The productivity data is messy and often should not be taken at face value. Our "Cautious Case For Productivity Optimism" in the summer of last year flagged three forces that should support better productivity growth in 2023 and 2024 have been cautious optimists about productivity improvement for some time now. Since that time, the productivity outcomes have continued to validate our cautious case and reveal the power of returning to full employment expeditiously.

Summary

Productivity growth looks to have inflected substantially higher in 2023 relative to a generally weak 2022. The causes appear to have little to do with AI or GLP-1s. Instead, we see three key factors that drove the realized productivity acceleration.

- Fiscal supports (CHIPS, IRA) for private investment, specifically in manufacturing plant construction in 2023.

- Supply chain healing for durable consumption goods and construction materials, both of which saw severe impairments in 2021 and 2022 that are finally unwinding.

- The dividends of full employment as past hires are trained up and grow more productive, even as more recent hiring trends have slowed. Consumer spending is undergoing a transition from job-driven growth to wage-driven growth.

Going forward, we think all three forces can continue to support productivity growth, but the first and third drivers are more likely to be supportive over time. Supply chains healing was such a powerful force in 2023 precisely because the inflationary effects of 2021 and 2022 shocks (shortages of manufactured inputs, commodity price spikes) were so severe.

(1) The Productivity Data For 2023 Looks Really Impressive

Impressive Q4 and 2023 Data: Last Thursday’s Q4 GDP release showed impressive strength and a sneaky upshot for data officially released tomorrow (February 1): productivity growth is set to look exceptionally strong for 2023. Real GDP in 2023Q4 grew at a 3.3% annualized rate as of the first preliminary estimate, with non-farm real gross value-added growing at a 3.7% annualized rate. Meanwhile, the preliminary estimate of hours worked in 2023Q4 showed only 0.8% annualized growth. Put the two together, and it implies a 2.8% annualized gain in nonfarm output-per-hour labor productivity. For some perspective, in the 5-15 years that preceded the pandemic, productivity growth only averaged about 1.45%.

Not a Fluke: It’s not as if this is merely one quarter of upside amidst a noisy trend; year-over-year productivity growth has flipped decisively from -2.0% in 2022Q3 to +2.4% in 2023Q3, and is now set to accelerate further to 2.7% in Q4. These numbers would put nonfarm productivity at a level above the pre-pandemic trend and on an encouraging trajectory.

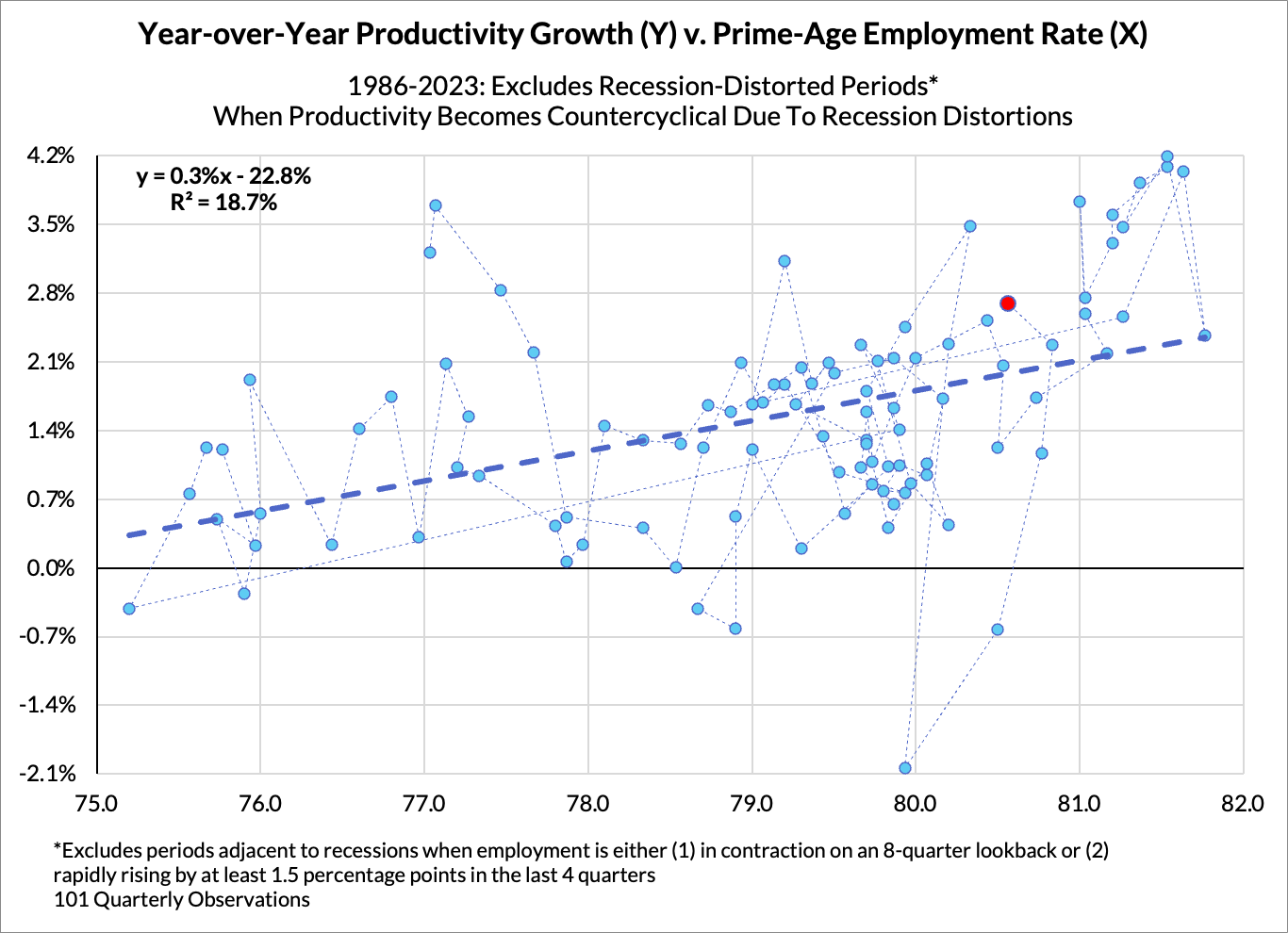

Looking Strong Versus History: As we’ve noted before, productivity growth has rarely looked this good over the past 50 years, especially if we exclude recession-related periods of job loss in which productivity first spikes before fully reverting back over time.

Why Do We Care About Higher Productivity Growth? Faster productivity growth implies that wages and gross labor income growth can grow faster without straining inflationary constraints. As we’ve written before, “potential output” and “maximum employment” are dynamic concepts with time-varying locations. When jobs and wages can grow faster without straining inflation, it reveals improvement in potential output and maximum employment, thereby allowing everyone the chance to earn and enjoy a higher standard of living.

(2) The Investment Data Does Not Show An AI-Driven Upturn

It’s Unlikely That This Productivity Upturn Was Driven By Advances in AI: It might be tempting to attribute any prospect of higher productivity growth to the latest and highest hyped technological trend. Unfortunately, it does not match up with details of what’s driving output and output per hour growth. Fixed investment in software, technological hardware, and R&D were all slowing and relatively tepid in 2023. To the extent there is an AI boom that catalyzes more capital spending and capital deepening, we’re just not seeing in the data thus far.

Construction and Fiscal Policy Mattered More: Real fixed investment growth rebounded in 2023 thanks to (1) a housing market shifting from contraction to stabilization and (2) an accelerating expansion in nonresidential construction. Two key facts supported growth here, neither of which had much to do with AI developments: (1) cooling construction cost inflation (as supply chains healed) and (2) the hyperbolic rise in manufacturing plant construction. Manufacturing plant construction itself seems to be a downstream and anticipated effect of how fiscal and industrial-level policies (CHIPS, IRA) are meant to support private investment.

AI Might Matter To Productivity In 2024: It would not surprise us to see faster real investment in tech hardware and software, but it’s a better forward-looking view than a good description of what has already transpired. As tempting as it might be, we would resist the urge to invoke a hot technology trend to explain productivity data on a "just-so" basis; that’s precisely the kind of evidence-free (or evidence-confirming) approach to macro that we seek to avoid.

The Consumer Drove Most Of The Output Outperformance In 2023

Consumer-Led Outperformance: While real fixed investment typically outperforms real consumption in business cycle expansions, in 2023, the two were virtually equal. Given the consumer’s outsized share of total final spending, it’s safe to describe 2023 GDP outperformance as consumer-led in total-dollar and total-chained-dollar terms.

Nominal Consumer Spending Growth Was Strong But It Didn’t Drive The Acceleration: While real consumer spending growth accelerated meaningfully, nominal consumer spending did not accelerate. Make no mistake, consumer spending is still growing at a reasonably solid clip, but it did slow over the course of 2023. Real consumption acceleration was therefore directly brought about through the same force that caused price disinflation, a clear sign of supply-side improvement.

If You Zoom Into Consumption, You’ll See That The Acceleration Was Concentrated In Durable Goods: While real consumption on services actually stabilized over the course of 2023, and real consumption nondurable goods only marginally popped reverted from contraction back into expansion, durable goods are the clear positive stand out. Real durable goods consumption accelerated from 0% year-over-year growth in 2022Q4 to 6% year-over-year growth in 2023Q4. Any narrative about “supply-side improvement” should be able to explain why it was durable goods consumption that most visibly benefited.

Real Durable Goods Consumption Acceleration Was Broad-Based: While goods that had some adjacency to the “chip shortage” (motor vehicles and parts, recreational information processing equipment) saw outsized outperformance, the pickup in real durable goods consumption growth was visible across all major categories.

Supply-Side Improvement Was Likely About Supply Chain Healing, Not Labor Supply: Durable goods production and distribution are not typically understood to involve a high intensity of domestic labor. The biggest challenge with durable goods in 2021 and 2022 was the physical capacity to produce key inputs, which were constrained on a global scale as a result of bullwhipped demand and the idiosyncratic policy measures to mitigate a global pandemic. As these issues have gradually unwound, motor vehicle production exited a 2-year supply-driven depression and consumers were in a better position to purchase and secure the technological hardware and software they had demanded. As much as the labor market also went through bullwhips and shortages of its own, it’s not clear that domestic labor availability was a key factor in this dimension of productivity improvement. Domestic labor content in consumed durable goods is quite low.

The Dividends of Full Employment Are Growing More Visible

Full Employment Has Helped: Productivity, as measured in terms of “output-per-hour,” is a ratio of real output to hours worked. Real output indeed accelerated, but hours worked also decelerated, falling from 3% year-over-year in 2022Q4 to 1.1% year-over-year in 2023Q4 (as per the latest estimate).

The Evidence Keeps Pointing To High Employment Rates Aiding Productivity Growth. We now have three distinct episodes in which productivity growth outperformed in the past 40 years for reasons other than aggregate job loss: the late 1990s, 2019, and 2023. What do those periods have in common? The Prime-Age 25-54 Employment Rate was elevated and above 80%, such that labor market was in a more mature state and job and hours growth was primed to endogenously cool. Productivity growth is a multi-causal phenomenon, but recent history suggests that getting to elevated levels of prime-age employment raise the odds of achieving impressive growth outcomes. In a univariate linear specification that excludes recession-distorted observations, 1% higher on the Prime-Age Employment Rate translates into an additional 0.3% of productivity growth.

If You Take The “Time-To-Train” Effects Seriously, A Faster Recovery Is A Better Recovery: There will be a lot of consternation about whether it was really worth it for fiscal and monetary policymakers to err on the side of an aggressive and swift employment recovery. There will be enough time for such retrospectives, but we would flag one key channel we discussed in an earlier piece: it takes time to unlock the productivity gains from an initial hire. A hire takes time to materially add to output and productivity, and that’s why strong hiring tends to coincide with weak productivity growth at first (hours grow faster than output). Layoffs and separations also do not have their full effect on productivity instantaneously, and that’s why productivity tends to spike when job loss is most acute. The sooner prospective workers are hired and trained up, the sooner the prospect for "true" productivity gains to shine through. The faster we get to a fully recovered state of the labor market, the sooner we might see outsized productivity gains and escape stagnant growth.

2024 Productivity Improvement Is Far From A Given: Continued productivity growth will require a variety of policy efforts and some good fortune. The interest in specialized hardware and software for AI applications has the potential to unlock more meaningful “capital deepening” in 2024. The scale of public investment legislation (IIJA, IRA, CHIPS) is admirable, but it will require judicious implementation decisions (and a data-dependent Fed) to ensure that these acts optimally “crowd in” private investment. Amidst an array of risks, the state of supply chains and commodity availability will also need continuous monitoring and tailored solutions along the way. As for maintaining full employment outcomes, the Fed is best positioned to be a first line of defense given the unique discretion they wield. We hope Fed officials will see the full supply- and demand-side stakes of achieving a soft landing in 2024.