By Skanda Amarnath, Yakov Feygin (Berggruen Institute)

State governments are on the front line of the COVID-19 pandemic and its economic fallout. In the coming weeks, they will be subject to increasing demands to expand healthcare capacity and support existing initiatives, all while tax revenue dries up and financial market turbulence freezes the municipal bond market. The Federal Government has begun to respond to this challenge by increasing Medicaid funding and issuing $50 billion in additional funds for public health initiatives. Nevertheless, the pace of the Federal response remains slow and local funding needs are still at risk of going unmet.

The Fed Should Immediately Commit To Support Short-Term Financing For State Governments

We are calling for the Federal Reserve (“Fed”) to exercise its existing authority under Section 14(2)(b) of the Federal Reserve Act to immediately commit to purchasing short-term municipal debt securities (“munis”) as is necessary to (1) stabilize all state government funding needs and (2) provide them with the appropriate financial flexibility to address the present public health crisis.

- The Fed can commit to this policy immediately, unlike other types of Fed interventions that require additional approval from the Secretary of the Treasury.

- If the Fed committed to making such financing available to state governments, it would influence market conditions instantaneously, even if full implementation required additional time.

Previous proposals have highlighted the value of exercising and expanding the Fed’s authority to support state and local governments (Konczal, Mason 2017). Our proposal provides a roadmap for how the Fed can design a funding facility to help state governments directly address the current crisis with existing statutory authority under the Federal Reserve Act. No additional legislative or executive action is required to enact our proposed policy.

Extending the Privilege of the Federal Government to State Governments

The Federal Reserve controls the quantity of reserves within the regulated financial system through temporary and permanent purchases and sales of United States Treasury debt securities (“Treasuries”). This ensures that the Treasury market remains liquid in both good times and bad. As a result, the Federal Government can use its balance sheet elastically to raise the necessary funds to overcome virtually any nominal balance sheet constraint (not to be confused with real resource constraints). Generally speaking, the more financial turbulence and risk-aversion that exists, the greater the flight to liquid assets. This dynamic results in lower yields on Treasuries and the associated cost of borrowing for the Federal Government.

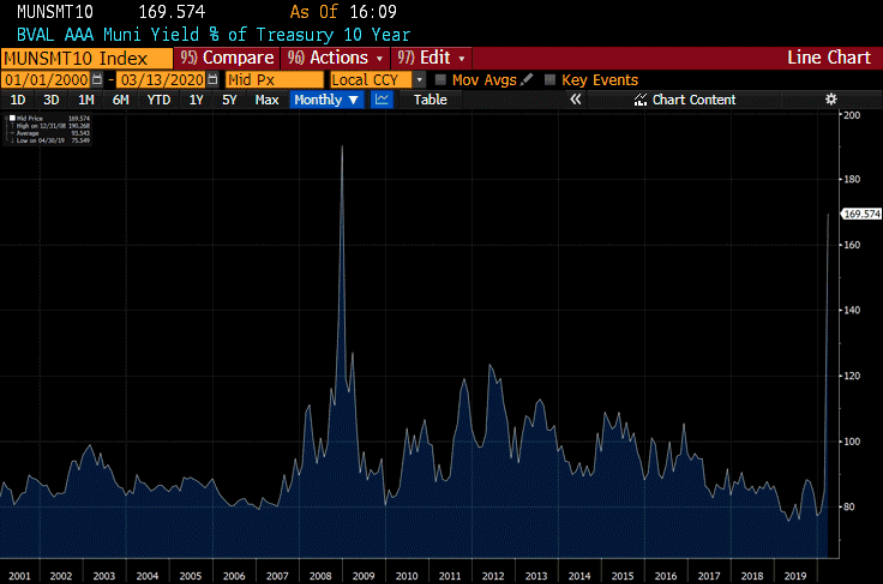

The Federal Reserve has been historically reluctant to extend such privilege to state governments. In periods of volatility and illiquidity across major asset classes, such as what we are witnessing today, munis are not immune. When market conditions become so highly correlated across asset classes, even the most prudent financial actors can be locked out of access to financing. This is especially true in periods of high economic uncertainty. On March 12, 2020, the municipal bond market experienced conditions that were reported to be “worse for the market than the aftermath of September 11th and the 2008 financial crisis,” with AAA-rated municipal debt trading at historically high yields relative to the 10-year U.S. Treasury Note.

State and Local Government Spending Has Been Highly Pro-Cyclical

A disruption to municipal bond markets will have dire effects on the economy at a time when states need to be ready to fight the COVID-19 epidemic. In 2019, state expenditures made up more than 40% of government spending, which in turn makes up more than a third of GDP. State spending has funded up to 72% of infrastructure investment spending since 1996.

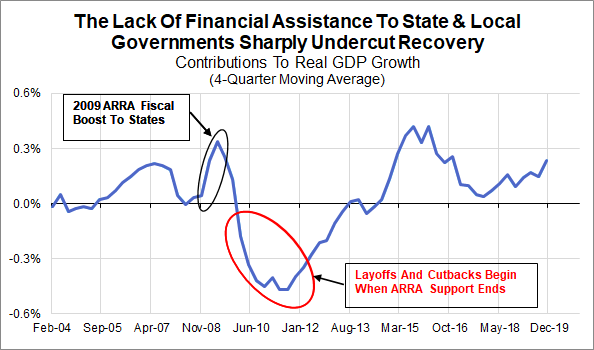

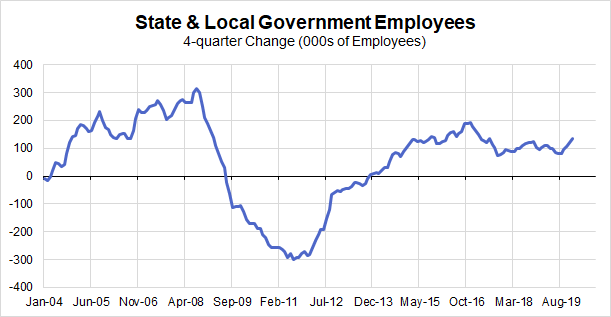

Shrinking state budgets offset much of the benefit of the 2009 American Recovery and Reinvestment Act (ARRA) fiscal stimulus during the Great Recession. When the funds from ARRA allocated to state and local governments dried up, we subsequently saw these governments sharply cut back on spending and increase layoffs.

The Statute Is Clear: The Fed Can Purchase Short-Term Muni Debt

Under section 14(2)(b) of the Federal Reserve Act, the Fed has the authority to:

“To buy and sell, at home or abroad, bonds and notes of the United States, bonds issued under the provisions of subsection (c) of section 4 of the Home Owners’ Loan Act of 1933, as amended, and having maturities from date of purchase of not exceeding six months, and bills, notes, revenue bonds, and warrants with a maturity from date of purchase of not exceeding six months, issued in anticipation of the collection of taxes or in anticipation of the receipt of assured revenues by any State, county, district, political subdivision, or municipality in the continental United States, including irrigation, drainage, and reclamation districts, and obligations of, or fully guaranteed as to principal and interest by, a foreign government or agency thereof, such purchases to be made in accordance with rules and regulations prescribed by the Board of Governors of the Federal Reserve System.”

The statute makes clear that the Fed has the authority to provide short-term financial support to state and local governments. Indeed, the most basic historical function of central banking is to ensure that the critical short-term financing needs of the sovereign are met in a time of crisis. The evident purpose of Section 14(2)(b) is to enable the Fed to lend directly to any entity of the federalist system to achieve its broader objectives.

Section 13(3) of the Federal Reserve Act, gave the Fed broad license to intervene in virtually any market during an emergency, but since the passage of the Dodd-Frank Act, such emergency measures must receive direct approval from the Secretary of the Treasury. Section 14(2)(b) is not subject to such restrictions and thus allows the Fed to take unilateral action today to provide states with a direct avenue to short-term financing.

Using the Fed’s Crisis Facilities As A Model

Prior Fed lending facilities during the Global Financial Crisis (“GFC”) offer a clear model of how the Fed can support state governments as they seek to make critical expenditures and investments in a time of crisis. The Commercial Paper Funding Facility (“CPFF”) was established on October 27, 2008 to purchase unsecured and asset backed commercial paper (“CP”) of maturities no more than three months. The facility was kept open through February 1, 2010, well after the recession officially ended and credit markets had normalized. The CPFF was remarkably effective in restoring liquidity for businesses that relied on CP markets to access affordable financing. If these businesses were not able to refinance affordably, ongoing market dysfunction would have surely led to even more layoffs and bankruptcies.

The CPFF’s successful provision of liquidity to businesses in the GFC makes it a model for establishing a short term, emergency muni funding facility. A short-term funding facility will allow state governments to ride out the COVID-19 pandemic and its associated market dysfunctions. Market turbulence did not begin with muni markets, but it now seems to be having a uniformly constraining effect across all issuers, regardless of their underlying financial health. Sales tax collections and other state-level revenue generators are likely to decline for virtually all governments as economic activity takes a hit. Without the same degree of working capital or stable lines of credit that are typically available to private sector entities, state governments are more likely to be forced into making sharp expenditure cuts if financial markets freeze up for a sustained period.

The Fed should make this facility temporarily available for at least twelve months after the associated economic impact of COVID-19 reaches its peak. This is already a significant enough crisis in terms of how it will test the capacity constraints of public health systems across the country. State governments should not have to simultaneously worry about financial market collateral damage depleting increasingly scarce fiscal resources. The Fed’s facility will ensure that state governments can easily roll over debt and meet their funding needs throughout the COVID-19 crisis by relieving some of the stresses weighing on the secondary muni market.

A Fed facility that was directly parameterized to the scale and timeline of the COVID-19 crisis would also short-circuit the pernicious pro-cyclicality of state laws that, to varying degrees, mandate balanced budgets. These laws encourage penny-pinching at the first sight of falling sales tax collections, even though the current moment should actually be spurring state governments to think ambitiously about how to address the current challenge and invest in new capacity. It is already a well-established practice that federally supported programs are not counted for states’ balanced budget requirements. Capital expenditures that can be backed by future revenue streams are similarly discounted. If necessary for maintaining the commitment to structurally balanced budgets, the Fed’s support should extend to state-owned public health corporations that are specifically dedicated to expanding hospitals and other public health infrastructure.

Considerations and Concerns

On first glance, these types of measures may seem extreme because of the absence of a recent precedent. However, in this pressing emergency, state governments bear the major financial cost associated with on-the-ground interventions to treat and prevent the spread of communicable diseases. Logistically speaking, were it not for their budget and financial constraints, they are arguably in the best position to allocate expenditures for expanding the capacity of our public health system. To guarantee that state governments make the necessary investments during this trying time, all institutions of the Federal Government should, within their statutory authority, play their appropriate supporting role.

Some critics might balk at taking such actions given the supposed difference between monetary policy and fiscal policy. To reiterate, the statute is quite clear that the Fed is already authorized to support the flow of certain types of financing to state and local governments. Presumably this power is of greatest importance in times of crisis. In 1933, during the height of the Great Depression, the Fed held 1,493 thousand dollars of municipal warrants, up from 120 thousand in 1927.

Some might be uncomfortable with extending the credit facility for a period that extends beyond the maturity limit specified in 14(2)(b). The CPFF is a clarifying analogue: the CPFF allowed the rollover of shorter-term 1-month and 3-month commercial paper for nearly 16 months on a timeline that covered some of the most challenging phases of the GFC. A similar commitment now would not only serve to calm financial markets, but would also enable states to have the confidence to calibrate their spending to what the public health crisis calls for, not what financial markets capriciously demand.

Coordinating a program with fifty state governments might seem like a daunting challenge for the Federal Reserve System. However, there are twelve regional reserve banks that should already have existing relationships with state treasurers. The decentralized structure of the Fed should alleviate this coordination problem and ensure that a responsive effort can take place swiftly.

The COVID-19 pandemic presents us with a major public health and economic challenge. While doctors, hospitals, nurses, and public healthcare workers struggle to contain the virus and treat the ill, central bankers should be doing all that they can to ensure that arbitrary financing constraints do not hinder the necessary response.