Our Labor Market Analysis goes beyond conventional unemployment statistics to assess the true health of the job market. We track prime-age (25-54) employment rates, various wage growth measures, and job dynamism indicators like quits and hires to measure labor market tightness.

Labor Market Analysis

Read the Latest

Read the Latest

Wage growth slowed in Q4 faster than consensus forecasts–-at an annualized rate just over 4%. We already noted in our preview that this would be very consistent with what the other Q4 macroeconomic & wage data was signaling. The scenario poised to trigger a hawkish overreaction did not materialize.

As we await the Q4 Employment Cost Index (ECI) release tomorrow (forecasting consensus: 1.2% QoQ, 4.9% CAGR; Q3: 1.2% QoQ, 4.8% CAGR), two key points to keep in mind. 1. The Q4 Data Showed Slowing Across Many Wage and Wage-Relevant Indicators, Potentially To 4.2% annualized.

While layoffs are painful to workers, more attention needs to be paid to the threat of a rise in unemployment arising from a slowdown in hiring. In this report, we examine the important role that a fall in hiring rates plays during unemployment increases.

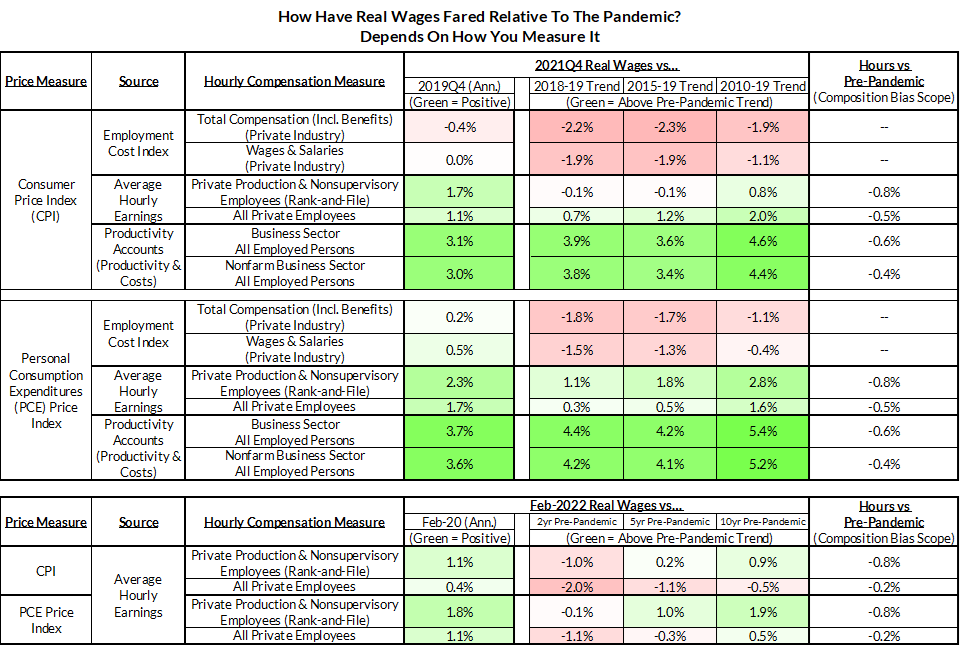

The Fed says that the labor market needs to cool in order to bring inflation down. A key part of the case for maintaining the current pace of rate hikes is built on high measures of wage growth. Jay Powell cited the last average hourly earnings figure as one sign

A Labor Supply Shock? Much ado has been made about the shortfall in the headline employment-to-population ratio and the headline labor force participation rate of late. Many have claimed that recent wage and price pressures trace back to a “labor supply shock”. Some have even tried to make the more

The Federal Reserve has given job vacancy data center stage in assessing the strength of the labor market. The theoretical and empirical issues with vacancies data show that this is a mistake.

As of the first quarter of 2022, we have effectively recovered the jobs and wages lost to the pandemic-induced recession.

The prime-age employment rate rose by 0.5% in November 2021 to 78.8%, but this was abnormally low relative to the not seasonally adjusted (NSA) estimate of 79.3%. The 2019Q4 peak was 80.3%. The next employment report will feature seasonal factor revisions in the household survey (the