Our Labor Market Analysis goes beyond conventional unemployment statistics to assess the true health of the job market. We track prime-age (25-54) employment rates, various wage growth measures, and job dynamism indicators like quits and hires to measure labor market tightness.

Labor Market Analysis

Read the Latest

Read the Latest

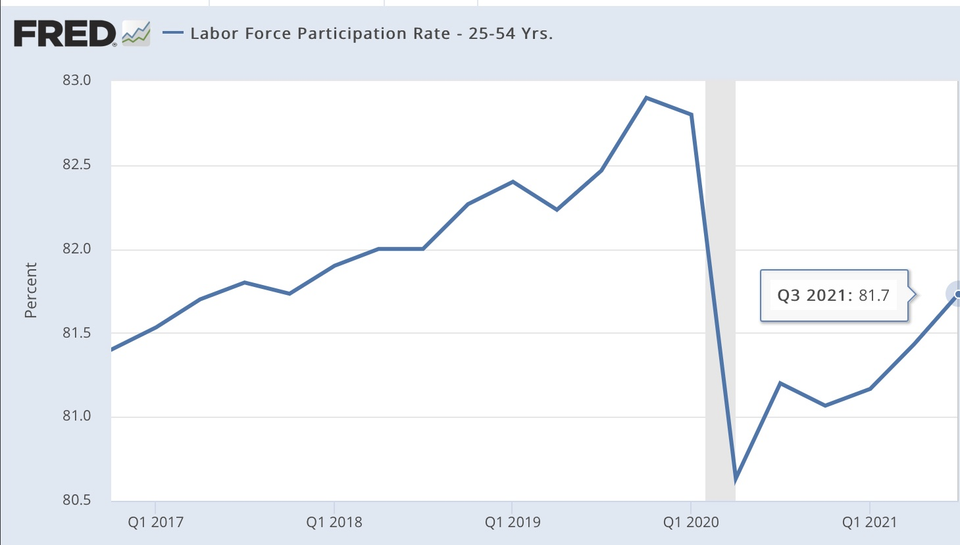

Chair Powell and others have bemoaned the allegedly sideways trajectory of labor force participation, while other commentators have taken an even more pessimistic view, assuming that a large swath of people who were employed just two years ago to be permanently unavailable now. To evaluate the recovery correctly (and measure

Critics are claiming the American Rescue Plan was too ambitious as fiscal stimulus. The data suggests today's inflation is due to the speed with which the economy is adding jobs, not the number of jobs added. As such, critics are really wishing for a slower recovery with a slower pace of job growth.

“Real wages” are often presented as a neutral measure of the ability of households to buy definite quantities of real goods after adjusting for changes in both prices and wages. In reality, "real wages" explain far less about household economic well-being than these stories confidently imply.

While The Shock may have ended, labor market indicators suggest that we still need to respond appropriately to The Slog if we are to avoid a repeat of the lackluster “jobless recovery” following the 2008 crisis.

Demand for workers with criminal justice involvement and a history of incarceration appears to be rising in several regions across the country over the past few years, according to interviews with eight job placement professionals in cities spanning the nation.

Labor force entry likely explains between ⅓ to ½ of the rise in US prime-age participation from its recent trough, and that the level and slope of labor force flows suggest prime-age participation may have even further to rise in the absence of exogenous shocks.

Canada shows us that even when PA EPOP is pushed to new highs, wage and price acceleration does not necessarily follow or persist. It is time we rethink the interactions between labor markets and inflation.