By Skanda Amarnath and Arnab Datta

Special Thanks to Omair Sharif and Kahaari Kenyatta

Executive Summary

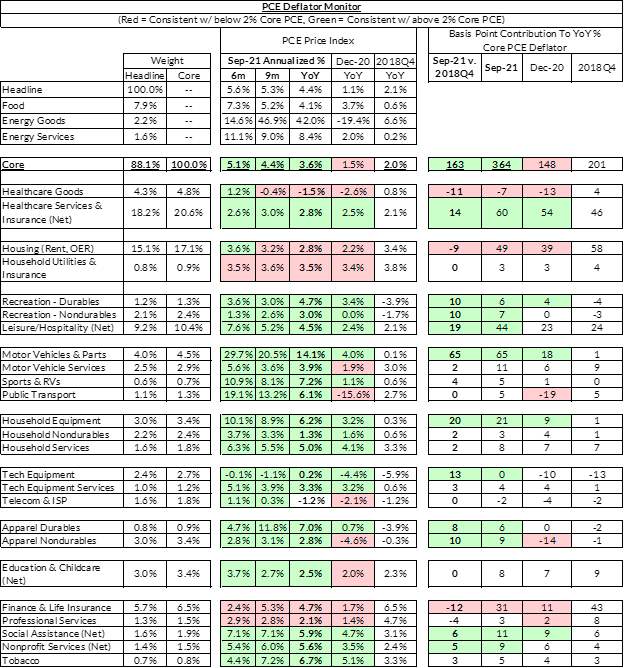

Policymakers concerned with economic growth should prioritize healthcare policies that create direct downward pressure on inflation readings. Healthcare goods, services, and insurance comprise approximately a quarter of the Fed’s preferred inflation gauge for policymaking (the deflator for “Personal Consumption Expenditures Excluding Food and Energy”—better known as “core PCE”). Unlike other major components of core PCE, federal policy and rule-making can have substantial and direct effects for healthcare. Keeping inflation readings in check over the coming years would represent a major opportunity to demonstrate that the ambitious fiscal response to the pandemic need not lead to high inflation. Targeted disinflationary healthcare policy at this juncture could dramatically shift the policymaking and macroeconomic paradigms for a generation.

Healthcare costs included in price inflation estimates encompass healthcare goods, like prescription drugs, and healthcare services. This is a broad category which includes services purchased out of pocket by consumers, as well as those services paid for by third parties on behalf of consumers—e.g., employers through employer-provided health insurance or by governments through Medicare and Medicaid. The health care services component includes outpatient services (physician and dental services, home health care, and laboratory services), as well as services provided in hospitals and nursing homes.

By asserting the federal government’s significant authority and leverage through Medicare, the following actions would likely have major disinflationary impacts.

Estimated Disinflationary Policy Impacts

Adjusting Medicare Reimbursement Rates

Medicare reimbursement rates play a key role in guiding rate-setting for many healthcare services. Following the enactment of the Affordable Care Act, and the imposition of a mandatory sequester, limits to the reimbursement rate provided noticeable disinflationary pressure over the medium term. Reimbursement rates are primarily set when the Center for Medicare and Medicare Services (CMS) determines the “conversion factor” and “relative value units” for services in the yearly Physician Fee Schedule. These rates have been proposed but not finalized for CY 2022. Finalizing the rule in its current state could feasibly reduce core PCE readings by another 0.1-0.2% in 2022 relative to 2021, and policymakers should work to ensure these changes aren’t weakened by Congress extending a 2021 across-the-board increase in physician fees. Together, these two decisions could provide a meaningful ballast to measured inflation in 2022. When coupled with the resumption of the Medicare sequester (0.1% subtraction from Core PCE) and the PAYGO implications from the American Rescue Plan for Medicare (0.2% subtraction from Core PCE), there is enough within enacted legislation and proposed regulation to buffer against potentially persistent sources of inflation acceleration like rent.

A considerable body of research shows that Medicare prices for services have an overall market-setting effect. As a component, healthcare services represent about 18% of core PCE (excluding the cost of health insurance itself). Relying on the BLS and specialist inflation forecasters, our best estimates suggest that Medicare and Medicaid service expenditures account for 7.2% of core PCE on their own. The healthcare services PCE deflator consistently ran at or above 3% per year for most of the 2000s and has returned to these elevated inflation rates more recently. However, healthcare services inflation in the 2010s ran at a substantially lower pace, falling briefly below 1% in 2015. This lower rate of healthcare inflation was driven by a handful of legislative actions (the Affordable Care Act, budget sequestration) and regulatory actions that lowered the services prices reimbursed by the federal government.

As the administration considers expanding Medicare and Medicaid in reconciliation, these measures would also help “pay-for” the cost, as they did for the Affordable Care Act. A 2% reduction in Medicare reimbursements in the Budget Control Act of 2011 resulted in approximately a 0.7% decline in healthcare services inflation and a 0.24% reduction in core PCE inflation.

How CMS Reimbursement Rate Factor Changes Can Impact Inflation

When CMS sets the Physician Fee Schedule, they can dampen inflation through two key components: (1) Relative Value Units (RVUs); and (2) the conversion factor. Relative value units are a measure of value assigned to a service, used to determine the fee for that service. RVUs are set individually for services using Current Procedural Terminology (CPT) codes and the conversion factor applies to most services. Each year an AMA panel makes recommendations to CMS about the level of RVUs appropriate for each CPT procedure, and CMS typically adopts between 75% and 90% of their recommendations. The conversion factor is a multiplier, determined by CMS, that is used in the formula to convert from RVUs to dollars and determine Medicare physician fees for services.

Since changes in the conversion factor affect all reimbursement rates, it is a powerful tool to reduce overall prices. However, lowering this conversion factor does not, by itself, guarantee disinflation: changes in the RVUs for various procedures might more than offset a fall in the conversion factor. For example, the CY 2021 conversion factor decreased relative to CY 2020 (even accounting for a 3.75% legislative increase), but the "offices of physicians" measure in the PPI jumped by 2.5% in January 2021. This pushed the overall PPI YoY rate from 0.8% in December 2020, to 3.2% in January 2021. While the conversion factor had been lowered, changes to Evaluation and Management (E/M) service codes increased the rates for codes related to family practice, internal medicine, and multi-specialty group practice. These changes increased Medicare payouts, and were closely linked to the 2.4% month-over-month bump in the corresponding PCE deflator in January 2021.

If the CY 2022 proposed Physician Fee Schedule is finalized, it could achieve disinflation by reducing the conversion factor from $34.89 to $33.58, a decrease of $1.31 (3.7%). Furthermore, some of the changes to important E/M codes are projected to only modestly increase (family practice at 2%, compared to 12% for CY 2021, internal medicine at 1%, compared to 6% for CY 2021).

Beyond this, two other factors may help decrease overall inflationary pressures: (1) the resumption of the 2% sequester (on pause until the end of 2021); and (2) a mandatory 4% cut resulting from PAYGO after passage of the American Rescue Plan.

There is significant pressure to delay a lot of these reductions. The CY 2021 conversion factor decrease was mitigated by a 3.75% across-the-board increase in the conversion factor that was passed in the Consolidated Appropriations Act of 2021. Many healthcare industry groups are advocating to extend this increase. Nonetheless, if the proposed Physician Fee Schedule is finalized, and the mandatory payment reductions continue, these changes will likely tamp down inflationary pressures in 2022.

Negotiate Prescription Drug Prices

To use prescription drug negotiation as a disinflationary strategy will require significant administrative urgency and resources, but the benefits in terms of reduced cost of living will be substantial. If the US can make it even a third of the way to bringing its drug prices in-line with international prices in a given year, we would see a ~0.7% reduction to the core PCE year-over-year inflation reading. Given how entrenched pharmaceutical interests are, a compromise whereby the government provides direct subsidization for R&D and other capital expenditures could help navigate the political challenge while still fully capturing the disinflationary benefits.

Core PCE inflation is running at 3.6% as of August, but implementation of even a subset of the suggested policies, coupled with the mechanical roll-off of some obvious sources of transitory inflation, can bring inflation back to the Fed’s preferred 2% target over the course of the upcoming calendar year. Policymakers focused on economic growth and recovery from the pandemic should prioritize disinflationary measures that pose minimal risks to the growth picture as a whole.

Prescription drugs make up 3.6% of core PCE and are notoriously high in the United States. According to the RAND Corporation, prices paid outside of the United States for prescription drugs are 61% lower than those paid in the United States—71% for brand-name drugs, which represent the bulk of all prescription drug spending. Were US prices to fall to the level of international prices, we would see a mechanical 2.2% cumulative reduction to core PCE readings. Policies that achieve full convergence with international prices would likely take multiple years, but accomplishing even a fraction could significantly reduce core PCE readings.

The narrower bipartisan Prescription Drug Pricing Reduction Act of 2019 (“Wyden-Grassley”) leaves Medicare Part D drug prices relatively unaffected and provides less authority to negotiate drug prices downwards. Wyden-Grassley’s reductions in federal outlays ($12B less) and out-of-pocket costs ($72B over 10 years) could reduce core PCE readings by 0.2%, but would take five years to fully appear.

In contrast, the Elijah Cummings Lower Drug Costs Now Act (“HR 3”) represents the most ambitious legislative attempt to lower prescription drug prices. By setting upper bounds for up to 250 drugs, HR 3 would help pull the cost of prescription drugs down to levels comparable with the lowest of six major countries. Even if convergence with international prices is spread out over multiple years, the impact on core PCE readings could reasonably amount to a 0.7% net reduction in annual inflation readings (assuming conservatively that a third of the convergence to international prices was achievable in a given year).

Understanding the Proposed Prescription Drug Negotiation Process

The biggest challenge in using prescription drug pricing reform to manage inflation is likely to be the timeline for implementation. While HR 3 will involve substantial modifications for it to pass, it still provides a helpful roadmap for understanding the timeline for medicare negotiation to translate into inflation measures.

H.R. 3 would authorize the Secretary of Health and Human Services (HHS) to negotiate prices directly with pharmaceutical companies for up to 250 prescription drugs each year, including the 125 most expensive drugs offered by Medicare Part D plans or sold anywhere in the commercial market. Under the law, the HHS Secretary would select at least 50 eligible drugs for negotiation, including drugs new to the market.

The legislation creates what amounts to a two-year runway for the entire negotiation effort for a given drug. With the first year of potential applicability being Plan Year 2024, here’s what the negotiation process looks like:

First, the selected drugs would have to be published in the Federal Register by the “selected drug publication date” -- which is April 15 of the “plan year” that begins 2 years prior to the year that a selected drug is subject to a negotiated price. In order to have negotiated drug prices applicable for 2024, the deadline for CMS to publish the first set of drugs (limited to 25) would be April 15, 2022, less than six months from now. Under 1194(e) of the Act, the Secretary must also collect information from manufacturers. That is a lot to cover in a short period of time, but CMS is given $600 million immediately, and a total of $3 billion over five years to implement negotiation.

HHS would then have to enter into agreements with manufacturers to negotiate prices in the two-month period between the April 15 publication and the beginning of the “voluntary negotiation period on June 15, 2022. The voluntary negotiation period would span between June 15, 2022 and March 31, 2023. Negotiations would be bound by an upper limit based on 120 percent of each drug’s average international market (AIM) price, which represents the average price in six countries: Australia, Canada, France, Germany, Japan, and the United Kingdom. For drugs without an AIM price, the upper limit would be set at 80 percent of the average U.S. manufacturer price. Following this process, HHS would have to publish the maximum fair price in the Federal Register by April 1, 2023.

Better Ways to Subsidize Drug Development

Key legislators oppose expansive negotiation of drug prices because of its negative impact on pharmaceutical interests, but it is still possible to overcome these political obstacles without diluting its disinflationary impact. Today’s high prices represent a perverse form of cross-subsidization in which seniors and the sick are asked to cover the (R&D) costs and investment risks pharmaceutical firms bear. Alternatively, the federal government could directly subsidize a greater share of R&D costs, independent of whatever prices CMS ultimately negotiates. It would be good policy and good politics to rely more heavily on government grants and long-term contracts as the primary cross-subsidization mechanism for pharmaceutical production and innovation. Direct R&D subsidization could provide valuable financial certainty to these firms and smooth over political obstacles while capturing the disinflationary impact of prescription drug pricing reform.

Rather than establishing simple but politically risky “price controls,” prescription drug pricing reform should transparently support private payers’ ability to bargain for lower prescription drug prices. This is a highly opaque and dysfunctional market, and there is clear space for reform that benefits all players while still trimming government outlays for prescription drugs and ensuring disinflationary outcomes in aggregate.

Whatever the politics, it’s worth remembering that there are a lot of steps between the enactment of prescription drug reform and disinflationary outcomes. Prescription drug negotiation has a long regulatory runway—data collection, opening bids, notice and comment, rule finalization, and actuarial analysis from insurance companies all have to happen before pharmacy counters and inflation readings reflect new prices. Nonetheless, passing expansive (and popular) legislation of this kind could likely become one of the government’s most powerful tools to combat inflation.

Conclusion

While the bulk of the current inflationary dynamics appear to be transitory, Congress and the White House need to stay nimble in the face of historically volatile and inherently uncertain macroeconomic dynamics. The Fed is willing to look past some of the current sources of inflationary pressure for the time being, but Congress and the White House should also be conscious that patience among Fed officials in the face of new inflationary pressure is likely thinner in the context of already-elevated inflation readings. While headline inflation readings are poised to fall through most of 2022, how quickly and broadly they fall is less clear. Rent and OER contributions to core PCE readings are likely to add ~0.4% above their current contribution, but current legislation and proposed rulemaking provides enough room for offsetting such a dynamic.

As such, regulatory and legislative interventions with disinflationary impacts should be prioritized. Healthcare policy, in the form of aggressive prescription drug pricing reform and reimbursement rate reductions, represents two of the most identifiably reliable methods for reducing core PCE readings over the medium term.

Much of the same logic within healthcare policy could also be extrapolated to higher education, where the federal government’s degree of subsidization enhances its ability to affect prices. However, the policy toolkit is less developed for education policy and the disinflationary effects of potential policy interventions are less understood. Investments in housing and transportation infrastructure could have similarly disinflationary effects, but the timeline over which that investment translates into lower prices is longer and less certain. Given the live debate around healthcare policy proposals, it would be wise for policymakers of all stripes to prioritize the enactment of disinflationary regulatory and fiscal policies that promote greater equity and efficiency.

Appendix