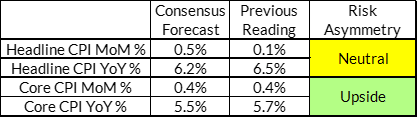

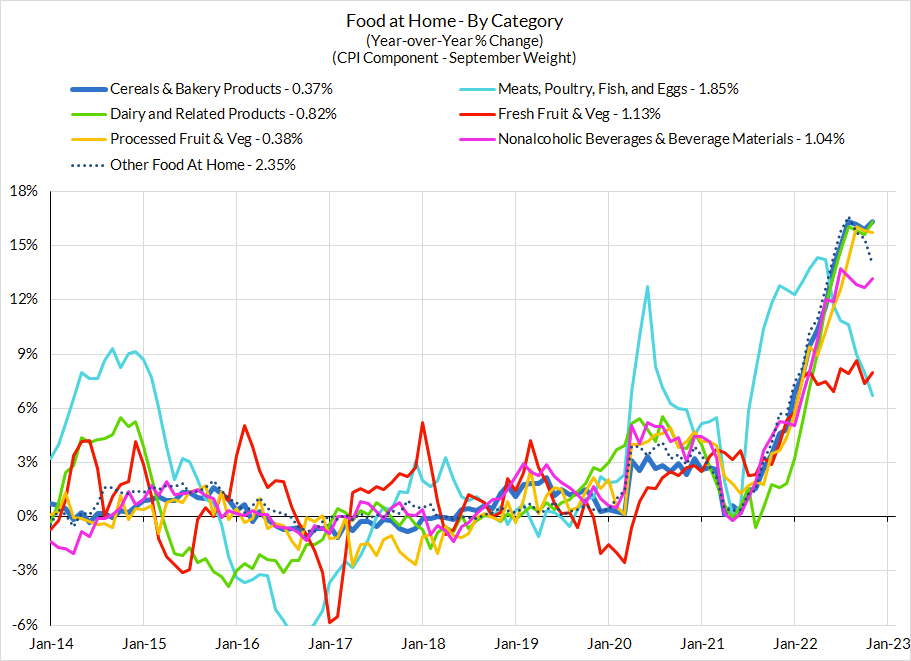

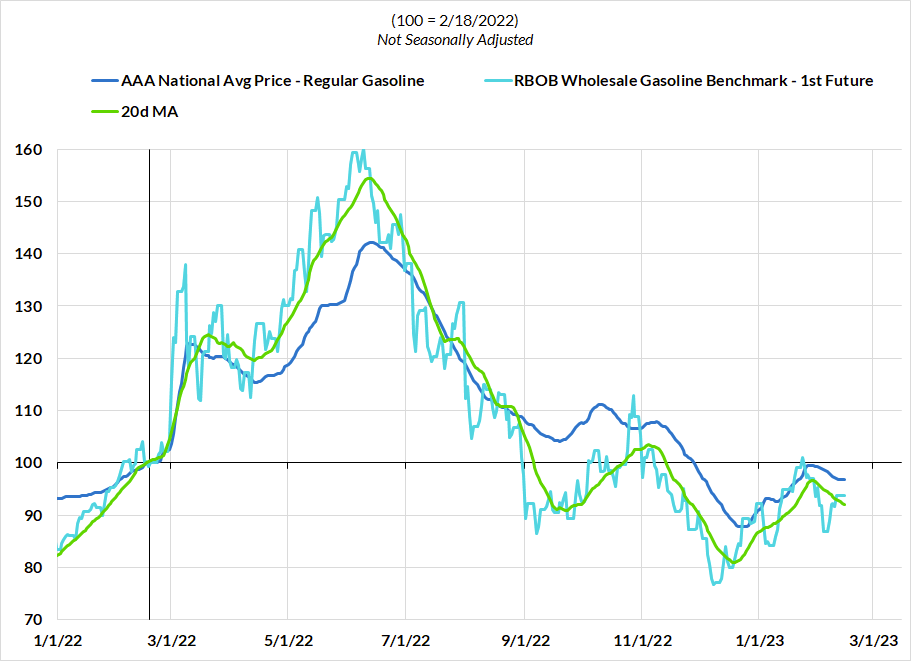

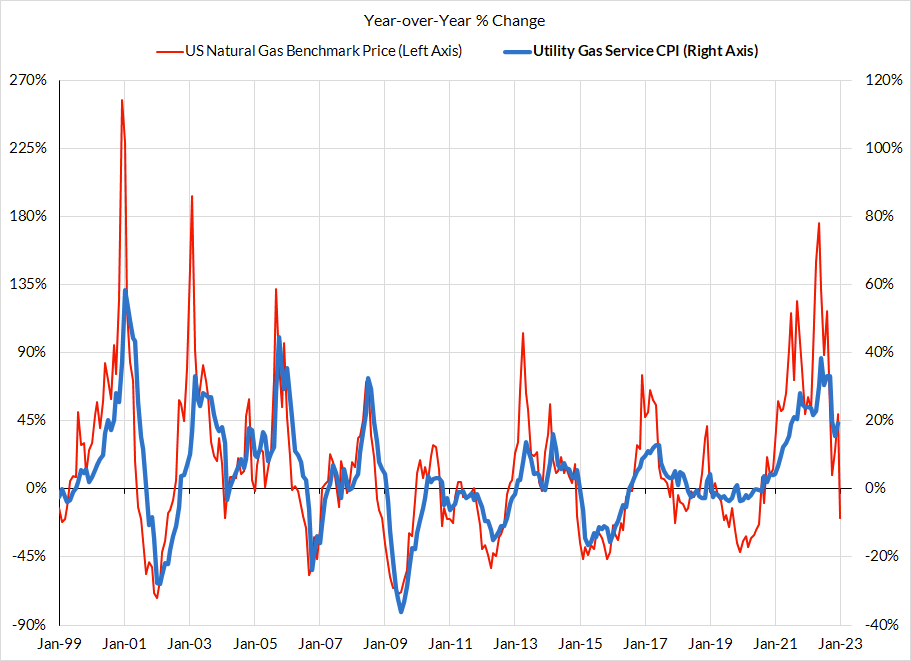

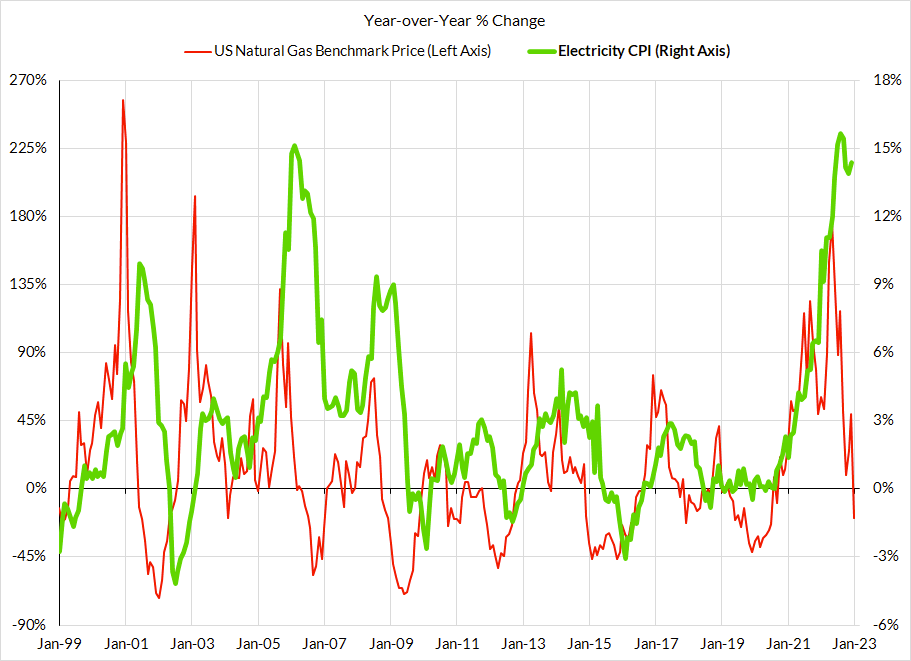

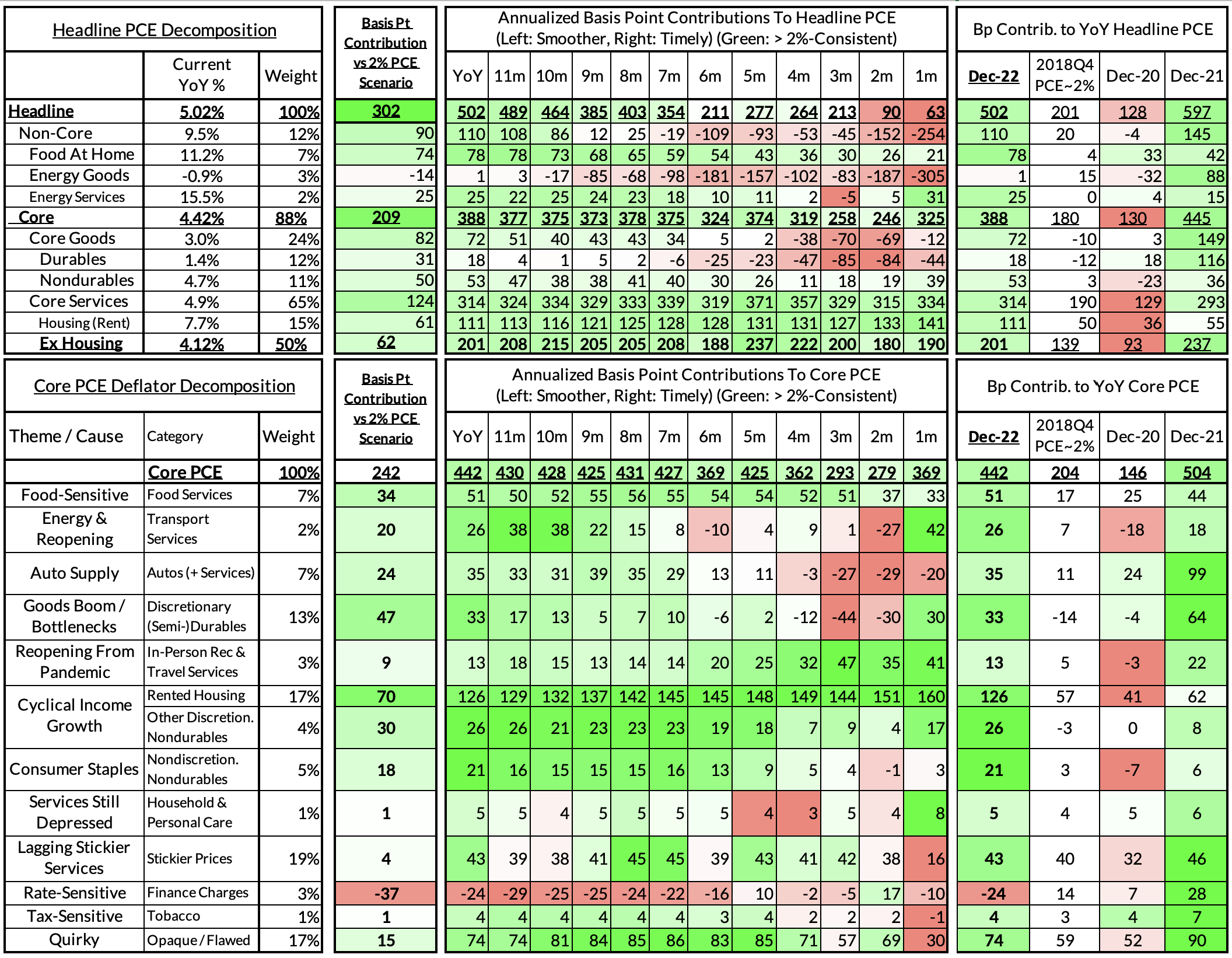

Summary: Relative to consensus forecasts, the risks for January & Q1 core inflation are now asymmetrically tilted to the upside (Jan core CPI ~ 0.4%). While we don't think the causes for upside risk are a sound basis for hawkish panic, the Fed would certainly be vulnerable to such a reaction as a result. As we noted in our February Fed recap, the FOMC clearly views 5-5.25% as a lower bound for the terminal Fed Funds Rate and such an upside surprise would only further cement the Fed's view here. Headline inflation risks are more balanced, thanks to declining benchmark natural gas prices and continued deceleration in food prices.

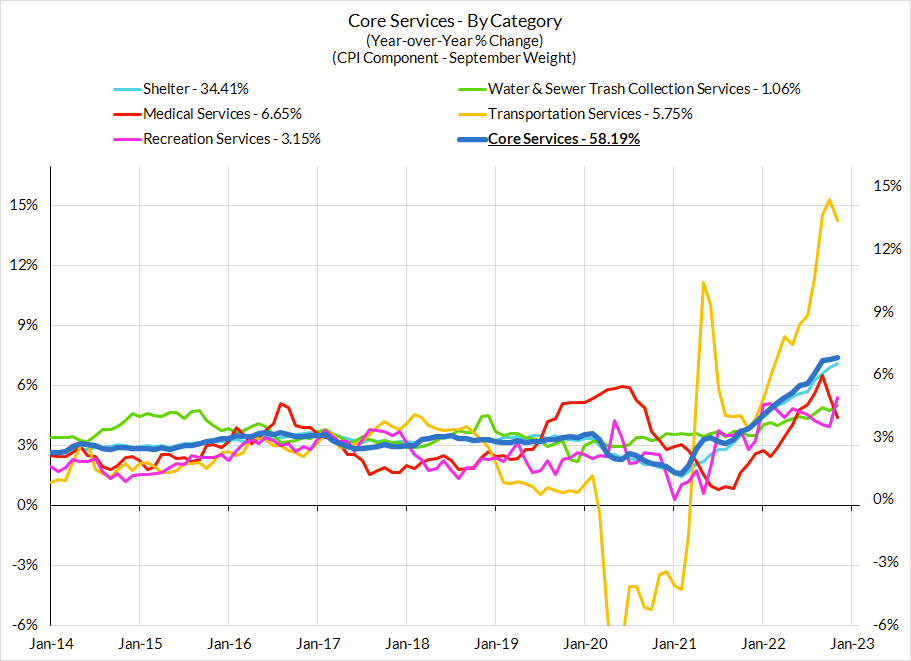

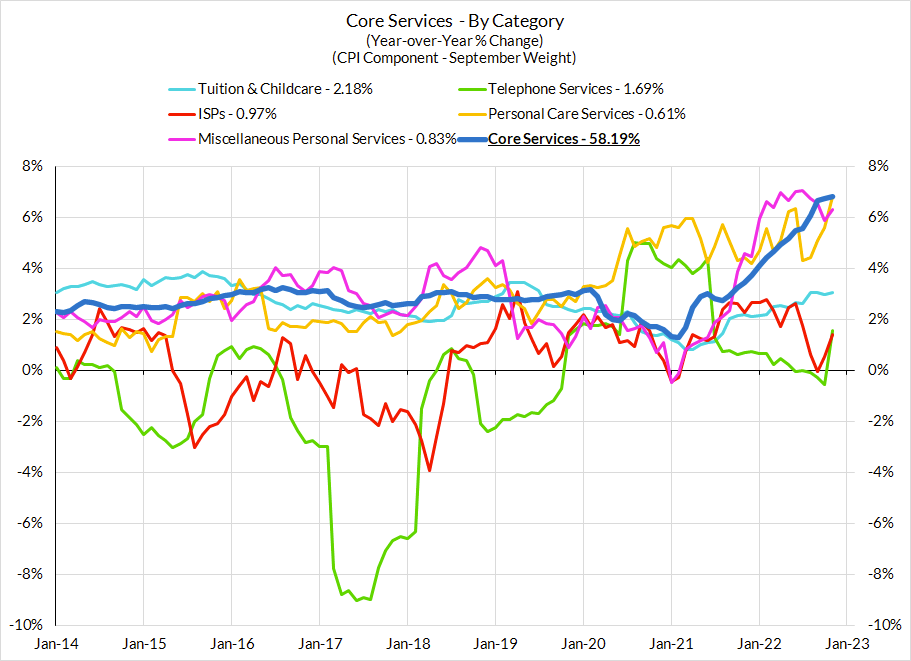

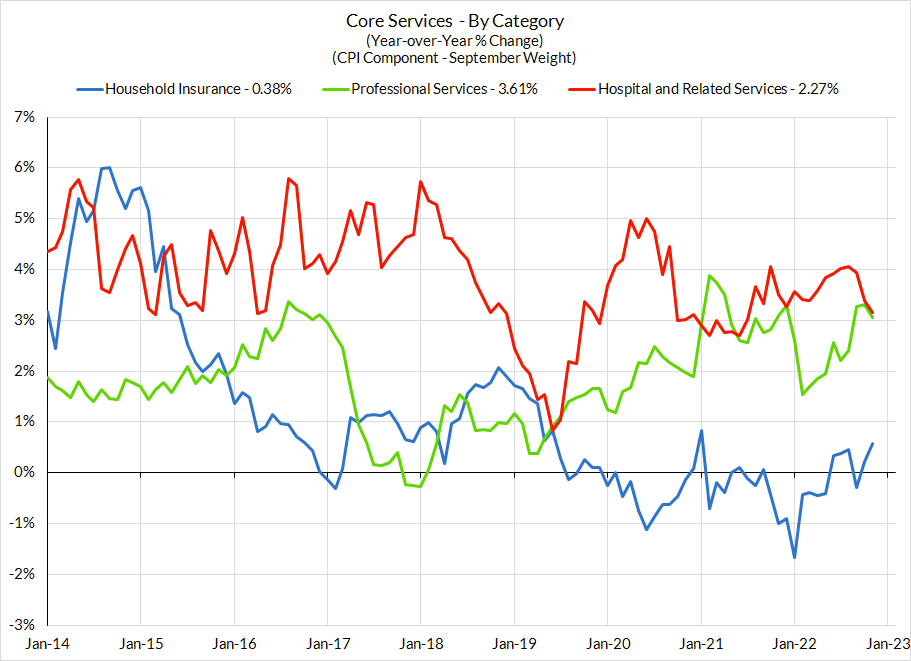

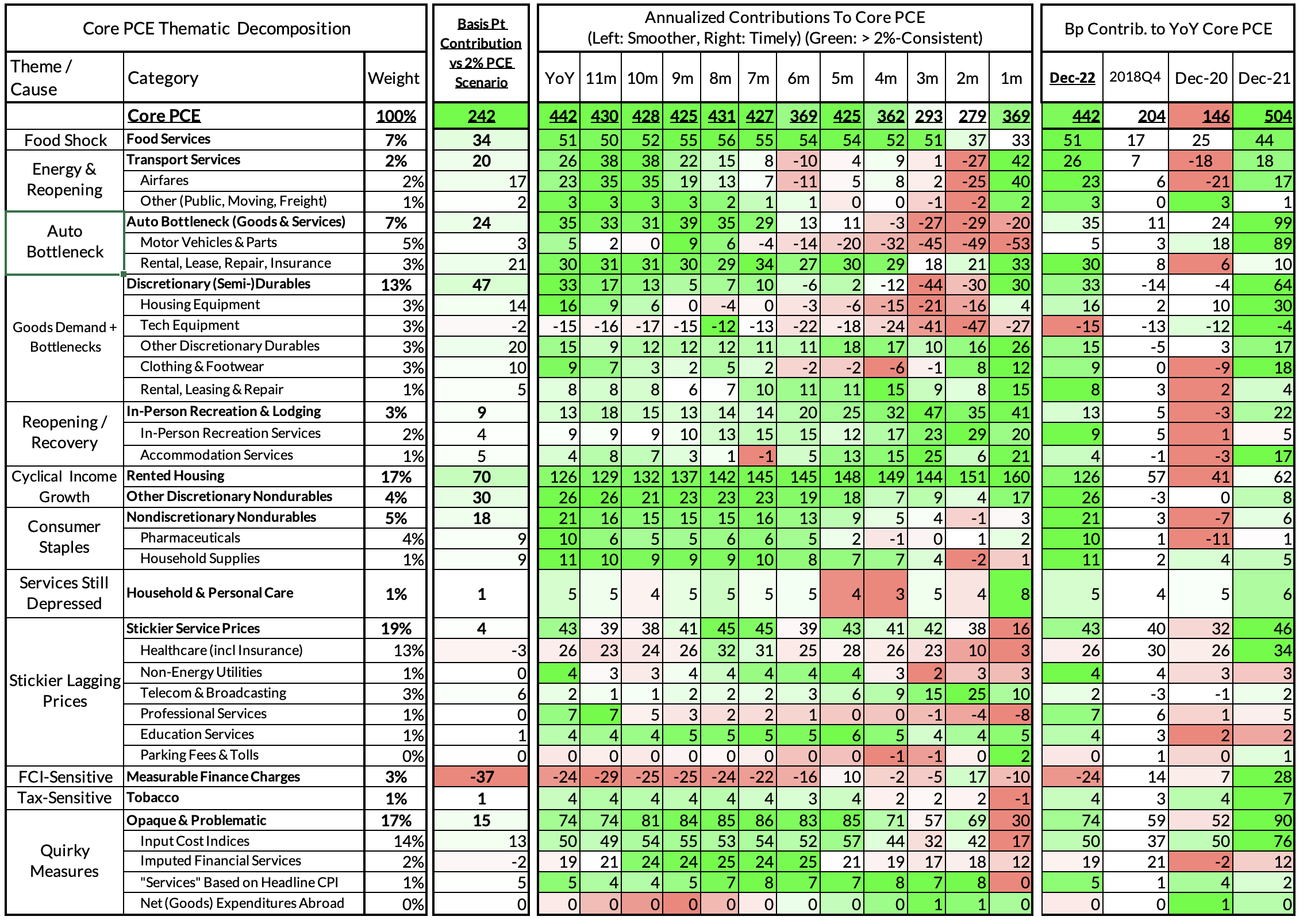

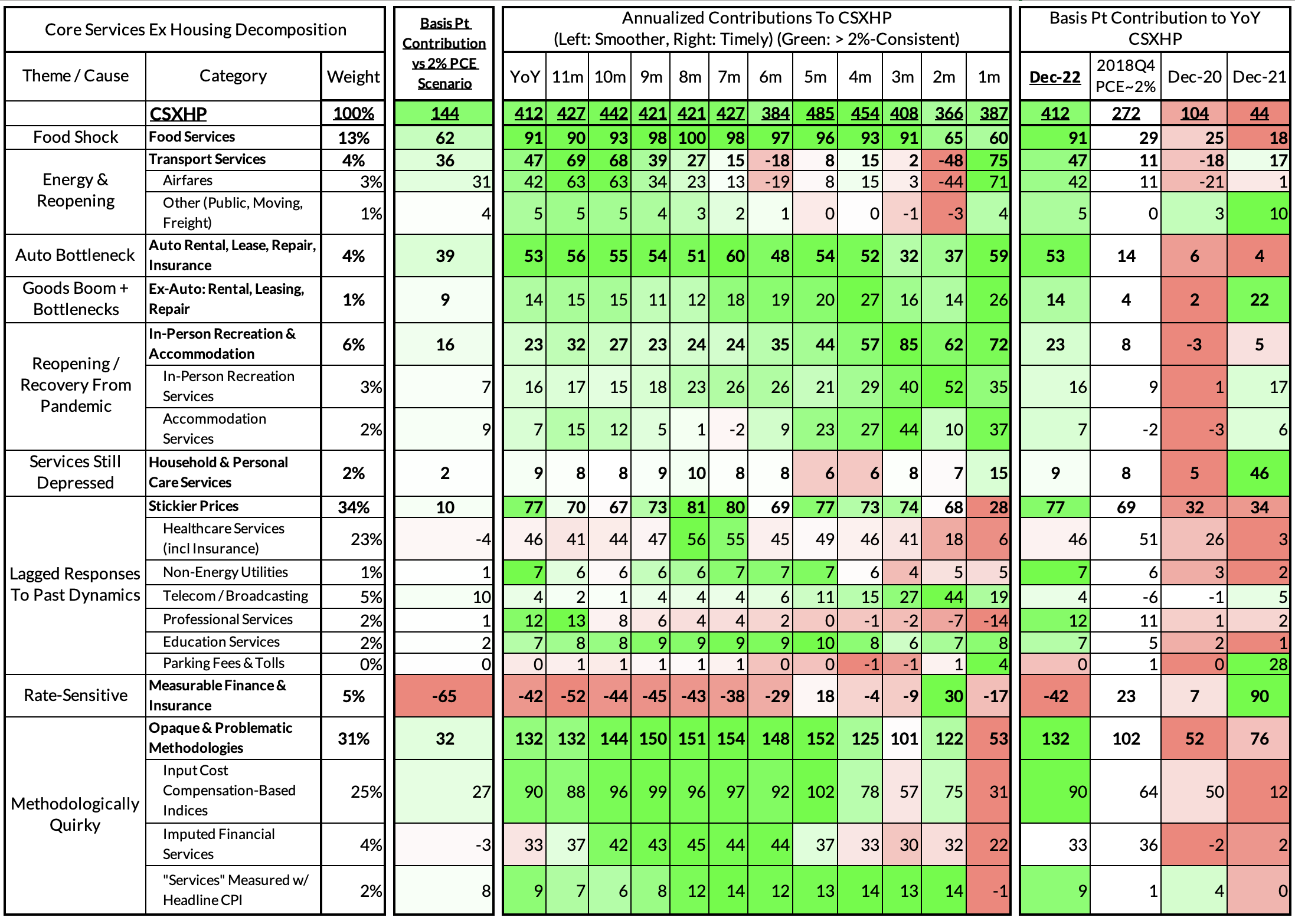

Key Dynamic: January (Q1 generally) is a time when firms with stickier and lagging service prices are more vulnerable to outsized price increases, especially when inflationary pressures were still elevated over the previous year. These upside core inflation risks are more pronounced for PCE than for CPI. The increases this month should still be softer than what we saw in January 2022 (0.7% core CPI increase) and thus result in declining year-over-year inflation readings. Key categories for tracking this view: healthcare services (PPI), non-energy utilities, telecommunications, broadcasting, and professional services.

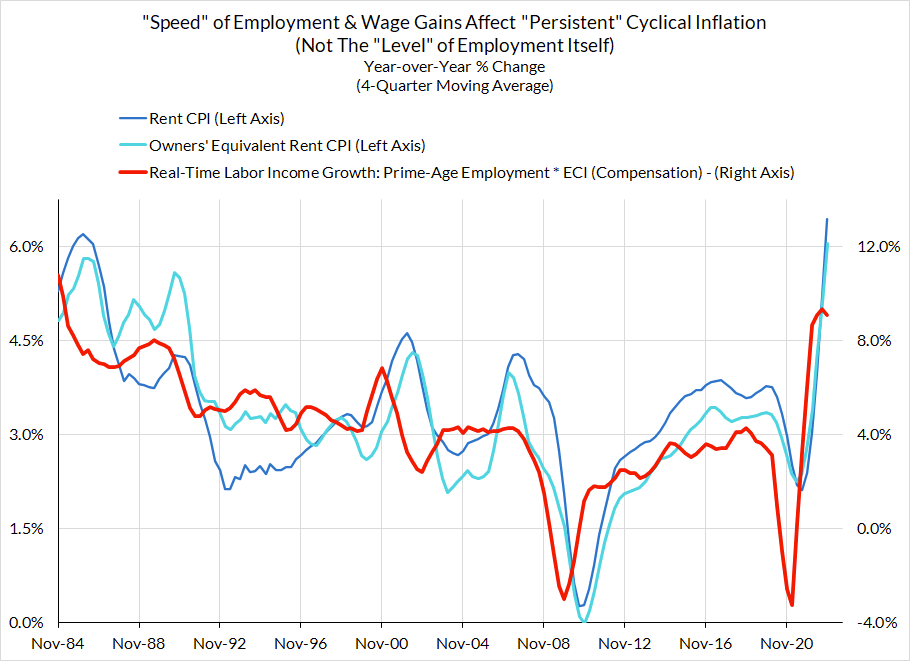

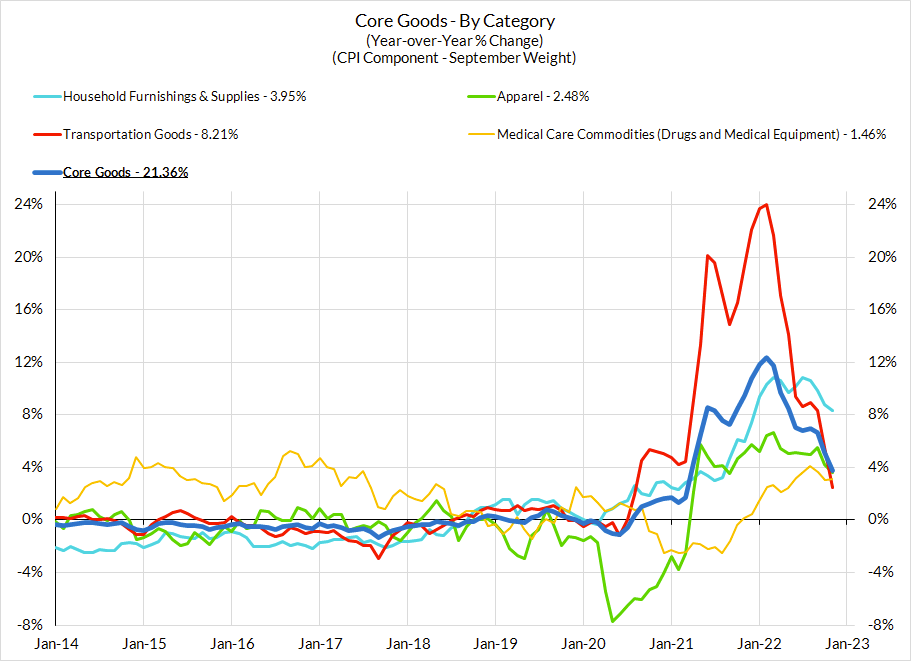

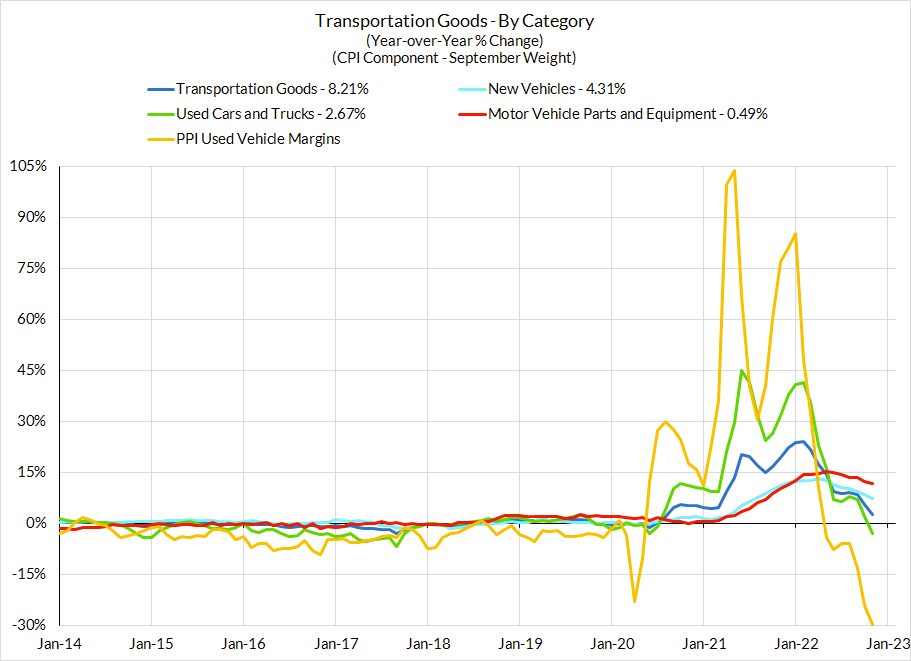

The More Likely Upside Scenario & Its Likely Policy Implications: In addition to stickier service prices, used cars are also likely to be less of a drag on core inflation prints in January than in Q4; they may even prove to be a source of upside in February and March. And while there is much hype about the implications of falling market rents, the CPI methodology involves a lot of smoothing and thus lags substantially; the recent run of rent CPI readings suggest more strength in Q1. Over the coming quarters, we expect slower job growth and wage growth to feed into rental CPI inflation, but that story is not likely to play out imminently.

Despite more signs of wage deceleration and more evidence presented that the Fed's alleged wage-price passthrough claims are weak, the Fed has continued its hawkish posturing. In the presence of upside inflation surprises in Core Services Ex Housing PCE, the Fed is more likely to follow through with expected tightening (2 more hikes) and threaten to go further (potentially hikes in June & July). The biggest concern for us is if this tightening push occurs amidst coincident labor market deterioration; thankfully such deterioration has not transpired as of yet.

The Less Likely Downside Scenario & Its Implications: Our 4-6 quarter outlook is one of substantial disinflation, but here are some plausible disinflationary dynamics that could materialize sooner than we now pencil in:

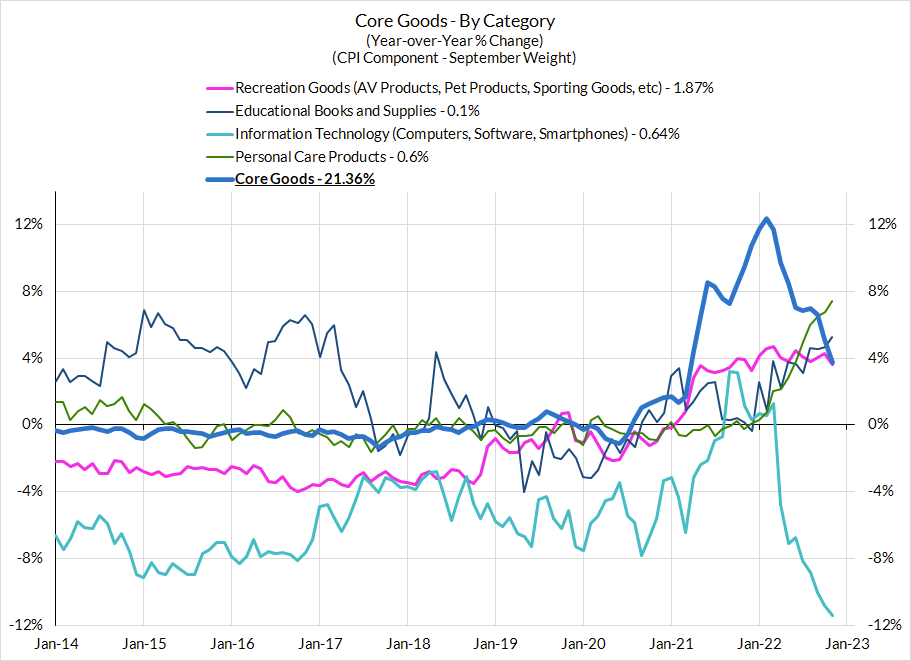

- More Ex-Auto Goods Deflation: Most of the goods deflation in Q4 was concentrated in automobiles and tech equipment. There were signs in January that retailers would look to clear excess goods inventory with additional discounting. While we expect to see some of this show up in January, we are not expecting it to fully pick up for the slack in used cars (housing equipment, apparel)

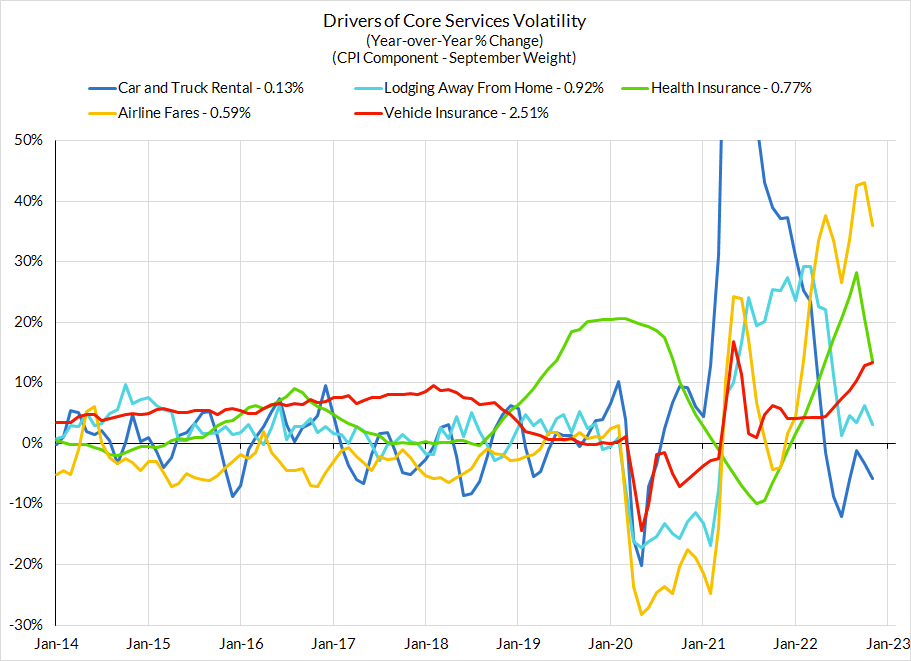

- Goods-Adjacent Services Sees Disinflation Sooner: Contrary to the Fed's potted framing, goods and services are not so neatly separable. The price of automobiles, food, and even energy have implications for major sources of core services inflation. Stabilization in those goods prices has disinflationary implications for motor vehicle services (rental, leasing, repair, insurance), food services, transportation services (e.g. airfares). We don't expect the handoff here to be imminent but if it were to transpire, it would definitely accelerate the path back to 2%.

- Peak Monthly Rent CPI Inflation: We're not so confident that rent CPI readings will trend down so linearly from here, even as we see all the signs of longer term deceleration (slower job growth, slower wage growth, slower household formation, improved supply, slower market rents). It would likely require 2-3 months of disinflation to know that we are past the peak.

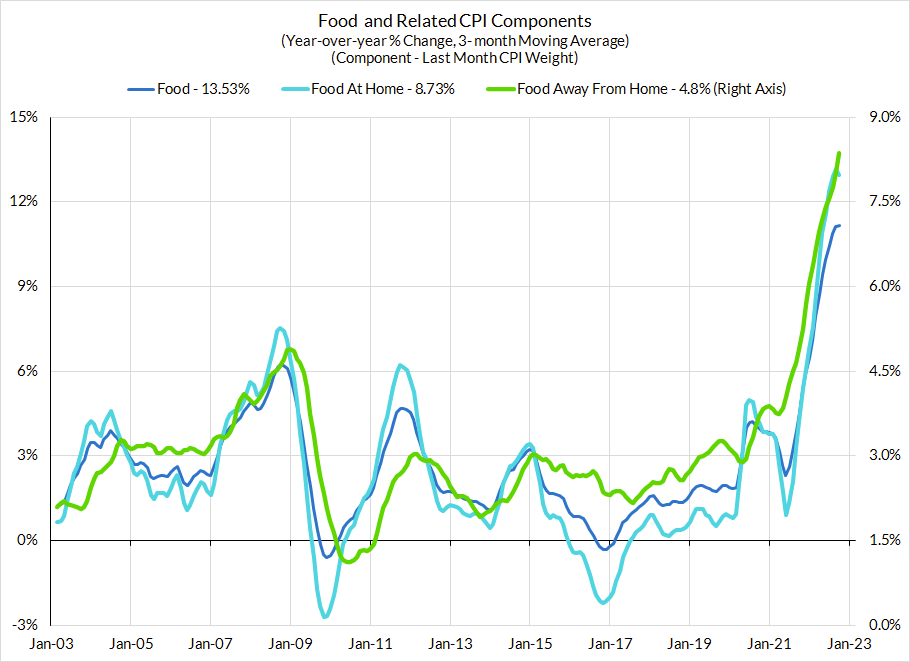

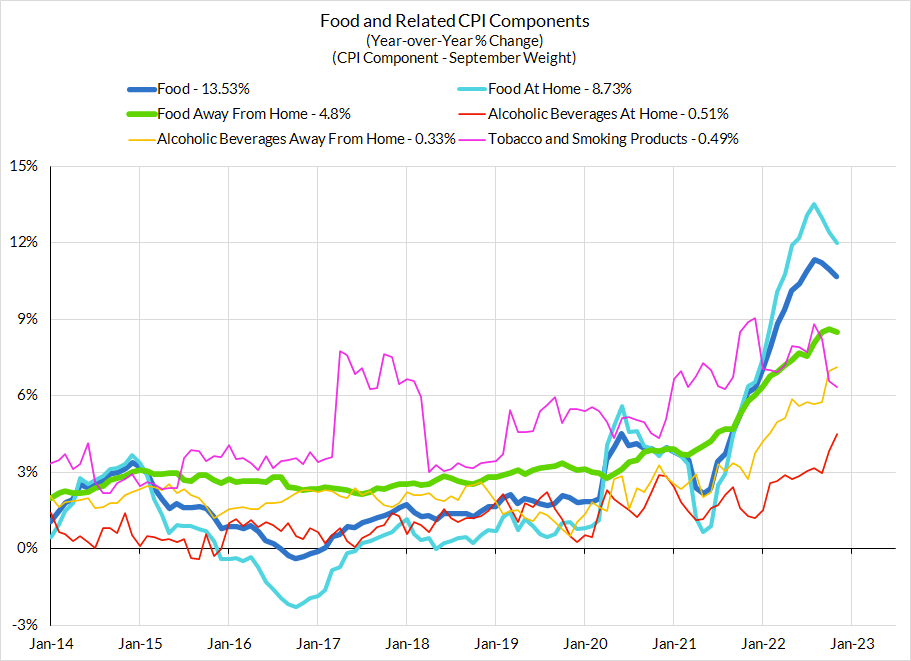

Final Note: Is The Most Important CPI Component To Fed Policy Outside Core CPI? Keen observers will know that food services are not included in core CPI but are included in core PCE. Food services takes even more importance in the Fed's "Core Services Ex Housing PCE" aggregation. But the dirty secret about food service prices is that they are highly connected to "food at home" prices that are excluded from both core CPI and core PCE. If food at home prices continue to decelerate as they have in the past few months, we expect food service prices to follow (with some lag).

Charts

Non-Core CPI Components

Core CPI Components

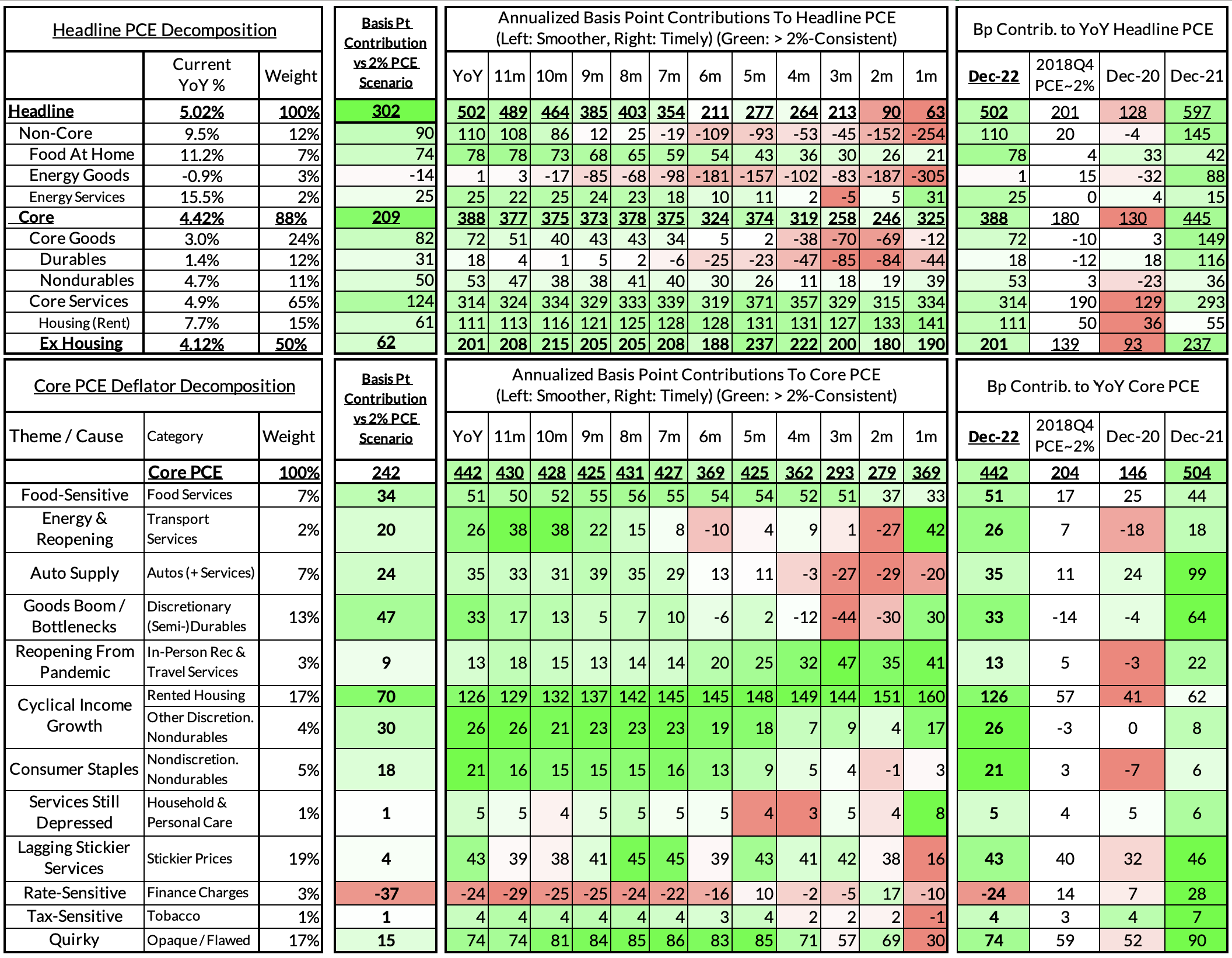

Headline PCE, Core PCE, CSXHP Heatmaps

Past Inflation Previews and Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible