This preview was published two business days ago for our Premium Donor distribution. Consider subscribing if you would like to support our public research and advocacy work, and receive early access to our data release previews. While the economic views expressed here remain unchanged, the policy implications have further cemented as a result of Chair Powell's Humphrey Hawkins hearing testimony. The labor market data would have to seriously reverse the strength of the January report to push Chair Powell back from his intention of hiking 50bps in March. While such a possibility could emerge due to seasonality issues flaring in the opposite direction, it is also distant from what our analysis of the labor market reflects.

Baseline View - What the data tell us to expect this Friday (it will be consistent with what could motivate a 50bp hike in March, now that Chair Powell's Congressional testimony today put it clearly on the table):

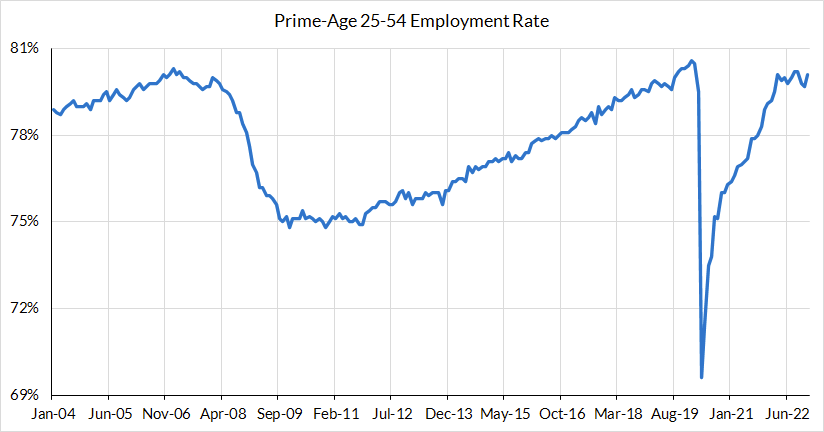

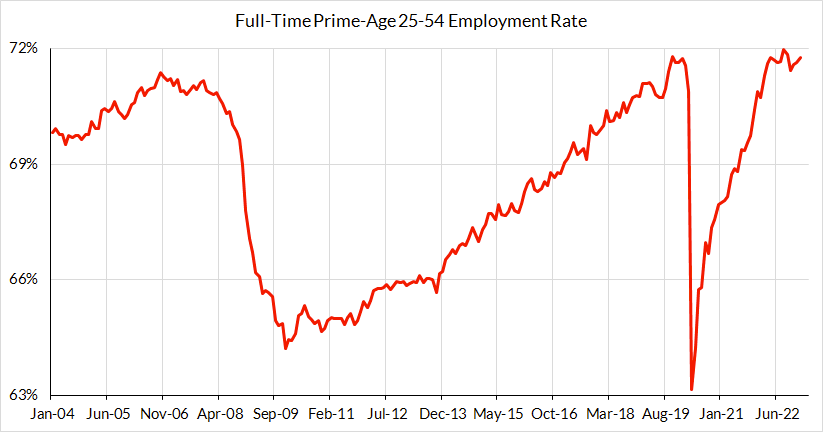

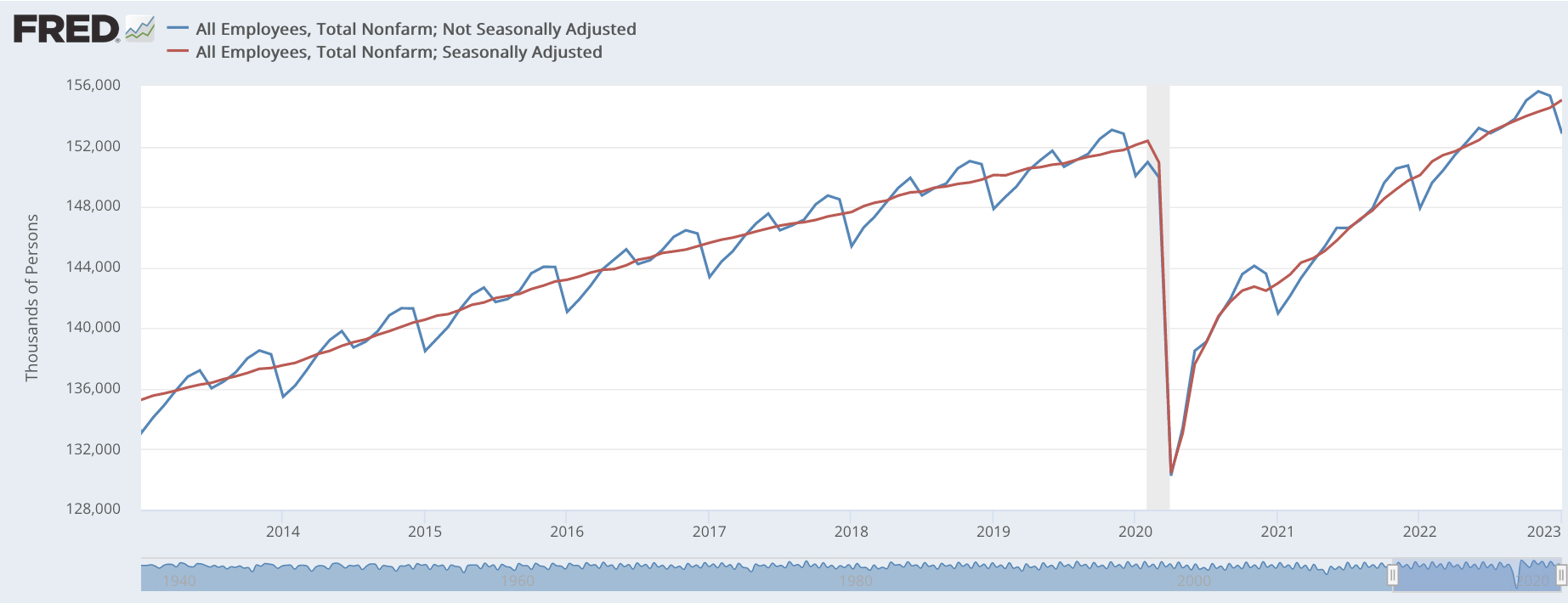

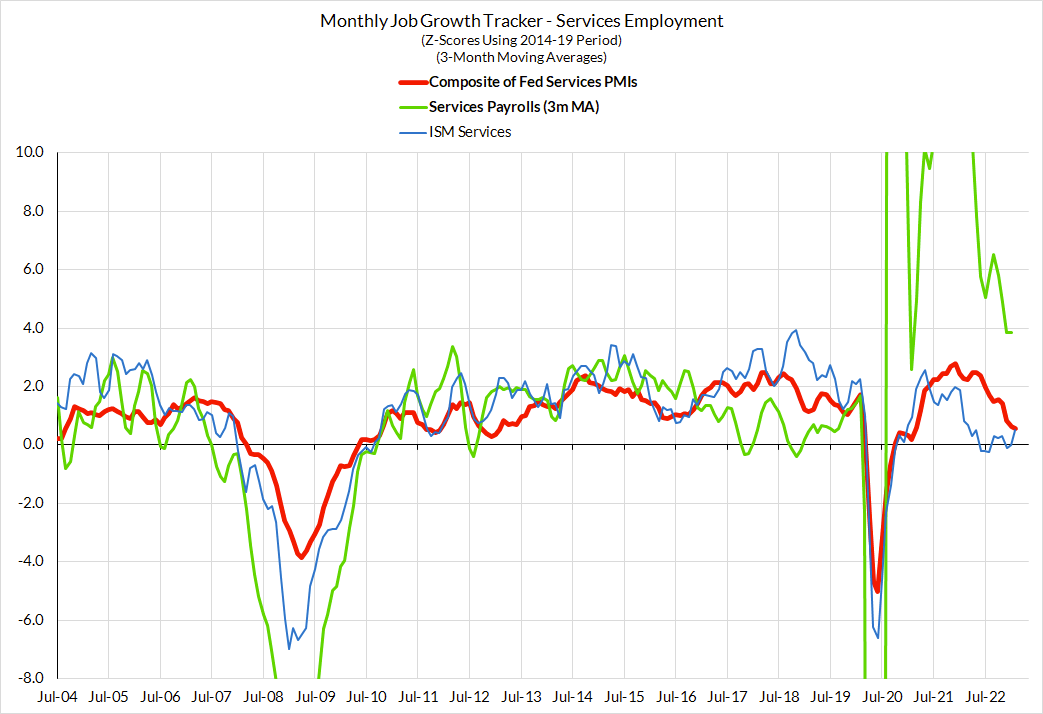

- Nonfarm payroll growth should cool substantially from the white-hot 517k gain in January; moderate risks are to the downside vs 224k consensus (likely 150k-200k). The big driver of the gain was an artifact of two things: (1) gross hires are falling but gross layoff rates are still low, (2) gross layoffs matter much more than gross hires in January (the month when layoffs are most pronounced). Perhaps this effect might even yield bigger revisions, but after January, hires generally matter much more than layoffs for job growth. Hiring rates have been trending lower on a number of estimates (JOLTS, Linkedin estimates, CPS), and that is likely to depress net job growth in February.

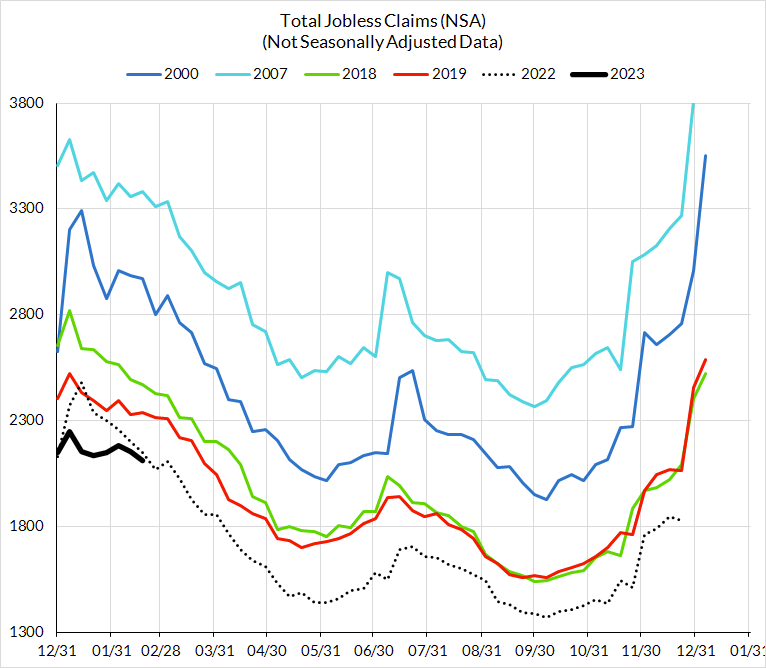

- The unemployment rate is likely to stay at 3.4% (consensus) but slight asymmetry to 3.5% over 3.3%. Jobless claims are only marginally trending down from January to February and the household survey is due for some "catch-up" relative to the establishment survey's employment gains. Yet the unemployment rate only just broke through to 3.4% on a rounded basis in January. In light of weaker gross hiring rates, their relevance in February, and the prospect for rising labor force participation, the unemployment rate is slightly more likely to tick up a (rounded) tenth of a percent in February (vs a downtick to 3.3%).

- Don't get headfaked by average hourly earnings (consensus: 4.7% year-over-year; 0.3% month-over-month): The second month of the quarter is a tempting time to claim to extrapolate a new trend in wages, especially ahead of the release of Q1 ECI release, but it's best to avoid at this stage. Revisions and seasonality shifts can drastically affect what you can see month to month.

Policy Risks:

- Upside: The unemployment rate staying low at 3.4% (or even a rounding error uptick to 3.5%) will continue to motivate the Fed to consider a 50bp hike at the March FOMC meeting. Given the upside dynamics to inflation readings in Q1 (now including a renewed upside impulse to used car values), our base case is for the Fed to raise interest rates at the March FOMC meeting by 50 basis points. With the Fed flipping from accelerating to decelerating to re-accelerating the pace of hikes, we are increasingly concerned about the uncertainty this imposes and how it gets reflected into financial and hiring conditions.

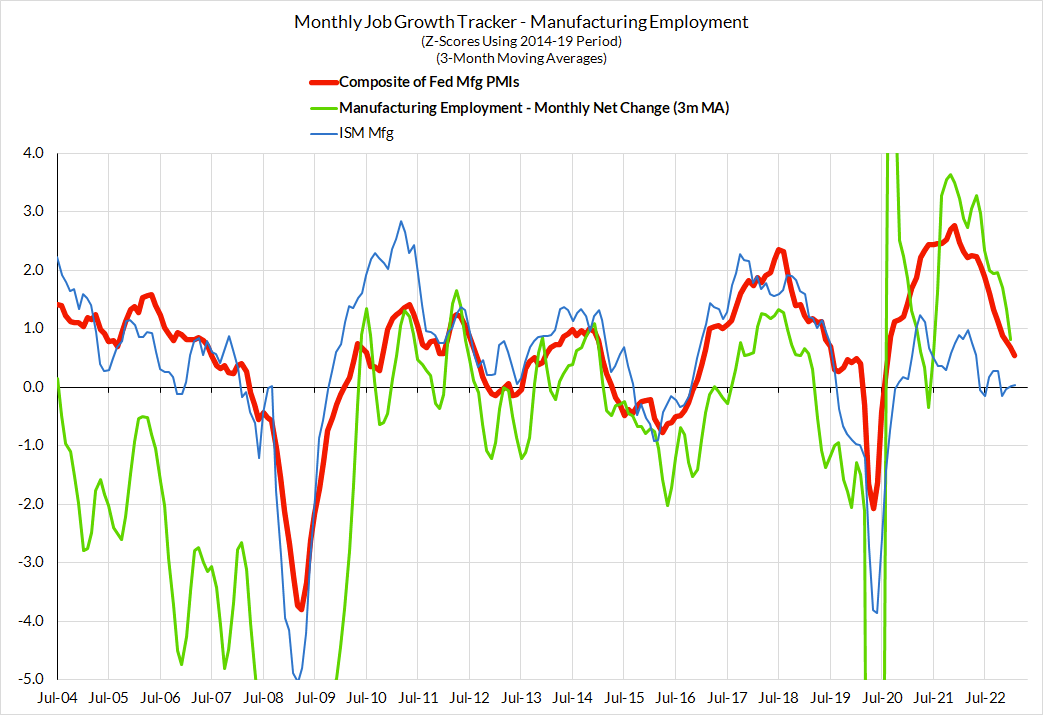

- Dovish: The biggest dovish game-changer from this release would be the prospect a monthly contraction in nonfarm payrolls. While we think that the labor market is still expanding right now (as per business surveys), we can see elevated risk of giveback from the blockbuster January payroll gain (due to residual seasonality reasons discussed earlier). This might cool some of the urgency to push for a 50bp hike. In its absence; it would require a soft February CPI release to get the Fed to back away from the 50bp track.

Charts