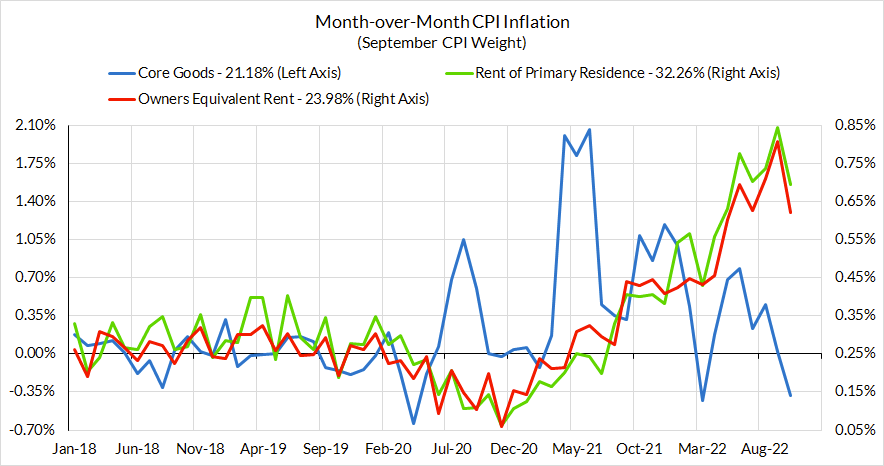

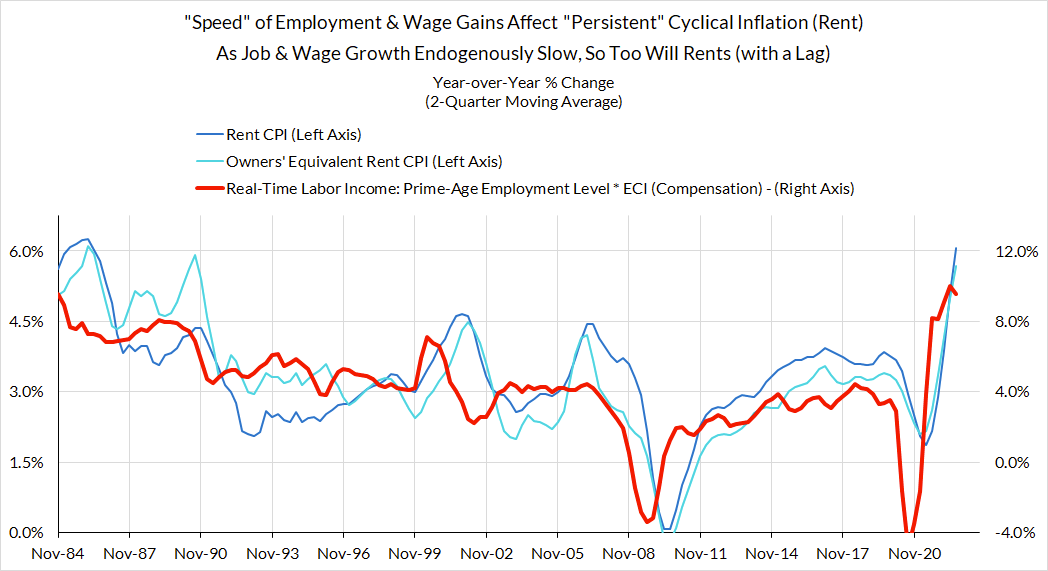

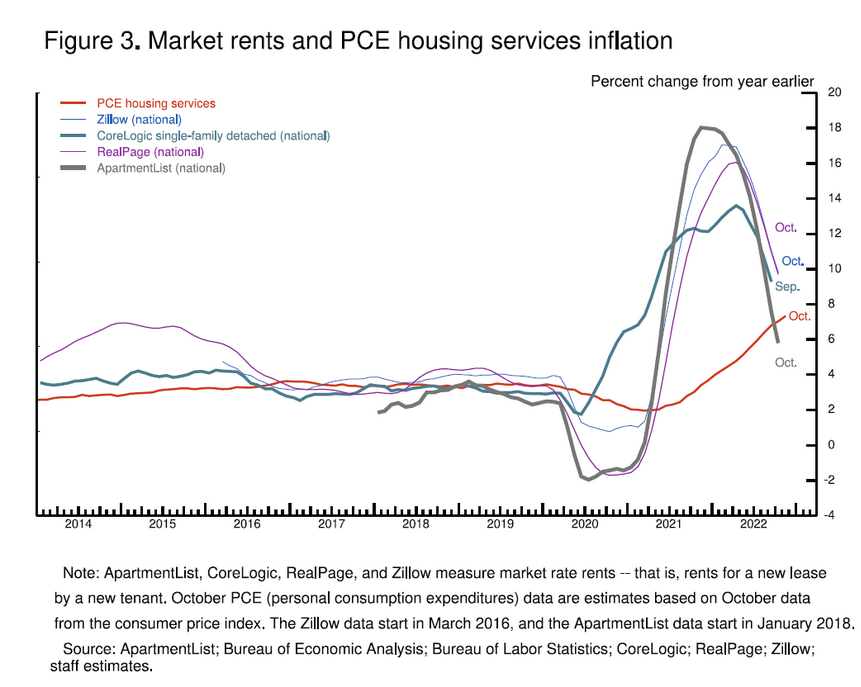

Not out of the woods yet on upside risks to monthly core CPI inflation: The forecasting consensus has shifted down from its 0.5% expectation for core CPI in October to a more optimistic 0.3% expectation in November. This seems to be mostly a reaction to the welcome core inflation "miss" last month, and is in large part justified so long as you're taking a longer view of the inflation outlook. But for the purpose of forecasting November CPI, the pace of deceleration in owners' equivalent rent from September (0.80%) to October (0.62%) seems at risk of some reversal. A return to rent and OER readings closer to September can still catch an optimistic forecasting consensus (for core CPI disinflation) offsides tomorrow (consensus year-over-year: 6.1% from October's 6.3%)

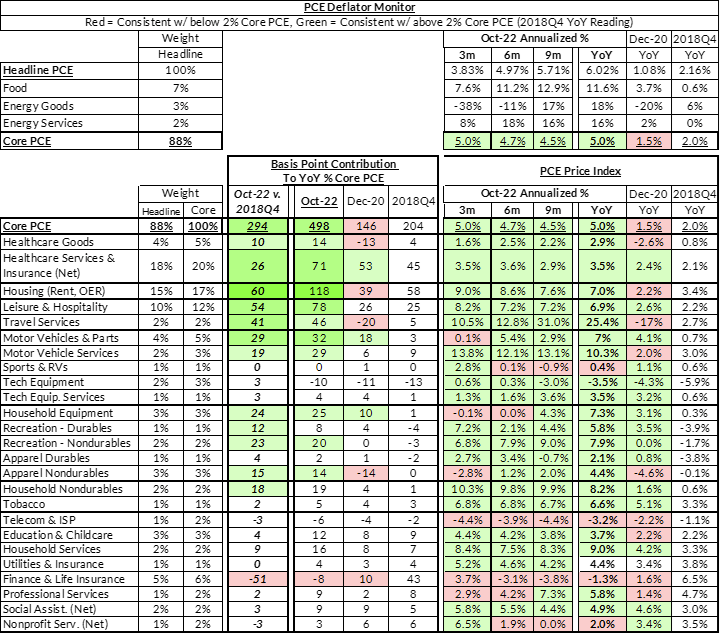

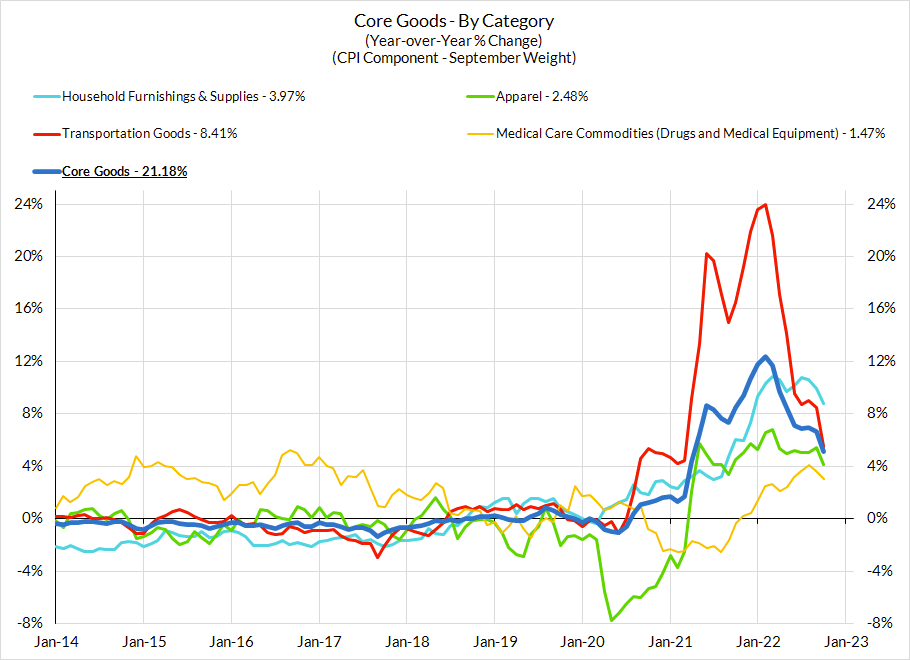

- Reason for Optimism: Wholesale used car price declines for several months are only just beginning to properly feed into the retail-level CPI data; we should see further declines in November and December used car data. The fundamentals for supply are continuing to improve and are likely to put more pressure on new and used car pricing in 2023.

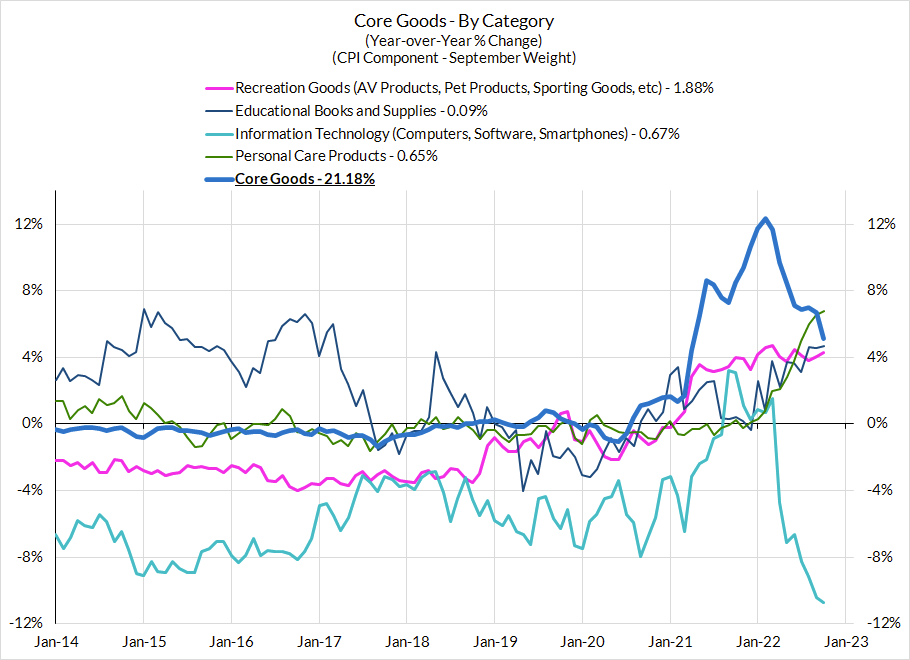

- Reason for Optimism: We are seeing other core goods prices also begin to correct in Q4 based on firm-level commentary on bloated retail inventories and discounting. Holiday-season+January is primetime for the kind of aggressive inventory-clearing discounting that can drive more aggressive goods deflation over the coming CPI releases.

- Reasons for Caution Tomorrow: Unfortunately, some of this well-placed optimism has to be countered by A) the risk of rent and OER CPI reverting to its September monthly growth rate, and B) the risk that the bulk of atypical discounting this holiday season takes place in December and January.

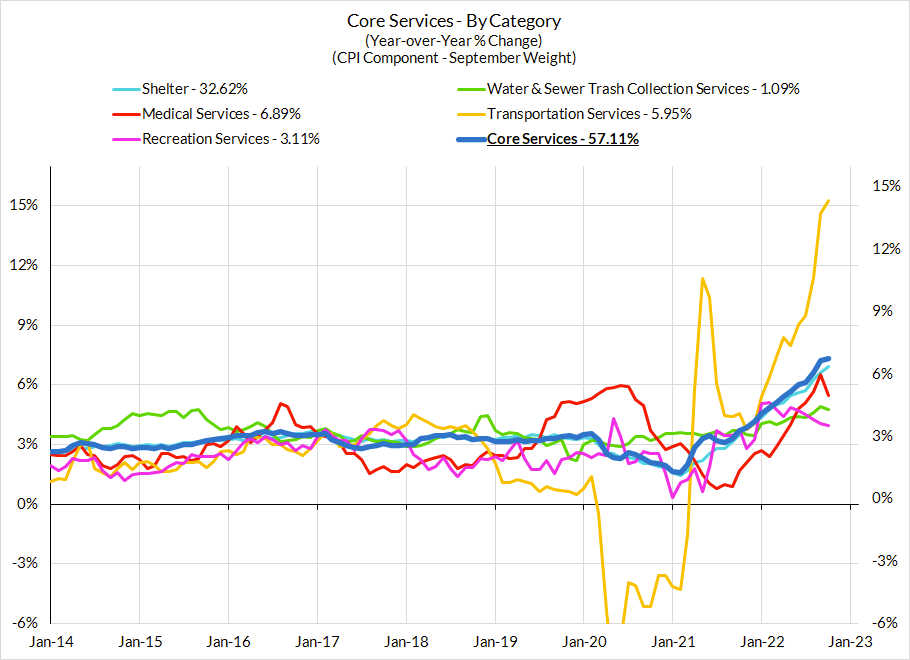

- The Longer-Term Outlook: Whether the reasons for caution tomorrow to deliver an upside surprise to Core CPI, the broader inflation outlook is continuing to improve. Chair Powell has himself set aside the rent and OER CPI readings as lagging the already-present deceleration in market rents. We will learn something from the pace of core goods deflation tomorrow, but keep in mind that individual months in the holiday season are subject to heightened volatility.

Non-core inflation is still facing cross-currents, but starting to tilt more favorably towards disinflation

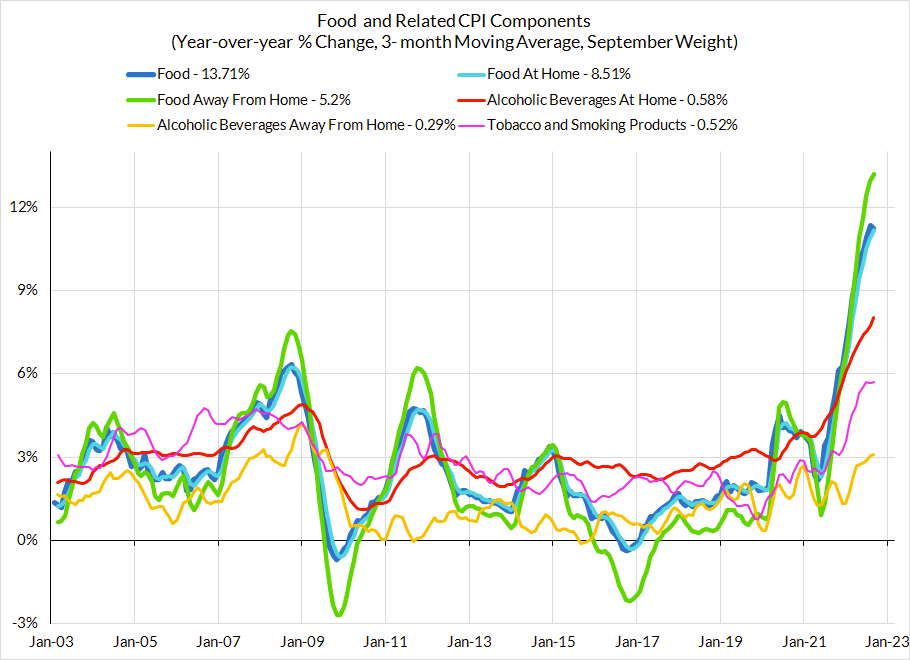

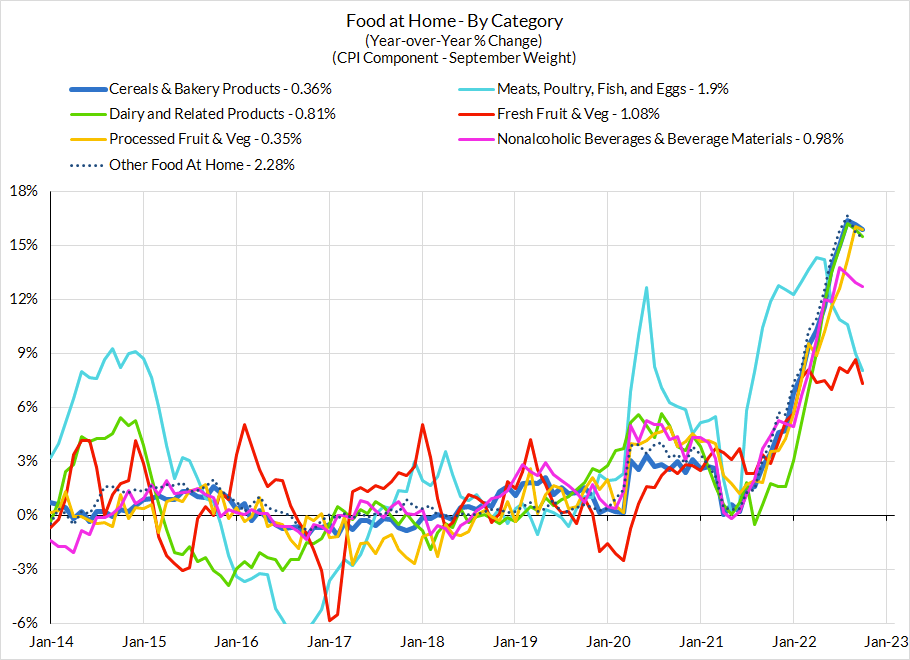

- Upside risk: Food pricing is still likely to run hot for the time being as a number of cost-push shocks are still filtering through the data. Moreover, food at home CPI (which is excluded from "core CPI" and "core PCE") has a lot of bearing on the pricing of key components that are included in core inflation (food services are included in "core PCE"; alcohol is included in "core CPI"; tobacco and smoking products are included in both). Food "at home" prices showed some sign of deceleration in October but we will need to see more sustained evidence of progress, and it will take even more time to filter into core-sensitive categories like food services, which typically lag pricing trends at the grocery store.

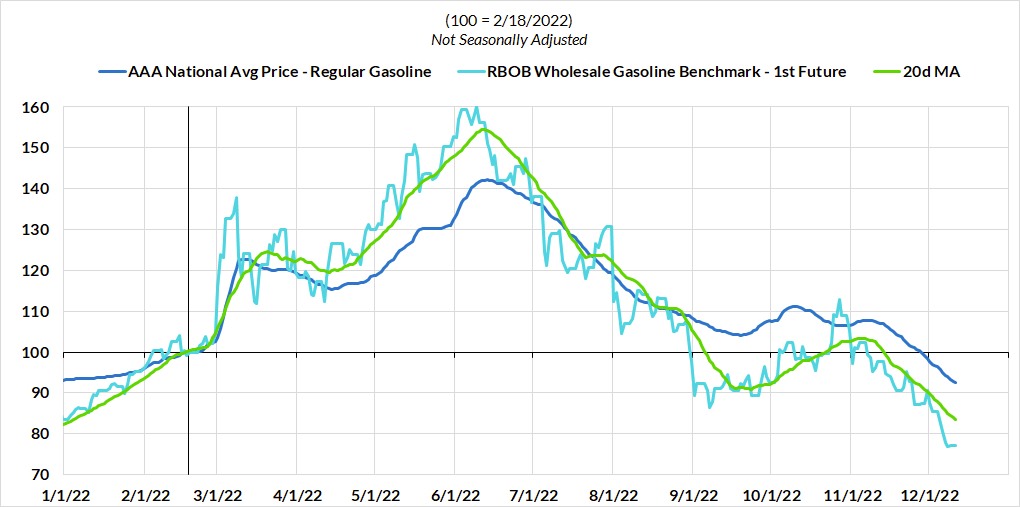

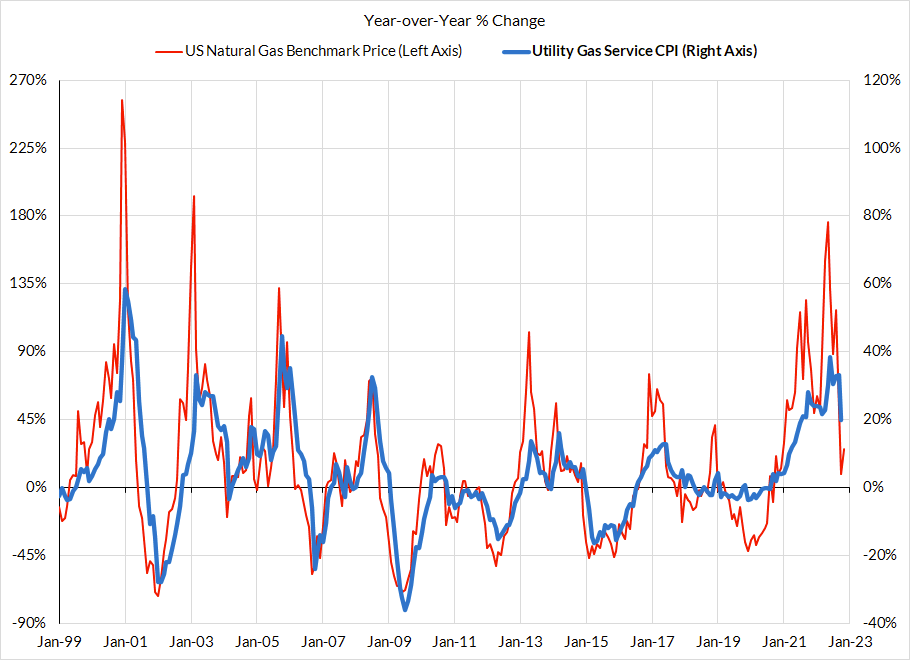

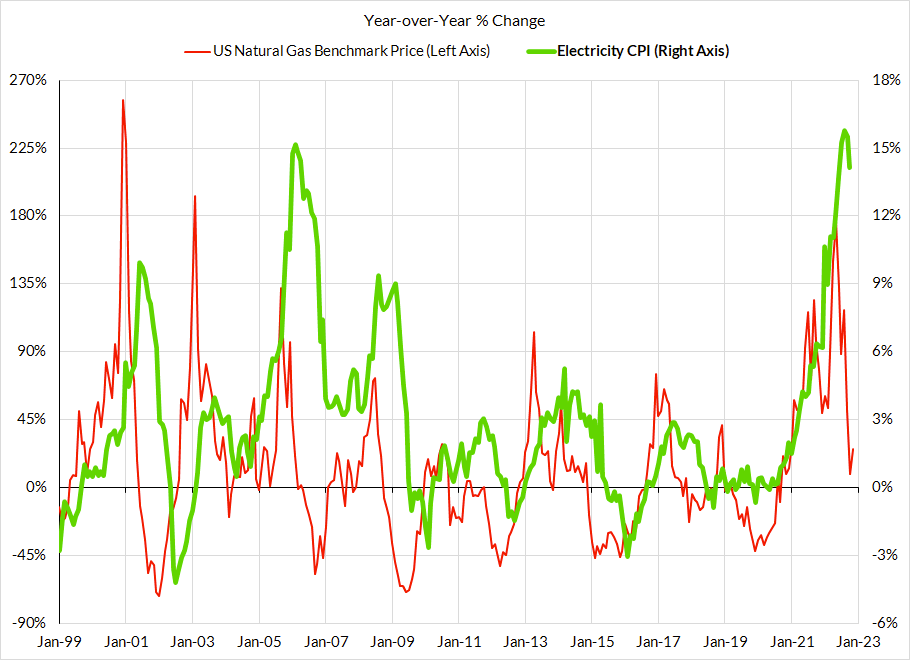

- Downside risk: Energy prices are starting to give more reason for broad-based optimism, but there will be lags to how commodity price declines in gasoline and natural gas filter through to CPI. Refining margins and crude oil prices are both compressing in a manner that will—over the next couple months—filter through to retail gas station pricing. Utility gas service pricing should show some stabilization after declines in natural gas benchmarks from a few months ago. Electricity CPI tends to respond with a longer and more variable lag to natural gas prices but the longer-term outlook is improving here as well.

Past Inflation Previews and Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me