Executive Summary

Debates about the origin of inflation have so far focused on supply chain disruptions, excessive fiscal stimulus, and an unwillingness to work among the labor force at large. None of these accounts adequately capture the actual constraints fettering economic production and growth today, nor do they adequately explain where price inflation has most substantially materialized. Rather than inflation due to a shortage of labor, what we are seeing today is inflation mostly due to an acute shortage of physical capacity. US consumption and inflation are tightly linked to the constraints stemming from

plant and equipment, which are often primarily located or manufactured overseas and subject to their own logistics constraints. If either of these become impaired, there is little ability to meet demand by redirecting production to domestic capacity.

However, this shortage of physical capacity is not wholly the product of mistaken actors. Instead, the decision to run down physical capacity was often an understandable and locally rational response to persistent demand shortfalls. We walk through three industries—all of which are disproportionately responsible for current inflationary pressure and representative of real production constraints—to show how price and production crashes led to a situation of long-run underinvestment in productive capacity. Such crashes inadvertently created the conditions that currently constrain production and thereby explain the bulk of realized inflation. The specific goal of this piece is to describe the nature of current economic constraints, an inquiry distinct from the (equally worthwhile) question of what caused these economic constraints to bind in the first place.

Shortages and Inflation

Most political and economic commentators have already found their preferred explanations for the past twelve months of inflation. For some on the left, the past year of inflation has been clear evidence of corporate price gouging, while some on the right believe prices are rising because of the alleged work disincentive effects of excessive stimulus or the augmented unemployment assistance package (which ended this past September). These explanations tend to fall short of capturing where exactly the bottlenecks in the economy are located. The political implications of these misaligned narratives can sometimes veer into impracticality or needless cruelty.

Instead, today’s inflationary pressures are best understood as the result of a physical capacity shortage (PCS), both domestically and abroad. Some aspects of the views above may contribute to the PCS view. It does take labor, whether foreign or domestic, to form capital, subject to other factors as well (e.g. time to build and plan, technology). Likewise, there is an aspect of our explanation that reveals how shareholders' preferences for capital-light strategies can aggravate capacity constraints and inflationary pressures. The PCS view aims to get to the heart of today’s economic challenges more directly and more precisely.

If we are looking to resolve the bottlenecks actually constraining the economy, the problem staring us in the face is the absence of readily available physical capital, rather than labor. While the pace of recovery has shown labor supply to be highly elastic, building a factory takes more than money and will: it takes time. The lead time on capital goods orders reported by the ISM has repeatedly hit new all-time highs over the pandemic, with the current median lead time for capital investment reported at nearly six months, not including the time involved in planning and financing that investment. If supply responses become highly inelastic due to insufficient physical capacity, prices rise to ration existing inventory and help fund the cost of future capacity expansion.

The Physical Constraint View

So far, much of the debate has been focused on pointing fingers at the “real cause” of inflation. Some point to the effects of the pandemic and associated policy responses like COVID-zero, and supply chain blindspots that have kneecapped key durable goods subsectors. The loss of Russian, Ukrainian and Belarusian production is likely to disrupt the supply of a new array of commodities and low-margin inputs. Those who argue that today’s inflation is a result of excess demand cite the unprecedented scale of fiscal support during the pandemic recession, as well as the strong consumption bias towards goods and away from services. Each of these are causal claims, and are worthy of separate discussion, but are beyond the scope of this piece.

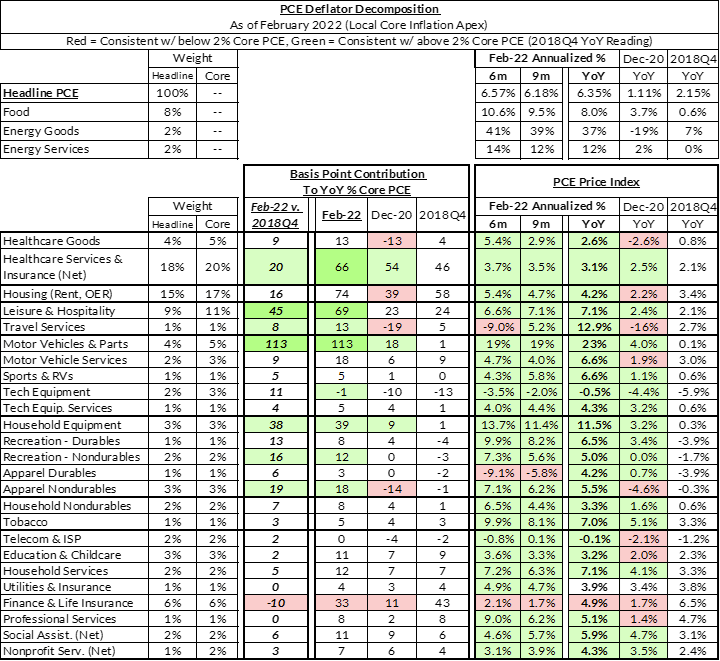

This physical capacity constraint has affected myriad industries in different ways, a fact visible in the increasing exasperation of the anecdotes shared in each month’s ISM Report on Business or in any Federal Reserve manufacturing survey. While many industries have seen rising inflationary pressures, it is easiest to illustrate the PCS view using a smaller subset of relatively capital-intensive sectors that account for the majority of the inflation overshoot, as measured by either the Consumer Price Index or the Personal Consumption Expenditures price deflator.

The semiconductor shortage has been a major narrative throughout the pandemic and the recovery, affecting high-tech and low-tech industries alike. One of the biggest knock-on effects from that shortage has been an acute shortage of new automobiles, which has driven extreme price movements in both the new and used vehicle markets. The microchip shortage has also affected the supply of other durable goods, like home appliances. Housing and furnishings both also saw substantial price movements over the pandemic and recovery, with disruptions to lumber supply a major factor in each. A shortage of logistics infrastructure has certainly exacerbated all of these problems and more. As the pandemic prevented the orderly operation of global shipping, supply chains became more and more jammed up, leading to shipping prices and lead times that have been rare since the advent of containerization. In each of these industries, employment has quickly recovered to – or even exceeded – its pre-pandemic trend, yet supply has remained constrained, driving prices higher. In a more academic register, these industries have seen highly elastic labor supply and highly inelastic capital supply since the end of the pandemic recession.

The origin points for each shortage – and the source of the accompanying price pressures – can be difficult to see in real time. Supply chains are difficult to monitor, even for participants. Even more difficult to see are the policy and business decisions that created such a fragile global system.

This makes the development of clear causal stories exceedingly difficult. However, the reasons behind each of the shortages we face - as well as the inability of markets and policymakers to respond quickly - share a certain family resemblance. In each case, despite the fact that production might marginally benefit from both more labor, the more proximate and sharply binding constraint has been the availability of physical production capacity. In fact, we recently told a version of this story that underlined the importance of imported inflation in durable goods. The best way to characterize the overarching dynamic behind today’s inflationary pressures is as a shortage of physical capacity.

Physical Constraints in Semiconductor Production

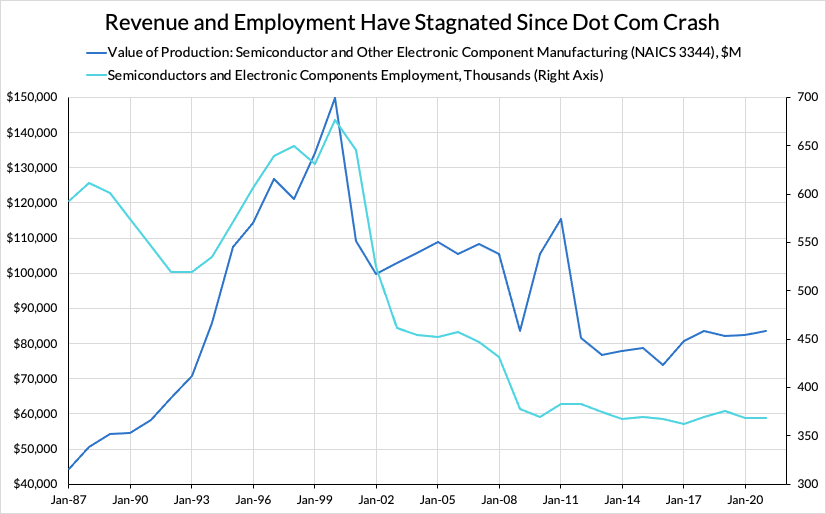

The roots of the pandemic semiconductor shortage lie in decades-long capacity loss that began with the bursting of the dot-com bubble. We have outlined this at length previously and those looking for a fuller exposition are encouraged to read “Supplying Demand: The Chip Shortage in Macro Context.” In a sentence, the failure to support demand after the crash sharply curtailed investment and led to widespread layoffs, which further reduced the impulse to invest in general.

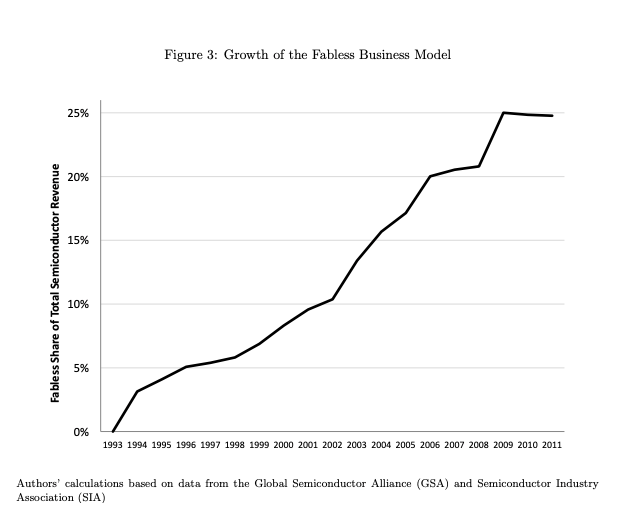

As we argued in “A Brief History of Semiconductors: How The US Cut Costs and Lost the Leading Edge,” this loss of manufacturing capacity was in many ways an intentional outcome of a federal policy strategy that emphasized research and development over manufacturing in semiconductors and other high-tech industries. This encouraged the development of capital-light business strategies which required far less domestic investment and hiring.

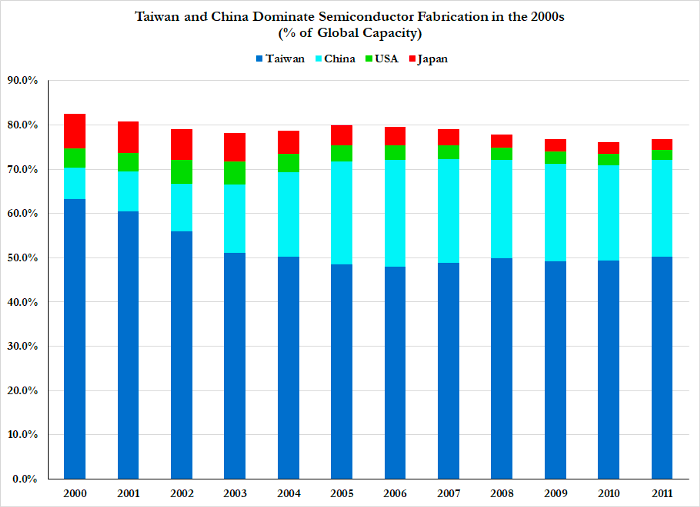

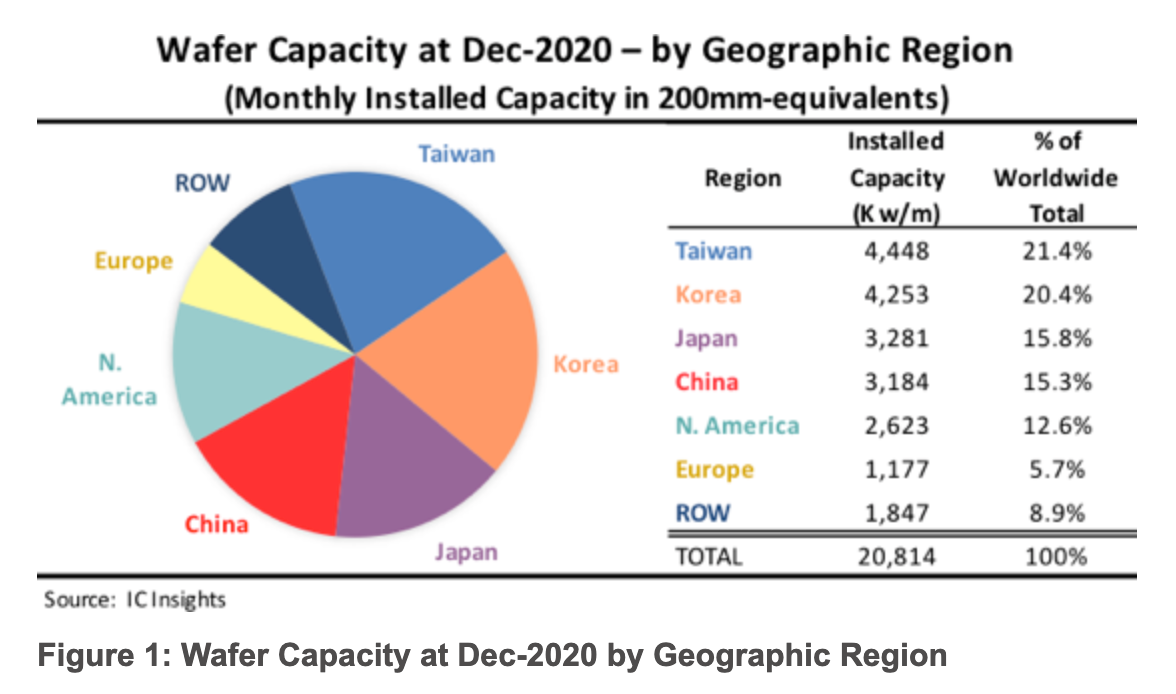

Semiconductor production capacity is highly capital-intensive with long lags between the decision to invest in new capacity and the point where that new capacity becomes profitable. Against a background of economic, technological and geopolitical uncertainty, US investors have been reticent to invest in this capacity expansion, preferring to focus on “fab-less” design-oriented approaches, while outsourcing most of the manufacturing to Asia.

This rolloff of capacity has been largely consistent with decades-long US policy, which has implicitly preferred outsourcing any manufacturing activities deemed low value-add or low return on assets, no matter the network effects lost at home or the geopolitical risks associated with such outsourcing.

Over the pandemic, this confluence of factors has meant that the ability to fulfill US domestic semiconductor demand has been constrained by its reliance on the availability of foreign capacity, as well as the logistics to ship that foreign production. If this represents a "labor shortage," it is not one that is happening domestically, and thus not one that can be solved through domestic policy.

Domestic labor, and what remains of domestic capacity, are not credible substitutes in the event of disruption to overseas production capacity. Over the past three years, this lack of domestic capacity has proven a meaningful constraint across the entire technological spectrum of semiconductor production. High-end chips (produced in Taiwan) and low-end chips (produced in China) have both contributed to dramatic production delays and price increases in home electronics, consumer durable goods and most especially automobiles.

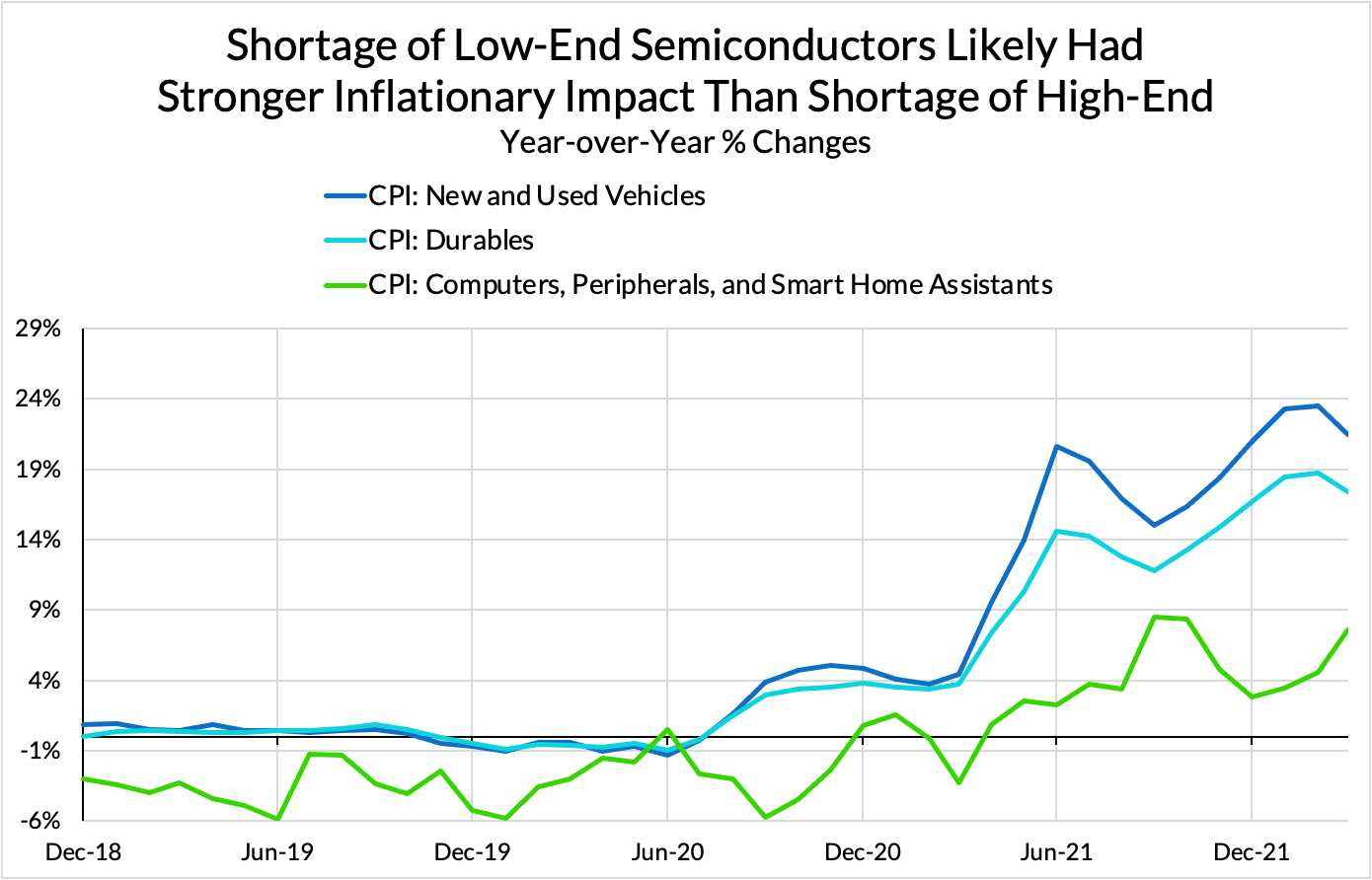

Interestingly, the shortage of low-end chips has proven substantially more inflationary than the shortage in high-end chips. Where producers of ultra-high-end electronics (think gaming PCs and the PlayStation 5) would rather keep prices steadier and ration more aggressively on delivery times, the bidding for vehicles and other consumer durables has been far more intense. We can see this clearly in the CPI components charted below.

In the event of a disruption to global trade and investment, the semiconductor industry in particular can create inflationary pressures far outside of its own sector. A slowdown in the ability to meet domestic semiconductor demand affects a wide range of seemingly-unrelated industries which share a common matrix of intermediate goods—particularly low-tech semiconductors. This result is difficult for policymakers to see, and difficult for policy to address directly, and could even be made worse by the standard set of anti-inflationary policy interventions. A shortage in physical capacity in upstream sectors is almost impossible to pick out when looking at aggregates and indices alone, and the temptation to link inflation to labor through simple Phillips curve-like models often prevails.

Ultimately, this physical capacity shortage in semiconductors has meant that each increase in prices leads to smaller increases in production and supply than one would expect, regardless of incentives. Without new supply coming online in response to price increases, hoarding dynamics might arise among purchasers of intermediate goods, further exacerbating the initial price impulse. We saw this in particular with auto manufacturers, who responded to long lead times for necessary semiconductors by (understandably) increasing their orders for those same semiconductors.

To increase productive capacity requires time and substantial investment, not an increase in sectors that rely on semiconductors for intermediate goods. Prices are liable to remain at elevated levels until one or another of these dynamics is productively addressed.

Physical Constraints in Housing

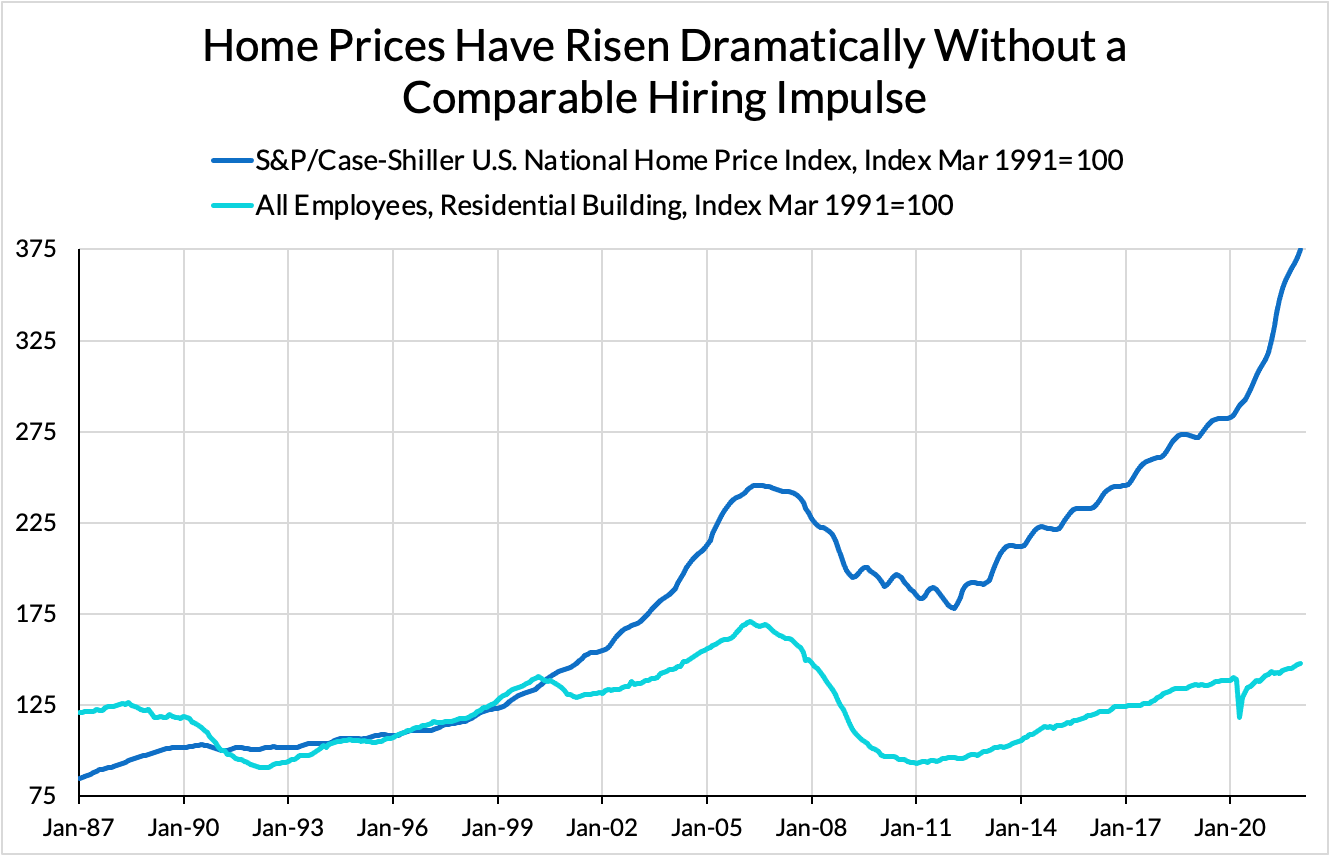

In housing, we see a similar story over the course of the recovery from the 2008 recession. As everyone knows, the period between the 2001 and 2008 recessions saw a dramatic build-up of housing assets in the US. As part of that buildup, the proportion of the labor force involved in residential construction surged, and suppliers expanded production to meet growing demand.

After the 2008 crash, minimal support was provided to housing as an industry, even if banks and certain other mortgage-backed security holders were bailed out. In response, the industry shed workers at an unprecedented rate, as many positioned themselves to weather a long-term downturn in the production of housing. What ensued was an extended period of weak levels of residential fixed investment (a flow) and units completed (a flow), and thus a prolonged loss of housing stock relative to what population levels would otherwise warrant.

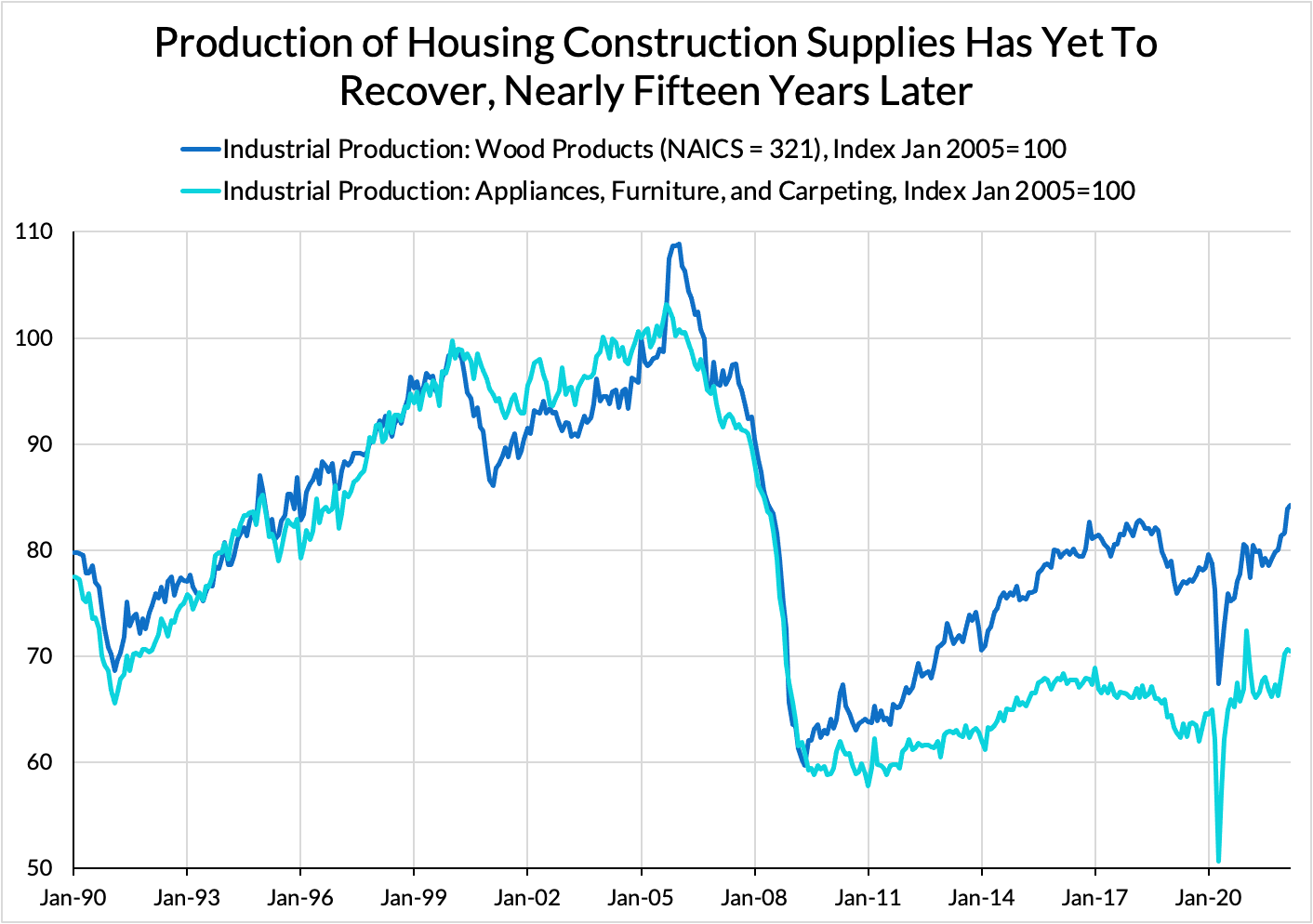

The 2008 crisis led not only to a substantial decline in the rate of investment in housing assets, but more importantly to substantial attrition in production capacity. Constructing a new house requires a tremendous number of different products – everything from lumber to plumbing to garage doors – all of which are sensitive to different input pressures and industry dynamics.

In the half-decade following the 2008 crash, every firm in these industries saw a steep decline in new orders, prompting them to close factories and lay off workers. This was a substantial disruption to the orderly operation of an industry that relies on the steady coordination of thousands of moving parts to produce new houses. We can see this dynamic most clearly in wood products, where the 2008 crash saw a fall in both capacity utilization and output. However, since capacity utilization returned without production returning as strongly, we can safely infer that the industry idled or lost a material amount of capacity. This might take the form of writing off old factories or mills or something subtler, like a rate of investment that remains steady but fails to replace depreciating equipment. Doubtless other sectors faced similar dynamics.

Although many discussed the upstream costs of allowing the auto industry to collapse in the same time period, comparatively less attention was paid to ensuring that the supply chain for housing remained resilient and robust after the 2008 crash. Since the end of the pandemic, that ecology of construction suppliers have hit capacity constraints in a number of other intermediate goods required for the production of new housing, materially slowing the supply response to the demand impulse.

When demand for housing rebounded, as it has since the middle of 2020, homebuilders remained reticent to hire new crews and expand production, expecting to be burned by a subsequent market downturn that would force them to lay off any newly-trained crews.

The decision not to support the industry through a crash led to diminished capacity once the crash ended and into the future. Just as with semiconductors, this resulted in an industry less sensitive to near-term price pressures, and with substantially less ability to quickly increase production in response to elevated demand. Just as with semiconductors, it is not really about the lack of domestic labor. Employment has been on the rise within the construction sector, but supplies of building materials and associated durable goods have remained in shorter supply, especially since much of that supply chain also exists primarily overseas. Employment has rebounded to the pre-pandemic trend, but remains nowhere near pre-2008 levels or trend growth rates. If the scarce material inputs for a house, whether they be finished goods like garage doors or intermediate inputs like resins, are produced in China or elsewhere, additional hiring gets you no closer to delivering more housing units for sale or for rent.

Physical Constraints in Oil

Oil markets and oil production are and have been structurally more volatile than semiconductors or housing, so the capacity constraint story happens on a much faster timeline. As with each of the previous examples, our explanation will be abbreviated for the sake of space, but more in-depth accounts of market dynamics can be found in our recent writing to support our energy policy proposal.

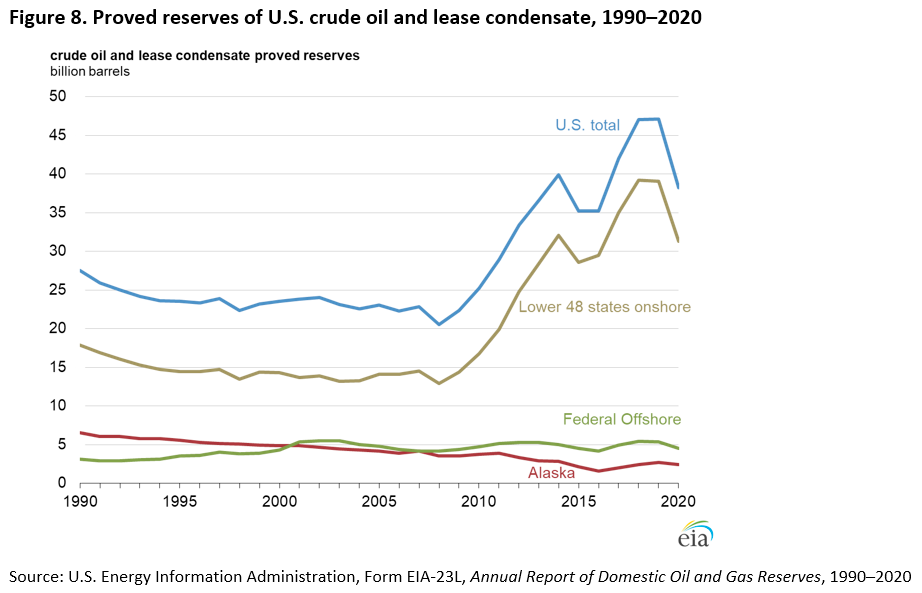

Until the latter half of the 2000s, the US was thought to have limited oil reserves, prompting decades of "peak oil" narratives. However, the development of hydraulic fracturing techniques for extracting oil and gas from shale formations dramatically changed the calculus. The development of this new extraction technique essentially doubled the US’s proven reserves in less than half a decade.

From 2010 to 2014, investment poured into exploration and production, leading OPEC to switch strategies and induce a glut that crashed the market and rendered these investments unprofitable. In fact, the extreme oil boom in North Dakota led the state to have unemployment rates near 3% in the aftermath of the Great Recession, when other states were facing rates upwards of 10%. When the price dropped precipitously in 2015 and 2016, it took a substantial volume of investment and employment with it.

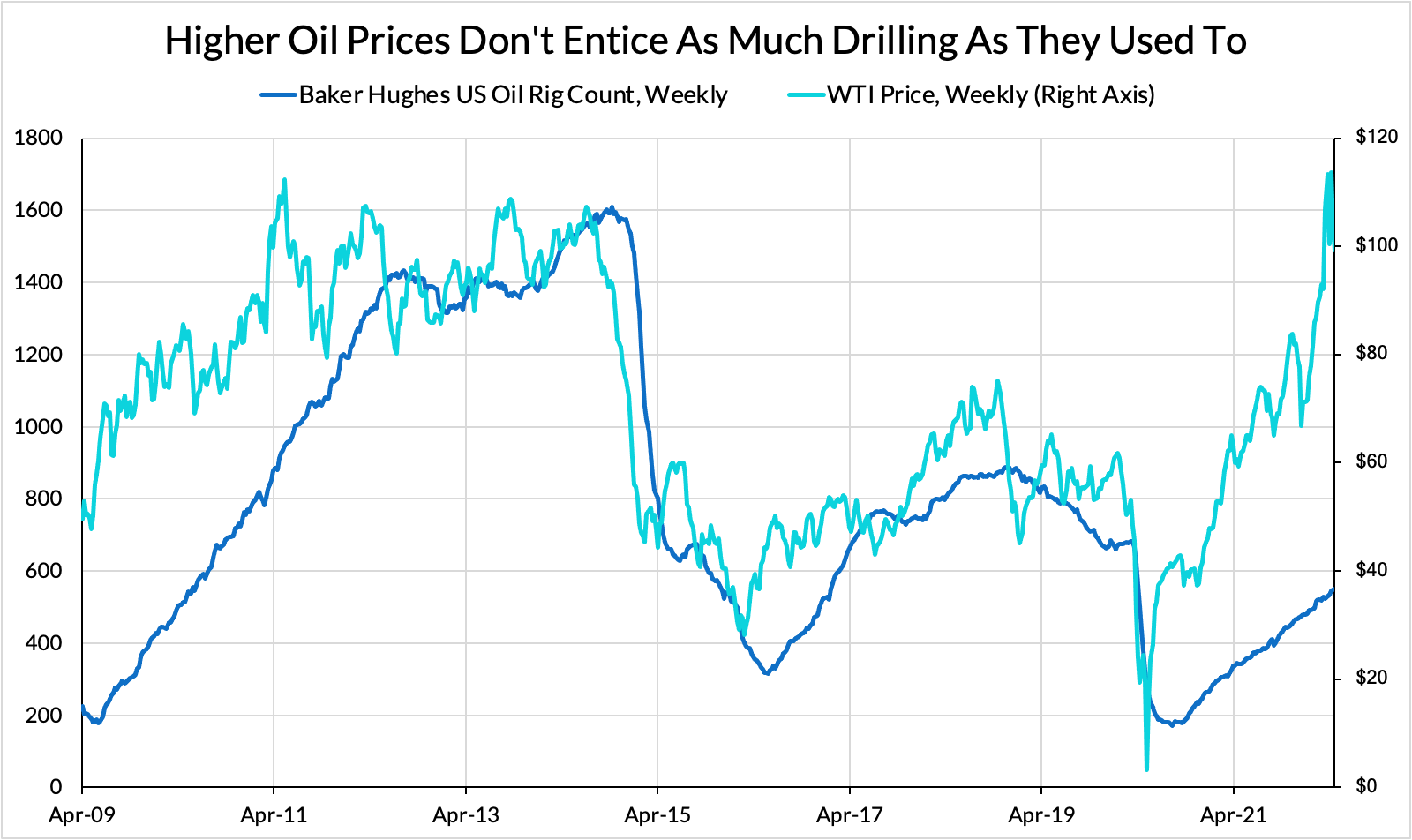

2017 to 2020 saw the same dynamic, with a run up in supply creating a glut which once again rendered the underlying investments unprofitable. That the shock which created the glut was the pandemic, rather than a price war with OPEC, changes little. Each time, cheap energy prices helped keep headline inflation low, but each crash substantially reduced the willingness of investors to invest. Why build out new production when oil prices were high, they asked, only to receive nothing back by the time that production came to market? In 2020, this boom-bust process reached its sharpest point when oil prices briefly went negative during the March and April lockdowns.

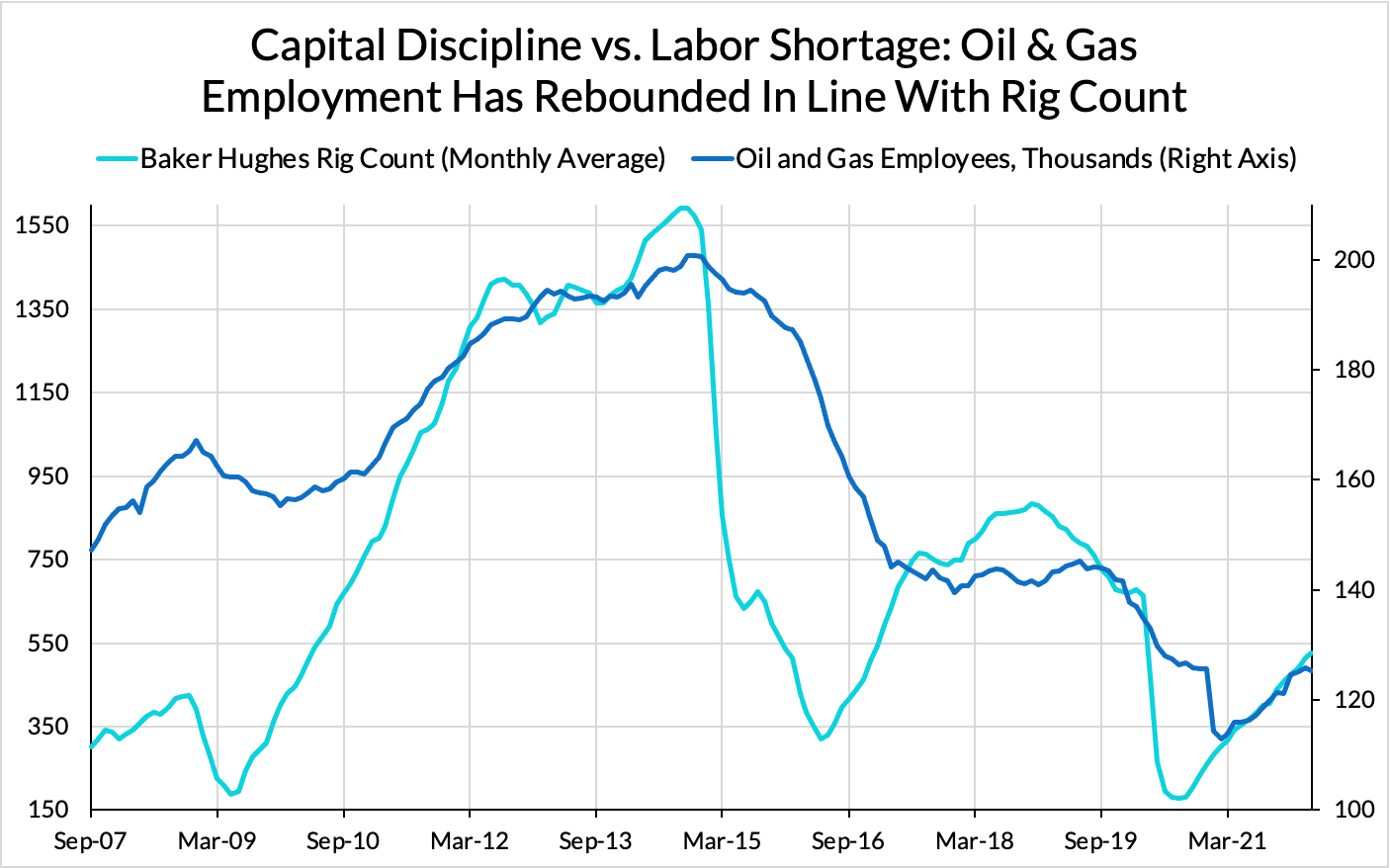

When oil prices rebounded with reopening, creditors and shareholders pressured management to engage in substantial capital discipline, waiting for high prices to validate past investments rather than building out further capacity today merely in anticipation of future demand growth. Even before Russia’s invasion of Ukraine, oil prices were reaching elevated levels, but the invasion and the ongoing loss of Russian supplies has pushed markets to a new degree of market tightness. However, severe market tightness has yet to be accompanied by a substantial acceleration in investment or rig counts.

As with semiconductors and housing, successive boom-bust cycles increased the degree of uncertainty associated with investment in the industry, making investors less inclined to invest—despite rising prices—while also running down domestic capacity.

Our points here are not to deny the existence of labor shortages. There is clearly some difficulty in securing oilfield services workers – a notoriously cyclical and physically demanding line of work – but the self-reporting of exploration and production firms (E&Ps) in the latest Dallas Fed Energy Survey clearly indicate that labor is not the proximate constraint to increasing investment. The predominant culprit for weak investment outcomes is “capital discipline,” the unwillingness of investors to finance accelerated capacity expansion. While better availability of oilfield services workers might still marginally help advance investment and future production, employment has generally stepped down with each boom-bust cycle as a byproduct of lower investment. The willingness to invest is not predominantly a function of labor availability.

Although food and energy are left out of core inflation measures, as with housing, this insensitivity of investment to prices has put a substantial squeeze on many households, with gasoline prices remaining elevated as refiners prepare for an extended period of elevated oil prices. As with semiconductors, oil prices feed into a myriad of other industries as an input cost, and so higher energy goods and services prices, if pushed far enough, are liable to create broad-based inflationary pressures (e.g. jet fuel prices influencing airfares, natural gas prices adding to fertilizer and food costs). Additionally, given the dependence on logistics for many of the sectors here, the price of diesel may have material impacts on overall and sector-specific inflation as well.

Tying It Together

In every discussed instance, inflation is most proximately a reflection of insufficient physical capacity. Additional availability of domestic labor could prove marginally helpful (especially in oilfield services and single-family home residential construction), but is nevertheless not critical to unlocking the physical capacity constraint on production. Moreover, each of these instances tends to reflect the explicit or implicit decision to allow physical capacity to dwindle or move to locations more removed from the influence of domestic labor market and macroeconomic dynamics. The abandonment of physical capacity levers US consumption ever closer to the development and operation of physical capacity that is either 1) more remote or 2) more heavily rationalized, running on thinner margins and increasingly vulnerable to the smallest of shocks. In each of these examples, greater rationalization and offshoring have also imposed new fragilities that–in the absence of greater coordination–are left unattended.

In none of the cases above has a tight labor market been—at least from the supply side—the determining factor for the substantial price inflation we have seen of late. There is a case to be made that the speed with which the labor market returned to pre-pandemic levels provided households with the demand necessary to bid prices up in these inelastic goods. However, that case is not one in which insufficient labor supply has driven inflation, the narrative that many policymakers and commentators rely on.

In each individual case, the decision to run down the capital stock in response to extreme demand uncertainty was rational, and had the predictable outcome of rendering that industry less resilient to shocks. Although a shortage of physical capacity is not desirable, it arose for reasons that seemed optimal to those making the decisions at each step. Keeping this fact in mind will help ensure that our policy responses are keyed to the present reality as well as the history that produced it.

The Path Forward For Policy

The question of how to produce a pro-investment policy that emphasizes the maintenance and expansion of economic capacity is not a simple one to answer, especially at a macroeconomic – rather than sectoral – level. Policy may be able to help, but greater industrial monitoring will give rise to more tools to craft a more resilient mix of domestic and foreign capacity. The heterogeneous nature of supply-side challenges require a more tailored suite of policy mechanisms that address the most urgent sources of capacity constraints and inflation, sources often beyond the Fed's immediate reach. Fiscal policy also has a role to play as well, with proposals like COMPETES/USICA show how government spending might help augment the development of physical capacity.

The reflexive turn to tighter monetary policy as an inflation control measure may risk worsening this capacity shortage. The domestic oil extraction industry knows all too well how tighter financial conditions can sharply slow down capital plans. Likewise, a stronger exchange rate may make for an awkward fit if domestic capacity could otherwise be well-suited to substitute for foreign capacity shortfalls.

Despite the complexity associated with inflation, the solutions are often opaque but not impossible. Supply-side constraints are difficult to describe or resolve if labor supply is the only variable of interest. A failure to divide constraints between labor and physical capital may, in turn, lead to poorly-tailored policy responses. However, this difficulty should not deter us from building the knowledge and policy program required to confront the physical capacity shortage, and accompanying inflation, that we face today. It is more important than ever that we develop the suite of tools that address and avoid inflation, or else disinflation by labor market weakness will remain the predominant policy mechanism.