Due to a technical error, our regular labor market recap was not released last week as intended. Apologies for the delay.

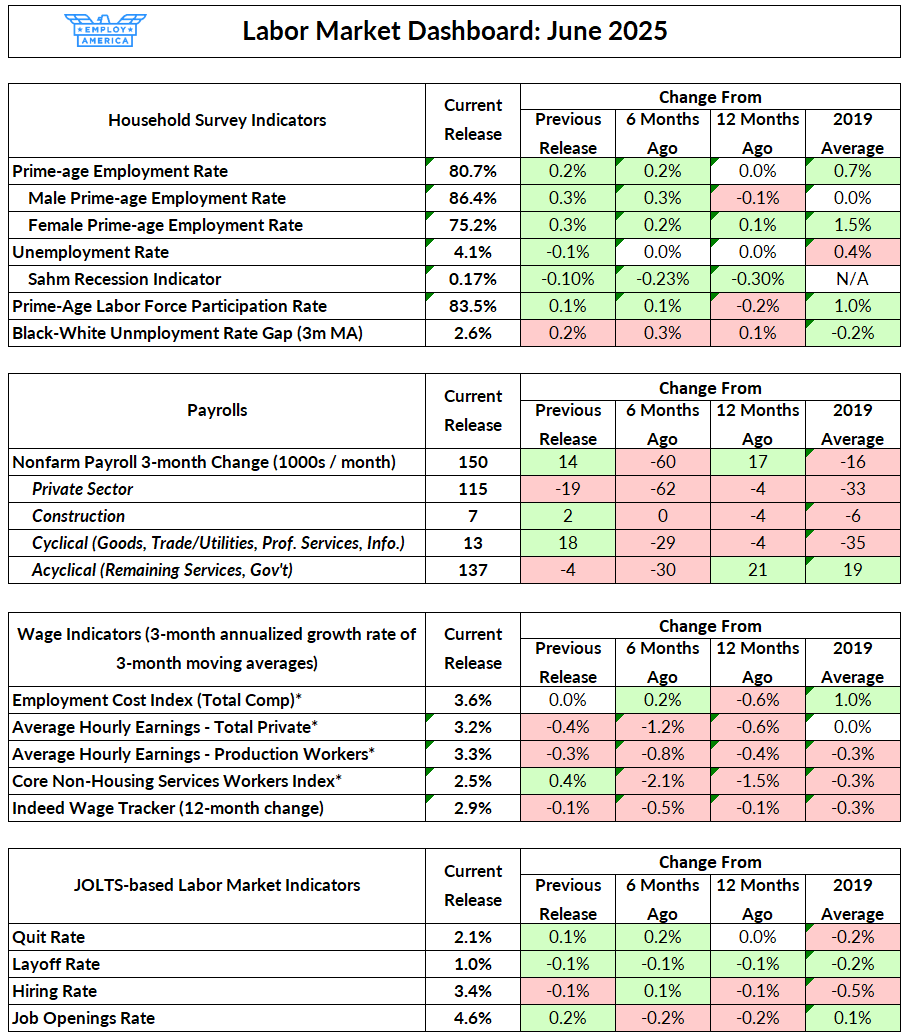

The labor market added 147,000 net jobs in June, with small upwards revisions to the previous two months. The job gains were mostly driven by government hiring, especially in state and local government (federal government employment fell). The unemployment rate fell by 0.1pp to 4.1%, the prime-age employment rate rose by 0.2 pp to 80.7%, with gains for both men and women. The prime-age labor force participation rate rose by 0.1pp to 83.5%.

On the wage front, average hourly earnings growth fell to 3.4%, its lowest since 2020. The Indeed Wage Growth Tracker fell to 2.9%, also its lowest since 2020. JOLTS measures are still similar to their readings from 12 months ago.

On the whole, this is a good jobs report. It’s hard to find much fault with the data here, and it significantly diminishes the prospects of a July cut. The weaknesses and imbalances we’ve been identifying in the labor market—imbalanced job growth led by acyclical industries, weak hiring, and potential headwinds coming later this year—still remain. Still, this month’s data shows more resilience in the labor market than many gave it credit for.

A Good Report

Nearly any way you look at it, the labor market data from June was good. Employment was up, participation (age-adjusted) was up, and the unemployment rate was down. These measures of labor utilization have now been bouncing around their current levels for nearly a year.

Nearly any way you look at it, the labor market data from June was good. Employment was up, participation (age-adjusted) was up, and the unemployment rate was down. These measures of labor utilization have now been bouncing around their current levels for nearly a year.

This month’s establishment survey was also impressive. There’s a big question right now about how much slower immigration reduces the “breakeven” rate at which payrolls need to increase in order to keep unemployment steady. The interesting question coming into this month’s report was whether a weak payroll print would be seen as labor market weakness by the Fed, or if they would wave it off by appealing to the lower immigration argument. But with 147,000 net jobs added, they won’t have to take a stand on that.

Playing a large role in the job gains this month were additions to government. Government employment contributed 73,000 jobs this month, accounting for about half of this month’s payroll gain.

Looking deeper into the details of the government payrolls number this month, the increase in state and local government was highly concentrated in education employment. Education workers account for about half of both state and local government employment. There was notable weakness in state government hiring earlier in the year, also driven by education workers. Hiring in education is highly seasonal. It’s also possible that state governments were holding off on hiring earlier in the year out of an abundance of caution with the change of Administrations, and are now catching up. Either way, we don’t expect to see further strength in state and local government employment continue.

Still, the fragilities in the labor market that we’ve been identifying this year continue. The “cyclical” industries are still contributing almost nothing to job growth, and “acyclical” industries (mostly government, education, and health) are accounting for almost all of the job growth in the economy.

Wage Growth Continues to Slow

Despite the good news on employment, the longer-run slowing trajectory of the labor market is still clear. We can see this in wage growth, which dipped to post-pandemic lows this month. Average hourly earnings fell to 3.7%, and the Indeed Wage Growth Tracker fell to 2.93%.

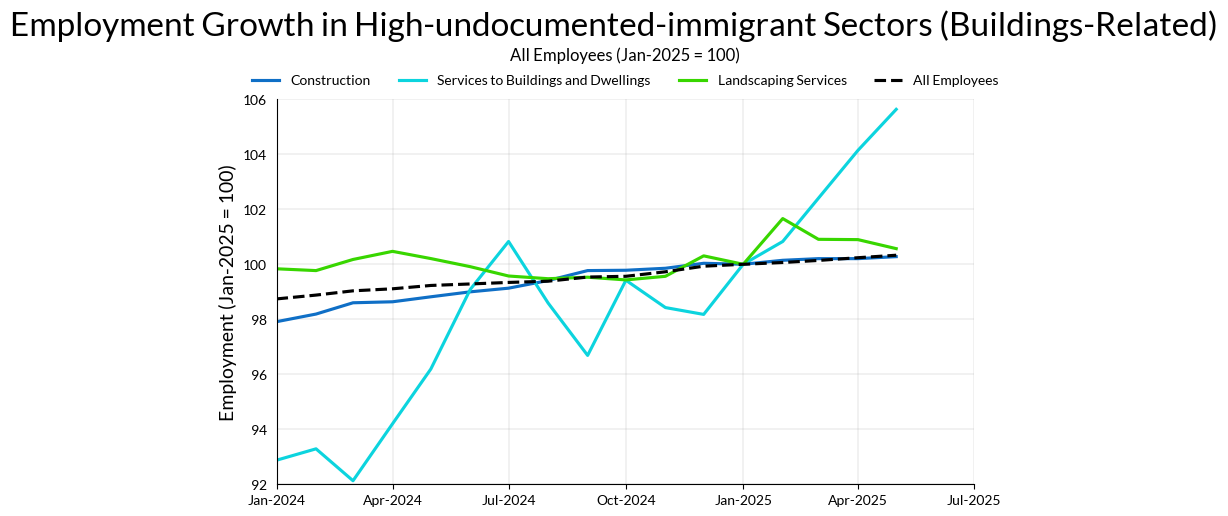

The slowdown in wage growth in job postings portends a further slowdown in actual wage growth, and with it, a slowdown in labor income. The slowdown is especially apparent in construction, where the rate of wage growth has slowed from around 3% at the beginning of this year to under 1.5%. That could be a warning sign of the coming broader construction employment slowdown we’ve been worried about ever since housing permits fell when the Fed raised rates.

Do We See Immigration Enforcement in the Jobs Numbers?

The past few months have seen a large number of reports of Immigrations and Customs Enforcement (ICE) raids at workplaces across the country. There are numerous anecdotes of immigrant workers staying home out of fear of these raids. Something that caught our attention was the significant jump in the quit rate in the Accommodation and Food Services sector.

Getting a sense of the prevalence of undocumented immigrants in the data is difficult. They are, after all, undocumented. They have strong incentives to not respond to surveys, and I was unsurprisingly unable to find little evidence of ICE raids having an effect on employment trends and flows in the Current Population Survey microdata.

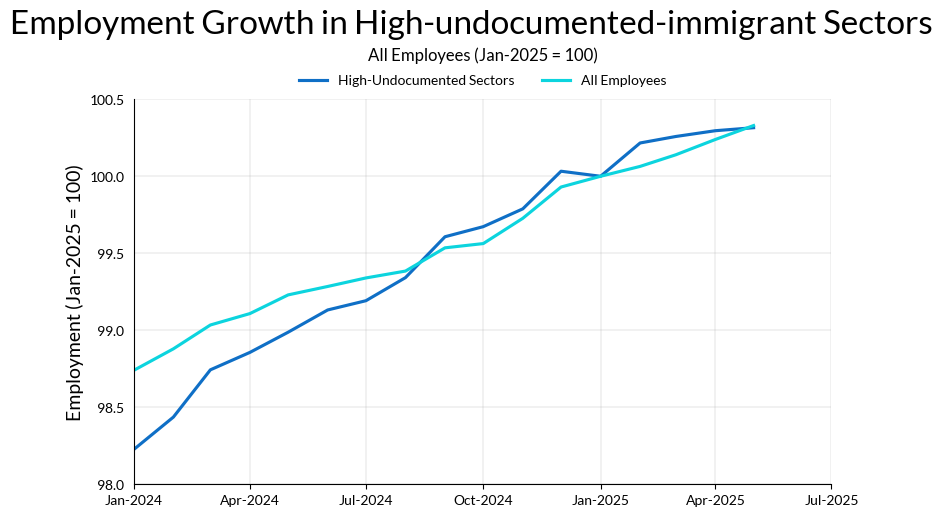

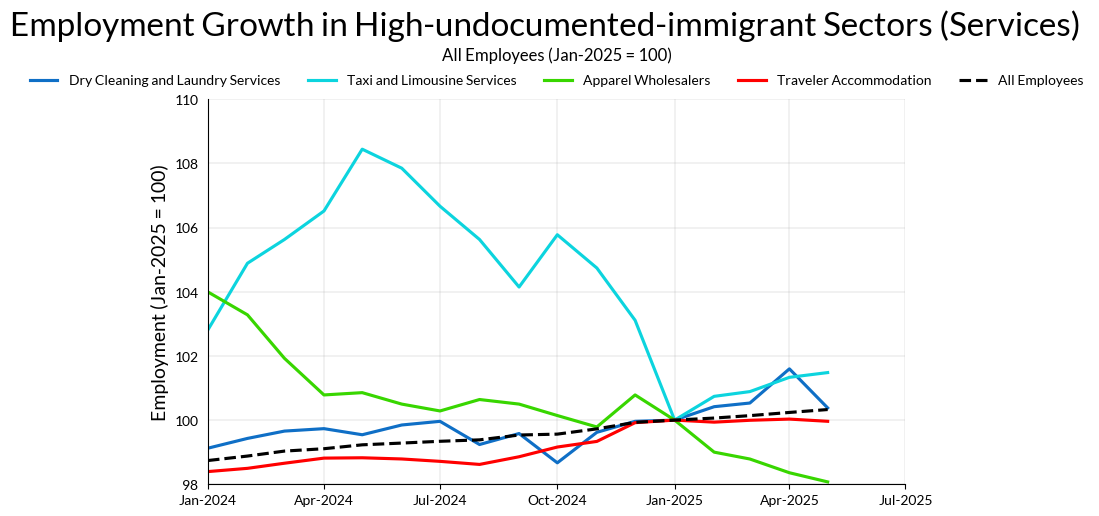

One possible avenue is to look at employment in sectors where undocumented immigrants are especially common. The data is a little dated at this point, but Pew uses an analysis of the 2022 American Community Survey to identify which sectors have the largest prevalence of undocumented workers. Below, I graph payroll employment in the sectors with the highest fraction of workers that are undocumented immigrants according to Pew's analysis. Those sectors were growing faster than the rest of the labor market in 2024, but since then, job growth in those sectors has matched pace with the rest of the economy.

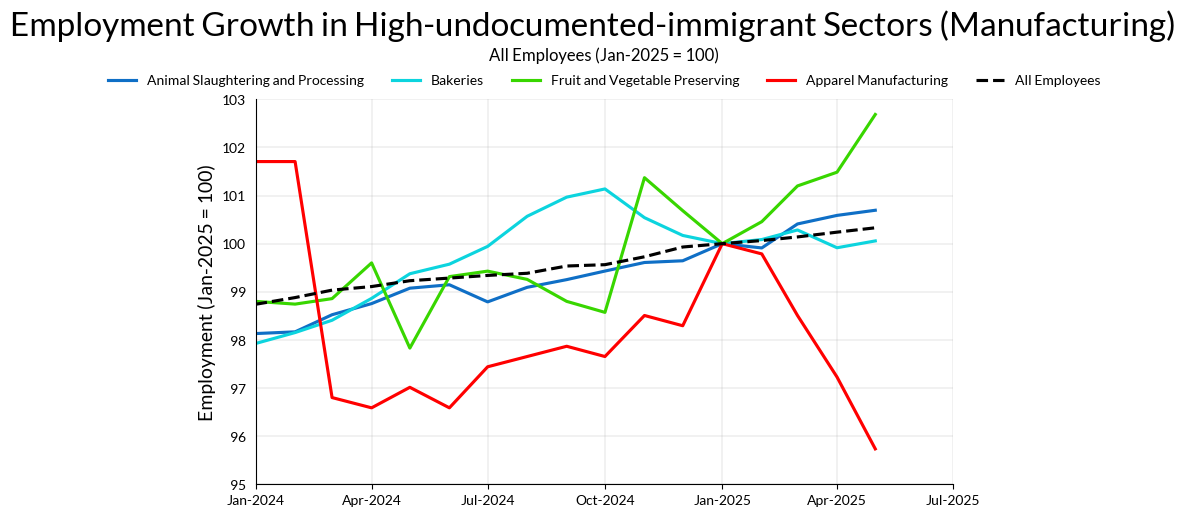

If we look sector-by-sector, it’s hard to draw any firm conclusions. Some sectors with large numbers of undocumented immigrants have seen fairly strong employment growth in 2025 (such as Services to Buildings and Dwellings and Fruit and Vegetable Preserving). Others, like Apparel Manufacturing, Apparel Wholesalers have seen employment declines (although it is easy to tell a tariff story around this particular sector). A large sector with many undocumented immigrant employees, Traveler Accommodation, has seen employment move sideways since the start of 2025.

It’s important to keep in mind that many undocumented immigrants work in sectors where data coverage is scarce. The sectors with the first and fifth highest share of undocumented immigrants that Pew identified, Private Households and Crop Production, fall out of the scope of the establishment survey. It may also simply be that despite the high-profile nature of these raids, the actual number of detained is small enough that there’s little effect on the overall employment numbers. It may also be too early to see it in the data.

A July Cut is Out

Despite a couple of FOMC members talking up the possibility of a July cut, the rest of the Committee is going to be relieved by the data and see it as reason to continue waiting for more data on the effect of tariffs before moving. Without confirmation that inflation will not get out of hand, the Committee seems like they’re committed to waiting until they see visible labor market deterioration before making a move—and this isn’t it.