At tomorrow's FOMC meeting, the Fed will almost certainly hike 25 basis points. With that hike comes the full conclusion of the Fed's ambitious yet sometimes opaque "maximum employment" forward guidance. A hike in March is a clear declaration that the Fed believes the economy has reached "maximum employment.

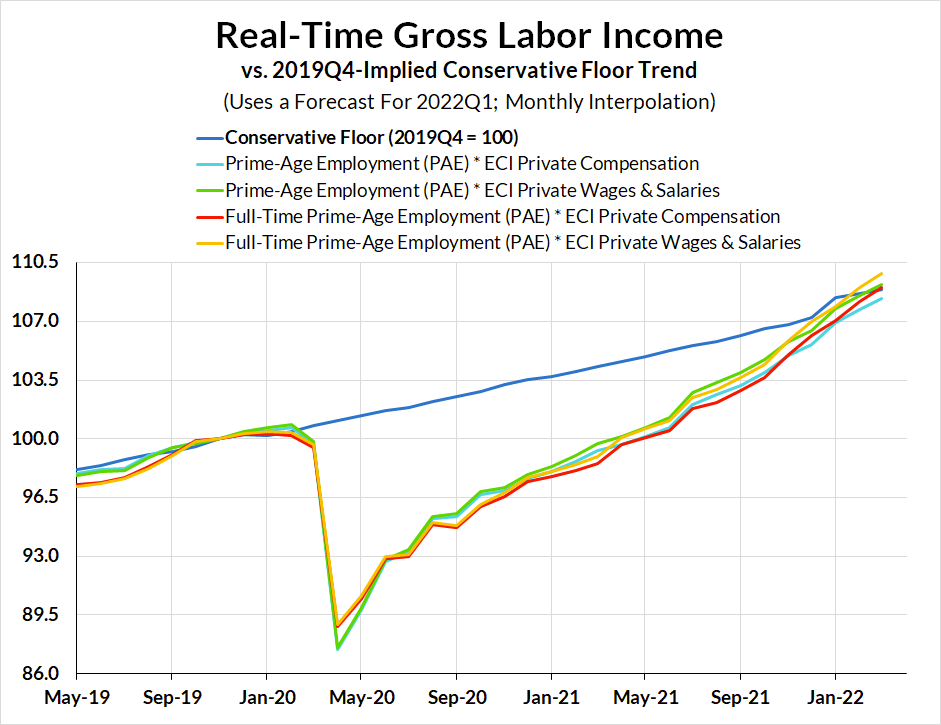

- Although we would have preferred clearer guidance on how the Fed measured and envisioned "maximum employment" — as well as greater emphasis on prime-age employment rates — the Fed has helped achieve a historically fast and robust labor market recovery. By our preferred framework and benchmarks, we have likely seen a full recovery in gross labor incomes to its pre-pandemic "level target" this month (March 2022). With trends in income growth and price inflation also likely to stay strong over the nearer term, the conditions required to justify policy tightening have been fulfilled.

- Fed officials deserve praise on two particular points with respect to its forward guidance: 1) they have not used excuses about "structural unemployment" to move the recovery goalposts (the unemployment rate has returned back below 4%) and 2) they are communicating a more dynamic view of maximum employment, such that progress in employment outcomes from here need not be viewed as necessarily inflationary.

- The Fed must remain nimble in an environment of frequent and unexpected shocks. The policy implications of hikes and expected hikes must be viewed in conjunction with broader financial conditions and the associated set of expected inflation outcomes.

Most criticism of the Fed has been made with respect to the rise in inflation, claiming that the Fed either directly caused inflationary pressures or was well-positioned to offset these pressures. Both views reflect a misguided and all-too-convenient view about how the Fed actually influences inflation. The Fed's dominant disinflationary mechanism operates by producing lower job growth or lower wage growth. Others might be tempted to nitpick the Fed's declaration of maximum employment at a time when the recovery still seems uneven. To be clear, there are surely communities that remain underrepresented and under-sampled by aggregate measures of labor market health. Yet the policy improvement relative to past crises has been real.

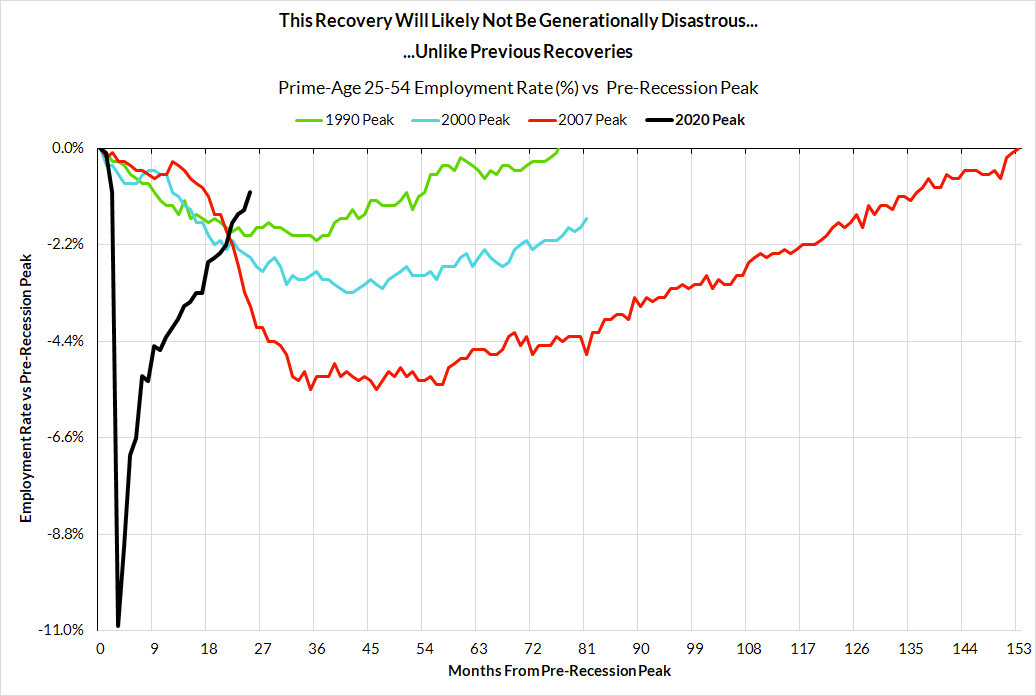

When coupled with the power of fiscal policy, the role of the Fed's forward guidance has ensured that policy tightening did not cost a generation of American workers their career prospects. The previous three recessions and the slowness of their recoveries left lasting damage on workers' employment outcomes. By pursuing tighter monetary and fiscal policy too early, policymakers in those earlier recoveries ensured that it would take half a decade for workers to regain their pre-recessionary employment.

The stars rarely align in such a way that fiscal policy powers a complete labor market recovery from a business cycle recession. By the metrics and benchmarks we have set forth under our own framework, we are now on track for a full recovery as of this current month (March 2022).

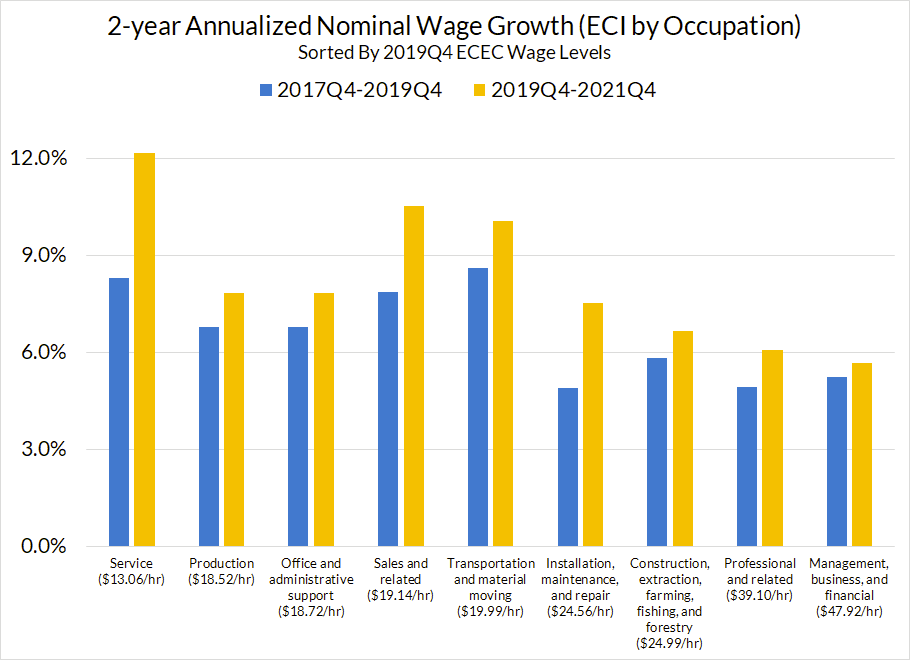

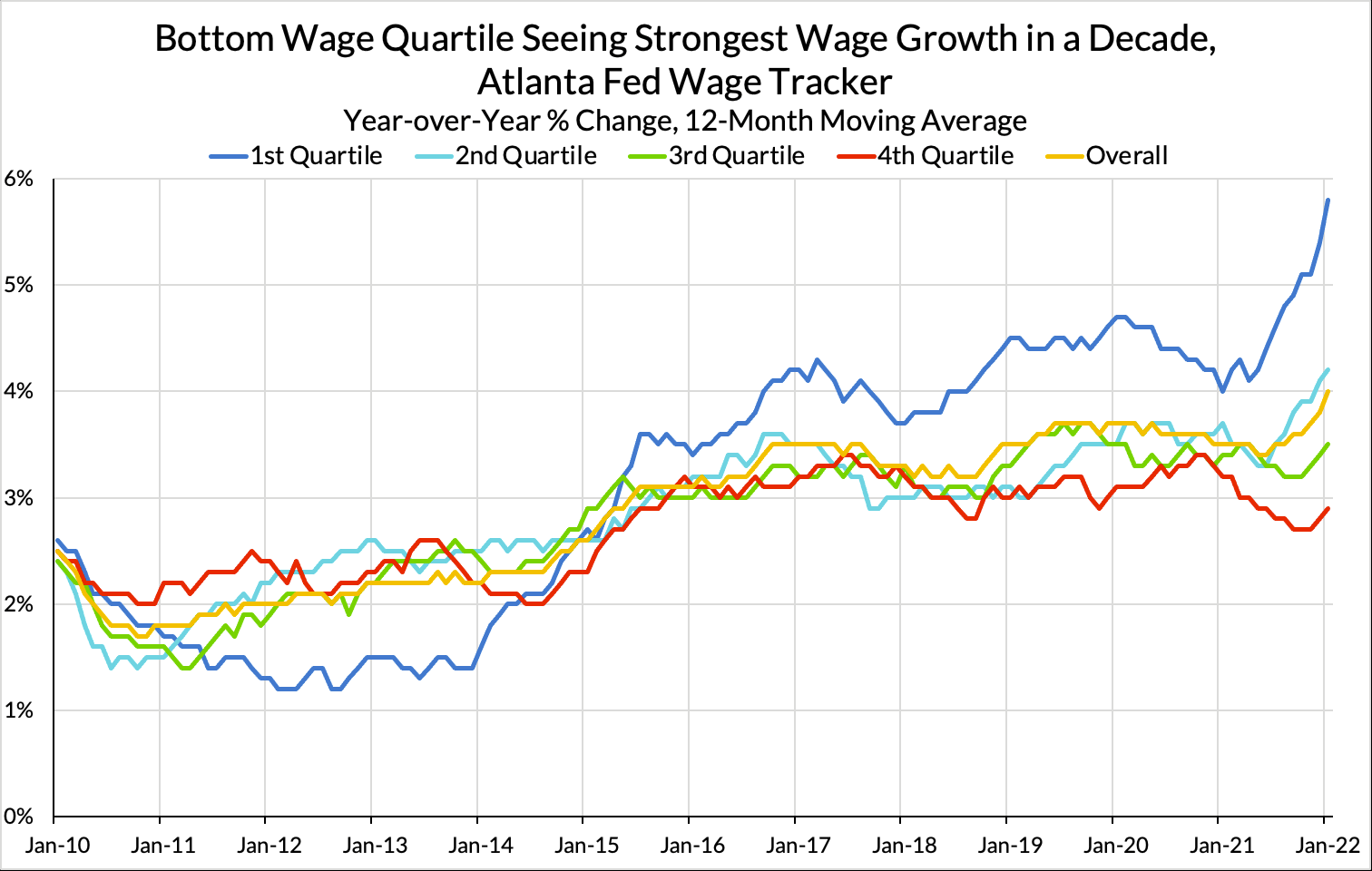

While the benchmarks in our framework reflect a more aggregated view of the labor market, the quality of this recovery also suggests a stronger nominal labor income recovery for those who work in lower wage occupations and at lower wages more generally.

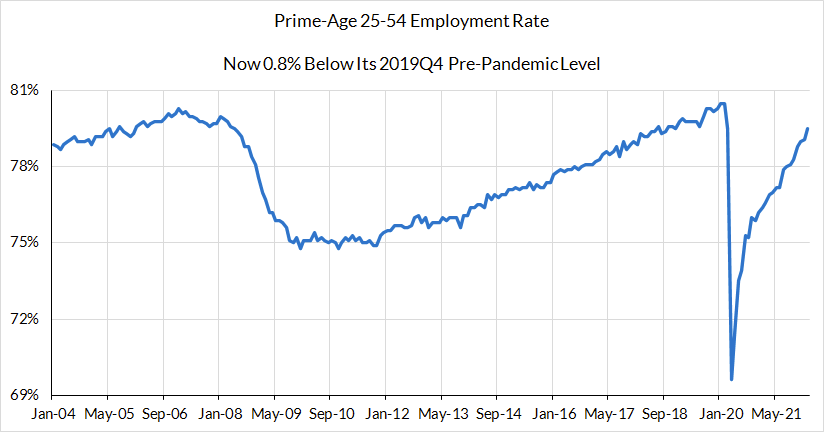

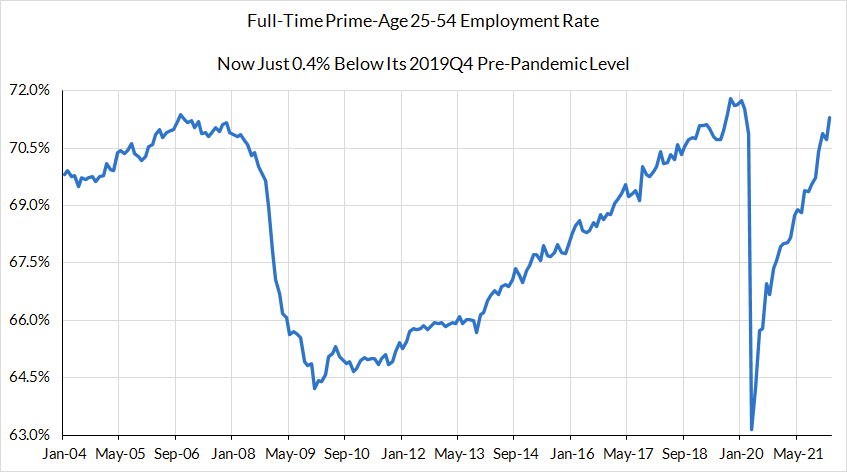

Because wage growth has been so strong over the past year, the labor market has reached our gross labor income targets a little faster than the core employment metrics that we have emphasized. We have written at length about the merits of the "Prime-Age 25-54 Employment Rate," as well as its full-time employment analogue. These two metrics have nearly returned to 2019Q4 pre-pandemic levels. With the momentum we see today, the latter might even get there in this current month (March 2022).

Initially, Chair Powell suggested he would take an inclusive view of labor market health when determining where "maximum employment" lay. Yet his preferred set of metrics to cite has shifted over time. It is regrettable that the Fed did not adopt a more transparent process for establishing the levels of various indicators consistent with maximum employment (one which could still leave room for flexibility and revision of indicators as circumstances changed). But all things considered, we are now at employment and wage levels that are consistent or nearly consistent with a full recovery from the pandemic-induced recession.

In our view, once workers who would have remained employed—absent the recession—have been brought back to work, it is more defensible to slow down the labor market for the sake of lower inflation. Had policymakers begun slowing economic and employment growth last year itself, millions of Americans would have been consigned to an incorrect diagnosis of "structural unemployability." The robust employment gains over the past 9 months are clear evidence that those workers are anything but structurally unemployable.

There are evident speed limits on the pace of labor utilization and wage gains consistent with the Fed's inflation goals, but the attainable destination over the longer run need not and should not be limited. The Fed's messaging here has been a welcome sign that the Fed will not unilaterally try to claw back employment gains purely for their own sake.

"The maximum level of employment that's consistent with price stability evolves over time within a business cycle and over a longer period, in part reflecting evolution of the factors that affect labor supply, including those related to the pandemic.”

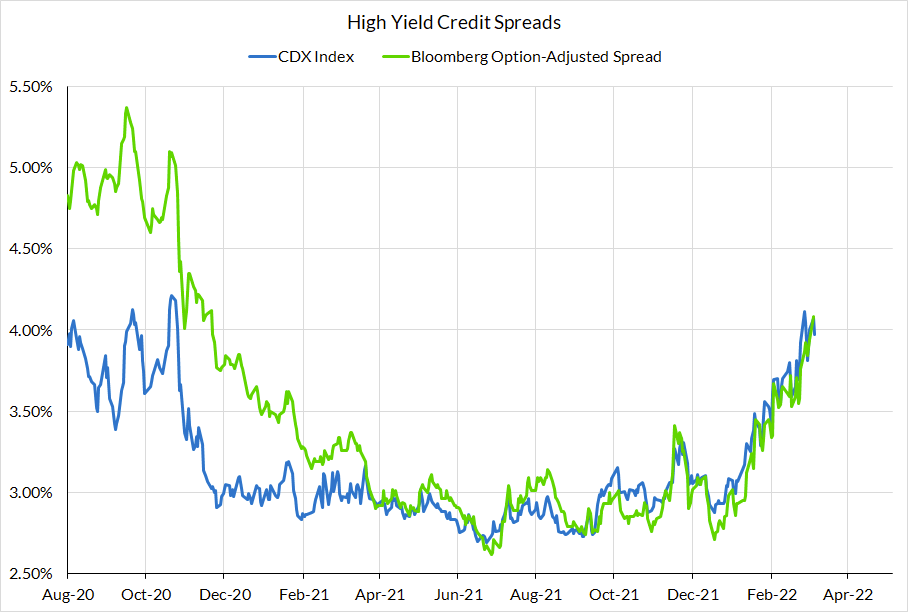

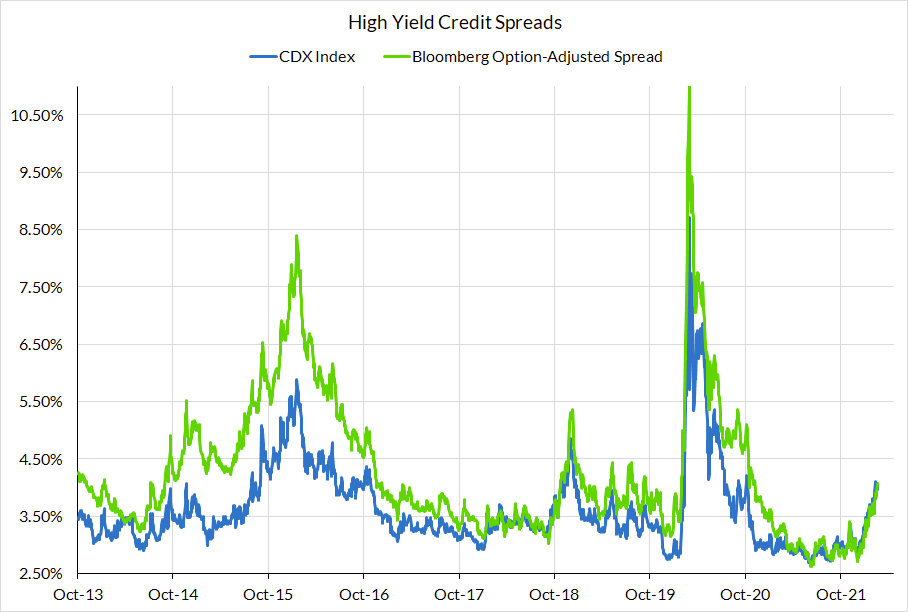

Though a Fed-induced economic slowdown may be defensible in the current economic context, the Fed must be extremely careful in calibrating their hikes. Risks are shifting by the hour, while volatility and financial market signals turn on a dime. Inflation is running hot and will be uncomfortably above target over the near-term, raising the voices of those blindly calling for rapid rate hikes without any attention to context. Yet if we see broad-based financial conditions tightening—credit spreads are already more than 110bps wider to start the year—there will be less need for further Fed-induced financial conditions tightening.

The risk premium widening we are already seeing is 1) amplifying the effects of rate hikes and 2) is more concerning than normal rate increases (which might otherwise have a neutral effect on credit spreads and other risk premium estimates).

It is common to frame the level of interest rates in reference to a "neutral rate of interest" (r-star), calling policy "accommodative" when policy rates are lower than r-star and "restrictive when above. However, the location of "r-star" is really not knowable in the moment and must inherently be sensitive to the effects of policy on its primary causal channels. R-star is the ultimate Monday Morning quarterback; its true location can only be known in retrospect. All we can really say with confidence now is that rate hikes and tighter financial conditions (higher risk premiums) will cause economic activity to decelerate at the margin. The scale of the deceleration is far less clear.

In the currently uncertain environment (including the fallout from the war in Ukraine and the mass lockdowns across China), even the effects of known shocks on activity and inflation are far from clear. The Fed must be prudently holistic in its evaluation of the stance of monetary policy and—most importantly—adaptable to rapidly changing economic dynamics.