The White House should not use the refining capacity crunch as a reason to avoid grappling with the fragile state of crude oil supply, as it appears to be doing. In gasoline and other refined products, there are two related but separable sources of scarcity: crude oil and refining capacity. Both contribute to the high price at the pump. While there are situations in which one bottleneck could make the other redundant, those conditions do not exist right now. Two related claims appear to be central to the decision to ignore crude supply right now, neither of which hold up well under mild scrutiny:

- If crude oil supplies improved, it would be the equivalent of simply squeezing on one end of the balloon. More crude oil supply would still get jammed up—given the refining bottleneck—and would only serve to exacerbate refining margins as a result.

- Refining margins are so supply constrained that they must be maximizing prices according to consumers' willingness to pay. Thus, any relief refiners see on their input costs will not be passed through to final gasoline prices.

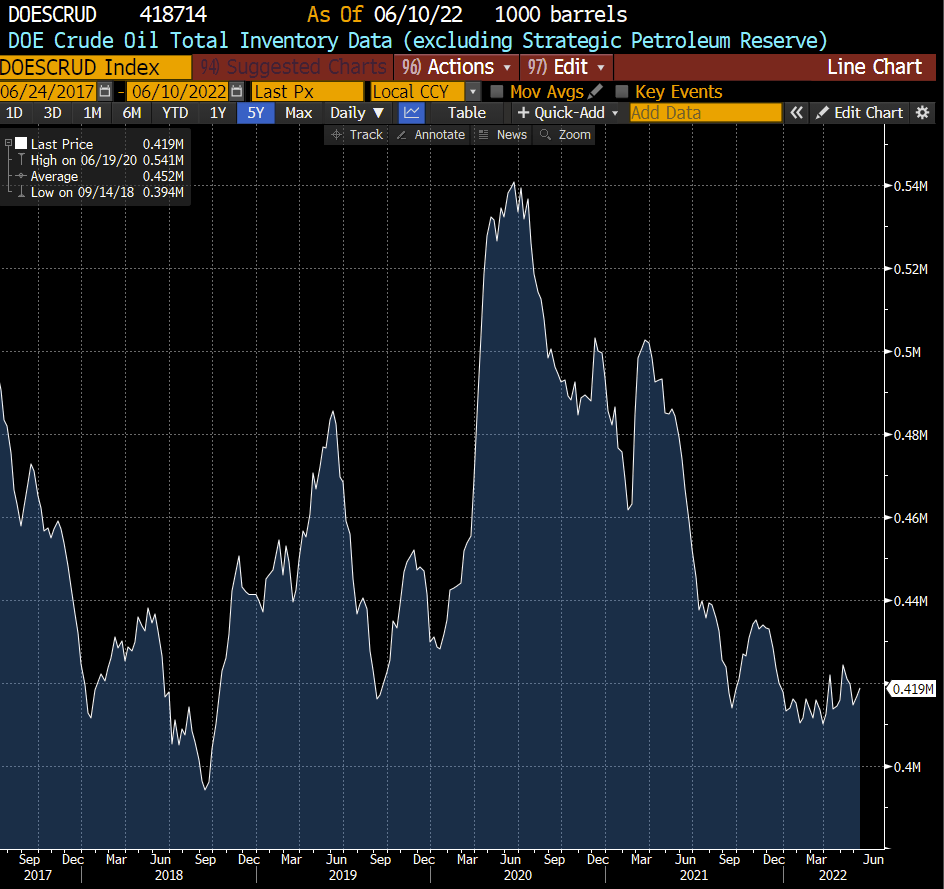

Some easy stylized facts cut against these two related ways of thinking. On the first point, just look at the Department of Energy's crude oil inventory data.

Private crude oil inventories in the United States still remain low (and are representative of the global supply-balance picture).

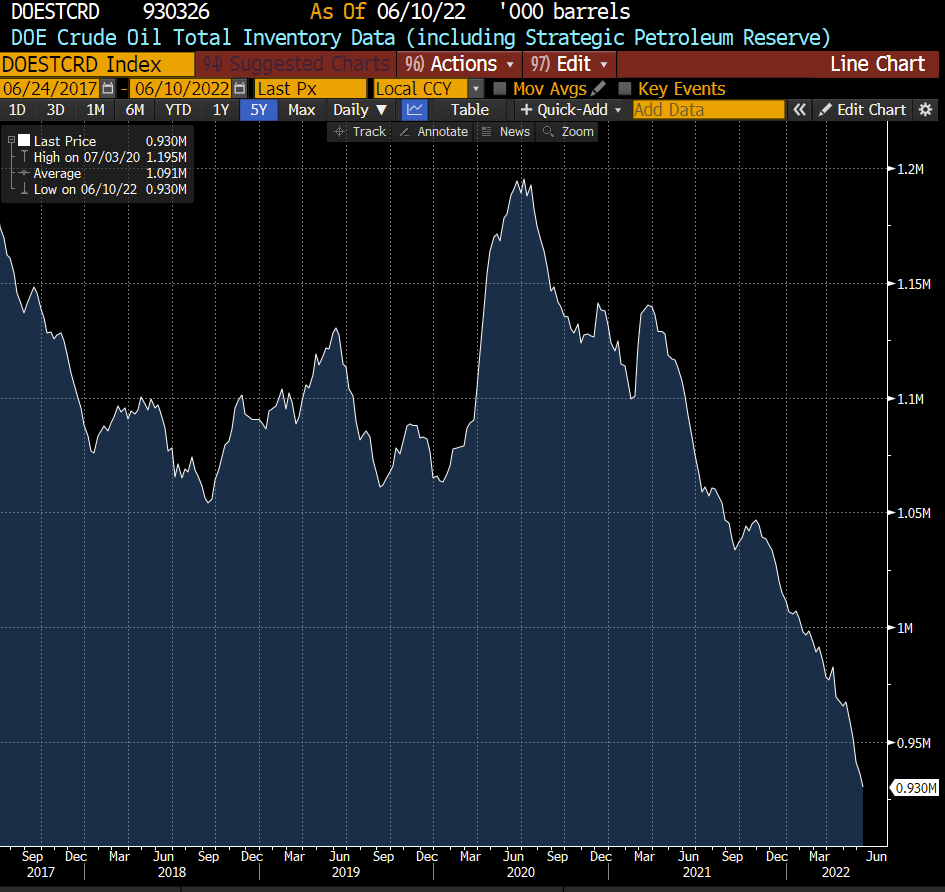

The recent stabilization of private inventories is somewhat misleading. Rather than a slowdown in outflows or an acceleration in production, inventories are stabilizing because of substantial inflows from the Strategic Petroleum Reserve release. Including the SPR and private inventories, the supply-demand picture looks more ominous.

If we were seeing a buildup in crude oil inventories against capacity constraints at refineries, then boosting crude oil supplies would indeed be pushing on a string. The risk of filled storage ("tank tops") would force discounting—as we saw in 2020Q2—but that discounting would not pass through to the price at the pump. This is not the case today: inventories are currently very low and the supply picture remains fragile.

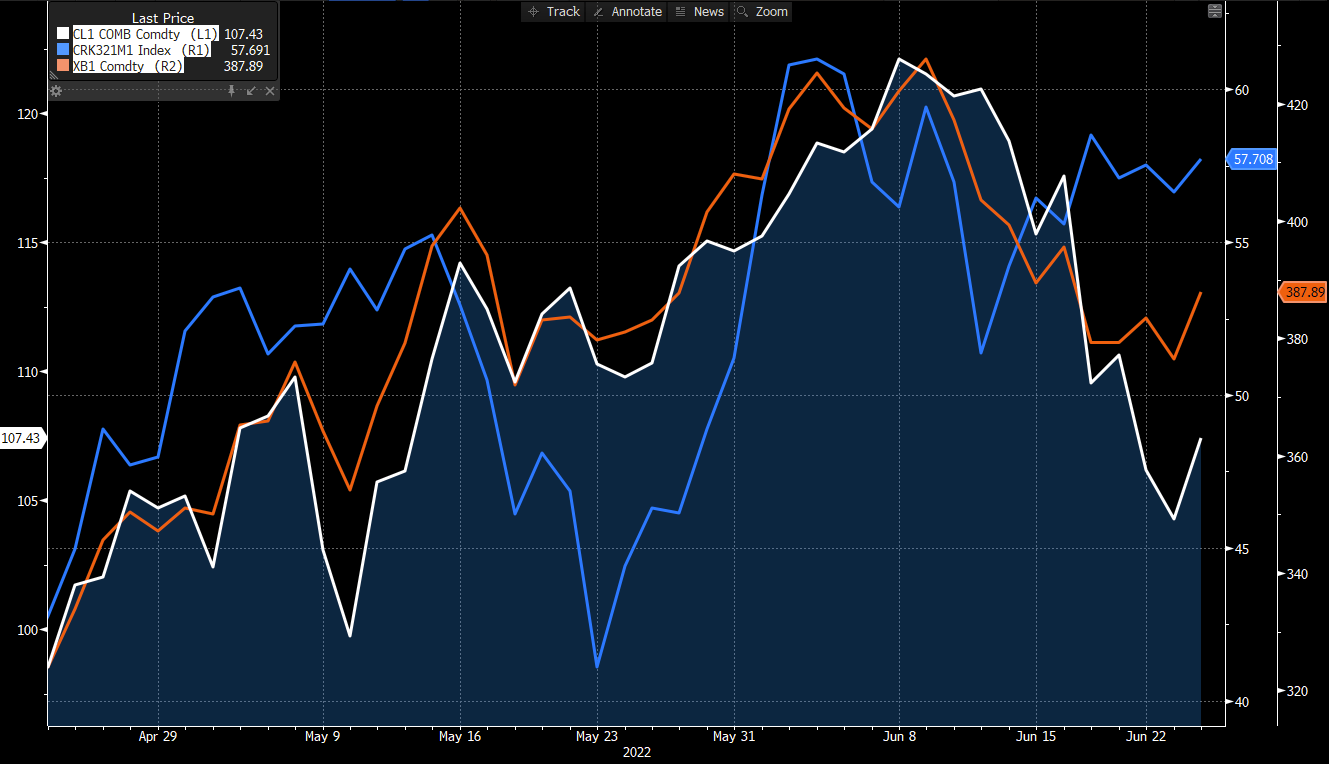

There's a related argument that, amidst a highly bottlenecked situation among refiners, prices are simply rising to the point of demand destruction. Under that assumption, any input cost relief for refiners in the form of lower crude oil prices would not be passed through to consumers. The recent evidence clearly cuts against this view. Crude oil prices have fallen, refiners' margins ("crack spreads") have been stable, and much of the input cost benefit has passed through to final gasoline prices.

To the extent that expanded crude oil supplies reduce crude oil prices, gasoline consumers stand to benefit, even with the current refining capacity crunch. The White House is clearly trying to take the refining capacity crunch seriously. However, with the risk of Russian supply losses still looming, solving the problem will require simultaneous attention to refinery capacity as well as the state of global crude oil supplies.

If the White House wants to get on top of the risks to global crude oil supplies over the coming year, it should be signaling constructive proposals on how to accelerate US production and use the SPR more effectively to store excess production in a price crash. The US is the leading producer of crude oil and time lags for bringing additional supply on line, even with current bottlenecks, are considerably shorter than virtually all other alternatives. It would be irresponsible not to coordinate with US industry to address key points of uncertainty that credibly hold back additional investment.