In the coming weeks, we hope to discuss in greater detail what kinds of labor market and inflation outcomes the Fed should be aiming for. Here is an initial layout of how some of our macroeconomic views tend to differ from senior Fed officials.

The Fed has increasingly gone back to its roots, embracing a cost-push Phillips Curve view of how the labor market primarily affects inflation. That view involves:

- Pursuing lower wage growth in order to tame price inflation (for a specific set of allegedly "labor-intensive" services), and

- Pursuing higher unemployment in order to achieve lower wage growth (even as it implies recessionary outcomes)

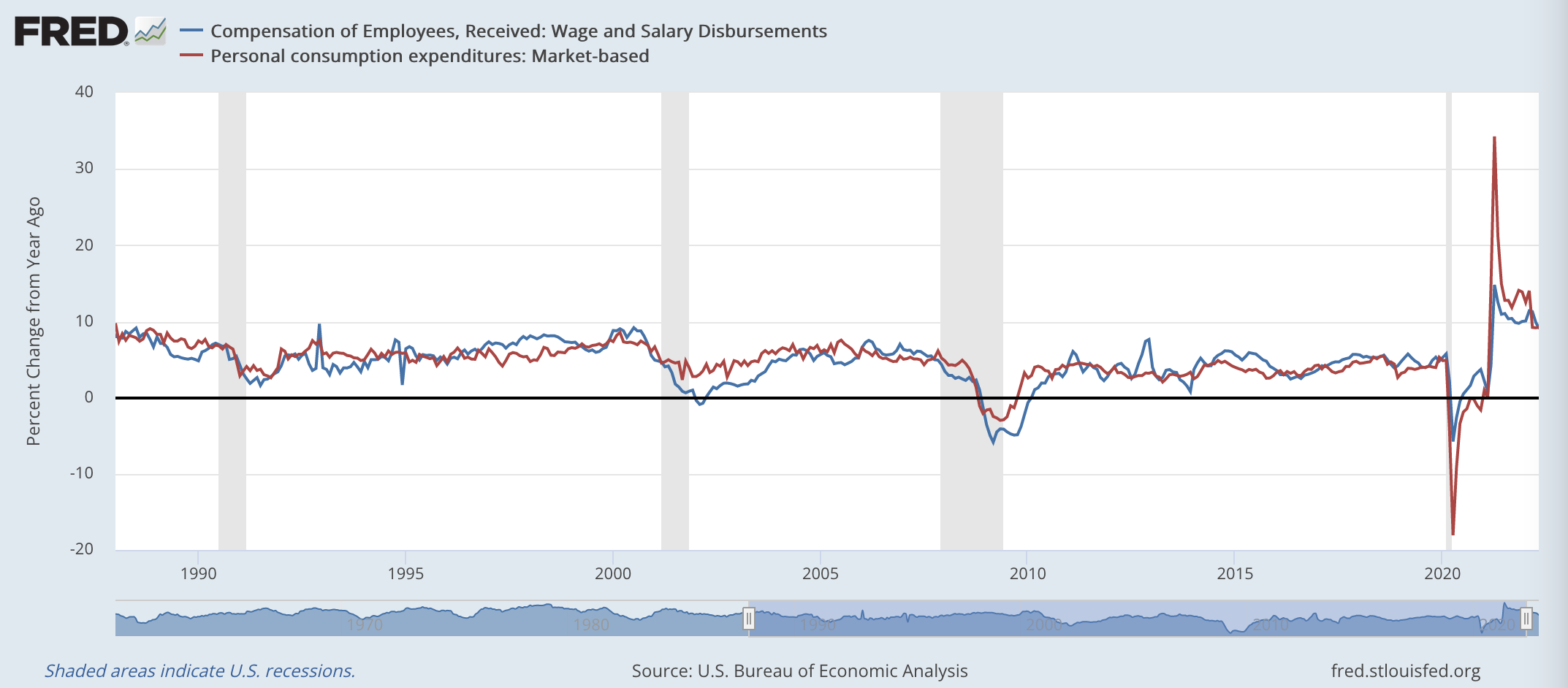

We are not denialists about the relevance of labor market conditions, but we subscribe to a different view of how the labor market primarily affects inflation, what we will call a demand-pull view. Labor incomes are the major and marginal funding source for household consumption. Stronger gross labor income growth—which is really just job growth plus wage growth—puts more demand-side pressure on aggregate nominal consumption growth. This in turn pressures consumer price inflation at the margin.

These two dynamics may seem like two sides of the same coin: complementary mechanisms that have equivalent implications for how the Fed should respond to labor market dynamics. But when it comes to how the Fed should react to incoming information under uncertainty, the two channels emphasize different sets of data for shaping the Fed's policy reaction function.

Difference #1: The Implications of Job Growth (Already) Slowing

The Cost-Push Phillips Curve View: The Fed is clearly unsatisfied with job growth merely slowing. Fedspeak and Fed projections make clear they are aiming for higher unemployment within the current calendar year, at a scale which would only be consistent with outright job loss. Why? Under a static Phillips Curve model of wage growth, the pace of nominal wage growth is—to a first approximation—determined by the level of unemployment. Slower job growth should directly lowers gross labor income growth assuming fixed wage growth, but Phillips Curve models of wage growth make the alternative assumption.

- If you strongly believe in a static wage Phillips Curve, then the lower unemployment rate will still cause additional labor scarcity that drives even faster wage increases. This in turn pushes up wage growth and labor-intensive service price inflation.

- Empirically speaking, we have good reasons to be skeptical of following static Phillips Curve models of wage growth, which perform poorly amidst changing economic conditions. Over time, there are many different unemployment rates that can align with a given pace of wage growth. Wage growth has decelerated in multiple business cycle expansions, even as the unemployment rate fell.

- If you think that wage growth might lag (as it tends to) and you are a strong believer in a static wage Phillips Curve (the Fed), then you might put outsized emphasis on seeing the unemployment rate go up. Fedspeak and the Fed's projections reflect a fixation with the level of the unemployment rate and the need for it to rise (some say a little, some say a lot). That really only makes sense if you think nothing short of a contraction in employment is necessary for wages to decelerate.

The Demand-Pull View: Job growth has already been slowing this year; that much we know. If you're not so confident about what drives wage growth over time, and you think it might move somewhat independently of a static Phillips Curve model, then the consumption-decelerating effects of slower job growth are more compelling. Lower job growth translates into lower aggregate household income growth, and that should lower aggregate consumption growth.

- Interestingly, we have seen over the course of 2022 that wage growth has decelerated on major measures even as the unemployment rate fell (or at least held steady). This is at odds with a static cost-push Phillips Curve view of the world.

- Likewise, other compelling drivers of wage growth, like the rate at which workers voluntarily quit their positions, also consistently declined in 2022 (even as unemployment fell further and stayed low).

- Phillips Curve adherents like to discuss the "sacrifice ratio," the amount of unemployment that must be imposed to achieve a desirably low inflation rate. While some might bask in the idea that they are the steely-eyed utilitarians, they might miss a huge opportunity cost if inflation can be lowered simply through a path involving slower—but still positive—job growth.

Difference #2: What Other Data Should The Fed Emphasize?

Aside from the unemployment rate and wage growth, there are other measures of prices and other points of economic data worth tracking to see how the labor market may (or may not) be affecting the inflation outlook.

The Cost-Push Phillips Curve View: The Fed has explicitly embraced a new special aggregate of consumer prices, Core Services Ex Housing PCE. CSXHP is meant to be a proxy of for how labor costs feed into (allegedly) labor-intensive prices. The fact that it has mildly risen but used to be more inertial is now being offered as proof positive that the labor market has caused permanent damage to the Fed's aspirations of hitting the inflation target.

- We are skeptical of the strength of this causal view. There are estimates of wages at the sectoral level that could be used for cross-validating the Fed's claims here; if the Fed can show us compelling evidence, we're willing to revise our priors (but we've already had a look and will share more reasons for skepticism soon enough).

- A quick run-through the categories that account for the share and volatility of CSXHP should caution against the Fed's a priori reasoning and evidence-light presumptions. Services businesses often raise prices for reasons other than changes in labor cost structure.

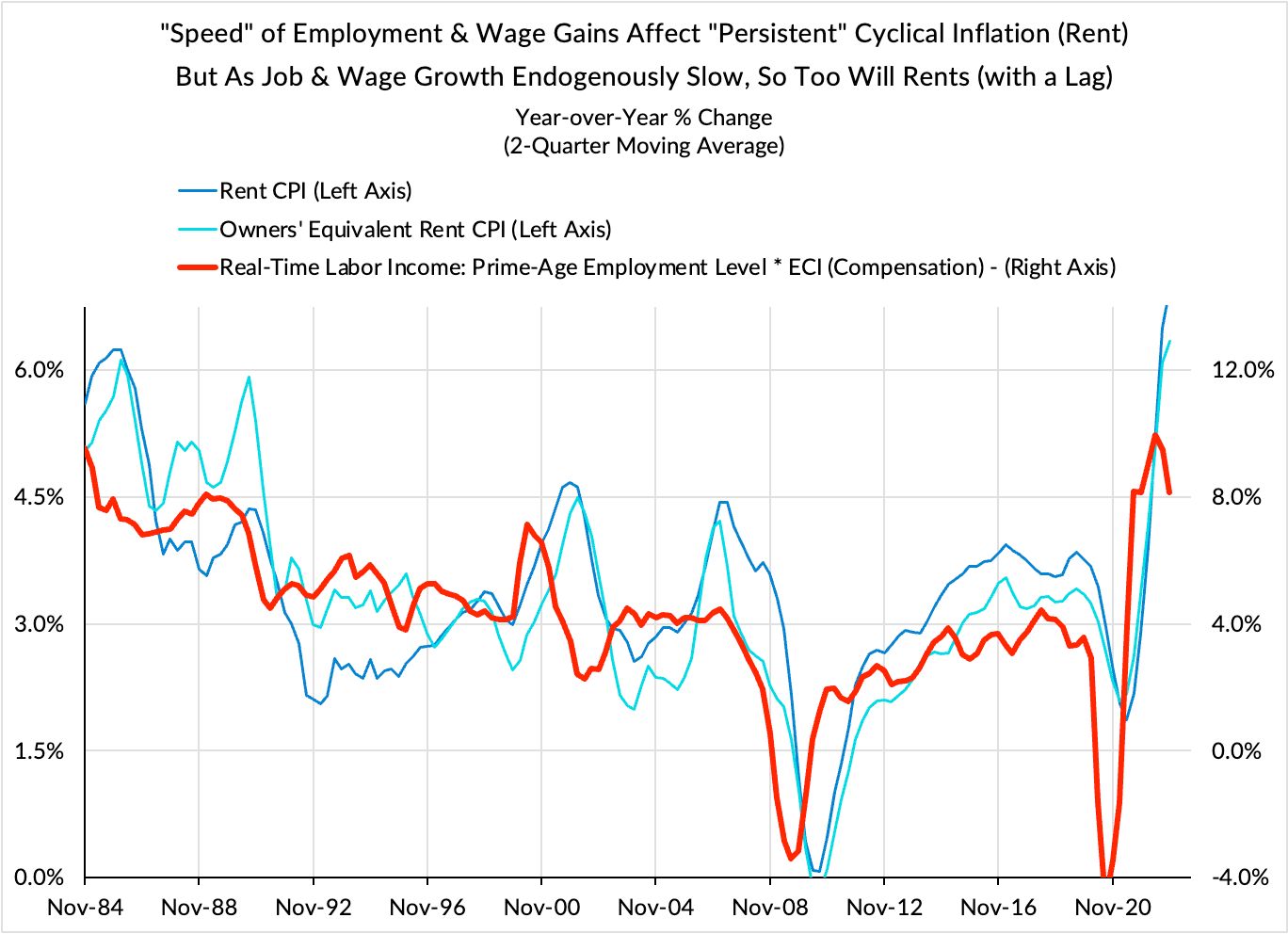

The Demand-Pull View: When the Fed first suggested looking through (rental) housing services inflation, most were probably heartened by the notion that the Fed would "see through" the lagged nature of the measure and show more policy flexibility. But in its full context, the Fed is making a more questionable policy judgment that housing services are not as sensitive to labor market conditions as other services prices. This claim does not hold up well empirically. Job growth and wage growth—when taken together—are excellent predictors of the trajectory of housing PCE inflation, especially since the inflation methodology smooths through some of the volatility associated with real-time market rent measures.

- You don't have to take our word for it; Stock and Watson's paper on Slack and Cyclically Sensitive Inflation specifically note the reliable sensitivity of rental inflation relative to other inflation components. Yes, the measure lags market rents substantially, but timeliness and cyclical sensitivity are not equivalent.

- Under the demand-pull view, the components worth elevating are those that are the most reliably sensitive to business cycle dynamics—and by extension labor market dynamics. That would include rent and owners' equivalent rent, but also other cyclically sensitive goods and services. These categories generally did spike with a lag relative to the strong economic growth tied to reopening and recovery. But as economic growth merely decelerates and normalizes, so too should the growth rate of prices.

- The variation of nominal consumer spending growth can strain supply-constrained services AND goods potentially. Everyone (including ourselves) dispenses with the pure general equilibrium view of inflation when in a foxhole. But CSXHP narrowing of the relevant price pressures misses some of the critical linkages central to the demand-pull view.

- The Fed should be tracking the pace of nominal consumer spending growth when trying to determine how inflationary current labor market conditions really are. We have seen growing evidence that nominal consumption growth and nominal retail sales are slowing back to a pre-pandemic and noninflationary pace, especially outside of the most volatile categories (e.g. gasoline, automobiles).

What we hope to find out in the coming months is the pace of labor income growth that is sufficient for bringing inflation down to more desirable rates. But that hope may go unrealized if the Fed is keen to aim for something much worse and act with sufficient speed and scale. Fed's view is leaning on 1) a misguided price aggregate, 2) a lagging measure (wage growth), and 3) a deeply unsettling goal for the unemployment rate.

Our own compass involves tracking data that is 1) more robustly sensitive to labor market conditions, 2) more timely (job growth, nominal consumption growth), and 3) more open to pathways that do not involve recessionary outcomes. Let's hope the Fed does not inadvertently foreclose the non-recessionary pathways that still could prove well within reach.