By Alex Williams

Executive Summary

Good policy proceeds equally from good politics and good policy analysis. While the Enhanced Unemployment Insurance provisions of the CARES Act were designed in part by the limitations of the existing UI system, they were extremely successful in supporting workers and driving down the poverty rate. As the pandemic continues, policymakers must learn from these successes regardless of their source and use them to improve future policy. Clear-eyed post facto policy evaluation is a critical aspect of this learning and improving process.

However, the nonpartisan Congressional Budget Office’s analysis of the macroeconomic impacts of the Enhanced Unemployment Insurance (EUI) provisions of the CARES Act is deeply flawed. They claim that for every dollar spent on EUI, headline GDP will only grow by 67 cents — a multiplier that, under normal Keynesian specifications, implies that unemployment recipients during the pandemic save roughly 60% of their benefits. Not only is this implication empirically incorrect, but more importantly, legislators may cite this incorrect and too-low multiplier in negotiations for future stimulus packages. While it is beyond the scope of this piece to outline an alternative specification and multiplier estimate, it is important to understand — and challenge — the assumptions made by the CBO in evaluating the impact of the unemployment insurance provisions of the CARES Act.

The CARES Act

The CARES Act was extraordinarily successful in containing the economic fallout from the COVID pandemic throughout the spring and summer of 2020. For workers, one of the most critical CARES Act programs was the expansion of unemployment benefits. These expansions provided longer benefits, broader eligibility for benefits, and an additional $600 per week payout until July 31st. Stories about the lives saved by this expansion abound. At the same time, expanded UI also provided a prop to consumer spending, and helped prevent the kind of fall in consumer durables spending and business investment that can lead recessions to feed back on themselves. Now that these programs have either expired already, or will expire soon absent congressional action, economists have begun preparing analyses of their economic impact.

Given the urgency of the situation and the speed with which the CARES Act was passed, certain aspects of the stimulus were more strongly informed by administrative and technological limitations than orthodox economic theory. Most of the time, unemployment insurance replaces roughly 40% of the laid off worker’s wages. While drafting the CARES Act, some economists and politicians wanted to ensure that unemployment benefits were targeted such that no more than 100% of lost wages were reimbursed to any worker. This proved impossible, owing to long-term underinvestment in antiquated unemployment insurance infrastructure. Instead, policymakers ran with a fixed UI top-up keyed to replace 100% of weekly wages for someone working at the average wage. Given the composition of layoffs, and the extreme income inequality that characterizes the US economy, this policy choice led to a much more generous expansion of unemployment insurance than many initially anticipated. The poverty rate fell by several percentage points during the summer, while economic indicators based on spending returned to trend much more quickly than anticipated. Although key parts of the unemployment insurance expansion were driven by technical limitations rather than academic theory, they had very positive policy outcomes that lawmakers should learn from.

Careful analysis of the policy impact of the CARES Act is critical, not only because of its unprecedented scale and unique constraints, but more importantly because of the pressing need for further economic stimulus. As policy analysts to Congress, the Congressional Budget Office has considerable ability to shape the discourse around the costs and benefits of various stimulus programs. Spending programs need to justify themselves to policymakers on the basis of good value for money, and not just moral or social need.

Fiscal Multipliers

From a cost-benefit perspective, macroeconomic stimulus programs can be judged by the size of their fiscal multipliers. Originally proposed by Richard Kahn, a student of JM Keynes, the fiscal multiplier is a measurement of the total increase in GDP brought about by an increase in government spending on a given program. The central idea is that the economy is a circular flow: one person’s spending is another’s income. However, every participant saves some portion of their income, so the increase in demand brought about by the original dollar in new spending shrinks with every cycle around the economy. Government purchases of goods and services tend to have a high multiplier, as they may induce new investment in capacity, while tax cuts to wealthy individuals tend to have a low multiplier, as the rich save a large portion of their income. Poor individuals often have low or negative savings rates, which means that transfers to them will have an outsize ability to boost total GDP. The conventional wisdom is that good macroeconomic policy focuses spending on activities and transfers with high fiscal multipliers, while seeking to avoid those with low multipliers. While some low-multiplier policies are decidedly worth the cost, policies with very low fiscal multipliers tend to encounter much heavier political resistance.

With all of this being said, it comes as a shock that the CBO has assigned Enhanced Unemployment Insurance a multiplier of 0.67 in its analysis of the economic impact of pandemic relief programs. This means that for every dollar transferred to unemployed workers, the CBO claims that GDP will only rise by $0.67, through both direct spending and the demand that spending induces. Estimates of the fiscal multiplier for unemployment spending are traditionally double or triple this number, having been recently estimated at 1.8 and 1.9. Multipliers like these would imply that spending on Enhanced Unemployment Insurance is a great value for money, yielding almost $2 in economic activity for every dollar spent by congress.

Hidden “Work Disincentive” Arguments

An exploration of the CBO’s methodology reveals a number of flawed assumptions about labor markets that dramatically and artificially lower their estimate of the policy’s macroeconomic impact. It is important to address these flawed assumptions, since the CBO’s model may bias lawmakers against future expansions of unemployment insurance that would both support workers and strengthen the economy as a whole.

The CBO gives four reasons for this shockingly low multiplier. If readers want to look for themselves, the quick version of the methodology is presented in the original report and expanded on in a second, explicitly methodological publication. First, they acknowledge that unemployment benefits do boost demand by replacing lost income. Next, they argue that high unemployment benefits weaken the incentive of job losers to seek new employment, both because the higher UI payments are relatively more comfortable to live on, but also because they may not be able to find a job that pays more than the level of the Enhanced Unemployment Insurance including the $600 PUA top-up. This is said to impact GDP through a reduction in labor supply by these unemployed workers. The CBO then claims that adding new workers to unemployment coverage (such as the contractors, freelancers, and gig workers covered by Pandemic Unemployment Insurance) further reduces labor supply by making these workers less likely to take a job if one is offered, since their choice is between the job and unemployment benefits rather than zero income. The CBO then points out that the labor supply impact of the prior two forces may be lessened by employers increasing wages in response to higher unemployment benefits, but that this is likely a rare dynamic. Throughout, the impact of social distancing measures on consumer spending is alluded to, but not quantified.

Evaluation on the basis of fiscal multiplier may seem like a novel method for evaluating the effectiveness of Enhanced Unemployment Insurance that gets us away from the endless moral arguments about whether UI “disincentivizes work.” However, in the CBO’s evaluation, the tired old “work disincentive” arguments immediately raise their heads. Of the four reasons the CBO gives, the only ones which lower the multiplier on unemployment spending rely on an economic story about “work disincentives.” In the report’s own words:

“All told, CBO estimates that the increased benefit amounts, the eligibility expansion, and the longer duration account for about 64, 25, and 11 percent of the legislation’s overall negative effect on output, respectively, through their effects on the overall supply of labor.”

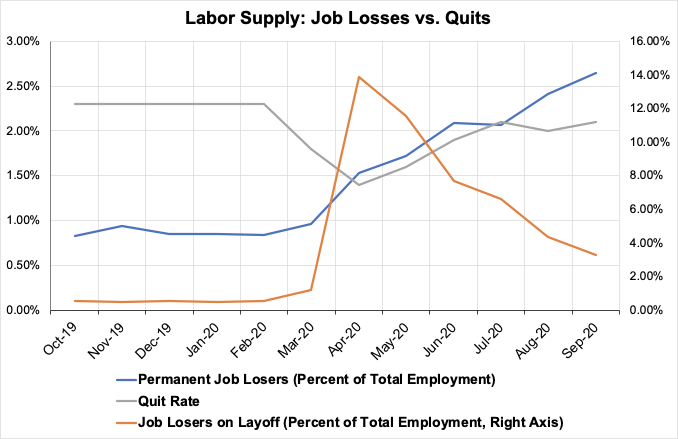

Leaving aside the obvious point that “disincentivizing work” was a clear public health need early on in the pandemic, these justifications don’t square with labor market data. Workers did not choose to supply less labor by voluntarily leaving their jobs during the pandemic, as we can see in the chart below, the quit rate has remained far below both the temporary and permanent job loss rates. This point is worth harping on: during a deadly pandemic, in an environment where employers frequently failed to provide adequate protection for their workers, the quit rate actually fell.

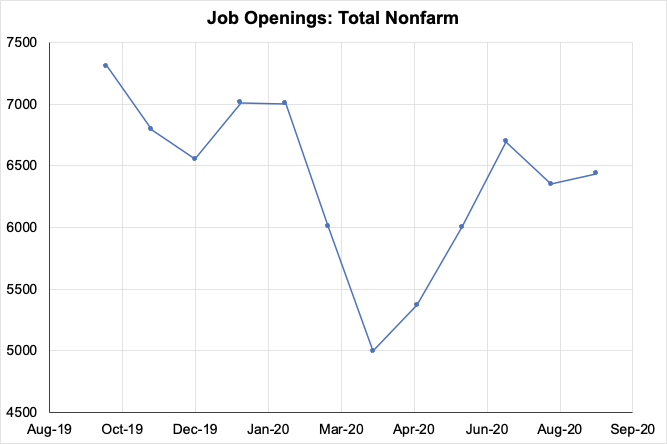

At the same time, workers did not refrain from taking new jobs, as there were not nearly enough new jobs to make up for lost ones. Workers cannot create jobs that aren’t there. Job openings fell sharply in the beginning of the pandemic, and only began to recover in the months that unemployed workers were receiving the $600 benefit.

At every point in the pandemic, labor supply has exceeded labor demand, whether for public health or economic reasons. Assigning a low multiplier to EUI on the basis that it cuts GDP by inducing shortages of labor is simply wrong. Right now, there aren’t jobs for any of these workers to take, let alone so many job openings that GDP is being dragged down by a shortage of willing workers. Despite appearing to be a different way to think about the impact of unemployment insurance on the economy, multiplier estimation becomes, in the CBO’s hands, another opportunity to trot out tired platitudes about “work disincentives.”

The critical point here is that when labor markets are as loose as they are now — and are likely to be for quite some time — labor supply is simply not a constraint on output. Unemployment insurance as an automatic stabilizer works on the demand side, by ensuring that when a worker loses a job, the economy as a whole remains roughly the same size.

Incredibly, if viewed from the demand rather than supply side, the CBO’s multiplier amounts to a claim that recipients of unemployment during the pandemic saved on average 60% of the benefits, and will not spend those savings until after 2023. Following the toy model of a circular economy alluded to above, for one dollar of unemployment insurance benefit to induce only $.67 in economic activity, 60% of the benefit amount would have to be saved every time the dollar changed hands. The unemployed person spends $.40 and saves $.60, while the recipient of that $.40 spends $.16 and saves $.24. By the time the original dollar has made enough laps to no longer induce new spending, only $.67 worth of demand will have entered the economy.

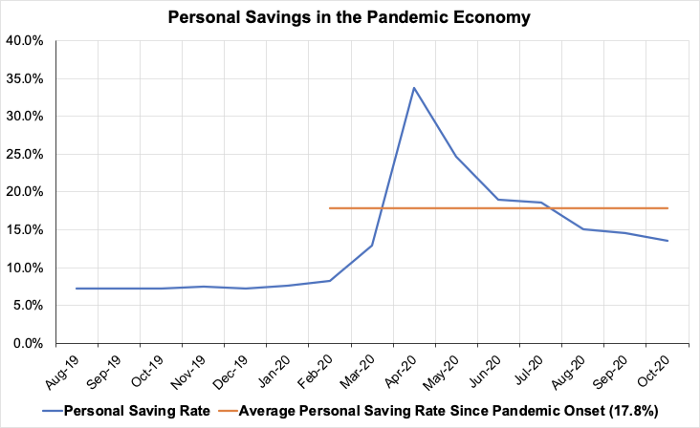

This is empirically absurd on its face. The savings rate for the economy as a whole did increase substantially while pandemic unemployment benefits were being disbursed, but not to anywhere near 60%, for even one month.

Unemployment insurance beneficiaries tend to have low incomes and concomitantly lower savings rates. These intuitions are borne out in multiple studies conducted by the JP Morgan Chase Institute, which find that, while unemployment insurance benefit recipients saved while the $600 PUA benefits were being paid out, two-thirds of these savings were spent in August alone, the first month after the benefits expired. Even if the recipients of spending by the unemployed — goods producers, grocery stores, landlords — were to save 100% of this income, the fiscal multiplier in 2020 would still be substantially higher than 0.67, in the neighborhood of 1 at a minimum, and likely much closer to historical estimates that place the fiscal multiplier near 2.

Learning From Data

If policy is to improve by making use of the lessons offered by the pandemic response, we must be careful and thorough in our post facto policy analyses. Rather than relying on “explicit assumptions about economic decision-making in DSGE models [that] are less dependent on historical data” as the CBO proudly claims to, we should check our model estimates against real world income and spending data.

Some politicians and economists did not initially want to provide unemployment insurance expansion that had replacement rates above 100% of wages. However, we can credit the speed of the recovery in consumption and investment to a policy that did just that. Given the still-widespread unavailability of jobs, and the pervasiveness of nominal debt contracts that must be paid, it is exceedingly difficult to believe that a reduction in labor supply plays any meaningful role in the macroeconomic impact of Enhanced Unemployment Insurance. A simple back-of-the-envelope model of a circular economy with a Keynesian multiplier — augmented with checking account balance data from JP Morgan Chase — can immediately disprove the CBO’s claims.

This kind of multiplier estimation will also be critical for the incoming Biden Administration, when choosing what macroeconomic stabilization policies to prioritize. An artificially low multiplier estimate predicated on assumptions that can quickly be disproved with reference to empirical data will not provide policymakers with useful information, and may bias them against policies we have seen to be successful. Multiplier estimates are likely to figure prominently in explorations of the macroeconomic impact of student debt cancellation, as well as prospective infrastructure, climate and jobs programs.

The development of a new method for calculating fiscal multipliers is far beyond the scope of this paper. What we can provide however, are strategies for identifying unrealistic assumptions which are likely to bias these kinds of estimates. Demand-side gut checks are critically important, as are examinations of the distributional outcomes of various policies. Most importantly, when a policy evaluation provides an empirically shocking — but potentially politically useful — estimate, it always helps to double or triple-check the methodology by which it was constructed.