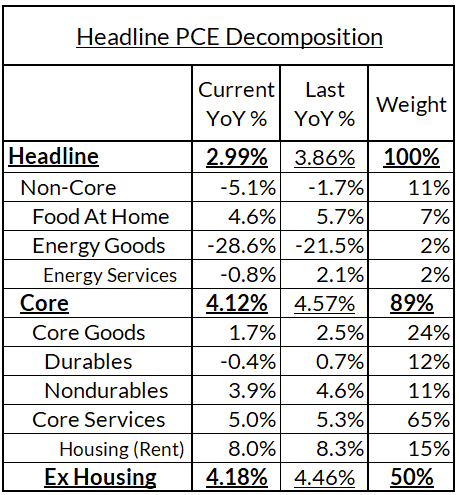

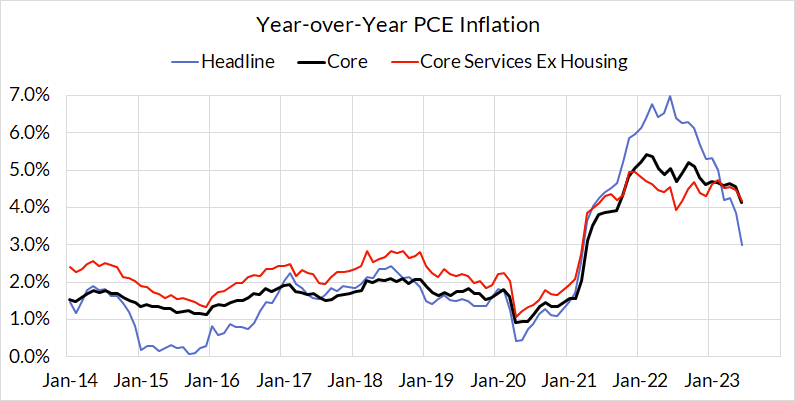

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

Today is a special iteration of the Core-Cast because we received some new information from the GDP release about Q2 Core PCE. We don't get the monthly incidence in this release, and because previous months also can be revised down, we cannot back out June readings purely from Q2, April, and May data.

Summary: The June release of PCE prices tomorrow should show softness in Core PCE and Supercore ("Core Services Ex Housing") PCE relative to consensus expectation and our nowcast. These downgrades are driven by lower than expected airfares in June, friendly revisions to non-CPI prices, and downside developments in the "dark spaces" of PCE that do not rely on CPI, PPI, or IPI inputs, namely Input Cost Indices and Imputed Financial Services. While we generally would stick with our month-over-month nowcast in this context (because we don't know the monthly incidence of PCE revisions), it's clear that our nowcasts would otherwise be too high vs what current information indicates.

The full version of this CoreCast is made available exclusively for our Premium Donors. To view the full version, sign up here for a trial or contact us for more information.