We'll have our usual monthly inflation preview soon, but for those curious, here's a bit of a preview to the preview...

We all should take heart in how 2022H2 highlighted the possibility and plausibility of a 'soft landing'—disinflation without more unemployment—at odds with the rigid Phillips Curve views. Ultimately the probability of a soft landing hinges on the Fed's perception of its feasibility and plausibility. But it would be irresponsibly premature to spike the football and celebrate the end of inflation. It will take more time to realize the full force of disinflationary pressures in train. Two forms of flawed evidence have cropped up more prominently of late among some who are confident about disinflation: (1) fixating on deceleration in money supply measures and (2) inadvertently hyping short run energy price changes as representative of broader trends with longer duration.

Upcoming data releases are likely to present inflationary bumps in the longer disinflationary road, thereby risking more hawkish panic about how the Fed should respond to inflation. These inflationary bumps are likely to stem from a series of issues that Goldman Sachs' research team and Omair Sharif have already done a great job of summarizing: (1) outsized price revisions at the turn of the calendar year, (2) near-term used car price stabilization, and (3) still-lagging rent CPI dynamics. Given these causes, we don't think hawkish panic is the right prescription, but our preferred framework may still lean towards incremental tightening during the upcoming meetings. We will discuss this in greater detail in our monthly inflation preview.

Near-term economic data rarely moves in a straight line and even within the broader trajectory of disinflation, there is ample room for short-term data trends to break from the current disinflation narrative right now.

Not Again With The Money Supply Measures

We shouldn't have to keep dealing with these arguments, but just as with job openings, lone episodic coincidence is driving claims of causal inference.

Alleged measures of broad money supply like "M2" spiked during the pandemic (in part due to methodological changes), and inflation subsequently spiked. Now M2 is contracting. Is this proof positive that M2 is the key to disinflation now? Sigh...

A lot of time series saw a historic spike during the pandemic and during reopening. From inflation, to GDP growth, to job growth, to COVID cases, to reported toilet paper shortages. Does that prove that those indicators are the key to inflation also? The same logic is inadvertently driving claims about the alleged forecasting power of job openings. We should frown on such flawed "episodic correlation = causation" reasoning. Empirically rigorous thinking should, at a bare minimum, try to look to other historic episodes to see whether indicators are able to predict inflation outside the calibrated sample...otherwise we are overfitting to a single pandemic-driven episode (whether we realize it or not).

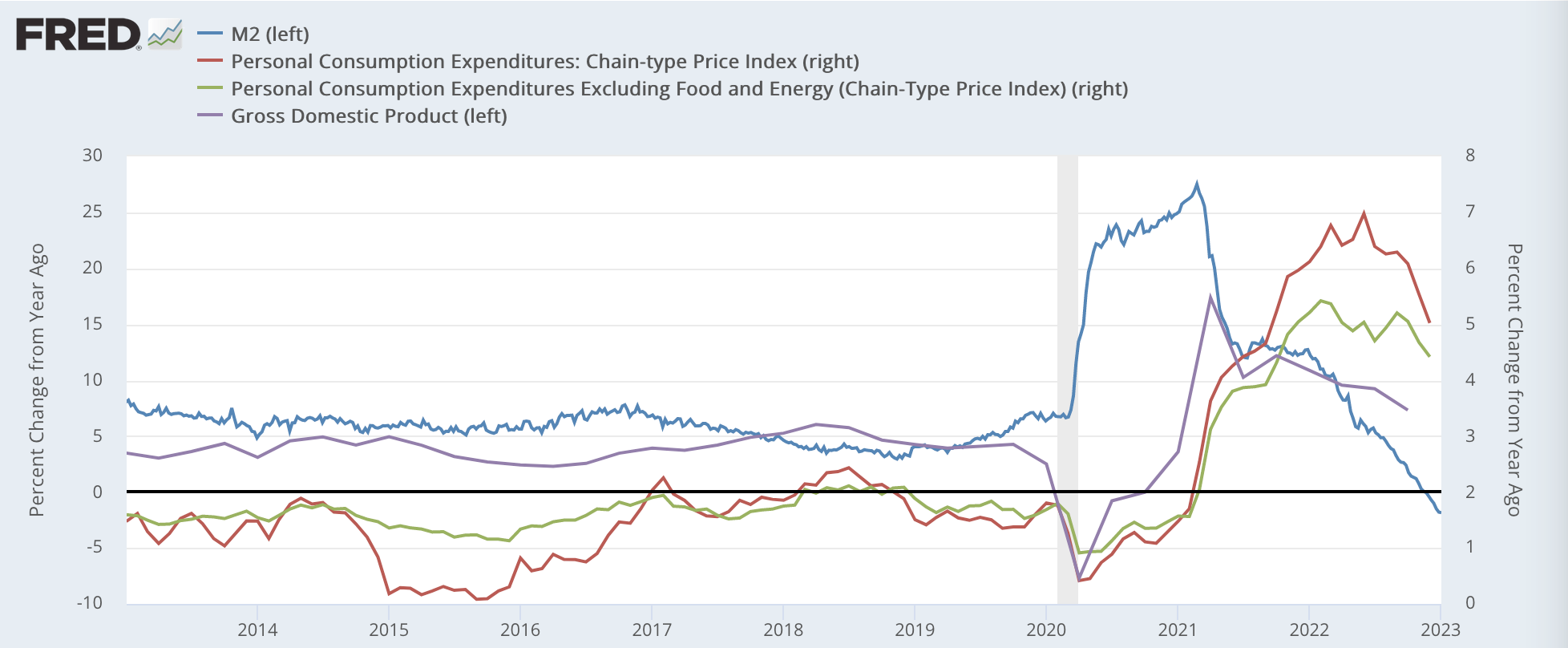

Look at the picture of M2 versus inflation measures over the past 5-10 years, and you can easily think there is a secretly strong relationship afoot. M2 spiked initially after the pandemic and inflation spiked subsequently. Voila!

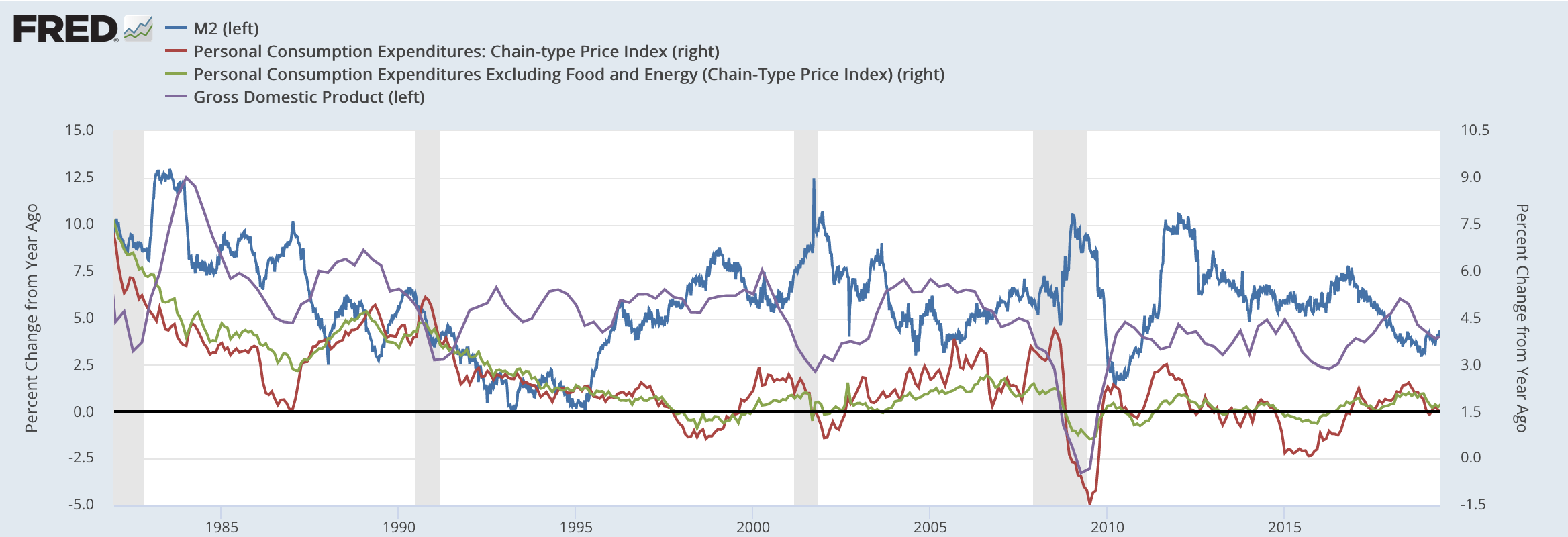

The empirical relationship between money supply measures and inflation (or nominal GDP) is far from impressive when looked over a longer sample that excludes the pandemic. Sometimes it takes a lot of care to avoid being misled by statistics, but the alleged relationship here isn't that hard to grow skeptical of.

For all of our empirical and analytical criticisms of job openings when leveraged as a business cycle indicator, those criticisms are even more egregiously applicable to to money supply measures. Aside from underwhelming empirical performance, these measures are bound to be flawed for a number of underlying reasons: (1) moneyness of a financial instrument is an ever-changing spectrum, (2) even if money took on a static definition, it is still hard to measure, (3) it is not clear that money supply measures actually reflect cyclical inflation dynamics relative in any meaningful sense, and (4) they can quickly grow removed from what central banks directly effect (interest rates and the supply of settlement balances).

Without boring you with the additional flaws, details, and debates about 'how money is created' and its full implications, people should know better than citing contracting M2 as a serious indicator of disinflation. It's a noisy indicator with highly limited underlying meaning.

When Fancier Econometrics Misses The Point

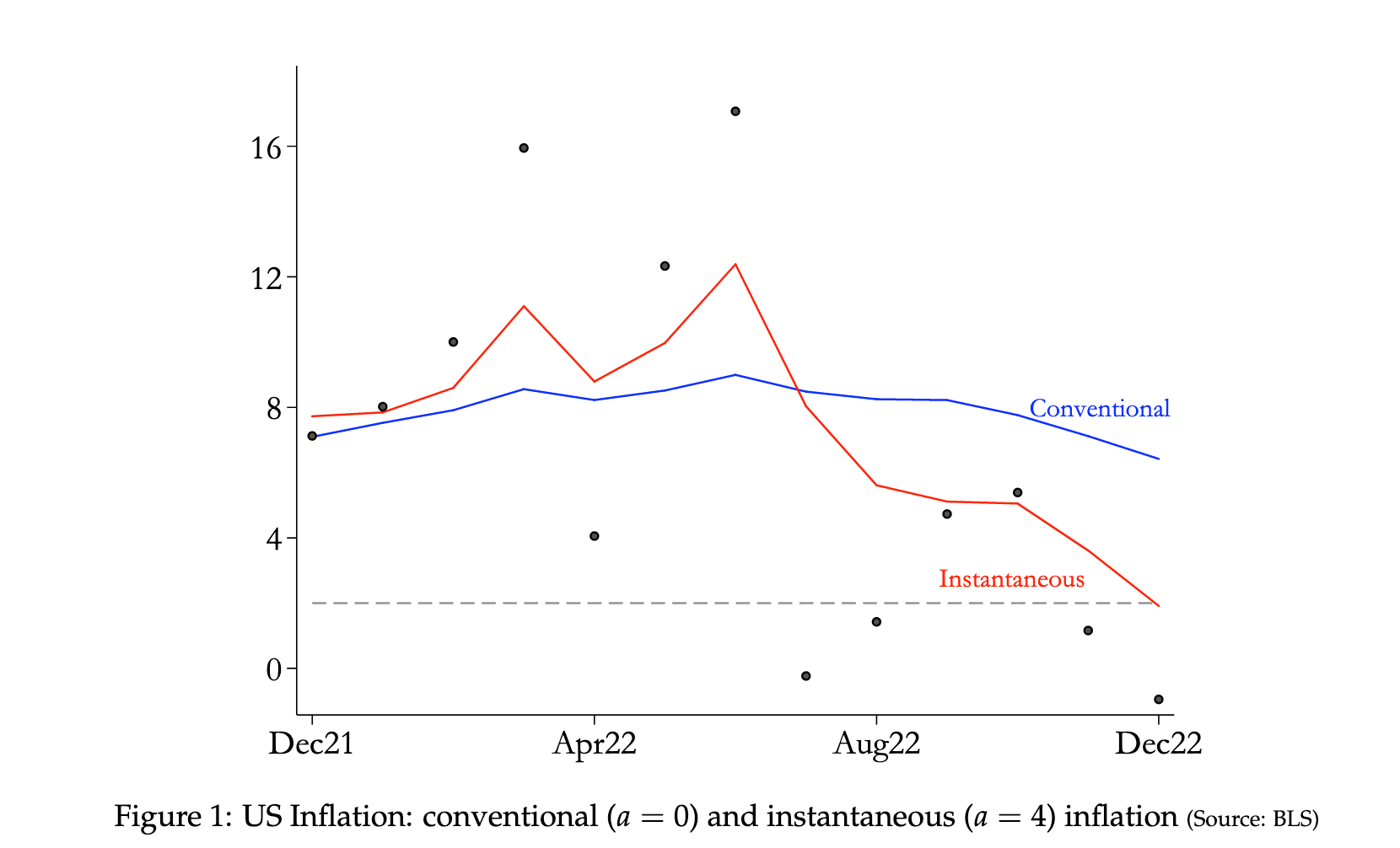

Jan Eeckhout had a provocative Twitter thread and short paper with the punchline that inflation is basically over in the United States and Europe. He specifies a more advanced method for identifying instantaneous inflationary pressure that cuts through the noise of base-effects in year-over-year readings. To be clear, this method—when constrained and calibrated correctly—can be very useful for monitoring real-time macroeconomic time series in a manner that is superior to year-over-year growth rates. But without thinking about what tends to drive headline inflation volatility in the first place, this measure guides towards flawed and complacent interpretations. What Eeckhout is really capturing are local trends in energy prices, the most volatile subcomponent of headline inflation.

If you were of the view that inflation is always exclusively (or even primarily) a monetary / macroeconomic general equilibrium phenomenon, then Eeckhout's measure has some merit. If you acknowledge that the microeconomics (of energy) dictates inflation reading changes in the short-run (and is not neatly offset by other prices), then this instantaneous measure of headline inflation has far less to offer. Whether folks want to admit it or not, we are all invoking some dose of microeconomics when using a "core" measure of inflation. His proclamation that inflation is 'over' should be treated skeptically, no matter how convenient it might be for that to be true.

Short-run energy price trends matter in the near-term for headline inflation, but it would be very problematic to let such dynamics be a key input for the management of interest rates and financial conditions. If Eeckhout's measure was applied to more stable measures of inflation, the picture of "instantaneous inflation" would still look encouraging but far from a proclamation of mission accomplished.