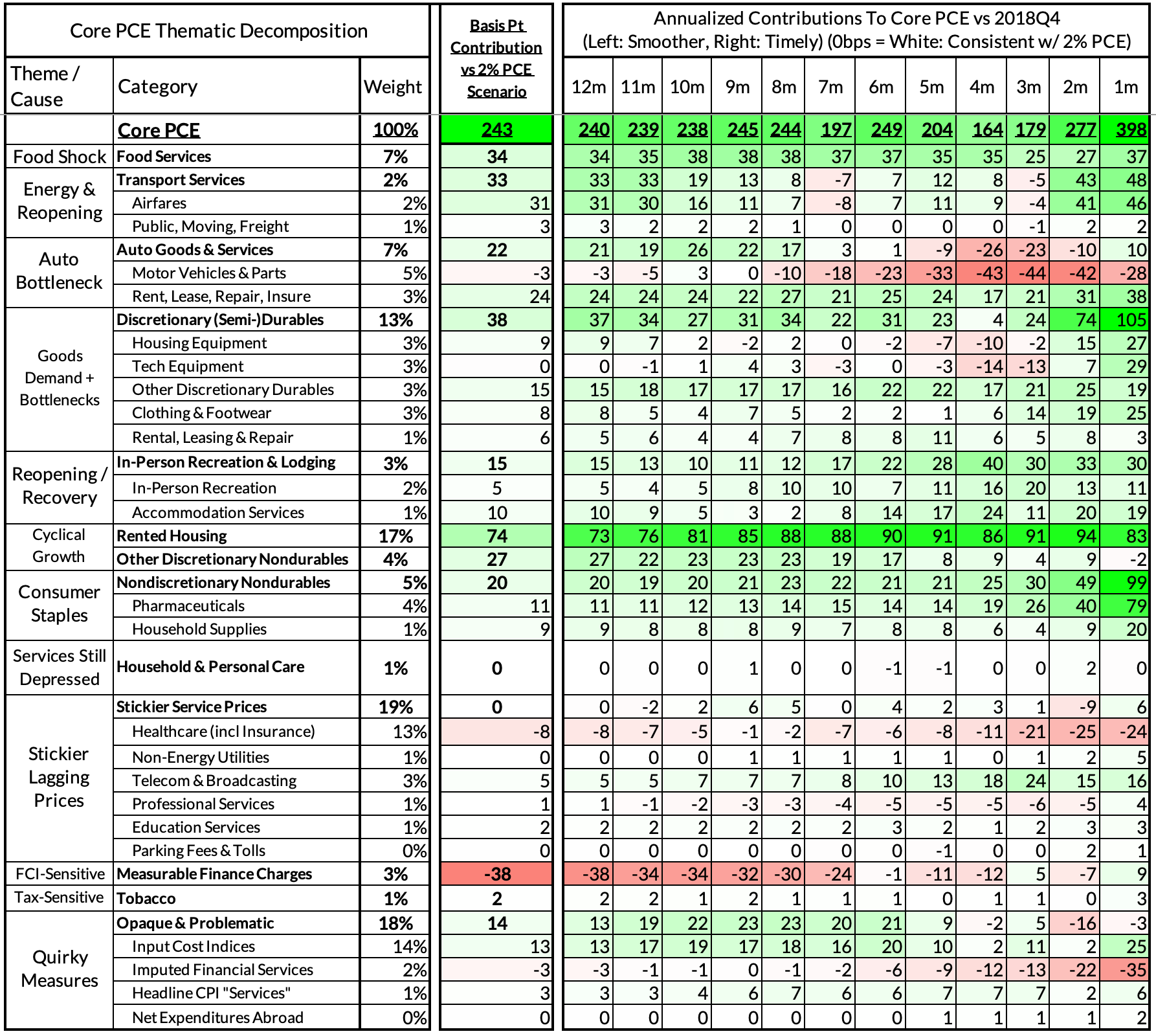

We're doing the dirty work of translating inflation inputs into PCE in real-time for you. There are some dark parts of PCE not related to CPI and PPI; we'll be back with an update when PCE is released. The associated heatmaps are dense, but they aim to give a holistic view of how individual inflation components reflect major inflation themes. Critical to us is the comparison of current component performance vs what transpires when inflation is running at 2%.

Summary

Today's PPI inputs pushed the year-over-year readings for headline, core, and core services ex-housing PCE up from December. The main driver was airfares, and specificially international flights (subject to typically modest change, depending on import price data that comes out tomorrow). This is not that much of a surprise in the context of global and China-related reopening measures and given that last January was Omicron-depressed.

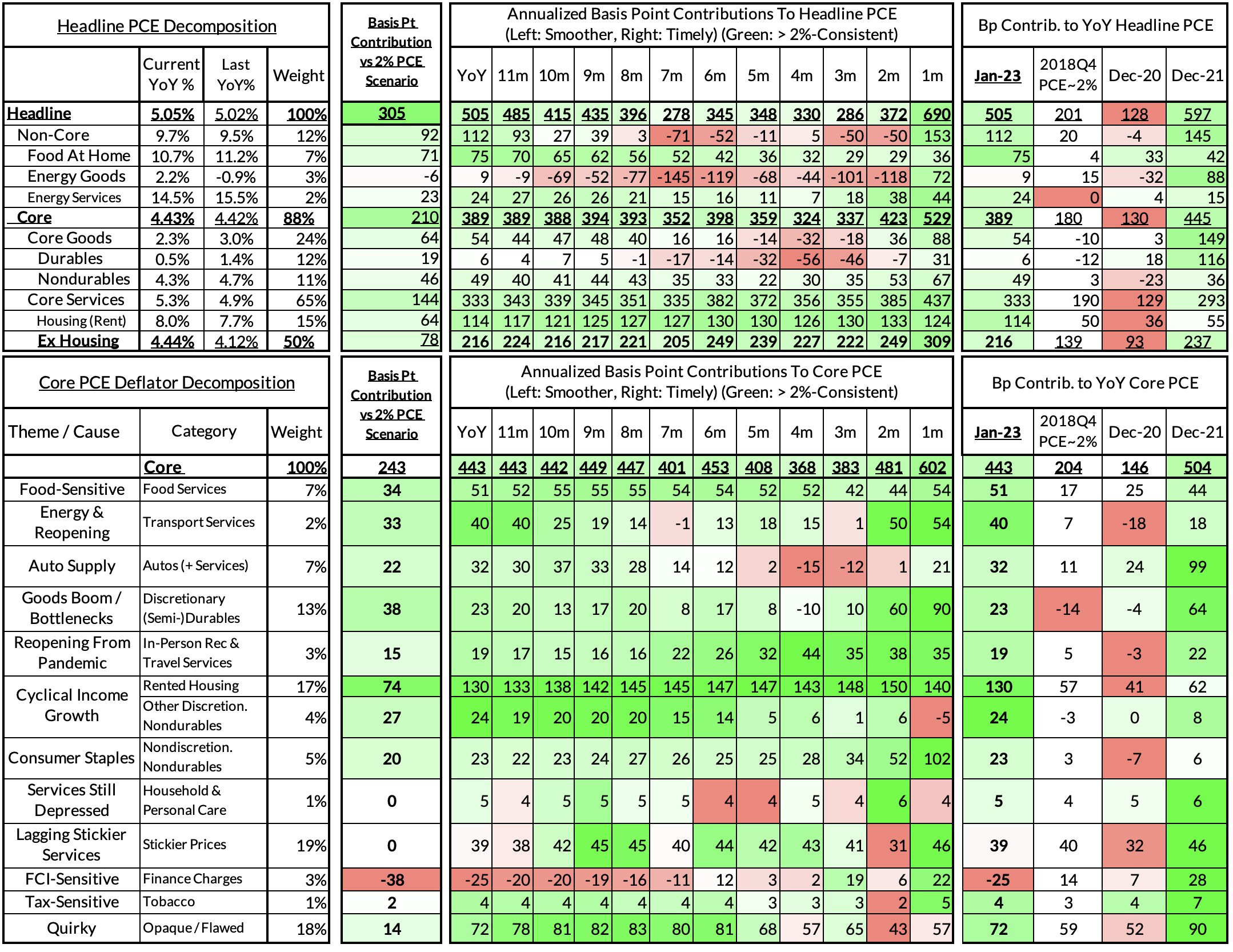

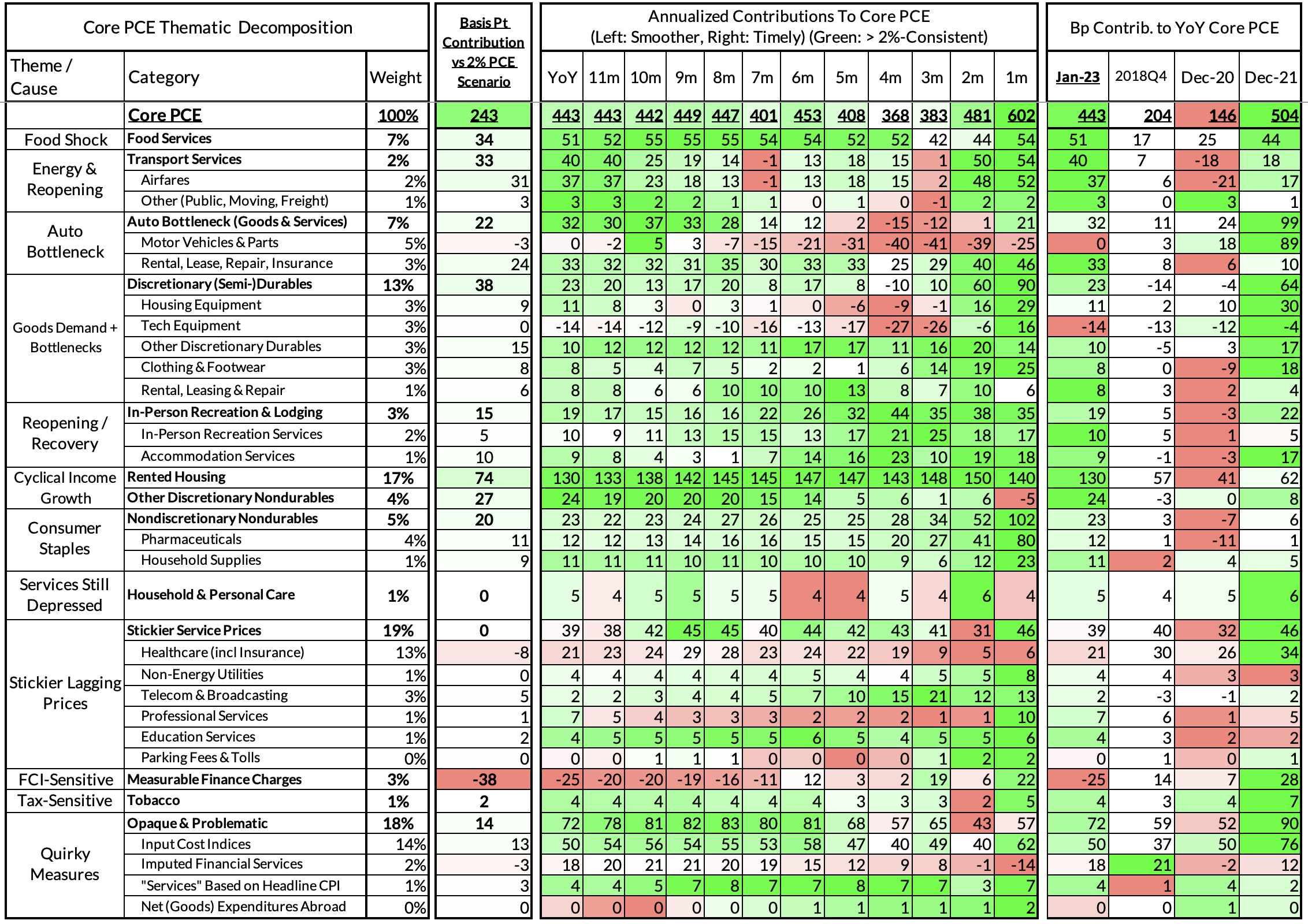

- Headline PCE is now on track to mildly increase, from 5.02% year-over-year in December to 5.05% in January (rounds up to 5.1%, 0.56% month-over-month increase)

- Core PCE is now on track to stay virtually flat from 4.42% year-over-year in December to 4.43% in January. (0.49% month-over-month increase)

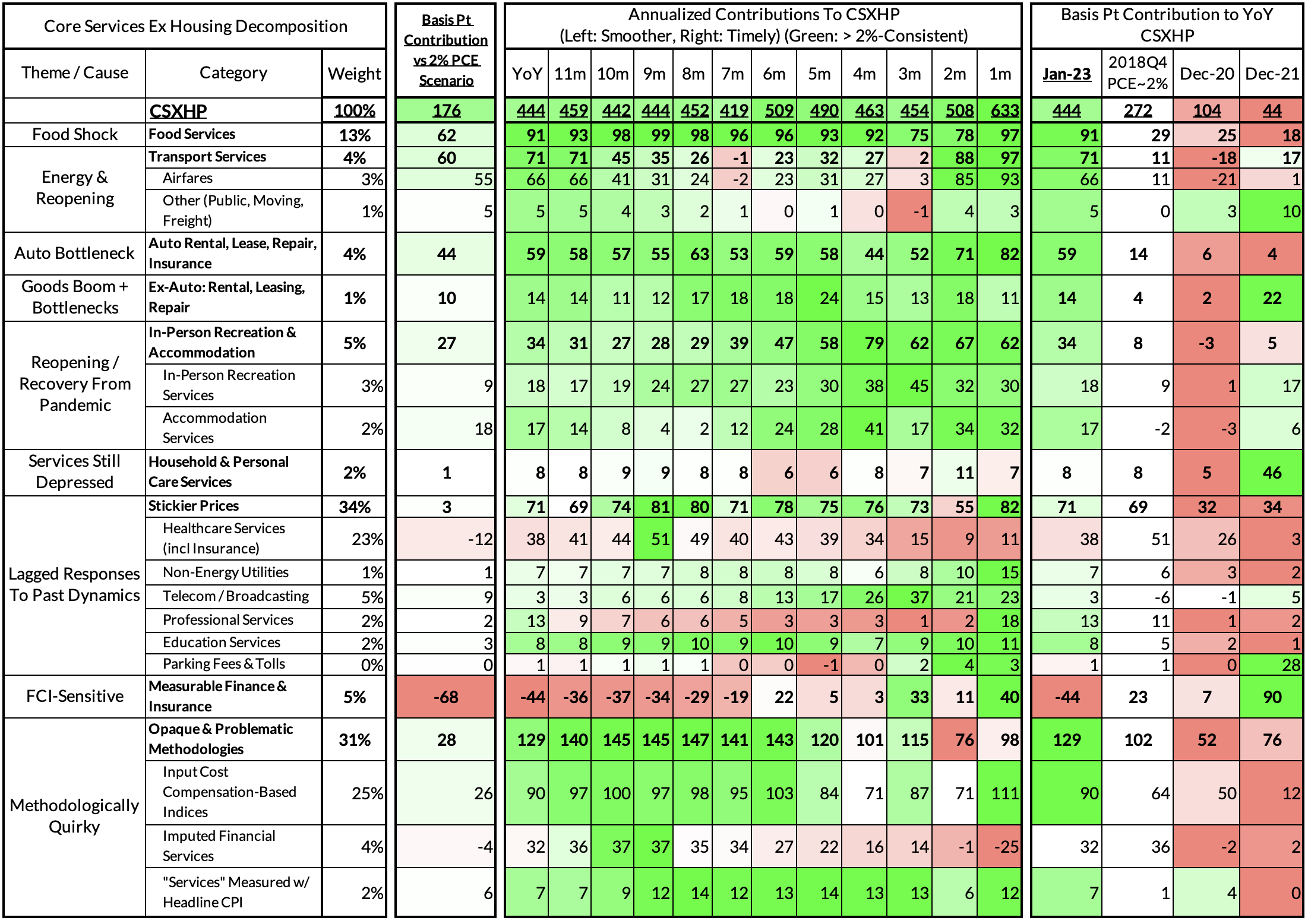

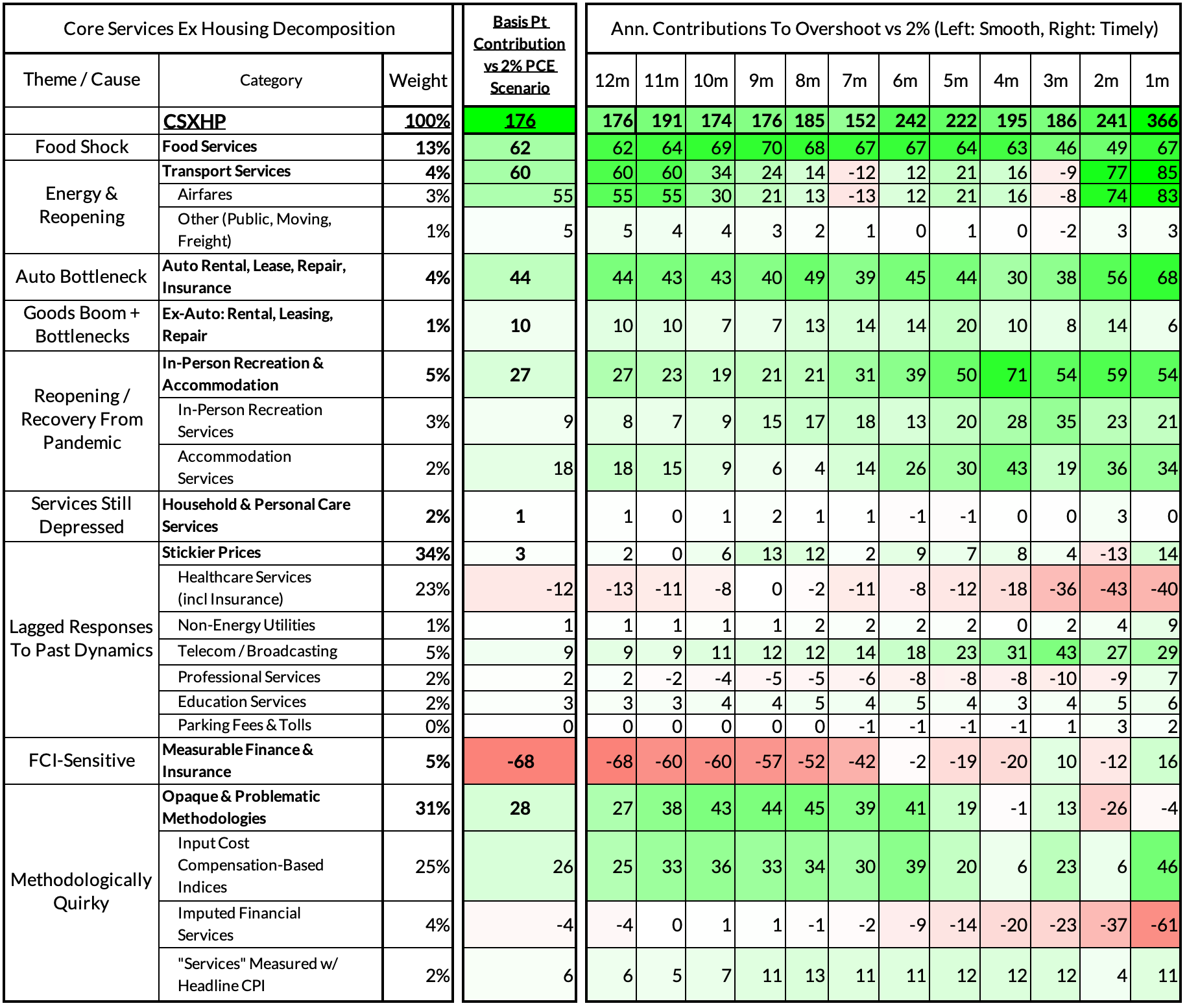

- Core Services Ex Housing PCE is currently on track to increase from 4.12% year-over-year in December to 4.44% in January. (0.51% month-over-month increase). This index is most vulnerable to revision since it involves a much higher share of non-CPI non-PPI inputs. Modest changes due to import prices for international flights but otherwise, we have to wait until the official PCE release.

The one potential silver lining here was that stickier prices like healthcare services did not see a surge, and in fact seem to be absorbing the effects of Congressional and CMS-implemented cost control measures (which also support the bargaining power of private payers for healthcare services). Airfares are a more volatile and flexible price (double-edged sword); should we get past this last burst of global reopening inflation, refining bottlenecks improve, and airlines improve their ability to scale service, the outlook can improve sooner.

Methodological Nuance (Feel Free To Skip)

Whereas airfare CPI follows select domestic routes, PCE takes a dynamic revenue-weighted approach and measures the price of international flights separately (under "Net Foreign Travel"). Even as of late 2022, global air travel was still depressed, but with the lifting of travel restrictions and the reopening of China, it shouldn't be such a surprise to see this surge. Remember also that January 2022 (the last year-over-year comparison if you don't trust seasonal adjustment) was depressed by Omicron.

Core PCE Heatmaps (The Good Stuff)

Core Services Ex Housing PCE Heatmaps (The Really Good Stuff)