What the data tells us to expect for Friday:

- Interpreting nonfarm payroll employment numbers will be messy due to the benchmark revision: The BLS folds in more comprehensive data each February on job creation. That can be especially substantial at the sectoral level and recast what the true employment trajectory looks like. The preliminary numbers suggest an upward revision of 462,000 jobs.

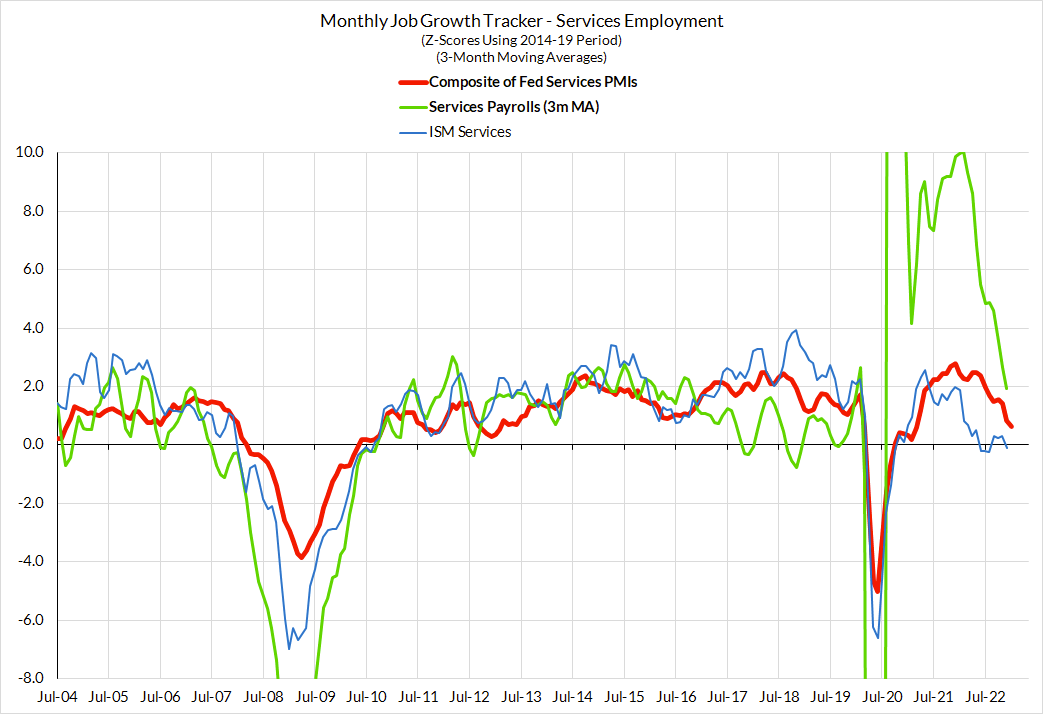

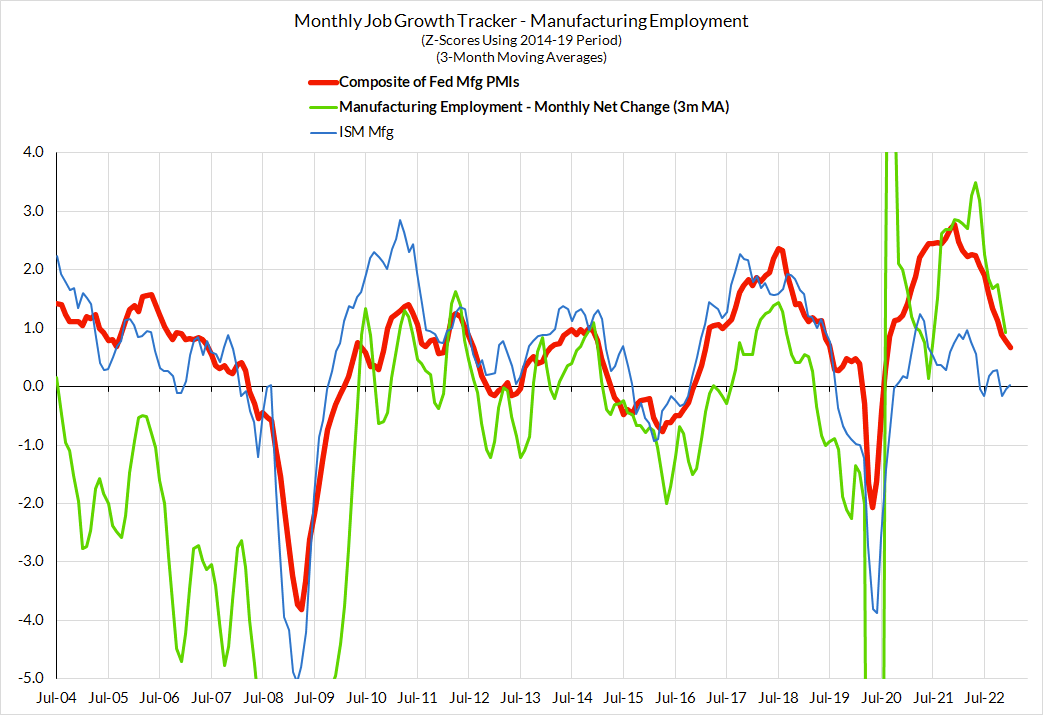

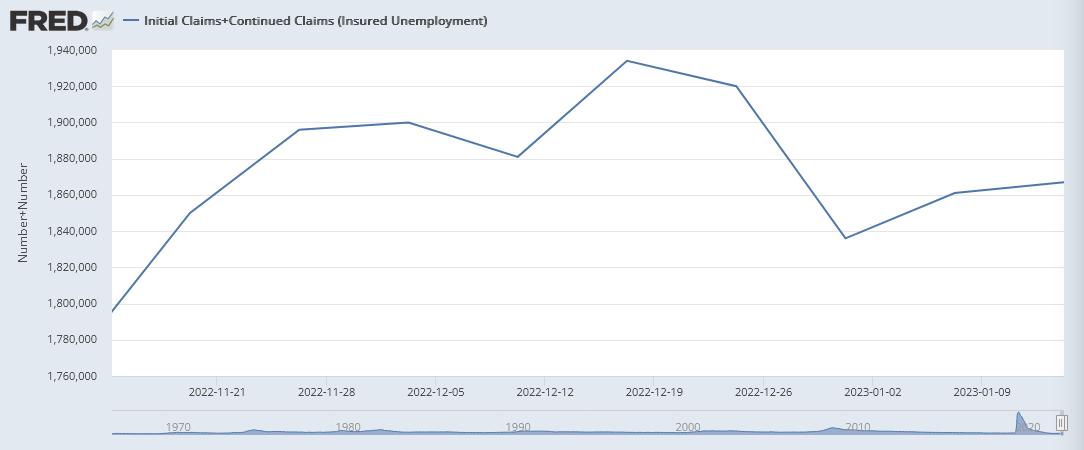

- Job growth is slowing but should still be positive. The Fed's business surveys and the unemployment insurance claims data confirm this broader trend (especially when looking at a 6-month moving average). They signal a slowing expansion, not an outright contraction.

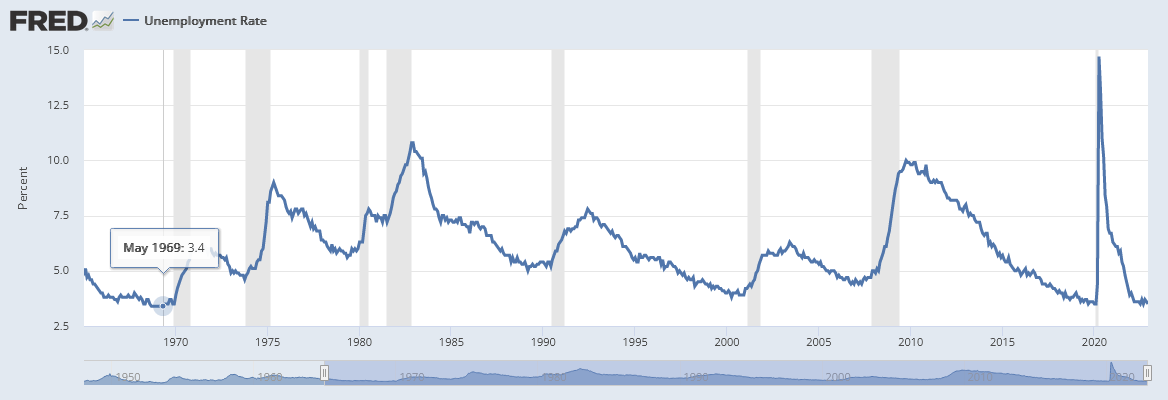

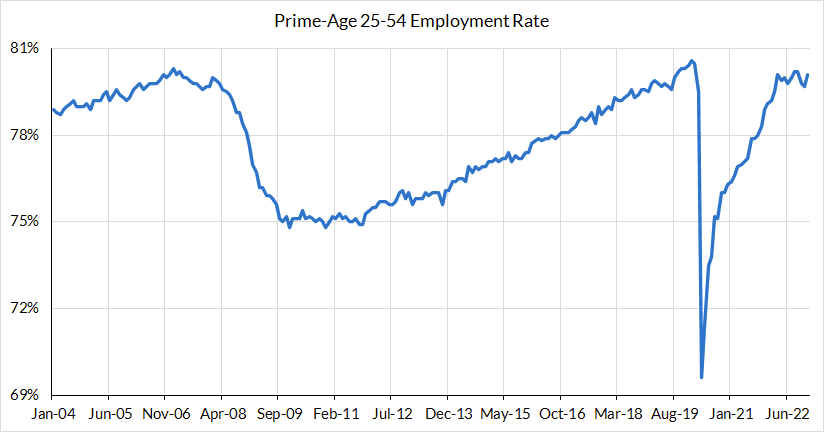

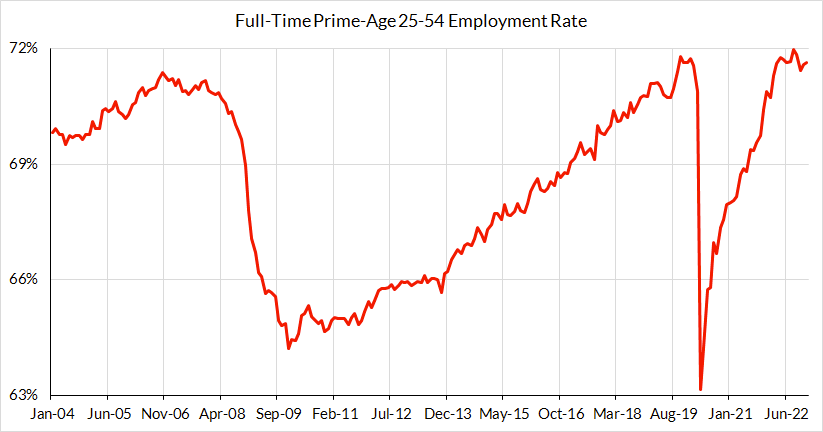

- The unemployment rate is more likely to fall to a new historic low than to rise. The claims data has been falling as a result of abnormally low separations in January (a month when workers typically leave their jobs following the holiday season). This could be offset by a rise in measured participation, as transpired last January, and as we seem to routinely see when the unemployment rate touches 3.5%. We care most about whether prime-age employment rates—which incorporate participation—keep improving; data trends suggest that they will.

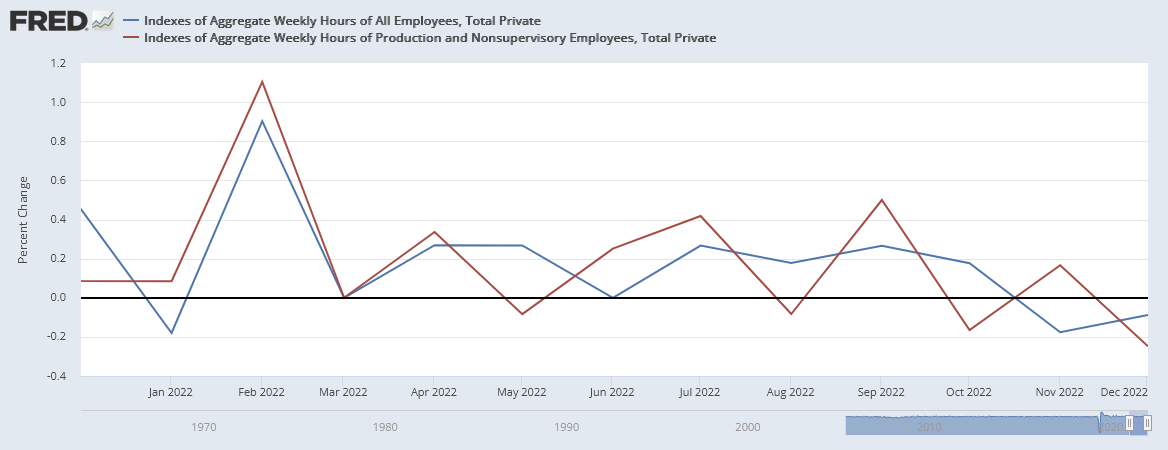

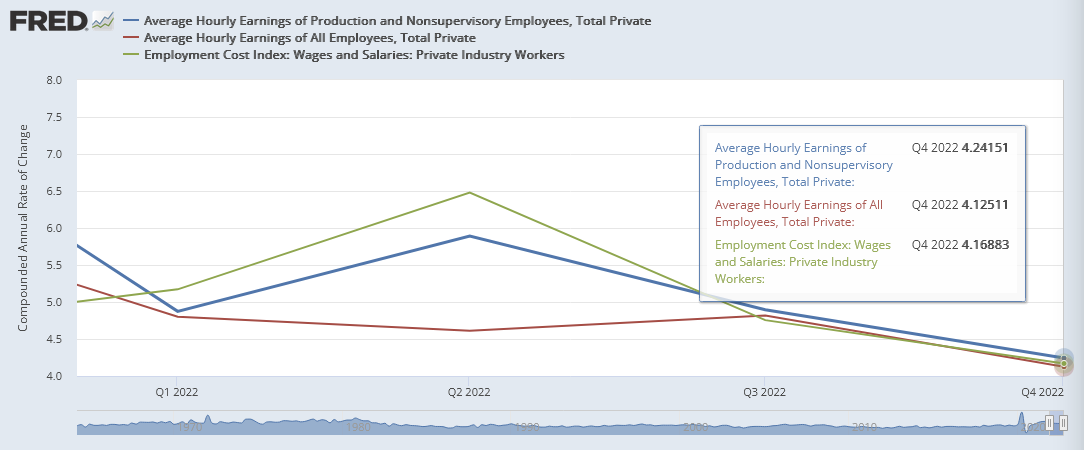

- Wage (average hourly earnings) growth is likely to be noisy for January, with some downside risk if hours worked recovers after illness likely pushed workers to cut hours in last two months of 2022. Regardless, we wouldn't put a lot of weight on this data for January. Whatever revisions to this data for November and December are still inferior to what we already learned from the Q4 employment cost index.

Policy risks we're watching out for:

- Upside: So long as the Fed implicitly relies on a wage Phillips Curve relationship to guide its thinking about inflation risk, a new low on the unemployment rate and higher wage growth will yield some reaction. Ultimately we don't think the Fed should be fooled by a hypothetically strong preliminary January AHE number, but the FOMC may be more alarmed if the unemployment rate is drifting further than what they project under optimal policy.

- Dovish: Nonfarm payrolls can do some whacky things month-to-month, especially if there is a weak survey response rate. With job growth indicators still continuing to slow, one has to wonder if statistical noise might yield a fluke negative print at some stage (net payroll employment decline). If there is a more fundamental dynamic afoot, we will see contraction in cyclical sectors like construction. It's far from our base-case for this Friday but it is plausible. If we are flirting with contracting employment (something we won't really know with high certainty for at least another month or two), the Fed is still less than willing to offset this dynamic.