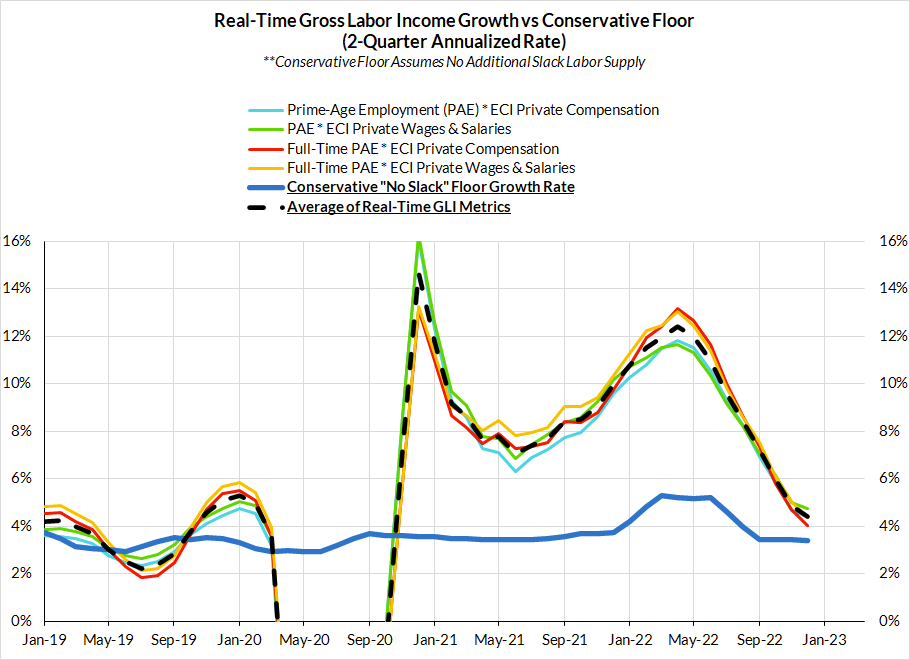

Wage growth slowed in Q4 faster than consensus forecasts–-at an annualized rate just over 4%. We already noted in our preview that this would be very consistent with what the other Q4 macroeconomic & wage data was signaling. The scenario poised to trigger a hawkish overreaction did not materialize. While nothing about inflation or wage growth is definitive at this stage, the Fed should take seriously the possibility that disinflation can materialize without recessionary rises in joblessness.

The Fed should shade down its assessment of inflation risks

- By The Fed’s Logic: The Fed seems to think the dominant relevance of the labor market to inflation runs from labor costs to service prices that consumers pay (outside of housing and energy). If wage growth is slowing, so too should the Fed’s ‘super-core’ inflation outlook

- Our view: There’s a lot more to inflation dynamics than the labor market, but the strongest nexus is on the demand-side via gross labor income growth. Slower labor income growth–whether it stems from slower job growth or slower wage growth–shades down the trajectory and outlook for nominal consumer spending. Under our own framework, the case for inducing additional financial conditions tightening is diminishing alongside the deceleration in gross labor income.

Should The Fed Really Be Aiming For A Recession To Slow Wages and Prices?

- By the Fed’s Logic: The Fed’s projections are based on a static Phillips Curve view of what drives wage growth. Why else would they aim for a recessionary rise in unemployment? But the second half of last year, and especially in Q4, shows yet another counterexample to this core tenet of Fed thinking. If wage and price growth can fall without a gratuitous and dangerous rise in unemployment, FOMC members should shade down their unemployment rate projections.

- Our view: We’ve long noted that the unemployment rate is a flimsy predictor of wage growth. Wages can decelerate even in the absence of a rise in the unemployment rate. It happened in the mid-1980s. It happened in the mid-2000s. And it appears to be true since the second half of last year. Benign outcomes are still feasible; foreclosing them through excessively tight Fed policy will be a massive infliction of avoidable human costs.