Summary:

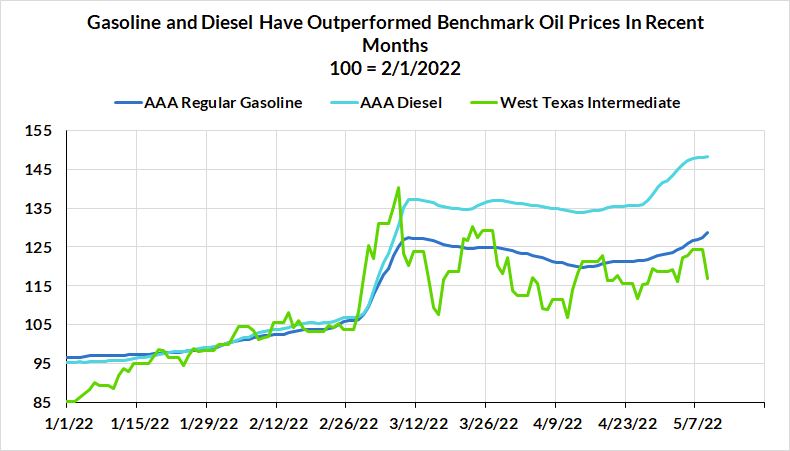

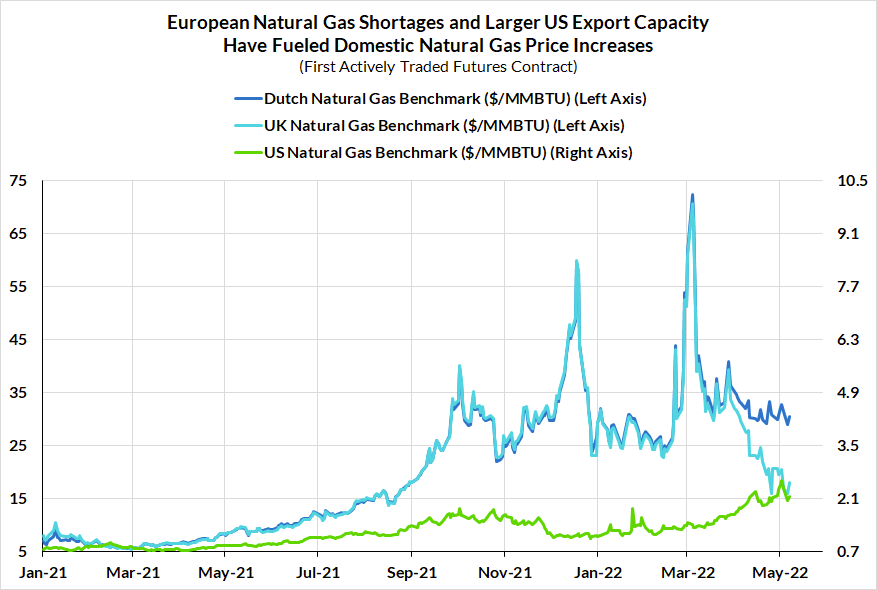

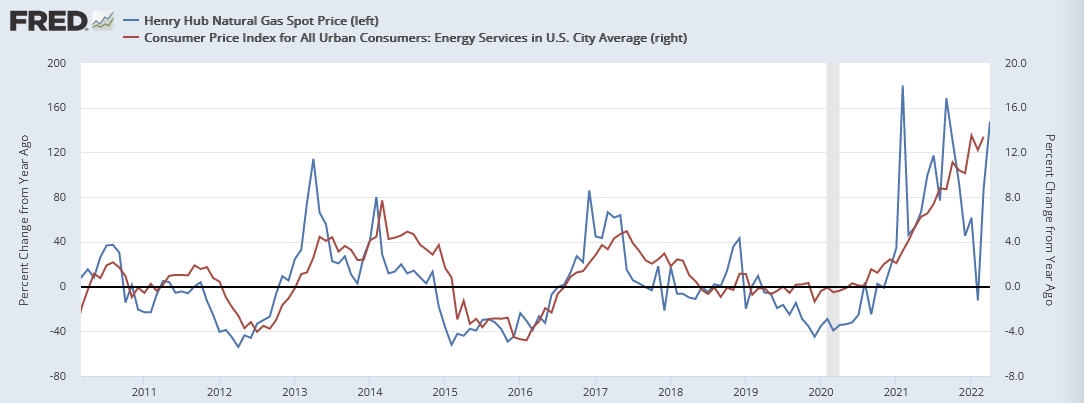

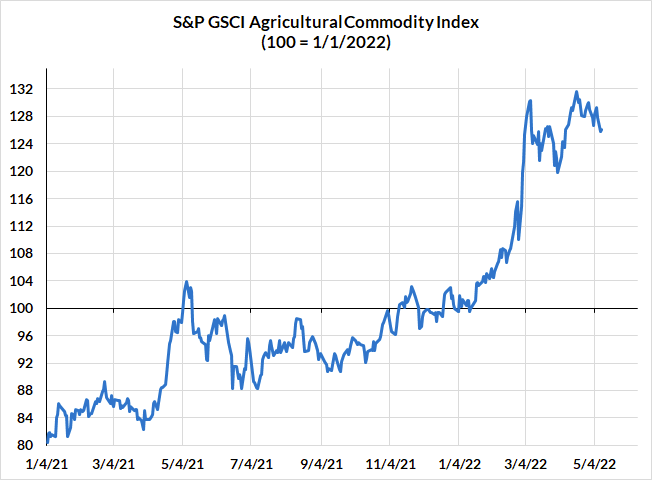

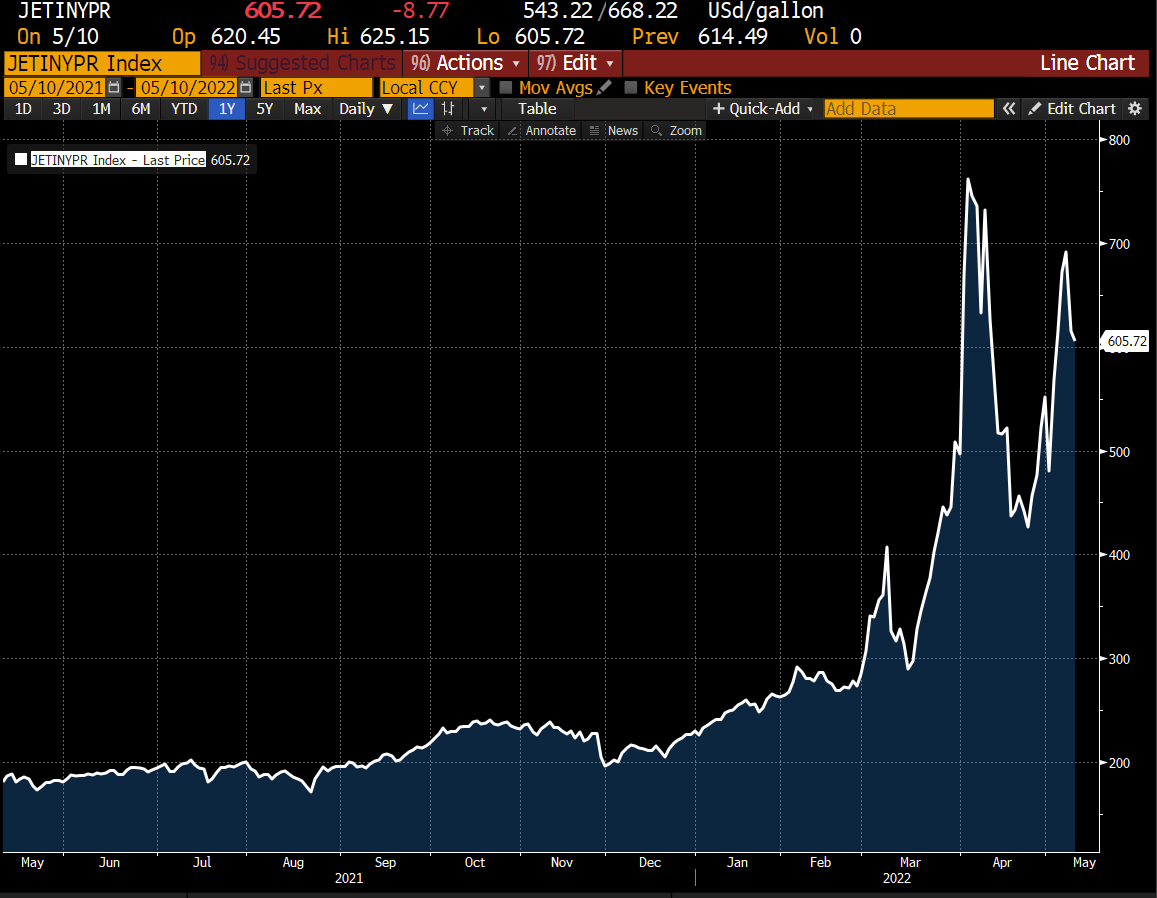

- Headline CPI inflation is more likely to punch above expectations (0.2%) for three reasons: (A) gasoline and diesel prices have outperformed crude oil, (B) spot natural gas prices have generally continued to climb and will likely pressure both electricity prices and utility gas service prices, and (C) food prices are still likely to be pressured from the effects of Russia’s invasion of Ukraine on agricultural commodity prices.

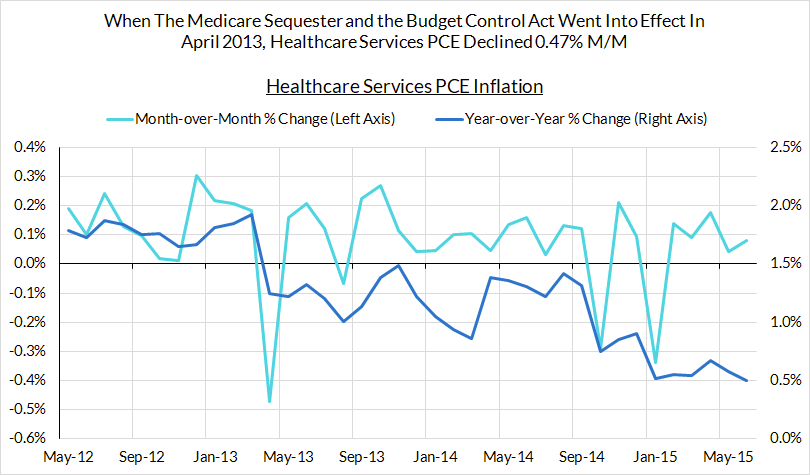

- Core PCE will be most notably slowed down by the effects of the first leg of the Medicare sequester. Because these effects fall out of the scope and methodology of CPI, they won't be noticeable tomorrow (but will be visible in the PPI data)

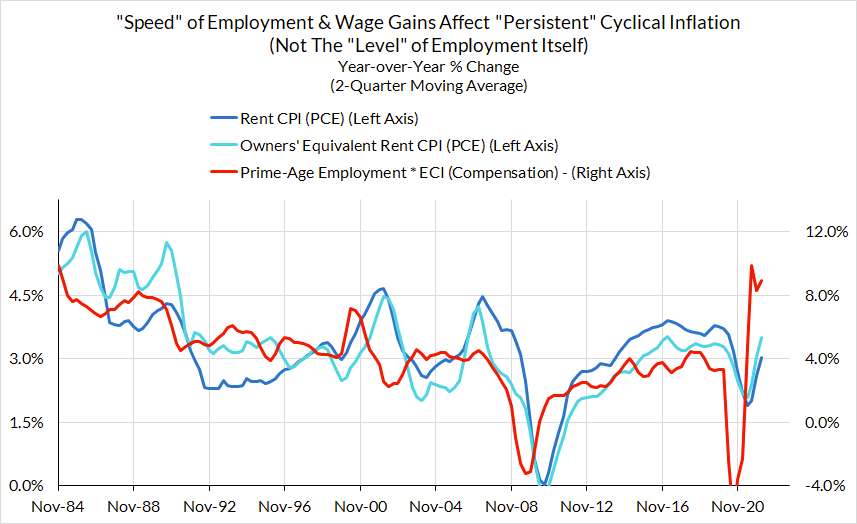

- Core CPI inflation faces several cross-cutting dynamics, but the recent deflation in used cars tilts risks marginally to the downside (vs 0.4% consensus forecast). Strong labor income growth in the past 5 quarters still presents local upside risk for rent, and jet fuel shortages and price spikes are likely to passed through to airfares. Meanwhile, we're seeing diverging trends among telecommunication providers with respect to pricing and quality provision that could serve as an important source of variation over the next 12 months.

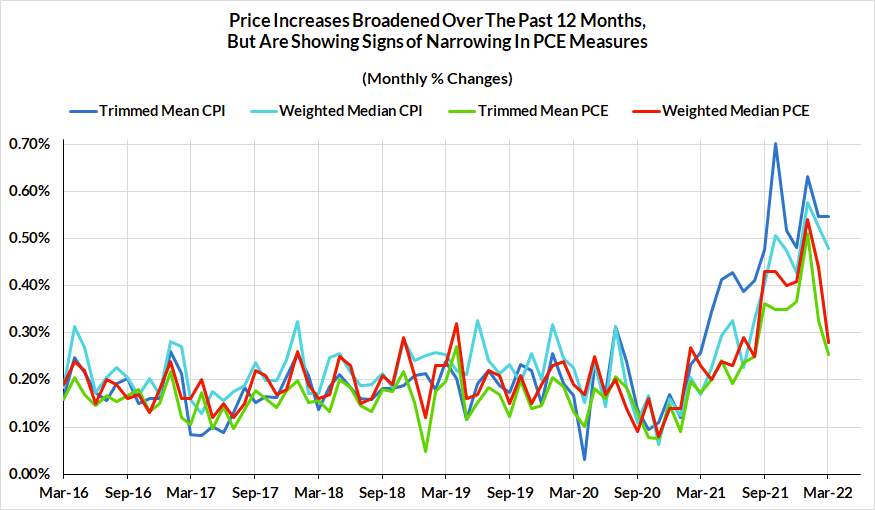

- The breadth of price increases are likely to signal some narrowing of upside price pressures, more so in Median and Trimmed Mean PCE aggregates than in Median and Trimmed Mean CPI aggregates, especially as we get further away from the calendar year turn and supply chain performance puts less pressure on most goods prices

1. Headline CPI upside risks

1(A) Refined products pushing up headline inflation than oil prices will suggest.

1(B) Energy services prices are likely to continue to see pressures from spot natural gas price increases. Despite otherwise ample domestic supplies, strong global demand and elevated Asian and European prices for natural gas have pulled up US benchmark prices. With some room for latency, this will continue to put upward pressure on electricity and utility gas service prices.

1(C) The Russia-Ukraine shock to agricultural commodity prices are likely to take time to fully pass through to consumer prices for food at home.

2. Core PCE will be most notably slowed down by the effects of the first leg of the Medicare sequester.

If you have been following our healthcare inflation commentary, you'll know how important healthcare services PCE inflation can be to the trajectory of core and headline PCE inflation. In April 2013, a series of actions intended to constrain government spending went into effect as part of the Budget Control Act. Among them, Congress enacted the Medicare sequester, which reduced payouts to Medicare providers. Healthcare services PCE inflation declined 0.47% month-over-month, primarily though not exclusively for that reason. While Congress has yet to enact the full Medicare sequester, the first half of the sequester went into effect in April 1, 2022 and the second half is currently slated to go into effect on July 1, 2022.

3. Core CPI inflation faces some cross-cutting dynamics, but the recent deflation in used cars is the most likely to stand out.

From used cars to airfares, from rent to telecommunication services, there are plenty of factors that can swing a given month's inflation print, but if it had to be reduced one for this month, it would probably (still) be used cars, which still signal weakness in its April CPI (given the lags to Manheim and Blackbook data).

Of course there are still sources of upside risk in this upcoming print, most notably from airfares due to the recovery in air travel (no major strains affecting air travel activity since Omicron).

While job growth and wage growth are likely to slow in the coming months and quarters, the surging pace of this recovery is still likely to impose upside risk around current rent and OER (owners' equivalent rent) inflation readings.

Finally, telecommunication is another potential sector to watch, as recent decisions made by companies are likely to produce dynamics with cross-cutting impacts on measured inflation. AT&T is raising prices on their older and lower-quality plans while 5G rollout has the potential to substantially affect quality-adjusted prices when it comes into fuller effect.

4. The breadth of price increases are likely to signal some narrowing of upside price pressures, though more so in PCE aggregates.

While judgments about relative persistence (or the dreaded "T-word") are more difficult to make in the moment or prospectively, we usually have a clear view in the moment about how "broad-based" inflation is proving to be. Over the latter half of 2021 and around the calendar year-turn, inflationary pressures clearly broadened, especially around most goods prices and some very obviously pandemic-affected services (airfares the key exception). However in the last couple of months, PCE prices have been looking relatively less "broad-based" relative to CPI.

Much of the broad-basedness reflected the relative contribution of goods prices to volatility and price breadth across CPI and, to a lesser extent, PCE. To the extent that goods prices were challenged by the physical supply side (COVID-zero, logistics challenges), we are least seeing logistics pressure beginning to meaningfully loosen domestically. Chinese lockdowns have shifted port backlogs from US ports to Chinese ones, while US trucking may have already begun to slow. Recent reports from the Logistics Managers’ Index, which measures shipping and warehousing conditions, reports rising capacity and falling prices. Even the effects of COVID-zero in China are starting to get swamped by the effects of lower demand stemming from the Chinese real estate and property sector.

Alongside the effects of the first leg of the Medicare sequester, we should see marginal signs of narrowing of inflationary pressures in April PCE, and to a lesser extent in April CPI (though keep in mind that strong rent and OER alone can be a swing factor behind a given month's weighted median and trimmed mean CPI reading...more difficult in the case of the PCE analogues).

Recap of Forward-Looking Commentary on Inflation Data

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth