Is productivity worryingly low right now? Some commentators have argued it is, going on to argue that the "disappointing" productivity data should be a primary factor in the Fed's upcoming policy decisions. By their logic, disappointing realized productivity performance in 2022 increases the likelihood of further productivity in the future, and therefore more wage-driven inflation risk. For some, this justifies further hikes from the Fed, thereby putting the labor market recovery at greater risk.

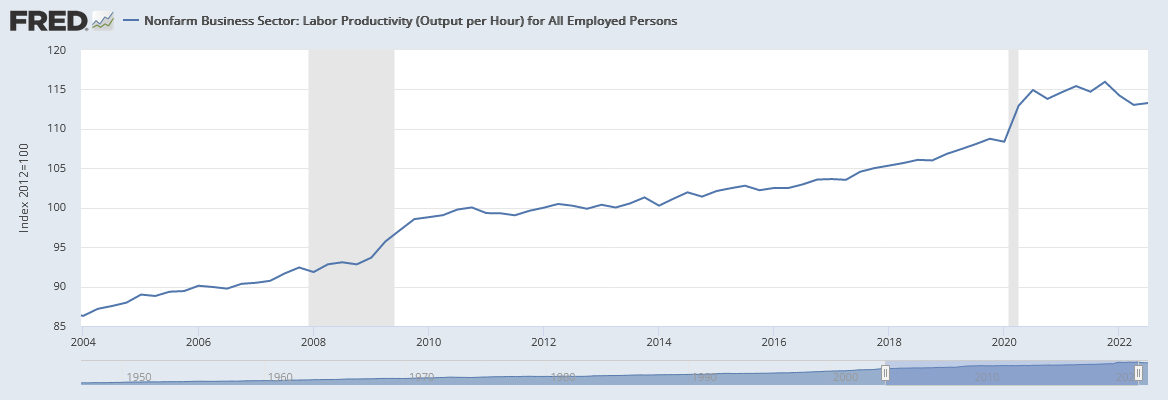

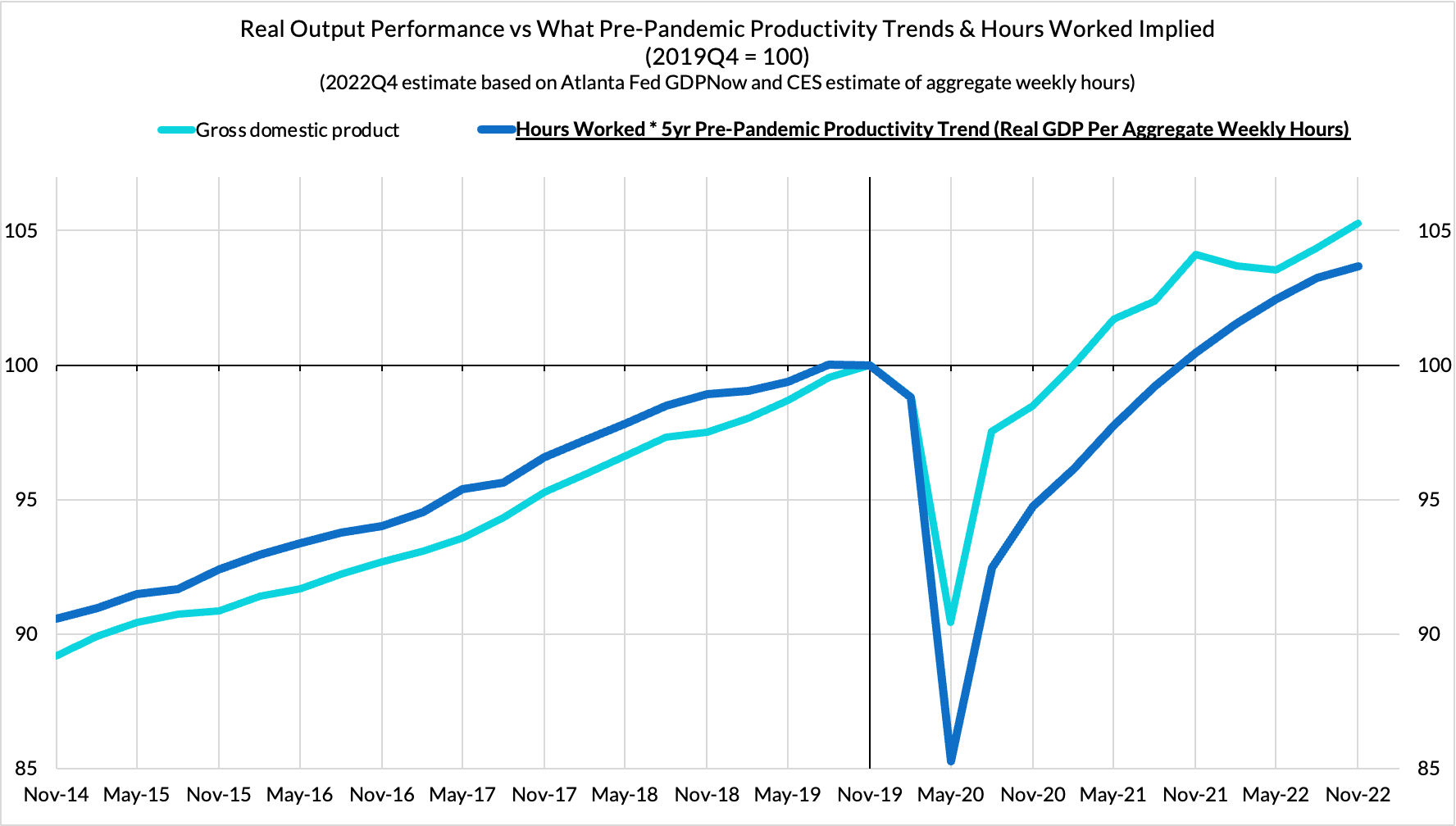

But is the premise even right? Seen in the proper context of the pandemic-induced recession and the subsequently rapid and complete recovery in employment, the productivity data looks...fine? It's in the same neighborhood as the 5-year trend that preceded the pandemic–in fact, it actually looks better than what that trend would predict. This would be cold comfort if it was merely an artifact of depressed employment, as was the case in the three years following the previous two recessions. But that is clearly not the case now.

The reason for real GDP underperforming its pre-pandemic trend is an aging population, which is (predictably) shifting down the trend in hours worked. Productivity is not the culprit. In a forthcoming piece, we will discuss some reasons for cautious optimism about productivity improvement, at least as measured by output per hour estimates.

But first, a cautionary note: the productivity data is generally bad and the commentary about the data is generally worse.

Intuitively, productivity is a microeconomic concept: how much "stuff" is each worker making per hour at work. Yet when measured with the statistics we have, all of these individual workers disappear and we are working with averages and aggregates which tell us little about the validity of the anecdata used to explain recent productivity data.

The official productivity estimates available to us are not measured in terms of productivity microdata, even at a firm- or establishment-level. Instead, it is a ratio of independently measured aggregates: roughly speaking, it is nominal GDP divided by the GDP deflator, divided by total hours worked. While the BEA does try to connect nominal expenditure observations to their price observations at a more granular microeconomic level, it makes no such attempt to connect these observations with each hour of labor performed. Astute readers will see this as analogous to the problems with "real wages."

So if these estimates are inherently mechanical, their causes are as well. A story about disappointing productivity data is a story about real output disappointing relative to total employment and total hours worked. If you spend hours working that contribute to to future – rather than currently measured – GDP, and then get laid off, your being laid off raises measured productivity in the short-term. This remains true even if those same "productivity-increasing" layoffs ultimately undercut the economy's long-term productive capacity.

Given all of the potential issues and perverse noise stemming from measurement problems, productivity is not a good variable for real-time policymaking. Today, though, we have to care merely because everyone else (and specifically the Fed) does. The Fed is leaning on claims of weak productivity to aim for weaker wage growth and recessionary job loss as a result. The last time the Fed ran this playbook in 1999 and 2000, not only did they catalyze a multi-year rise in mass joblessness...they ultimately helped to weaken productivity growth in the process.

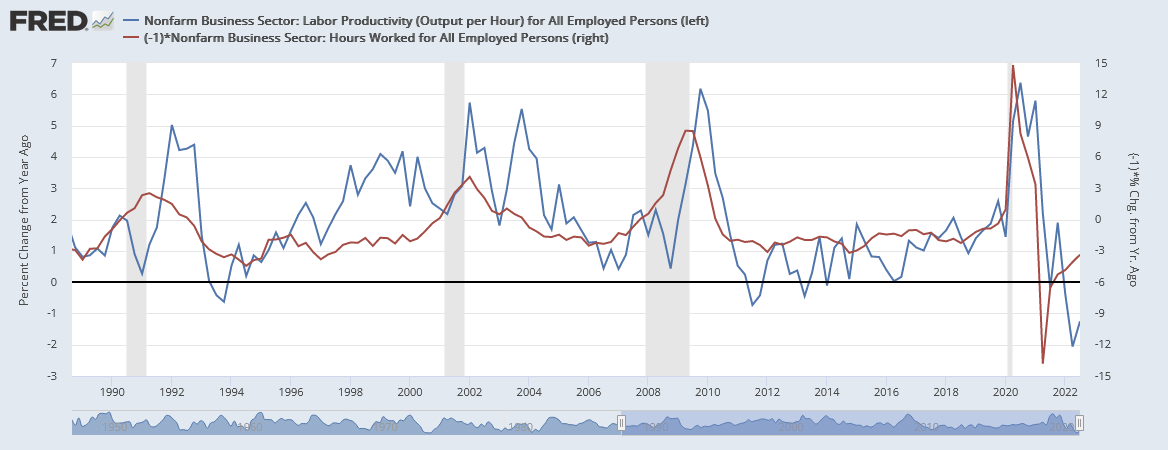

The missing context: Productivity estimates tend to surge in recessions, and worsens as employment recovers.

The first thing to contextualize about productivity as measured: it predictably surges during recessions. Productivity growth is locally strongest when jobs and hours worked are in decline.

Today's hours worked does not neatly align today's produced output. Often those hours produce intermediate and intangible services that support future output growth, but without necessarily adding to measures of today's GDP. Recessionary job loss tends to predictably raise productivity estimates in a sharp and sudden manner, only to subsequently underperform once employment begins to finally recover.

If you look closely, the productivity slowdown from 2021 onwards seems to be mostly a predictable give-back from the recession-driven productivity surge in 2020. Even now, the most-cited measure of productivity—nonfarm output per hour—has been growing faster since 2019Q4 than it did over the 5 years that preceded the pandemic. The annualized growth rate of nonfarm productivity was 1.49% from 2019Q4 to 2022Q3. It was 1.41% from 2014Q4-2019Q4.

Real GDP—which includes agricultural output—is also outperforming what would be implied by (1) its pre-pandemic 5-year productivity trend and (2) the current recovery in hours worked. And unlike the previous labor market recoveries, this recovery actually was swift and virtually complete. Whatever "labor supply disappointment" commentators want to complain about, it seems almost entirely a function of an aging population and not a sudden structural shift in prime working age persons' work preferences.

What we are left with is actually an encouraging picture: we recovered the jobs and hours back previously lost to the recession with real GDP still outperforming what pre-pandemic productivity trends implied! The reason for real GDP not reaching its pre-pandemic trend is an aging population, which is shifting down the trend in hours worked. While pandemic-induced population loss may have hastened some of the "labor-supply-reducing effects" of an aging population, the bulk of this dynamic should have been known ahead of time. It is not a reflection of productivity dynamics.

In a forthcoming piece, we will highlight some cautious reasons for optimism about productivity data given what we know about the sources of relative output and productivity disappointment, but for now, please please please try to put the productivity data in its proper context.