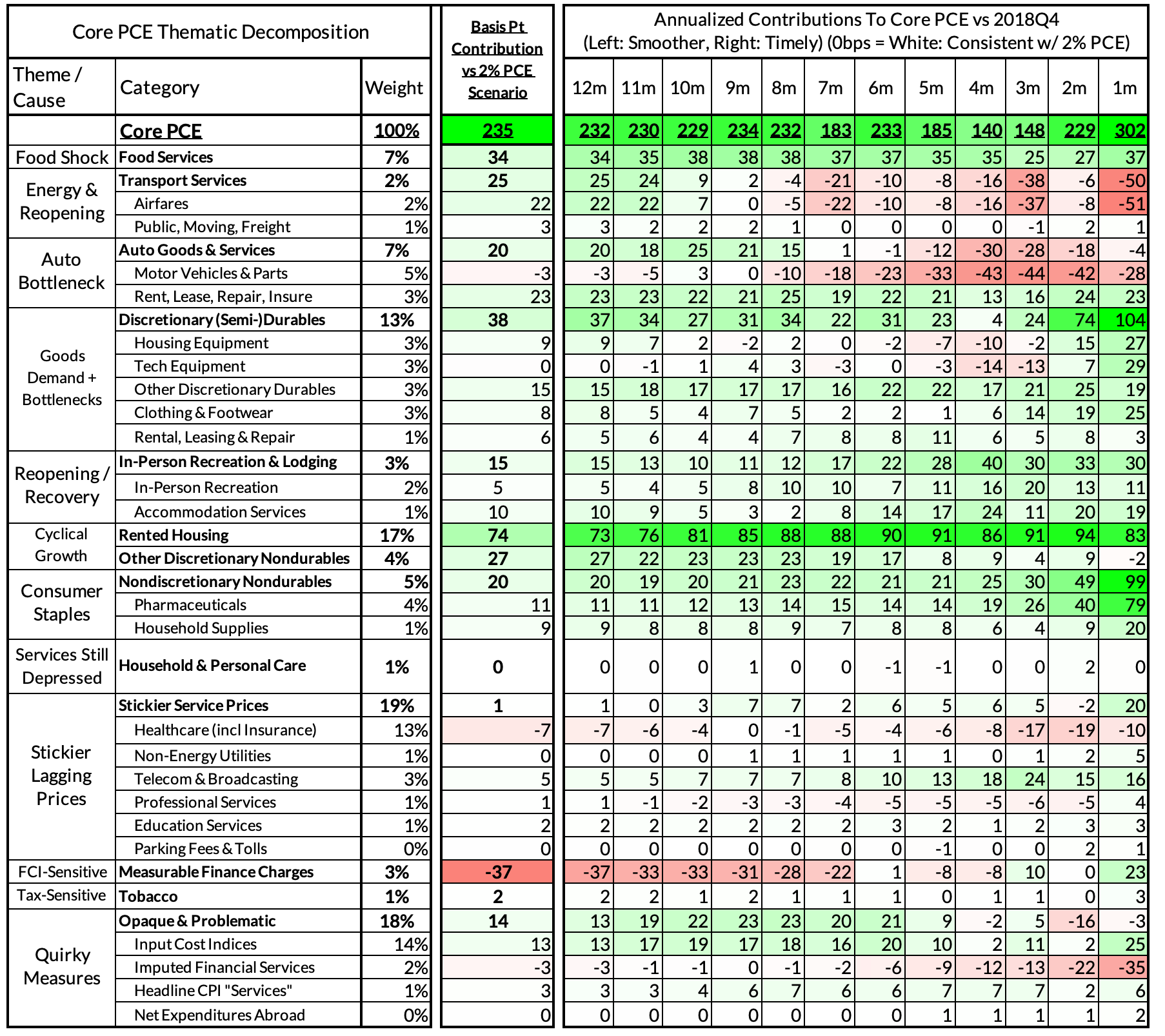

We're doing the dirty work of translating CPI to PCE in real-time for you. We'll be back on Thursday to provide an update after the PPI release, which will inevitably reshape the nowcast. The associated heatmaps are somewhat dense and intense: they give a holistic view of how inflation components and macro themes are contributing to (or subtracting from) the current inflation overshoot.

Summary

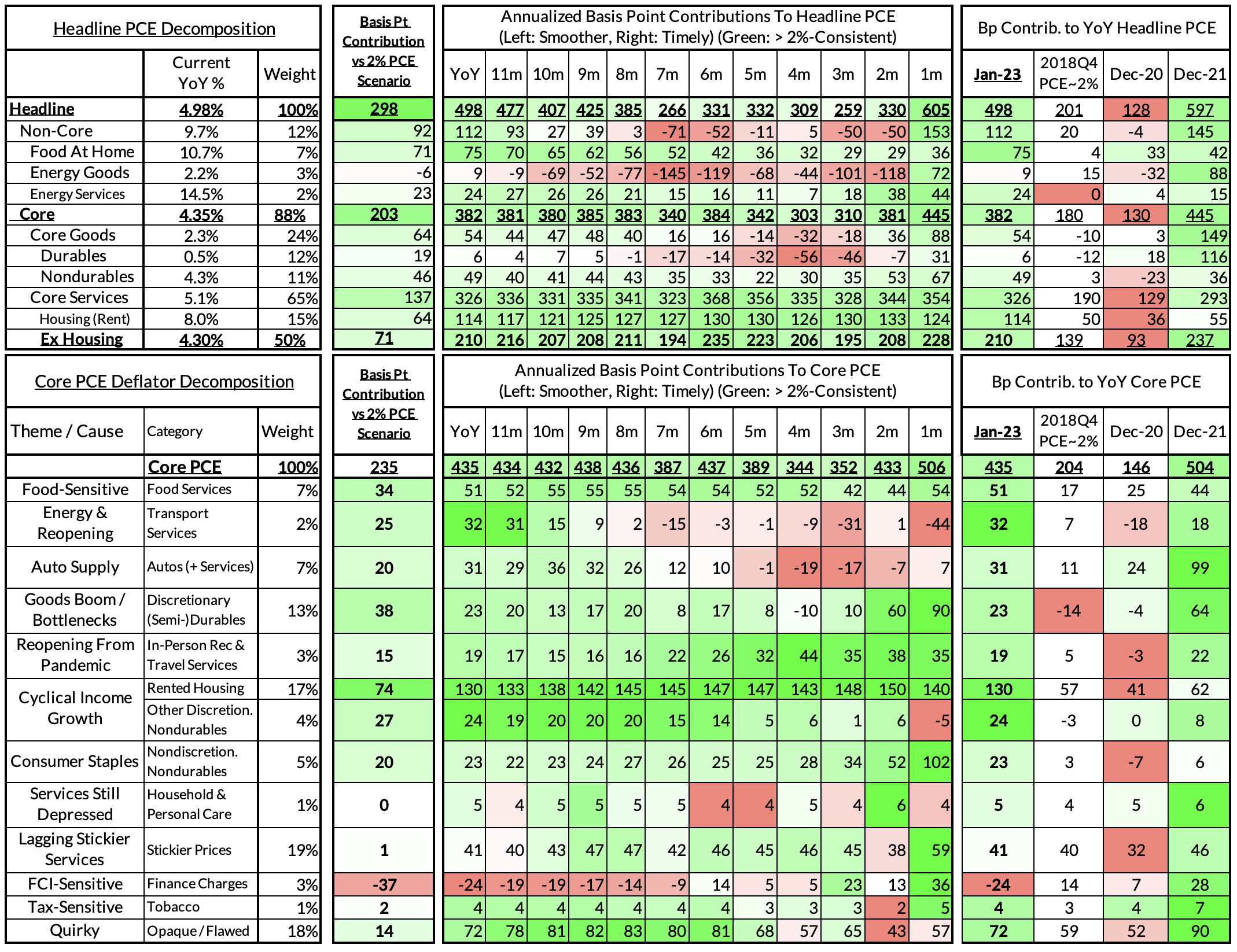

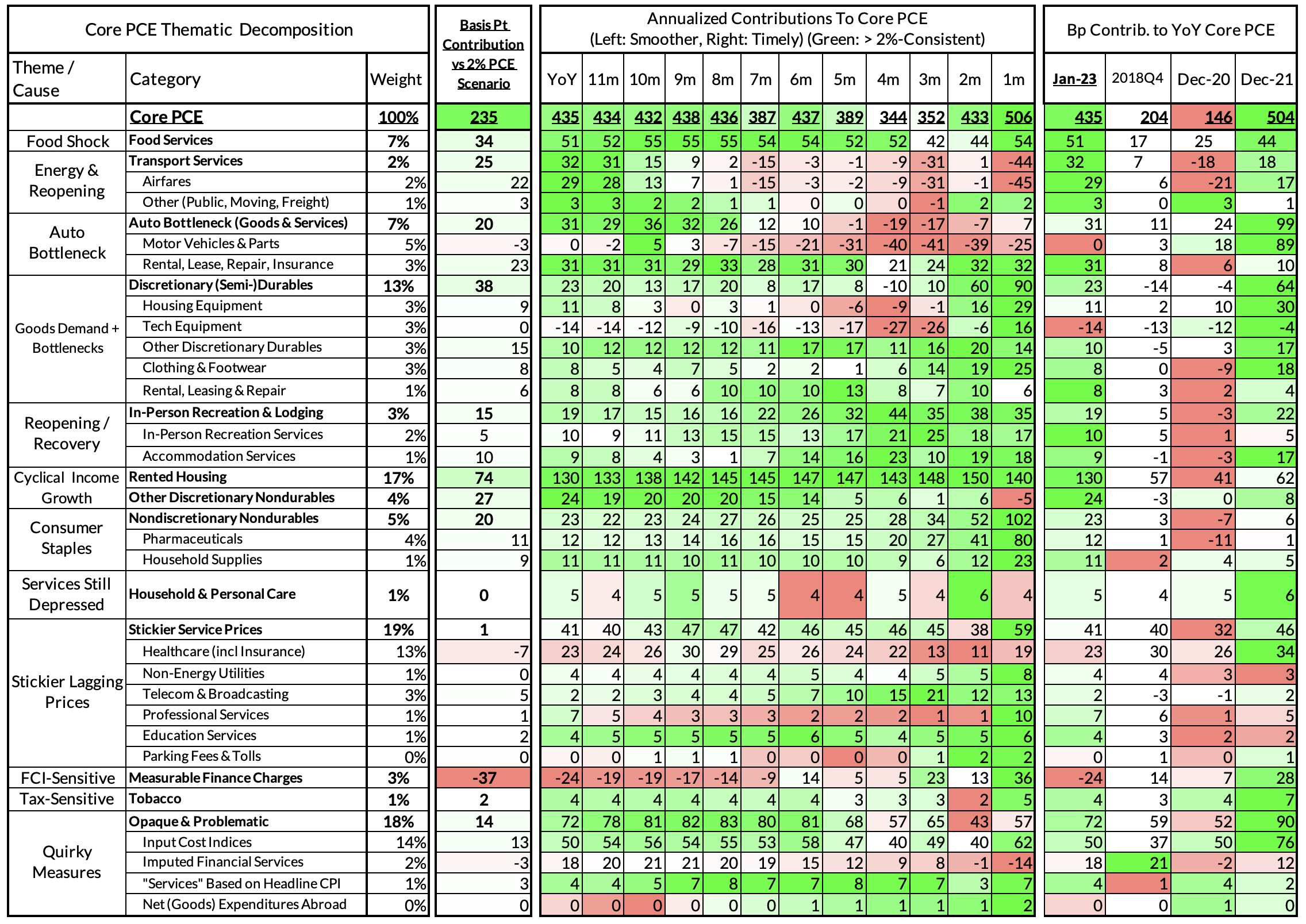

We still have critical data left outstanding for nowcasting the entirety of January PCE (including January PPI on Thursday), but today's CPI reading was roughly consistent with our more pessimistic preview, especially in the details. January / Q1 is a time for lagging price revisions to come through. We didn't see broad-based goods deflation or deceleration in key 'goods-adjacent services' (aside from airfares), but we weren't counting on that either. Taking mostly static year-over-year and composition assumptions:

- Headline PCE is currently on track to stay virtually flat, from 5.02% year-over-year in December to 4.98% in January. (0.5% month-over-month increase)

- Core PCE is currently on track to tick down slightly from 4.42% year-over-year in December to 4.35% in January. (0.4% month-over-month increase)

- Core Services Ex Housing PCE is currently on track to increase from 4.12% year-over-year in December to 4.30% in January. This index is most vulnerable to revision since it involves a much higher share of non-CPI inputs. We'll have a clearer picture on Thursday

Methodological Considerations (Feel Free To Skip)

The Fed's preferred inflation gauges are deflators of Personal Consumption Expenditures (PCE), the consumer spending component of GDP. These price indices are based on a few input data sources, including the Consumer Price Indices (CPI) and Producer Price Indices (PPI), but are methodologically distinct from them. We usually have a decent read of PCE deflators after CPI (which tends to be the first inflation gauge released), but there are a lot of controls and calculations to account for. When updating views month to month about inflation, the dirty work here matters.

For our nowcast, we're taking relatively static assumptions for that which we cannot see as of yet: (1) most of the non-CPI inputs to PCE and (2) the composition/weighting associated with January PCE (which depends on January consumption data). Non-CPI inputs are presumed to retain their existing year-over-year reading in all cases except airfares. We are overriding the Omicron-induced 7% monthly decline in airfares PPI/PCE in January 2022, and instead using airfares CPI to nowcast airfares PCE (until Thursday).

Core PCE Heatmaps

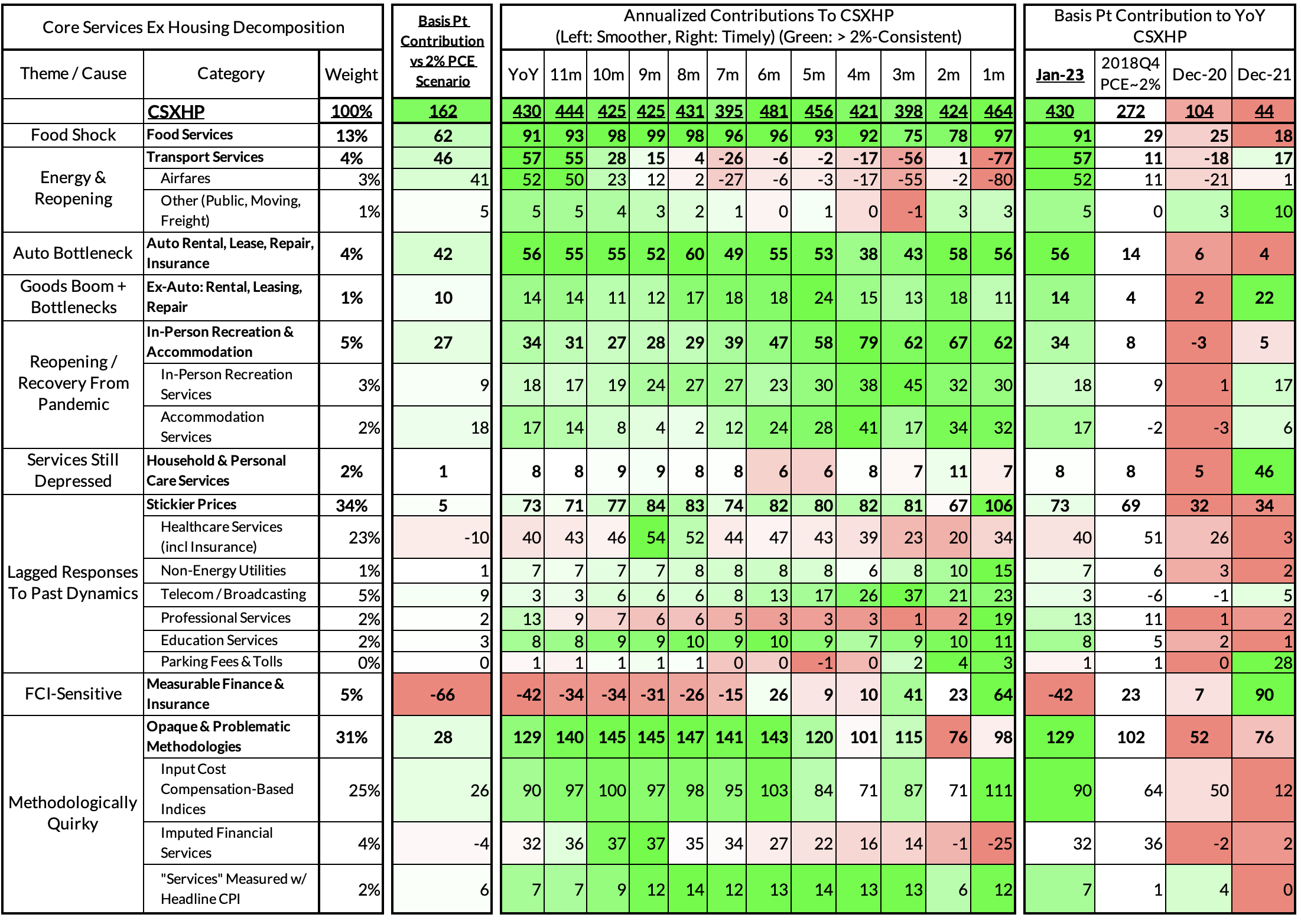

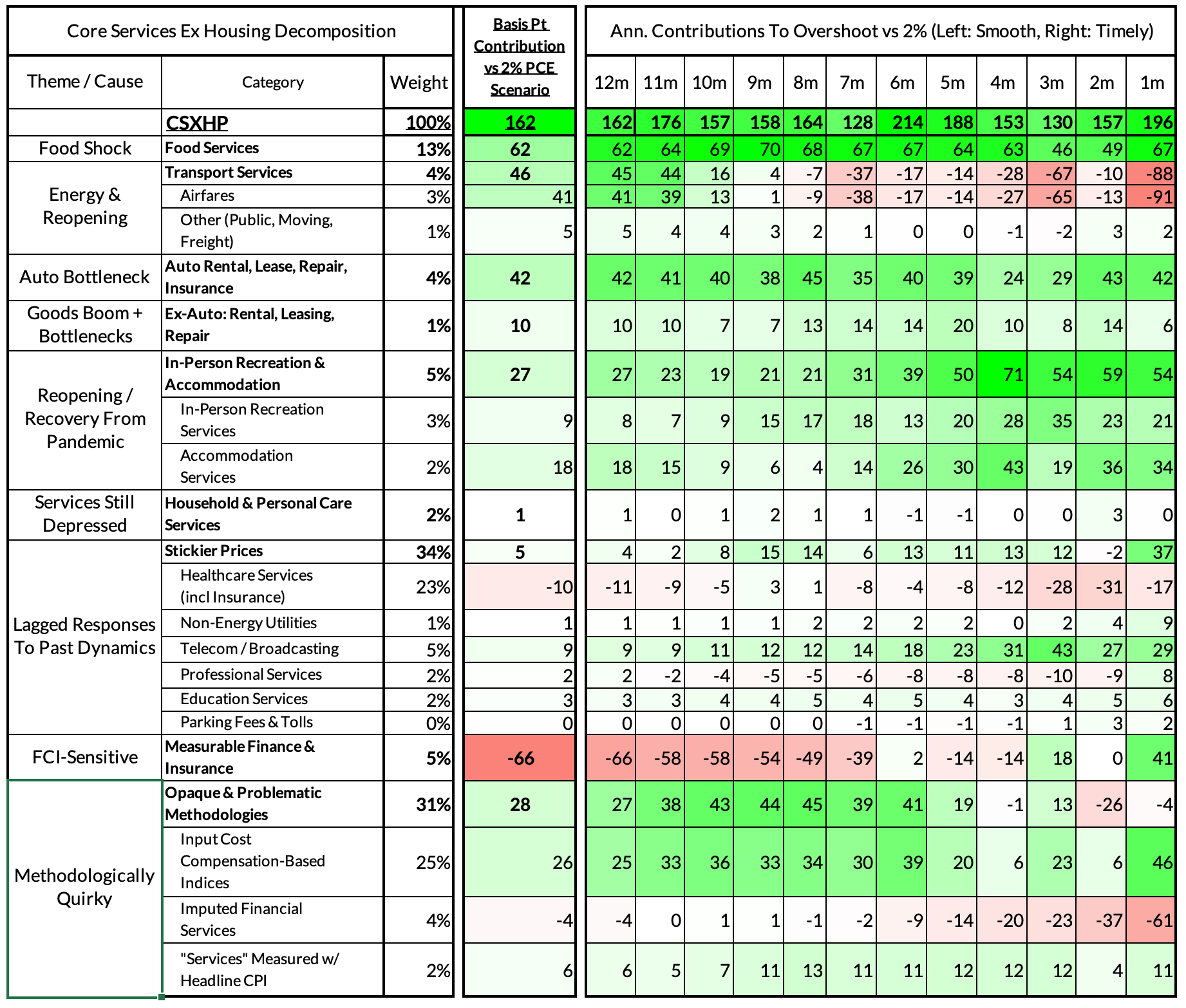

Core Services Ex Housing PCE Heatmaps