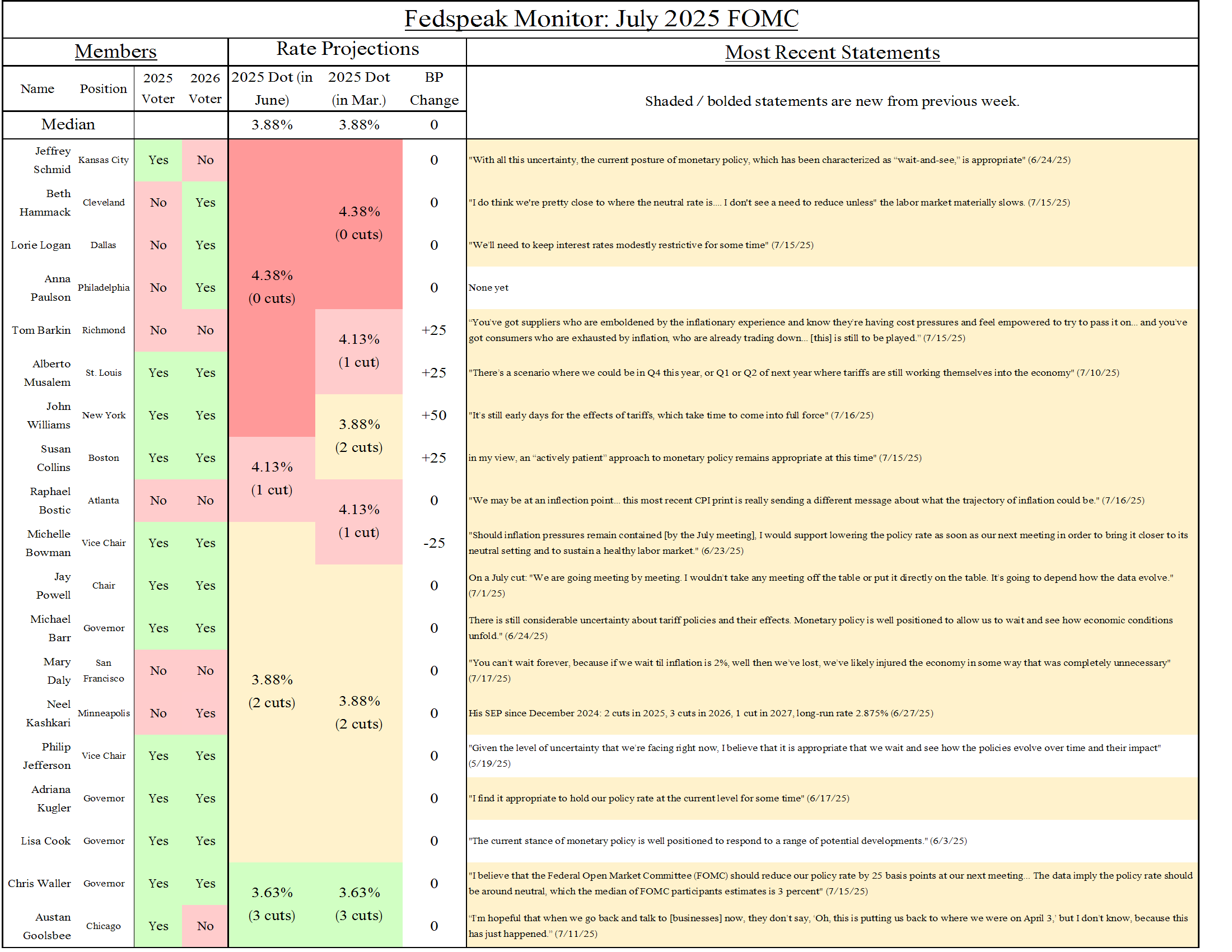

A few of the Committee members have started to discuss the idea of a July cut. We know from the previous meeting that two members (Bowman and Waller) were floating the idea of a cut at the July meeting. Since then, no other members have joined them. We expect Bowman and Waller to dissent in favor of a cut. For Waller, a dissenting vote is a way of auditioning for the Fed chair appointment.

Since the last meeting on June 18th, the Fed has seen just one more month of labor market data and one more month of inflation data (the PCE report for May plus the CPI/PPI/IPI inputs for June).

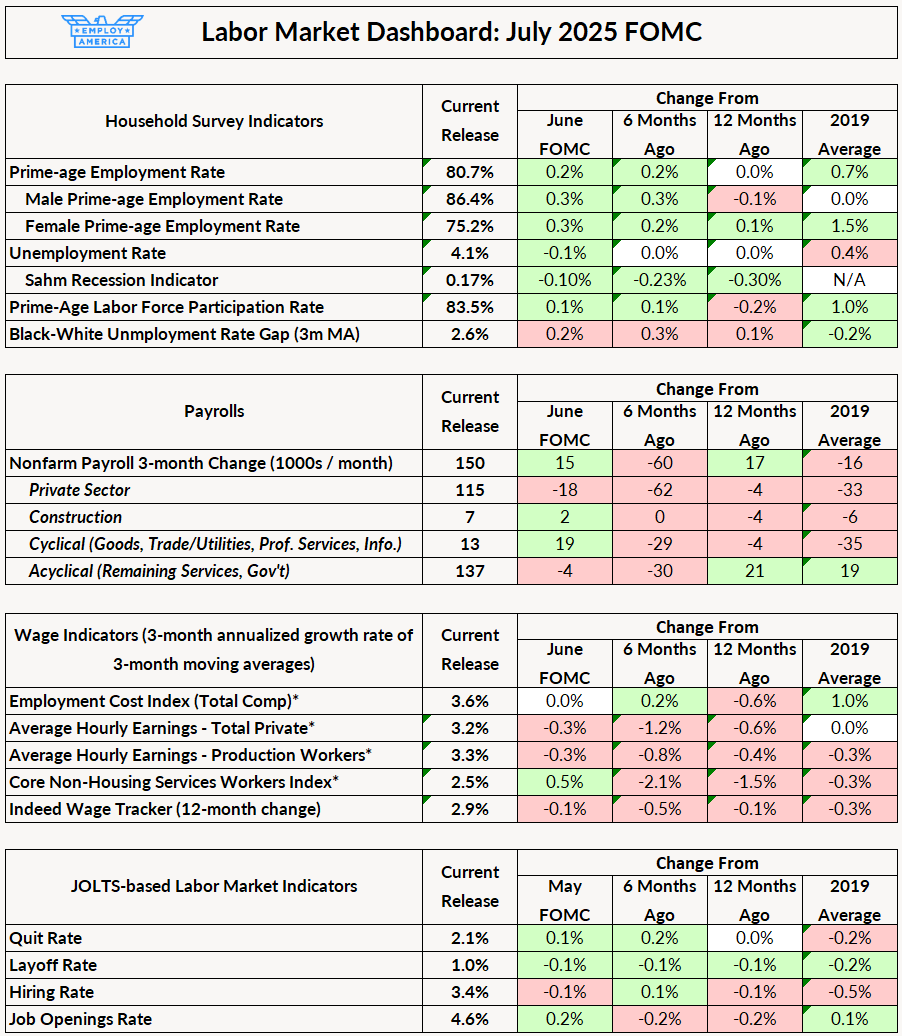

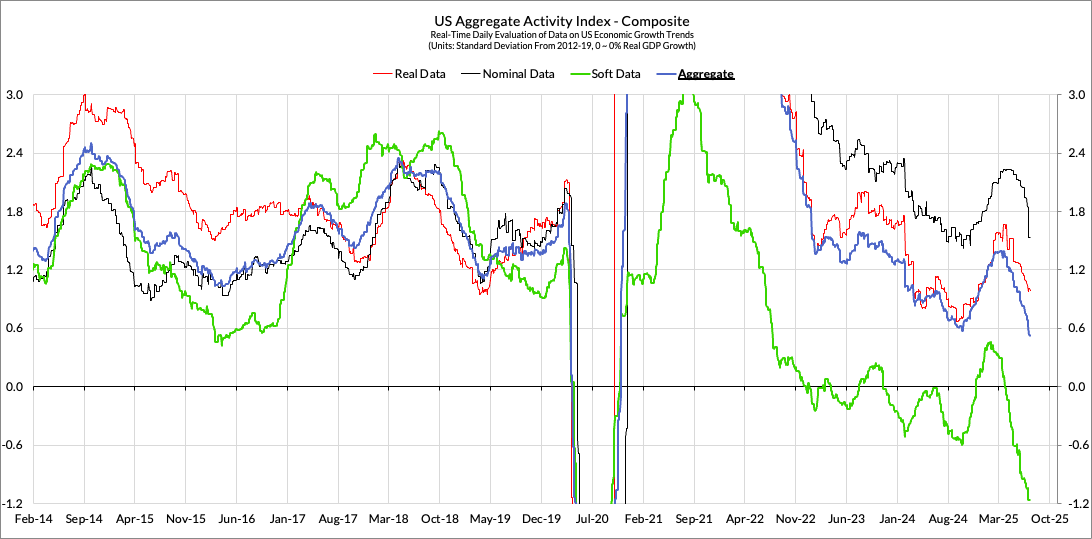

On the whole, the labor market data from June was good news. In the household survey, the prime-age employment rate rose and the unemployment rate fell by 0.1pp to 4.1%. Nonfarm payroll growth was strong, although a large portion of job growth came from state and local government employment. Wage growth continued to slow, but is still healthy. The weaknesses we’ve been highlighting still remain (imbalanced job growth led by acyclical industries, weak hiring, and potential headwinds coming later this year), but overall the strength of June’s report is enough to keep the Fed in wait-and-see mode.

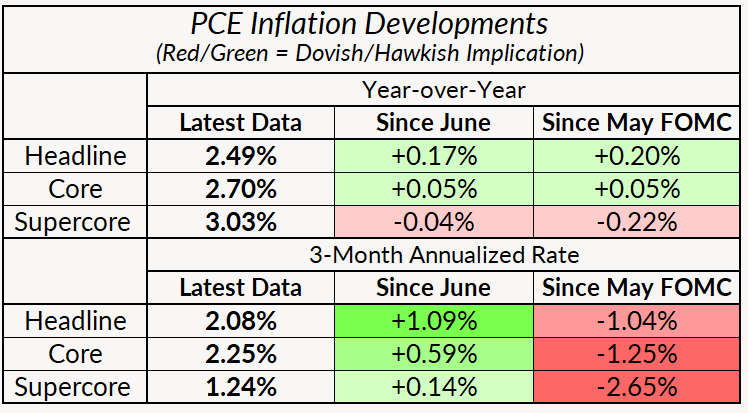

On the inflation front, we’re starting to see the impacts of tariffs come through. The inflation data for June came in somewhat softer than expected, but there were nascent signs of tariffs affecting prices in non-auto core goods. It’s still early days in the tariff pass-through process, and both we, forecasters, and the Fed expect goods inflation to hit harder later this year.

The big development outside of the data is Trump’s on-again-off-again threats to remove Powell. Trump has been critical of Powell for months, but the last few weeks have seen Trump ramp up his criticisms of Trump, culminating in a meeting with House Republicans where Trump reportedly shared a draft letter firing Powell (which he later denied), and now cost overruns in the Eccles renovation are being used as a pretext to potentially find cause to dismiss Powell.

For most of the Committee, Fedspeak since the June meeting looks much like the Fedspeak in the prior few meetings. Most members are still emphasizing patience, with many members penciling in a later impact of tariffs on inflation.

Meanwhile, Bowman and Waller have come out in support of a July cut. Both of them are appealing to the risk of a deteriorating labor market and a belief that policy should look through what they think will be muted tariff impacts on inflation. Waller laid out a case for a July cut grounded in the data, citing slowing private-sector payroll growth (which he believes will be revised downwards) and his estimates that inflation-sans-tariff effects is close to 2%.

Besides these two, Daly (who is not a voting member this year) is the most vocal member talking about rate cuts. Unlike other members, who are looking for visible labor market deterioration before cutting, she is advocating for a preemptive cut. However, she’s less excited about a July cut, and is probably looking more towards September.

Since the data have not changed much since the last meeting, neither have our stances on the risks to the labor market and how monetary policy should navigate tariff uncertainty. The risk of a slowdown in the next couple of quarters due to trade policy and unbalanced job growth is elevated, even if the headline jobs numbers look good. The difficulty of interpreting inflation under trade policy highlights the shortcomings of inflation targeting, and strengthens the case for nominal targeting. If you haven’t read it, see Skanda Amarnath’s piece on specific language changes the Fed can make to its Consensus Statement to better deal with supply shocks.

Among the available candidates, Waller is making a strong case for being the next Fed chair. His argument that rate cuts are needed because the labor market is weakening may not be flattering to the President, but it is grounded in the labor market data and could have sway over other Committee members. If the President is looking for lower rates, Waller is the candidate that commands the most respect from the rest of the Committee, and therefore is most likely to actually make lower interest rates happen.