Citation links can be found in the PDF attached. If you are interested in more timely access to this content, feel free to reach out to us here.

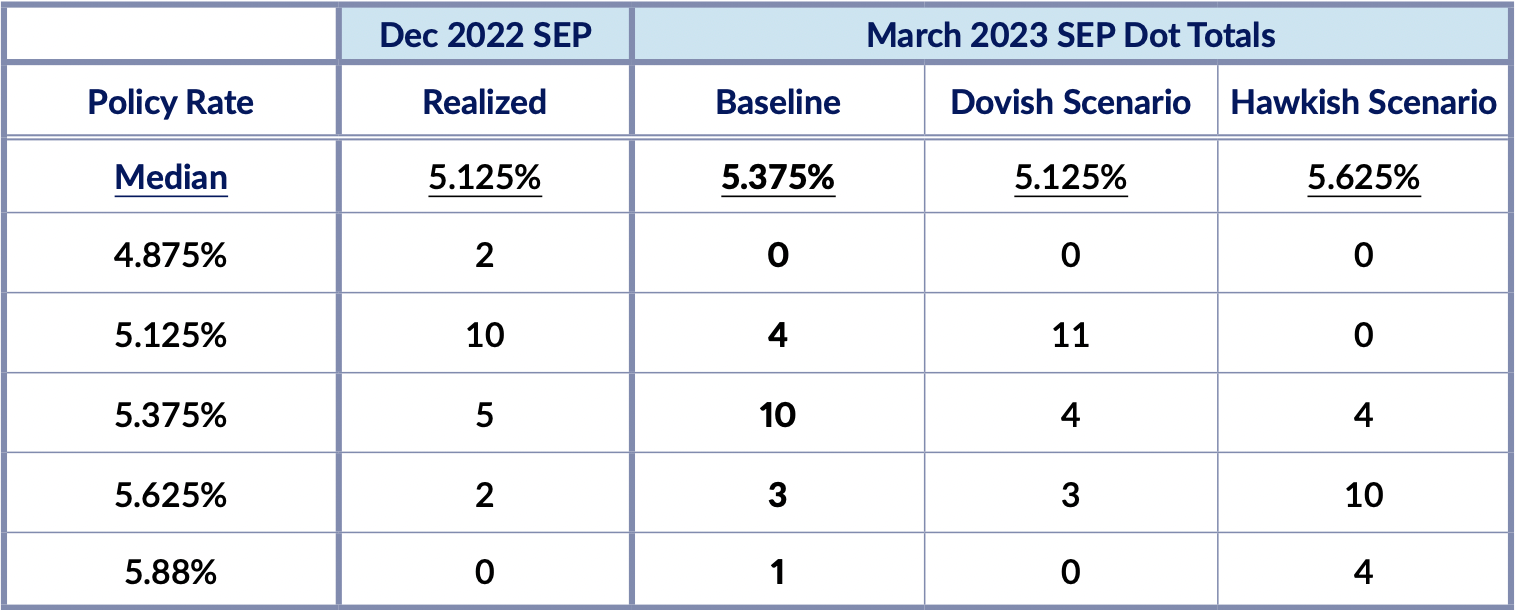

Baseline Scenario: Terminal rate projections (2023 dots) rise another 25 basis points to 5.375% at the March FOMC meeting. Job growth has proven resilient (less than expected recession risk) and January PCE inflation data is likely running hotter than the Fed projected in December. We are also baking in the assumption that February labor market and CPI data will come in stronger than consensus, adding to the likelihood that some FOMC members will lift their dot as a result.

Balance of Risks vs Baseline: A hawkish scenario is more likely than a dovish one. A 50bp hike in March is a far (but plausible) reach, but a 50bp rise in 2023 year-end dot (to 5.625%) seems more firmly on the cards.

Drivers of hawkish scenarios:

- Residual seasonality affecting labor market and activity data, including the February jobs report on Friday.

- Sticky prices creating a seasonal echo that pushes up Q1 inflation data (also see here).

- Fading used cars deflation.

The Fed would be forced into a tricky quandary if market pricing drifts towards pricing a 50bp hike following February CPI, which comes out during the blackout period. Nevertheless, FOMC members seem largely keen to stick to the more prudent 25bp pace of hikes and it will take a substantial amount of data to force a change in course now. The dots are the more flexible signaling device for additional hawkishness.

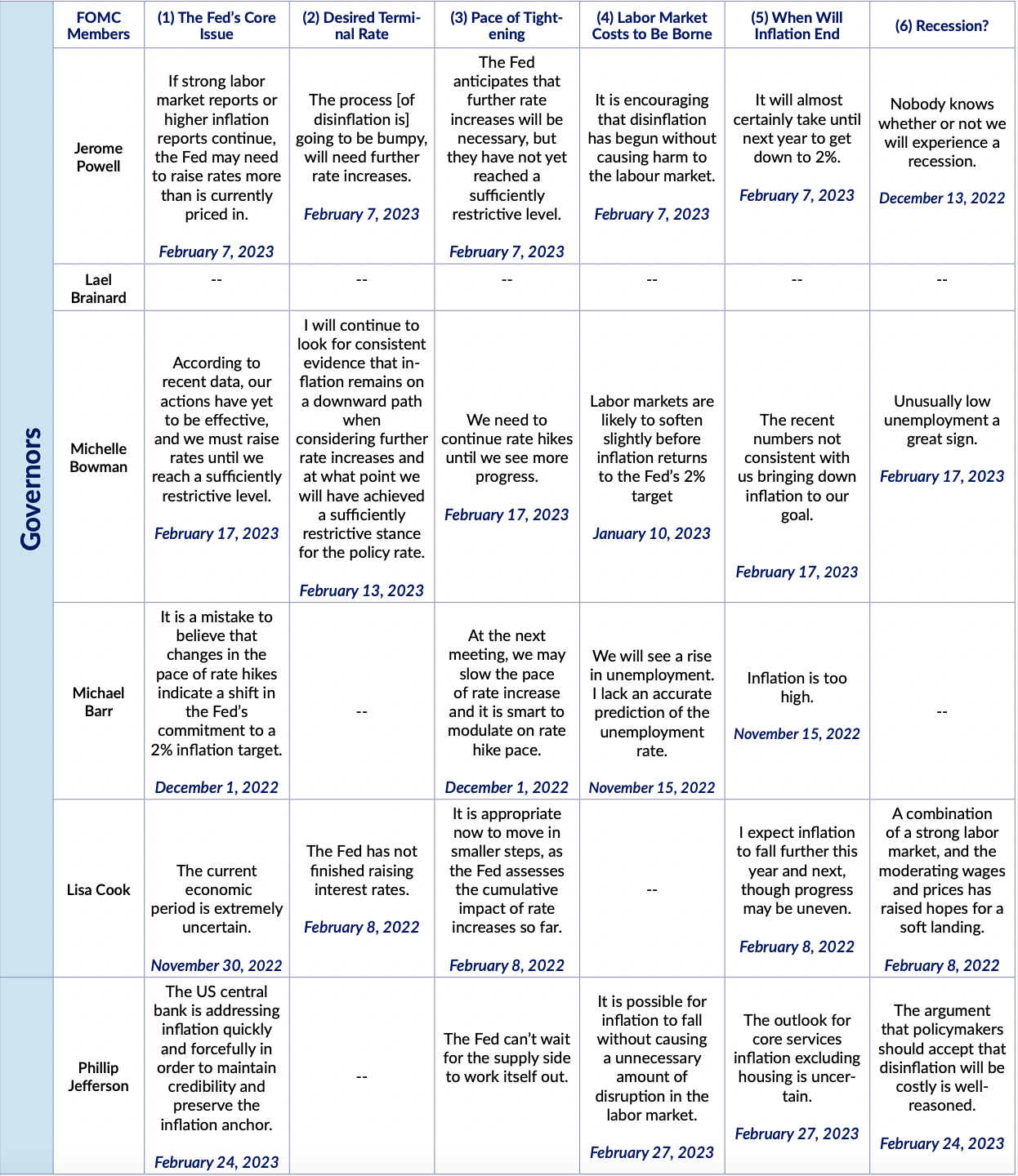

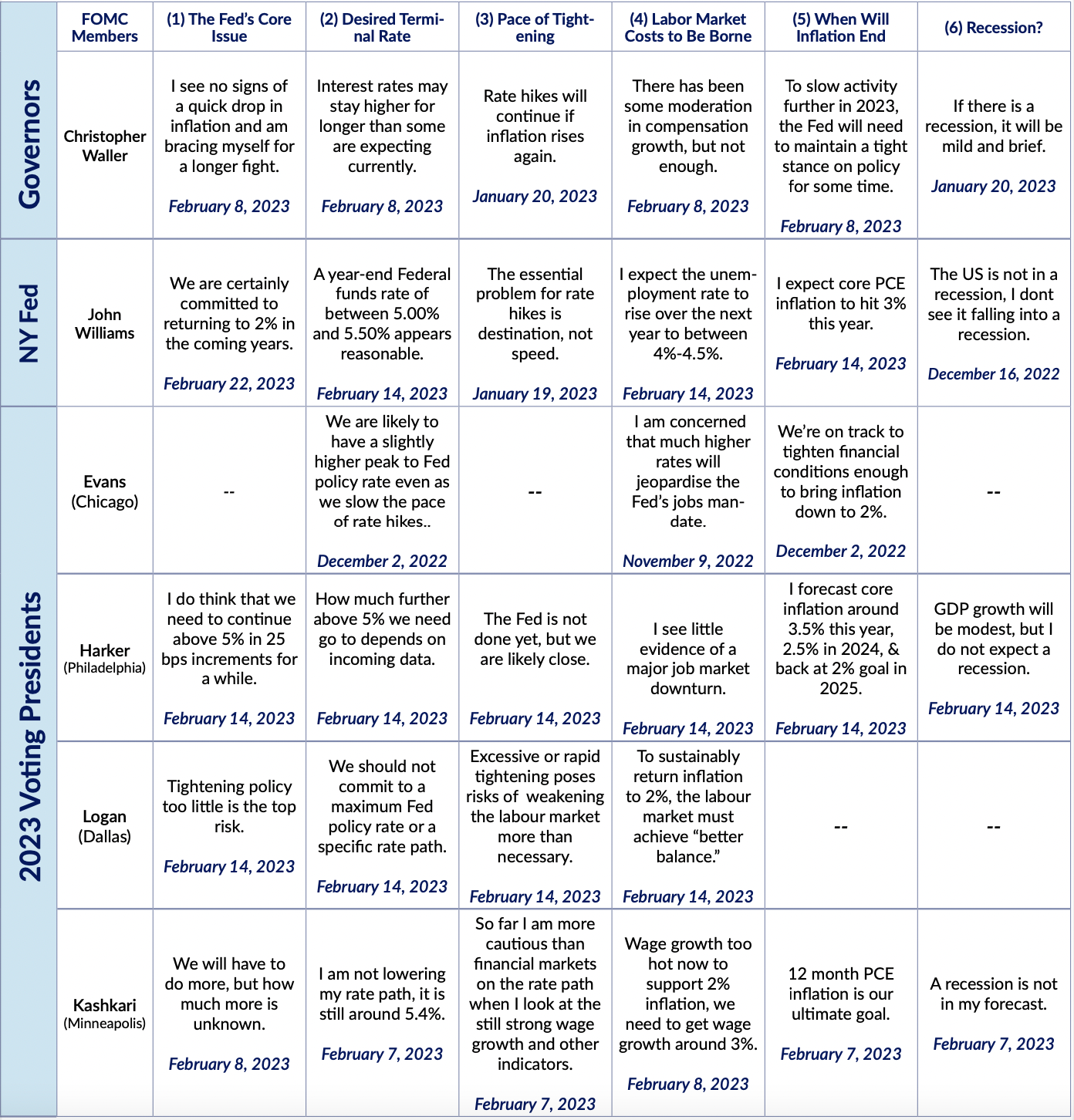

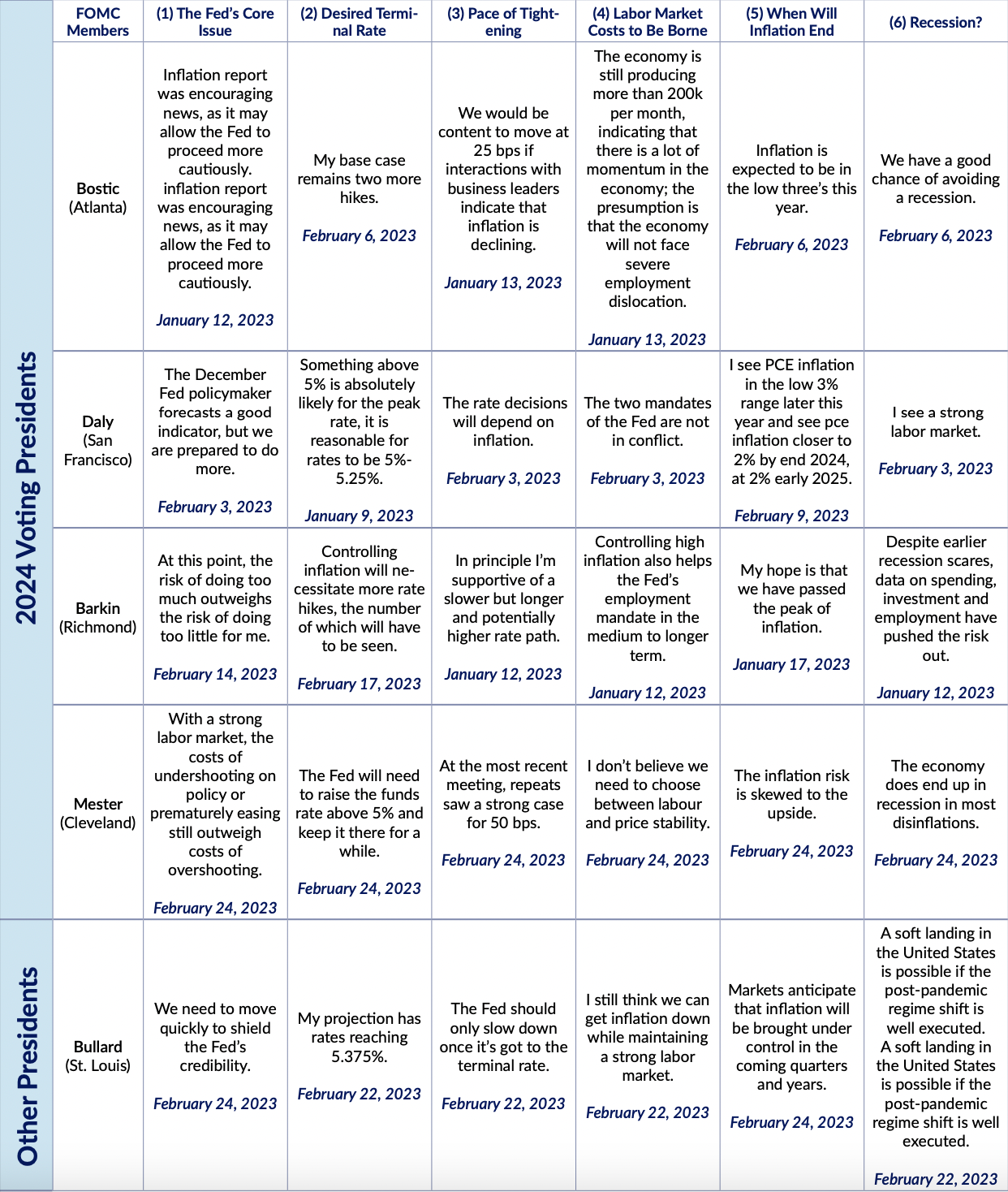

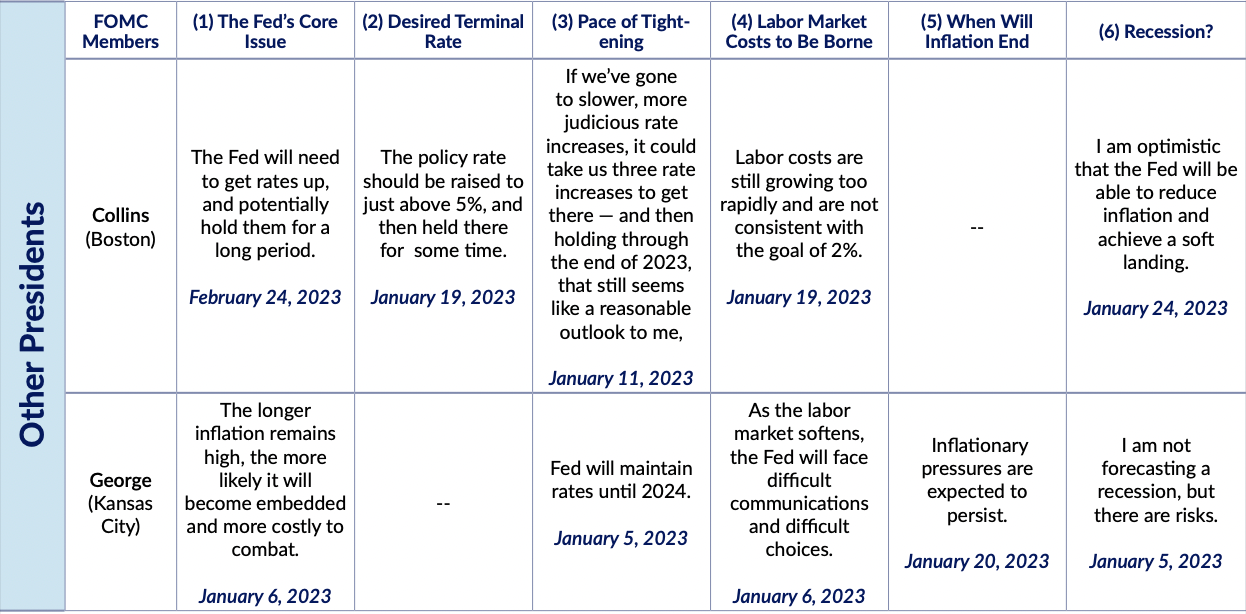

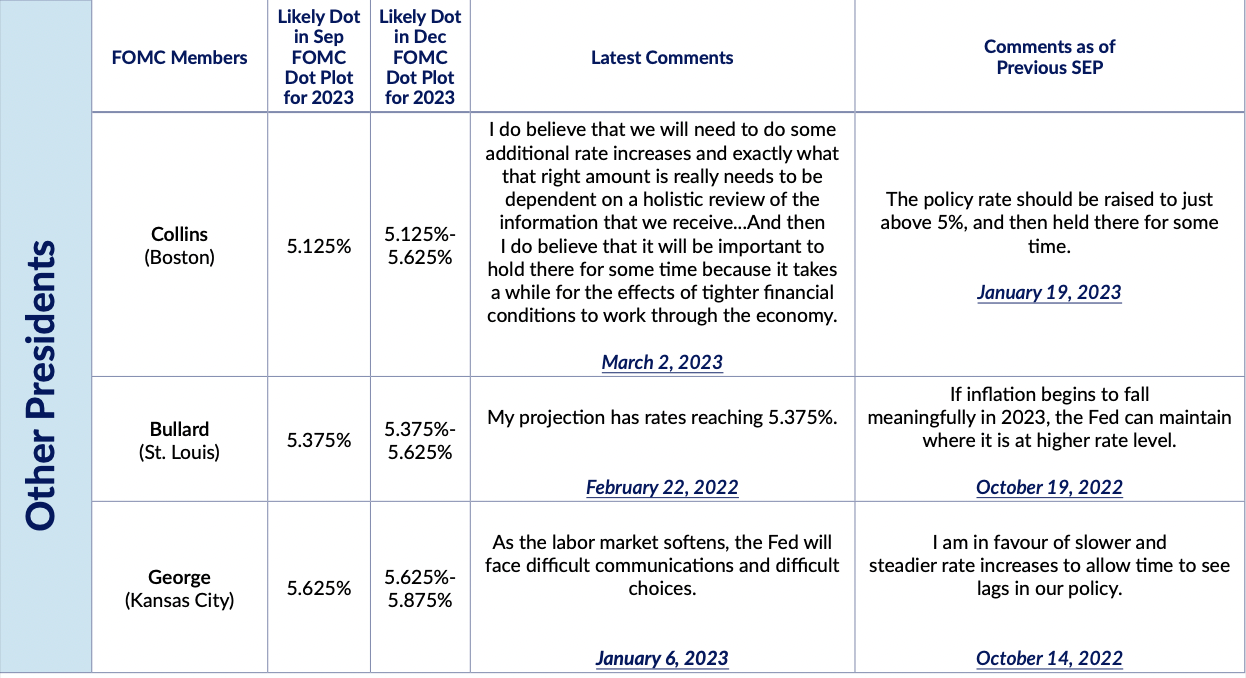

Summary Table:

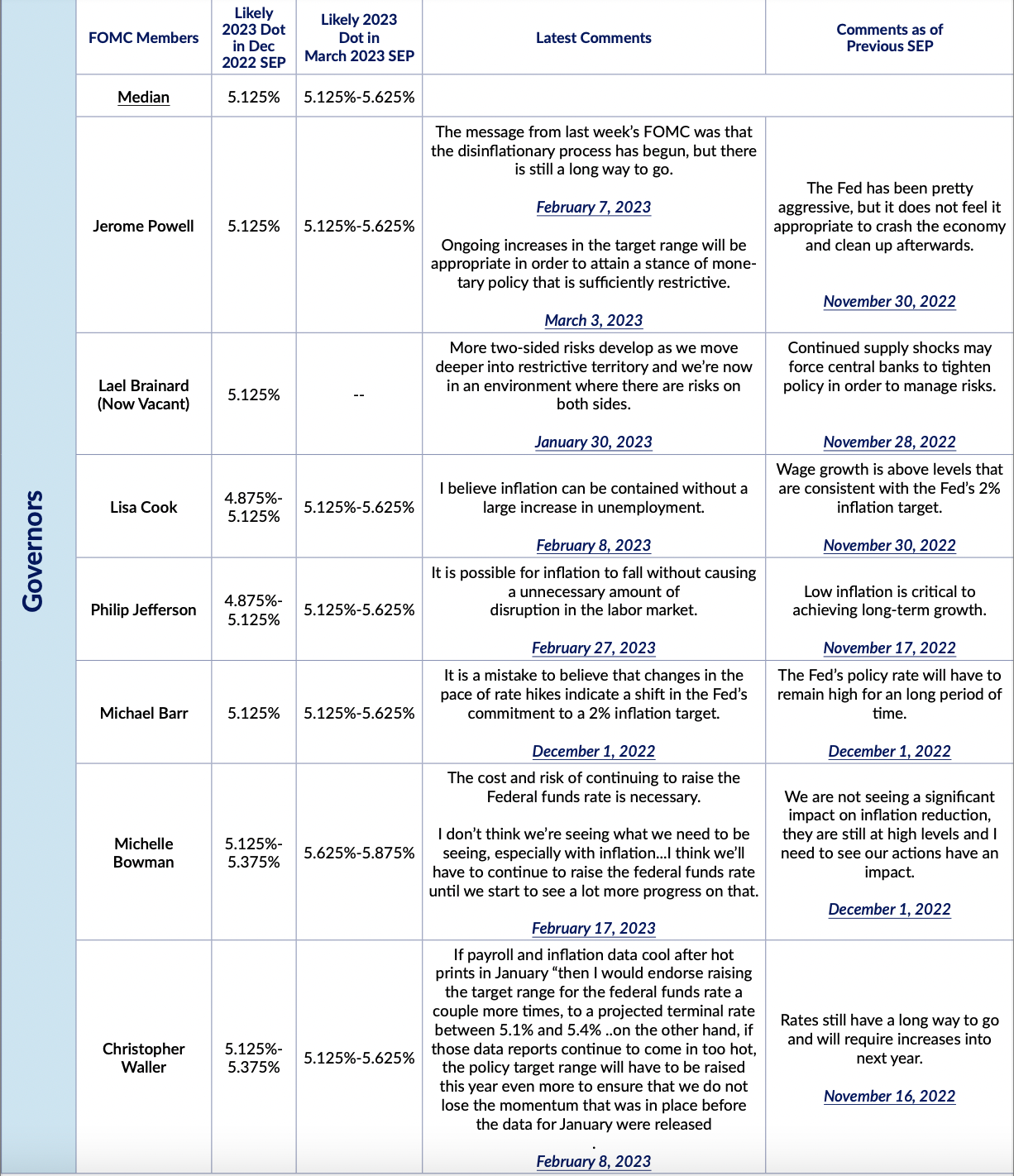

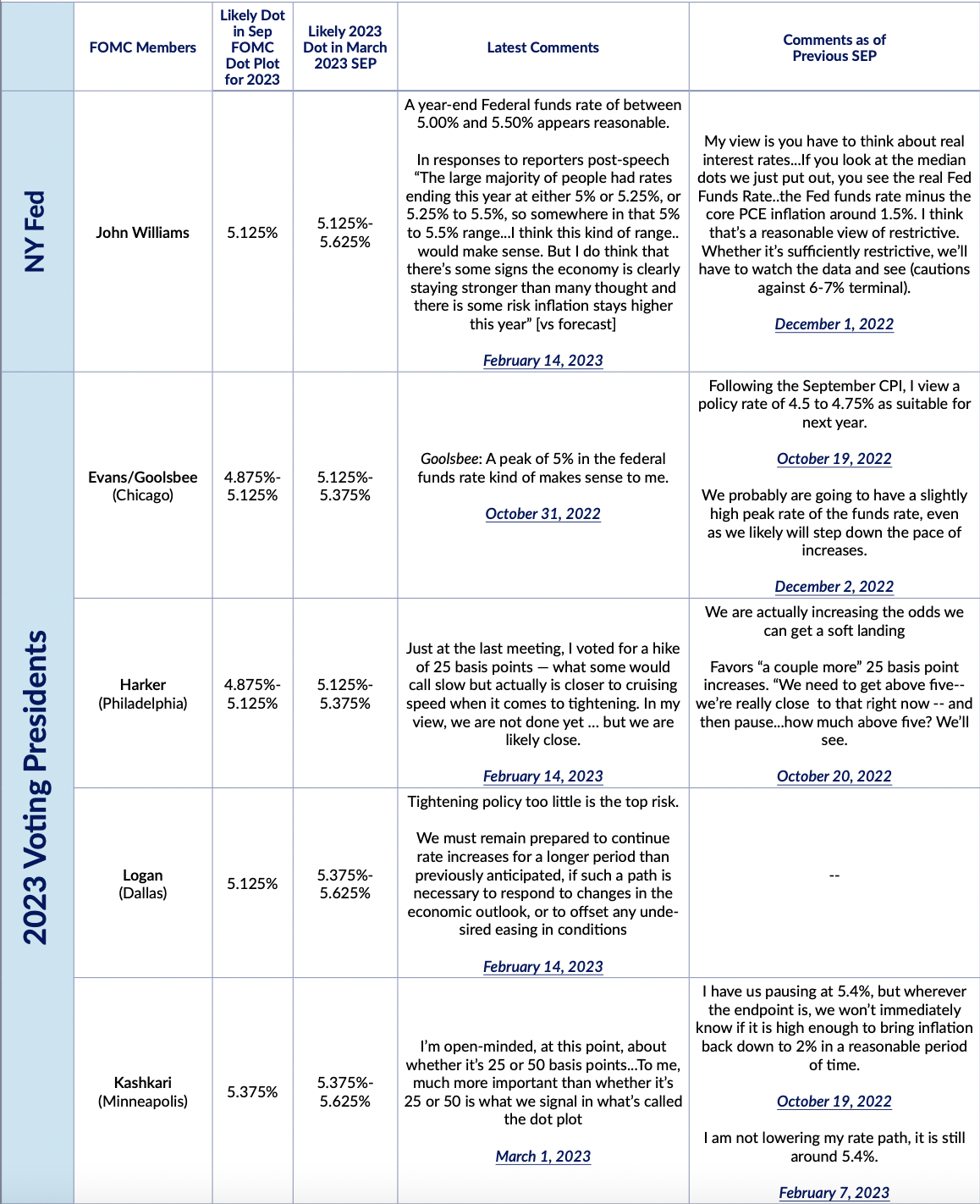

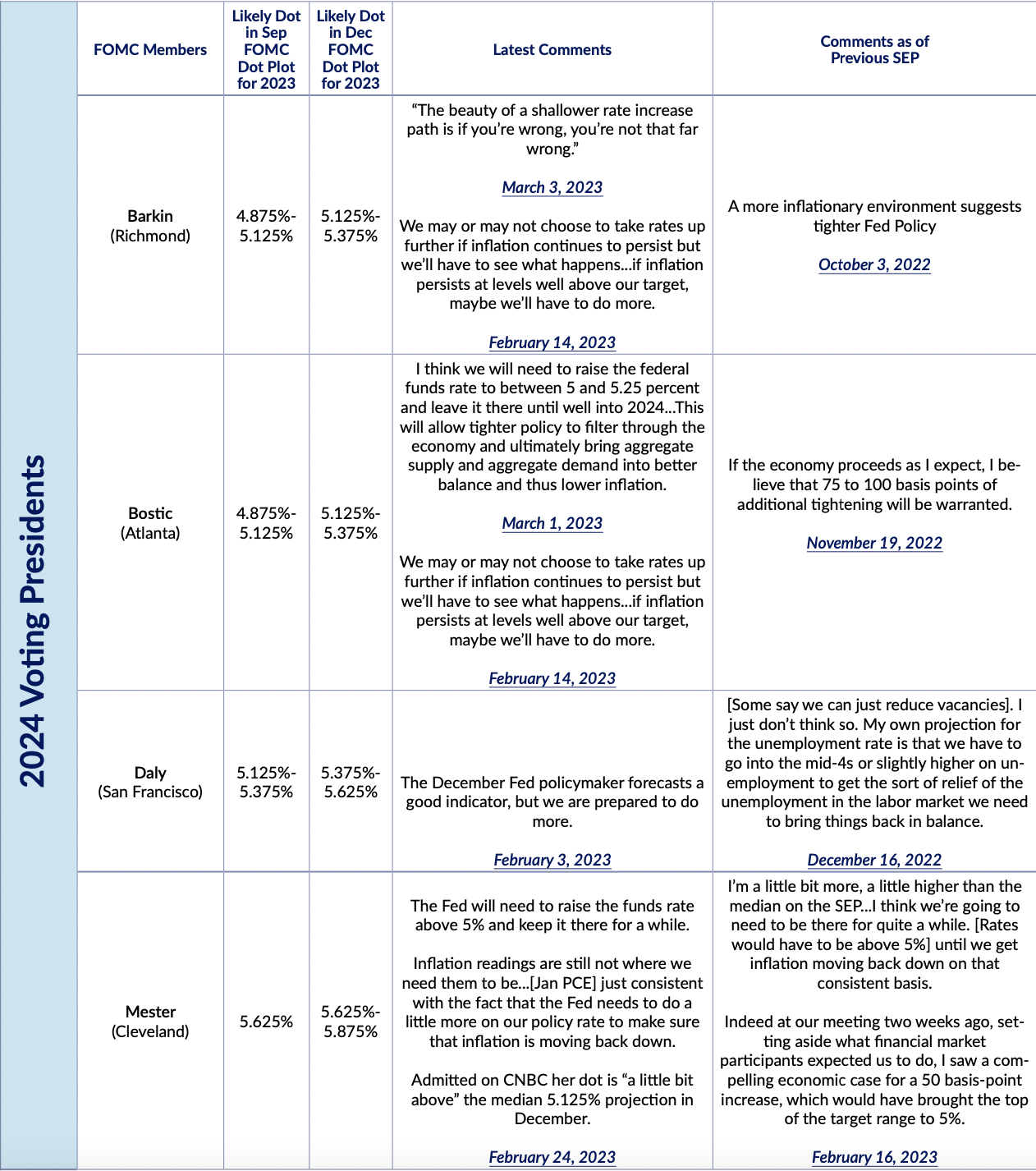

Monetary Policy:

Multi-Dimensional: