September headline CPI inflation will likely come in near the consensus forecast of 0.2% as gyrations in commodity markets slow. In our view, upside risks weigh more heavily to the non-core components of inflation relative to consensus because of how the ‘Russia shock’ affects a number of food and energy prices (not just gasoline).

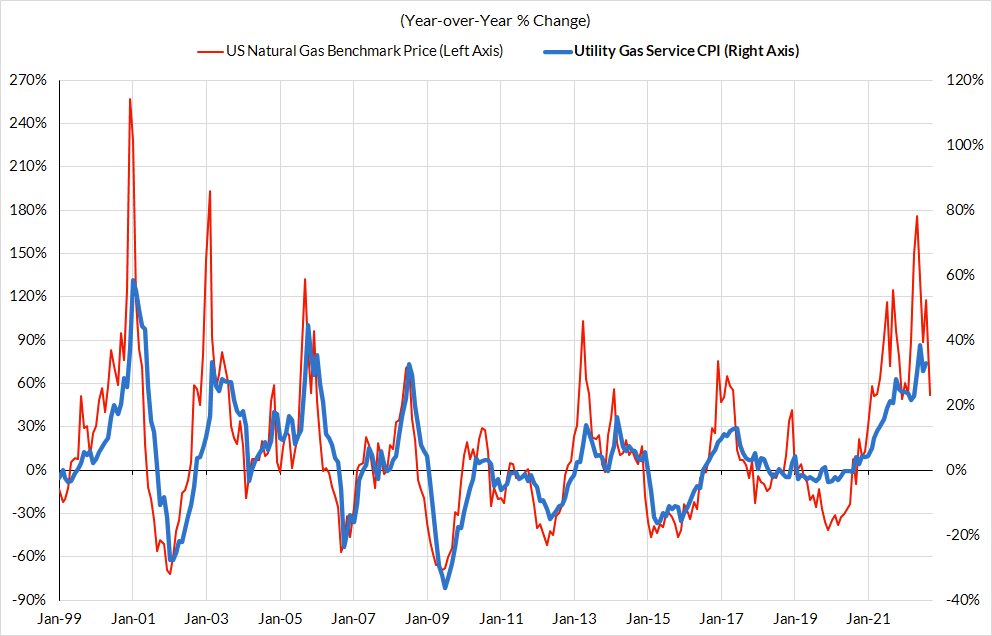

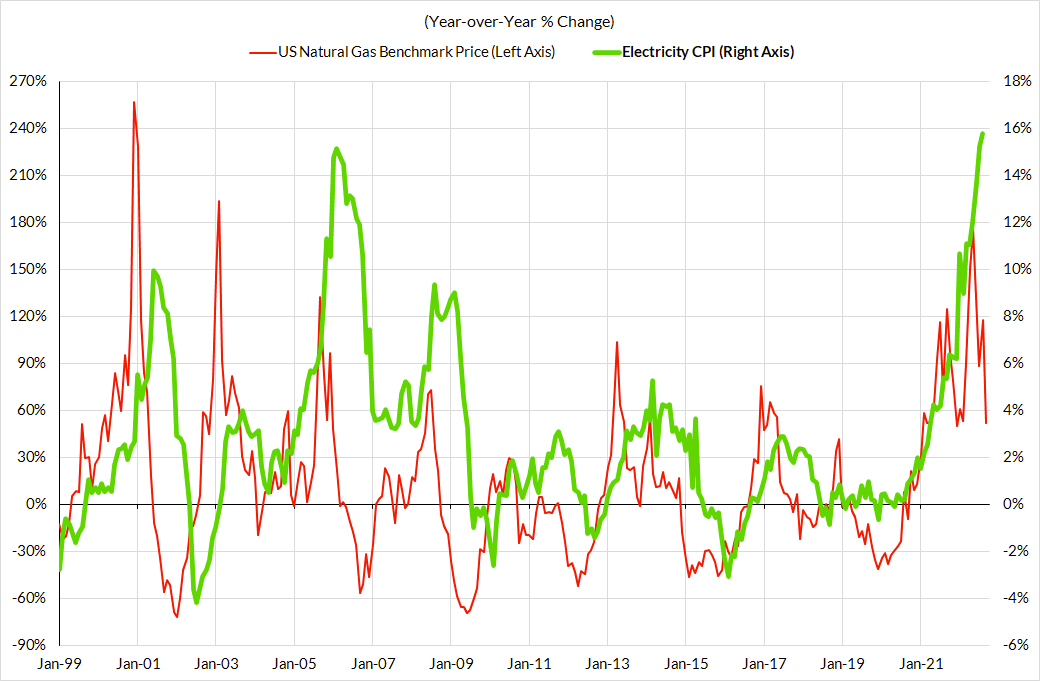

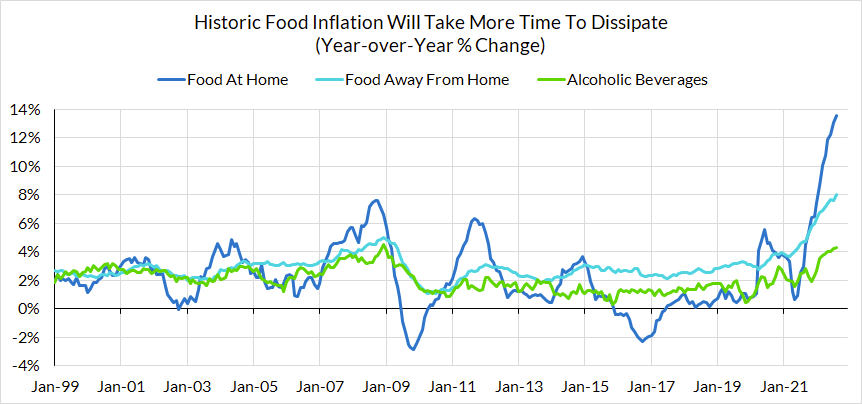

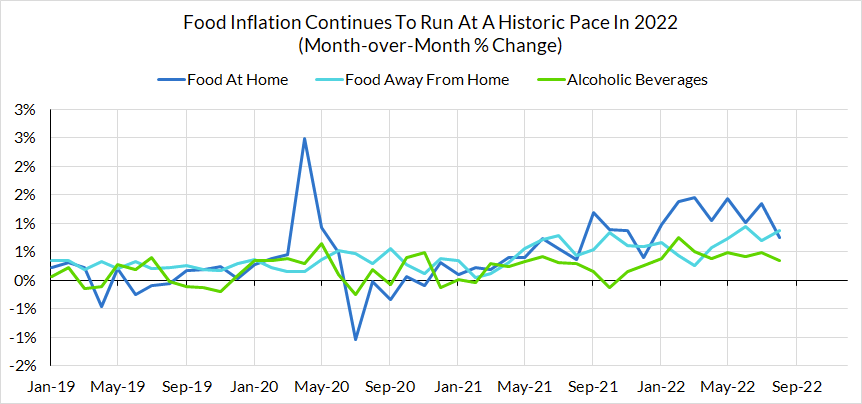

- Even though there appears to be a potential peak in benchmark natural gas prices, the Ukraine-related surge is likely to filter into a number of industrial prices that depend on natural gas and households will see their electricity bills revised substantially to the upside this year as a result. Meanwhile, the supply chain for food is likely to remain dysfunctional for the next few quarters. While there has been cooling in some agricultural commodity prices, input costs within the supply chain for both retailed food products and food services are still being absorbed. These dynamics have also predictably spilled over into alcohol beverage pricing, which is actually a part of core CPI. Despite positive monthly inflation, year-over-year headline inflation should continue to fall (as expected) for a third consecutive month, from 8.3% to roughly 8.1%.

Core CPI readings have modest downside risk relative to the consensus forecast at 0.4% – which would otherwise imply a year-over-year increase from 6.3% to 6.5%. Downside risk ultimately hinges on the variable lag from higher-frequency data, wholesale prices, and elevated inventories into the CPI data.

- We tried to be cautious last month over the much-anticipated declines in used car prices and with full hindsight, even more caution was warranted. A similar disappointment due to lags could be on the cards this month. Automobile supply is starting to normalize just as demand continues to cool, but it may take time for high-frequency wholesale data to fully filter through into retail pricing data the CPI captures.

- Contrary to what some of the commentary indicated, rent (and OER) inflation in August was about as strong as should have been anticipated. The record "shelter" inflation print was an artifact of lodging prices no longer deflating. Crudely speaking, the best forecast for next month's rent and OER CPI reading is the growth rate in the previous month. While monthly deceleration would be a highly welcome development, it should not be a baseline assumption. Better to see signs of deceleration materialize in the CPI data before revising monthly inflation forecasts.

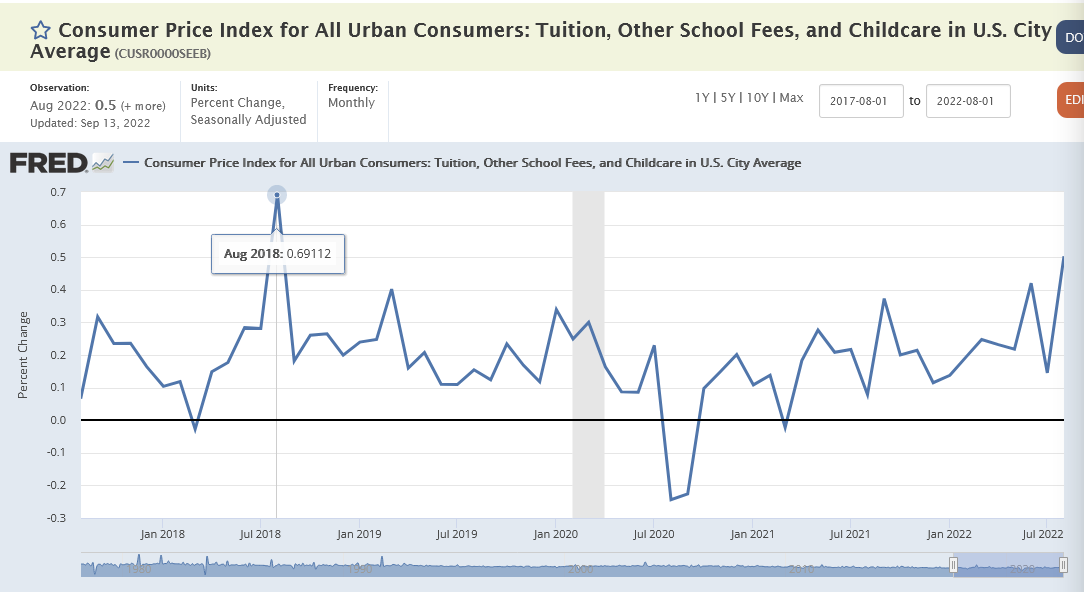

- Services inflation in September likely turns on the pace of tuition increases this year. Price changes in college and high school tuition are primarily implemented in August and September. August this year was especially strong but a strong August does not always imply a strong September (see 2018). Upside and downside core inflation risks in September will likely turn on whether August tuition increases reflected front-loading a further increase in pricing trends here.

With a slightly longer horizon than the next one or two inflation prints, there is growing room for optimism about the trajectory of inflation. Whether the Fed will have the patience to allow these dynamics to take hold before they inflict permanent damage to the labor market remains to be seen.

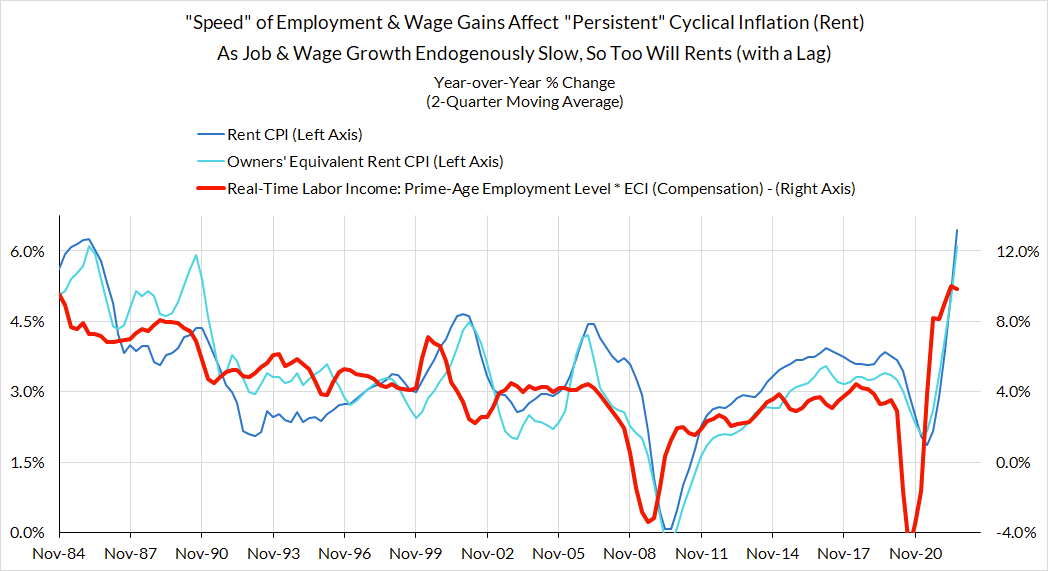

- The main driver of the most inertial component of inflation (rent & OER) is the growth rate of jobs and wages, both of which are now well-past their base effect surge from 2021Q3 to 2022Q2. The pace of labor market expansion in Q3 is still respectable but no longer indicative of breakneck income growth. We should see more meaningful slowing in rental inflation in early 2023.

- Reopening impulses that caused inflation to surge further this year—like airfares and lodging—are now moving closer to maturity.

- Likewise, we are growing closer to more normalized pricing patterns in goods, with automobiles likely to lead the way, followed by discretionary retailed goods, and lastly nondiscretionary staples.

Energy

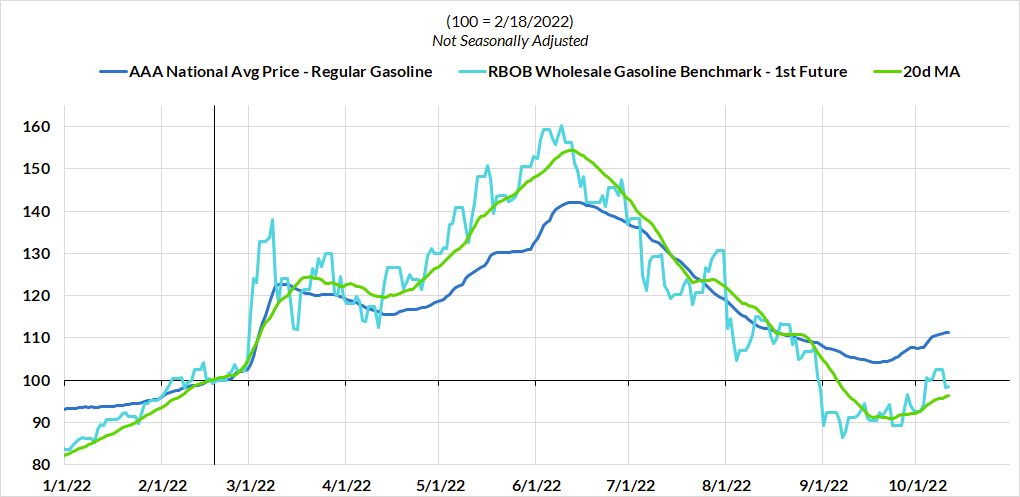

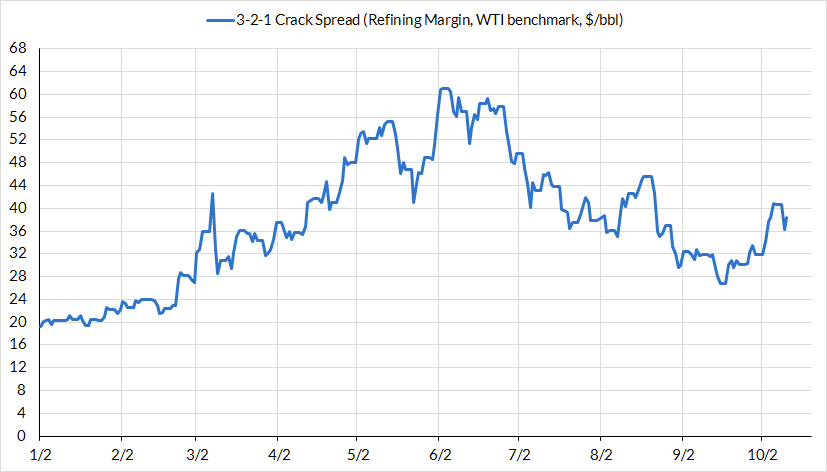

Compared to past months, September was relatively uneventful in energy markets. Crude oil and natural gas prices fell steadily as markets worked to adapt to a decelerating global growth trajectory. Despite the Nord Stream bombings and steadily rising exports, domestic spot prices for natural gas fell substantially over the month. Nevertheless, the record prices previously achieved for refined petroleum products and natural gas are still likely to push up prices in electricity and potentially other goods and services.

Food

Core Services Implications - Rent and Education

Housing will remain an idiosyncratic source of strength in inflation regardless of Federal Reserve actions over the next year. A new paper from the Bureau of Labor Statistics finds that, due to artifacts of statistical construction and differences in measurement definitions and methodologies, rent CPI lags real-time market rent measurements by as much as a year.

In practical terms, this means that the cake is already baked on next year’s shelter inflation. Rents rose substantially over 2021, and the rate of increase appears to have peaked. If the BLS' paper is any indication, the Fed will be dealing with elevated prints from 2021 rent increases long after market rates have turned around. It will take time for the rat to move through the snake.

We have long held that the strongest point where the labor market affects inflation is with respect to rent and OER, and the labor market is suggesting a similar decelerating trajectory to what the market rent data is implying. While employment and wage growth have surged in previous quarters, and this alone will feed into rent/OER inflation with a 3-4 quarter lag, the growth of employment and wages is also showing increasing signs of slowing to a more normalized growth rate.

As for what could really swing this upcoming print, education is one key sector that has outsized leverage in September. Since most price increases materialize in August and September, the seasonally adjusted increases are of outsized volatility and impact. Risks appear balanced but whatever the direction, the readings here are likely to draw some additional coverage from commentators and news outlets.

Core Goods

Everyone has been holding their breath waiting for declines in wholesale used car prices to show up in CPI, but the path from one to the other is long and winding, with several threatening detours.

We saw throughout 2021 that market indicators tended to lead CPI indicators by 3-6 months on the way up. Whether that holds on the way down depends on many factors. Blackbook data is showing ten consecutive weeks of 1% decline in wholesale auto prices.

However – as Fed Vice Chair Brainard pointed out in a recent speech – automobile dealer margins have surged alongside disappearing supply. For wholesale price decreases to translate into retail prices more in line with historical averages, we will likely have to see substantial margin compression as well.

One source of that margin compression may be from new vehicles, where we found out in September that capacity utilization has ticked up substantially as supply chain snarls have eased.

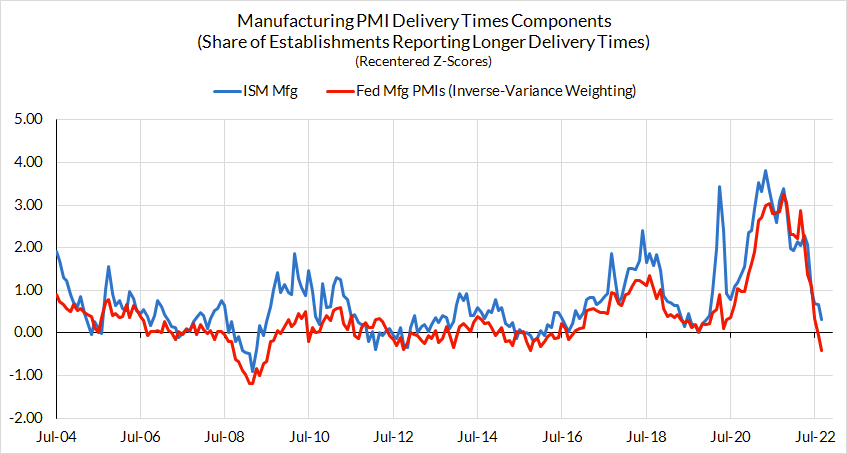

Nevertheless, capacity utilization will take time to fully normalize, only after which are we likely to see the full deflationary potential in force. Some commentators have claimed that inflationary supply chain dynamics have already eased but this characterization still seems premature. Delivery times may no longer be increasing at a historic pace, but they still remain at historically elevated levels. We still have yet to see sustained compression in delivery times that would be indicative of a healing supply chain.

On the strength of recent production increases, and projected future increases, analysts are beginning to argue for the threat of “oversupply” in 2023, which would be deeply welcome from an inflation perspective.

Recap of Forward-Looking Commentary on Inflation Data

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?