While it is true that base effects should create more favorable terrain for year-over-year headline CPI inflation readings to decline in this calendar year, the full implications of the current commodity supply shocks stemming from the Ukraine invasion still remain underrated. It is plausible that we return or even surpass the current peak for year-over-year headline CPI inflation (8.6% year over year). The fast decline in year-over-year inflation readings that many have been long awaiting...will certainly take longer to fully manifest.

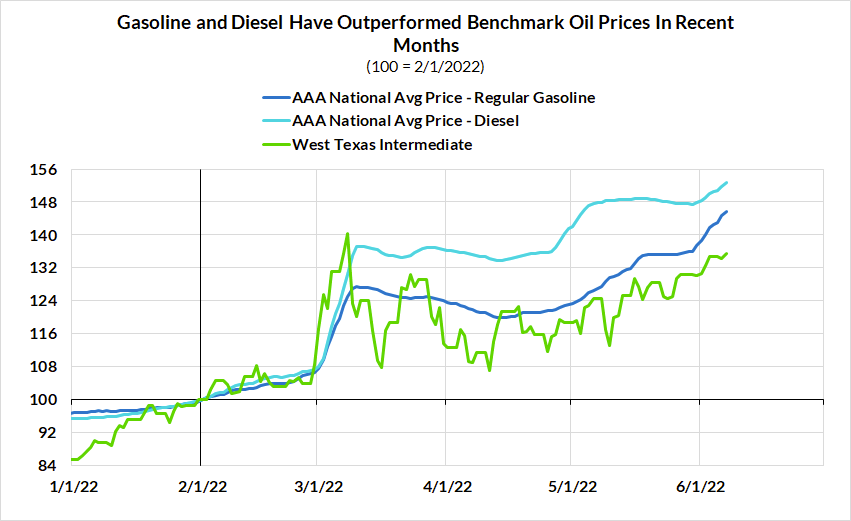

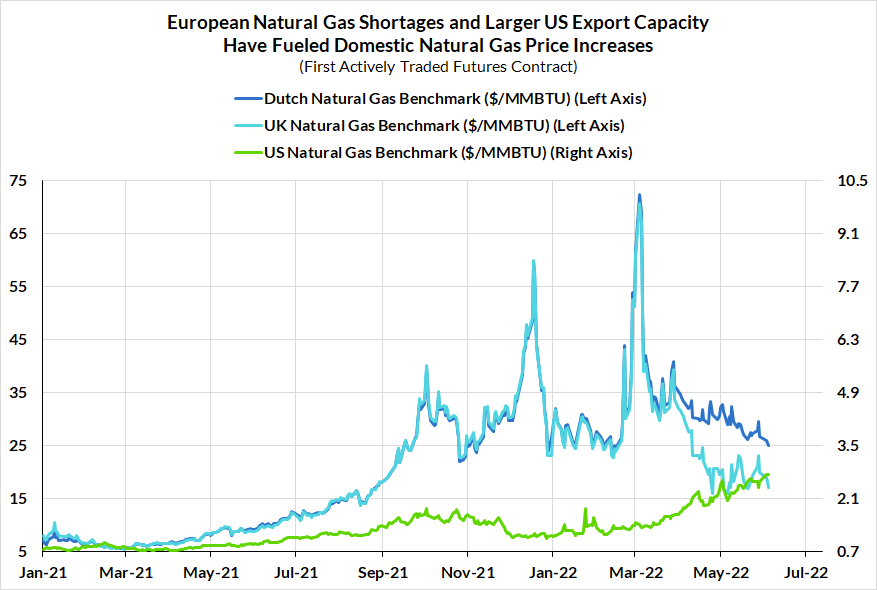

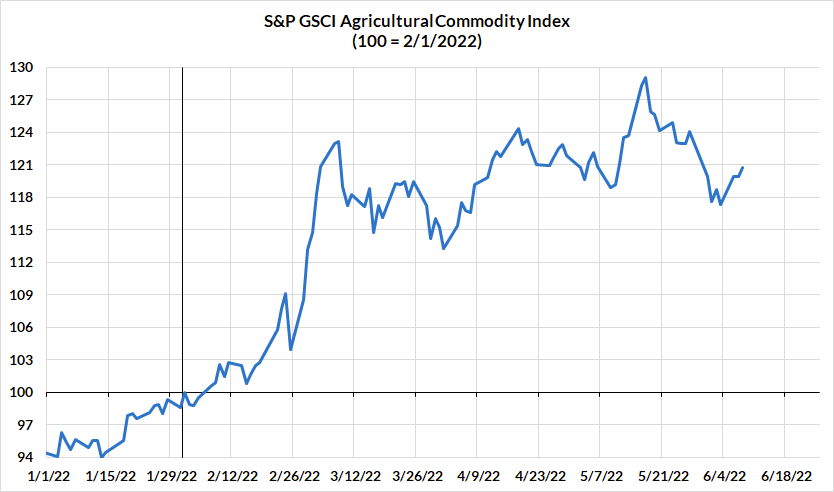

- May headline inflation is more likely to beat consensus forecast estimates (0.7% m/m). Our base-case is for a 0.9% m/m increase, but a 1.0% gain (which would push headline CPI year-over-year inflation back to its 8.6% peak) remains very plausible. Russia shock is not just limited to global crude oil prices. It is also a key culprit global refining capacity crunch that elevates the price of refined petroleum products. But even beyond that, Russia's invasion will affect US CPI through its effect on natural gas and food prices. The global scramble for US LNG, along with expanded US LNG export capacity, has pulled US natural gas prices up, marginally closer to overseas benchmark prices. That means higher electricity and utility gas bills for American consumers. And while more slow-moving and less identifiable, the shock to key agricultural commodities and inputs are also likely to filter into food inflation, which was already running at an elevated pace (the passthrough from commodity prices to grocery prices is more variable and extended).

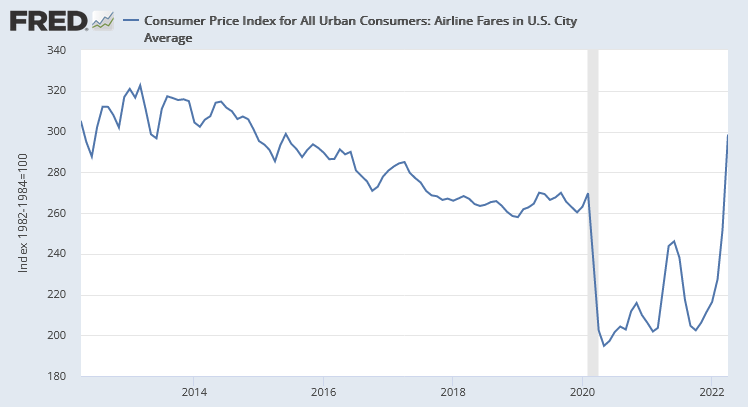

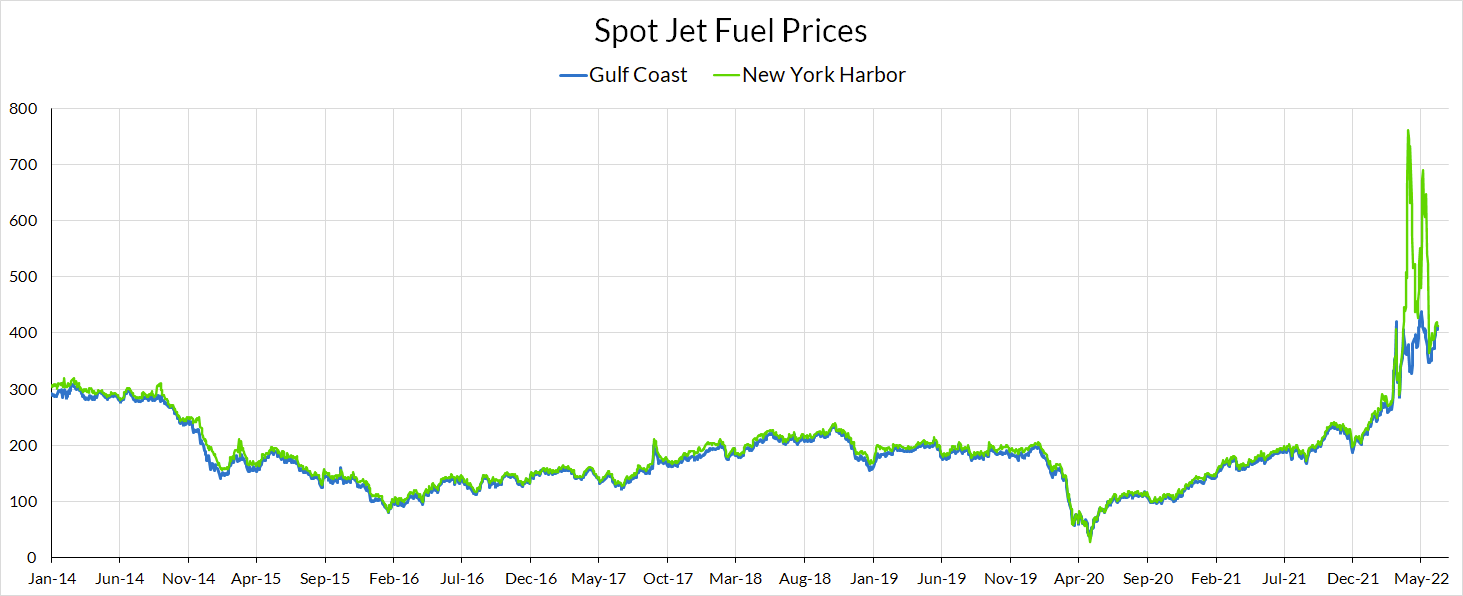

- May core CPI inflation is also liable to run hot relative to consensus (0.5% m/m) due to the sharp recovery in airfares and the general trend in rent inflation. While possibly less strong than April's print, airfare CPI is likely to punch strong for very similar reasons. The pandemic destroyed air travel demand but with consumer behavior rapidly normalizing now, air travel demand is surging at a time when jet fuel (a critical input for airfares) is seeing extreme price spikes tied to the global refining capacity crunch. While used car prices were a helpful offset over the past three months (as rental car companies stopped scrambling to replenish their fleets), that impulse has now dissipated. Meanwhile, the most persistent and demand-sensitive component of core inflation—rent / owners' equivalent-rent—is likely to show continued strength, thereby keeping median and trimmed mean CPI running strong

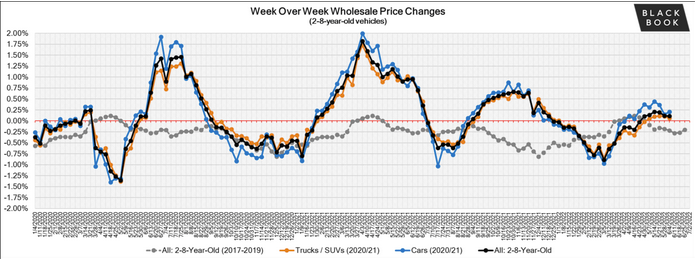

- As we move closer to Q3, the outlook for core goods suggests a meaningful contributor to disinflation. Automakers are projecting a normalization in their specific microchip supplies in the back half of the calendar year and a ramp up to more normal levels of production (which was historically constrained in 2021 and is only gradually recovering in 2022). On top of this, we are seeing major general merchandise (Target, Amazon, Walmart) retailers signal excess inventory and a need to engage in aggressive discounting to counter this dynamic. Housing-attached durable goods (tools, appliances) might also be in the infant stages of a price correction as the housing activity is clearly cooling.

Charts and Takeaways

The global refining capacity crunch has exacerbated the implications of the global shortage in crude oil for US consumers.

Global benchmark natural gas prices were diverging prior to the Russian invasion of Ukraine due to European challenges managing natural gas inventories and future supply contracts. But since the invasion, we have seen an escalated scramble for exported liquefied natural gas supplies, most prominently from the United States (in the form of LNG exports). The result has been lower European benchmark prices but higher benchmark prices in the United States, especially as US LNG export capacity expands. For US CPI, that means higher electricity prices and higher utility gas service prices. Natural gas will also have prominent effects on other products for which natural gas is a key input (fertilizer, any good and service that relies on electricity).

While agricultural input and commodity prices do not have a reliable effect on consumer price indices, the over 20% surge in agricultural commodity prices (directly tied to Russia and Ukraine's role as major global food exporters) is likely to push up prices within the US. The domestic agricultural sector has been facing serious drought and will be eager to export surplus production to capitalize on elevated overseas prices.

Air travel is also likely to see continued upside pressure, partially due to some methodological quirks, and simply because the recovery in air travel demand has been sizable since Omicron dissipated. Prior to April, this was the last major pandemic-affected service that was well-short of a full recovery. Jet fuel prices have surged as a result of the refining capacity crunch, and this too will get passed through to consumers amidst rapidly recovering air travel demand.

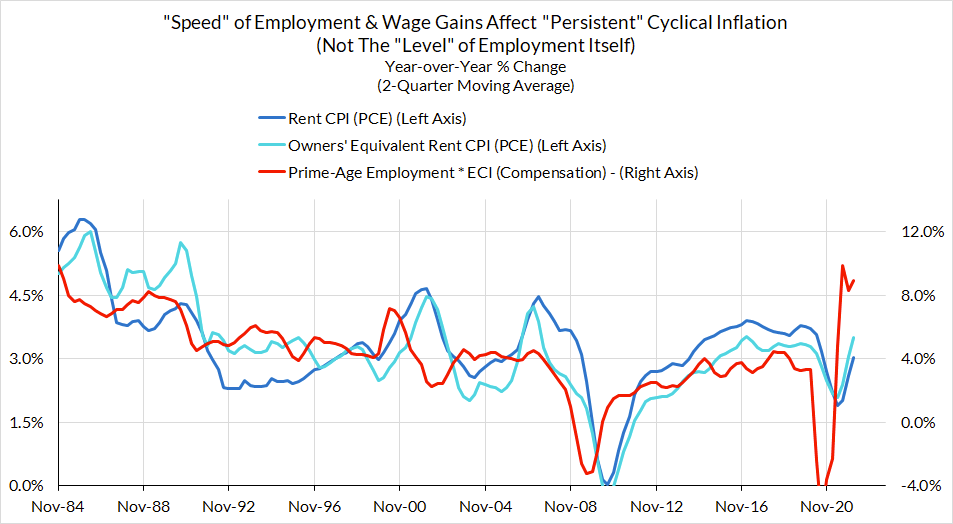

The most persistent demand-sensitive component of inflation is rent (and owners' equivalent rent). With labor income growth running hot in 2021 and 2022Q1, it is safe to assume that monthly rent CPI inflation prints will stay hot through most of the 2022 calendar year (before abating in 2023 in response to the labor market slowdown in 2022).

Finally, wholesale used car prices have likely seen a shift in their seasonal pattern that CPI measures will likely miss, all of which translates to stronger used cars inflation in May, June, and possibly July. Greater relief will likely coincide with the normalization of new car production and sales in 2022H2.

Recap of Forward-Looking Commentary on Inflation Data

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation