Friday's employment report is set to be messy for a number of reasons, not just because Omicron is likely to weigh somewhat heavily on nonfarm payroll estimates. At the risk of sounding like a broken record, your best bet to avoid getting spun around by all of the moving parts: focus on the prime-age employment-to-population ratio. It will help cut through some of the distortions associated with benchmark revisions to nonfarm payrolls, changing population estimates, and the effects of Omicron.

Weakness attributable to Omicron could show up in both the household and the establishment surveys, but relatively speaking, Omicron is likely to have a more substantial impact on the establishment survey. It would not be surprising to see a contracting nonfarm payroll employment in January coincide with a declining unemployment rate (total jobless claims fell between the December and January survey weeks). The establishment survey's estimates of the workweek are more likely to be skewed to the downside due to Omicron-related absences. Meanwhile average hourly earnings estimates are likely to be skewed to the upside, as illness-related absences lower aggregate and average hours worked more so than than they lower aggregate and average earnings.

- Annual Revisions To Nonfarm Payrolls: January employment reports involve benchmark revisions to the previous year's data in the establishment survey (the CES, which is used for calculating nonfarm payroll employment estimates). What you see right now in terms of nonfarm payroll estimates for 2021 will almost certainly be revised substantially after this Friday. Estimates might be revised upward given the elevated rate of business formation in 2021 but they might also be revised down because of downward revisions to population estimates, due in part to lower immigration.

- New Population Controls: January employment reports also involve a revised baseline for population growth in the household survey (CPS, what's used to calculate unemployment, participation, and employment-to-population). Raw counts of employment levels cannot be neatly compared between December and January for this reason. Focus on the evolution of employment-to-population ratios to help cut through the noise.

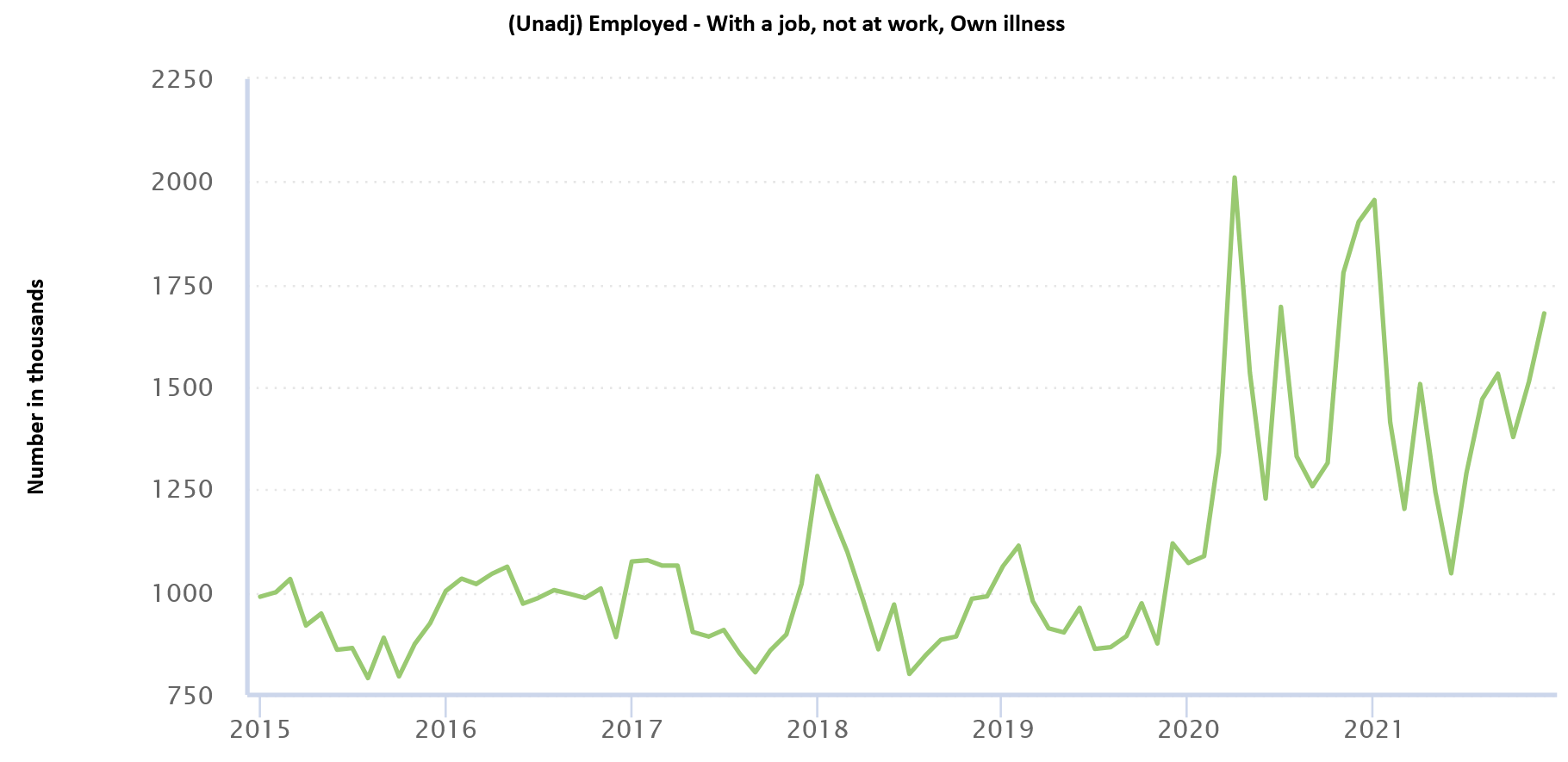

- Omicron's Differential Impact: The Omicron variant is likely to show up differently between the household and establishment surveys. Whereas the household survey makes a separate classification for those persons who were not at work because of illness but who otherwise have a job, nonfarm payrolls are more likely to exclude those persons. Hours are also vulnerable to declines both in the aggregate and for the average worker, at least relative to aggregate and hourly earnings.

There is still a big COVID constraint in this data. In December, 1.679 million people with a job were not at work due to "illness." As our nearby figure shows, this series has been strongly inversely correlated with changes in private payroll growth. pic.twitter.com/jMlXQQYtor

— RenMac: Renaissance Macro Research (@RenMacLLC) January 7, 2022

Some of these dynamics may not materialize, and the household survey could still show plenty of weakness because of Omicron. January data is poised to be incredibly messy. We will likely have to wait until the following employment report (in the first week of March) to get a cleaner read on labor market performance.