- August headline CPI inflation will likely come in close to the consensus forecast at -0.1% – which would be the lowest single-month reading since the onset of the pandemic. We see risks to headline balanced versus current consensus. Gasoline will weigh heavily to the downside, but the surge in natural gas prices, its potential implications for energy services, and the ongoing issues affecting grain and food prices generally, risks are more balanced than might be appreciated. Year-over-year headline inflation will likely fall for a second consecutive month, from 8.5% to roughly 8.1%.

- Core CPI inflation readings will likely align with the consensus forecast at 0.3% (consistent with an uptick in year-over year readings from 5.9% to 6.1%), but downside risks are sizable if used car price declines in private measures fully feed through in August itself. However, the full scale of the declines likely will take more than another month before they fully feed into CPI. We should see more goods deflation and disinflation over the coming months that offsets some of the relative strength in cyclical rent pressures over the coming months in this calendar year.

- As we continue to move through the energy crisis, oil and gas will continue to produce volatile dynamics for headline inflation. Oil prices have substantially corrected but upside risks lurk as sanction and embargo plans regain focus towards the end of the calendar year. Food prices are also unlikely to abate drastically until grain and livestock supplies regain some global balance; the combination of widespread drought in the United States with the loss of supplies from Ukraine will take time to overcome (and show up in CPI).

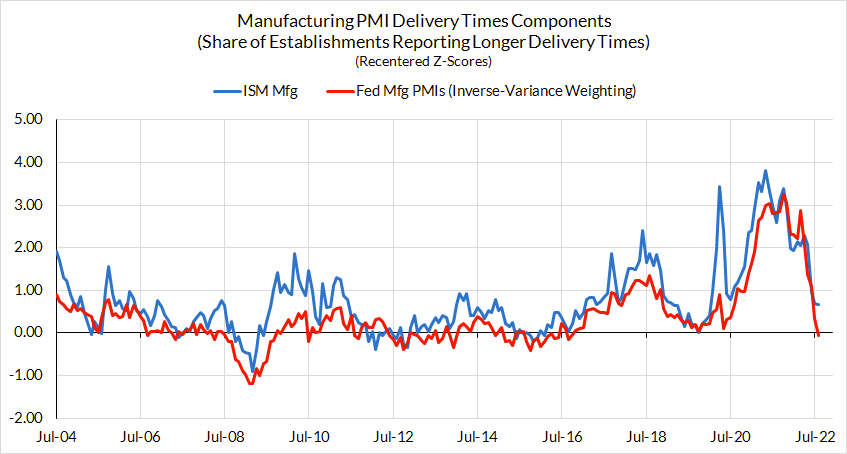

- Supply chains are stabilizing, especially in goods production. Per ISM, new orders are moderating, allowing manufacturers to work through their backlogs. At the same time, freight costs are continuing to decrease, signaling that the worst of the logistics problems are likely behind us.

- Over the next months, year-over-year core inflation readings will likely continue to fall as holiday sales coincide with elevated inventory. Relief is on the way.

Overall, headline inflation is likely to come in near consensus, with substantial disinflation from falling energy prices, while core inflation is likely to run stronger. Despite a robust core print, there are good reasons to believe relief is on the way in future. There are a number of different dynamics worth digging into here, but hopefully we avoid last month’s debate about whether year-over-year or month-over-month inflation statistics are “better.”

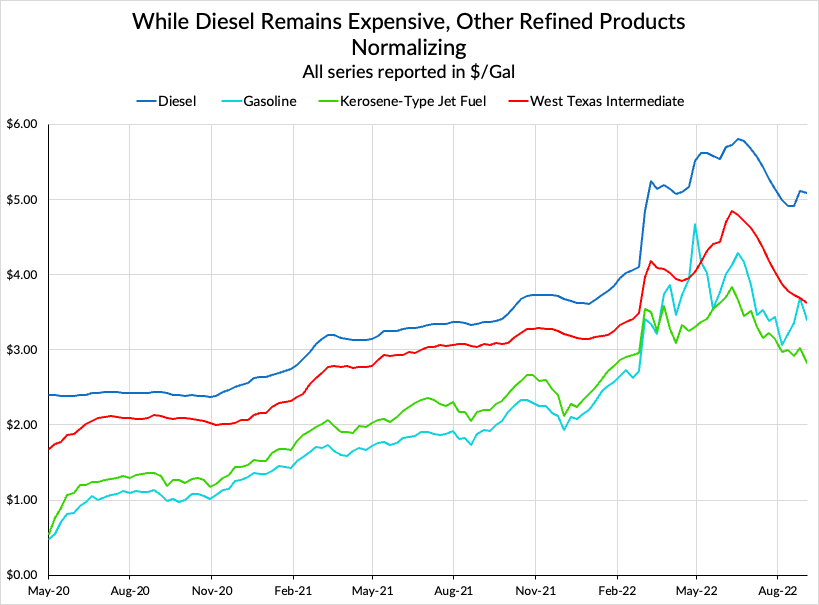

Volatile energy prices continue to drive headline CPI, but beneath the aggregate are a number of different stories. First, refined product spreads are continuing to normalize, despite the price of diesel remaining elevated.

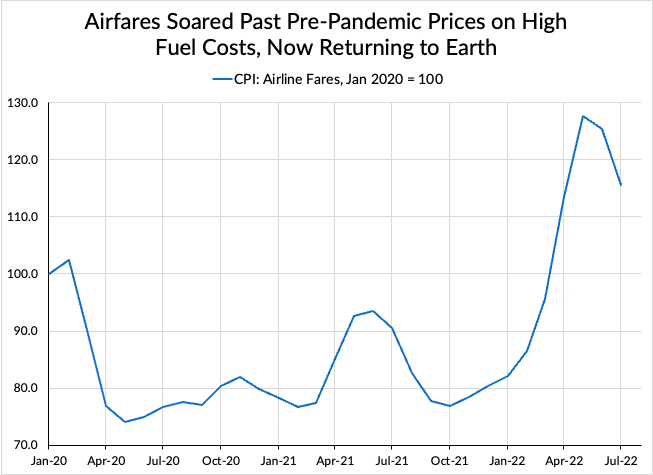

This has some interesting impacts: sky-high fuel prices in May and June meant that airfares went from 20% below pre-pandemic prices to 20% above in the span of two months. As the chart shows, falling fuel prices have led to falling airfares. With the price of jet fuel continuing to fall, airfares will be worth watching this month.

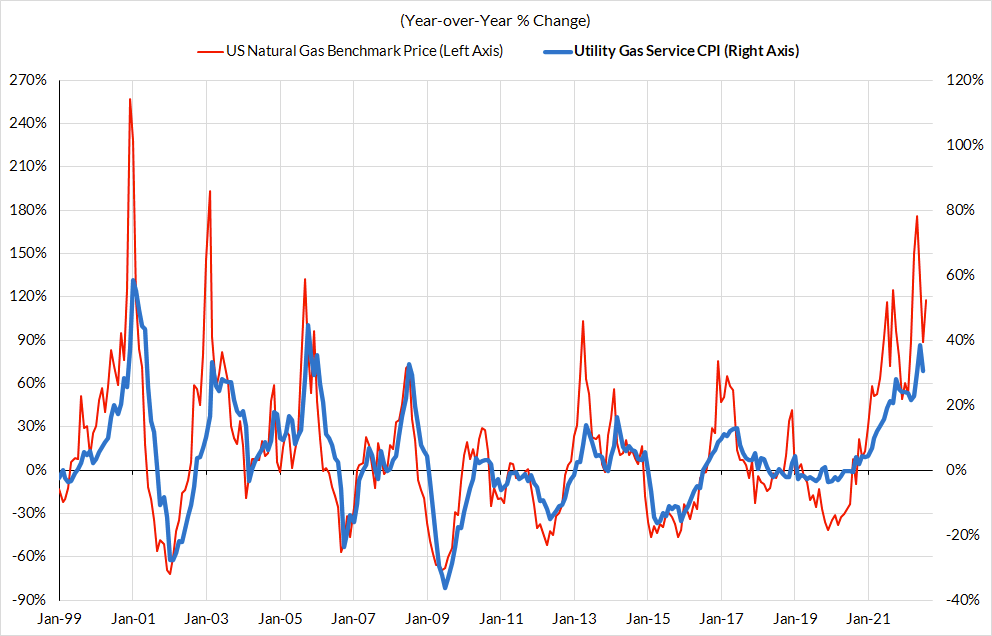

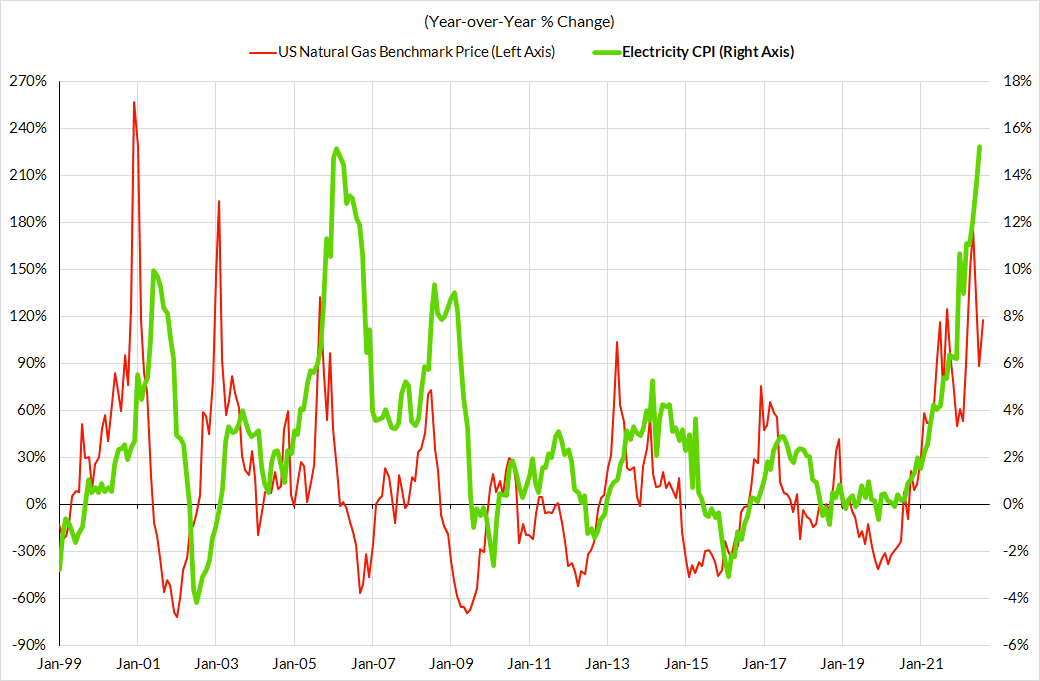

Following the closure of the Freeport LNG export facility, US consumers saw some relief on natural gas prices in July. However, prices have begun to rise again as the facility’s reopening is confirmed. This is likely to lead to rising utility gas costs, alongside rising electricity costs.

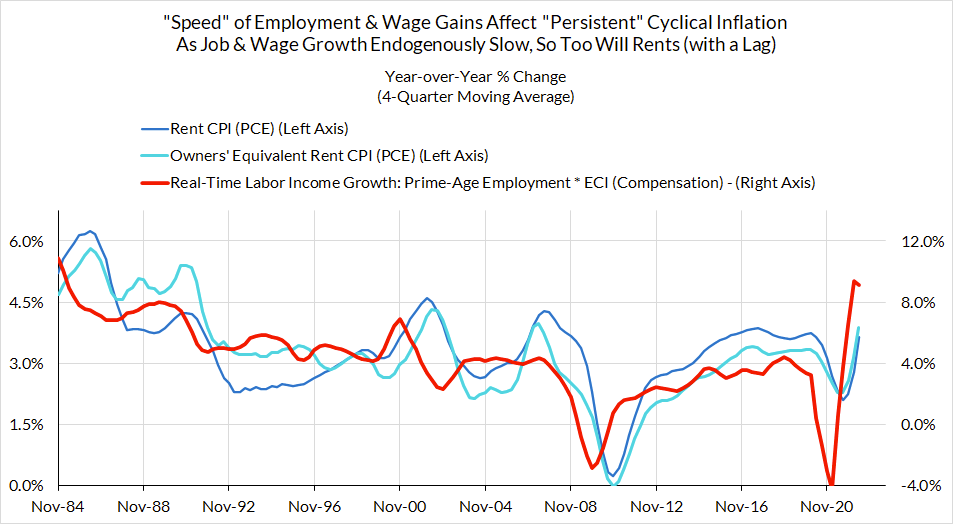

As labor markets remain tight, rents will likely remain elevated, meaning that CPI housing inflation still has room to run. Cooling in the housing market as financial conditions begin to tighten again and mortgage interest rates rise is unlikely to have a substantial disinflationary effect on housing components. Expect continued inflation in these components through the end of the year, absent serious labor market problems.

Over the coming months, there are a few key sectors worth looking at as likely sources of disinflation in core CPI between now and the end of the year. While these may start out as a trickle, when all combined, they may end up looking more like the early stages of a flood in the rearview. Some retailers have begun to see inventory begin to stack up substantially in recent quarters. Holiday season is the most likely period to observe abnormal discounting behavior.

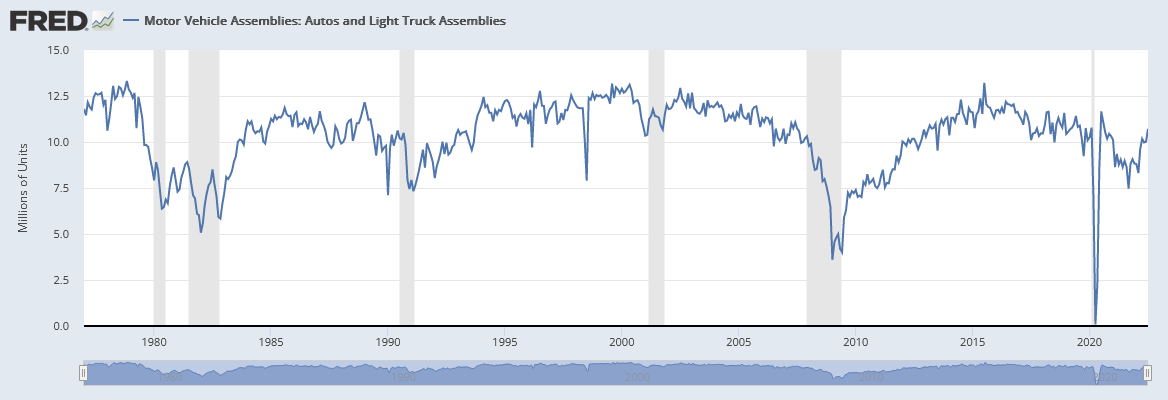

Real-time data from used automobile wholesalers has shown consistently falling week-over-week prices for the past three months, substantially below historical trend for this time of year. However, there is a varying lag time between market metrics and CPI metrics within used cars, so this price softening is likely to show up in weaker core inflation prints between now and the end of the year. While tightening financing conditions have likely played some part in the observed declines, the bigger potential for deflation requires the supply-side recovery in automobiles to continue over the coming months and quarters.

As logistics bottlenecks wind down – there are currently fewer container ships queuing at pacific ports than at any time this year – we may see some disinflation in high-import-content industries like apparel. Apparel is also likely to see the impact of deep discounts at retailers looking to offload inventory of pandemic-era staples that are now in much lower demand.

In all, this month’s CPI numbers are unlikely to surprise those who have been watching closely, but the media fireworks after last month’s 0.0% headline print suggest the August CPI will stoke similar fireworks.

Recap of Forward-Looking Commentary on Inflation Data

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks