Note: This post has been revised to reflect some updating issues we previously had.

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

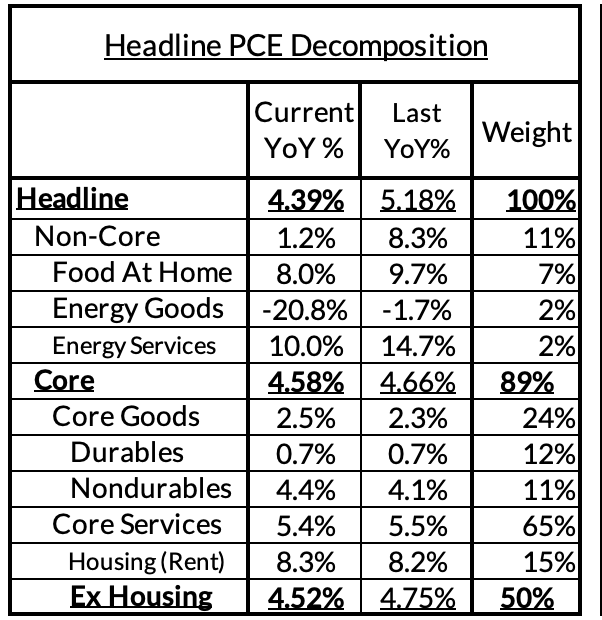

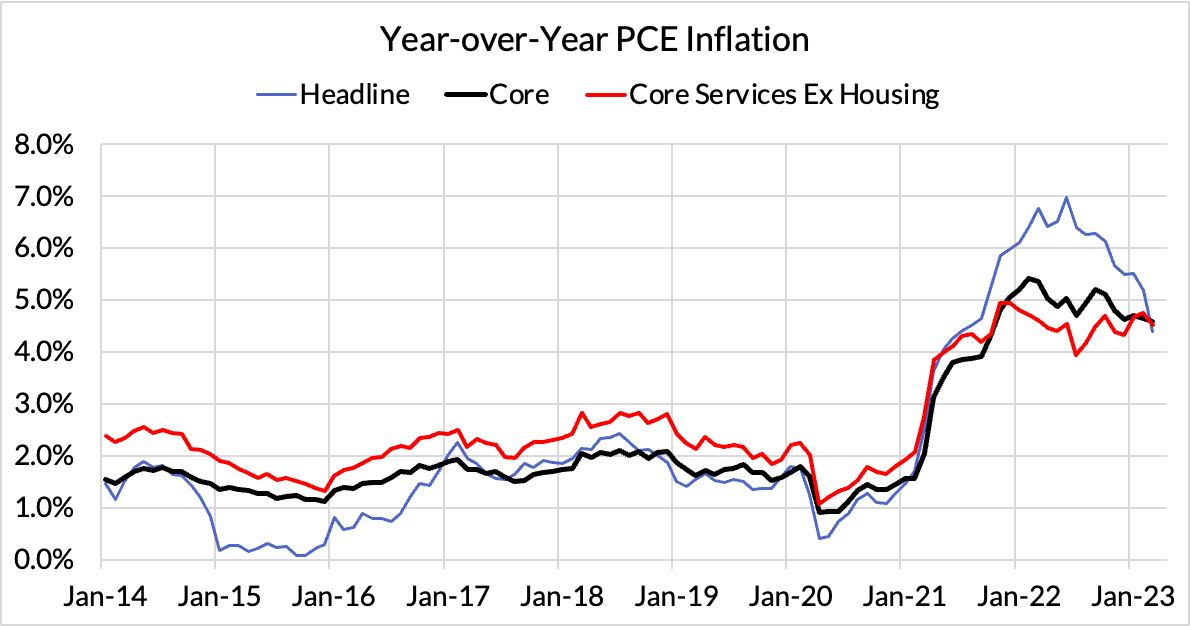

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

Summary

Despite a seemingly encouraging March CPI release, March PCE readings showed some upside through PPI revisions to the last 4 months and a strong set of numbers in healthcare services. Outside of automobiles, airfares, and healthcare services—where additional upside risks potentially lurk—our own inflation outlook is now looking more encouraging. But headed into the May FOMC meeting, the Fed is faced with mixed information set, with local deceleration in month-over-month inflation weighed against upside revisions to previous months.

This Core-Cast is exclusive to our High-Frequency Descriptive Analysis distribution. To view the full version, consider subscribing to our full distribution by reaching out to us here.