Summary

Since the passage of the Inflation Reduction Act, efforts to secure the supply of energy transition commodities have intensified considerably. The Biden Administration has announced prizes, research and development initiatives, and loans for recovery projects to improve the U.S. supply chain for critical minerals. Other advanced economies are acting: Canada has announced an ambitious critical minerals strategy and the European Union briefly considered stockpiling critical minerals. These activities are at least partially a response to China’s aggressive market strategy and continued dominance in the supply chain. Recently, the US and allied nations have floated the idea of a “buyers club” to secure supply of critical minerals.

Across nations, the agency or agencies tasked with executing the obligations of such a club have several design questions to answer, including what products to target, how to price the products, and how to match government authorities to the financial realities of commodity markets.

This piece continues the Lithium branch of our Contingent Supply series on the use of buffer stocks to provide for better energy security and energy market stability. Our first piece with the lithium project outlined the benefits of a spodumene-centric lithium strategy. The second explored how to select the right location for a spodumene reserve economically and strategically. The third piece outlines the importance of a deep, liquid benchmark contract for lithium as a means of expanding the capacity frontier and reducing exposure to price volatility.

This piece illustrates the positive outcomes that would arise out of a lithium benchmark tied to a storage reserve, and the Federal Government’s interest in pursuing those outcomes.

Introduction

In our last piece, we wrote about the importance of a deep, liquid benchmark tied to a physical reserve for lithium in supporting decarbonization and securing a more resilient energy future. The history of the development of the spot market for crude oil, through benchmarks like Brent and WTI, offers insight into the outcomes one could expect from the creation of similarly liquid and deep benchmarks.

Of course, the creation of these markets in oil was driven by private sector actors (particularly pure traders like the “King of Oil,” Marc Rich), rather than as an initiative of the Federal Government. Still, it’s important that the establishment of these benchmarks arose largely out of monumental, geopolitical cleavages, like nationalization in major exporting countries in the Middle East and North Africa, rather than the activities of purely economic actors.

Most importantly, the development of deep liquid benchmarks resulted in several important outcomes, each of which would support the goals of boosting production, increasing competition, and building more resilient supply chains for lithium. And in the lithium case, the Federal Government could help establish a more effective channel to manage and limit price volatility.

The Outcomes of a Well-Functioning Lithium Market—and Their Relationship to Production, Competition and a Resilient Supply Chain

A deep lithium benchmark, tied to a physical reserve, would support several outcomes—each of which would help the goals of supporting competition, boosting production, and building a more resilient supply chain.

Smaller Producers Would Have Easier Access to Financing

A liquid lithium market would help smaller producers thrive in several ways. First, the standardization provided by liquid markets reduces the cost of securing offtake agreements.

Mines are risky investments. They have high upfront investment costs – in both capital and regulatory terms – as well as years-long lead time between investment, initial production and book revenue. Larger producers (particularly those that are vertically integrated and have a diverse stream of revenues) can secure financing more easily or can direct free cash flow towards new investment opportunities. Smaller producers, without the ability to hedge price volatility, do not typically begin construction until a percentage of the future mined product is sold at a fixed price above the project’s required break-even.

That’s partially to mitigate risk, but primarily because external debt financing is often contingent on these offtakes, which can sometimes account for as much as 50% of a mine’s production. Securing offtakes is far more challenging and time-consuming for smaller and newer producers who do not typically have the deep existing relationships that major producers do. Access to capital then is typically much more restricted for smaller and newer producers. The result is that mines need far more equity and higher implied spot prices for their products.

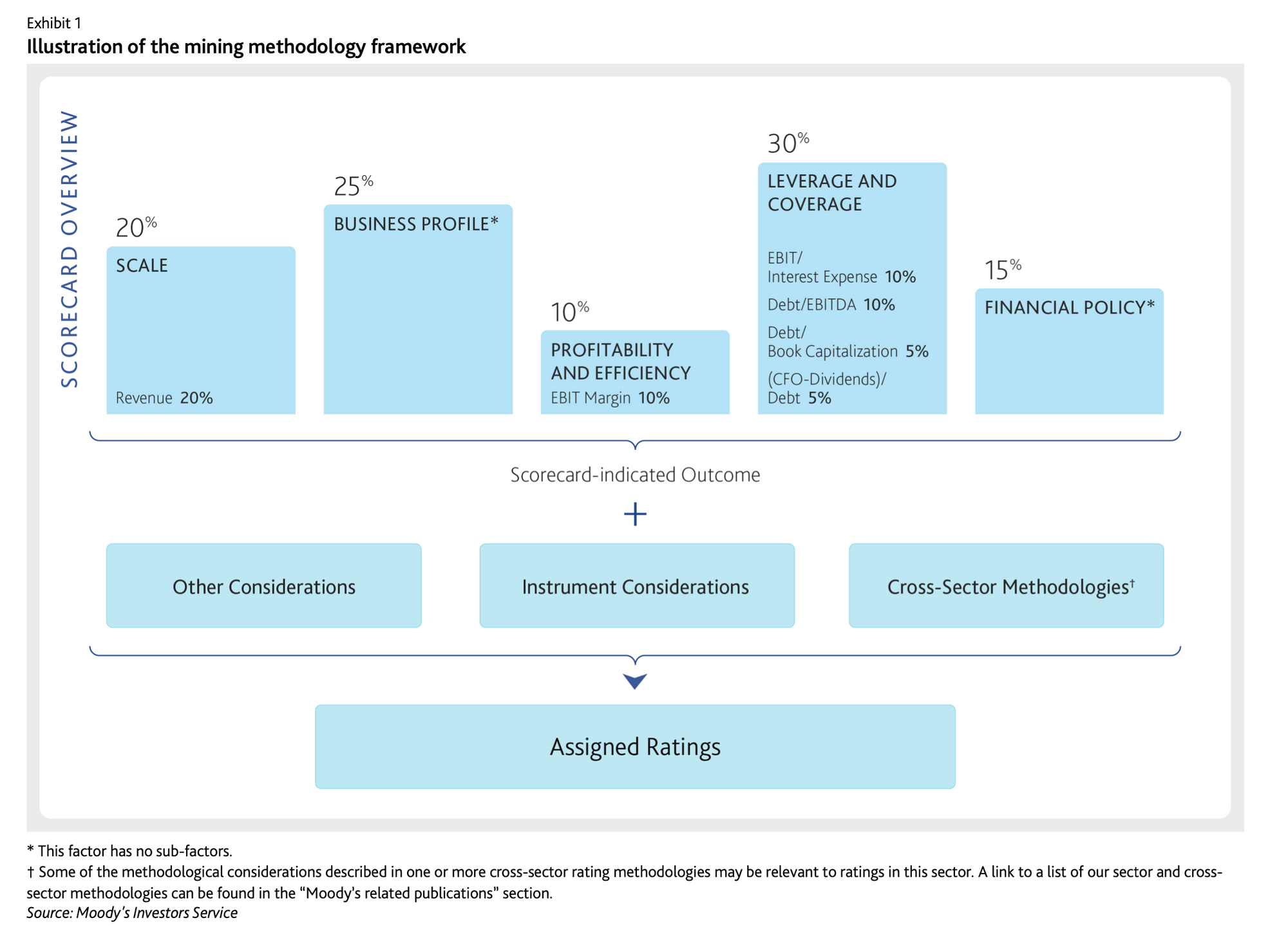

For a deeper exploration, consider the view from the other side of the ledger and consider how lenders evaluate the credit of a mining company, exemplified in Moody’s methodology for mining below:

Scale (being large) and business profile (being diversified, low cost) have more impact than either profitability metrics, leverage, or both combined. Ratings agencies prefer financing large, diversified companies. This naturally concentrates the credit markets for metals and mining among the larger, established players—creating a powerful one-way ratchet to industry consolidation and concentration.

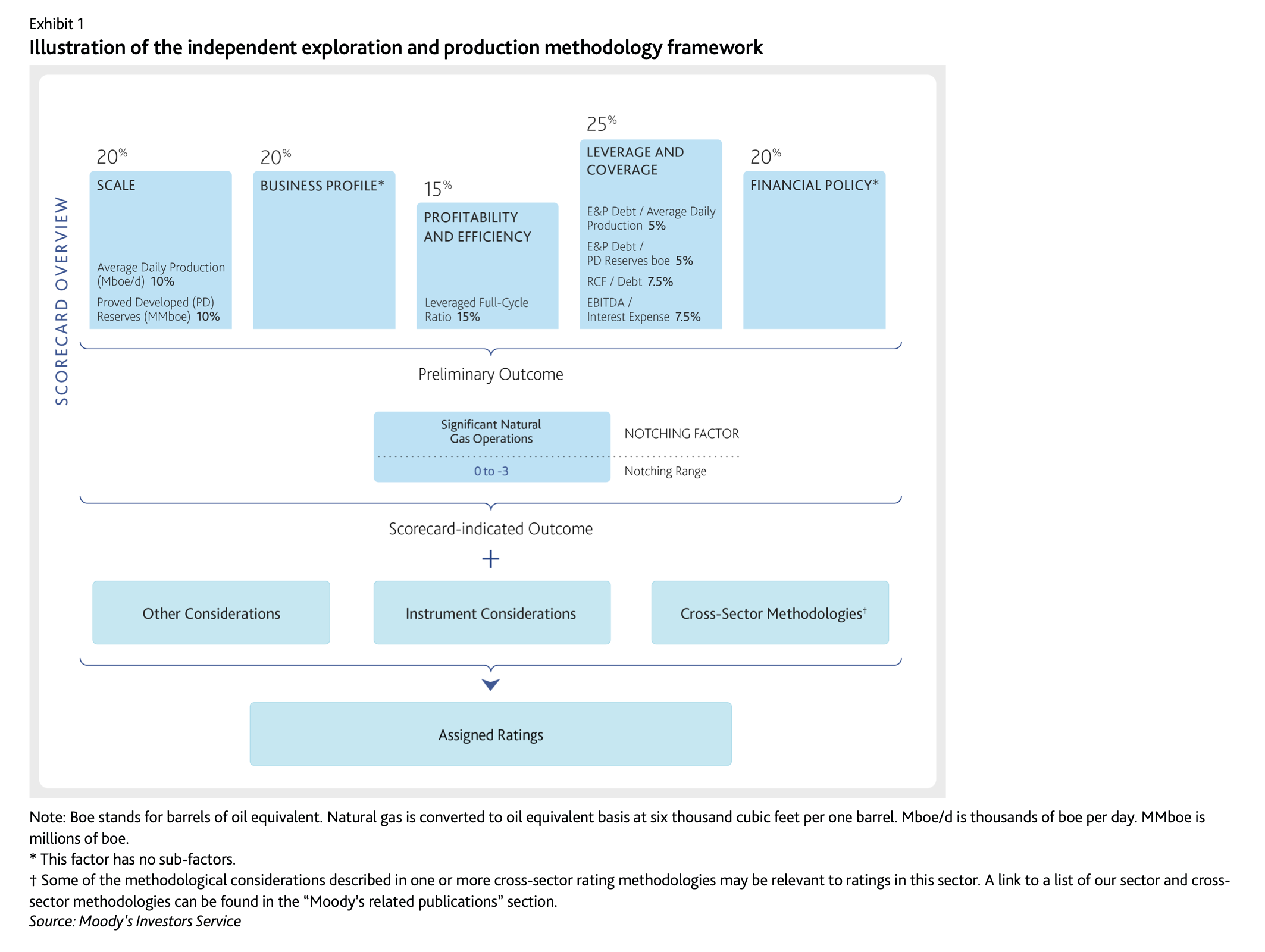

For independent oil and gas exploration, a market with benchmarks, the metrics are subtly (but critically) different.

The emphasis on “leveraged full-cycle ratio” (LFCR) weights profitability and efficiency higher, at the expense of business diversification. The LFCR is a measure of capital efficiency—the degree to which a company’s investment is profitable per unit investment. And LFCR can be actively and intentionally improved by hedging away price risk.

If there’s no market in which that risk can be hedged away, the risk becomes part of the price of the deal, raising financing costs for newer and smaller lithium mining operations. This materially constrains financiers because while risks associated with the particular asset like construction cost and time, geological or processing problems and the like can be diversified away among a large number of offtakes, spot prices cannot. The “magic” of spot hedging that allows banks to lend large amounts to a large number of players in oil and gas without excessively correlated risk simply does not work. Therefore, the ability to hedge price risk, like through a deep futures market, is critical to allowing smaller or less-diversified players into the relevant credit markets.

Even when the financing is centered on the expected appreciation of the underlying asset rather than the unique profile of the operators (like in the case of asset-backed financing facilities), bankers are even more narrowly focused on properly modeled and hedged cash flow from the underlying physical asset, and those hedges are often contractually obligated. Their aim is to remain very senior and highly-secured in the capital stack at lower loan-to-value levels that provide more acceptable degrees of overall price risk.

This presents a challenge for smaller-scale and emerging producers, and trends the industry towards consolidation under existing larger scale diversified miners like BHP, Rio Tinto, or Albemarle. The end result could end up looking like the oil industry for the first 60 years of the twentieth century, where rather than as a function of supply and demand, prices were controlled by the dominant “Seven Sisters.”

A deep market of futures, deliverable to physical reserves, could help resolve these issues. By having longer dated futures and physical clearing as easily available market resources, end buyers would be able to enter contracts for longer term supply with full knowledge of the product and spec to be delivered.

Enabling smaller producers supports the overarching goals of production, competition, and resilience. How? Smaller producers tend to be the ones more likely to add production at the margin, particularly because capital planning at larger firms tends to be less sensitive to the market than smaller ones. So by enabling smaller producers, you’re more likely to have a net positive impact on production overall. Enabling smaller producers just increases the number of participants in the market, boosting competition, and in the process creating a more resilient supply chain, where the loss of any single company’s production is less likely to impact the whole.

The Lithium Sector Would Crowd In More Investment

A lithium futures market would also help crowd in more private investment, through two mechanisms. The first is by making it easier for banks to invest in the small producers who often have the hardest time securing the financing necessary for mining investments, as described in the previous section.

Secondly, a liquid financial market can help crowd in investment from a wider array of market participants, including institutional investors. This lowers the overall cost of financing, while broadening the terms and scale of its availability. At present, an investor looking to diversify their commodity exposure can only do so through direct investments in specific companies. This is risky—even though one might be bullish about the prospects of the lithium market over the next decade, it’s much harder to know for sure that any specific company won’t fall flat on its face despite a bull run. It’s cheaper and easier to use instruments that arise from benchmark contracts like futures options or ETFs.

A futures market would increase the ability for investors to participate in the lithium business. A general bullishness (or bearishness) could be traded on via the financial markets. This is the case in oil—where the introduction of WTI substantially increased the participation of hedge funds, pension funds, insurance companies, and retail investors in the oil market. Though some hedge funds made tremendous amounts of money, others took massive losses, absorbing the market’s downside risk. A well-functioning lithium market may also be able to crowd-in further private investment into the upstream and downstream services involved in making the benchmark and storage facility maximally effective.

Both mechanisms would increase the availability of capital available for lithium investment—hopefully boosting production in the process.

Reduce exposure to price volatility across the supply chain

As demand for energy transition commodities continues to accelerate, lithium prices are likely to become more volatile. This is a major risk for participants across the supply chain—producers can get burned if uncertain timelines misalign with market prices, price shocks can limit the ability for processors to create the refined lithium necessary for industrial goods, and those industrial producers can find their inputs to be more expensive, costs ultimately passed onto consumers (consider, for example the dramatic inflationary effects across sectors from the semiconductor shortage).

The Federal Government can and should do more to stabilize that volatility (more on that later), but a liquid futures market can help participants hedge their exposure to price volatility. That’s one role that benchmarks play in today’s oil markets. Participants with exposure to crude prices even beyond producers can all use benchmarks to hedge price risk. Refiners locked into contracts for refined goods can hedge their financial exposure to volatility in the price of their input feedstock – physical crude oil – by purchasing WTI futures.

Even those who are not crude users often use crude contracts to hedge—airlines, for example, hedge their exposure to jet fuel price volatility through the crude futures market. A spodumene benchmark could play the same role, with everyone from processors to battery manufacturers using the contract as a means to limit their exposure to input price volatility in lithium.

This is especially important as the Federal Government is investing considerable resources into standing up a domestic industry for processing lithium. Although demand is expected to rise–the effects of price volatility could potentially weaken a wide range of government-led investments across the supply chain.

Improve price discovery and transparency

Finally, a liquid benchmark would have one important outcome: a more efficient market. The development of spot and future markets would increase price transparency and discovery.

The spot market for oil is quite new in historical terms: prior to its introduction, rather than being a function of supply and demand, prices were set through fixed, long-term agreements by a market-dominating oligopoly.

The solution to this state of affairs was the introduction of the modern spot market for oil delivery. This provided a single price around which market participants could orient themselves, provide liquidity, and give context for the scope of hedging transactions. This, for a time, stabilized the overall market and permitted the development of a common global market.

The introduction of the spot market also creates transparency around which economic actors can organize and design their own contracts. As the market becomes deeper, it also becomes more difficult for a localized market failure to impact the rest of the supply chain.

The most important thing that a transparent spot market provides is transparency and information. Public resources around prices and grading will allow refineries to target the production of increasingly-standardized grades of lithium product and precursor, creating a positive feedback loop of increasing liquidity and interoperability.

A synthesized explanation below, from ICE:

“It is the value of the refined products that ultimately determines the value of the crude oil that makes them. If a crude oil is good at making gasoline, and gasoline has a strong value that will make this crude oil attractive to buy and refine.

“The basic concept is straightforward, but the actual process to assess the value of crude oil involves an intricate maze of steps and decisions. The consumer sends signals to refineries about what products are needed. A refinery then shops around and buys, at the best available price, the crude oil that can make the product. Sometimes that crude oil is at the other side of the world.

“Refiners need meaningful price signals to quickly assess the value of a crude. Those signals come from the oil spot market where around 40 million barrels move around every day. To distill price clarity from the large variety of oils on offer and the large group of players, the market created benchmarks. They represent a reference level for crudes of roughly the same quality in the same location.”

As more producers enter the market – potentially drawn in by high prices for lithium – it is imperative to maintain price transparency and standardization in order to better facilitate hedging and price discovery. Transparency is the cornerstone of a fair market.

The USG’s Role: An Effective Channel to Reduce Volatility

One skepticism might arise: why should the Federal Government take a role here? Even if all these benefits are real, the spot market for oil was largely a creation of private actors. And the private market has created some benchmarks (though none connected with a physical store) and could create more—so why should the Federal government play any role here at all?

We have two answers: first, in order to deliver on its decarbonization commitments, the Federal Government has an obligation to support the development of industries necessary to the success of the project. Establishing an arms-length spot-and-futures market for lithium attached to physical storage reserves is a critical next step in bringing our climate response from the launchpad to cruising altitude. Second, supporting a benchmark would create an effective channel for the Federal Government to limit price volatility in lithium. So, while the hedging and scaling benefits will be beneficial for decarbonization, the Federal Government also has an opportunity to build an effective policy channel for limiting lithium price volatility into the heart of the market while boosting production long-term.

The Experience from the Strategic Petroleum Reserve

Most government agencies are not well-equipped to interface with modern financial markets – aside from the Treasury and the Federal Reserve – as we have previously written. For this reason, many fiscal policy interventions to impact the private sector occur on separate channels that lay alongside markets, rather than through market channels themselves. Although the government is big enough to make a dent in private sector activity, its attempts to swing markets are often accompanied by leakage and inefficiency.

Take the case of the Strategic Petroleum Reserve (SPR). As we described in our last piece, the benchmark indices arose partially as a result of the wave of nationalizations and the embargoes and the resulting price shocks. At nearly the same time, the SPR was created to store strategic quantities of oil in order to limit our nation's vulnerability to future supply disruptions. That mandate included an acquisition authority to support domestic production goals and objectives including “encouragement of competition in the petroleum industry” and “maximizing the overall domestic supply of crude.”

However, using an acquisition authority to carry out these market objectives has been difficult in practice. Following our advocacy, the Biden Administration recently changed its acquisition regulations to use forward, fixed-price contracts to encourage domestic production. And while the Department of Energy has admirably executed contracts using this authority, the mechanism is still clunky and occurs alongside the market. The lengthy solicitation process, logistical challenges, and general bureaucratic hurdles have made the impact of these interventions more indirect than strictly necessary. A simpler and more efficient mechanism would be directly trading the futures curve for WTI. By lifting up the back of the curve, DOE’s acquisition would feed through to equity valuations, encouraging more investment. DOE can use its existing authority to do this, but building the operational capacity to do something different than previously executed is a major challenge.

It’s Time to Pioneer a New Approach

In the case of lithium however, the fact that there isn’t a useful benchmark now provides an opportunity for the Federal Government to build one, with a structure to implement policy objectives like price stabilization and production incentives. Here, the Federal Reserve and Treasury have been historically particularly effective during financial crises. When a crisis emerges, like the 2008 Global Financial Crisis or the COVID-19 recession, the Fed and Treasury have stepped in as a lender of last resort to cap downside risk in certain environments.

Our goal is for the Federal Government to pioneer a similar approach to provide governance of prices and investment incentives in the lithium sector. The first step is establishing a direct channel through which to provide that governance: a liquid lithium benchmark, (spodumene, as we’ve previously argued for). With such a benchmark in place, the government could carry out the aforementioned goals of boosting production, supporting competition, and increasing resilience in the supply chain. It could also limit volatility by managing price shocks and crashes, stepping in as the “buyer of last resort” in the event of a dramatic cut in demand in China, or to release spodumene onto the market to limit a dramatic rise in the prices of batteries that threatens our decarbonization goals. Our next piece will expound on how, using existing authorities, the Federal Government could carry out this objective, but also provide guidance on what legislation would be helpful.

Conclusion

In conclusion, the time to set up a lithium futures market is not when problems arrive. Whether those problems take the form of geopolitical difficulties with major lithium producers like China, or a slowdown in decarbonization due to an unregulated crush into a poorly-set-up market, the time to start work on building a lithium futures market is now.