Labor Markets

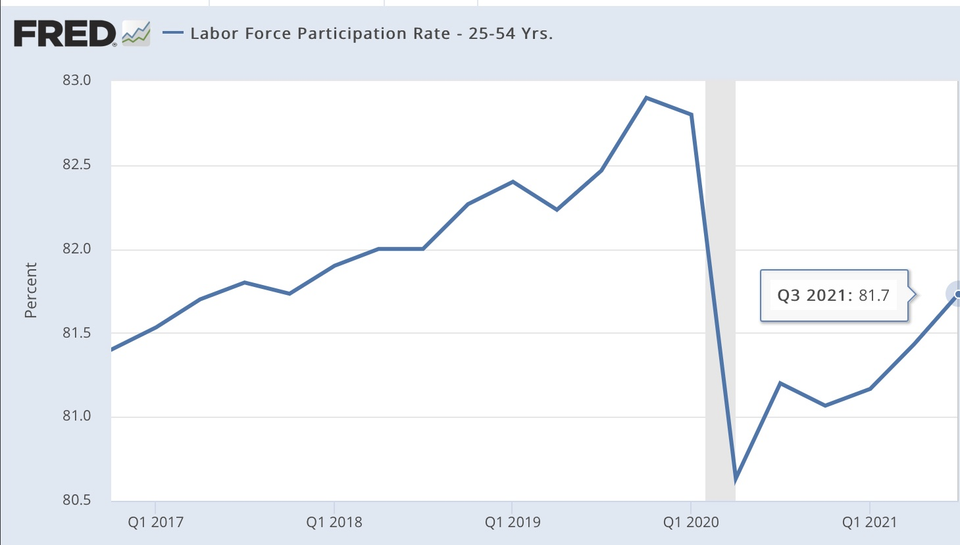

If the Fed wants to stay true to the "maximum employment" component of its forward guidance, and the "broad and inclusive" nature of that goal, it is imperative that their interest rate policy actions reflect a full recovery on both of these measures.

Chair Powell and others have bemoaned the allegedly sideways trajectory of labor force participation, while other commentators have taken an even more pessimistic view, assuming that a large swath of people who were employed just two years ago to be permanently unavailable now. To evaluate the recovery correctly (and measure

Critics are claiming the American Rescue Plan was too ambitious as fiscal stimulus. The data suggests today's inflation is due to the speed with which the economy is adding jobs, not the number of jobs added. As such, critics are really wishing for a slower recovery with a slower pace of job growth.

While The Shock may have ended, labor market indicators suggest that we still need to respond appropriately to The Slog if we are to avoid a repeat of the lackluster “jobless recovery” following the 2008 crisis.

Between mid-February and mid-March, the number of Americans unemployed grew by 1.4 million. But the rise in Americans reporting any type of labor market disruption — absence, wanting more hours, or not having a job at all — was almost four times that number: 5.6 million.

The coronavirus shock will lead to a dramatic spike in the unemployment rate. But even this surge could understate the true labor market damage from the virus.

Sharp changes to unemployment insurance systems are needed to stabilize the American economy, incentivize compliance with public health guidance, and keep American families financially secure.

Demand for workers with criminal justice involvement and a history of incarceration appears to be rising in several regions across the country over the past few years, according to interviews with eight job placement professionals in cities spanning the nation.

The Fed now recognizes that its interventions have helped to create millions of jobs and promoted a better equilibrium in the long run. A deeper shift to its reaction function is now needed.