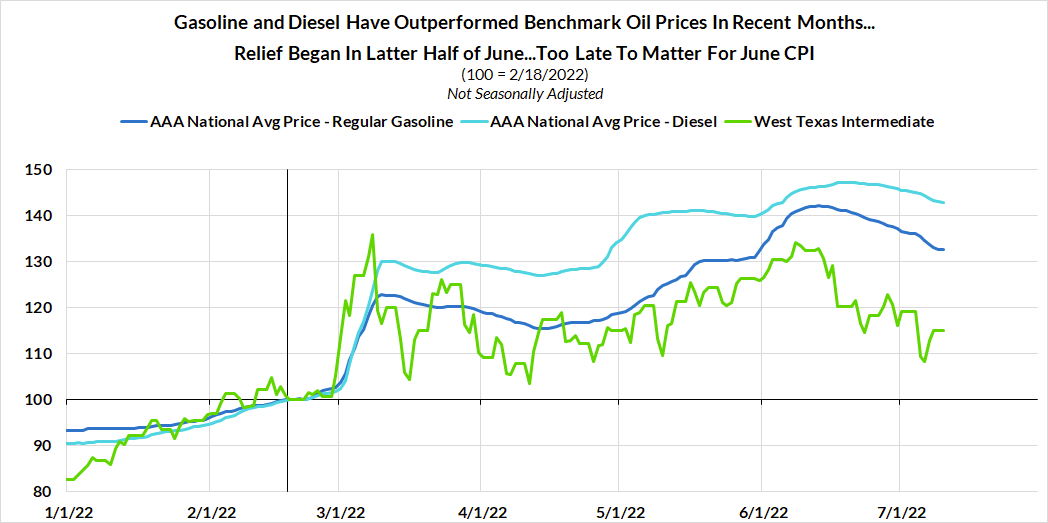

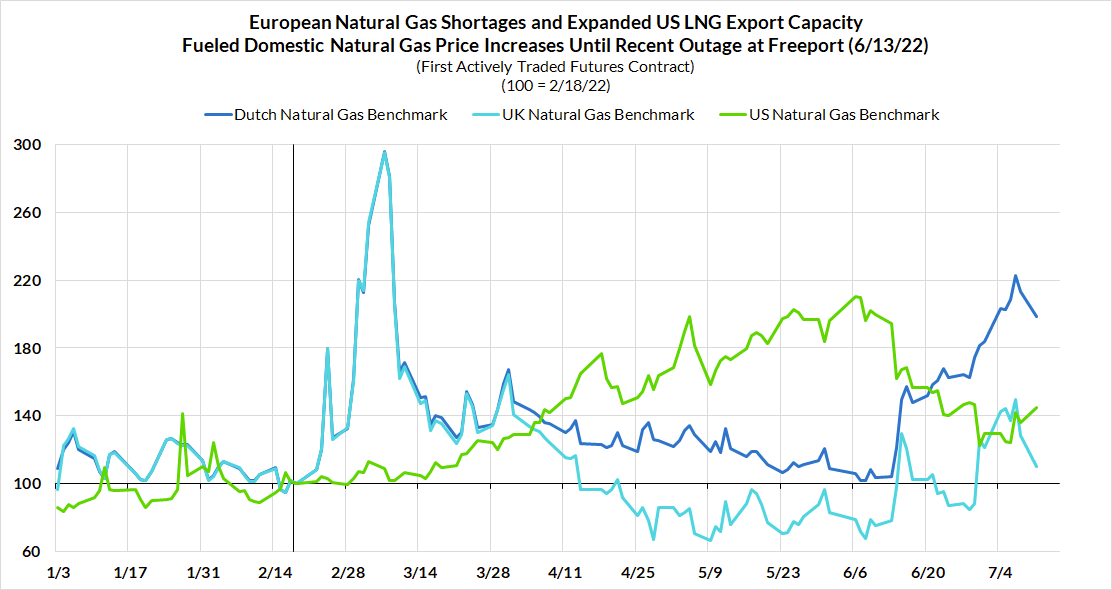

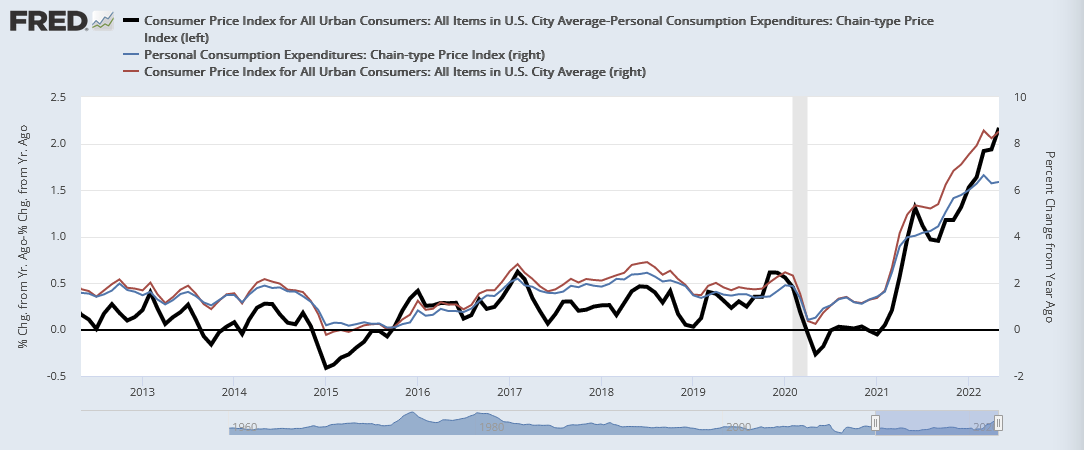

As was warned in our May CPI preview (Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large), the "peak inflation" calls were likely to prove premature. With the rapid rise of gasoline prices in the first half of June and passthrough from higher US benchmark natural gas prices still filtering, headline year-over-year inflation is now set to move higher. The good news is that many of these pressures should begin dissipating soon, but probably not soon enough to show material relief in this upcoming June CPI release.

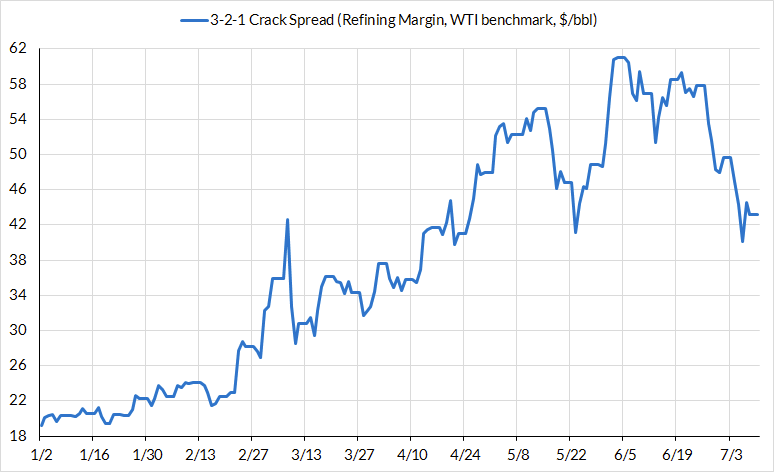

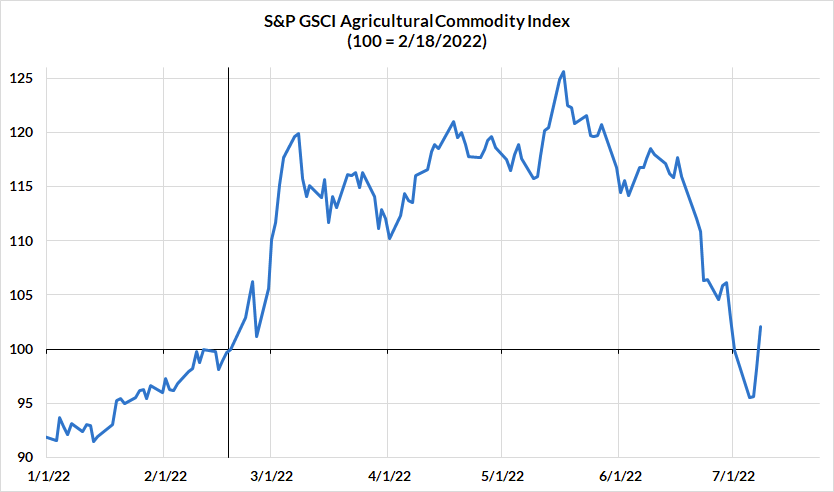

- Hot headline CPI dynamics (energy and food) will continue in June (forecast: 1.0%-1.2% vs consensus: 1.1%), but the main drivers are abating and should show some relief in subsequent releases. Refining margins and gasoline prices peaked in mid-June; this should pay disinflationary dividends in July CPI. US natural gas benchmark prices (due to an outage at Freeport LNG terminal) corrected; with an approximately 1-2 month passthrough timeline, this could help ease energy services CPI (utility gas service, electricity). Agricultural commodity prices passes through to retailed food prices with longer and more variable lags, but supports some inflation easing in H2.

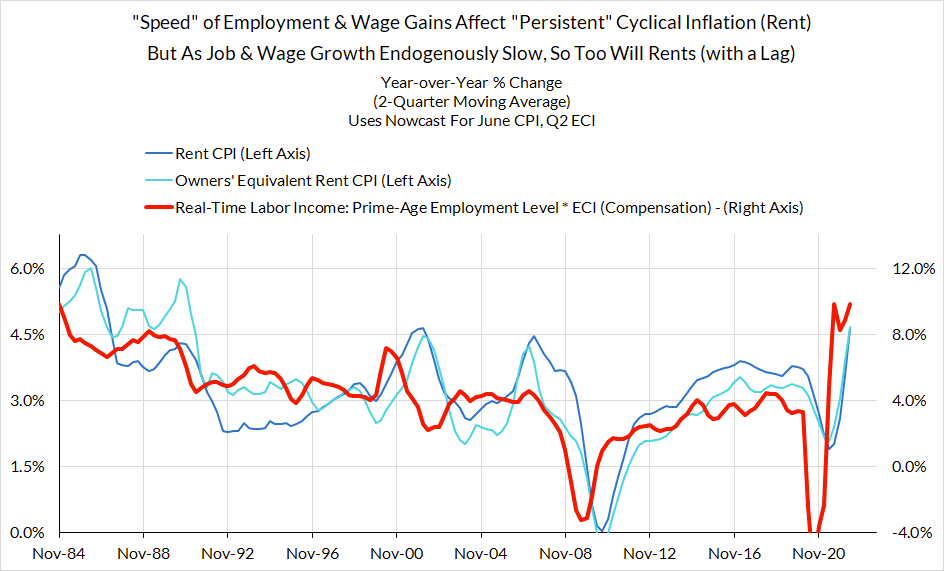

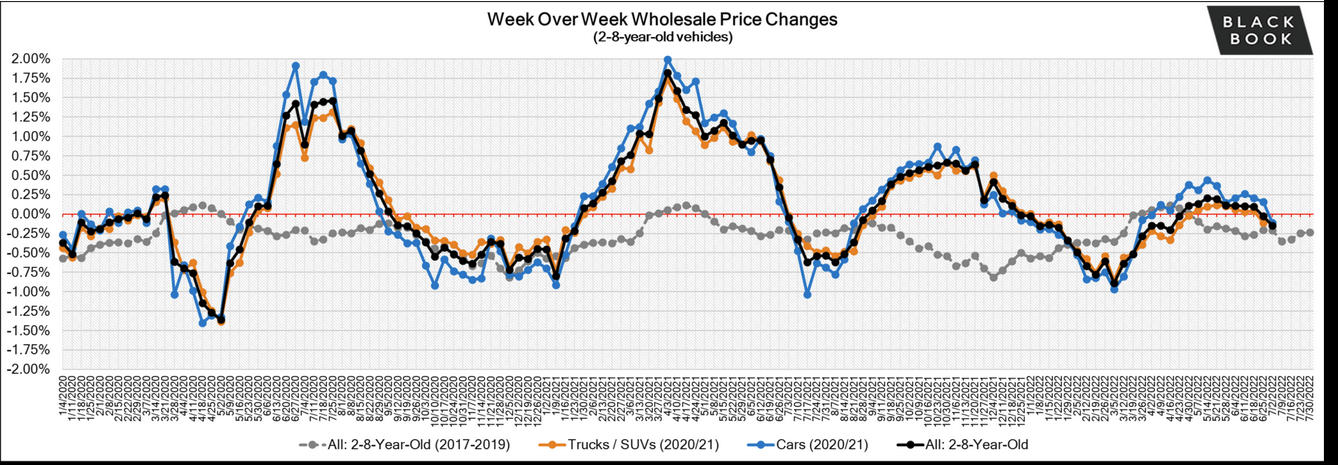

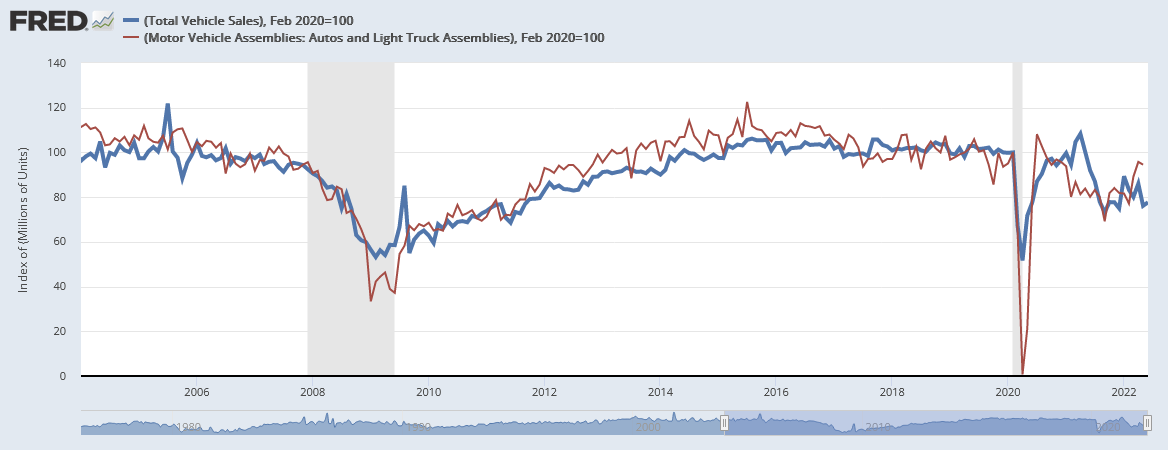

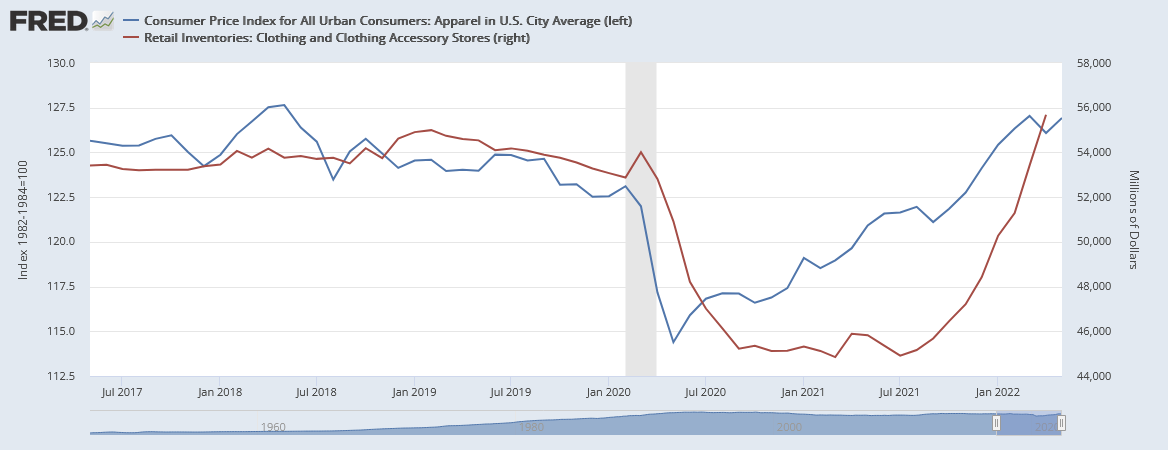

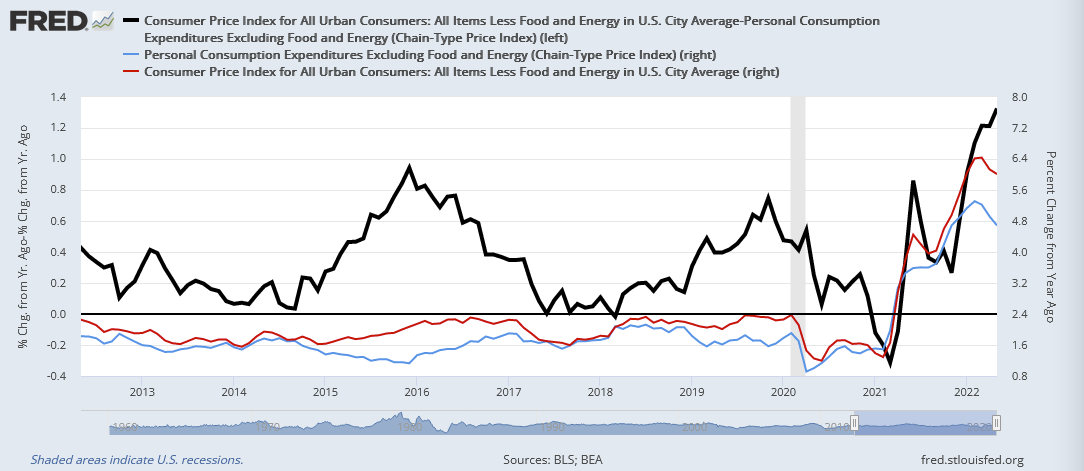

- Core CPI inflation has some sticky supports (forecast: 0.4%-0.5% vs consensus: 0.5%), but services CPI inflation should begin abating now, and as the calendar year progresses, goods deflation is likely to be a growing force. The upside airfares impulse is virtually over for now, but the strong monthly readings for rent and OER will continue to play a pivotal role for core CPI, median CPI, and trimmed mean CPI. But we are also nearing a peak in terms of monthly rent inflation rates, with risks tilted towards marginal deceleration as the labor market cools down. Autos have the most downside risk over the course of H2, but with production inventories, and sales still depressed as of June, auto-related prices will be a source of core CPI upside tomorrow. Core goods ex-autos (apparel, electronics, household supplies) could show some relief in June due to bloated inventories and improving supply chain dynamics, but here too, the bulk of the deflationary relief will transpire in H2.

- The CPI-PCE Wedge Will Matter Again especially as the second half of the Medicare sequester takes effect in July. The Fed targets the PCE deflator, not the Consumer Price Index. Year-over-year PCE inflation is 6.3% as of May, 230 basis points lower than year-over-year CPI inflation (8.6%). The realized wedge has been a function of elevated energy and food inflation, but there are also dynamics within the "core" (ex food ex energy) components that imply weaker core PCE readings than what core CPI used to imply. Among these dynamics is the divergence in healthcare services inflation. Congress allowing the full Medicare sequester to take effect will mean more disinflation for core PCE. Substitution dynamics are also likely to drive a wider structural wedge, as consumers substitute expenditures away from highly inflationary categories. We are already seeing some of this effect take hold. In May, core CPI was 0.63% M/M, core PCE was 0.35% M/M.

Recap of Forward-Looking Commentary on Inflation Data

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large